| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Turkey Off-the-Road Tire Market Size 2023 |

USD 117.73 Million |

| Turkey Off-the-Road Tire Market, CAGR |

2.48% |

| Turkey Off-the-Road Tire Market Size 2032 |

USD 147.13 Million |

Market Overview:

Turkey Off The Road Tire Market size was valued at USD 117.73 million in 2023 and is anticipated to reach USD 147.13 million by 2032, at a CAGR of 2.48% during the forecast period (2023-2032).

The growth of the Turkey Off-the-Road (OTR) tire market is driven by several key factors. First, the rapid development of infrastructure projects across the country, supported by government investments, is increasing the demand for heavy-duty vehicles and construction machinery, both of which rely heavily on OTR tires. Additionally, the agricultural sector’s shift towards mechanization is a significant driver, as modern farming equipment requires durable tires for improved performance and efficiency. Technological advancements in OTR tire designs, particularly in terms of durability, performance, and fuel efficiency, are also contributing to market growth, as end-users seek high-quality, long-lasting solutions. However, the market is challenged by fluctuating raw material costs and the presence of counterfeit products, which can undermine the quality and safety standards of tires in use.

Regionally, Turkey’s geographical location plays a crucial role in its OTR tire market development. The western regions, including major industrial hubs like Istanbul and Izmir, are experiencing rapid urbanization and industrial growth, driving demand for construction and mining equipment. The central Anatolian region, with its strong agricultural presence, is increasingly adopting mechanized farming techniques, fueling the need for agricultural OTR tires. In the eastern regions, known for their mineral and resource extraction activities, the demand for OTR tires is also growing due to the expansion of mining operations. The diverse regional requirements, from agriculture to heavy industry, are creating a broad and dynamic market for OTR tires in Turkey.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Turkey Off-the-Road (OTR) tire market is projected to grow from USD 117.73 million in 2023 to USD 147.13 million by 2032, driven by infrastructure development and mechanization in agriculture.

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Government investments in infrastructure projects, including roads and urban development, are increasing demand for heavy-duty vehicles and construction machinery, leading to higher OTR tire requirements.

- The shift towards agricultural mechanization in Turkey is significantly boosting the demand for specialized OTR tires designed for modern farming equipment.

- Technological advancements in OTR tire design, focusing on durability, fuel efficiency, and the development of radial ply tires, are making these tires more attractive to various industries.

- The Turkish mining sector, with its expanding resource extraction activities, continues to fuel the demand for heavy-duty OTR tires that can withstand harsh mining environments.

- The market faces challenges from fluctuating raw material prices, such as rubber and steel, which can impact production costs and reduce profitability for manufacturers.

- Counterfeit OTR tires in the market pose safety risks and operational disruptions, requiring stronger enforcement of intellectual property and quality control measures to ensure product reliability.

Market Drivers:

Infrastructure Development

The Turkish Off-the-Road (OTR) tire market is witnessing significant growth driven by the ongoing infrastructure development in the country. The Turkish government has been investing heavily in transportation and construction projects, including roads, bridges, and urban development initiatives. These projects require the use of heavy machinery, such as excavators, cranes, and dump trucks, all of which rely on OTR tires. The demand for durable and high-performance tires is increasing as construction companies and contractors seek to optimize the efficiency and productivity of their equipment. The expansion of the construction sector, particularly in urban areas, directly influences the need for OTR tires, ensuring continued market growth.

Agricultural Mechanization

Another key driver for the Turkey OTR tire market is the increasing mechanization of the agricultural sector. For instance, Petlas, a leading Turkish tire manufacturer, has expanded its agricultural tire production capacity by 20% in 2023 to meet rising demand from the country’s rapidly modernizing farming sector. Agriculture remains a vital part of Turkey’s economy, with significant portions of the population engaged in farming activities. As farmers adopt advanced machinery for planting, harvesting, and soil management, the demand for specialized agricultural OTR tires rises. These tires are designed to provide superior traction, durability, and comfort, which are essential for the heavy demands placed on machinery in challenging agricultural environments. The shift toward mechanized farming is essential for enhancing productivity and efficiency, further boosting the market for OTR tires in the agricultural segment.

Technological Advancements in Tire Design

Technological innovations in OTR tires are also playing a pivotal role in driving market growth in Turkey. Advances in tire design and materials have improved the durability, performance, and cost-efficiency of OTR tires. Manufacturers are increasingly focusing on creating tires that can withstand harsh operating conditions such as extreme temperatures, rugged terrains, and heavy loads. For instance, companies such as Bridgestone and Michelin have introduced OTR tires with advanced features, including reinforced sidewalls and deep treads for greater durability and grip. The integration of smart technologies, such as tire pressure monitoring systems (TPMS) and digital sensors, allows real-time monitoring of tire pressure and wear, reducing maintenance costs and downtime for end-users. The development of radial ply tires and improved tread patterns for better traction and longer life cycles has resulted in higher adoption rates. Furthermore, the integration of smart technologies in tires, such as sensors for monitoring pressure and wear levels, is driving demand for more sophisticated tire solutions across various sectors. These advancements help end-users optimize tire performance and reduce maintenance costs, making OTR tires more attractive to businesses across industries.

Rising Demand from the Mining Sector

The mining sector in Turkey is also contributing to the growth of the OTR tire market. Turkey is rich in natural resources, including coal, gold, and other minerals, and the mining industry continues to expand to meet both domestic and international demand. This sector relies heavily on large, specialized machinery, including haul trucks, loaders, and excavators, all of which require OTR tires designed to handle the extreme conditions of mining environments. As mining operations grow and become more advanced, there is a growing need for tires that offer high load-bearing capacity, excellent durability, and the ability to withstand rough terrains. The expansion of mining activities in regions rich in natural resources directly impacts the demand for high-quality OTR tires, thus fueling market growth.

Market Trends:

Shift Towards Radial Tires

One of the key trends in the Turkey Off-the-Road (OTR) tire market is the shift towards radial tires, which are becoming increasingly popular due to their improved performance and durability. Radial tires offer several advantages over bias-ply tires, including better fuel efficiency, longer lifespan, and superior traction, which are critical for heavy-duty machinery used in construction, mining, and agriculture. For instance, Özka’s AGROLOX Radial Tractor Tire is specifically designed for increased traction on both land and roads, featuring a renewed pattern, double-angle tread structure, and flexible sidewalls for comfortable driving and excellent mud repellence. As these industries demand tires that can withstand the stresses of extreme environments, the adoption of radial tires continues to grow. This shift is further driven by the rising emphasis on cost-effectiveness and operational efficiency, as businesses seek to reduce maintenance costs and enhance productivity. The long-term benefits of radial tires are prompting both manufacturers and end-users to prioritize them in their purchasing decisions.

Increased Focus on Sustainability

Sustainability is an emerging trend in the Turkey OTR tire market, with a growing focus on producing eco-friendly tires and reducing the environmental impact of tire manufacturing and disposal. As the global pressure for sustainability intensifies, Turkish tire manufacturers are increasingly investing in research and development to produce tires using sustainable materials and manufacturing processes. For instance, Kordsa, a leading Turkish manufacturer of tire reinforcement products, received the ISCC (International Sustainability Carbon Certification) Plus certification in 2023 for its eco-friendly production of recycled polyester yarn, single cords, and cord fabrics, demonstrating a commitment to circular production and international sustainability standards. There is also a rising interest in the recycling of used tires, which are often repurposed for other industrial applications or recycled into new products. The development of tires with reduced rolling resistance, improved fuel efficiency, and lower emissions aligns with Turkey’s broader environmental goals and supports the increasing demand for green products. This trend is not only important for regulatory compliance but also resonates with environmentally-conscious consumers and businesses seeking to minimize their carbon footprint.

Technological Integration in Tires

The integration of advanced technology into OTR tires is another notable trend in the Turkish market. With the rise of the Internet of Things (IoT) and smart technology, tire manufacturers are increasingly incorporating sensors into OTR tries to monitor pressure, temperature, and wear. These sensors provide real-time data that can help businesses optimize tire maintenance, improve safety, and reduce downtime. The use of such smart tires is particularly beneficial for industries such as mining and construction, where machinery operates in harsh conditions. By offering insights into tire health, these technologies enable businesses to make informed decisions about maintenance and replacement, ultimately enhancing operational efficiency and reducing overall costs.

Growth of E-Commerce in Tire Sales

The Turkish OTR tire market is also experiencing a rise in e-commerce sales, which is reshaping the way tires are marketed and distributed. The convenience of online platforms has made it easier for businesses to purchase OTR tires directly from manufacturers or authorized distributors, bypassing traditional distribution channels. This trend is being driven by the increasing digitization of businesses across various sectors, as well as the growing preference for a seamless online purchasing experience. E-commerce platforms are also providing more detailed product information, including specifications, reviews, and comparisons, which enable customers to make more informed purchasing decisions. As a result, e-commerce is becoming a significant channel for both large and small-scale businesses looking to procure OTR tires, further fueling market expansion.

Market Challenges Analysis:

Fluctuating Raw Material Prices

A significant restraint in the Turkey Off-the-Road (OTR) tire market is the volatility in raw material prices. Key components such as rubber, steel, and carbon black, which are essential for tire production, often experience price fluctuations due to global supply chain disruptions and market imbalances. For instance, CEAT Tyres, a major player in the tire industry, reported that rising carbon black and raw material costs in early 2025 led to a decline in its share price and squeezed profit margins, directly impacting its ability to absorb cost increases without passing them on to customers. These price variations can lead to higher production costs for tire manufacturers, which may be passed on to consumers, thus affecting overall demand. Companies in the OTR tire market must continuously adapt to these fluctuations, which can reduce profit margins and hinder the affordability of tires, particularly for industries such as construction and agriculture that rely heavily on cost-effective solutions.

Counterfeit Products and Quality Concerns

The presence of counterfeit tires in the Turkish market represents another significant challenge. Counterfeit OTR tires, often made with substandard materials, pose serious safety risks to users and negatively affect the reputation of legitimate tire manufacturers. These low-quality products can cause higher maintenance costs, reduced efficiency, and even accidents, leading to significant operational disruptions. The proliferation of counterfeit tires, coupled with limited enforcement of intellectual property rights, further complicates the market for genuine, high-quality OTR tire products. Addressing these quality concerns is crucial for ensuring the safety and reliability of tires used in demanding applications like mining and construction.

Regulatory Compliance and Environmental Standards

Regulatory compliance is another challenge facing the OTR tire market in Turkey. The growing emphasis on sustainability and environmental regulations requires tire manufacturers to adopt eco-friendlier production methods and meet stricter emissions standards. While this trend is beneficial in the long term, the initial costs of transitioning to greener technologies can be prohibitive for some manufacturers. Additionally, the disposal of used tires remains a significant environmental issue, as improper disposal can lead to pollution and landfills. Manufacturers must invest in recycling programs and adopt sustainable practices to meet both local and international environmental standards, which can strain resources and increase operational costs.

Economic Uncertainty

Economic uncertainty in Turkey, including inflation and currency fluctuations, adds another layer of complexity to the OTR tire market. As businesses face rising costs of raw materials and labor, the purchasing power of end-users can be reduced, particularly in industries that operate on tight budgets. Economic instability can lead to delayed or canceled projects, particularly in sectors like construction and mining, which rely heavily on OTR tires for their equipment. This uncertainty can result in a sluggish market, making it challenging for manufacturers and distributors to predict demand and maintain stable growth.

Market Opportunities:

The Turkey Off-the-Road (OTR) tire market presents significant opportunities, particularly in emerging sectors such as renewable energy and electric vehicle (EV) infrastructure. As Turkey continues to invest in renewable energy projects, including wind and solar farms, the demand for specialized machinery and equipment is increasing. This growth opens opportunities for OTR tire manufacturers to provide tires tailored for these high-performance machines, which are often used in rugged and remote environments. Additionally, the rise of electric vehicles, including electric construction equipment, presents new opportunities for tire manufacturers to design and produce tires that cater to this evolving market. As both sectors grow, demand for durable, high-performance tires will increase, creating a significant market opportunity for manufacturers to capitalize on.

Turkey’s strategic geographic location positions it as a gateway between Europe, Asia, and the Middle East, providing substantial export potential for the OTR tire market. As Turkey continues to grow its industrial base and strengthen its position as a global manufacturing hub, there is an opportunity for local tire producers to expand their reach beyond the domestic market. The rising demand for OTR tires in neighboring countries, particularly in the Middle East and Eastern Europe, offers a chance to increase exports. Additionally, Turkey’s growing construction and mining sectors, paired with its investment in infrastructure, create a consistent demand for OTR tires, presenting a stable market for long-term growth. Manufacturers can take advantage of these regional dynamics to strengthen their market presence both domestically and internationally.

Market Segmentation Analysis:

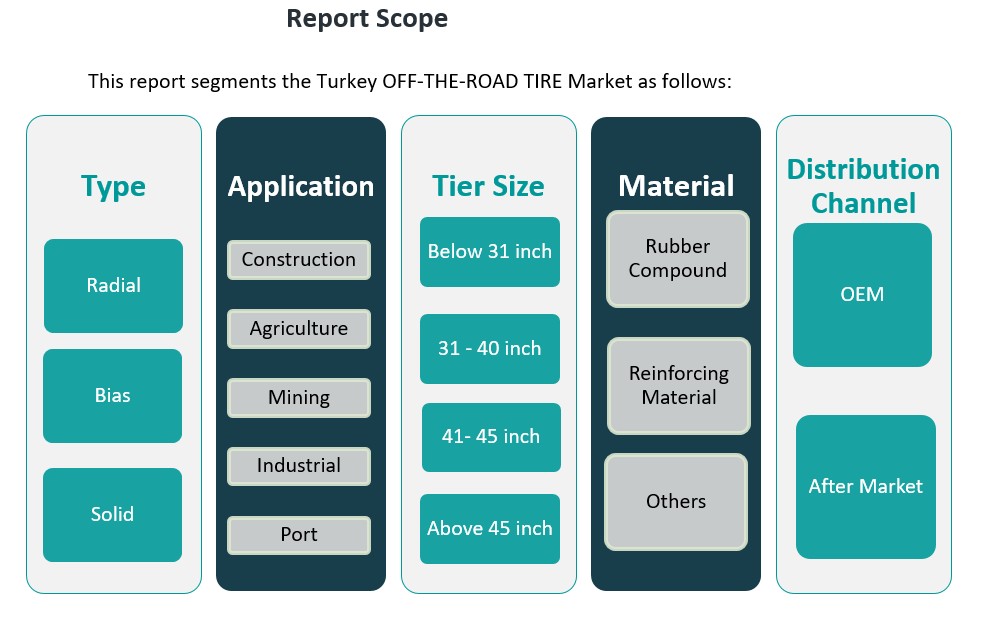

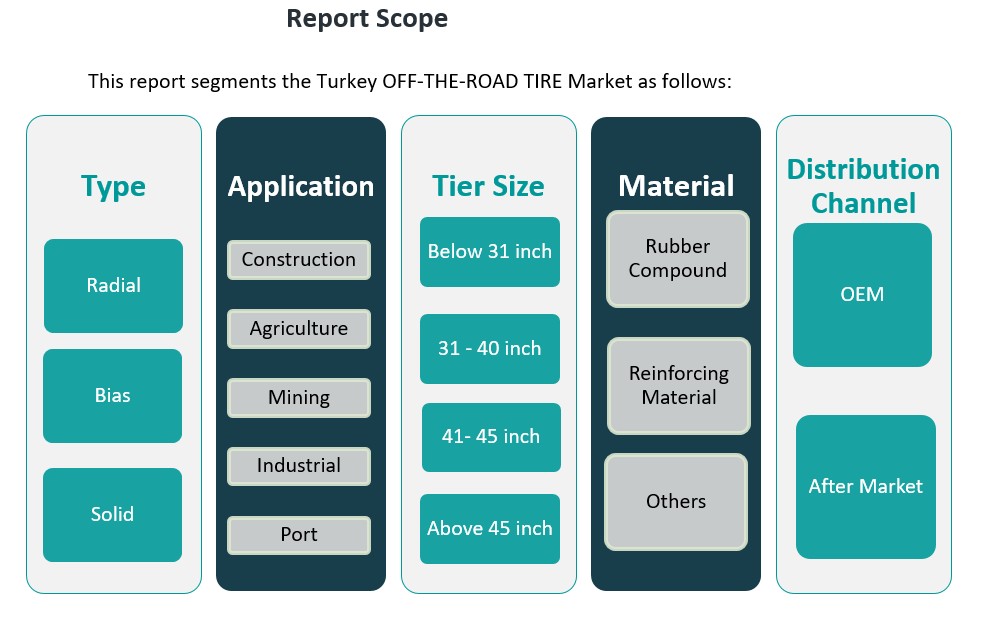

The Turkey Off-the-Road (OTR) tire market can be segmented across various dimensions, including type, application, tier size, material, and distribution channel, each offering distinct growth opportunities.

By Type Segment

The OTR tire market in Turkey is primarily categorized into radial, bias, and solid tires. Radial tires are gaining significant traction due to their durability, fuel efficiency, and longer lifespan, making them popular in sectors such as construction and mining. Bias tires, while less efficient, are still widely used for applications requiring robust performance in difficult terrains. Solid tires are increasingly being used in industrial applications, where high durability and resistance to punctures are essential, especially in port and industrial environments.

By Application Segment

The demand for OTR tires varies across several key applications: construction, agriculture, mining, industrial, and port operations. The construction sector is the largest consumer of OTR tires due to the heavy machinery required for large-scale infrastructure projects. Agriculture, with the adoption of mechanized farming equipment, also contributes significantly to demand. The mining industry relies on OTR tires for heavy-duty trucks and machinery used in resource extraction, while industrial and port applications drive demand for tires capable of handling high loads and harsh operating environments.

By Tier Size Segment

Tier size plays a crucial role in determining the types of tires required. Tires below 31 inches are generally used in lighter machinery, while tires in the 31-40-inch range are prevalent in construction equipment. Larger tires, particularly those above 45 inches, are in high demand in the mining and heavy-duty industrial sectors, where substantial weight-bearing capacity is needed.

By Material Segment

The material segment includes rubber compounds, reinforcing materials, and others. Rubber compounds are the primary material, offering essential durability and performance, while reinforcing materials, such as steel and fabric, enhance the strength and longevity of OTR tires.

By Distribution Channel Segment

OTR tires in Turkey are distributed through OEM (Original Equipment Manufacturer) and aftermarket channels. OEM sales dominate, driven by direct tire supply to manufacturers of construction and mining equipment. However, the aftermarket segment is also growing, as businesses seek replacement tires and upgrades for their existing machinery.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The Turkey Off-the-Road (OTR) tire market exhibits regional dynamics influenced by sector-specific demands and infrastructure development. While precise market share percentages by region are not publicly available, general trends can be observed based on industrial activities and regional economic focuses.

Marmara Region

The Marmara region, encompassing Istanbul and its surrounding provinces, stands as a significant contributor to Turkey’s OTR tire market. This area is a hub for industrial activities, including construction, manufacturing, and logistics. The ongoing urbanization and infrastructure projects in Istanbul and neighboring cities drive the demand for OTR tires, particularly in construction and industrial applications. The presence of major ports and logistics centers further amplifies the need for robust tires capable of supporting heavy-duty vehicles operating under demanding conditions.

Aegean and Mediterranean Regions

The Aegean and Mediterranean regions, with cities like Izmir and Mersin, are pivotal in Turkey’s agricultural sector. The mechanization of agriculture in these areas has led to an increased demand for OTR tires suited for agricultural machinery. Additionally, the Mediterranean region’s expanding infrastructure projects contribute to the demand for construction-related OTR tires. These regions benefit from a combination of agricultural and industrial activities, fostering a diverse market for OTR tires.

Central Anatolia and Eastern Anatolia Regions

Central Anatolia, including cities like Konya, and Eastern Anatolia are known for their agricultural activities. The adoption of mechanized farming equipment in these regions necessitates durable OTR tires designed for agricultural machinery. While these areas may not have the same level of industrial activity as the Marmara region, the agricultural sector’s reliance on specialized tires presents a steady demand for OTR products.

Black Sea Region

The Black Sea region, with its unique terrain and emphasis on agriculture, particularly hazelnut and tea cultivation, drives the need for OTR tires tailored for specific agricultural applications. The region’s focus on specialized farming equipment creates a niche market for OTR tires designed to perform under the region’s specific agricultural conditions.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

- Lassa Tire

Competitive Analysis:

The Turkey Off-the-Road (OTR) tire market is highly competitive, with several global and regional players vying for market share. Major international tire manufacturers such as Michelin, Bridgestone, and Goodyear dominate the market, offering a broad range of OTR tires designed for various applications, including construction, mining, and agriculture. These companies leverage their technological expertise, global distribution networks, and strong brand recognition to maintain a competitive edge. Local players also play a significant role in the market, catering to specific regional demands with tailored solutions. Turkish manufacturers such as Petlas and Kirov contribute to the market by offering cost-effective alternatives, often focused on the agricultural and industrial segments. The competition is driven by factors such as price sensitivity, product innovation, and the ability to provide durable tires suited for Turkey’s diverse terrain and demanding operational environments. The focus on enhancing tire longevity and performance is crucial for maintaining market leadership.

Recent Developments:

- In January 2025, Maxam Tire expanded its product portfolio by launching a new line of rubber tracks for construction equipment, introducing three versatile models—MT130, MT150, and MT170 designed to perform across a variety of surface conditions and applications. This launch marks Maxam’s commitment to continuous innovation in the OTR tire industry, further supported by new features in the MAXAM Mobile App to assist contractors in selecting and managing their equipment needs.

- In March 2025, Linglong Tire showcased its latest advancements at TyreXpo Asia 2025, presenting its core product segments, including OTR tires, and unveiling a new concept tire composed mostly of sustainable materials. This move underscores Linglong’s strategy to focus on eco-friendly and sustainable tire solutions, alongside significant investments in research and development. The company also used the event to strengthen international partnerships, including football sponsorships with prominent European clubs.

- In March 2024, Goodyear, a major global tire manufacturer, introduced the RL-5K OTR tire, which features a three-star load capacity rating. This new product is designed for heavy-duty loaders and wheel dozers, offering enhanced durability and operational performance for demanding off-the-road applications. The RL-5K tire launch demonstrates Goodyear’s ongoing commitment to advancing OTR tire technology, with a focus on efficiency, durability, and performance for industrial and construction equipment.

Market Concentration & Characteristics:

The Turkey Off-the-Road (OTR) tire market exhibits moderate concentration, with a blend of global and domestic manufacturers catering to diverse industrial needs. International brands such as Michelin, Bridgestone, Goodyear, and Pirelli dominate the high-end segment, particularly in construction and mining applications, leveraging advanced technology and global supply chains. Local players like Petlas and Kirov offer cost-effective alternatives, focusing on the agricultural and industrial sectors. This dual presence fosters a competitive environment, balancing premium offerings with value-driven solutions. The market is characterized by a growing preference for radial tires, which account for over 60% of total sales, due to their superior durability and fuel efficiency. The OEM segment leads in sales, driven by direct supply to equipment manufacturers, while the aftermarket segment is expanding as industries seek replacement tires. Technological advancements, such as the integration of sensors for real-time monitoring and the development of eco-friendly tires, are becoming increasingly prevalent. These trends reflect the market’s responsiveness to technological innovation and sustainability demands. Overall, the Turkey OTR tire market is evolving towards higher performance, sustainability, and technological integration, presenting opportunities for both established and emerging players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for OTR tires is expected to rise as Turkey invests in large-scale infrastructure projects, driving construction machinery usage.

- Increased mechanization in agriculture will continue to propel the market for agricultural OTR tires, especially in rural regions.

- The mining sector’s growth will sustain the need for heavy-duty tires designed to handle extreme operating conditions.

- Advancements in tire technology, such as improved durability and fuel efficiency, will be critical in meeting market demands.

- The shift towards radial tires will gain momentum due to their superior performance and longer lifespan.

- E-commerce platforms will play an increasingly important role in the distribution of OTR tires, expanding accessibility for businesses.

- Eco-friendly and sustainable tire solutions will grow in importance as manufacturers address environmental concerns.

- The demand for smart tires with IoT sensors will rise to optimize performance and reduce maintenance costs.

- Local manufacturers will continue to cater to cost-sensitive markets, offering competitive alternatives to global brands.

- Regional market growth in areas like Marmara and Central Anatolia will drive sector-specific demand for specialized OTR tires.