Market Overview:

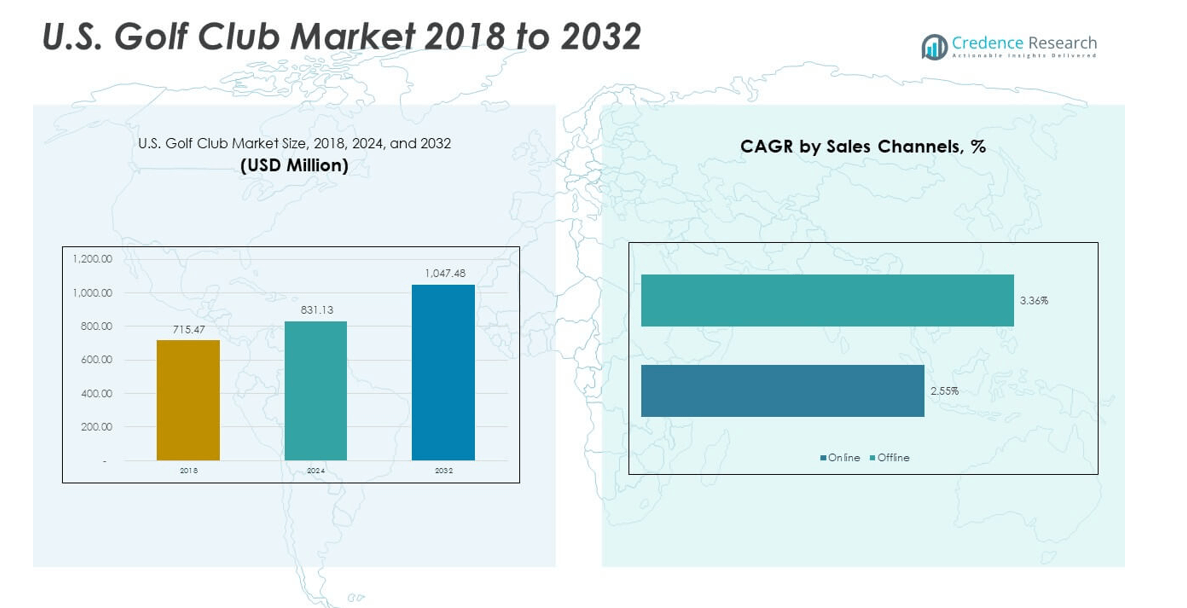

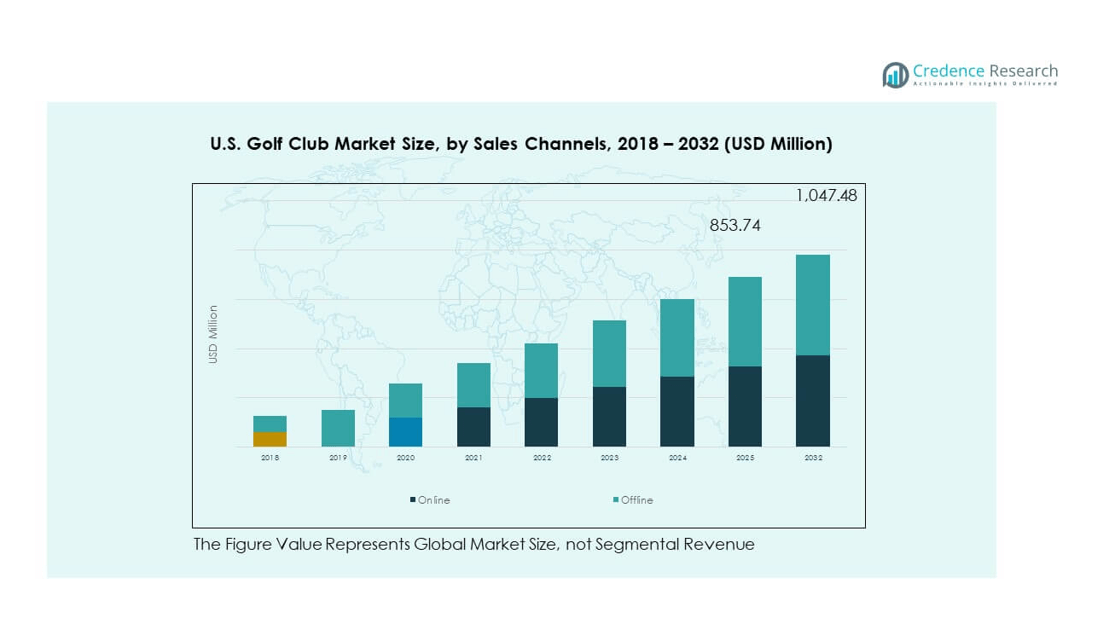

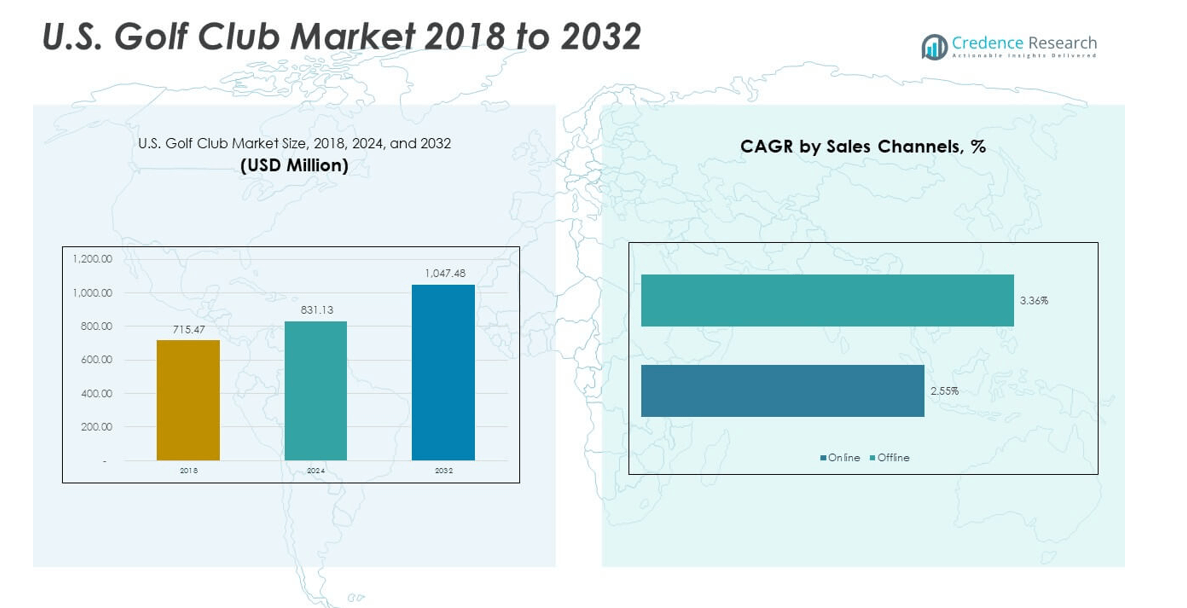

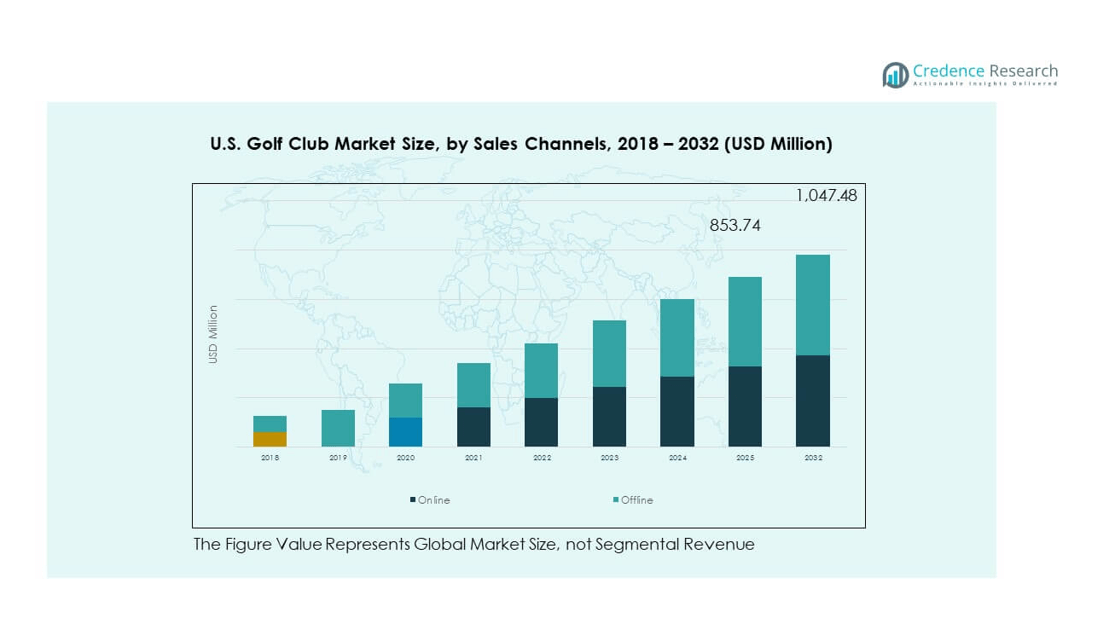

The U.S. Golf Club Market size was valued at USD 715.47 million in 2018 to USD 831.13 million in 2024 and is anticipated to reach USD 1,047.48 million by 2032, at a CAGR of 2.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Golf Club Market Size 2024 |

USD 831.13 million |

| U.S. Golf Club Market, CAGR |

2.93% |

| U.S. Golf Club Market Size 2032 |

USD 1,047.48 million |

The market growth is driven by the increasing popularity of golf as both a recreational and competitive sport, supported by rising participation across various age groups. Advancements in golf club design, incorporating lightweight materials and enhanced aerodynamics, are improving performance and attracting new players. Growing interest from younger demographics, coupled with the expansion of golf tourism and corporate golf events, is further fueling demand. Additionally, the influence of professional golf tournaments and celebrity endorsements is boosting brand visibility and product adoption.

Regionally, the U.S. golf club market demonstrates strong penetration across states with well-established golf traditions, including Florida, California, and Arizona, due to favorable climates and abundant golf course infrastructure. Emerging growth is observed in regions investing in new golf facilities and community sports programs, particularly in the Midwest and Southern states. The market’s expansion is also supported by increasing urban golf concepts and indoor golf simulators, enabling participation in areas with seasonal weather limitations.

Market Insights:

- The U.S. Golf Club Market was valued at USD 715.47 million in 2018, reached USD 831.13 million in 2024, and is projected to attain USD 1,047.48 million by 2032, registering a CAGR of 2.93% during the forecast period.

- The Global Golf Club Market size was valued at USD 3,154.4 million in 2018 to USD 3,736.7 million in 2024 and is anticipated to reach USD 4,835.6 million by 2032, at a CAGR of 3.31% during the forecast period.

- Growing participation across multiple age groups and demographic segments supports steady demand, with golf gaining popularity both recreationally and competitively.

- Advancements in club materials, including carbon composites and titanium alloys, enhance performance and fuel interest among amateur and professional players.

- High equipment costs and the availability of affordable alternatives restrain adoption among budget-conscious consumers.

- Seasonal dependency, particularly in colder states, limits outdoor play and reduces market activity during off-peak months.

- States such as Florida, California, and Arizona lead the market due to favorable climates, established golf culture, and strong course infrastructure.

- Emerging growth is seen in the Midwest and Southern states, driven by new golf facilities, community programs, and indoor simulator adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Engagement Through Expanding Golf Participation and Infrastructure Growth:

The U.S. Golf Club Market benefits from the growing interest in golf among diverse demographics. It gains momentum from expanding golf course infrastructure in both urban and suburban locations. Demand increases with the rising number of public courses, driving accessibility for amateur players. The influence of televised tournaments and professional player endorsements reinforces product visibility. Corporate events and golf tourism contribute to steady year-round sales. Lightweight materials and advanced designs improve player performance, encouraging repeat purchases. Indoor simulators extend play opportunities in regions with seasonal weather. It draws sustained interest by blending recreational appeal with competitive spirit.

- For instance, TaylorMade Golf reported significant player engagement increases tied to the proliferation of their advanced driver models such as the Stealth™ series, which utilize 60 layers of carbon fiber to optimize performance, underscoring the impact of innovation and visibility through high-profile endorsements and televised events.

Innovation in Golf Club Materials and Design Improving Player Performance:

Innovations in shaft composition, clubface engineering, and weight distribution are enhancing swing control. The U.S. Golf Club Market benefits from research-led product launches that target both amateurs and professionals. Manufacturers integrate carbon composites and titanium alloys to boost durability and precision. Consumer awareness of custom-fit clubs grows, creating demand for premium equipment. Digital fitting technologies refine product recommendations, strengthening customer loyalty. Retailers showcase new models with demonstrable performance gains. It adapts to evolving play styles through technology-driven enhancements. The link between improved technology and game performance ensures consistent demand growth.

- For instance, Callaway Golf introduced its Elyte Fairway Woods featuring Ai 10x faces and Step Sole technology, resulting in 57% less turf interaction compared to previous models and enabling higher launch and lower spin for increased distance and forgiveness.

Expanding Youth and Female Participation Broadening the Customer Base:

An increasing number of junior golf programs introduces the sport to younger audiences. The U.S. Golf Club Market gains from school-level tournaments and community outreach programs. Female participation rises through targeted marketing and inclusive club designs. Brands offer lighter shafts and optimized grips to suit diverse player profiles. Social media campaigns highlight relatable golf influencers, fostering engagement. Industry collaborations with sports academies strengthen entry-level adoption. It benefits from a more balanced demographic mix that supports long-term market sustainability. Sponsorships and grassroots programs ensure continuous player development pipelines.

Integration of Digital Tools and Data Analytics Enhancing User Experience:

The use of digital swing analysis tools influences purchase decisions. The U.S. Golf Club Market responds with clubs compatible with performance tracking devices. Manufacturers integrate sensors into grips and shafts for real-time feedback. Golfers seek equipment that pairs seamlessly with training apps. Retailers deploy launch monitors in fitting sessions to personalize recommendations. It aligns product innovation with the growing interest in measurable improvement. Data-driven insights empower both professionals and amateurs to refine techniques. Technology integration becomes a decisive factor in premium segment sales.

Market Trends:

Growing Popularity of Custom Fitting Services in Retail and Online Platforms:

Custom fitting becomes a mainstream expectation among serious golfers. The U.S. Golf Club Market witness’s strong adoption of advanced fitting technologies. Retail stores use motion capture and launch monitor systems to recommend ideal specifications. Online platforms offer virtual fitting consultations, increasing accessibility. Brands create modular designs that allow shaft and head adjustments. Consumers appreciate the enhanced comfort and improved accuracy from tailored equipment. It drives customer retention by delivering personalized experiences. This trend aligns with the premiumization of golf gear across key segments.

- For instance, Titleist fitting specialists now use TrackMan swing technology and advanced SureFit systems to optimize club specs, providing club recommendations based on real-time swing data, which has been widely adopted in both retail and indoor environments to ensure personalized solutions for all skill levels.

Expansion of Eco-Friendly Manufacturing and Sustainable Material Adoption:

Eco-conscious practices are influencing golf equipment production. The U.S. Golf Club Market adopts recycled metals, biodegradable grips, and low-impact coatings. Manufacturers highlight sustainability as a brand differentiator. Energy-efficient production facilities reduce operational footprints. Marketing campaigns emphasize environmental stewardship alongside performance. It appeals to younger demographics valuing responsible consumption. Regulatory pressure on material sourcing encourages industry compliance. The shift towards green manufacturing strengthens brand positioning.

- For instance, Ping has implemented renewable energy strategies that reduced energy consumption in its Arizona plant, while recycling of total manufacturing waste and minimizing use of hazardous materials by shifting to sustainable metals and recycled components.

Growth of Multi-Channel Sales Strategies Combining Retail and Digital Presence:

The blending of physical and online sales channels boosts accessibility. The U.S. Golf Club Market integrates showroom experiences with e-commerce convenience. Retailers offer click-and-collect options to bridge in-store and online engagement. Virtual reality demos showcase club performance before purchase. Exclusive online launches attract digitally active consumers. It enables brands to reach customers beyond traditional golf hubs. Partnerships with sporting goods marketplaces expand market coverage. Seamless channel integration supports consistent brand identity.

Increasing Influence of Lifestyle Branding and Fashion-Driven Designs:

Golf clubs are marketed alongside apparel and accessories for a complete lifestyle package. The U.S. Golf Club Market benefits from aligning with high-profile fashion brands. Limited-edition releases create exclusivity and collectible appeal. Influencer partnerships promote golf as a modern lifestyle choice. Aesthetic customization options, including colors and finishes, attract style-conscious buyers. It supports the sport’s evolution from traditional image to contemporary culture. Celebrity endorsements further enhance desirability among non-traditional players. Golf clubs become both performance tools and status symbols.

Market Challenges Analysis:

High Equipment Costs Limiting Wider Consumer Adoption:

Premium golf clubs often carry significant price tags, restricting adoption among budget-conscious players. The U.S. Golf Club Market faces pressure to justify these prices through innovation and performance benefits. Entry-level players may opt for used or lower-cost alternatives. Retailers must balance stocking high-margin premium models with accessible options. It encounters competition from rental programs offered at golf courses. Seasonal participation patterns reduce off-peak sales potential. Currency fluctuations can influence import costs for foreign-made components. High costs remain a barrier to consistent customer acquisition.

Seasonal Dependency and Shifting Consumer Leisure Preferences:

Participation levels in outdoor golf depend heavily on favorable weather conditions. The U.S. Golf Club Market experiences fluctuations in demand during off-seasons in colder states. Indoor simulators offer partial solutions but require substantial investment. Competing leisure activities, including esports and fitness classes, divert consumer spending. It must continuously innovate to keep golf relevant for younger audiences. Aging course infrastructure in some regions limits player engagement. Shifting cultural interests can influence long-term participation rates. Addressing these factors is critical for sustained growth.

Market Opportunities:

Rising Interest in Indoor and Simulator-Based Golf Experiences:

Urban golfers increasingly turn to simulator venues for year-round play. The U.S. Golf Club Market benefits from partnerships with these facilities. Brands position themselves as preferred suppliers for high-tech indoor setups. Club designs tailored for simulator environments create niche revenue streams. It captures demand from players seeking convenient practice options. Indoor golf’s social component appeals to younger demographics. This setting introduces golf to new audiences unfamiliar with traditional courses.

Expansion into Emerging Demographics and Untapped Regional Markets:

Targeting younger players and diverse ethnic groups presents growth potential. The U.S. Golf Club Market aligns marketing with inclusive community programs. Retailers identify underserved regions with limited golf retail presence. It leverages school partnerships to introduce golf early. Multilingual campaigns broaden audience reach. Emerging suburban developments often include golf facilities, boosting demand. Collaborations with local sports councils enhance brand visibility.

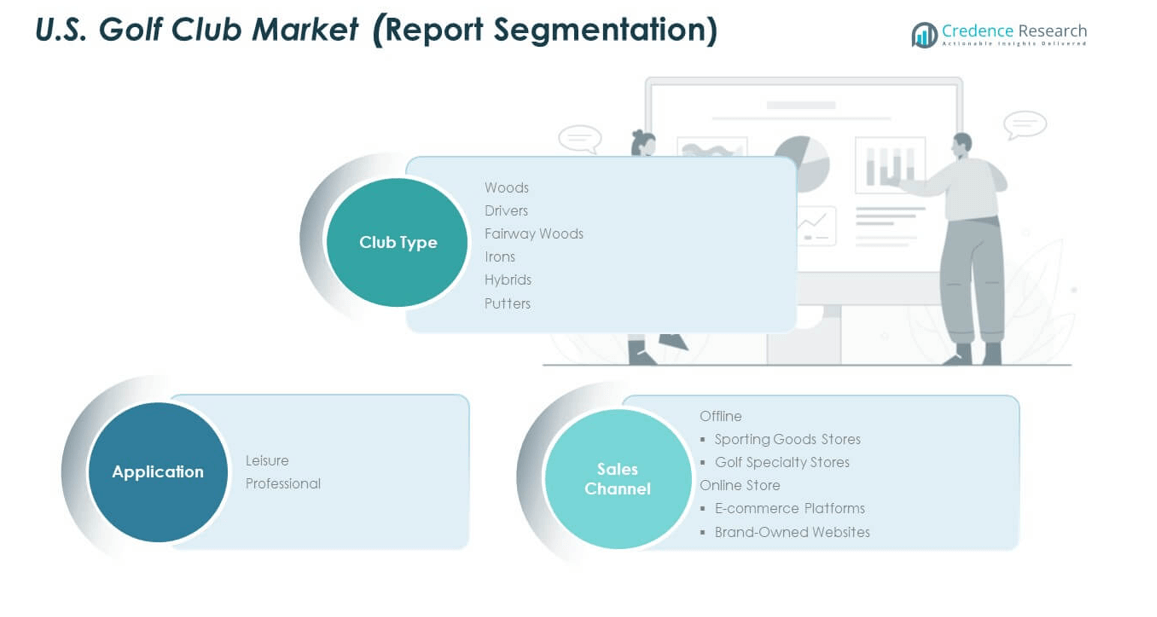

Market Segmentation Analysis:

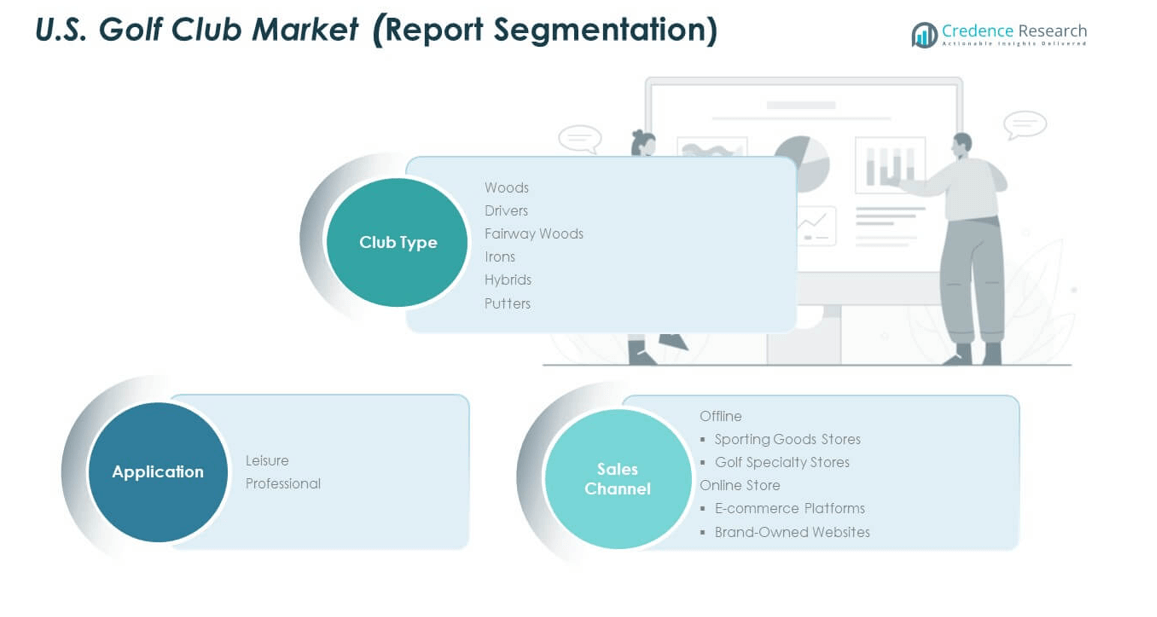

By Club Type

The U.S. Golf Club Market is segmented into woods, drivers, fairway woods, irons, hybrids, and putters. Woods and drivers dominate premium performance demand, supported by advanced material integration and aerodynamic designs that enhance distance. Fairway woods and hybrids attract versatile players seeking control and adaptability across varied course conditions. Irons maintain strong demand among both professionals and amateurs due to their precision and custom-fit availability. Putters, though smaller in market share, remain essential for all player categories, with innovations in alignment aids and weight balance sustaining interest.

- For instance, Cobra Golf’s 3D-printed irons achieved 100 grams of weight savings—roughly 36% of a 275-gram iron head—allowing redistributed tungsten weights for a lower center of gravity and enhanced forgiveness without compromising blade feel, benefiting professionals and amateurs alike.

By Application

The market is divided into leisure and professional segments. Leisure users represent the largest consumer base, driven by recreational participation and golf tourism growth. Professional players influence high-value sales through demand for precision-engineered, custom-fit clubs. Performance differentiation in this segment fuels technological advancements across the industry. It leverages professional endorsements to shape purchasing behavior among serious amateurs and aspirational players.

- For instance, tour professional Gary Woodland credited Cobra’s Aerojet driver for providing increased launch angle and comparable ball speed to his previous driver, resulting in greater drive distance and forgiveness on tour.

By Sales Channel

The market is categorized into offline, online, and others. Offline sales, including sporting goods stores and golf specialty stores, lead due to the importance of in-person fitting and testing experiences. Specialty stores maintain strong brand loyalty through personalized service and access to exclusive models. Online channels, including e-commerce platforms and brand-owned websites, are expanding rapidly by offering convenience, broader assortments, and competitive pricing. The “others” segment covers emerging retail formats and simulator-based sales, creating incremental opportunities. This multi-channel structure enables broad reach across both traditional and digitally engaged consumers.

Segmentation:

By Club Type

- Woods

- Drivers

- Fairway Woods

- Irons

- Hybrids

- Putters

By Application

By Sales Channel

- Offline

- Sporting Goods Stores

- Golf Specialty Stores

- Online Store

- E-commerce Platforms

- Brand-Owned Websites

- Others

Regional Analysis:

South – Largest Market Share Driven by Year-Round Play

The U.S. Golf Club Market sees its highest concentration in the South, holding approximately 38% of the total share. States such as Florida, Texas, and Georgia lead due to year-round favorable weather, a high density of golf courses, and a strong golfing tradition. Golf tourism and retirement communities create steady demand for both premium and mid-range clubs. The presence of large golf resorts and major PGA Tour events enhances visibility and drives seasonal sales peaks. It sustains strong volumes through recreational players, corporate events, and professional tournaments. Infrastructure investments and expanding community golf programs continue to strengthen the region’s position.

West – High-End Demand Supported by Tourism and Innovation

The West commands about 27% of the market, led by California, Arizona, and Nevada. Favorable climate conditions and a growing number of luxury golf facilities attract both domestic and international players. The region benefits from strong professional golfing activity and innovative retail environments showcasing advanced club technologies. Golf communities and resorts target affluent buyers seeking high-performance and custom-fit equipment. It capitalizes on a diverse customer base, including retirees, young professionals, and golf tourists. The rapid rise of simulator-based indoor golf venues in metropolitan areas further extends market reach and engagement.

Midwest and Northeast – Steady Participation Despite Seasonal Constraints

The Midwest and Northeast together hold around 35% market share, with the Midwest accounting for approximately 20% and the Northeast about 15%. The Midwest maintains a loyal golfing base supported by affordable public courses and competitive amateur tournaments. The Northeast features a mix of private clubs, historic courses, and high-income consumers willing to invest in premium products. Seasonal constraints in both regions limit outdoor play periods, but indoor simulators and winter leagues sustain off-season activity. It adapts to these market patterns through pre-season promotions and targeted indoor equipment offerings. The continued presence of golf associations and community engagement programs ensures consistent participation across both regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Haywood Golf

- BirTee Golf

- TaylorMade Golf Company

- Roger Cleveland Golf Company, Inc.

- Cleveland Golf

- Acushnet Company

- PXG

- Takomo Golf Company

- Golfsmith International Holdings, Inc.

- Wilson Sporting Goods Co.

- Other Key Players

Competitive Analysis:

The U.S. Golf Club Market features a competitive landscape shaped by a mix of established equipment manufacturers and emerging specialty brands. Major players like Callaway, TaylorMade, and Wilson maintain dominance through expansive distribution networks and continuous product innovation. Challenger brands such as PXG and bespoke putter specialists offer high-end, differentiated products that attract serious players seeking performance advantages. It responds to competitive pressure by investing in custom fitting services and digital technologies. Retailers and e‑commerce platforms compete through pricing strategies and exclusive model offerings. Specialist brands leverage social media and influencer engagement to gain traction among younger consumers. The market retains fluidity, with brand loyalty influenced by endorsements, technological edge, and adaptability to evolving player preferences.

Recent Developments:

- In July 2025, TaylorMade Golf Company electrified the market with the launch of its 2025 equipment lineup, including the Qi35 family of drivers and woods. The launch offers models for advanced and beginner golfers, featuring the P7TW irons and forgiving Qi HL irons. The new Spider Tour putters and extensive customization options have been praised in product demos and player endorsements for performance and innovation.

- In March 2025, Roger Cleveland Golf Company, Inc. sparked excitement as Roger Cleveland himself returned to the company he founded, stepping in as Founder and Advisor after his tenure at Callaway. This homecoming signals a renewed focus on design excellence and innovation, with Cleveland set to collaborate on new product creation and elevate the brand’s standing in clubmaking.

Market Concentration & Characteristics:

The U.S. Golf Club Market demonstrates moderate concentration, with a few major equipment makers commanding a large share while a growing number of niche and specialist brands capture premium segments. It balances mass-market demand facilitated through sporting goods chains with high-performance, custom-fit products sold via specialty stores and online platforms. The market reflects a dual structure: entrenched supply infrastructure offers scale and efficiency, while smaller players drive innovation and differentiation. It maintains dynamic competition through constant product evolution, targeted marketing, and direct-to-consumer channels that disrupt traditional retail models.

Report Coverage:

The research report offers an in-depth analysis based on club type, application, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising participation across youth, female, and senior demographics will expand the active player base.

- Continued innovation in materials and club design will enhance performance and drive premium product demand.

- Growth in golf tourism will sustain demand in states with strong course and resort infrastructure.

- Expansion of urban golf concepts and indoor simulators will improve year-round market accessibility.

- E-commerce growth and direct-to-consumer models will reshape distribution strategies.

- Personalization and custom fitting will become standard expectations for serious golfers.

- Sustainability initiatives in manufacturing will strengthen brand positioning among eco-conscious consumers.

- Professional tournaments and celebrity endorsements will maintain high brand visibility.

- Strategic acquisitions and partnerships will consolidate market share among leading brands.

- Regional investments in new golf facilities will boost adoption in emerging states.