Market Overview:

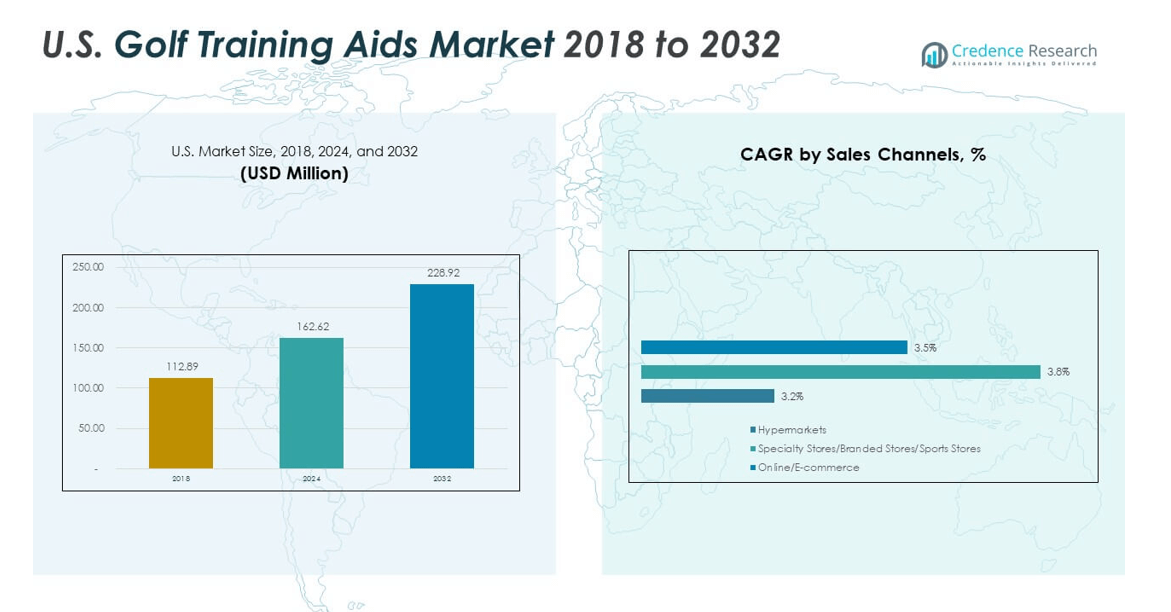

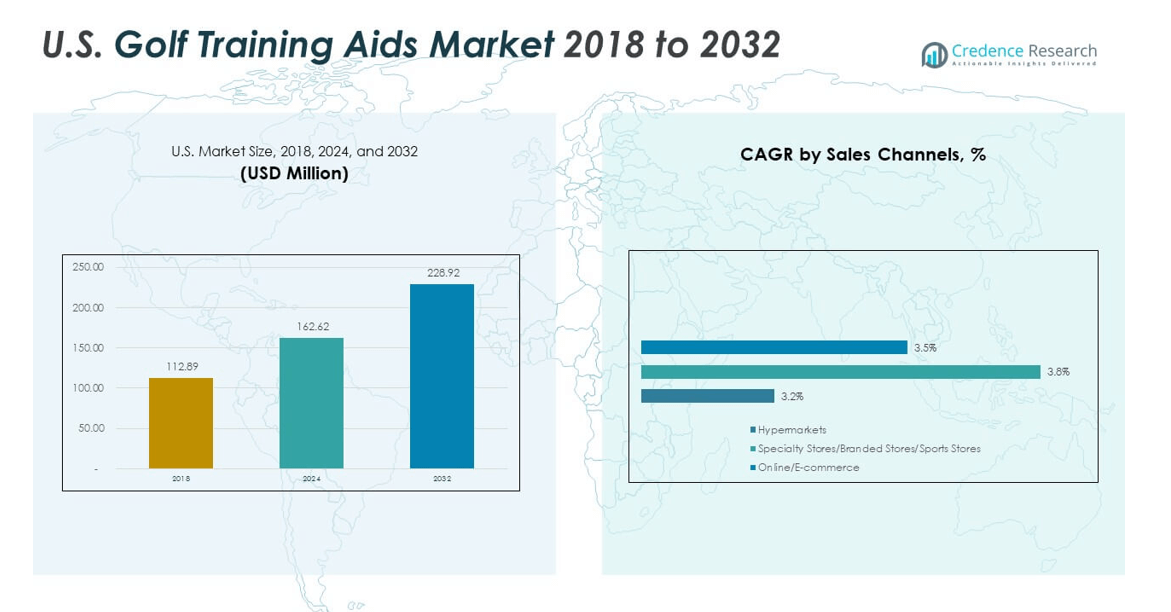

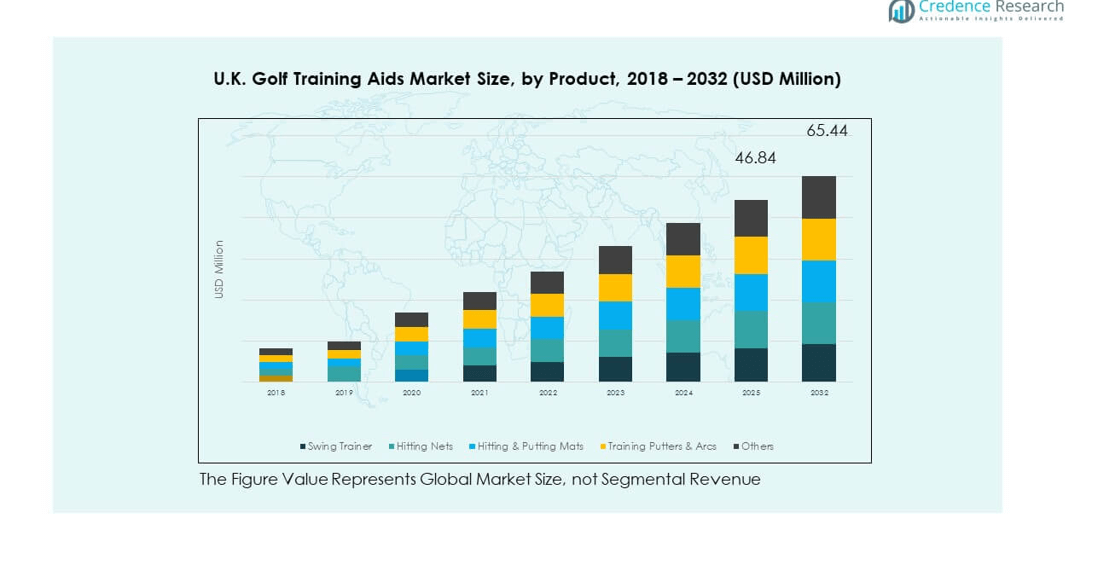

The U.S. Golf Training Aids Market size was valued at USD 112.89 million in 2018 to USD 162.62 million in 2024 and is anticipated to reach USD 228.92 million by 2032, at a CAGR of 4.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Golf Training Aids Market Size 2024 |

USD 162.62 million |

| U.S. Golf Training Aids Market, CAGR |

4.44% |

| U.S. Golf Training Aids Market Size 2032 |

USD 228.92 million |

Growth in the U.S. Golf Training Aids Market is driven by a rising interest in golf as both a recreational and competitive sport, supported by increased participation across diverse age groups. Advancements in training technologies, such as smart swing analyzers and virtual simulators, are enhancing skill development and engagement. The market is also benefitting from golf academies and clubs integrating innovative training equipment, as well as the growing demand for portable and user-friendly aids that cater to both amateur and professional players.

Regionally, the U.S. holds a dominant position in the golf training aids market due to its extensive golf course infrastructure, established golf culture, and high participation rates. States with year-round favorable climates, such as Florida, Arizona, and California, lead in adoption owing to their active golf communities. Emerging growth is observed in northern states as indoor golf simulators and seasonal training aids gain traction. Urban areas are also contributing to market expansion through the rise of golf entertainment venues and tech-enabled training facilities.

Market Insights:

- The U.S. Golf Training Aids Market was valued at USD 162.62 million in 2024 and is projected to reach USD 228.92 million by 2032, growing at a CAGR of 4.44%.

- Rising participation in golf across diverse age groups and skill levels is boosting demand for advanced and user-friendly training aids.

- Technological integration, including AI-powered swing analyzers and immersive simulators, is enhancing training efficiency and adoption.

- High product costs, particularly for advanced simulators and smart devices, are limiting accessibility for budget-conscious consumers.

- Market saturation in certain product categories is increasing competition and making differentiation a key challenge.

- The South holds the largest market share at 37%, driven by favorable weather, high golf course density, and strong tourism activity.

- Indoor facilities and urban golf entertainment venues are expanding opportunities, especially in regions with seasonal climate limitations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Participation Across Diverse Age Groups and Skill Levels

The U.S. Golf Training Aids Market benefits from steady growth in participation rates among both younger and older demographics. Increased youth engagement through school programs and junior leagues is building a foundation for lifelong involvement in the sport. Senior players are adopting training aids to maintain skill levels and physical activity. Golf’s popularity is supported by lifestyle shifts favoring outdoor leisure activities, boosting demand for equipment that enhances skill improvement. Professional tours and celebrity endorsements create greater awareness of training innovations. The accessibility of affordable beginner-friendly aids is drawing more first-time users. Golf academies are integrating modern training tools into their curricula. Broader demographic participation is fostering consistent market growth.

- For instance, the First Tee program in the United States has involved over 10.5million young people ages 5-18 since its inception, offering in-school and after-school access to golf training aids and skill-building opportunities.

Advancements in Smart Golf Technology and Data-Driven Training

Technology integration is a critical growth factor in the U.S. Golf Training Aids Market, with devices now offering advanced swing analysis and real-time feedback. Smart sensors, wearable devices, and AI-powered coaching tools are gaining adoption among players at all levels. Data visualization platforms help golfers understand and correct specific swing mechanics. These tools promote measurable performance improvements, driving repeat purchases and upgrades. Professional players use high-end analytics systems, influencing amateurs to adopt similar products. Affordable versions of advanced devices are expanding the customer base. Retailers are promoting bundled training packages that combine hardware and software solutions. The market’s technological evolution is reshaping player expectations for training efficiency.

- For instance, companies like HackMotion introduced wrist sensor devices that provide immediate, accurate swing feedback utilizing advanced motion sensor technology, capturing precise wrist angles and clubface control metrics for each swing.

Strong Institutional Support from Golf Academies and Clubs

The market receives strong backing from golf institutions that invest in advanced training infrastructure. Golf academies use innovative tools to attract and retain students seeking measurable improvement. Private clubs integrate high-tech simulators and practice aids to enhance member experiences. Indoor golf facilities are incorporating advanced systems, allowing year-round practice regardless of weather. Corporate golf programs are also introducing training aids for employee wellness and networking activities. Partnerships between equipment makers and golf schools accelerate product adoption. Retail partnerships with clubs help in promoting premium aids. Institutional endorsements contribute significantly to the credibility and visibility of training aids.

Expansion of Retail and Online Distribution Channels

The availability of training aids through multiple retail formats is strengthening the market’s accessibility. Specialty golf stores offer personalized fitting sessions with advanced devices. Large sporting goods retailers stock both entry-level and professional-grade aids to cater to broad audiences. E-commerce platforms provide extensive product ranges with competitive pricing and customer reviews. Subscription models for training software are creating recurring revenue streams. Seasonal promotions and bundled offers drive higher sales volumes. International brands entering the U.S. market through online channels enhance product diversity. Distribution expansion ensures that advanced golf training tools reach both urban and rural markets effectively.

Market Trends:

Integration of AI and Virtual Coaching Platforms

The U.S. Golf Training Aids Market is witnessing rapid adoption of AI-powered virtual coaching solutions that replicate in-person instruction. Advanced systems offer video-based swing analysis with instant feedback from certified coaches. Virtual platforms reduce the need for frequent travel to training facilities, appealing to busy professionals. The integration of AI algorithms enables precise adjustments to a player’s stance, grip, and swing path. Such tools allow remote monitoring of progress, creating long-term engagement between players and instructors. Portable devices are connecting to mobile apps, providing continuous learning opportunities. This shift towards hybrid coaching models is increasing user confidence in tech-based training. Manufacturers are now developing AI systems that adapt in real time to a player’s improvement curve. Cross-platform compatibility is enhancing accessibility for users across multiple devices.

- For instance, TrackMan’s AI Motion Analysis V2, released in April 2025, enables automatic detection of body joints and club positions throughout the entire swing sequence (P1 to P9), providing frame-by-frame analysis in under five seconds per swing.

Growth in Multi-Functional and Space-Saving Training Equipment

Players are seeking compact solutions that deliver multiple training benefits within a single product. Multi-functional aids combine swing path correction, putting alignment, and strength training in one unit. Such designs cater to golfers who face space constraints at home. Lightweight and portable products allow players to practice anywhere, from indoor spaces to outdoor ranges. Adjustable features within a single aid cater to varying skill levels. This approach maximizes value for consumers while reducing the need for multiple purchases. Manufacturers are focusing on modular designs that can expand with skill progression. Customizable attachments are being introduced to extend the lifespan and utility of each aid. Retailers are promoting such equipment as cost-effective solutions for diverse training needs.

Rising Popularity of Immersive Golf Simulation Experiences

Immersive simulation technology is expanding beyond elite training centers into consumer households. High-definition simulators provide lifelike course experiences alongside performance tracking. Integration with wearable swing monitors creates a comprehensive training environment. Simulators appeal to players in colder climates, ensuring year-round engagement. The popularity of golf-themed entertainment venues is increasing exposure to simulator-based training. Players appreciate the ability to compete with peers in a virtual setting while improving skills. This trend supports the convergence of leisure, competition, and skill development in a single experience. Manufacturers are enhancing simulator realism with advanced physics engines and weather replication. Subscription-based simulator content is encouraging ongoing customer engagement.

- For instance, Foresight Sports’ GCQuad and newer GC3S launch monitors use patented quadroscopic and triscopic camera systems to deliver unmatched accuracy for both ball and club data capture.

Increased Demand for Sustainable and Eco-Friendly Training Aids

Sustainability is influencing purchase decisions in the U.S. Golf Training Aids Market. Manufacturers are using recycled materials in product design without compromising durability. Eco-friendly packaging is becoming a standard expectation from consumers. Biodegradable training mats and non-toxic practice balls appeal to environmentally conscious buyers. Partnerships with environmental organizations are boosting brand credibility. This aligns with the broader sports industry’s commitment to reducing ecological footprints. Retailers are dedicating shelf space to green-certified golf products. Sustainability-driven innovation is becoming a competitive differentiator in the market. Brands are adopting transparent supply chain practices to strengthen consumer trust. Product lines with certified sustainability labels are seeing stronger growth momentum.

Market Challenges Analysis:

High Product Costs and Limited Accessibility in Certain Segments

Premium golf training aids often carry high price tags, limiting accessibility for entry-level players and budget-conscious consumers. The U.S. Golf Training Aids Market faces the challenge of balancing advanced technology with affordability. Players in rural areas may have fewer opportunities to experience high-end products before purchase. Limited awareness of low-cost alternatives can slow adoption rates in emerging golf communities. The high cost of advanced simulators and smart devices restricts their use to affluent segments. Price sensitivity is more prominent among casual players, creating market gaps. Retailers must bridge this divide through financing options and targeted marketing campaigns. Partnerships with community sports programs could expand exposure in underserved markets. Stronger promotional efforts around value-oriented products may help attract cost-conscious buyers.

Market Saturation and Differentiation Difficulties

With a growing number of brands offering similar solutions, differentiation is becoming more difficult. The U.S. Golf Training Aids Market must address issues of product redundancy, where multiple aids target the same performance area without offering unique value. Intense competition can lead to price wars that erode profitability. Brand loyalty is harder to maintain when alternatives are easily available. Product innovation cycles must accelerate to stay relevant against new entrants. Customer retention requires ongoing engagement through training content and community building. Saturation in certain categories may shift focus toward niche product development. Collaborations with professional athletes could help brands stand out in a crowded marketplace. Exclusive distribution agreements might also provide a competitive advantage in specific regions.

Market Opportunities:

Expansion into Indoor Golf Entertainment Venues

Indoor golf venues present significant growth potential for the U.S. Golf Training Aids Market. Such spaces cater to both casual players and serious trainees, offering a controlled environment for skill improvement. Manufacturers can partner with these venues to showcase and sell premium aids. The integration of training products into entertainment experiences increases consumer exposure. Urban areas with limited outdoor golf facilities represent strong adoption potential. Corporate event hosting at these venues can further boost visibility for innovative products. Collaborating with hospitality groups could create bundled entertainment and training packages. Targeting high-traffic entertainment hubs may accelerate brand recognition and adoption.

Customization and Personalization in Training Aids

Personalized training aids tailored to a player’s unique swing style and performance goals can create a competitive edge. The U.S. Golf Training Aids Market can benefit from offering modular tools that adapt to different skill levels. Data-driven customization through AI can strengthen player commitment to specific brands. Personalized branding options also appeal to gift buyers and corporate clients. Manufacturers that integrate adaptive technology into their designs can tap into premium consumer segments effectively. Offering interactive design tools online can increase customer engagement during the buying process. Partnerships with golf academies could help validate and promote personalized product lines.

Market Segmentation Analysis:

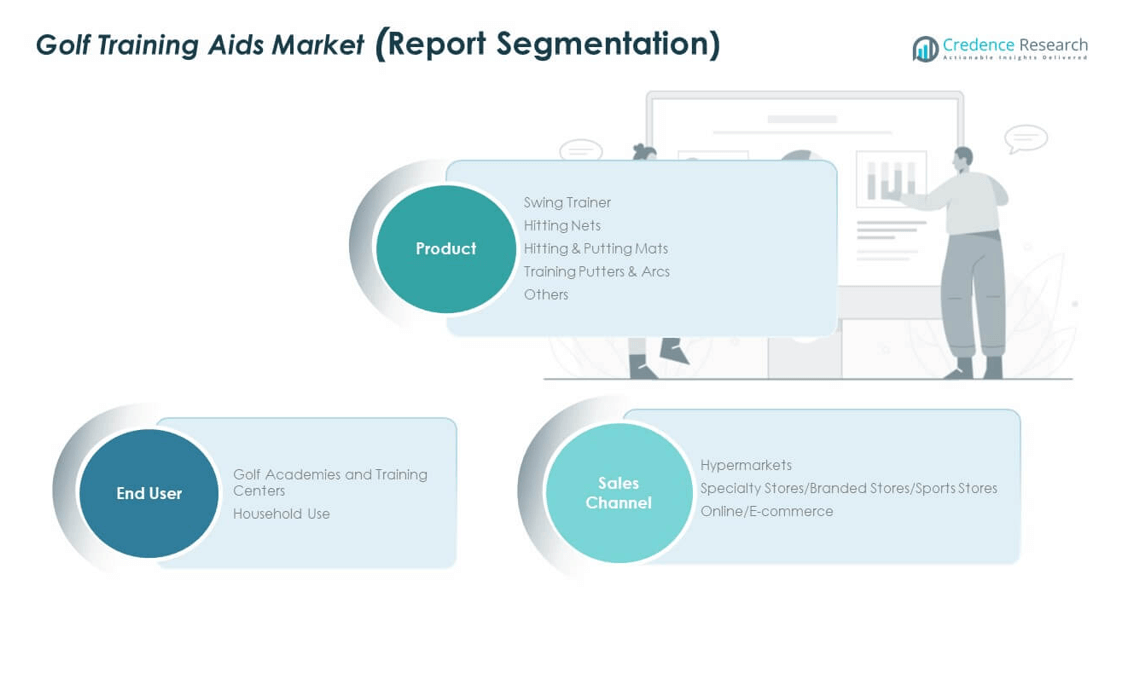

The U.S. Golf Training Aids Market is segmented by product, end user, and sales channel, reflecting the diverse range of consumer needs and purchasing behaviors.

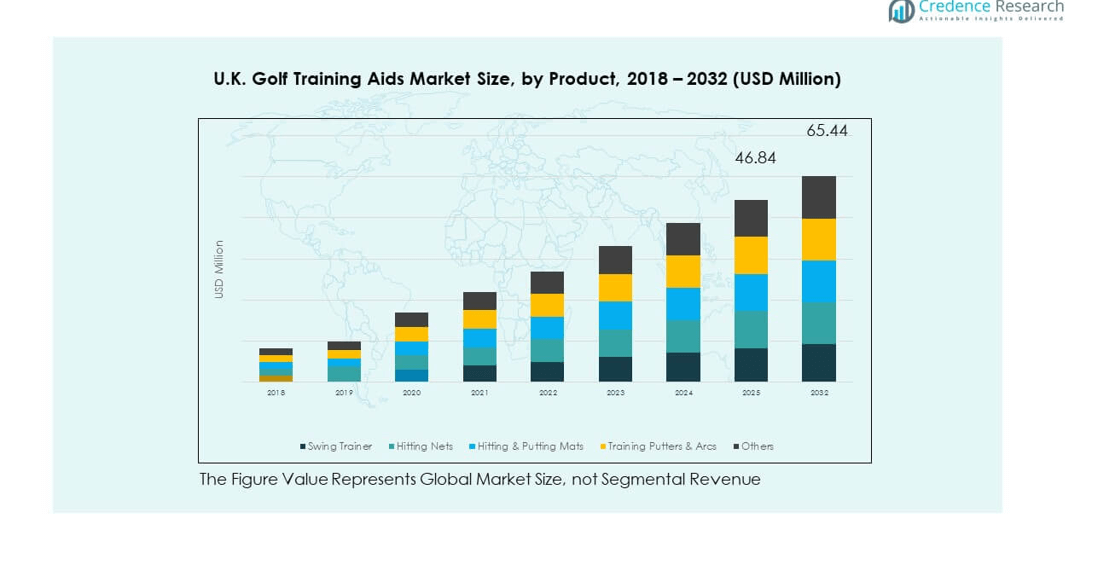

By product, swing trainers hold a significant share due to their role in improving swing mechanics and consistency, appealing to both amateurs and professionals. Hitting nets and hitting & putting mats cater to players seeking flexible practice options at home or in training facilities. Training putters and arcs are favored for putting accuracy enhancement, while the others category includes niche tools designed for specialized skill improvement.

- For example, Kavooa Pro swing training aid, developed by collegiate golfer Dylan Horowitz. Kavooa Pro utilizes a tripod-based adjustable rod system for real-time feedback, helping steady a player’s head and hips through each swing.

By end user, golf academies and training centers represent a substantial segment, driven by structured training programs and the integration of advanced equipment to attract and retain students. Household use is expanding as more players invest in personal training aids for convenience and regular practice, supported by compact and portable product designs. This shift toward home-based training solutions is influencing product innovation and affordability.

- The International Junior Golf Academy (IJGA) in Orlando, FL, offers world-class facilities equipped with advanced golf training technology, including TrackMan Doppler radar, K-Vest 3D motion capture, and Swing Catalyst performance studios, providing detailed performance analysis and real-time feedback to enhance player development.

By sales channel, specialty stores, branded outlets, and sports stores remain important for hands-on product trials and expert guidance. Hypermarkets contribute to market reach through their accessibility and competitive pricing. Online and e-commerce platforms are witnessing strong growth, offering extensive product choices, customer reviews, and delivery convenience. The expansion of digital retail is also enabling smaller brands to compete with established players, reshaping the competitive landscape.

Segmentation:

By Product Segment

- Swing Trainer

- Hitting Nets

- Hitting & Putting Mats

- Training Putters & Arcs

- Others

By End User Segment

- Golf Academies and Training Centers

- Household Use

By Sales Channel Segment

- Hypermarkets

- Specialty Stores / Branded Stores / Sports Stores

- Online / E-commerce

Regional Analysis:

The U.S. Golf Training Aids Market shows a strong regional performance led by the South, which holds 37% of the market share. Favorable weather conditions, a high concentration of golf courses, and a large retirement population contribute to sustained demand in states like Florida, Texas, and Georgia. The presence of major golf events and training academies further strengthens product adoption. The South also benefits from tourism-driven golf activity, which supports sales in both retail and hospitality-linked venues. Manufacturers are leveraging the region’s established golf culture to introduce advanced and premium training aids. Regional clubs and resorts are active partners in promoting new technologies to members and guests.

The West accounts for 28% of the market share, driven by golf’s strong recreational appeal and the popularity of year-round outdoor sports in states such as California, Arizona, and Nevada. Urban centers in the West are adopting golf entertainment venues that integrate advanced training systems. Indoor golf facilities are also expanding to cater to both competitive and leisure golfers. The West’s focus on sustainability aligns with the rising demand for eco-friendly golf training aids. Product diversity in this region is supported by both domestic and international suppliers, creating a highly competitive environment. Retailers are emphasizing premium, tech-enabled products to attract affluent and tech-savvy consumers.

The Midwest and Northeast collectively account for 35% of the market share, with the Midwest holding 20% and the Northeast 15%. Seasonal climate conditions in these regions drive interest in indoor training solutions and simulators. The Midwest has a strong community golf culture, with local clubs and academies investing in modern training infrastructure. In the Northeast, densely populated metropolitan areas create high potential for urban golf entertainment venues. Both regions are seeing increased adoption of compact, space-efficient training aids for home use. Growth in e-commerce is helping overcome geographical constraints, enabling customers to access a wide variety of products year-round. These regions are also becoming important testing grounds for hybrid golf retail models combining in-store experiences with digital sales platforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- West Coast Netting

- Acushnet Holdings Corp.

- Ace Nettings

- PlaneSWING

- Pro-Fit Net Installations Ltd

- EyeLine Golf

- Optishot Golf

- Skytrak

- FinalPutt

- Saber Golf

- Other Key Players

Competitive Analysis:

The U.S. Golf Training Aids Market is characterized by the presence of both established brands and emerging innovators competing across product categories. Leading players such as Acushnet Holdings Corp., EyeLine Golf, SkyTrak, and OptiShot Golf leverage advanced technologies, brand reputation, and strong distribution networks to maintain market share. Niche companies like PlaneSWING and Saber Golf focus on specialized training tools, targeting specific performance areas. Competition centers on product innovation, pricing strategies, and strategic partnerships with golf academies, retailers, and entertainment venues. E-commerce growth has intensified rivalry by enabling smaller brands to compete with larger players. Manufacturers are investing in sustainable materials, AI-driven training systems, and modular product designs to capture evolving consumer preferences. Product differentiation and brand credibility remain critical to success.

Recent Developments:

- In April 2025, GolfNow onboarded over 320 new golf properties across North America—including traditional golf courses and off-course fitting, training, and entertainment venues—and integrated its technology and services into their daily operations. It reflects growing demand for golf training facilities and underscores how the North America Golf Training Aids Market connects with expanding infrastructure

- In May 2025, EyeLine Golf launched the Speed Trap 2.0, a new and highly versatile training aid designed to improve swing path and ball striking in golfers of all skill levels. This innovative product quickly became popular in North America for delivering immediate feedback, helping users correct slices and hooks while enhancing overall swing trajectory.

- In April 2024, OptiShot Golf announced the launch of its Nova simulator, manufactured entirely in America. Nova sets a new standard for golf simulation with a single high-speed camera, infrared sensors, and integration with the company’s Orion Live simulator software, offering 20+ digital courses and robust online play features

Market Concentration & Characteristics:

The U.S. Golf Training Aids Market demonstrates moderate concentration, with a mix of dominant players and numerous smaller competitors serving niche segments. It is innovation-driven, with product lifecycles influenced by technological advancements and consumer trends. The market favors companies that offer integrated training solutions combining physical aids with digital coaching platforms. Distribution diversity, spanning specialty stores, hypermarkets, and e-commerce, supports market accessibility. Competitive positioning depends on product performance, pricing, and brand recognition. Companies that adapt quickly to emerging training trends and consumer demands are more likely to retain market relevance. Strategic brand collaborations and targeted marketing campaigns are becoming essential for sustaining competitive advantage.

Report Coverage:

The research report offers an in-depth analysis based on Product, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. Golf Training Aids Market will experience steady growth driven by rising participation in both recreational and competitive golf.

- Integration of AI, smart sensors, and data analytics will shape the next generation of training aids for precision improvement.

- Indoor golf facilities and entertainment venues will expand adoption, supporting year-round training opportunities.

- Sustainability initiatives will influence product development, with greater use of recycled and eco-friendly materials.

- E-commerce will remain a critical channel, offering broader product access and enabling smaller brands to compete effectively.

- Partnerships between manufacturers and golf academies will strengthen product credibility and adoption among serious players.

- Multi-functional and modular designs will attract consumers seeking space-efficient and value-driven training solutions.

- Advanced simulators and immersive technologies will appeal to tech-savvy golfers and high-income segments.

- Marketing strategies will increasingly focus on personalization and tailored performance solutions.

- Continuous innovation and brand differentiation will remain essential to maintaining a competitive edge in the evolving market.