| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Protein Based Sports Supplements Market Size 2024 |

USD 304.77 Million |

| UK Protein Based Sports Supplements Market, CAGR |

7.40% |

| UK Protein Based Sports Supplements Market Size 2032 |

USD 539.71 Million |

Market Overview

UK Protein Based Sports Supplements Market size was valued at USD 304.77 million in 2024 and is anticipated to reach USD 539.71 million by 2032, at a CAGR of 7.40% during the forecast period (2024-2032).

The UK protein-based sports supplements market is primarily driven by increasing health awareness, rising gym memberships, and growing participation in fitness and sports activities. Consumers are increasingly seeking high-protein diets to support muscle recovery, weight management, and overall wellness, fueling demand for convenient supplement options. Additionally, the rise of plant-based and clean-label protein supplements is attracting a broader demographic, including vegans and individuals with dietary sensitivities. The market also benefits from strong online retail growth, making products more accessible and promoting brand visibility. Key trends include the integration of functional ingredients such as probiotics and adaptogens, personalized nutrition, and eco-friendly packaging, reflecting consumers’ shifting preferences towards holistic health and sustainability. Influencer marketing and endorsements by athletes further amplify product reach and consumer trust. Together, these drivers and trends are creating a dynamic and competitive landscape, encouraging innovation and sustained market expansion throughout the forecast period.

The geographical landscape of the UK protein-based sports supplements market reflects strong demand across urban centers such as London, Manchester, Birmingham, and Scotland, where rising fitness culture, gym memberships, and health-conscious lifestyles drive consistent consumption. London leads in innovation and premium product adoption, while Manchester and Birmingham show growing interest in convenience-driven formats like protein bars and RTD beverages. Scotland, though relatively smaller, is gaining momentum due to increasing awareness and accessibility through online platforms. Key players operating in the UK market include Volac International Ltd., FrieslandCampina (Vifit Sport), Bulk Powders, Arla Foods Ingredients Group P/S, and Nutrend D.S., A.S. Other notable brands such as Multipower (Atlantic Grupa), Olimp Laboratories, Scitec Nutrition, and Reflex Nutrition also play a crucial role in offering a wide range of protein formats catering to different dietary needs and fitness goals. These companies leverage innovation, branding, and distribution to maintain a strong foothold in the competitive market landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK protein-based sports supplements market was valued at USD 304.77 million in 2024 and is projected to reach USD 539.71 million by 2032, growing at a CAGR of 7.40% during the forecast period.

- The global protein-based sports supplements market was valued at USD 7,372.05 million in 2024 and is projected to reach USD 13,140.51 million by 2032, growing at a CAGR of 7.49%.

- Increasing fitness awareness and gym memberships across urban centers are boosting demand for protein supplements.

- Consumers are shifting toward convenient, on-the-go options such as protein bars and ready-to-drink beverages.

- Leading players like Volac International Ltd., Bulk Powders, and FrieslandCampina focus on innovation and wide product offerings.

- High costs of premium products and lack of consumer awareness in rural areas remain key challenges.

- London, Manchester, Birmingham, and Scotland are major regions driving market growth, each showing unique consumption patterns.

- The rising preference for plant-based and clean-label protein supplements is reshaping product development and branding strategies.

Report Scope

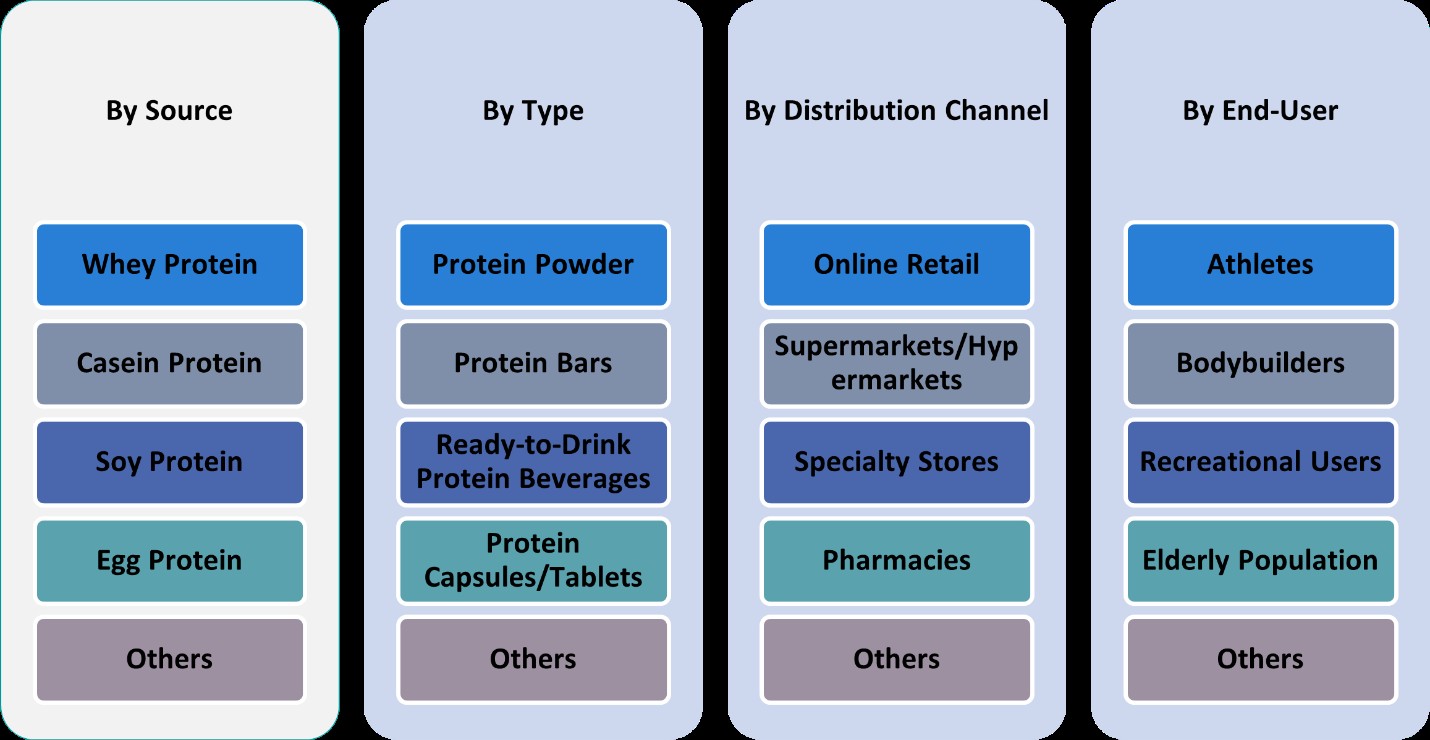

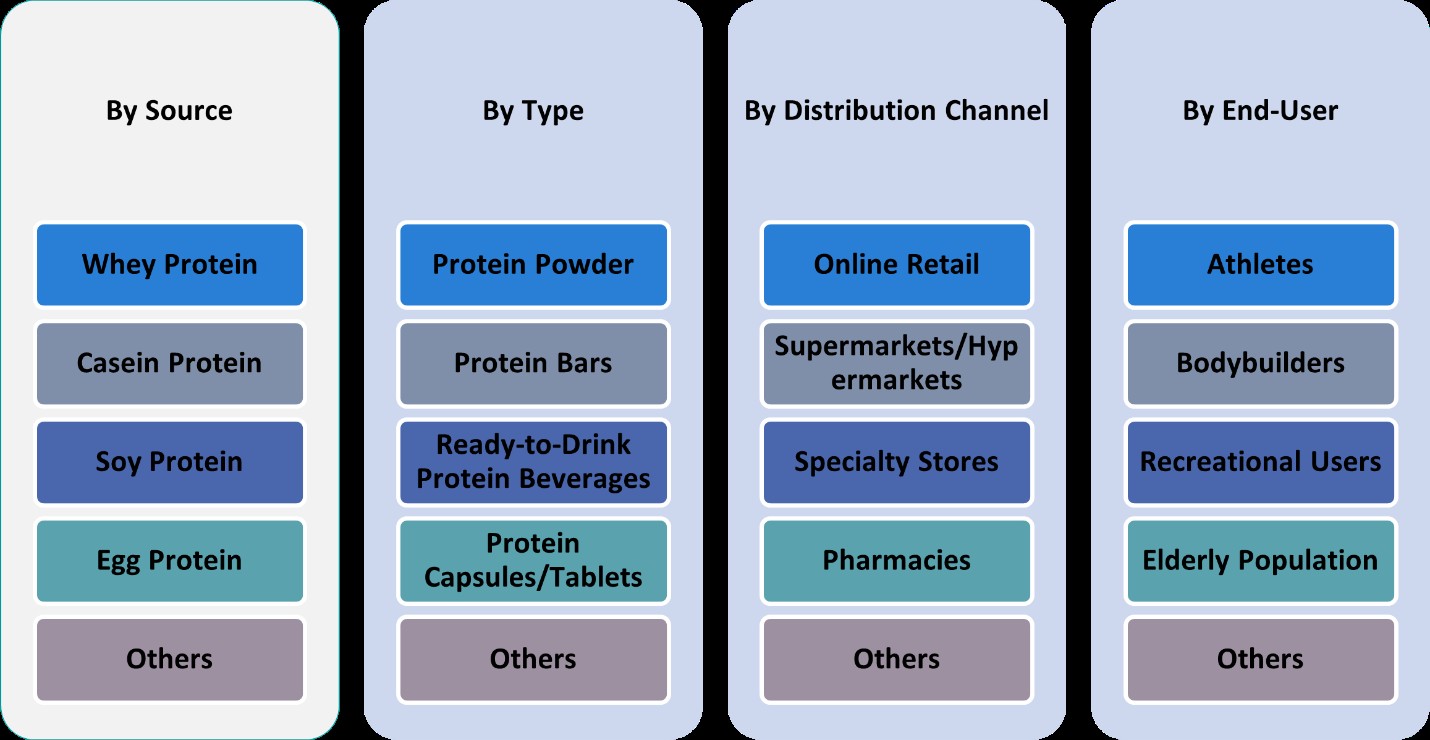

This report segments the UK Protein Based Sports Supplements Market as follows:

Market Drivers

Rising Health Consciousness and Fitness Engagement

The growing emphasis on health and wellness among UK consumers is a major driver of the protein-based sports supplements market. For instance, a report by the UK Department of Health and Social Care highlighted that public health campaigns promoting regular exercise and balanced diets have significantly increased awareness about the benefits of protein consumption. People are now more informed about the role of protein in supporting muscle repair, boosting metabolism, and maintaining a healthy weight. This shift in consumer behavior is especially notable among younger demographics, including millennials and Gen Z, who are highly engaged with fitness communities, both online and offline. The demand for convenient, high-protein dietary supplements that align with these fitness goals continues to grow, significantly contributing to the expansion of the market.

Growing Popularity of High-Protein Diets

The widespread adoption of high-protein and low-carbohydrate diets is another strong factor propelling the market forward. For instance, a report by the National Health Service (NHS) noted the rising popularity of diets such as keto and paleo, which emphasize protein intake for weight loss and muscle gain. Protein-based sports supplements, including powders, bars, and ready-to-drink shakes, offer consumers a quick and efficient way to meet daily protein intake targets. This trend has also gained momentum among non-athletes seeking to improve their general health or manage medical conditions such as diabetes and obesity. The versatility and portability of protein supplements make them especially appealing to busy professionals and fitness enthusiasts looking for on-the-go nutrition solutions. As the benefits of protein consumption continue to be promoted by nutritionists, trainers, and influencers, demand for protein-based supplements is expected to remain robust.

Innovation in Product Formulations and Clean-Label Demand

Product innovation and clean-label initiatives are playing a vital role in driving the UK protein-based sports supplements market. Manufacturers are increasingly focusing on introducing supplements that cater to a wide range of dietary preferences, including plant-based, organic, allergen-free, and non-GMO formulations. The rise of veganism and vegetarianism has led to increased demand for protein supplements derived from pea, hemp, rice, and soy, offering alternatives to traditional whey or casein-based products. Consumers are also seeking products with transparent labeling, minimal artificial ingredients, and functional health benefits beyond basic nutrition, such as added vitamins, minerals, and probiotics. This trend reflects a broader movement toward holistic health and wellness, influencing purchasing decisions and brand loyalty. Companies that prioritize ingredient quality, sustainability, and product transparency are gaining a competitive edge in the evolving marketplace.

Expansion of E-Commerce and Digital Marketing Strategies

The rapid growth of e-commerce platforms and digital marketing has significantly contributed to the accessibility and popularity of protein-based sports supplements in the UK. Online retailers offer a wide variety of product options, competitive pricing, subscription models, and user reviews that guide informed purchasing decisions. The convenience of online shopping, especially post-pandemic, has shifted a considerable portion of consumer traffic away from traditional brick-and-mortar stores. At the same time, brands are leveraging influencer marketing, fitness communities, and social media channels to connect directly with their target audience. Product visibility, personalized recommendations, and targeted advertisements have become key to capturing consumer interest and driving repeat purchases. The digital ecosystem not only enhances customer engagement but also allows for the continuous introduction of innovative products based on evolving consumer trends and feedback.

Market Trends

Shift Towards Plant-Based and Sustainable Protein Sources

One of the most prominent trends in the UK protein-based sports supplements market is the increasing demand for plant-based protein options. For instance, a report by the Vegan Society highlighted that British consumers are increasingly adopting vegetarian, vegan, and flexitarian diets, driving demand for protein supplements derived from pea, rice, hemp, and soy. These products are not only suitable for individuals with lactose intolerance or dairy allergies but also appeal to ethically and environmentally conscious consumers. The emphasis on sustainability is further reflected in the sourcing of raw materials, eco-friendly packaging, and carbon-neutral production practices. This shift is reshaping product development strategies, with companies prioritizing both nutritional value and environmental responsibility to stay aligned with evolving consumer expectations.

Integration of Functional and Holistic Nutrition

UK consumers are increasingly seeking sports supplements that offer more than just protein. For instance, a report by the British Nutrition Foundation noted a growing interest in multifunctional products that combine protein with ingredients like collagen, probiotics, adaptogens, and superfoods. This trend reflects a holistic approach to health and wellness, where consumers look for comprehensive benefits like improved gut health, enhanced immunity, reduced inflammation, and better skin health. Products tailored to specific goals—such as recovery, energy boost, or weight management—are gaining popularity. This has encouraged brands to innovate and create customized blends that align with various lifestyle needs, broadening the appeal of protein supplements beyond the traditional gym-goer or athlete.

Growth of On-the-Go and Convenient Formats

Convenience continues to shape consumer preferences, leading to a surge in demand for ready-to-consume protein supplements. In the UK, time-pressed individuals are increasingly turning to products like protein bars, ready-to-drink (RTD) shakes, and single-serve sachets that offer nutritional support without preparation time. These formats are particularly attractive to working professionals, students, and frequent travelers who seek portable, mess-free options. The growth of this trend is also prompting companies to enhance the taste, texture, and packaging of their offerings, making them more appealing and accessible. As lifestyles become busier, the popularity of these on-the-go protein solutions is expected to remain strong.

Influence of Digital Fitness and Social Media

The digitalization of fitness through online workout platforms, mobile apps, and social media influencers has significantly impacted consumer behavior in the protein supplement market. Influencers, fitness coaches, and nutritionists frequently endorse protein-based supplements, increasing product visibility and consumer trust. Social media platforms like Instagram, YouTube, and TikTok have become powerful tools for promoting new product launches, reviews, and fitness transformations. Consumers are more likely to try products recommended by individuals they follow and admire, especially when supported by authentic content and user-generated reviews. This digital influence is not only driving product awareness but also shaping purchasing trends and brand loyalty across the UK.

Market Challenges Analysis

Regulatory Compliance and Product Transparency

One of the key challenges facing the UK protein-based sports supplements market is navigating the evolving regulatory landscape. For instance, a report by the Food Standards Agency (FSA) emphasized the importance of adhering to stringent food safety standards, particularly regarding labeling, ingredient safety, and health claims. Non-compliance or ambiguous claims can result in penalties, product recalls, or loss of consumer trust. Additionally, the growing demand for clean-label and all-natural supplements puts pressure on manufacturers to ensure transparency in ingredient sourcing, processing, and labeling. Ensuring quality consistency, especially in imported raw materials and third-party manufacturing, further complicates regulatory adherence. Smaller brands often struggle with the financial and operational burden of maintaining compliance while staying competitive on pricing and innovation.

Intense Market Competition and Price Sensitivity

The UK protein-based sports supplements market is highly competitive, with numerous domestic and international brands vying for consumer attention. This saturation has led to intense pricing pressure, making it challenging for smaller players to sustain profitability while maintaining product quality. Large multinational brands benefit from economies of scale and established distribution networks, enabling them to offer aggressive pricing and promotional strategies. Additionally, consumer price sensitivity, especially in an uncertain economic climate, compels many buyers to choose cost-effective options over premium or niche products. This trend can hinder innovation and limit the adoption of high-quality, sustainable, or functional supplements. Brands must also invest heavily in marketing and brand positioning to differentiate themselves in a crowded marketplace, which can strain resources and reduce margins. Balancing product differentiation with affordability remains a critical hurdle for sustained growth in this dynamic sector.

Market Opportunities

The UK protein-based sports supplements market presents strong growth opportunities driven by evolving consumer preferences and expanding health-conscious demographics. As wellness becomes a lifestyle priority across various age groups, there is growing demand for protein supplements beyond traditional athletes and bodybuilders. This shift opens opportunities to target a broader consumer base, including older adults seeking muscle maintenance, women interested in weight management, and teenagers adopting fitness routines early. Additionally, the increasing popularity of personalized nutrition creates space for tailored protein solutions based on individual health goals, dietary restrictions, or fitness levels. Companies that offer customizable products, such as protein blends with added vitamins, probiotics, or adaptogens, are well-positioned to tap into this trend. Furthermore, collaborations with fitness influencers and digital platforms can enhance consumer reach and foster brand loyalty in a highly competitive environment.

The rise of plant-based nutrition offers another promising growth avenue, especially as more UK consumers embrace vegan or flexitarian lifestyles. Plant-based protein supplements are gaining traction for their perceived health benefits, sustainability, and ethical sourcing, encouraging innovation in alternative protein sources such as pea, hemp, and rice. Brands that emphasize clean-label formulations, environmentally responsible packaging, and transparent ingredient sourcing can differentiate themselves in this expanding segment. In addition, the rapid expansion of e-commerce platforms allows for direct-to-consumer models, subscription services, and data-driven marketing strategies that cater to convenience-driven consumers. These digital opportunities enable smaller brands to compete with established players by building niche followings and offering unique product experiences. As consumer interest in holistic health and functional nutrition grows, companies that align product innovation with lifestyle trends will find ample room for sustainable growth in the UK protein-based sports supplements market.

Market Segmentation Analysis:

By Type:

The UK protein-based sports supplements market is segmented into protein powder, protein bars, ready-to-drink (RTD) protein beverages, protein capsules/tablets, and others. Among these, protein powder holds the largest market share due to its versatility, high protein concentration, and widespread use among gym-goers and athletes. It remains a staple in fitness nutrition, commonly used in shakes and smoothies for muscle recovery and growth. However, ready-to-consume formats like protein bars and RTD beverages are witnessing rapid growth, driven by the rising demand for convenience and on-the-go nutrition. These formats appeal to busy professionals, casual exercisers, and health-conscious individuals seeking quick and tasty solutions without compromising on nutritional value. Protein capsules and tablets cater to niche consumers who prefer supplements in compact forms, particularly for dietary support rather than performance enhancement. The “others” category, including cookies, pancakes, and baked goods fortified with protein, is also gaining popularity as brands continue to innovate and meet the demand for functional foods aligned with daily wellness goals.

By Source:

Based on protein source, the market is divided into whey protein, casein protein, soy protein, egg protein, and others. Whey protein dominates the UK market due to its high biological value, rapid digestibility, and proven effectiveness in supporting muscle repair and athletic performance. Casein protein, with its slower digestion rate, is often consumed before bedtime or between meals, offering prolonged amino acid release. Soy protein stands out as a popular plant-based alternative, particularly among vegans and individuals with dairy intolerance. It provides a complete amino acid profile and supports heart health, making it a favored choice in clean-label and allergen-free product lines. Egg protein, although less mainstream, is gaining traction for its high-quality protein content and natural source appeal. The “others” segment, which includes hemp, rice, and pea protein, is expanding swiftly in response to the plant-based movement. As consumer awareness of sustainability and dietary inclusivity increases, demand for diverse protein sources is expected to further shape market offerings.

Segments:

Based on Type:

- Protein Powder

- Protein Bars

- Ready-to-Drink Protein Beverages

- Protein Capsules/Tablets

- Others

Based on Source:

- Whey Protein

- Casein Protein

- Soy Protein

- Egg Protein

- Others

Based on End- User:

- Athletes

- Bodybuilders

- Recreational Users

- Elderly Population

- Others

Based on Distribution Channel:

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies

- Others

Based on the Geography:

- London

- Manchester

- Birmingham

- Scotland

Regional Analysis

London

London dominates the UK protein-based sports supplements market, accounting for approximately 35% of the total market share in 2024. The city’s high population density, widespread fitness culture, and strong presence of premium gyms, health clubs, and wellness centers significantly contribute to its leadership in the segment. Londoners tend to have greater disposable incomes and exhibit strong health-conscious behaviors, making them more inclined to purchase high-quality, branded protein supplements. Moreover, the city benefits from a vibrant e-commerce ecosystem and widespread availability of niche products through online platforms and retail chains. The concentration of sports events, influencer-driven health trends, and digital fitness platforms further supports robust consumer demand. With a diverse and progressive population, there is also rising interest in vegan and plant-based protein options, adding to the region’s product diversity and market volume.

Manchester

Manchester holds the second-largest share in the UK market, contributing around 25% of the national revenue from protein-based sports supplements. The region’s growing urban population, expanding fitness infrastructure, and increasing participation in athletic and bodybuilding communities have boosted supplement consumption. Manchester is home to several universities and young professionals who prioritize physical fitness and nutrition, driving consistent demand for protein powders, RTD beverages, and protein bars. The local market is also witnessing rising popularity of independent health stores and fitness-focused cafes, which serve as key distribution channels. Digital marketing campaigns and influencer-led promotions on platforms like Instagram and TikTok play a crucial role in shaping consumer behavior. This tech-savvy, fitness-aware audience values both convenience and performance benefits, pushing brands to introduce tailored solutions in portable and innovative formats.

Birmingham

Birmingham accounts for approximately 20% of the UK protein-based sports supplements market and shows steady growth potential. The region is characterized by a mix of working professionals, students, and athletes who are increasingly adopting fitness-focused lifestyles. A rise in local fitness chains, wellness workshops, and nutrition counseling has spurred awareness around protein supplementation for muscle recovery, weight management, and daily health goals. Birmingham consumers show a growing interest in clean-label and affordable protein options, particularly among middle-income groups. As price sensitivity remains a factor, value-for-money products that offer nutritional benefits and trusted quality are gaining traction. Retailers are also expanding their health and wellness sections to cater to this growing consumer base, offering both global brands and emerging local labels.

Scotland

Scotland represents around 15% of the UK market for protein-based sports supplements and is emerging as a promising region with increasing health and fitness awareness. While the market is relatively smaller compared to major English cities, rising participation in outdoor activities, gym culture, and amateur sports has enhanced demand for performance nutrition. Urban centers like Edinburgh and Glasgow are seeing a rise in boutique fitness studios, organic health stores, and plant-based cafés, which support broader supplement adoption. Additionally, the Scottish government’s initiatives to promote public health and physical activity are indirectly fostering demand for nutritional products, including protein supplements. As awareness around the benefits of protein grows and accessibility improves via online channels, the market is likely to expand further in Scotland, particularly among younger consumers and those seeking plant-based or allergen-free alternatives.

Key Player Analysis

- Volac International Ltd.

- FrieslandCampina (Vifit Sport)

- Bulk Powders

- Arla Foods Ingredients Group P/S

- Nutrend D.S., A.S.

- Multipower (Atlantic Grupa)

- Olimp Laboratories

- Scitec Nutrition

- Reflex Nutrition

Competitive Analysis

The UK protein-based sports supplements market is highly competitive, with both domestic and international players striving to expand their market presence through innovation, branding, and strategic partnerships. Leading companies such as Volac International Ltd., FrieslandCampina (Vifit Sport), Bulk Powders, Arla Foods Ingredients Group P/S, Nutrend D.S., A.S., Multipower (Atlantic Grupa), Olimp Laboratories, Scitec Nutrition, and Reflex Nutrition play a significant role in shaping the competitive landscape. These players offer a wide range of protein products, including powders, bars, RTD beverages, and plant-based alternatives, catering to diverse consumer preferences and dietary needs. Innovation remains a key focus, with companies investing in R&D to develop products that combine performance benefits with convenience and taste. Many brands are enhancing their market reach through e-commerce platforms, subscription models, and influencer marketing. Clean-label claims, high-protein content, and sustainable sourcing are also becoming central to competitive positioning. As health-conscious consumers demand more personalized and transparent products, companies that adapt quickly to trends and maintain product quality are more likely to sustain growth and customer loyalty in this evolving market.

Recent Developments

- In March 2025, Quest Nutrition introduced Quest Protein Milkshakes, ready-to-drink beverages with a category-leading 45 grams of protein per bottle. Available in chocolate, vanilla, and strawberry flavors, these shakes cater to high-protein diets with minimal sugar and carbs.

- In December 2024, Dymatize launched Performance Protein Shakes and Energyze Pre-Workout Powder. The ready-to-drink shakes contain 30 grams of high-quality proteins along with BCAAs for muscle recovery and growth.

- In November 2024, Myprotein expanded operations in India by manufacturing locally to meet growing demand. The brand introduced localized flavors such as Kesar Badam and Nimbu Pani and launched Clear Whey Isolate as a refreshing alternative to traditional protein shakes.

- In January 2024, Abbott launched Protality, a high-protein weight-loss shake designed for individuals on weight-loss medications. Each serving contains 30 grams of protein and is tailored to preserve muscle mass while supporting weight loss.

Market Concentration & Characteristics

The UK protein-based sports supplements market exhibits a moderate to high level of market concentration, with a mix of established global players and emerging domestic brands competing for consumer attention. The market is characterized by rapid product innovation, strong brand loyalty, and increasing consumer demand for high-quality, convenient, and clean-label protein options. Leading companies dominate shelf space in both retail and online channels, leveraging extensive distribution networks and strategic marketing efforts. However, the market remains dynamic, with new entrants frequently introducing niche and plant-based offerings that appeal to evolving consumer preferences. Product differentiation is driven by factors such as protein source, formulation, flavor variety, and added functional benefits like vitamins or probiotics. The market also displays a growing inclination towards personalized nutrition, sustainability, and transparency in ingredient sourcing. As consumer expectations continue to rise, companies must remain agile, responsive, and focused on health-centric innovation to maintain competitiveness in this maturing yet opportunity-rich landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK protein-based sports supplements market is expected to witness consistent growth driven by increasing consumer focus on fitness and muscle building.

- Rising participation in sports and gym activities will continue to drive demand for high-protein supplements.

- The popularity of plant-based and vegan protein products is projected to rise significantly due to growing health and sustainability concerns.

- E-commerce will play a crucial role in market expansion, with online platforms offering convenience and wider product availability.

- Manufacturers are likely to invest more in product innovation and flavor enhancement to attract a broader consumer base.

- The demand for clean-label and additive-free protein supplements is expected to grow as consumers become more ingredient-conscious.

- Collaborations with fitness influencers and social media marketing will strengthen brand visibility and consumer engagement.

- Younger demographics, particularly millennials and Gen Z, will continue to shape the market with their preference for active lifestyles.

- Expansion into ready-to-drink and protein snack formats will create new revenue opportunities for manufacturers.

- Regulatory support and clearer labeling guidelines are anticipated to enhance consumer trust and ensure product quality.