| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| United Kingdom Human Insulin Market Size 2023 |

USD 868.55 Million |

| United Kingdom Human Insulin Market, CAGR |

4.41% |

| United Kingdom Human Insulin Market Size 2032 |

USD 1,281.77 Million |

Market Overview

United Kingdom Human Insulin Market size was valued at USD 868.55 million in 2023 and is anticipated to reach USD 1,281.77 million by 2032, at a CAGR of 4.41% during the forecast period (2023-2032).

The United Kingdom human insulin market is driven by the rising prevalence of diabetes, increasing awareness about diabetes management, and advancements in insulin delivery technologies. An aging population and lifestyle changes have further escalated the demand for effective insulin therapies. Government initiatives promoting early diagnosis and improved healthcare infrastructure also contribute to market growth. Additionally, the trend toward personalized medicine and the adoption of biosimilar insulin products are shaping the market landscape. Pharmaceutical companies are focusing on research and development to introduce innovative formulations with enhanced efficacy and fewer side effects. Digital health integration, such as smart insulin pens and connected devices, is gaining traction, offering better patient compliance and monitoring. Furthermore, collaborations between healthcare providers and private organizations to improve access to insulin therapies are expected to support sustained market expansion. These drivers and emerging trends collectively position the United Kingdom’s human insulin market for steady growth through 2032.

The United Kingdom human insulin market is geographically diverse, with key demand concentrated in urban centers such as London, Manchester, Birmingham, and Scotland. These regions benefit from robust healthcare infrastructure, specialized diabetes care centers, and strong government support for diabetes management programs. The market is influenced by factors such as population density, healthcare access, and regional awareness campaigns. Major players in the UK market include Novo Nordisk, Eli Lilly, and AstraZeneca, which dominate the landscape with their broad portfolio of insulin products, ranging from traditional human insulin to advanced biosimilars and innovative delivery systems. Additionally, companies like Pfizer, Biocon, and Lupin are also contributing to the competitive dynamics with a focus on expanding their market share through cost-effective insulin options and continued research into diabetes therapies. These key players drive innovation and play a pivotal role in ensuring access to effective insulin solutions across the UK.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The United Kingdom human insulin market was valued at USD 868.55 million in 2023 and is projected to reach USD 1,281.77 million by 2032, growing at a CAGR of 4.41% during the forecast period (2023-2032).

- The global human insulin market was valued at USD 21,000 million in 2023 and is projected to reach USD 31,208 million by 2032, growing at a CAGR of 4.50% from 2023 to 2032.

- The increasing prevalence of diabetes, especially Type 2, and an aging population are key drivers of market growth.

- Advancements in insulin delivery technologies, such as smart pens and pumps, are transforming diabetes management.

- The adoption of biosimilar insulin products is accelerating due to cost-effectiveness and increasing availability.

- Competitive pressure in the market is heightened by major players like Novo Nordisk, Eli Lilly, and AstraZeneca, which drive innovation and product offerings.

- Market restraints include high treatment costs and regulatory hurdles that can impact the availability of new insulin therapies.

- Regionally, London and Manchester dominate the market, with other areas like Scotland seeing steady growth in demand.

Report Scope

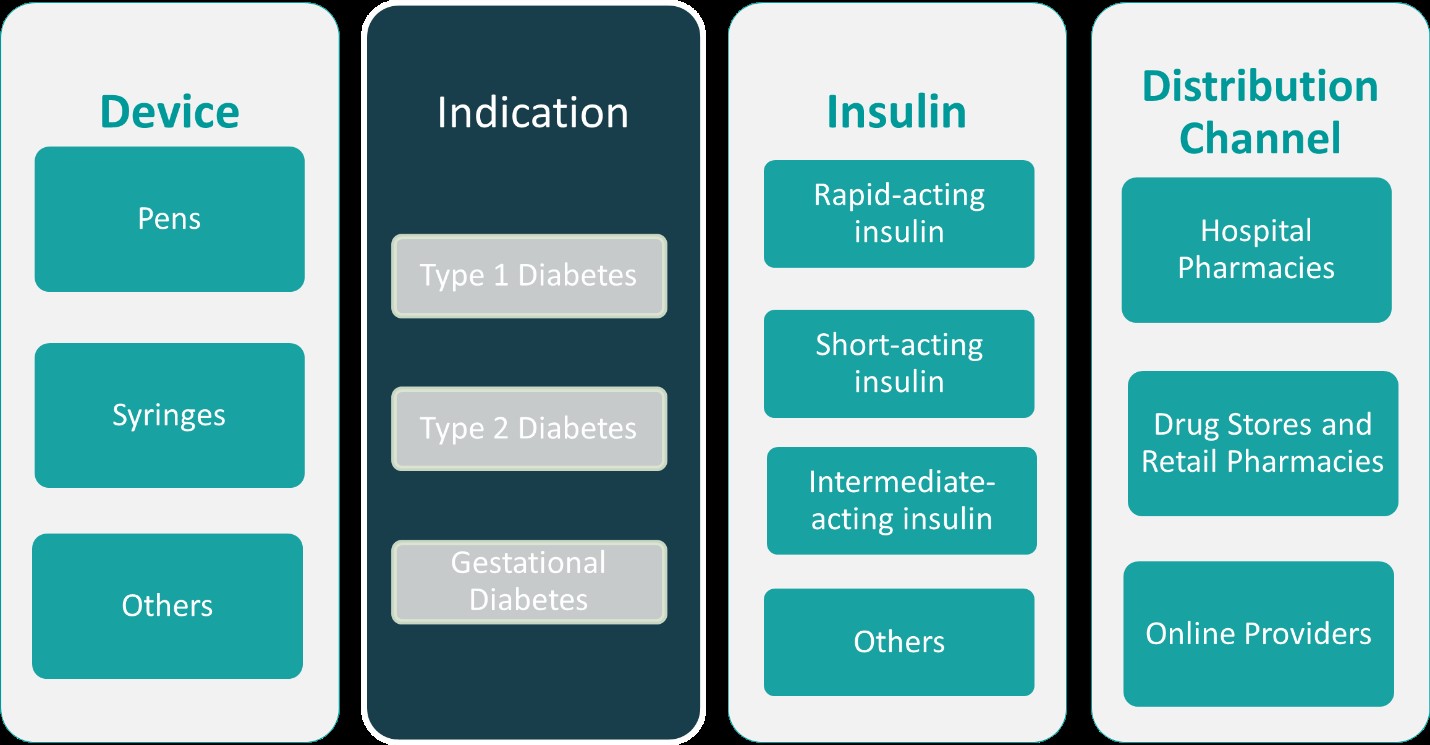

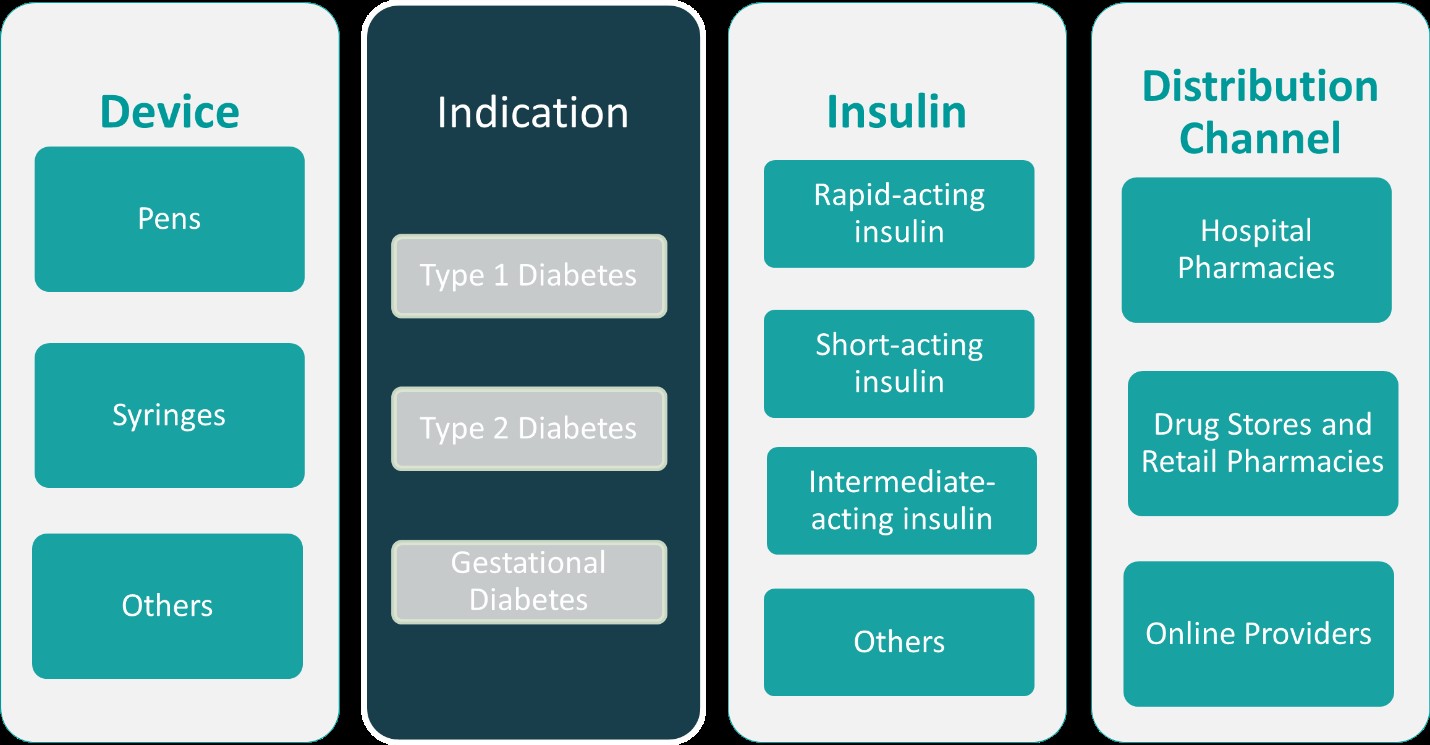

This report segments the United Kingdom Human Insulin Market as follows:

Market Drivers

Rising Prevalence of Diabetes

The increasing incidence of diabetes remains a primary driver of the United Kingdom human insulin market. Sedentary lifestyles, unhealthy dietary habits, and the growing aging population have significantly contributed to a rise in Type 1 and Type 2 diabetes cases. According to leading health organizations, the number of people diagnosed with diabetes continues to grow steadily each year, resulting in greater demand for effective insulin therapies. Early diagnosis initiatives and national screening programs have also heightened awareness, ensuring that more patients receive timely and adequate treatment. As diabetes becomes more prevalent across various age groups, the consistent need for human insulin solutions will continue to propel market growth.

Advancements in Insulin Delivery Technologies

Technological innovation in insulin delivery methods has significantly enhanced patient outcomes and comfort, contributing to market expansion. Traditional insulin administration through syringes is gradually being replaced by advanced devices such as insulin pens, pumps, and smart delivery systems. For instance, the National Diabetes Audit tracks the adoption of insulin pump therapy and other advanced delivery systems across NHS practices, reflecting a growing shift toward digital insulin management solutions. These technologies provide patients with easier, more accurate, and more discreet options for managing their insulin needs, resulting in improved adherence to therapy. In particular, digital insulin pens that sync with mobile apps are gaining popularity, offering real-time dosage tracking and reminders. Such innovations are transforming diabetes management from a cumbersome daily routine into a streamlined, patient-centered experience, thereby supporting sustained growth in the human insulin sector.

Government Initiatives and Healthcare Improvements

Supportive government policies and continuous improvements in healthcare infrastructure are major contributors to the human insulin market’s growth in the United Kingdom. The National Health Service (NHS) plays a pivotal role in ensuring widespread and affordable access to insulin therapies through various reimbursement and subsidy programs. Additionally, public health campaigns aimed at promoting early diagnosis, preventive healthcare, and patient education have enhanced the overall management of diabetes across the country. Investments in modernizing hospitals and clinics with state-of-the-art diabetes care facilities have also facilitated quicker access to specialized treatments. These efforts not only ensure that patients receive the necessary care but also create a favorable environment for market expansion.

Growing Adoption of Biosimilar Insulin

The introduction and growing acceptance of biosimilar insulin products present another strong driver for the United Kingdom’s human insulin market. Biosimilars offer comparable efficacy and safety to their branded counterparts but at significantly lower costs, making them an attractive alternative for healthcare providers and patients alike. For instance, a Diabetes Care study analyzing biosimilar insulin adoption in England found that biosimilars generated £900,000 in savings between 2015 and 2018, with potential missed savings amounting to £25.6 million due to slow uptake. The NHS’s initiatives to encourage the use of biosimilars have resulted in increased adoption rates, easing the financial burden on both the system and individuals. Pharmaceutical companies are investing heavily in the development and commercialization of new biosimilar products, further intensifying competition and fostering innovation. As cost-effectiveness and accessibility become more important to healthcare systems and consumers, the biosimilar segment is expected to play a vital role in shaping the future of the human insulin market in the United Kingdom.

Market Trends

Shift Toward Personalized Diabetes Management

One of the key trends influencing the United Kingdom human insulin market is the growing shift toward personalized diabetes management. Healthcare providers are increasingly adopting patient-specific treatment plans that consider individual lifestyle, genetics, and disease progression. Tailored insulin therapies not only improve treatment outcomes but also enhance patient satisfaction and compliance. Advances in diagnostic technologies and data analytics have made it possible to monitor blood glucose trends more accurately, allowing for more precise insulin dosing. As personalization becomes a standard expectation in healthcare delivery, the demand for flexible and customizable human insulin solutions is anticipated to grow significantly.

Rising Popularity of Digital Health Solutions

Digital health innovations are reshaping the landscape of diabetes care in the United Kingdom, particularly in insulin management. Technologies such as smart insulin pens, continuous glucose monitoring (CGM) systems, and mobile health applications are enabling patients to manage their condition more proactively. For instance, the State of Digital Government Review discusses the UK’s investment in digital healthcare, highlighting the NHS app as one of the most widely used digital health tools. These tools offer real-time feedback, dosage tracking, and remote monitoring, enhancing both self-care and clinical decision-making. Telemedicine platforms have also gained prominence, allowing diabetes specialists to reach more patients efficiently. The integration of digital solutions into insulin therapy is not only improving patient engagement but also driving better long-term health outcomes, making it a major trend in the market.

Emphasis on Early Diagnosis and Preventive Care

An increasing emphasis on early diagnosis and preventive care is shaping the future of the human insulin market in the United Kingdom. Public health campaigns and educational initiatives are raising awareness about the importance of early intervention in diabetes management. For instance, the Advancing Our Health: Prevention in the 2020s consultation document outlines the UK’s strategy for proactive, predictive, and personalized prevention, including targeted support and lifestyle interventions. Early detection enables timely initiation of insulin therapy, preventing complications and improving patient quality of life. Additionally, preventive strategies focusing on lifestyle modifications and risk factor management are gaining traction among healthcare providers. This proactive approach is expected to reduce the long-term economic burden of diabetes on the healthcare system and fuel sustained demand for human insulin products tailored for early-stage management.

Increased Adoption of Biosimilar Insulin Products

The adoption of biosimilar insulin products is gaining significant momentum in the United Kingdom, supported by favorable regulatory frameworks and cost-saving initiatives. Biosimilars provide similar efficacy and safety as originator biologics but at reduced prices, offering healthcare systems a viable solution to manage rising treatment costs. The NHS actively promotes the use of biosimilars to improve affordability and expand access to insulin therapies. As more biosimilar options become available, competition among pharmaceutical manufacturers is intensifying, leading to greater innovation and price efficiency. This trend is expected to continue, making biosimilars a critical component of future market growth.

Market Challenges Analysis

High Cost of Insulin Therapy and Budget Constraints

One of the most pressing challenges facing the United Kingdom human insulin market is the high cost associated with insulin therapy. Despite the widespread availability of insulin through the National Health Service (NHS), the overall economic burden on the healthcare system remains substantial. For instance, a report by Nursing in Practice estimates that diabetes treatment and management cost the UK nearly £14 billion in 2021/22, accounting for approximately 6% of the total NHS budget. Branded insulin products, particularly newer analog formulations, often come with premium pricing, placing strain on NHS budgets. This is especially concerning given the rising prevalence of diabetes and the corresponding increase in long-term insulin demand. While biosimilar insulin offers a cost-effective alternative, its adoption has not yet reached its full potential due to limited awareness among patients and some resistance from healthcare providers. Budgetary constraints and the need to balance cost with clinical efficacy continue to challenge policy makers and providers, potentially limiting access to the most advanced or appropriate therapies for certain patient populations.

Regulatory Hurdles and Supply Chain Vulnerabilities

The UK human insulin market also faces challenges related to regulatory processes and supply chain vulnerabilities. Post-Brexit regulatory adjustments have created complexities in the approval and distribution of pharmaceutical products, including insulin. Changes in import and export regulations, coupled with evolving standards for biosimilar approvals, have introduced uncertainty and delays for manufacturers. Additionally, global supply chain disruptions—exacerbated by geopolitical tensions and raw material shortages—have led to intermittent insulin availability and increased logistical costs. These disruptions threaten the timely and consistent delivery of insulin, particularly to rural and underserved areas. Ensuring a stable supply of high-quality insulin remains a priority, yet achieving this goal requires coordinated efforts across stakeholders, including government agencies, manufacturers, and healthcare providers. Without improved resilience and clarity in regulatory and distribution frameworks, the market may face ongoing risks that hinder its ability to meet growing patient needs.

Market Opportunities

The United Kingdom human insulin market presents several promising opportunities, particularly in the areas of innovation and expanding patient access. As the demand for more effective and patient-friendly insulin therapies grows, there is significant scope for pharmaceutical companies to invest in advanced formulations and delivery systems. Innovations such as ultra-rapid-acting insulins, long-acting analogs, and smart insulin technologies offer the potential to improve glycemic control and enhance quality of life for patients. Additionally, the integration of digital health tools with insulin delivery such as smart pens and mobile health platforms creates new avenues for remote monitoring, personalized dosing, and real-time data sharing. These innovations not only improve patient outcomes but also support healthcare professionals in delivering more efficient and proactive diabetes care.

Another key opportunity lies in expanding the adoption of biosimilar insulin products, which offer cost-effective alternatives to branded formulations without compromising efficacy or safety. With the NHS focused on optimizing healthcare expenditure, biosimilars are well-positioned to play a crucial role in expanding access to insulin therapies, particularly among economically constrained populations. Moreover, growing awareness and education about biosimilars among both healthcare providers and patients can drive higher adoption rates in the coming years. Public-private partnerships, along with targeted government initiatives, also present an opportunity to enhance early diagnosis, preventive care, and outreach in underserved regions. As the UK continues to invest in its healthcare infrastructure and digital transformation, market participants who align with these priorities by offering accessible, technology-enabled, and cost-efficient solutions will be well-placed to capitalize on the evolving needs of the insulin market.

Market Segmentation Analysis:

By Device:

The United Kingdom human insulin market, when segmented by device, reveals that insulin pens hold the largest share due to their ease of use, accuracy, and convenience for patients requiring daily insulin administration. These devices are increasingly preferred over traditional methods, particularly among younger patients and those managing Type 1 diabetes, as they support better adherence and offer discreet usage. Syringes, although still in use, especially in clinical settings and among cost-sensitive patient groups, are gradually declining in preference due to their complexity and reduced comfort. The “Others” category, which includes emerging technologies such as insulin pumps and smart delivery systems, is gaining traction as digital integration in diabetes care accelerates. These innovative devices are expected to see growing adoption, supported by technological advancements and favorable healthcare policies encouraging personalized and connected care. Overall, the device-based segmentation highlights a clear shift toward user-friendly and tech-enabled insulin delivery systems that cater to evolving patient expectations and improve treatment compliance.

By Indication:

Based on indication, Type 1 diabetes represents a significant portion of the UK human insulin market, given the lifelong dependency of these patients on insulin therapy. Individuals with Type 1 diabetes require continuous and closely monitored insulin administration, which drives consistent demand across various age demographics. However, Type 2 diabetes dominates the market due to its higher prevalence and increasing incidence linked to aging populations, sedentary lifestyles, and rising obesity rates. The insulin needs of Type 2 patients vary, often escalating with disease progression, thus supporting long-term market growth. Gestational diabetes, though representing a smaller segment, presents an emerging opportunity as awareness and screening improve among pregnant women. Proper insulin management during pregnancy is crucial for maternal and fetal health, and the demand for safe, rapid-acting insulin options in this group is steadily rising. This indication-based segmentation underscores the importance of tailored insulin therapies that address the diverse and growing needs of the UK’s diabetic population.

Segments:

Based on Device:

Based on Indication:

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

Based on Insulin:

- Rapid-acting insulin

- Short-acting insulin

- Intermediate-acting insulin

- Others

Based on Distribution Channel:

- Hospital Pharmacies

- Drug Stores and Retail Pharmacies

- Online Providers

Based on the Geography:

- London

- Manchester

- Birmingham

- Scotland

Regional Analysis

London

London, as the capital and the largest urban area, holds the highest market share, accounting for approximately 35% of the total market. This can be attributed to its significant population size, advanced healthcare infrastructure, and higher awareness levels surrounding diabetes management. London also benefits from its concentration of specialized diabetes centers and research institutions, which drive both innovation and adoption of advanced insulin therapies. The presence of a diverse demographic in the region ensures a robust demand for a wide range of insulin products, from traditional syringes to innovative smart insulin devices, facilitating continued market dominance.

Manchester

Manchester holds a market share of around 18%. As one of the major cities in the north, Manchester is home to a large urban population with a growing demand for diabetes management solutions. The region’s healthcare system is well-established, and there is an increasing emphasis on preventative care and early diagnosis, which positively impacts insulin market growth. The widespread availability of both branded and biosimilar insulin products in Manchester also supports higher adoption rates, especially as healthcare providers aim to balance cost and efficacy for a diverse patient base. Continued efforts in public health campaigns and increasing patient education contribute to the region’s expanding market.

Birmingham

Birmingham, with a market share of approximately 14%, represents the third-largest region in terms of human insulin consumption. This Midlands city is known for its significant healthcare facilities, including several diabetes care centers, which cater to a growing diabetic population. Birmingham’s market growth is also driven by a rising awareness of diabetes management solutions, particularly as Type 2 diabetes rates increase due to lifestyle factors. Healthcare providers are increasingly adopting insulin pens and biosimilars, contributing to broader accessibility to insulin therapies and fueling market growth in this region.

Scotland

Scotland, accounting for about 12% of the UK market share, presents a unique regional landscape for human insulin. The demand in Scotland is driven by an aging population and increasing rates of Type 2 diabetes, a trend prevalent across rural areas as well as urban centers like Edinburgh and Glasgow. Scotland also benefits from government support for diabetes care, including public health initiatives aimed at improving access to affordable insulin therapies. While the overall market share is smaller compared to southern regions, Scotland’s focus on early diagnosis and tailored diabetes care provides a growing opportunity for insulin product adoption, particularly in underserved rural communities.

Key Player Analysis

- Novo Nordisk A/S

- MannKind Corporation

- Pfizer

- Wockhardt

- Biocon

- Lupin

- Tonghua Dongbao Pharmaceutical Co

- Eli Lilly and Company

- AstraZeneca

Competitive Analysis

The United Kingdom human insulin market is highly competitive, driven by key global players who continually innovate and expand their product portfolios. Leading players such as Novo Nordisk, Eli Lilly and Company, AstraZeneca, Pfizer, Wockhardt, Biocon, Lupin, MannKind Corporation, and Tonghua Dongbao Pharmaceutical Co dominate the market. These companies offer a wide range of insulin products, including traditional human insulin, insulin analogs, and biosimilars, catering to diverse patient needs. As competition intensifies, companies are increasingly focusing on enhancing their product portfolios with advanced delivery systems, such as insulin pens, pumps, and smart devices that improve patient adherence and convenience. The market is also witnessing a shift towards biosimilar insulin products, driven by the need for cost-effective alternatives to branded insulins. These biosimilars offer comparable efficacy and safety, making them attractive options for both healthcare providers and patients, especially in public healthcare systems like the NHS. Additionally, the growing demand for personalized diabetes care is prompting companies to invest in technologies that enable precise insulin management, such as continuous glucose monitoring (CGM) systems integrated with insulin delivery devices. In response to regulatory changes and rising demand for more affordable options, the competitive landscape is evolving. Companies are also exploring collaborations and partnerships to expand their reach and improve access to insulin therapies. The focus on cost efficiency, improved patient outcomes, and technological advancements continues to shape the dynamic and competitive environment of the UK human insulin market.

Recent Developments

- In April 2025, Novo Nordisk announced the discontinuation of Human Mixtard, India’s largest-selling human insulin brand, as part of a global strategy to prioritize newer, patented diabetes and weight loss therapies such as Ozempic and Wegovy. While vial forms of Mixtard, Actrapid, and Insulatard will remain available, pen devices (Penfills and FlexPens) are being phased out, which is expected to disrupt patient access and preference in India.

- In April 2025, Pfizer discontinued the development of danuglipron, its once-daily oral GLP-1 receptor agonist for obesity and type 2 diabetes, following a case of drug-induced liver injury and after reviewing clinical and regulatory feedback. This decision halts further clinical development for both obesity and diabetes indications.

- In March 2025, Biocon Biologics entered a strategic collaboration with Civica, Inc. to expand access to Insulin Aspart in the United States. Biocon will supply the drug substance, which Civica will formulate and commercialize after completing development and clinical trials.

- In December 2024, Lupin acquired the Huminsulin® portfolio in India from Eli Lilly and Company. The range includes Insulin Human (Huminsulin R, NPH, 50/50, and 30/70) and is indicated for type 1 and type 2 diabetes. Lupin had previously marketed these products under a distribution agreement, and the acquisition is aimed at strengthening its diabetes portfolio.

- In November 2024, MannKind’s Afrezza® (insulin human) Inhalation Powder received approval from India’s CDSCO. MannKind expects to ship product to its partner Cipla by the end of 2025.

- In October 2024, Wockhardt filed for approval of its fast-acting insulin analog, Aspart injection (ASPARAPID™), with the Drugs Controller General of India (DCGI). The product, developed indigenously, will be offered in cartridges, vials, and prefilled disposable pens. This expands Wockhardt’s diabetes biosimilars portfolio and addresses a market with limited competition.

Market Concentration & Characteristics

The United Kingdom human insulin market exhibits moderate concentration, dominated by a few major players that account for a significant share of the market. These companies lead with established product portfolios that include both branded and biosimilar insulin products. The market is characterized by a competitive landscape, driven by the need for cost-effective solutions and advanced insulin delivery systems. Market players are focused on continuous innovation, introducing new formulations and technologies such as smart insulin pens, pumps, and continuous glucose monitoring systems to improve patient adherence and outcomes. Additionally, there is an increasing emphasis on personalized care, with products being tailored to meet the specific needs of patients with Type 1, Type 2, and gestational diabetes. The presence of biosimilars is growing, contributing to price competition and enhancing market accessibility. Despite the competition, the market remains somewhat concentrated, with a few dominant players leading the charge in innovation and market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Device, Indication, Insulin, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The United Kingdom human insulin market is expected to experience steady growth due to the rising prevalence of diabetes.

- Technological advancements in insulin delivery systems, such as smart pens and pumps, will drive increased market demand.

- Biosimilar insulin products are anticipated to gain further traction, providing more affordable options for patients.

- Personalized diabetes care solutions, including continuous glucose monitoring and tailored insulin regimens, will become more prevalent.

- The market will see increased adoption of insulin therapy in rural and underserved regions as healthcare access improves.

- The demand for insulin will rise as an aging population requires more diabetes management solutions.

- Innovative collaborations between healthcare providers and pharmaceutical companies will accelerate product development and availability.

- Government policies aimed at improving access to affordable insulin will continue to shape market dynamics.

- Continued focus on early diagnosis and prevention programs will increase the demand for insulin therapies.

- The introduction of next-generation insulin formulations, with enhanced efficacy and fewer side effects, will redefine treatment standards.