| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Compression Sportswear Market Size 2024 |

USD 198.15 Million |

| UK Compression Sportswear Market, CAGR |

6.68% |

| UK Compression Sportswear Market Size 2032 |

USD 332.36 Million |

Market Overview

UK Compression Sportswear Market size was valued at USD 198.15 million in 2024 and is anticipated to reach USD 332.36 million by 2032, at a CAGR of 6.68% during the forecast period (2024-2032).

The growth of the UK Compression Sportswear market is primarily driven by the rising awareness of health, fitness, and active lifestyles among consumers, coupled with increasing participation in sports and fitness activities. The demand for performance-enhancing apparel that supports muscle recovery, improves blood circulation, and reduces fatigue is fueling market expansion. Additionally, advancements in fabric technology, such as moisture-wicking materials and seamless designs, are enhancing product appeal. The growing popularity of athleisure trends, where consumers seek stylish yet functional sportswear for both workouts and casual wear, further supports market growth. Moreover, endorsements from professional athletes and fitness influencers, along with the increasing penetration of e-commerce platforms, are accelerating product visibility and accessibility. The market is also witnessing a surge in demand for sustainable and eco-friendly compression wear, as consumers become more conscious of environmental impacts. These factors collectively contribute to the steady and sustained growth of the UK Compression Sportswear market.

The geographical analysis of the UK Compression Sportswear market highlights strong demand across major urban centers such as London, Manchester, Birmingham, and key regions of Scotland. These areas exhibit a high concentration of fitness enthusiasts, athletes, and health-conscious consumers, driving the consistent uptake of compression apparel. Urban populations with active lifestyles, along with access to well-established retail and e-commerce networks, further contribute to market growth in these regions. In terms of key players, the market features the presence of leading global and regional brands, including Under Armour, Adidas AG, Nike Inc., and PUMA SE, all of which offer a wide range of performance-driven compression sportswear. Other notable players such as BV SPORT, Medi, Spanx Inc., Triumph International Corporation, Leonisa SA, and Skins International Trading AG are enhancing market competition through product innovation, strategic partnerships, and digital sales channels. This competitive environment fosters continuous product development and caters to the evolving preferences of UK consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Compression Sportswear market was valued at USD 198.15 million in 2024 and is projected to reach USD 332.36 million by 2032, growing at a CAGR of 6.68% during the forecast period.

- Increasing fitness awareness and rising participation in sports and recreational activities are key drivers of market growth.

- Sustainable and eco-friendly compression sportswear is gaining popularity among environmentally conscious consumers.

- The market is highly competitive, with key players like Under Armour, Adidas, Nike, and PUMA focusing on innovation and strategic partnerships.

- High product costs and limited consumer awareness regarding the benefits of compression wear act as major restraints.

- London, Manchester, Birmingham, and Scotland are the key regional markets, driven by strong fitness cultures and access to retail networks.

- Growing demand for personalized, inclusive, and smart compression sportswear is shaping new opportunities in the market.

Report Scope

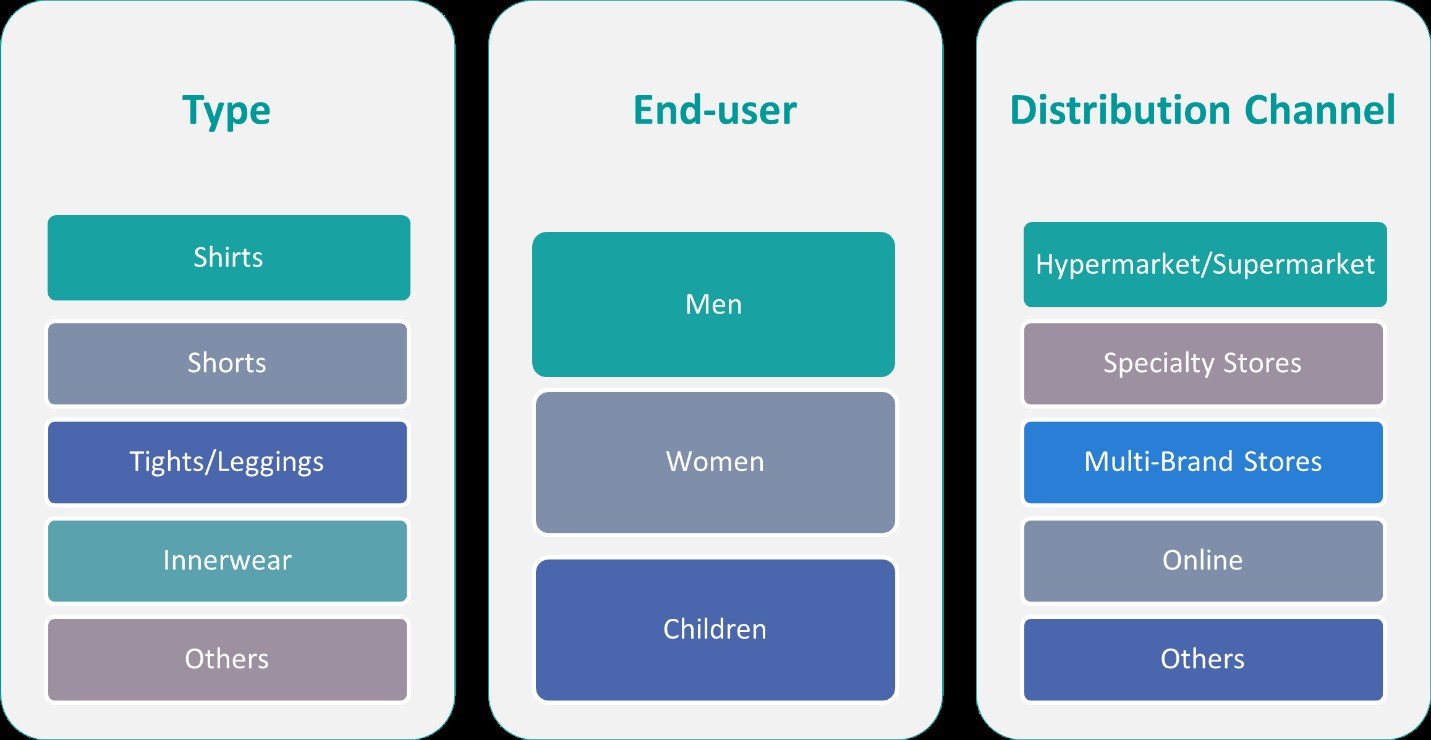

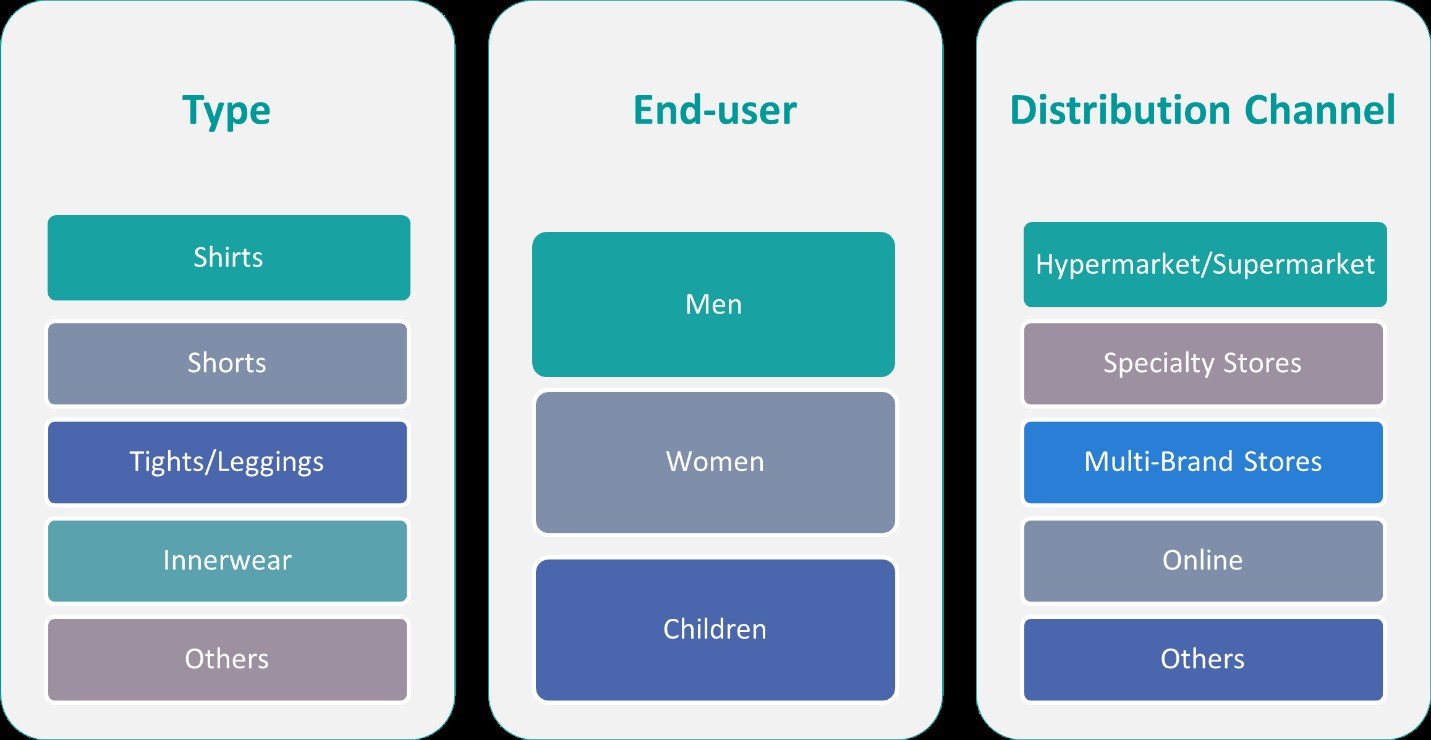

This report segments the UK Compression Sportswear Market as follows:

Market Drivers

Rising Health and Fitness Awareness

One of the primary drivers of the UK Compression Sportswear market is the growing emphasis on health, wellness, and physical fitness among consumers. Over the past decade, there has been a notable shift in lifestyle choices, with more individuals prioritizing regular exercise, sports participation, and active living. This cultural movement toward health-conscious behavior has directly impacted demand for functional sportswear, particularly compression garments that aid performance and recovery. Consumers are increasingly seeking apparel that not only provides comfort but also offers physiological benefits such as improved blood circulation, reduced muscle fatigue, and enhanced athletic performance. This heightened awareness continues to propel the adoption of compression wear across diverse age groups and demographics.

Technological Advancements in Fabric and Design

Technological innovation in fabric engineering and garment construction plays a pivotal role in driving market growth. Manufacturers are investing in the development of advanced compression fabrics that are lightweight, breathable, and moisture-wicking, while delivering optimal muscle support. For example, the integration of Lycra Sport fabric into compression garments enhances their stretchability and recovery power, providing athletes with improved comfort and performance during intense physical activities. Seamless designs, stretchable materials, and body-mapped compression zones are some of the key innovations that enhance the functionality and comfort of these garments. Additionally, brands are incorporating features such as UV protection, anti-odor technology, and temperature regulation to cater to the evolving preferences of fitness enthusiasts. The ability to combine performance-driven attributes with aesthetic appeal is influencing consumer purchase decisions and expanding the market base.

Growth of the Athleisure Trend

The global rise of the athleisure trend has significantly impacted the UK Compression Sportswear market. Consumers today seek versatile apparel that blends athletic functionality with casual and fashionable styling, allowing them to transition seamlessly from workouts to daily activities. For instance, the increasing acceptance of athletic wear as casual attire in workplaces and social settings has fueled demand for compression sportswear that offers both style and performance. Compression sportswear, which was traditionally used exclusively for athletic purposes, has evolved into a lifestyle product embraced by a broader audience. The demand for stylish, form-fitting, and performance-enhancing apparel has surged, particularly among younger consumers and urban populations. This trend is further amplified by celebrity endorsements, social media influence, and the visibility of fitness culture in mainstream media, all of which contribute to a growing preference for compression wear as part of everyday fashion.

Expansion of E-commerce and Digital Fitness Platforms

The rapid growth of e-commerce channels and digital fitness platforms has emerged as a crucial driver of the UK Compression Sportswear market. Online retail has made premium and niche compression products more accessible to a wider consumer base, offering a diverse range of brands, sizes, and price points. In addition, the rise of virtual fitness programs, home workouts, and fitness tracking apps has increased consumer engagement with sportswear brands, driving demand for specialized apparel. E-commerce platforms enable personalized marketing strategies, detailed product information, and customer reviews, influencing buying behavior. This digital shift has not only improved product visibility but also fostered greater market competition and innovation, contributing to the sustained expansion of the compression sportswear segment.

Market Trends

Increasing Demand for Sustainable and Eco-Friendly Sportswear

A prominent trend shaping the UK Compression Sportswear market is the growing consumer preference for sustainable and environmentally responsible products. As awareness of environmental issues rises, consumers are actively seeking sportswear made from recycled, organic, or biodegradable materials without compromising on performance and comfort. For instance, brands like BAM are pioneering sustainable sportswear by using bamboo, a highly renewable resource, in their activewear collections, which not only reduces environmental impact but also offers moisture-wicking and antibacterial properties. Leading brands are responding by integrating eco-friendly fabrics such as recycled polyester and plant-based fibers in their compression wear collections. Additionally, companies are focusing on ethical manufacturing practices and transparent supply chains to align with the values of environmentally conscious consumers. This shift toward sustainability is not only a response to regulatory pressure and corporate responsibility but also a strategic move to capture the loyalty of a new generation of mindful shoppers.

Growing Popularity of Customization and Personalization

Personalization is becoming a key trend in the UK Compression Sportswear market, as consumers increasingly seek products tailored to their individual preferences and fitness needs. Brands are offering customizable options in terms of fit, compression level, color, and design to enhance the user experience and meet specific athletic requirements. Technological advancements in digital printing and on-demand manufacturing have made it easier for companies to provide personalized compression wear at scale. This trend is particularly popular among fitness enthusiasts, professional athletes, and sports teams who require unique garments to optimize performance or reflect personal branding. Customization not only increases customer satisfaction but also strengthens brand engagement and loyalty.

Integration of Smart Textiles and Wearable Technology

The integration of smart textiles and wearable technology is an emerging trend influencing the UK Compression Sportswear market. Companies are investing in innovative garments that incorporate sensors and biometric tracking capabilities to monitor performance metrics such as heart rate, muscle activity, and body temperature. For instance, researchers at the University of Edinburgh and Heriot-Watt University have developed flexible sensor technology that can be integrated into compression garments to measure pressure and physiological parameters, enhancing the effectiveness of wearable technology in sportswear. This convergence of sportswear and technology caters to the growing demand for data-driven fitness solutions, enabling athletes and fitness enthusiasts to optimize their training routines and recovery processes. While still in the early stages of adoption, smart compression wear is gaining traction among tech-savvy consumers seeking enhanced functionality from their athletic apparel. This trend is expected to accelerate as wearable technology becomes more affordable and seamlessly integrated into everyday sportswear.

Expansion of Gender-Inclusive and Plus-Size Offerings

The market is witnessing a positive trend toward inclusivity, with brands expanding their product ranges to cater to diverse body types, genders, and athletic needs. There is increasing demand for compression sportswear designed specifically for women, including maternity-friendly options and apparel that addresses anatomical differences. Additionally, the market is responding to calls for greater size diversity, with more brands introducing plus-size compression garments that offer the same performance benefits as standard sizes. This trend reflects broader societal movements toward body positivity and inclusivity, encouraging participation in fitness activities across all demographics and further driving market growth.

Market Challenges Analysis

High Product Cost and Market Saturation

One of the primary challenges facing the UK Compression Sportswear market is the relatively high cost of premium compression apparel, which limits accessibility for price-sensitive consumers. Advanced compression garments are typically manufactured using high-quality, performance-driven fabrics and innovative design technologies, resulting in higher production costs. For instance, the use of advanced materials like smart textiles and nanotechnology enhances performance but also increases production expenses, making these products less affordable for budget-conscious consumers. Additionally, as the market continues to expand, the growing number of local and international brands has intensified competition, leading to market saturation. Smaller or emerging brands often struggle to differentiate themselves and gain market share amid well-established players with strong brand recognition and extensive distribution networks. This competitive environment places pressure on pricing strategies and profit margins, creating barriers to sustained growth.

Limited Consumer Awareness and Product Misconceptions

Another significant challenge in the UK Compression Sportswear market is the limited consumer awareness regarding the actual benefits and appropriate use of compression garments. While professional athletes and fitness enthusiasts are well-informed about the physiological advantages of compression wear, such as enhanced blood circulation and muscle recovery, many general consumers remain unaware or skeptical of these claims. Misconceptions about the effectiveness of compression apparel, often fueled by inconsistent marketing messages and lack of standardized performance metrics, can hinder market penetration. Furthermore, some consumers perceive compression garments as uncomfortable or overly restrictive, leading to reluctance in adoption. This gap in consumer education, coupled with varying product quality across brands, poses a challenge for manufacturers aiming to build long-term customer trust and loyalty. Addressing these awareness gaps through clear communication, evidence-based marketing, and product innovation is essential to overcoming these barriers and unlocking the market’s full growth potential.

Market Opportunities

The UK Compression Sportswear market presents significant opportunities driven by the evolving fitness landscape and shifting consumer preferences. As more individuals embrace active lifestyles, there is a growing demand for specialized performance wear that enhances athletic output and accelerates muscle recovery. This trend is further supported by the increasing penetration of fitness apps, home workouts, and digital fitness platforms, which encourage consumers to invest in high-quality athletic apparel. Additionally, the rising focus on holistic wellness, which includes both physical fitness and recovery, creates new avenues for brands to introduce innovative compression products tailored for post-workout recovery, injury prevention, and overall well-being. Expanding product offerings beyond traditional gym wear to include yoga, cycling, running, and leisure categories can help brands capture a broader customer base and tap into niche fitness segments.

Another promising opportunity lies in the growing demand for sustainable and inclusive sportswear. Consumers in the UK are increasingly prioritizing eco-friendly materials, ethical production processes, and transparent sourcing in their purchasing decisions. Brands that invest in sustainable compression wear, such as those made from recycled fibers or biodegradable fabrics, are well-positioned to attract environmentally conscious customers and strengthen their market presence. Furthermore, expanding product lines to offer gender-neutral, plus-size, and adaptive compression sportswear can help companies cater to underserved segments and foster brand loyalty. Technological advancements, such as the integration of smart textiles and biometric monitoring features, also present untapped potential for brands seeking to differentiate themselves and deliver value-added benefits. By leveraging these emerging trends and aligning with evolving consumer values, manufacturers and retailers in the UK Compression Sportswear market can unlock new revenue streams and drive long-term growth.

Market Segmentation Analysis:

By Product Type:

The UK Compression Sportswear market is segmented by product type into shirts, shorts, tights/leggings, innerwear, and others. Among these, compression shirts and tights/leggings hold a significant market share, owing to their wide application in various sports and fitness activities. Compression shirts are particularly popular among athletes and gym-goers for providing upper body muscle support and enhancing blood circulation during workouts. Similarly, tights and leggings have witnessed growing demand, especially among runners, cyclists, and fitness enthusiasts, due to their ability to improve lower body performance and reduce muscle soreness. Shorts are also a key segment, favored by athletes participating in high-intensity sports. Innerwear, though a niche segment, is gaining traction as consumers increasingly seek comfort and support beyond outer garments. The “Others” category, which includes compression socks, sleeves, and accessories, is also experiencing steady growth, driven by increased interest in injury prevention and recovery-focused products. Overall, product diversification across these categories supports sustained market expansion.

By End- User:

Based on end-user segmentation, the UK Compression Sportswear market is categorized into men, women, and children. The men’s segment currently dominates the market, driven by high participation rates in sports, fitness activities, and gym workouts. Male consumers tend to prioritize performance-enhancing apparel, which boosts demand for compression garments across product categories. However, the women’s segment is emerging as the fastest-growing category, supported by the increasing involvement of women in fitness routines, yoga, running, and athletic sports. The rise of body-positive movements and growing demand for functional yet fashionable activewear further contribute to this growth. Additionally, compression sportswear designed specifically for women, including maternity-friendly and anatomically tailored garments, is gaining market traction. The children’s segment, although smaller in comparison, is witnessing gradual growth, fueled by increasing awareness of health and fitness among younger age groups and the rise in organized sports activities for children. Brands focusing on gender-specific designs and inclusive sizing are well-positioned to capitalize on these evolving end-user preferences.

Segments:

Based on Product Type:

- Shirts

- Shorts

- Tights/Leggings

- Innerwear

- Others

Based on End- User:

Based on Distribution Channel:

- Hypermarket/Supermarket

- Specialty Stores

- Multi-Brand Stores

- Online

- Others

Based on the Geography:

- London

- Manchester

- Birmingham

- Scotland

Regional Analysis

London

London holds the largest market share in the UK Compression Sportswear market, accounting for approximately 35% of the total market revenue in 2024. As the country’s capital and economic hub, London boasts a highly urbanized and health-conscious population with a strong inclination toward fitness, sports, and active lifestyles. The presence of a large number of fitness centers, gyms, and sports clubs, coupled with the popularity of outdoor running and cycling culture, significantly drives demand for compression sportswear in the region. Moreover, London’s diverse consumer base, high disposable income levels, and access to premium retail outlets and online platforms contribute to the market’s robust performance. The city’s fashion-forward population also supports the growing athleisure trend, blending performance wear with casual clothing, which further fuels demand for compression apparel.

Manchester

Manchester represents the second-largest regional market, holding an estimated 25% share of the UK Compression Sportswear market in 2024. The city’s strong sporting heritage, particularly in football and athletics, plays a pivotal role in promoting the use of performance-enhancing apparel such as compression wear. Manchester’s thriving fitness culture, supported by a wide network of gyms, fitness studios, and sports academies, creates substantial opportunities for market growth. Additionally, the younger demographic in Manchester, with a strong focus on wellness and active living, contributes to the increasing adoption of compression garments. The rise of local sportswear brands, e-commerce platforms, and the presence of professional athletes endorsing fitness apparel further strengthen the market in this region.

Birmingham

Birmingham accounts for approximately 20% of the UK Compression Sportswear market share in 2024, making it a key regional contributor. The city’s diverse population and growing interest in recreational sports and fitness activities drive consistent demand for compression sportswear. Birmingham has witnessed an increase in gym memberships, fitness events, and participation in community-based sports programs, all of which positively impact market growth. Moreover, the city’s strategic position as a commercial hub in the Midlands supports a strong retail infrastructure, including both physical and online sportswear outlets. The expanding awareness of the health benefits associated with compression wear among fitness enthusiasts and amateur athletes in Birmingham further supports sustained demand.

Scotland

Scotland holds an estimated 20% market share in the UK Compression Sportswear market in 2024, driven by increasing fitness participation and outdoor sports culture. Major cities such as Edinburgh and Glasgow are witnessing rising consumer interest in health and wellness, contributing to growing demand for functional sportswear. Scotland’s favorable landscape for outdoor activities, including running, cycling, and hiking, creates additional opportunities for compression apparel brands. Furthermore, local fitness initiatives, sporting events, and the growing athleisure trend have positively influenced market dynamics. Although the Scottish market is smaller compared to England’s major cities, increasing digital penetration and expanding distribution channels are supporting steady growth in compression sportswear sales across the region.

Key Player Analysis

- Under Armour, Inc.

- Adidas AG

- Nike Inc.

- PUMA SE

- BV SPORT

- Medi

- Triumph International Corporation

- Spanx Inc.

- Leonisa SA

- Wacoal America Inc.

- Skins International Trading AG

- Ann Chery

- 2XU Pty Ltd

Competitive Analysis

The UK Compression Sportswear market is characterized by intense competition, with the presence of several leading global and regional players driving market dynamics. Key players operating in the market include Under Armour, Inc., Adidas AG, Nike Inc., PUMA SE, BV SPORT, Medi, Triumph International Corporation, Spanx Inc., Leonisa SA, Wacoal America Inc., Skins International Trading AG, Ann Chery, and 2XU Pty Ltd. These companies are actively engaged in product innovation, strategic collaborations, and aggressive marketing efforts to strengthen their market position and cater to evolving consumer preferences. Leading companies focus heavily on research and development to introduce compression apparel that enhances athletic performance, improves muscle recovery, and offers superior comfort. Many players are also leveraging sustainability trends by incorporating eco-friendly fabrics and ethical manufacturing practices into their product lines, appealing to environmentally conscious consumers. Additionally, the market is witnessing increased investments in digital marketing, e-commerce platforms, and direct-to-consumer channels to enhance visibility and customer engagement. Price competitiveness remains a challenge, with premium brands maintaining higher pricing strategies, while smaller players attempt to attract customers through affordable offerings without compromising on quality. The growing emphasis on product customization, inclusive sizing, and gender-specific designs further intensifies competition, encouraging continuous innovation and diversification to meet evolving consumer demands across the UK.

Recent Developments

- In February 2025, Adidas AG launched several new products, including the Lightblaze shoe and the Mystic Victory pack for football boots. Adidas continues to focus on innovative designs and collaborations.

- In January 2025, Nike showcased innovative recovery footwear at CES 2025, featuring compression and heat technology, and is also developing a compression and heat vest as part of its wearable line, collaborating with Hyperice to boost athlete warm-up and recovery.

Market Concentration & Characteristics

The UK Compression Sportswear market exhibits a moderately concentrated structure, characterized by the presence of a few dominant international brands alongside several regional and niche players. Leading companies maintain a significant share of the market due to their strong brand recognition, extensive product portfolios, and established distribution networks. However, the market also accommodates smaller and emerging brands that focus on specific consumer segments or innovative product offerings. The market is highly dynamic and driven by continuous product development, technological advancements, and evolving consumer preferences. Characteristics of the market include a strong focus on performance-enhancing features, sustainability, and premium quality, reflecting the demands of fitness enthusiasts and professional athletes. Additionally, digitalization and the rise of e-commerce platforms have transformed market accessibility, allowing both large and small players to reach a broader consumer base. Intense competition, brand loyalty, and increasing demand for customized and inclusive sportswear further define the landscape of the UK Compression Sportswear market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK Compression Sportswear market is expected to continue its steady growth over the next decade.

- Rising fitness awareness and active lifestyle adoption will drive sustained demand for compression apparel.

- Increasing focus on recovery wear and injury prevention will expand product innovation.

- Sustainable and eco-friendly materials will play a crucial role in future product development.

- E-commerce and direct-to-consumer channels will dominate sales distribution.

- The market will witness higher demand for gender-neutral, plus-size, and inclusive compression sportswear.

- Technological integration, such as smart fabrics and biometric monitoring, will become more prominent.

- Regional markets beyond major cities will show gradual growth due to increased fitness participation.

- Competitive intensity will rise with new entrants and product diversification.

- Strategic collaborations, influencer marketing, and digital fitness partnerships will shape future market strategies.