| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Compression Sportswear Market Size 2024 |

USD 1,322.62 Million |

| U.S. Compression Sportswear Market, CAGR |

6.90% |

| U.S. Compression Sportswear Market Size 2032 |

USD 2,254.82 Million |

Market Overview

U.S. Compression Sportswear Market size was valued at USD 1,322.62 million in 2024 and is anticipated to reach USD 2,254.82 million by 2032, at a CAGR of 6.90% during the forecast period (2024-2032).

The U.S. compression sportswear market is driven by the growing awareness of health and fitness, with more individuals engaging in sports and physical activities. The demand for products that enhance performance, reduce muscle fatigue, and accelerate recovery is rising. Advances in fabric technology, such as moisture-wicking, breathability, and durability, are further boosting market growth. Additionally, the increasing popularity of fitness influencers and athletes endorsing compression wear contributes to consumer confidence. The trend toward athleisure and the shift towards active lifestyles among various age groups also support market expansion. Furthermore, the growing recognition of the therapeutic benefits of compression wear, including improved circulation and muscle support, is driving adoption among both professional athletes and recreational users. The combination of performance benefits, technological innovations, and changing consumer behavior are key factors fueling the market’s growth.

The U.S. compression sportswear market exhibits strong regional demand, driven by increasing fitness awareness and the adoption of active lifestyles. Key players in the market, such as Under Armour, Nike, and Columbia Sportswear, dominate the landscape by offering innovative products that cater to different athletic needs, from performance enhancement to recovery support. Regional trends show significant growth in the Western and Northeastern U.S., where activewear is highly integrated into daily life, while the Southern and Midwestern U.S. also experience steady demand due to outdoor activities and fitness culture. These companies are constantly innovating in fabric technology, expanding their product portfolios, and leveraging endorsements from athletes to maintain a competitive edge. Smaller players like 2XU, CW-X, and Zensah are also contributing to the market by focusing on specialized compression wear for niche segments, further intensifying the competition.Bottom of Form

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. compression sportswear market was valued at USD 1,322.62 million in 2024 and is expected to reach USD 2,254.82 million by 2032, growing at a CAGR of 6.90% during the forecast period.

- Increasing fitness awareness and a growing interest in active lifestyles are key drivers propelling the demand for compression sportswear.

- Advancements in fabric technology, such as moisture-wicking and breathability features, are contributing to market growth.

- The rise of smart compression wearables and the expanding athleisure trend are significant market trends.

- Intense competition from major players like Under Armour, Nike, and smaller brands such as Zensah and CW-X is shaping the market landscape.

- High product costs and limited awareness in certain regions present market restraints for wider adoption.

- The market is expanding across regions, with strong demand in the Western and Northeastern U.S., driven by active communities and fitness trends.

Report Scope

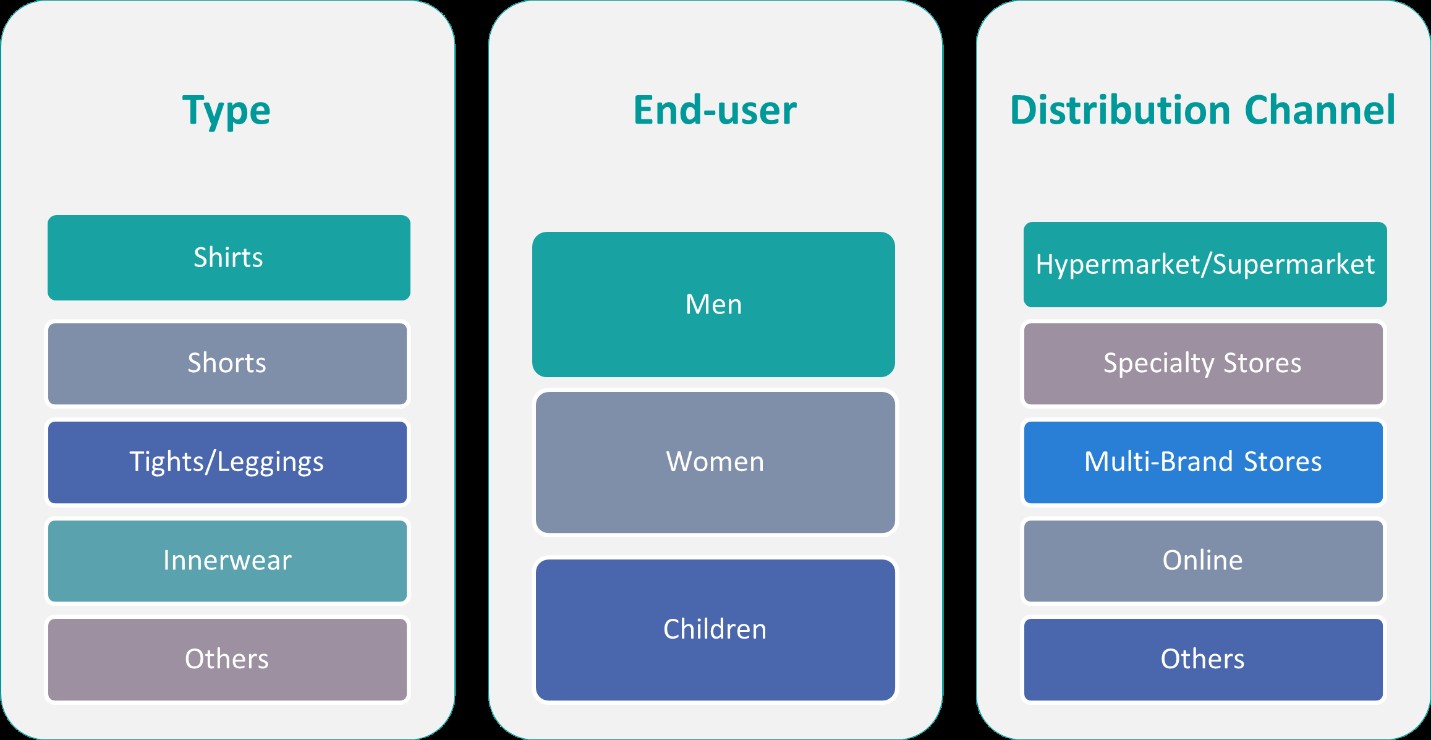

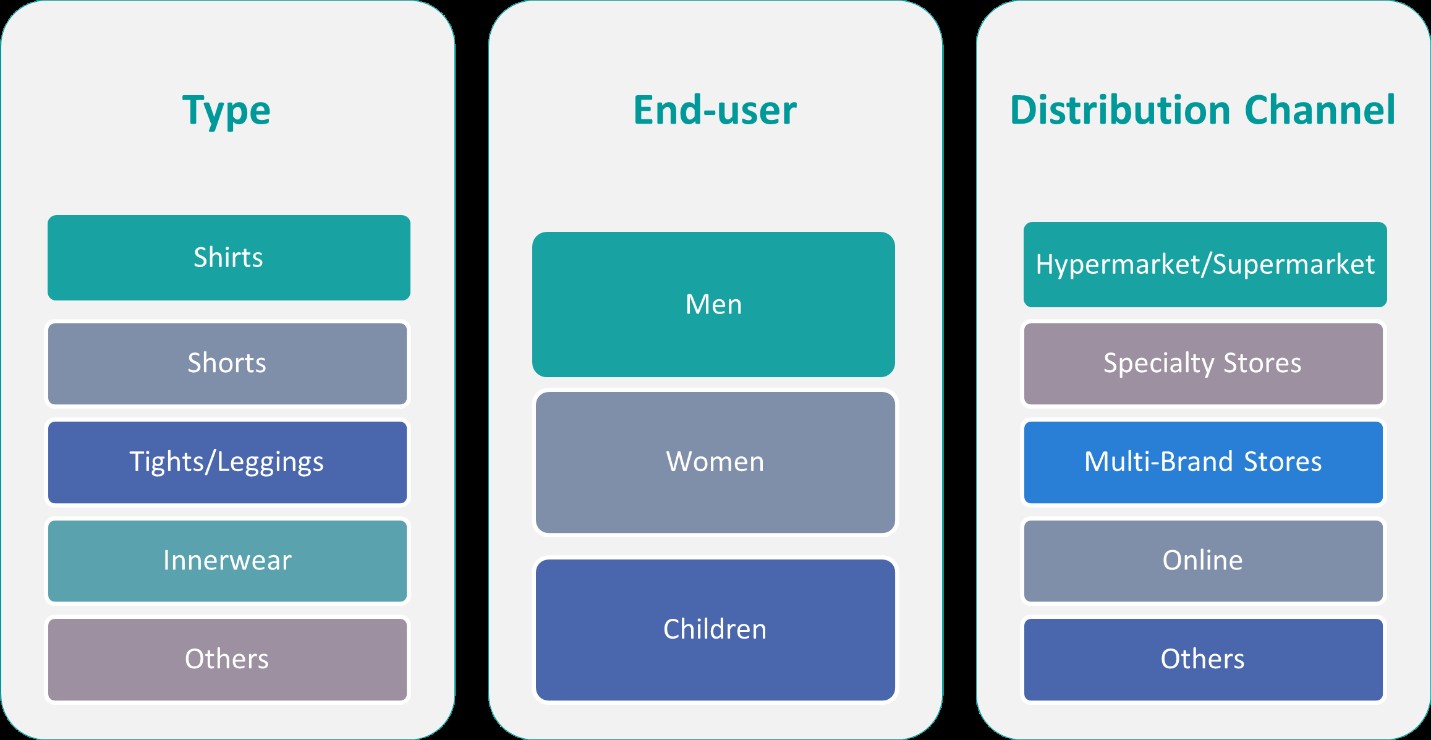

This report segments the U.S. Compression Sportswear Market as follows:

Market Drivers

Growing Awareness of Fitness and Sports Activities

The increasing focus on health and fitness is one of the primary drivers behind the growth of the U.S. compression sportswear market. As more individuals adopt active lifestyles, they seek products that can improve their exercise performance, reduce the risk of injury, and support quicker recovery. For instance, the rise of digital fitness platforms and social media influencers promoting active lifestyles has encouraged more people to engage in regular exercise, contributing to the growing demand for compression sportswear. Compression sportswear, such as shirts, shorts, and leggings, is widely recognized for its ability to enhance blood circulation and provide muscle support, which appeals to both professional athletes and fitness enthusiasts. This growing interest in fitness activities, coupled with the desire to achieve optimal performance, continues to drive the demand for compression wear.

Advancements in Fabric Technology

Technological innovations in fabric design have played a significant role in the growth of the compression sportswear market. Modern compression garments are designed using advanced materials that offer benefits such as moisture-wicking, breathability, and enhanced durability. For example, the development of fibers like NEOLAST by Celanese and Under Armour provides improved stretch, durability, and wicking properties, enhancing the performance and comfort of compression wear. The use of specialized fabrics that provide targeted compression at strategic areas of the body has further improved the functionality of compression sportswear, making it more appealing to consumers. These advancements in fabric technology have greatly enhanced the appeal of compression garments for a broader range of athletes and fitness enthusiasts, fueling market expansion.

Influence of Athleisure Trend

The growing athleisure trend, where individuals incorporate athletic wear into their everyday wardrobe, has also been a driving force for the compression sportswear market. Compression garments are not only used for sports and fitness activities but are increasingly being worn as part of casual or streetwear due to their comfort, style, and functional benefits. As consumers become more health-conscious and prioritize comfort in their daily attire, the demand for high-quality compression wear that can be used both for physical activity and as part of a casual outfit continues to rise. This trend has expanded the market beyond athletes, reaching a wider audience and further accelerating growth.

Increased Awareness of Health Benefits

The therapeutic benefits of compression wear are increasingly recognized among both athletes and individuals dealing with specific health concerns. Compression garments are known to improve circulation, reduce muscle fatigue, and aid in recovery after intense physical activity. Additionally, they are often recommended for individuals suffering from conditions such as arthritis, deep vein thrombosis, and muscle soreness. As more people learn about the health benefits associated with compression wear, there is growing adoption among not only athletes but also the general population seeking ways to improve their well-being. This heightened awareness of the health advantages of compression sportswear is contributing significantly to the market’s expansion.

Market Trends

Increased Adoption of Smart Compression Wear

A notable trend in the U.S. compression sportswear market is the rise of smart compression garments. These advanced wearables integrate sensors and other smart technology to monitor an individual’s performance, muscle activity, and recovery metrics in real-time. Smart compression wearables provide data on heart rate, muscle fatigue, and sweat levels, allowing athletes to optimize their workouts and recovery processes. This trend aligns with the growing interest in wearable technology and fitness tracking devices, further propelling the demand for high-tech compression garments that provide personalized insights for improved performance and health monitoring.

Expansion of Product Range and Customization Options

The U.S. compression sportswear market is also seeing an expansion in the variety of products available, offering more options for specific athletic needs. Compression garments are no longer limited to basic leggings and shirts; brands are introducing specialized items like compression socks, arm sleeves, and knee supports, catering to a wider range of sports and fitness activities. For example, companies like Bandages Plus offer custom compression garments tailored to individual needs, including custom arm sleeves and leg sleeves, which provide precise compression and support for various medical conditions and athletic activities. Moreover, many brands now offer customizable compression garments that allow athletes to select different levels of pressure for targeted muscle support. This growing product diversification and the ability to personalize compression wear are meeting the specific needs of various athletes, leading to broader adoption across different sports disciplines and fitness levels.

Sustainability and Eco-Friendly Materials

Sustainability is becoming an important trend in the U.S. compression sportswear market, as consumers increasingly prioritize environmentally friendly products. Many sportswear brands are focusing on using sustainable materials such as recycled fabrics, organic cotton, and biodegradable textiles for their compression garments. Additionally, eco-friendly manufacturing processes, including reduced water consumption and lower carbon emissions, are gaining traction. Consumers are becoming more conscious of the environmental impact of their purchases, and brands are responding by offering compression wear that not only benefits athletes’ performance but also contributes to sustainability. This growing demand for eco-conscious products is helping shape the future of the compression sportswear market.

Rise of Influencer Marketing and Social Media Influence

Social media and influencer marketing have become powerful tools for driving consumer interest and awareness in the U.S. compression sportswear market. Athletes, fitness influencers, and celebrities are increasingly endorsing compression wear on platforms like Instagram, YouTube, and TikTok. For example, the influence of social media on consumer behavior is evident in how fitness trends and product endorsements by popular influencers can quickly go viral, driving consumer purchases and brand visibility. Their reach and credibility help educate a broader audience about the benefits of compression garments, driving consumer purchases. This trend is particularly influential among younger consumers who are more likely to engage with social media content and are heavily influenced by trends in fitness culture. As social media continues to play a key role in shaping consumer behavior, the visibility of compression sportswear through influencer collaborations will likely continue to fuel market growth.

Market Challenges Analysis

High Cost of Premium Products

One of the key challenges facing the U.S. compression sportswear market is the high cost associated with premium compression garments. While these products offer significant performance and recovery benefits, they often come at a premium price. This can limit accessibility for a broader consumer base, particularly for budget-conscious individuals or those new to fitness. As a result, the market faces price sensitivity, with some consumers opting for lower-cost alternatives that may not offer the same level of effectiveness. The challenge for brands is to balance product quality with affordability while ensuring that compression wear remains accessible to a wide range of consumers.

Intense Market Competition

The U.S. compression sportswear market is highly competitive, with numerous brands vying for consumer attention and market share. Established sportswear companies, such as Nike, Under Armour, and Adidas, dominate the market with their well-recognized product lines, making it difficult for smaller brands to stand out. For example, the presence of strong retail networks and strategic partnerships allows these brands to maintain a robust market presence, intensifying competition for new entrants. Additionally, the influx of new entrants and startups in the compression wear space has intensified competition. As a result, brands must invest heavily in marketing, innovation, and differentiation to stay relevant and capture the attention of consumers. This competitive landscape presents a challenge for companies looking to maintain profitability and secure long-term growth in an increasingly crowded market.

Market Opportunities

The U.S. compression sportswear market presents several growth opportunities driven by the increasing popularity of fitness and wellness. As more individuals embrace active lifestyles, there is an opportunity for brands to expand their product offerings to cater to a wider range of consumers, from casual fitness enthusiasts to professional athletes. By introducing innovative and specialized compression wear tailored to specific sports or fitness activities, companies can tap into niche markets. Additionally, the growing trend of athleisure provides an opportunity for compression wear to be marketed as functional yet stylish apparel suitable for both workouts and everyday use. This diversification allows brands to reach a broader audience and boost sales across various demographics.

Moreover, the rise of wearable technology presents a significant opportunity for companies to integrate smart features into compression sportswear. By incorporating sensors and data analytics, smart compression garments can monitor real-time performance metrics such as muscle activity, heart rate, and recovery rates. This technology offers consumers valuable insights to enhance their workouts and recovery processes, creating a strong competitive advantage for companies that innovate in this area. Additionally, with the increasing focus on sustainability, brands have an opportunity to differentiate themselves by offering eco-friendly compression wear made from recycled or biodegradable materials. As consumers become more environmentally conscious, the demand for sustainable products will continue to grow, providing companies with an opportunity to appeal to this eco-aware consumer segment.

Market Segmentation Analysis:

By Product Type:

The U.S. compression sportswear market is segmented by product type into shirts, shorts, tights/leggings, innerwear, and other categories. Among these, tights/leggings hold the largest share due to their widespread use in various physical activities, including running, yoga, and strength training. These garments are preferred for their flexibility, comfort, and ability to provide targeted muscle compression, aiding in improved performance and recovery. Shirts and shorts also contribute significantly to the market, especially for athletes and fitness enthusiasts who seek compression wear for upper body and lower body support. Innerwear, such as compression bras and boxers, is gaining traction, particularly for women who prefer specialized support during physical activities. The “others” category includes accessories such as arm sleeves and knee supports, which are gaining popularity for their targeted compression benefits. As consumers demand greater variety and functionality from compression wear, brands are increasingly diversifying their product lines to cater to specific athletic needs.

By End- User:

The U.S. compression sportswear market is also segmented by end-user, with key categories including men, women, and children. Men dominate the market, driven by their higher participation in fitness activities and sports, as well as a greater preference for compression wear to improve athletic performance and muscle recovery. Women’s segment is growing rapidly due to the increasing number of female athletes and fitness enthusiasts who prioritize both performance and comfort. Compression wear for women, such as leggings, shirts, and sports bras, is designed to cater to specific body shapes and support needs, further driving demand. The children’s segment, though smaller, is emerging, with parents increasingly opting for compression wear to enhance comfort and support during their children’s sports activities. As the market for compression sportswear expands, catering to the unique needs of different age groups and genders will be crucial for sustained growth.

Segments:

Based on Product Type:

- Shirts

- Shorts

- Tights/Leggings

- Innerwear

- Others

Based on End- User:

Based on Distribution Channel:

- Hypermarket/Supermarket

- Specialty Stores

- Multi-Brand Stores

- Online

- Others

Based on the Geography:

- Western United States

- Midwestern United States

- Southern United States

- Northeastern United States

Regional Analysis

Western United States

The U.S. compression sportswear market is experiencing robust growth across various regions, with the Western United States holding the largest market share. This region accounts for approximately 30% of the total market, driven by a high concentration of health-conscious consumers, outdoor enthusiasts, and athletes. States like California, Oregon, and Washington are major contributors, as they have well-established fitness cultures and a growing interest in activewear. Additionally, the prevalence of tech innovation and wearable fitness technology in the region further drives the demand for compression sportswear, particularly products integrated with smart features for performance tracking and recovery.

Midwestern United States

In the Midwestern United States, the market share is around 25%. This region, encompassing states like Illinois, Michigan, and Ohio, is witnessing a steady rise in the adoption of compression wear. Growing awareness of the benefits of compression sportswear, coupled with a strong presence of sports teams and fitness clubs, contributes to its expanding popularity. The region’s middle-income demographic is also more likely to invest in compression wear, particularly in urban centers with higher disposable income. As health and wellness trends continue to gain traction, the demand for compression products in the Midwest is expected to grow consistently.

Southern United States

The Southern United States holds approximately 20% of the market share, with states like Texas, Florida, and Georgia leading the demand for compression sportswear. The region’s market growth is fueled by a combination of high temperatures, which make breathable, moisture-wicking compression wear essential, and the increasing participation in outdoor activities such as running, cycling, and sports. Additionally, the Southern U.S. has a large population of fitness enthusiasts and athletes, further boosting the demand for compression garments designed to support performance and recovery. The trend toward athleisure in Southern states is also contributing to the market’s growth.

Northeastern United States

The Northeastern United States accounts for the remaining 25% of the market share. With states like New York, Pennsylvania, and Massachusetts, the Northeast has a diverse demographic that includes both urban and suburban populations. High levels of physical activity, especially in metropolitan areas, drive the demand for compression sportswear. Additionally, the increasing awareness of health and fitness benefits, particularly among younger consumers, is fueling growth. Athleisure and performance wear are increasingly seen as staples in daily wardrobes, contributing to the demand for compression wear in this region. The Northeast is expected to maintain steady growth, particularly in areas with strong sports communities and fitness trends.

Key Player Analysis

- Under Armour, Inc.

- Nike Inc.

- Columbia Sportswear Company

- YONEX Co. Ltd.

- PVH Corp.

- 2XU

- A4 Sportswear

- Augusta Sportswear

- Craft

- CW-X

- Zensah

- Pacterra Athletics

Competitive Analysis

The U.S. compression sportswear market is highly competitive, driven by a blend of global giants and specialized athletic brands. Leading players such as Under Armour, Inc., Nike Inc., Columbia Sportswear Company, YONEX Co. Ltd., PVH Corp., 2XU, A4 Sportswear, Augusta Sportswear, Craft, CW-X, Zensah, and Pacterra Athletics collectively shape the market landscape. These key players compete on factors such as product innovation, brand recognition, and technological advancements in fabric and design. The industry is driven by continuous advancements in compression technology, including moisture-wicking fabrics, muscle support features, and ergonomic designs aimed at enhancing athletic performance and recovery. High brand loyalty and premium pricing strategies characterize the competitive environment, with established brands leveraging strong distribution networks, strategic partnerships, and athlete endorsements to maintain market dominance. At the same time, smaller and emerging brands focus on innovation, sustainability, and specialized product lines to differentiate themselves and capture niche market segments. The market also reflects a growing emphasis on athleisure trends, driving competition beyond functionality into lifestyle and fashion categories. As consumer demand evolves, competition intensifies around factors such as product customization, eco-friendly materials, and digital engagement strategies.

Recent Developments

- In February 2025, Adidas AG launched several new products, including the Lightblaze shoe and the Mystic Victory pack for football boots. Adidas continues to focus on innovative designs and collaborations.

- In January 2025, Nike showcased innovative recovery footwear at CES 2025, featuring compression and heat technology, and is also developing a compression and heat vest as part of its wearable line, collaborating with Hyperice to boost athlete warm-up and recovery.

Market Concentration & Characteristics

The U.S. compression sportswear market is characterized by moderate to high market concentration, with a few dominant players such as Nike, Under Armour, and Adidas holding significant market shares. These key brands leverage strong brand equity, advanced product innovation, and extensive distribution networks to maintain competitive advantages. The market exhibits characteristics of premium pricing strategies, driven by product differentiation in terms of fabric technology, performance enhancement, and ergonomic design. Consumer demand is influenced by growing health awareness, increasing participation in fitness and sports activities, and the rising popularity of athleisure fashion. Additionally, the market is marked by continuous innovation, with a focus on moisture-wicking materials, muscle support features, and compression technology aimed at improving athletic performance and recovery. Barriers to entry remain relatively high due to established brand loyalty, economies of scale, and significant marketing investments. However, niche brands and emerging startups continue to challenge incumbents by targeting specialized consumer segments and sustainability trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. compression sportswear market will continue to grow, driven by increasing health consciousness and fitness participation.

- Demand for technologically advanced compression apparel will rise as consumers seek enhanced performance and recovery benefits.

- Athleisure trends will further blur the line between sportswear and casual wear, expanding the consumer base.

- Sustainability initiatives will shape product development, with brands focusing on eco-friendly materials and ethical production.

- Digitalization and e-commerce platforms will play a key role in market expansion and customer engagement.

- Collaborations with athletes and sports influencers will remain a crucial marketing strategy to boost brand visibility.

- Customized and size-inclusive compression apparel offerings will gain traction to cater to diverse consumer preferences.

- Innovation in fabric technology will continue, emphasizing comfort, breathability, and muscle support.

- Niche brands will challenge established players by targeting specific sports categories and performance needs.

- The market will experience steady consolidation as leading players acquire emerging brands to strengthen their market position.