| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Pea Proteins Market Size 2024 |

USD 92.16 Million |

| UK Pea Proteins Market, CAGR |

12.16% |

| UK Pea Proteins Market Size 2032 |

USD 230.78 Million |

Market Overview:

The UK Pea Proteins Market is projected to grow from USD 92.16 million in 2024 to an estimated USD 230.78 million by 2032, with a compound annual growth rate (CAGR) of 12.16% from 2024 to 2032.

The UK pea protein market is being driven by several key factors that reflect the evolving consumer preferences and industry dynamics. Health-conscious consumers are increasingly turning to plant-based proteins due to their nutritional benefits, including being hypoallergenic, gluten-free, and high in essential amino acids. This shift towards plant-based diets is also fueled by the rising awareness of the health risks associated with animal-based protein sources, such as higher cholesterol levels and potential for foodborne illnesses. In addition to health benefits, sustainability is a significant driver, as pea protein offers a more environmentally friendly alternative to animal proteins. With lower resource requirements for cultivation, such as reduced water and land usage, pea protein aligns well with the growing demand for sustainable food options. Furthermore, product innovation plays a pivotal role, as pea protein is being incorporated into a diverse range of food products, from meat substitutes to energy bars, catering to the expanding market for plant-based foods.

The UK holds a significant position in the European pea protein market and is projected to maintain its leadership through 2030. The market’s growth in the UK is supported by a large and growing consumer base increasingly seeking plant-based alternatives. Health and sustainability trends are particularly prominent in urban centers like London, where consumer demand for vegan, vegetarian, and flexitarian diets is strong. The rise in the number of fitness centers and the increasing awareness of health issues among the population further support the demand for plant-based proteins. Additionally, the UK government’s emphasis on reducing carbon footprints and encouraging sustainable farming practices has fostered a favorable regulatory environment for plant-based products. This combination of shifting consumer habits, urbanization, and policy support positions the UK as a leader in the European market for pea protein.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Pea Proteins Market is projected to grow from USD 92.16 million in 2024 to USD 230.78 million by 2032, with a CAGR of 12.16%.

- The Global pea proteins market is projected to grow from USD 2,229.15 million in 2024 to USD 5,618.92 million by 2032, at a CAGR of 12.25%.

- Health-conscious consumers are increasingly turning to pea protein for its hypoallergenic, gluten-free, and nutrient-rich properties, driving the market’s growth.

- The rising awareness of the health risks associated with animal-based proteins, such as higher cholesterol and foodborne illnesses, is encouraging the shift toward plant-based alternatives like pea protein.

- Sustainability is a significant driver, as pea protein requires fewer resources like water and land, making it an eco-friendly alternative to animal proteins.

- Ongoing product innovation, particularly in meat substitutes and dairy alternatives, is broadening the applications of pea protein, attracting a wider consumer base.

- The UK government’s policies promoting sustainable farming and plant-based nutrition are creating a favorable regulatory environment, further boosting pea protein demand.

- Consumer demand for plant-based products is strongest in urban centers like London and the Southeast, where vegan, vegetarian, and flexitarian diets are more prevalent.

Market Drivers:

Health Consciousness and Dietary Shifts

One of the primary drivers of the UK pea protein market is the growing health consciousness among consumers. As individuals become more aware of the health risks associated with animal-based protein sources, such as higher cholesterol and saturated fats, many are opting for plant-based alternatives. Pea protein, known for its hypoallergenic properties and its ability to support muscle growth and repair, is becoming increasingly popular. For example, Royal DSM launched Vertis Textured Pea Canola Protein, which is soy-free, gluten-free, and dairy-free while providing all nine essential amino acids required for a complete protein. It is particularly favored for its digestibility and suitability for people with food allergies, such as those avoiding dairy or gluten. This shift towards plant-based eating is also reflected in the rise of vegan and flexitarian diets, with many consumers seeking healthier, more sustainable sources of protein.

Sustainability and Environmental Impact

Sustainability concerns are another key driver for the growth of the UK pea protein market. The production of plant-based proteins, particularly pea protein, is significantly less resource-intensive compared to animal protein production. Pea cultivation requires fewer water resources, produces lower greenhouse gas emissions, and has a smaller overall environmental footprint than animal agriculture. As consumers become more environmentally conscious, they are increasingly choosing plant-based alternatives to reduce their ecological impact. The shift towards sustainable food options is being further reinforced by government policies and industry initiatives aimed at promoting sustainable agriculture and reducing carbon footprints, further driving the demand for pea protein in the UK.

Product Innovation and Market Expansion

The ongoing innovation in the food and beverage sector is a significant factor propelling the UK pea protein market. Manufacturers are continuously developing new products that incorporate pea protein, expanding its application beyond traditional uses. Pea protein is now found in a wide array of products, from meat substitutes like plant-based burgers to dairy alternatives such as vegan cheese and milk. Additionally, pea protein is increasingly being integrated into health-focused products like protein bars, smoothies, and nutritional supplements. For instance, companies like Puris Foods have introduced plant-based products such as AcreMade, a proprietary pea protein-based egg alternative. This product diversification not only caters to the growing demand for plant-based foods but also helps attract a wider range of consumers, including athletes, health enthusiasts, and those with dietary restrictions, further driving market growth.

Government Support and Industry Trends

Government support for plant-based food products has played a significant role in boosting the UK pea protein market. The UK government has implemented policies to promote sustainable agriculture and reduce meat consumption, which aligns with the rising popularity of plant-based foods. Additionally, the increasing focus on reducing the carbon footprint and encouraging plant-based nutrition has created a favorable regulatory environment for the growth of pea protein. This support is complemented by growing industry trends, such as the increasing number of foodservice establishments offering plant-based menus and the rise in supermarkets stocking plant-based protein products. These trends are not only responding to consumer demand but also shaping the future of the UK food industry, positioning pea protein as a key ingredient in the future of sustainable food production.

Market Trends:

Growing Popularity of Meat Alternatives

One of the key trends in the UK pea protein market is the rising demand for meat alternatives. As consumers shift away from traditional animal-based proteins, the market for plant-based meat substitutes continues to expand. For instance, Beyond Meat’s new line of plant-based chicken products, launched in March 2024, utilizes a proprietary pea protein blend that achieves similarity to chicken muscle fiber structure, as confirmed by electron microscopy analysis. Pea protein, with its neutral taste and excellent texture, has become a popular choice for plant-based meat products such as burgers, sausages, and nuggets. The popularity of brands like Beyond Meat and Impossible Foods, which utilize pea protein as a core ingredient, highlights this growing trend. As more consumers adopt flexitarian and vegan diets, the demand for high-quality, protein-rich plant-based meat alternatives is expected to continue to rise, further driving the demand for pea protein in the UK.

Increased Adoption in Functional Foods and Beverages

Another significant trend in the UK pea protein market is its growing use in functional foods and beverages. As health-conscious consumers increasingly seek products that provide nutritional benefits beyond basic sustenance, pea protein is being integrated into a wide variety of functional foods. These include protein-packed snacks, smoothies, and beverages designed to support athletic performance, muscle recovery, and overall health. The convenience and nutritional profile of pea protein make it an attractive ingredient for on-the-go products. Additionally, the market is witnessing a rise in plant-based protein powders and supplements, catering to athletes and fitness enthusiasts who are seeking vegan-friendly protein options to support their active lifestyles.

Clean Label and Transparency Demand

Consumers in the UK are increasingly demanding clean-label products that are free from artificial additives and preservatives. This trend towards transparency and natural ingredients is benefiting the pea protein market, as pea protein is viewed as a clean, minimally processed ingredient that aligns with consumer preferences for simple, recognizable ingredients. The clean-label movement is particularly strong among younger, more health-conscious consumers, who are looking for natural alternatives to traditional animal-based proteins. For example, Unilever introduced a new pea protein-based drink under its “The Vegetarian Butcher” brand in February 2024, targeting consumers seeking nutritious, sustainable, and allergen-friendly beverage options. In response to this demand, manufacturers are focusing on providing products that are not only plant-based but also free from unnecessary additives and artificial ingredients, further enhancing the appeal of pea protein.

Expansion of Plant-Based Offerings in Retail

The expansion of plant-based product offerings in major retail chains is a significant trend contributing to the growth of the UK pea protein market. Supermarkets and grocery stores across the UK are increasingly dedicating more shelf space to plant-based foods, including those that contain pea protein. This trend is supported by the rising popularity of plant-based diets and the increasing consumer acceptance of alternative protein sources. Major retailers are responding to this demand by introducing new plant-based product lines, including pea protein-based snacks, ready-to-eat meals, and frozen foods. The increasing visibility and availability of plant-based products in mainstream retail outlets is not only benefiting pea protein but is also encouraging broader consumer adoption of plant-based diets.

Market Challenges Analysis:

Limited Consumer Awareness

One of the key restraints in the UK pea protein market is the limited consumer awareness regarding the benefits and versatility of pea protein. While plant-based diets are growing in popularity, pea protein is still less recognized compared to other plant-based proteins, such as soy or hemp. Many consumers remain unaware of the nutritional advantages of pea protein, including its complete amino acid profile and hypoallergenic properties. This lack of awareness can hinder the widespread adoption of pea protein, especially among mainstream consumers who are unfamiliar with plant-based protein options. Educating consumers about the benefits of pea protein and its potential applications in everyday foods is crucial for overcoming this challenge.

Price Sensitivity and Cost of Production

Another challenge facing the UK pea protein market is the relatively high cost of production. Pea protein extraction and processing require advanced technology and significant investments, which can make the end products more expensive than their animal-based counterparts or other plant-based alternatives. For instance, the cost of equipment, energy, and labor involved in the extraction and purification process contributes to the overall price of pea protein. This price differential can limit the affordability of pea protein-based products, particularly in price-sensitive market segments. While the price of pea protein is expected to decrease as production scales up, the initial higher costs could continue to pose a challenge in making these products accessible to a wider consumer base, especially in the face of rising living costs in the UK.

Supply Chain Limitations

The UK pea protein market also faces supply chain challenges, particularly in securing a consistent supply of high-quality peas. The demand for plant-based proteins, including pea protein, is growing rapidly, which puts pressure on the agricultural supply chain. The availability of peas is affected by factors such as weather conditions, crop yields, and the competition for land use. Any disruptions in the supply chain, such as poor harvests or geopolitical factors impacting imports, can lead to price fluctuations and supply shortages. Ensuring a stable, sustainable supply of peas is crucial for maintaining market growth and meeting consumer demand for pea protein-based products.

Market Opportunities:

The UK pea protein market presents significant opportunities driven by the increasing demand for plant-based foods and the shift toward healthier, sustainable dietary choices. As more consumers adopt vegan, vegetarian, and flexitarian diets, the demand for plant-based protein alternatives, including pea protein, continues to grow. This presents a valuable opportunity for companies to innovate and develop new products using pea protein, such as meat substitutes, dairy alternatives, and protein supplements. Given the rising consumer interest in health and wellness, there is an expanding market for functional foods and beverages that incorporate pea protein to offer additional nutritional benefits. Manufacturers who focus on creating products that cater to these health-conscious consumers stand to benefit from this growing trend.

Another significant market opportunity lies in the increasing popularity of clean-label and transparent products. Consumers in the UK are becoming more discerning about the ingredients in their food, preferring natural and minimally processed options. Pea protein, with its hypoallergenic, gluten-free, and non-GMO properties, is well-positioned to meet this demand for clean-label products. As awareness of the environmental impact of food production grows, the sustainability benefits of pea protein—such as lower water usage and reduced carbon emissions compared to animal-based proteins—offer a compelling advantage. Companies that emphasize the eco-friendly nature of their pea protein products are likely to appeal to the increasing number of environmentally conscious consumers. These trends collectively present substantial growth opportunities for the UK pea protein market in the coming years.

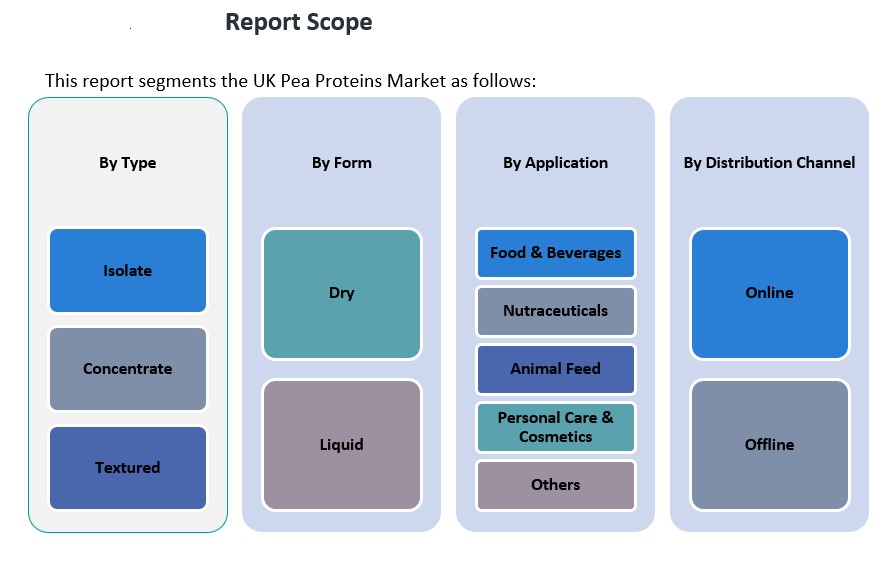

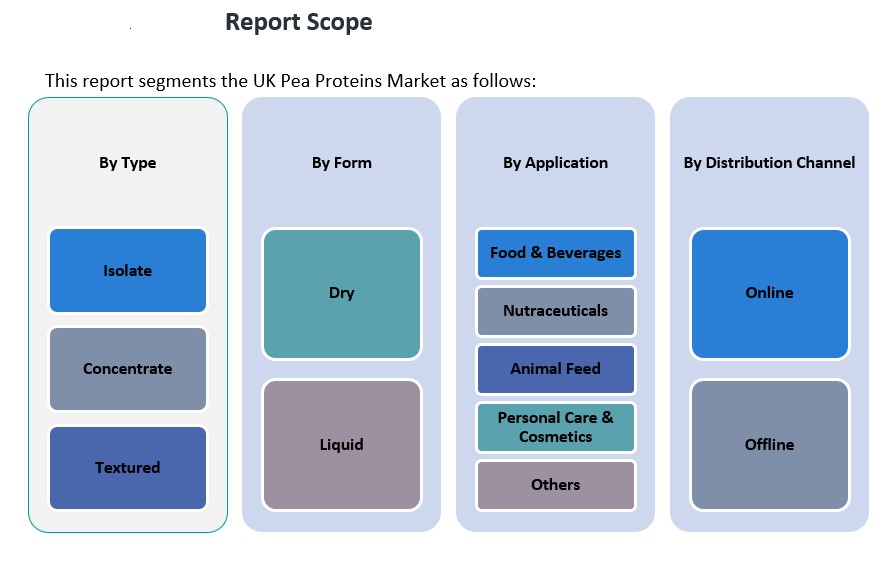

Market Segmentation Analysis:

The UK pea protein market is segmented by type, application, form, and distribution channel, each presenting distinct opportunities for growth and innovation.

By Type, the market is primarily divided into isolates, concentrates, and textured pea proteins. Isolates hold the largest share due to their high protein content and versatile use in various applications, particularly in food and beverage products. Pea protein concentrate is also widely used, especially in nutraceuticals and animal feed, while textured pea protein is gaining traction in the production of plant-based meat alternatives, appealing to consumers seeking texture similar to animal-based products.

By Application, the UK pea protein market is most prominent in the food and beverage sector, where it is used in a variety of plant-based meat substitutes, dairy alternatives, and protein-enriched foods. Nutraceuticals is another significant application, driven by the growing demand for functional foods that promote health and wellness. Additionally, pea protein is increasingly utilized in animal feed, offering a sustainable alternative to traditional animal-based protein sources. The personal care and cosmetics segment is also expanding, as pea protein is recognized for its nourishing properties in skincare and haircare products.

By Form, the market is segmented into dry and liquid pea protein. Dry forms are more commonly used in food, beverages, and nutraceuticals due to their ease of storage and incorporation into formulations, while liquid pea protein is preferred in ready-to-drink products and specific functional foods.

By Distribution Channel, online sales channels are rapidly growing, driven by the convenience of purchasing plant-based products online, while offline channels, including supermarkets and health stores, continue to play a vital role in market penetration. Both channels are essential to expanding consumer access to pea protein products.

Segmentation:

By Type

- Isolate

- Concentrate

- Textured

By Application

- Food & Beverages

- Nutraceuticals

- Animal Feed

- Personal Care & Cosmetics

- Others

By Form

By Distribution Channel

Regional Analysis:

The UK Pea Proteins Market exhibits significant growth across various regions, driven by increasing consumer demand for plant-based and sustainable food alternatives. The market is influenced by factors such as health consciousness, dietary preferences, and a growing inclination toward environmentally friendly protein sources. In this analysis, we will explore the market dynamics in key regions of the UK, highlighting the market share and factors driving growth in each area.

London and the Southeast Region

London and the Southeast hold the largest market share in the UK Pea Proteins Market. This region accounts for over 40% of the market, driven by its substantial concentration of health-conscious consumers and a growing number of vegan and vegetarian populations. The demand for pea protein-based products in the food and beverage sector, especially in plant-based meat alternatives, dairy substitutes, and protein-enriched snacks, is accelerating. Additionally, London’s diverse consumer base and the influence of the urban lifestyle contribute significantly to the consumption of plant-based proteins. The strong retail infrastructure, coupled with significant investments in plant-based food startups, further supports growth in this region.

Midlands and East of England

The Midlands and East of England represent the second-largest market segment, capturing around 25% of the total market share. The growth in this region is primarily driven by the increasing adoption of plant-based diets among consumers in urban and suburban areas. Several food manufacturers in the Midlands are incorporating pea protein into their product lines, especially in nutraceuticals, animal feed, and personal care applications. The region’s robust food processing industry and growing demand for plant-based protein in both the industrial and consumer sectors contribute to the market expansion.

North of England

The North of England holds approximately 20% of the market share, with a notable rise in demand for pea protein in various sectors. The increase in consumer awareness of health and wellness, combined with rising vegan and flexitarian trends, is fostering the growth of plant-based food products in this region. Key cities like Manchester and Liverpool are seeing a surge in the availability of pea protein-based products, with more local food and beverage brands entering the market. Moreover, there is growing support for sustainable agriculture in the North, which is positively influencing the market.

Scotland and Wales

Scotland and Wales contribute to around 15% of the UK market share. These regions are experiencing gradual growth in the adoption of plant-based diets, with increasing awareness of the environmental impact of animal-based proteins. The demand for pea protein is growing in alternative food products, particularly plant-based dairy and meat substitutes, as consumers in these areas become more environmentally conscious. Additionally, the presence of local manufacturers producing pea protein-based products helps to support market development.

Key Player Analysis:

- Roquette Frères

- Cosucra Groupe Warcoing

- Burcon NutraScience Corporation

- Emsland Group

- Shandong Jianyuan Group

- Naturz Organics

- Fenchem Biotek Ltd.

- Kerry Group

- Sotexpro

- Meelunie B.V.

Competitive Analysis:

The UK pea protein market is highly competitive, with several key players actively contributing to the market’s growth. Prominent companies in the sector include Roquette Frères, Ingredion Incorporated, and Cargill, which are leaders in the production of pea protein isolates and concentrates. These companies have established a strong market presence through strategic partnerships, innovative product offerings, and significant investments in research and development to improve product quality and functionality. Additionally, emerging players such as The Green Lab and Puris Foods are gaining traction by focusing on sustainable production methods and expanding their product portfolios to cater to the growing demand for plant-based protein alternatives. The competitive landscape is characterized by an increasing focus on clean-label and non-GMO pea protein products, which cater to the rising consumer preference for transparency and health-conscious food options. As the market continues to expand, companies are likely to differentiate themselves through innovation, sustainability practices, and expanding distribution channels.

Recent Developments:

- In April 2024, Nestlé introduced a new range of plant-based protein products under its “Garden Gourmet” brand in the UK, focusing on sustainable sourcing and enhanced nutrition. This launch specifically features products made with pea protein, aiming to meet the rising demand among flexitarian and vegan consumers for high-quality, protein-rich plant-based alternatives.

- In February 2024, Roquette launched four multifunctional pea proteins under its NUTRALYS® portfolio. These new products—NUTRALYS® Pea F853M (isolate), NUTRALYS® H85 (hydrolysate), NUTRALYS® T Pea 700FL (textured), and NUTRALYS® T Pea 700M (textured)—are designed to improve taste, texture, and functionality in plant-based foods like nutritional bars and meat alternatives.

- In March 2023, Archer-Daniels-Midland Company (ADM) entered into a joint venture agreement with Marel hf., a provider of advanced food processing solutions, to establish an alternative protein innovation center in the Netherlands. This partnership aims to drive innovation in the plant-based protein sector, potentially impacting the UK market through new product developments and technologies.

- In March 2023, Nepra Foods partnered with The Scoular Company to manufacture and distribute specialized plant-based products. This collaboration leverages Scoular’s robust supply chain network to promote Nepra’s products, while Nepra contributes its R&D expertise to develop innovative offerings using specialty ingredients.

Market Concentration & Characteristics:

The UK Pea Proteins Market exhibits moderate concentration, with a few dominant players holding significant shares, while numerous smaller companies cater to niche segments. Major market players have established strong partnerships with food manufacturers, driving innovation and the adoption of pea protein in various applications such as food & beverages, nutraceuticals, and animal feed. These players leverage their extensive distribution networks and product diversification to maintain a competitive edge. The market is characterized by increasing competition, with companies focusing on product innovation, clean-label formulations, and sustainability. The rising demand for plant-based and allergen-free proteins has prompted businesses to enhance their product offerings, such as pea protein isolates, concentrates, and textured forms. Additionally, consumer trends toward healthier eating, ethical sourcing, and eco-friendly production practices are shaping market dynamics, pushing companies to align with these evolving preferences to capture greater market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK pea protein market is expected to grow significantly, driven by increasing consumer demand for plant-based protein alternatives.

- The rise of flexitarian, vegan, and vegetarian diets will further boost the market, with pea protein gaining popularity as a versatile ingredient.

- Health-conscious consumers will continue to seek pea protein for its hypoallergenic, gluten-free, and nutrient-rich properties.

- Sustainable production methods will gain importance, as pea protein offers a eco-friendlier alternative to animal-based proteins.

- The development of new applications in food and beverages, such as meat substitutes and dairy alternatives, will drive market diversification.

- Increased investment in research and development will lead to innovations in pea protein extraction, improving product quality and functionality.

- As retailers expand their plant-based offerings, the availability of pea protein products in mainstream grocery stores will increase.

- The growth of online sales channels will provide broader access to pea protein products, especially among younger, tech-savvy consumers.

- Government support for sustainable agriculture and plant-based nutrition will continue to foster a favorable environment for the market’s growth.

- Competition within the market will intensify, encouraging companies to innovate and differentiate through clean-label, non-GMO products.