Market Overview:

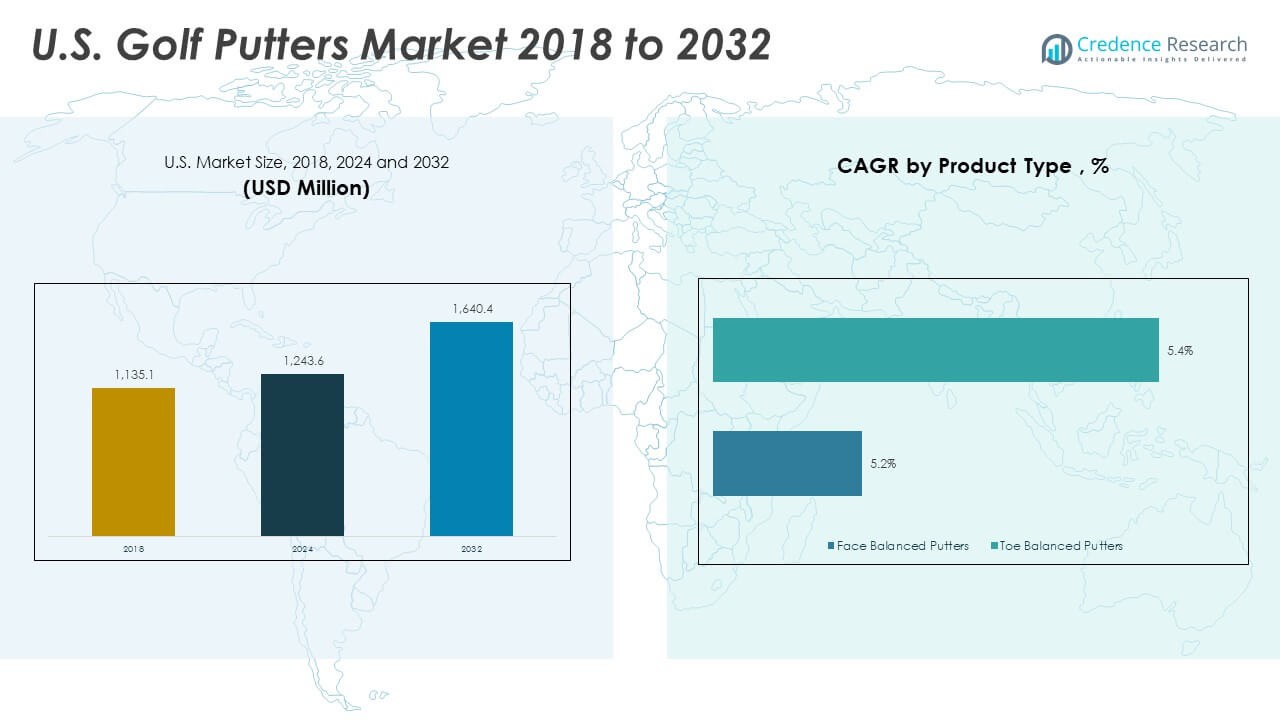

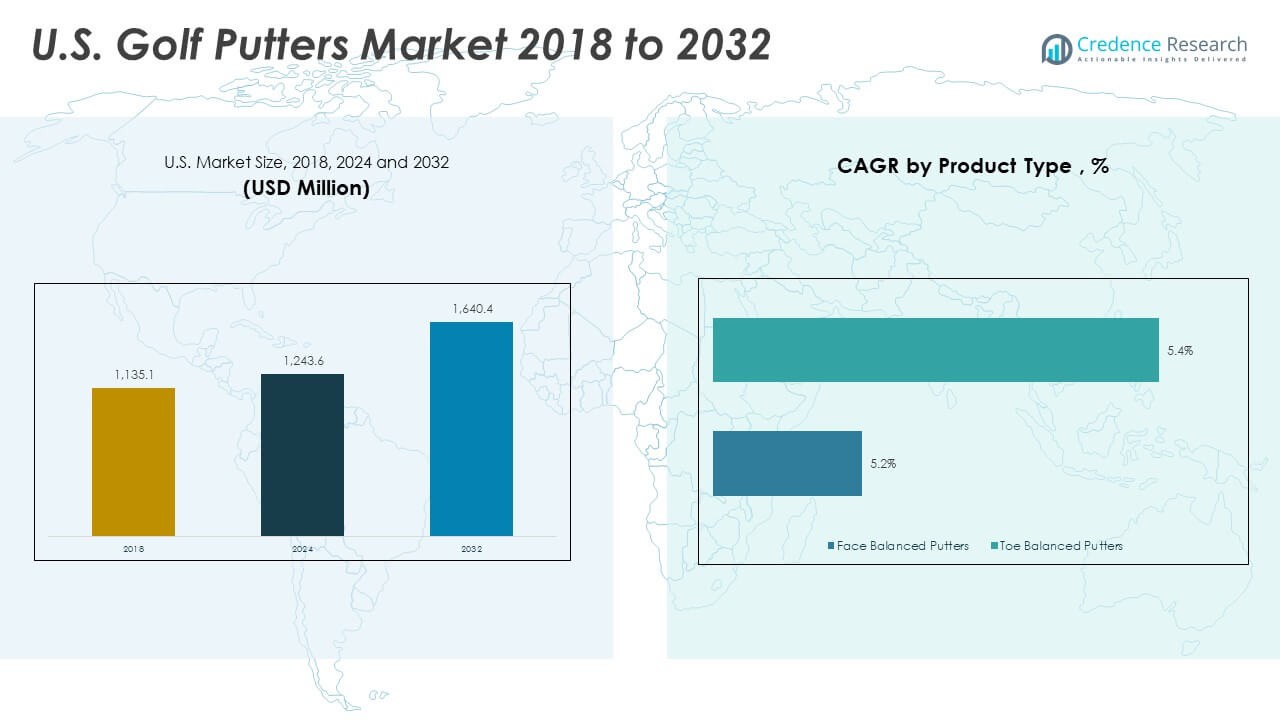

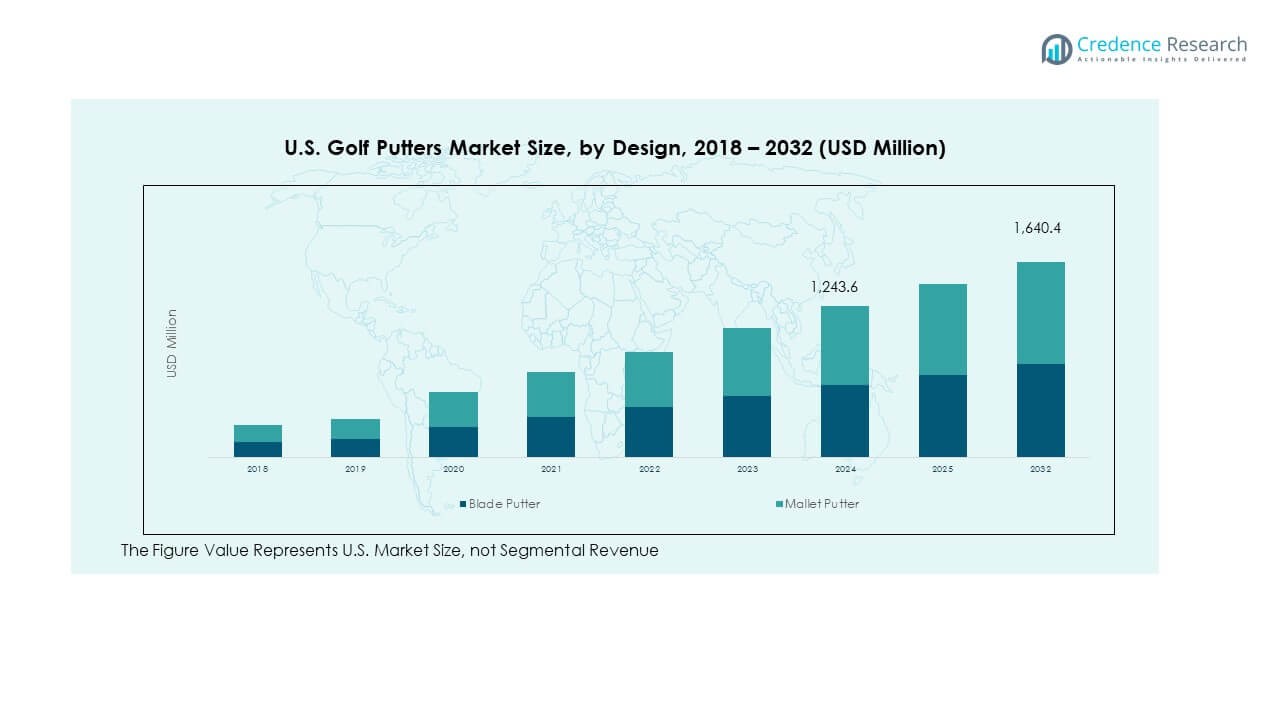

The U.S. Golf Putters Market size was valued at USD 1,135.10 million in 2018 to USD 1,243.6 million in 2024 and is anticipated to reach USD 1,640.4 million by 2032, at a CAGR of 3.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Golf Putters Market Size 2024 |

USD 1,243.6 Million |

| U.S. Golf Putters Market , CAGR |

3.52% |

| U.S. Golf Putters Market Size 2032 |

USD 1,640.4 Million |

The U.S. golf putters market is primarily driven by the growing interest in golf as both a recreational and professional sport, supported by investments in golf course infrastructure and training facilities. Manufacturers are integrating advanced materials and designs, including face-balanced and high-MOI models, to improve player performance and precision. Rising adoption of smart putters with embedded sensors further attracts technology-savvy players, while customization options enhance consumer engagement. Increasing visibility through professional tournaments and endorsements strengthens demand, as golfers continue to seek performance-driven and aesthetically appealing products.

The U.S. dominates the golf putters market due to its large base of professional tournaments, extensive golf courses, and strong consumer purchasing power. States such as California, Florida, and Texas serve as key hubs, with thriving golfing communities and tourism-driven demand. The Midwest also shows consistent growth due to community-level golf participation and youth training programs. While established regions continue to lead with high adoption rates, emerging golfing clusters across the South and Western U.S. are contributing to steady expansion, aided by promotional campaigns, golf tourism, and increasing accessibility of entry-level equipment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Golf Putters Market was valued at USD 1,135.10 million in 2018, reached USD 1,243.6 million in 2024, and is projected to hit USD 1,640.4 million by 2032, expanding at a CAGR of 3.52%.

- The Global Golf Putters Market size was valued at USD 3,120.0 million in 2018 to USD 3,493.8 million in 2024 and is anticipated to reach USD 4,607.8 million by 2032, at a CAGR of 3.6% during the forecast period.

- The South holds 38% share, driven by year-round play and golf tourism, the West holds 27% share, supported by affluent consumers and advanced retail, and the Midwest holds 22% share, reflecting strong community-level participation.

- The Northeast, with 13% share, is the fastest-growing region due to its affluent base, strong corporate golf culture, and premium equipment adoption despite seasonal limitations.

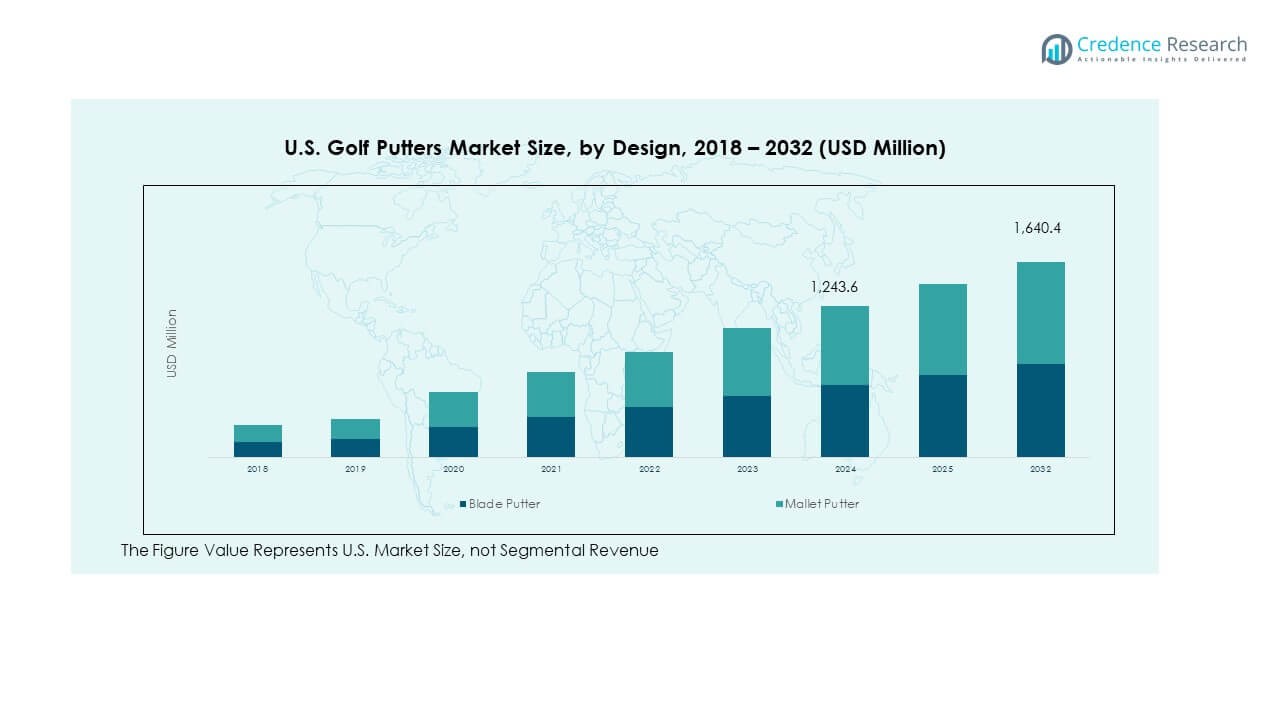

- By design, Mallet Putters accounted for 61% share in 2024, supported by stability, alignment features, and high adoption among professionals and amateurs.

- Blade Putters represented 39% share in 2024, maintaining popularity among traditionalists seeking precision and control in performance-driven segments.

Market Drivers

Rising Golf Participation and Lifestyle Integration

The U.S. Golf Putters Market is strongly driven by a steady increase in golf participation, fueled by both recreational players and professional athletes. It benefits from the sport’s popularity among different age groups, including millennials and retirees who view golf as both a leisure activity and a networking platform. Golf course expansions, coupled with indoor simulators, enhance accessibility and attract new players. It is further supported by golf associations investing in grassroots programs that boost youth involvement. Professional tournaments broadcast across media channels expand awareness and drive consumer spending. Growing interest in fitness and outdoor activities reinforces golf as a preferred sport. This trend supports consistent demand for performance-oriented and beginner-friendly putters.

Product Innovation and Advanced Design Integration

Manufacturers focus on continuous product innovation, making design and technology pivotal drivers for market growth. The U.S. Golf Putters Market benefits from advanced engineering techniques that deliver face-balanced shafts, high-MOI models, and alignment aids to improve accuracy. It is seeing significant traction from players who seek putters tailored to their stroke type, increasing adoption across different skill levels. Customizable grips, shafts, and head shapes create a personalized experience that strengthens consumer loyalty. Brands integrate lightweight materials, advanced metals, and composite inserts to enhance durability and playability. Integration of AI and data-driven analysis into putter design further differentiates premium offerings. Professional endorsements highlight performance benefits, expanding product visibility. This innovation-centric approach continues to shape competitive dynamics.

Technological Adoption and Smart Putter Evolution

The rising adoption of smart golf putters with embedded sensors and connected technology is transforming consumer expectations. The U.S. Golf Putters Market leverages digital innovation to provide data analytics on swing mechanics, stroke paths, and alignment feedback. It appeals to technologically engaged golfers who seek measurable improvements in performance. Training apps and cloud-based analytics platforms complement smart putters, creating an ecosystem that appeals to younger audiences. It is supported by manufacturers collaborating with sports technology firms to expand value-added features. These advancements make premium categories more attractive and elevate the overall perception of golf equipment. Smart putters also serve as training aids, bridging the gap between recreational players and professionals. This integration strengthens the link between golf and data-driven sports performance.

- For instance, Arccos launched its third-generation P3 putter sensor, which is 40% smaller and 20% lighter than the previous model, delivering real-time stroke analytics and helping golfers reduce their handicap by an average of 5.78 strokes after 10 rounds, based on user data from over 10 million recorded rounds globally.

Endorsements, Retail Expansion, and Consumer Engagement

The endorsement of high-profile golfers creates aspirational value and builds brand trust among consumers. The U.S. Golf Putters Market capitalizes on the popularity of PGA and LPGA events, where athletes showcase advanced putters to global audiences. It is reinforced by retailers and pro shops offering wider ranges of models, enabling hands-on trials that influence purchasing decisions. Online platforms and e-commerce expansion broaden accessibility, particularly for younger demographics accustomed to digital shopping. Golf tourism across destinations like Florida and California boosts exposure and on-site sales of branded putters. Community golf programs and events generate localized awareness that fuels incremental growth. Retail bundling strategies with golf accessories enhance sales penetration. This synergy between retail presence and professional endorsements continues to drive consumer adoption at scale.

- For instance, Scotty Cameron’s Custom Shop releases employ a rare drawing-style entry process for limited edition putters, creating exclusivity that drives high consumer engagement and rapid sell-outs within hours of product drops, supported by global pro golfer endorsements on major tours.

Market Trends

Customization and Personalization Demand

A strong trend in the U.S. Golf Putters Market is the growing consumer demand for customization and personalization. Players are increasingly attracted to bespoke designs, from head shapes to shaft colors, engravings, and grip textures. It reflects a consumer shift toward equipment that aligns with personal style and comfort. Golfers seek tailor-made solutions to enhance both aesthetics and playability. Manufacturers now offer online configurators and retail-based customization experiences. Personalized products appeal to premium buyers who value exclusivity and uniqueness. This trend elevates customer engagement and strengthens brand loyalty across competitive segments. The ability to personalize products continues to influence purchasing behavior at all levels.

- For instance, in 2023, Bettinardi Golf introduced its Limited Run SS35 Tiki Putter, crafted from 303 stainless steel with intricate tribal-inspired milling and a black PVD finish, reinforcing its reputation for precision craftsmanship and exclusivity in the premium putter segment.

Sustainability and Eco-Friendly Material Adoption

Sustainability has emerged as a defining trend in the U.S. Golf Putters Market, with manufacturers exploring eco-friendly materials and processes. Golfers are becoming conscious of environmental impacts, preferring brands that align with sustainability values. It leads to experimentation with recyclable metals, reduced-emission coatings, and packaging alternatives. Brands highlight green initiatives to build a responsible brand image among younger and socially aware consumers. Golf courses also emphasize sustainability, reinforcing the appeal of eco-conscious products. Eco-friendly innovations create differentiation in a competitive market while aligning with broader sports industry sustainability goals. It strengthens consumer trust and fosters long-term engagement.

Growing Popularity of Mallet Putters

Mallet putters are gaining traction as a dominant trend, driven by their high stability, forgiving nature, and alignment assistance. The U.S. Golf Putters Market is seeing players of varying skill levels adopt mallet models to improve consistency and confidence. It appeals to both professionals and amateurs who seek larger sweet spots and improved balance. Manufacturers highlight mallet putters in new product lines, showcasing innovative designs with bold alignment aids. The preference for mallet shapes reflects evolving consumer behavior toward performance enhancement. This trend influences the product mix across retail and online channels. It ensures mallet putters continue to dominate premium offerings in the coming years.

- For example, Ping’s PLD putters are precision CNC-milled from forged 303 stainless steel, with the DS 72 mallet model featuring a 365-gram headweight. These tour-validated designs are trusted by professionals including Bubba Watson and Tony Finau, underscoring their performance credibility at the highest level of competition.

Integration of Lifestyle and Digital Engagement

The U.S. Golf Putters Market reflects the broader trend of lifestyle and digital engagement influencing consumer purchasing. Golfers expect integrated experiences that extend beyond the course, such as digital communities, app-based performance tracking, and online tutorials. It creates opportunities for brands to establish ongoing customer relationships beyond the initial sale. Social media campaigns featuring influencers and professional golfers amplify product visibility. E-commerce platforms highlight personalized recommendations, increasing brand interaction. Golfers align purchases with lifestyle identity, linking equipment to leisure, status, and community engagement. This alignment transforms putter purchases into lifestyle decisions. It strengthens market appeal and creates long-term consumer retention pathways.

Market Challenges Analysis

Intense Competition and Price Sensitivity

The U.S. Golf Putters Market faces significant challenges from intense competition among global and regional brands. It operates in a fragmented landscape where established players like Odyssey, TaylorMade, and PING compete against emerging manufacturers offering lower-cost alternatives. The high degree of price sensitivity among entry-level golfers often limits adoption of premium models. Retailers struggle to balance consumer affordability with demand for advanced features, creating pressure on margins. It results in a crowded market environment where differentiation becomes difficult. Frequent product launches increase the need for aggressive marketing budgets, straining smaller brands. Maintaining brand loyalty in a competitive market requires continuous innovation. These dynamics present ongoing challenges for manufacturers seeking long-term growth.

Shifts in Golf Participation and Seasonal Dependency

The U.S. Golf Putters Market is also challenged by fluctuations in golf participation levels and strong seasonal dependency. It is heavily influenced by weather conditions, limiting consistent play in colder states. Declines in youth participation or limited access to affordable facilities may restrict future demand. Economic uncertainties can reduce discretionary spending, impacting equipment sales across income groups. Manufacturers face difficulties forecasting demand during downturns in participation. Rental models and second-hand equipment markets also affect new putter sales. Maintaining stable growth requires overcoming these external dependencies. Companies must focus on expanding indoor training solutions and diversified distribution channels to counter seasonal risks.

Market Opportunities

Expansion of Golf Tourism and Recreational Facilities

The U.S. Golf Putters Market presents strong opportunities through the growth of golf tourism and expansion of recreational facilities. It benefits from international visitors and domestic players seeking premium golf experiences across renowned destinations. Resorts and golf-centric travel packages promote on-site purchases and rentals, fueling market penetration. Investments in public and private courses enhance accessibility to new audiences. Community-level programs encourage broader adoption, creating pathways for first-time buyers. High visibility of golf in media and entertainment adds aspirational value. Companies that align with tourism-driven sales channels gain opportunities to increase revenue and expand product reach.

Rising Digital Retail and E-Commerce Penetration

E-commerce and digital retail channels create significant opportunities for the U.S. Golf Putters Market. It capitalizes on online platforms offering personalized recommendations, trial programs, and virtual fitting tools. Consumers increasingly prefer the convenience of online shopping supported by detailed product reviews and video demonstrations. Digital platforms expand reach beyond traditional pro shops, attracting younger demographics. Direct-to-consumer sales strategies strengthen brand profitability by reducing reliance on intermediaries. Bundled promotions and subscription-based models further enhance recurring revenues. Companies that effectively integrate online and offline experiences are positioned to capture higher market share and build lasting consumer relationships.

Market Segmentation Analysis:

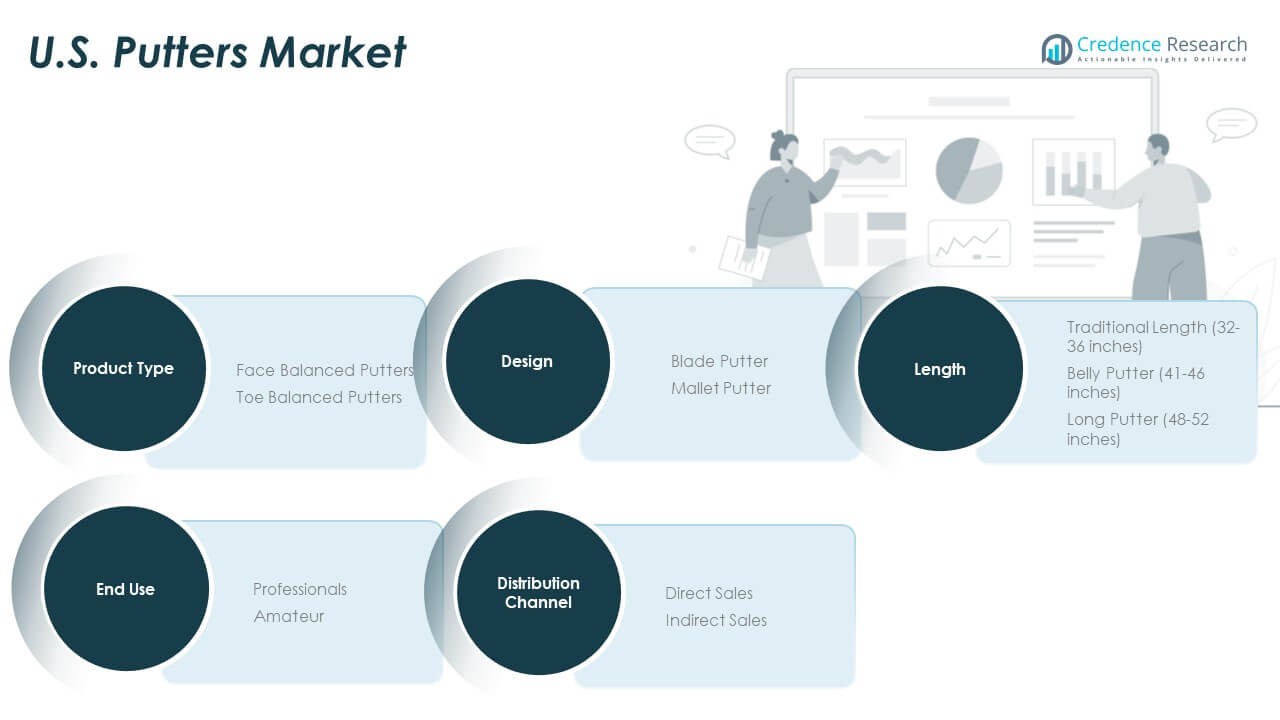

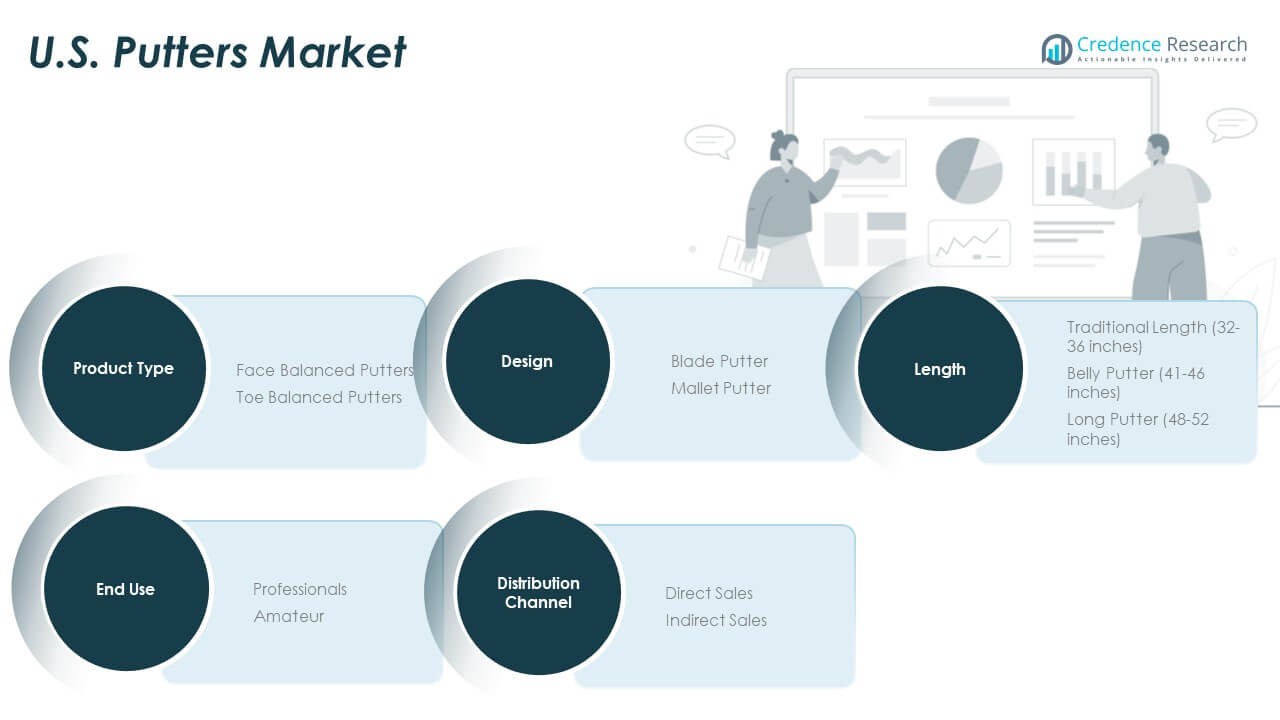

The U.S. Golf Putters Market demonstrates strong segmentation across product type, design, end-use, length, and distribution channels, reflecting the diverse needs of golfers at varying skill levels.

By product type, face balanced putters dominate demand due to their stability and suitability for straight strokes, while toe balanced putters appeal to players favoring arcing strokes. This differentiation ensures broad consumer coverage across performance-driven categories.

- For instance, Odyssey introduced the Ai‑ONE Jailbird Mini DB (Double Bend) in This face‑balanced model features a double‑bend shaft, designed for straight‑stroke players, and benefits from the AI‑designed Ai‑ONE insert that enhances face stability and consistency.

By design, blade putters retain popularity among traditionalists and skilled professionals seeking precision and feel, while mallet putters lead growth with their larger sweet spots, forgiveness, and advanced alignment aids. It caters to a wide audience, from new entrants to experienced golfers upgrading equipment.

By end-use segmentation shows professionals driving demand for premium models with advanced features, whereas amateurs contribute significantly to volume sales, especially in mid-range price categories.

By Length-based segmentation highlights traditional putters (32–36 inches) as the standard preference, while belly putters (41–46 inches) and long putters (48–52 inches) attract niche segments seeking alternative techniques for stroke control.

- For instance, Scotty Cameron’s 2024 Phantom mallet series including models such as the Phantom 5, Phantom 7, and Phantom 9 came in standard lengths of 33″, 34″, and 35″, catering directly to the mainstream preference for putters in the 32–36-inch range.

By distribution channels reinforce this diversity, with direct sales gaining traction through brand-owned stores and e-commerce platforms, while indirect sales via retailers, golf shops, and sporting goods outlets continue to dominate accessibility. It creates a balanced distribution ecosystem that strengthens consumer reach.

Segmentation:

By Product Type

- Face Balanced Putters

- Toe Balanced Putters

By Design

- Blade Putter

- Mallet Putter

By End-use

By Length

- Traditional Length (32–36 inches)

- Belly Putter (41–46 inches)

- Long Putter (48–52 inches)

By Distribution Channel

- Direct Sales

- Indirect Sales

Regional Analysis:

The U.S. Golf Putters Market is led by the South, which holds a 38% market share, driven by its warm climate, high concentration of golf courses, and strong tourism appeal in states such as Florida and Texas. It benefits from year-round playability, supporting higher equipment sales and consistent demand across both professional and amateur segments. Major golf resorts and PGA events further strengthen consumer exposure to premium putter brands. The presence of golf academies and youth programs in this region fosters long-term market expansion. Strong retail networks and golf tourism packages encourage purchases of both standard and customized putters. It continues to dominate as the central hub for golf-driven consumption and investment.

The West region accounts for a 27% market share, supported by California’s significant influence on both recreational and professional golf activity. It benefits from a mix of affluent consumers, innovative retail environments, and strong brand presence in urban centers. High adoption of smart and technologically advanced putters is evident in this region, reflecting its progressive consumer base. Golf entertainment venues and simulator-driven play in metropolitan cities also drive product exposure. It appeals strongly to younger demographics, linking lifestyle, technology, and golf. The West continues to serve as a major growth center for innovation and premium product demand.

The Midwest and Northeast collectively capture 22% and 13% market share respectively, highlighting steady but seasonal demand. The Midwest is characterized by strong community-level participation and public courses that fuel consistent sales of mid-priced putters. It contributes to growing amateur adoption while maintaining a loyal base of professional users. The Northeast faces seasonal constraints but leverages high-income populations and corporate participation in golf events to sustain premium demand. It also benefits from proximity to prestigious clubs and golf institutions that drive aspirational purchases. Together, these regions ensure balanced market growth across diverse consumer groups.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. Golf Putters Market is characterized by strong competition among global and domestic brands, each striving to differentiate through innovation, endorsements, and distribution reach. Leading companies such as Odyssey Golf (Callaway), PING, TaylorMade, and Titleist maintain dominance by offering a wide range of premium and performance-driven putters. It benefits from continuous product launches that incorporate advanced materials, high-MOI designs, and smart sensor technology. Smaller niche players such as Piretti Fine Putters and L.A.B. Golf target high-end enthusiasts with handcrafted and bespoke offerings, strengthening the luxury segment. Competition extends to pricing strategies, with brands balancing affordability and premium positioning to appeal to diverse golfers. Retail partnerships, e-commerce expansion, and sponsorship of professional athletes enhance visibility across segments. Competitive intensity pushes companies to focus on personalization, technological integration, and consumer engagement to retain market share. The presence of both mass-market players and boutique brands ensures a diverse landscape where innovation and brand loyalty drive long-term advantage.

Recent Developments:

- In August 2025, PXG announced the launch of its latest high-MOI mallet putters in Scottsdale, Arizona, targeting the North America golf putters market. These new putters feature advanced customization options and performance enhancements designed for both amateur and professional golfers, reflecting the continued demand for innovative technology and premium quality in golf equipment.

- In August 2025, Breakthrough Golf Technology launched the Paradox putter, a zero torque model engineered with Swing Balance Technology to enhance distance control. The Paradox showed a 20% faster true roll and missed putts finishing 10% closer to the hole in testing, and is offered in both blade and fang designs with adjustable loft and lie options.

- In July 2025, private equity firm L Catterton, backed by LVMH, acquired a majority stake in L.A.B. Golf, a company known for its innovative putter designs. L.A.B. Golf sold about 130,000 units last year and is expected to triple its volume in 2025, with putters starting at $399 per unit.

- In July 2025, L.A.B. Golf experienced a significant development with a $200 million acquisition by L. Catterton, a private equity firm backed by LVMH. This acquisition is set to enhance L.A.B. Golf’s market presence and product development capabilities. Known for its innovative putters that minimize torque during putting strokes, L.A.B. Golf combines traditional designs with advanced technology such as their LINK.1 Custom Putter, which promotes stability and accuracy.

- In January 2025, Odyssey released the Ai-ONE Silver Milled Putters, including models such as Two T CH, Three T S, Seven T DB, and Seven T CH, designed with advanced AI-driven milling for enhanced putting precision. The official launch date was January 17, 2025.

Market Concentration & Characteristics:

The U.S. Golf Putters Market exhibits a moderately concentrated structure, where a few leading companies hold significant market share but smaller players continue to influence niche categories. It is defined by steady product innovation, strong reliance on professional endorsements, and high consumer expectations for quality and performance. Market characteristics reflect a balance between tradition and technology, as golfers value both classic blade putters and advanced mallet designs with digital enhancements. The competitive environment is shaped by seasonal demand, consumer preference for customization, and a growing digital retail presence. This dynamic creates a market that rewards continuous differentiation while sustaining long-term growth opportunities.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Design, End-Use, Length and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. Golf Putters Market will continue to evolve with advanced material adoption, where lightweight alloys and composite inserts improve durability and precision.

- Demand for smart putters integrated with sensors and performance analytics will grow, appealing to data-driven golfers seeking measurable improvements.

- Customization and personalization options will expand, offering golfers greater control over aesthetics, grip, and shaft alignment to match individual styles.

- Rising participation among younger demographics will sustain long-term growth, supported by training programs, simulator facilities, and community golf initiatives.

- Professional endorsements and tournament visibility will remain critical, enhancing the credibility of premium brands and influencing purchasing behavior.

- Expansion of e-commerce platforms and digital retail strategies will strengthen accessibility, encouraging direct-to-consumer engagement across broader audiences.

- Mallet putters will continue to dominate design preference, supported by their forgiveness, alignment stability, and increasing adoption among both amateurs and professionals.

- Sustainability practices in manufacturing will gain importance, with brands emphasizing recyclable materials and eco-friendly packaging to align with consumer values.

- Urban golf entertainment venues and virtual play environments will create new exposure channels, boosting interest among casual players and first-time users.

- The competitive landscape will intensify, pushing brands to innovate continuously while balancing affordability with high-performance features to capture diverse customer segments.