Market Overview

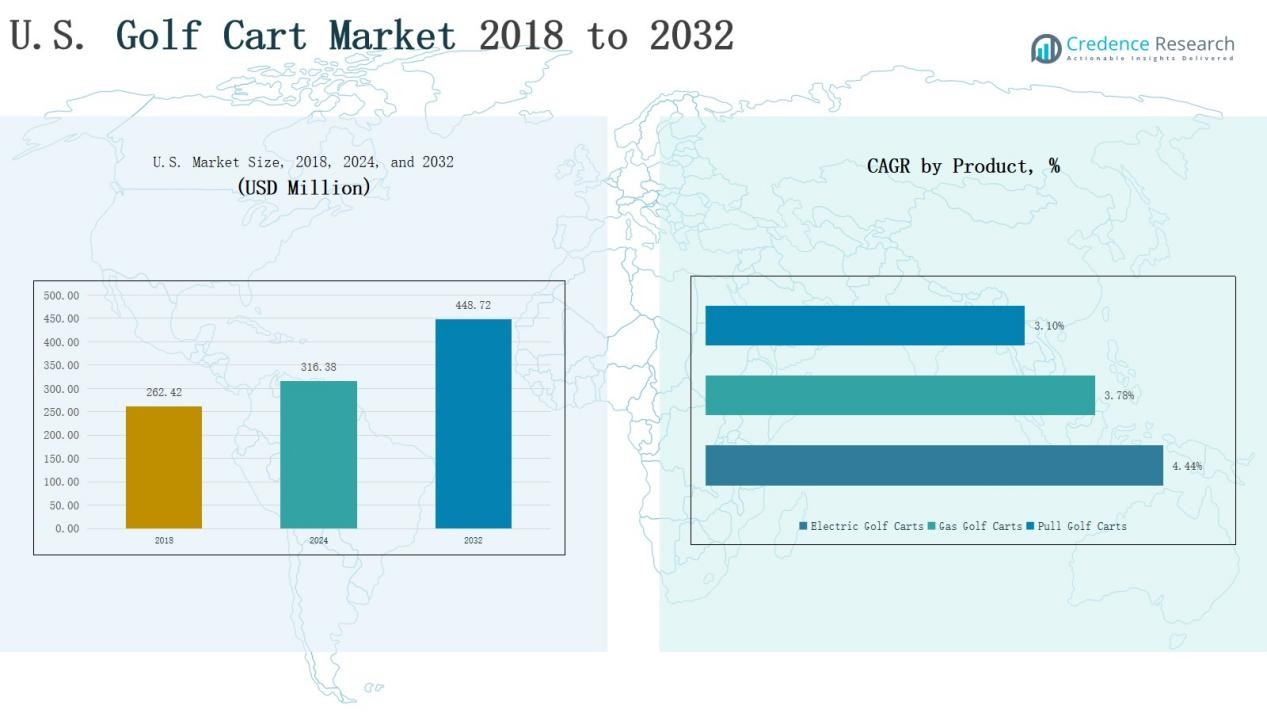

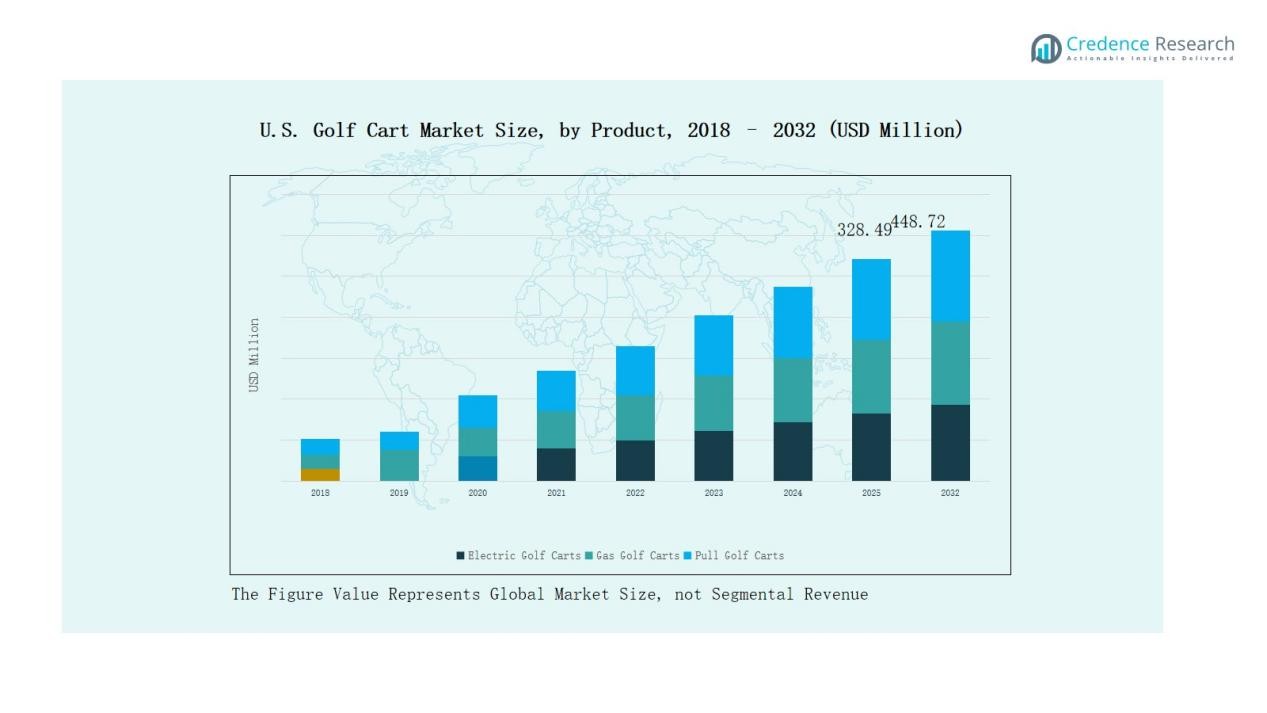

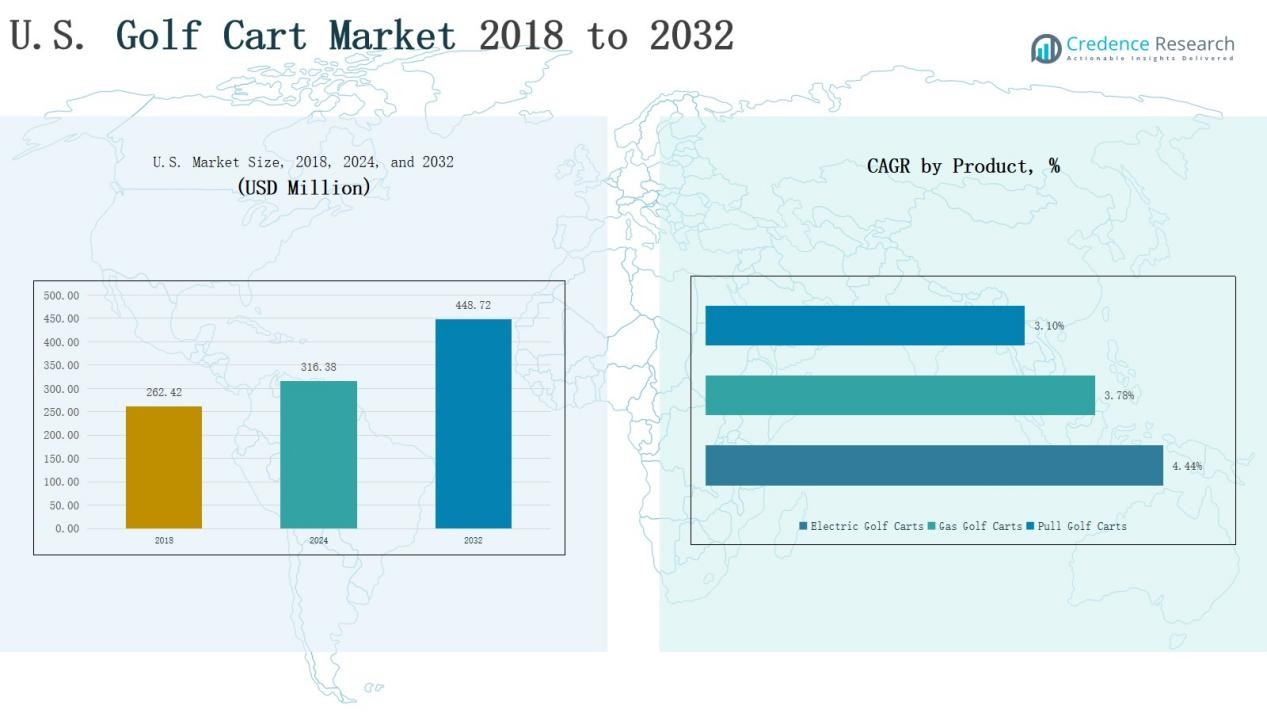

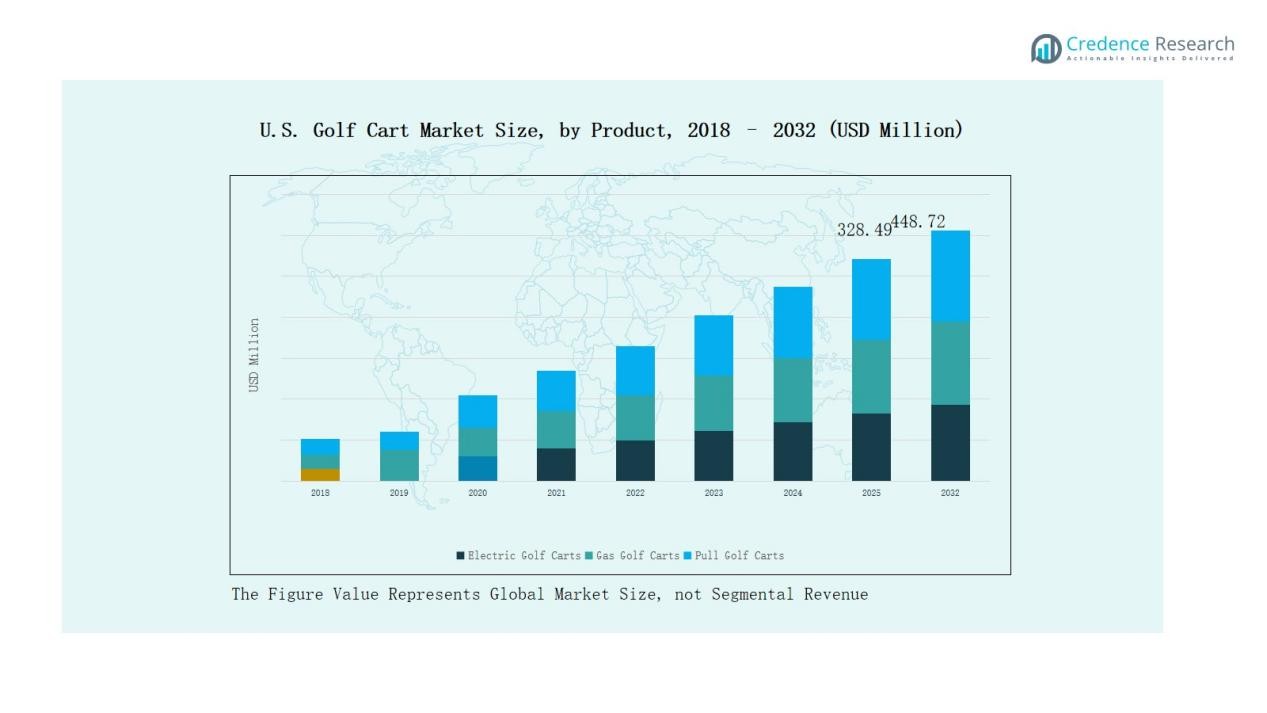

U.S. Golf Cart Market size was valued at USD 262.42 million in 2018 to USD 316.38 million in 2024 and is anticipated to reach USD 448.72 million by 2032, at a CAGR of 3.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Golf Cart Market Size 2024 |

USD 316.38 Million |

| U.S. Golf Cart Market , CAGR |

3.93% |

| U.S. Golf Cart Market Size 2032 |

USD 448.72 Million |

The U.S. Golf Cart Market features a competitive landscape with prominent players such as Club Car, Yamaha Golf-Car Company, E-Z-GO, Garia, Motocaddy, PowaKaddy, and Cruise Car, Inc., each leveraging product innovation, advanced electric and hybrid models, and customized solutions to strengthen their market position. These companies compete across golf, commercial, and personal transportation segments, focusing on performance, design, and sustainability to capture a diverse customer base. Regionally, the Southeast emerges as the leading market, accounting for 38% of the national share, driven by a high concentration of golf courses, retirement communities, and resort developments that sustain consistent demand for premium and utility golf carts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Golf Cart Market was valued at USD 316.38 million in 2024 and is expected to reach USD 448.72 million by 2032, growing at 3.93% CAGR.

- Electric golf carts lead with 56% share, driven by eco-friendly demand, battery technology advancements, and lower maintenance costs compared to gas and pull cart models.

- Key growth drivers include rising demand for sustainable mobility, expanding non-golf applications, and continuous infrastructure development in golfing hubs like Florida, Arizona, and South Carolina.

- Major challenges involve high initial purchase costs, regulatory restrictions on street use, and competition from alternative mobility options such as e-bikes and low-speed vehicles.

- The Southeast dominates with 38% market share, followed by the Southwest at 24%, Midwest at 18%, West at 12%, and Northeast at 8%.

Market Segment Insights

By Product

In the U.S. Golf Cart Market, electric golf carts lead the product segment, driven by increasing demand for eco-friendly transportation, reduced maintenance needs, and advancements in battery technology that enhance range and charging efficiency. Regulatory incentives promoting zero-emission vehicles further encourage adoption. Golf courses, resorts, and commercial facilities favor electric models for their quiet operation and minimal environmental impact, making them the preferred choice over gas and pull cart alternatives.

- For instance, E-Z-GO, which has introduced electric models featuring enhanced battery management systems that reduce charging time by up to 30%, making them preferred choices for commercial facilities focused on operational efficiency.

By Application

Golfing stands as the primary application segment, supported by a strong golfing culture, a high concentration of courses in key states, and ongoing investments in course development and upgrades. Fleet replacement cycles and rising participation in both recreational and competitive golf sustain steady demand. While utility work and recreation applications are expanding, golfing remains the central driver due to its established infrastructure and consistent equipment needs.

- For instance, Troon Golf is advancing sustainable golf course management practices, including water-saving irrigation systems and eco-friendly maintenance, to meet the preferences of environmentally conscious golfers

By Seating Capacity

The 2-seater category dominates the seating capacity segment, valued for its suitability in golf courses, compact structure, and cost-effectiveness. These models are widely used for personal and fleet purposes, offering optimal maneuverability on narrow paths and greens. Their affordability and ease of operation make them the top choice for course operators and individual users. While 4-seater and 6-seater models are gaining popularity in resorts and residential communities, 2-seaters continue to hold a strong position due to their versatility and broad appeal.

Key Growth Drivers

Rising Demand for Sustainable Mobility Solutions

The U.S. Golf Cart Market benefits from growing adoption of electric golf carts, driven by environmental concerns, lower operating costs, and supportive regulatory frameworks. Consumers, golf courses, and commercial facilities increasingly favor battery-powered models due to their zero emissions, quiet operation, and reduced maintenance requirements. Advancements in lithium-ion battery technology enhance range and charging efficiency, making electric variants more appealing for both recreational and utility applications. This shift toward sustainable mobility continues to expand the market’s customer base and strengthens long-term growth prospects.

- For instance, electric golf carts produce zero tailpipe emissions, reducing greenhouse gases significantly compared to gasoline-powered models, thereby contributing to cleaner air and healthier ecosystems in communities and golf courses.

Expansion Beyond Golf Course Applications

Market growth is fueled by the increasing use of golf carts in non-golf settings such as resorts, gated communities, airports, industrial parks, and college campuses. These environments value golf carts for their compact size, maneuverability, and cost-effective transportation capabilities. The ability to customize carts with utility beds, seating configurations, and accessories broadens their appeal across diverse sectors. As urban planners and facility managers seek efficient short-distance transportation options, the demand for versatile golf cart solutions continues to increase, diversifying revenue streams for manufacturers.

- For instance, Sutlej Automotives from India produces durable electric golf carts that are increasingly used in resorts and gated communities for internal transit. Their golf carts are valued for quality craftsmanship and long-lasting battery life suitable for extensive daily use.

Infrastructure Development in Golfing Hubs

The development and renovation of golf courses across the United States directly boost the demand for golf carts. Rising interest in golf, supported by tourism, sporting events, and community developments in states like Florida, Arizona, and South Carolina, stimulates consistent fleet purchases and replacements. Luxury resorts and private golf clubs increasingly invest in modern, technologically advanced fleets to enhance customer experience. These infrastructure projects create recurring demand for both standard and customized golf carts, reinforcing the market’s stability and encouraging product innovation.

Key Trends & Opportunities

Integration of Smart Features and Connectivity

A notable trend in the U.S. Golf Cart Market is the incorporation of advanced technologies such as GPS navigation, touchscreen displays, fleet management software, and IoT connectivity. These features enhance user convenience, improve operational efficiency for fleet operators, and support preventive maintenance. Golf courses leverage real-time cart tracking to optimize usage, while commercial operators benefit from performance monitoring and route optimization. The rising interest in connected mobility creates opportunities for manufacturers to differentiate their offerings and appeal to tech-savvy consumers and premium market segments.

- For instance, Tara Electric Vehicles emphasizes sustainability while integrating advanced smart features such as energy-efficient batteries, GPS navigation, and app connectivity for safety and convenience.

Customization and Premiumization of Product Offerings

Consumers increasingly seek golf carts with customized designs, premium interiors, and advanced performance features. Manufacturers respond by offering a wide range of options, from luxury seating and enhanced suspension systems to aesthetic upgrades like unique paint finishes and alloy wheels. This trend aligns with the growth of high-end resorts, gated communities, and private clubs where carts serve as status symbols. The premiumization trend not only drives higher margins but also enables market players to target niche, high-value customer segments effectively.

- For instance, Tomberlin’s E-Merge GT model offers automotive-grade design, digital gauges, LED lighting, and street-legal capabilities, appealing to those who want a high-end cart for both golf courses and urban environments.

Key Challenges

High Initial Purchase Costs

Despite their operational advantages, golf carts—especially electric and premium models—carry high upfront costs, which can deter individual buyers and smaller businesses. The expense of advanced features, lithium-ion batteries, and customization increases total purchase price. For cost-sensitive markets, these factors may slow adoption rates, particularly outside of affluent regions and commercial sectors. Manufacturers face the challenge of balancing affordability with innovation to expand market penetration.

Regulatory Restrictions on Street Use

In many U.S. states and municipalities, golf carts face strict regulations for on-road use, including limitations on speed, required safety equipment, and designated operating zones. These restrictions limit their applicability for broader transportation needs in urban areas. Navigating the patchwork of local laws complicates sales strategies and restricts market expansion potential. To overcome this, industry stakeholders must work with policymakers to create standardized regulations that allow safe, limited on-road integration.

Competition from Alternative Mobility Solutions

The market faces competitive pressure from alternative short-distance transportation options such as electric bikes, scooters, and low-speed vehicles (LSVs). These alternatives often offer lower costs, greater portability, and fewer regulatory barriers, making them attractive to certain customer segments. As consumer preferences diversify, golf cart manufacturers must innovate and market their unique value propositions—such as passenger capacity, stability, and comfort—to maintain market share in an increasingly competitive mobility landscape.

Regional Analysis

Southeast

The Southeast holds the largest share of the U.S. Golf Cart Market at 38%, supported by its high density of golf courses, retirement communities, and luxury resorts. Florida, Georgia, and South Carolina lead adoption due to favorable climates and strong tourism activity. It benefits from a consistent influx of golf enthusiasts and resort visitors, driving demand for both personal and fleet purchases. Electric golf carts are particularly popular in this region, encouraged by environmental regulations and cost savings. Local governments and private communities actively invest in infrastructure that accommodates cart usage. The market in the Southeast continues to expand with urban planning that integrates low-speed mobility solutions.

Southwest

The Southwest accounts for 24% of the market, driven by golf tourism and real estate developments in states like Arizona, Nevada, and Texas. Its warm climate supports year-round golf activities, prompting high fleet turnover rates in golf clubs and resorts. The region also sees strong demand in gated communities and resort towns where carts are used for daily mobility. Gas-powered models retain notable demand in rural and desert terrains for their endurance and performance. Ongoing residential and hospitality projects create opportunities for premium and customized carts. It remains a competitive space for manufacturers targeting both luxury and utility applications.

Midwest

The Midwest represents 18% of the U.S. Golf Cart Market, with demand concentrated in suburban and rural communities. Seasonal golfing activity drives a cyclical purchasing pattern, with peak demand during spring and summer months. Golf courses, public parks, and recreational facilities are the primary end-users. Utility applications, particularly in agricultural settings, support year-round usage. The market is gradually shifting toward electric models as battery performance improves. It continues to offer growth potential through replacement demand and expanding non-golf applications.

West

The West holds 12% of the market, led by California and other states with active golf and leisure industries. The region emphasizes environmentally friendly mobility, accelerating the adoption of electric carts. High-end resorts and coastal communities are significant buyers, often opting for luxury, feature-rich models. Regulatory policies favor zero-emission transportation, which aligns with regional sustainability goals. Recreational and utility use is expanding, particularly in tourism-driven areas. It remains an attractive market for innovative and premium cart solutions.

Northeast

The Northeast captures 8% of the U.S. Golf Cart Market, with demand driven by seasonal golf activities and resort communities. The shorter golf season results in a smaller but steady market base. Golf courses, country clubs, and coastal resorts dominate purchases. There is a gradual transition toward electric carts, supported by municipal incentives. Utility carts are also used in institutional and commercial properties. It remains a niche but consistent contributor to overall market revenue.

Market Segmentations:

By Product

- Electric Golf Carts

- Gas Golf Carts

- Pull Golf Carts

By Application

- Golfing

- Utility Work

- Recreation

By Seating Capacity

- 2 Seater

- 4 Seater

- 6 Seater and Above

By Region

- Southeast

- Southwest

- Midwest

- West

- mortheast

Competitive Landscape

The competitive landscape of the U.S. Golf Cart Market is characterized by the presence of established manufacturers and emerging players competing through product innovation, technology integration, and service differentiation. Leading companies such as Club Car, Yamaha Golf-Car Company, E-Z-GO, Motocaddy, PowaKaddy, and Garia focus on expanding their electric and hybrid offerings to meet rising demand for sustainable mobility. It is marked by strong brand loyalty in the golfing sector, while non-golf applications drive competition in customization, durability, and performance. Strategic initiatives, including fleet management solutions, IoT-enabled monitoring, and premium design features, are increasingly used to capture high-value customers in resorts, gated communities, and commercial facilities. Partnerships with golf courses, real estate developers, and leisure operators strengthen market penetration. Price competitiveness remains important, but differentiation through technological advancements and after-sales service plays a critical role in sustaining market share and ensuring long-term customer retention.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Club Car, LLC

- Yamaha

- Motocaddy

- PowaKaddy

- Stewart Golf

- Xiamen Dalle Electric Car Co., Ltd.

- E-Z-GO

- Textron Specialized Vehicles Inc.

- Cruise Car, Inc.

- GDRIVE Golf Cart

- Matrix Motor Distribution LTD

- Other Key Players

Recent Developments

- In March 2025, Club Car introduced its next-generation Tempo golf car, featuring an Automatic Park Brake with StopSmart™ technology, a redesigned dashboard, enhanced storage, and improved charging options.

- In May 2025, Kandi Technologies rolled out its first U.S.-assembled electric golf cart from its new manufacturing facility in Garland, Texas, strengthening local production capabilities.

- In April 2025, Motocaddy introduced three upgraded electric golf carts, including the 10th-generation S1 model and refreshed M7 GPS Remote and M7 Remote versions, integrating advanced battery and design features.

- In June 2025, Robera launched the Neo self-driving golf trolley through Kickstarter, featuring AI-powered navigation and swing analysis, with deliveries planned for July 2025.

Market Concentration & Characteristics

The U.S. Golf Cart Market demonstrates a moderate to high level of market concentration, with a few dominant players such as Club Car, Yamaha Golf-Car Company, and E-Z-GO holding significant shares through established distribution networks and strong brand recognition. It is characterized by steady demand from both golfing and non-golfing applications, supported by growing adoption in resorts, gated communities, industrial facilities, and institutional campuses. Electric models lead the product mix due to environmental regulations, operational efficiency, and advancements in battery technology. The market shows high product differentiation, with manufacturers focusing on customization, premium design, and integration of smart features to attract diverse customer segments. Seasonal demand patterns, particularly in regions with favorable climates, influence sales volumes and inventory planning. It maintains competitive intensity through continuous innovation, strategic partnerships, and after-sales support, ensuring long-term customer relationships and recurring fleet replacement opportunities across commercial and recreational segments.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Seating Capacity and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Electric golf carts will continue to gain market share due to advancements in battery technology and charging infrastructure.

- Demand from non-golf sectors such as resorts, gated communities, and industrial facilities will expand steadily.

- Integration of GPS tracking, IoT connectivity, and fleet management software will become standard in premium models.

- Customization options in design, seating, and accessories will attract niche and high-value customer segments.

- Regulatory support for low-emission and zero-emission vehicles will drive adoption in urban and suburban areas.

- Luxury and high-performance models will see increased demand from affluent residential communities and resorts.

- Replacement cycles for aging fleets in golf courses will create consistent recurring sales opportunities.

- Manufacturers will focus on lightweight materials and ergonomic designs to improve efficiency and comfort.

- Expansion into rental and shared mobility services will open new revenue streams.

- Strategic partnerships with real estate developers and hospitality operators will strengthen market penetration.