Market Overview:

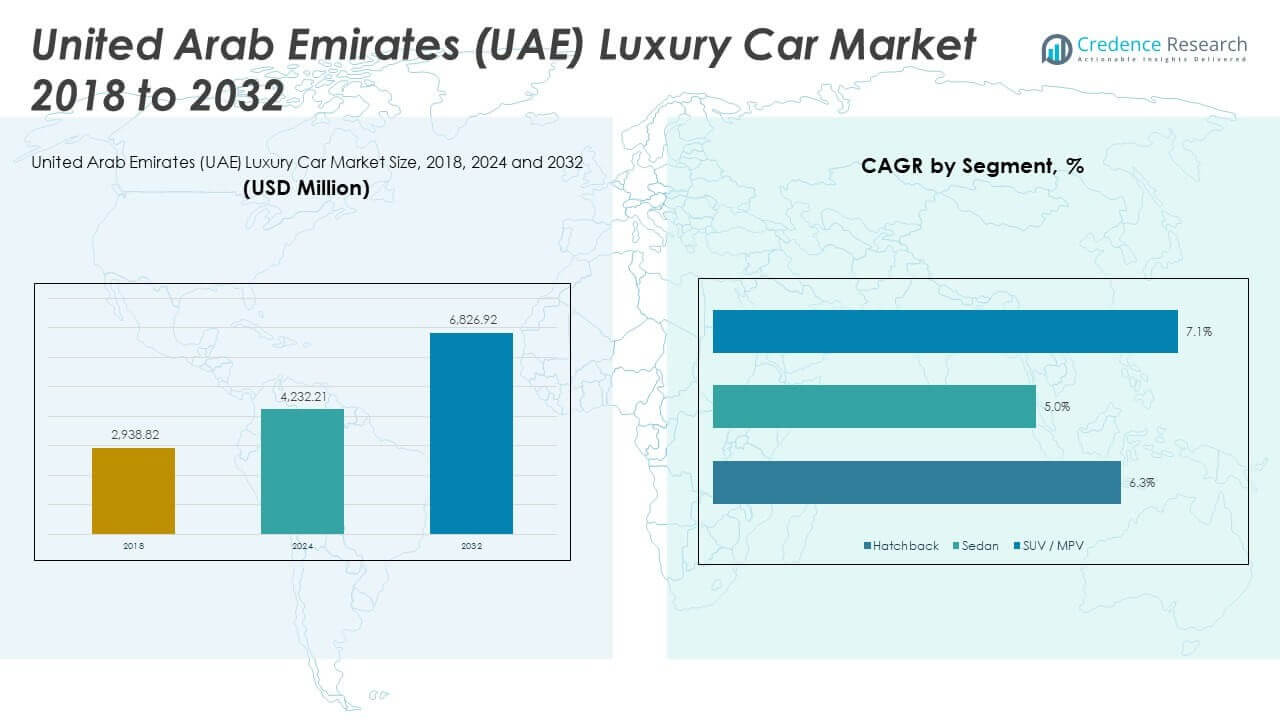

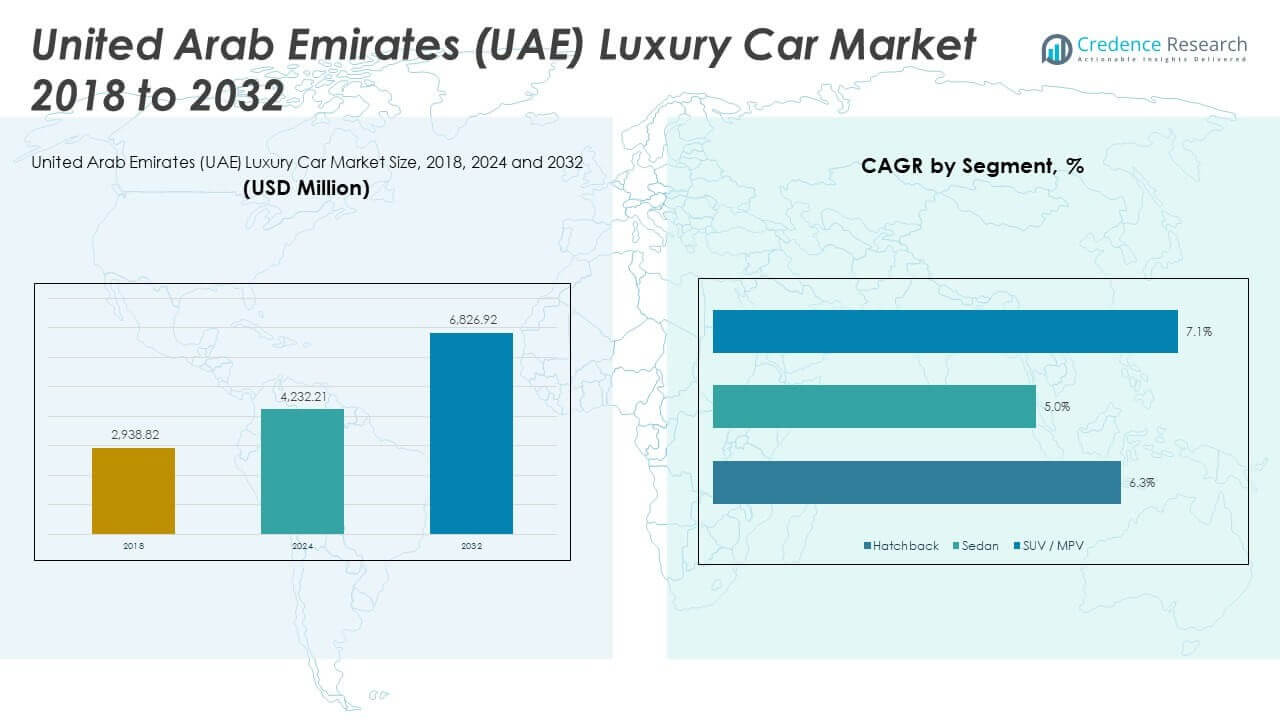

The United Arab Emirates (UAE) luxury car market, valued at USD 4,232.21 million in 2024, is projected to grow steadily at a CAGR of 5.73% to reach USD 6,826.92 million by 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| United Arab Emirates (UAE) Luxury Car Market Size 2024 |

USD 4,232.21 Million |

| United Arab Emirates (UAE) Luxury Car Market, CAGR |

5.73% |

| United Arab Emirates (UAE) Luxury Car Market Size 2032 |

USD 6,826.92 Million |

Several key factors underpin this growth. Firstly, the UAE is home to a rapidly growing affluent population with high disposable incomes. Luxury car ownership is often seen as a symbol of success and status among this demographic, leading to a sustained demand for high-end automotive brands.

Government policies in the UAE also play a crucial role in fostering this market growth. These policies promote economic diversification and attract foreign investment, making luxury cars more accessible through low import duties. The presence of a well-developed infrastructure in the UAE further enhances the allure of luxury car ownership, contributing to a conducive environment for market growth.

Consumer preferences are evolving towards personalized experiences and brand consciousness, further fuelling the demand for luxury cars. Emerging trends, such as the rising preference for Sport Utility Vehicles (SUVs) and the introduction of electric and hybrid vehicles, indicate the evolving landscape of luxury car ownership in the UAE.

However, the market also faces challenges. Economic fluctuations and increasing competition necessitate adaptability and innovation from luxury car manufacturers. Despite these challenges, the future outlook for the UAE luxury car market remains promising. Continued economic prosperity, evolving consumer preferences, and government initiatives supporting the growth of the automotive sector are expected to drive the market forward.

The UAE luxury car market is poised for significant growth in the coming years, driven by a combination of favourable economic conditions, government policies, and changing consumer preferences. However, to fully capitalize on these opportunities, luxury car manufacturers will need to navigate the challenges of economic fluctuations and increasing competition, and continue to innovate to meet the evolving needs and preferences of consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Economic Prosperity and Rising Affluence:

The UAE’s thriving and diversified economy, driven by its strategic location and abundant oil & gas reserves, has contributed to a population with increasing disposable incomes. For instance, this affluent demographic represents a prime market for luxury car brands seeking to tap into the desire for premium experiences and elevated social status. The demand for luxury automobiles is fueled by the aspiration of owning prestigious vehicles that reflect one’s success and sophistication in the prosperous UAE society.

Shifting Consumer Preferences and Brand Appeal:

UAE consumers exhibit a growing penchant for luxury car brands, drawn to the exclusivity, prestige, and technological innovation associated with these vehicles. Beyond mere transportation, owning a luxury car symbolizes individuality and makes a bold statement of achievement. For instance, consumers aspire to align themselves with brands like Rolls Royce and Bentley that offer not just products but lifestyle experiences synonymous with luxury and refinement. Luxury Cars market unit sales are expected to reach 3.7k vehicles in 2028.

Government-Led Initiatives and Infrastructure Development:

The UAE government’s focus on promoting tourism, business growth, and foreign investment has contributed to a conducive environment for luxury goods, including high-end automobiles. Extensive infrastructure development, such as world-class road networks, not only enhances the appeal of luxury cars but also provides an optimal platform for showcasing their performance and features. These initiatives align with the UAE’s vision of becoming a global hub for commerce, leisure, and innovation.

Tailored Marketing Strategies and Product Diversification:

Luxury car manufacturers continuously adapt their marketing strategies to resonate with the diverse and multicultural population of the UAE. They tailor their approaches to appeal to the unique preferences and lifestyles of consumers in the region. Moreover, these brands are expanding their product portfolios to include SUVs and crossovers, catering to the practical needs and preferences of UAE drivers navigating diverse terrains and urban landscapes.

Accessibility through Leasing and Financing Options:

The popularity of leasing and financing arrangements has democratized access to luxury cars, making them attainable for a broader segment of the population. Aspirational buyers who may not afford an outright purchase can now experience luxury through flexible leasing terms. This trend aligns with the UAE’s tech-savvy and brand-conscious consumer base, offering the opportunity to enjoy the latest models with ease and convenience.

Market Trends:

Shifting Preferences Towards SUVs and Performance Vehicles:

Consumers in the UAE are increasingly favoring SUVs and performance vehicles over traditional luxury sedans. For instance, the Lamborghini Urus and Porsche Cayenne, both high-performance SUVs, have seen a surge in popularity in the UAE. This trend reflects a growing desire for a blend of luxury, practicality, and power. In 2021, SUVs were the most common body type of passenger cars in the UAE with a market share of just over 50%. Manufacturers are catering to this demand by introducing high-performance SUVs and sporty sedans, further fueling market growth.

Rising Demand for Customization and Personalization:

Discerning UAE luxury car buyers seek vehicles tailored to their unique preferences. For instance, Rolls-Royce offers its customers in the UAE a nearly limitless array of customization options, from bespoke paint colors and interior trims to personalized performance packages and accessories. Another example is Ferrari, which has introduced an unprecedented level of customization for their Dubai flagship model, allowing customers to tailor every aspect of their car to personal preferences. Manufacturers are responding by offering extensive customization options, including bespoke interiors, exclusive paint colors, and personalized technology packages. This trend highlights the growing importance of a unique and personalized ownership experience in the luxury car market.

Growing Popularity of Electric and Hybrid Luxury Cars:

Increasing environmental consciousness and government incentives are driving the adoption of electric and hybrid luxury cars in the UAE. For instance, the Tesla Model S and Porsche Taycan, both luxury electric vehicles, have been well-received in the UAE. In October 2022, the share of leads for electric car listings stood at 2.77% whereas October 2023 saw the share jump to 6.25% — a significant increase of 3.48%. The UAE government has launched several initiatives to promote electric vehicles as part of its broader sustainability and environmental goals. These vehicles offer a sustainable alternative to traditional gasoline-powered models without compromising on luxury or performance. As charging infrastructure expands and battery technology improves, electric and hybrid luxury cars are expected to gain further traction in the market.

Evolving Retail Landscape and Online Presence:

The UAE luxury car market is witnessing a shift towards a more digital retail experience. Luxury car dealerships are increasingly utilizing online platforms to showcase their inventory, offer virtual consultations, and facilitate online car purchases. This digital transformation caters to the evolving preferences of tech-savvy consumers who seek a convenient and personalized car buying journey.

Focus on Enhanced After-Sales Services:

Recognizing the importance of customer satisfaction, luxury car manufacturers in the UAE are placing a greater emphasis on after-sales services. This includes offering extended warranties, personalized maintenance packages, and exclusive ownership benefits. By prioritizing exceptional after-sales care, luxury car brands aim to cultivate long-term customer loyalty and brand advocacy.

Market Restraints and Challenges:

Economic Fluctuations and High Import Duties:

The UAE’s luxury car market is heavily influenced by economic conditions. Fluctuations in oil prices, a major driver of the UAE’s economy, can lead to decreased consumer spending on luxury goods like cars. Additionally, high import duties levied on luxury vehicles inflate their final price tag, potentially deterring some high-net-worth individuals from making a purchase.

Shifting Consumer Preferences and Rise of Sustainable Transportation:

A growing segment of consumers, particularly younger generations, are becoming more environmentally conscious. This could lead to a shift in preference towards electric vehicles (EVs) or other sustainable transportation options, potentially impacting the sales of traditional luxury gasoline-powered cars.

Increasing Competition and Market Saturation:

The UAE luxury car market is witnessing growing competition from established players and new entrants. This intensifies competition for market share and brand loyalty. Additionally, the market may be nearing saturation in certain segments, making it challenging for manufacturers to introduce new models that significantly stand out from existing offerings.

Fluctuations in Currency Exchange Rates:

The UAE Dirham (AED) is pegged to the US Dollar (USD). Fluctuations in the exchange rate between these currencies can impact the affordability of imported luxury cars. A stronger USD can make luxury cars more expensive for UAE consumers, potentially leading to a decline in sales.

Evolving Regulations and Infrastructure for Electric Vehicles:

While the UAE is actively promoting electric vehicle adoption, the current infrastructure is still under development. This includes a limited network of charging stations and a lack of readily available spare parts and service options for EVs. Additionally, government regulations and policies concerning EVs are still evolving, creating some uncertainty for both consumers and manufacturers.

Recent Developments:

- In September 2023, Dubai Police incorporated 100 Audi RS e-tron GTs, fully electric with a 488-kilometer range, into their luxury patrol car fleet.

- In February 2023, AW Rostamani Group launched NXT Luxury, its first luxury used-car showroom in Dubai.

Segmentation Analysis:

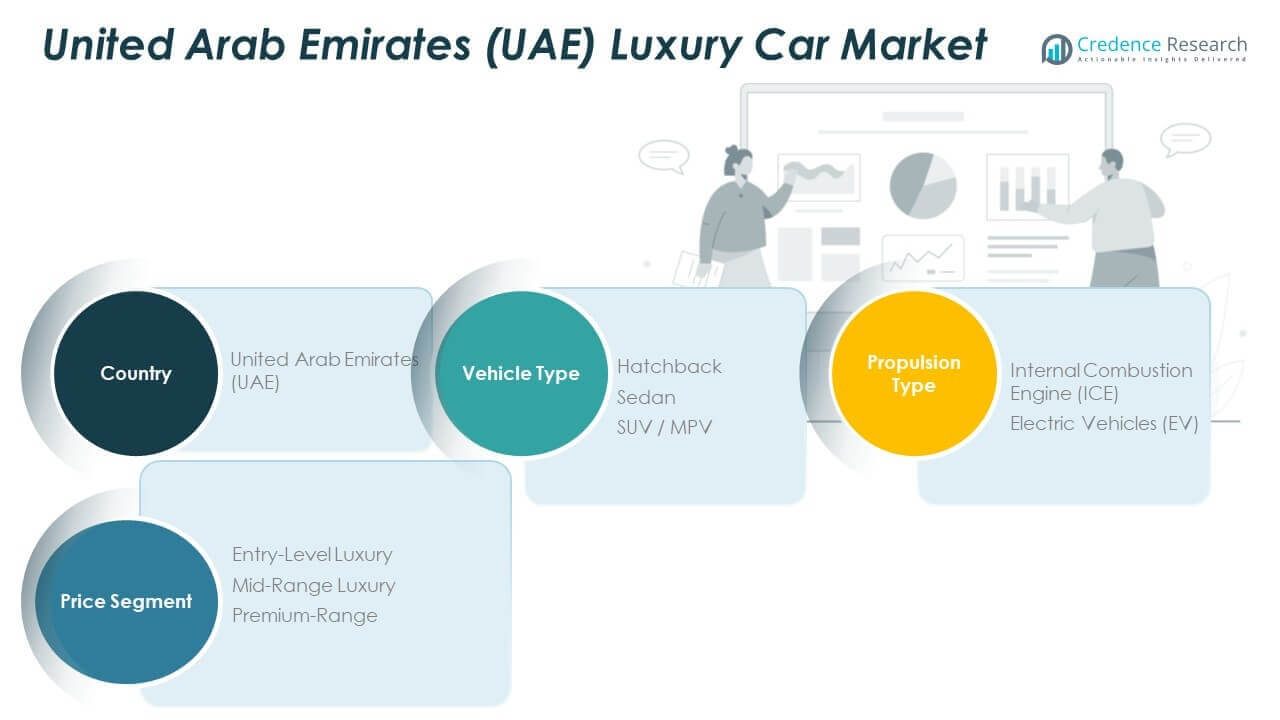

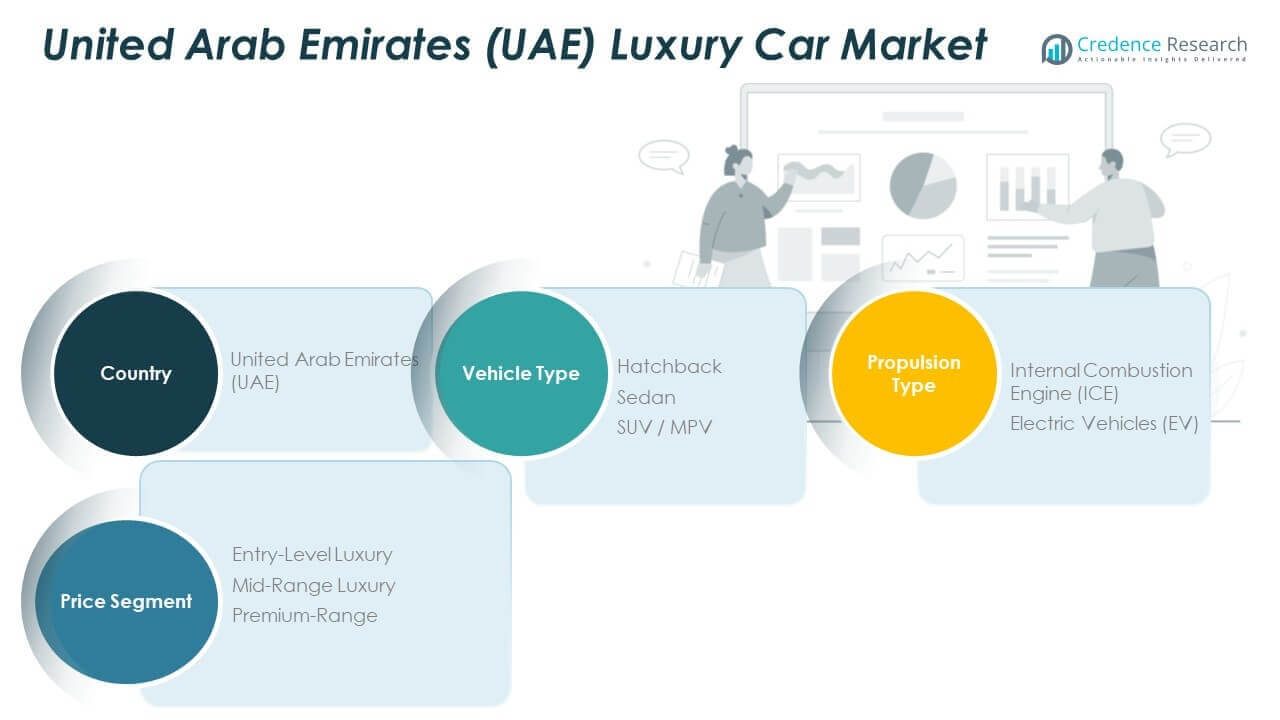

Vehicle Type:

- SUVs: The most popular segment due to a preference for spaciousness, comfort, and off-road capabilities favored by the region’s terrain.

- Sedans: Still hold a significant share, particularly for premium business use and a preference for a classic luxury car experience.

- Sports Cars: A niche segment catering to driving enthusiasts seeking high performance and exclusivity.

By Propulsion:

- The market is divided into two primary segments: Internal Combustion Engine (ICE) and Electric/Hybrid vehicles. Currently, the ICE segment dominates the market due to established consumer preferences and existing infrastructure. However, the electric and hybrid segment is rapidly gaining traction, driven by increasing environmental awareness and advancements in battery technology. This shift is expected to enhance the appeal of electric luxury vehicles, making them a significant part of the market in the coming years.

By Price Segment:

- The luxury car market is also categorized into entry-level luxury, mid-level luxury, and ultra-luxury segments. The mid-level luxury segment holds the largest market share, appealing to a broad range of consumers seeking premium features without the ultra-luxury price tag. The ultra-luxury segment, while smaller, is characterized by high demand among affluent consumers, particularly in emerging markets where wealth is increasing.

Segments:

By Vehicle Type:

By Propulsion:

By Price Segment:

- Entry Level

- Mid-Range

- Premium-Range

By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE

Key player:

- Rolls-Royce Motor Cars Limited

- BMW AG

- Koenigsegg Automotive AB

- Automobili Lamborghini S.p.A.

- W Motors

- Daimler AG

- Volkswagen AG

- Aston Martin Lagonda Limited

- Ferrari S.p.A.

- Automobiles Ettore Bugatti

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Regional Analysis:

The UAE luxury car market is on the brink of significant expansion, driven by a convergence of regional factors conducive to the proliferation of high-end vehicles. With a growing population experiencing an uptick in disposable income, particularly among high-net-worth individuals, there’s a burgeoning demand for luxury cars perceived as symbols of status and aspiration. This demand is further fueled by a steady influx of wealthy individuals drawn to the UAE’s business opportunities and lavish lifestyle offerings. Additionally, the deeply entrenched cultural appreciation for luxury brands, coupled with supportive government policies promoting foreign investment and robust infrastructure development, creates an appealing landscape for luxury car manufacturers and dealerships. As consumer preferences continue to evolve towards personalized experiences and cutting-edge features, manufacturers have the opportunity to capitalize on this trend by offering innovative offerings tailored to the discerning tastes of UAE consumers.

Future Outlook:

- A growing affluent population in the UAE with increasing disposable income is expected to fuel demand for luxury cars.

- A shift in consumer preferences towards premium experiences, personalization, and technological advancements will drive demand for high-end vehicles with cutting-edge features.

- The UAE’s supportive government policies promoting tourism and economic diversification are expected to create a positive environment for the luxury car market.

- The increasing popularity of SUVs within the luxury car segment, catering to both on-road and off-road preferences, is likely to remain a significant trend.

- A growing focus on sustainability is propelling the demand for electric and hybrid luxury cars, and government initiatives promoting electric vehicles will further accelerate this trend.

- Luxury car dealerships are expected to elevate the customer experience through personalized services, digital showrooms, and innovative marketing strategies.

- The market for pre-owned luxury cars is anticipated to witness significant growth, driven by affordability and wider options for budget-conscious buyers.

- The growing adoption of online platforms for buying and selling luxury cars is expected to offer greater convenience and wider choices for consumers.

- Luxury car manufacturers are likely to place a stronger emphasis on after-sales services like maintenance packages, extended warranties.

- The intensifying competition within the luxury car market is expected to drive innovation in design, technology, and performance.