| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Industrial Catalyst Market Size 2024 |

USD 9210.01 Million |

| U.S. Industrial Catalyst Market, CAGR |

6.32% |

| U.S. Industrial Catalyst Market Size 2032 |

USD 15042.29 Million |

Market Overview:

The U.S. Industrial Catalyst Market is projected to grow from USD 9210.01 million in 2024 to an estimated USD 15042.29 million by 2032, with a compound annual growth rate (CAGR) of 6.32% from 2024 to 2032.

Several factors are driving this market expansion. The increasing demand for petroleum-based fuels such as diesel, gasoline, kerosene, fuel oils, and jet fuels, particularly from the industrial and power generation sectors, is a significant contributor. Additionally, the automotive industry’s growing need for catalytic converters to reduce toxic emissions has led to a heightened demand for palladium-based catalysts. Furthermore, the pharmaceutical sector’s rising requirement for chiral compounds has amplified the use of catalysts in complex chemical synthesis processes. The expansion of the chemical manufacturing sector and the focus on energy-efficient production methods are further stimulating catalyst adoption. As industries transition to cleaner technologies, the demand for environmentally friendly catalytic solutions continues to rise. Increasing environmental awareness and regulatory compliance are pushing companies to adopt more effective catalytic technologies. This growing emphasis on process optimization and emission control has made catalysts a cornerstone in industrial innovation.

Regionally, North America holds a substantial share of the global industrial catalyst market, accounting for approximately 46% in 2024. This dominance is attributed to robust industrialization, a well-established petrochemical sector, and significant investments in research and development. The region’s emphasis on sustainable practices and stringent environmental regulations further propels the demand for advanced catalyst technologies. The presence of leading catalyst manufacturers and government support for green industrial processes also contribute to market growth. Additionally, ongoing innovation in nanocatalysts and bio-based catalysts offers new opportunities for regional expansion. Urbanization, infrastructure development, and increased energy consumption further reinforce North America’s need for industrial catalysts. The U.S., in particular, continues to lead in technological advancements and deployment of cutting-edge catalytic systems across various industrial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. industrial catalyst market is projected to grow from USD 9.21 billion in 2024 to USD 15.04 billion by 2032, with a compound annual growth rate (CAGR) of 6.32%.

- The global industrial catalyst market is projected to grow from USD 31.56 billion in 2024 to USD 51.15 billion by 2032, with a CAGR of 6.22% from 2024 to 2032.

- North America accounts for approximately 46% of the global industrial catalyst market in 2024, driven by robust industrialization and a well-established petrochemical sector.

- The increasing demand for petroleum-based fuels, such as diesel, gasoline, and jet fuels, particularly from the industrial and power generation sectors, significantly contributes to market expansion.

- The automotive industry’s growing need for catalytic converters to reduce toxic emissions has led to heightened demand for palladium-based catalysts.

- The pharmaceutical sector’s rising requirement for chiral compounds has amplified the use of catalysts in complex chemical synthesis processes.

- Expansion in chemical manufacturing and a focus on energy-efficient production methods are further stimulating catalyst adoption.

- As industries transition to cleaner technologies, the demand for environmentally friendly catalytic solutions continues to rise, driven by increasing environmental awareness and regulatory compliance.

Market Drivers:

Growing Demand from the Petrochemical and Refining Industries

The petrochemical and refining industries in the U.S. are major contributors to the expansion of the industrial catalyst market. Catalysts play a vital role in enhancing the efficiency of refining processes, enabling higher yields of value-added products such as gasoline, diesel, and jet fuel. For example, fluid catalytic cracking (FCC) units utilize advanced zeolite-based catalysts to enhance selectivity toward naphtha and liquefied petroleum gas (LPG). With the rising consumption of energy and petroleum-based fuels across various sectors, including manufacturing, transportation, and power generation, the demand for high-performance catalysts continues to grow. Refineries are also focusing on maximizing throughput and minimizing operational costs through the adoption of advanced catalyst systems, thereby reinforcing market growth.

Stringent Environmental Regulations and Emissions Control

Environmental regulations imposed by agencies such as the U.S. Environmental Protection Agency (EPA) are significantly influencing the demand for industrial catalysts. These regulations aim to reduce the environmental footprint of industrial operations by limiting emissions of volatile organic compounds (VOCs), greenhouse gases, and other pollutants. As a result, industries are increasingly relying on catalysts to comply with these standards and improve process sustainability. Catalysts are essential in automotive catalytic converters and industrial exhaust treatment systems, contributing to cleaner emissions and regulatory compliance. The continuous push toward greener processes have driven innovation in catalyst formulation, further boosting their adoption across industries.

Advancements in Chemical Manufacturing and Process Optimization

The rapid evolution of the chemical manufacturing sector has created a favorable environment for the adoption of industrial catalysts. Catalysts enable more efficient chemical reactions, reduce energy consumption, and improve product selectivity, making them integral to modern chemical production. The growing demand for specialty and fine chemicals, polymers, and pharmaceuticals in the U.S. supports the need for catalytic technologies that ensure precision and scalability. Moreover, as manufacturers strive for leaner operations and higher yields, the deployment of sophisticated catalyst systems becomes a strategic priority. These trends are fostering continuous investment in catalyst research and development, expanding the scope of applications in the market.

Technological Innovation and Industry Collaboration

Technological innovation remains a critical driver in the U.S. industrial catalyst market. The development of novel catalyst materials, such as nanostructured and bio-based catalysts, is opening new pathways for industrial applications. These advancements allow for improved activity, stability, and selectivity, enabling more sustainable and cost-effective processes. For instance, BASF Environmental Catalyst inaugurated a hydrogen component lab focused on cost-effective solutions for green hydrogen production. Industry collaboration among catalyst manufacturers, research institutions, and end-user industries is further accelerating innovation. Joint ventures and partnerships focused on customized catalyst solutions are helping companies address specific operational challenges and regulatory demands. As a result, the U.S. market is witnessing a surge in tailored catalytic solutions that align with evolving industry needs.

Market Trends:

Rising Adoption of Green and Sustainable Catalysts

The U.S. industrial catalyst market is experiencing a notable shift toward sustainable and environmentally friendly catalytic materials. With increasing focus on climate change and carbon neutrality, industries are prioritizing the use of green catalysts derived from renewable or biodegradable sources. Bio-based and non-toxic metal catalysts, such as those using iron or copper instead of precious or rare metals, are gaining traction across chemical and environmental applications. For instance, researchers are developing catalysts for electrochemical hydrogenation to produce ammonia without relying on the traditional Haber process, which is energy-intensive and emits significant greenhouse gases. In addition, regulatory pressures and corporate sustainability goals are pushing manufacturers to replace traditional catalysts with those offering improved environmental performance. This trend is fostering R&D investments aimed at creating next-generation catalysts that align with circular economy principles.

Growing Demand in the Renewable Energy Sector

Another prominent trend shaping the market is the growing integration of catalysts in renewable energy technologies. In particular, the U.S. is witnessing increased use of catalysts in hydrogen production, fuel cells, and biomass conversion. Catalysts play a crucial role in the electrolysis of water and reforming of biomass to produce clean hydrogen, which is becoming central to the country’s long-term energy strategy. For instance, according to the U.S. Department of Energy, the demand for clean hydrogen is expected to reach 10 million metric tons per year by 2030. This upward trajectory is driving innovation in catalyst materials designed specifically for energy transition applications.

Increased Investment in Nanocatalyst Technologies

Nanotechnology is emerging as a transformative force in the industrial catalyst landscape. The U.S. is at the forefront of nanocatalyst research, supported by academic institutions and government-funded programs. Nanocatalysts offer superior surface area, selectivity, and reactivity compared to conventional materials, making them ideal for high-precision processes in sectors such as petrochemicals, pharmaceuticals, and environmental remediation. Recent advancements in nanoparticle synthesis and surface engineering have enabled the development of catalysts with enhanced durability and tunable properties. As manufacturing processes become more complex, the demand for nano-engineered catalysts is expected to grow substantially, offering opportunities for high-value innovation.

Digitalization and Process Automation in Catalyst Applications

Digital transformation is increasingly influencing catalyst performance and industrial process optimization. Companies in the U.S. are leveraging artificial intelligence (AI), machine learning (ML), and advanced analytics to model catalytic behavior and predict outcomes with greater accuracy. This trend is leading to more efficient catalyst design, real-time monitoring of reaction conditions, and predictive maintenance in manufacturing facilities. Additionally, digital tools are enabling faster scale-up from lab to commercial production, shortening development cycles. As industries adopt smart manufacturing practices, digital integration is expected to play a central role in enhancing catalyst effectiveness and supporting data-driven decision-making.

Market Challenges Analysis:

High Production and Raw Material Costs

One of the primary restraints affecting the U.S. industrial catalyst market is the high cost associated with catalyst production and raw materials. Many industrial catalysts rely on rare and precious metals such as platinum, palladium, and rhodium, which are not only expensive but also subject to volatile global pricing. These fluctuations can significantly impact production costs and profit margins for manufacturers. Additionally, the complex synthesis and purification processes required to produce high-performance catalysts contribute to increased operational expenditures. As a result, smaller firms and cost-sensitive industries may be deterred from investing in advanced catalytic technologies, thereby limiting market penetration.

Technical Limitations and Catalyst Deactivation

Another major challenge facing the market is catalyst deactivation, which occurs when a catalyst loses its effectiveness over time due to fouling, poisoning, or thermal degradation. For example, in hydrodesulfurization processes, sulfur compounds can poison molybdenum-based catalysts by forming stable surface compounds that block active sites, reducing effectiveness and lifespan. This issue leads to reduced process efficiency, increased downtime, and higher maintenance costs for industrial facilities. The need for frequent catalyst replacement can disrupt production schedules and reduce overall productivity. Furthermore, some industrial applications require highly specific reaction conditions, which limit the use of general-purpose catalysts and necessitate the development of customized solutions—often at higher costs and longer lead times. These technical limitations present a barrier to broader adoption across sectors with diverse operational requirements.

Stringent Regulatory and Waste Disposal Challenges

While environmental regulations drive demand for catalysts in emissions control, they also pose compliance challenges regarding waste management and catalyst disposal. Used catalysts often contain hazardous substances and require specialized handling, recycling, or disposal methods, all of which add regulatory complexity and cost. Companies must navigate a rigorous framework of environmental standards, which can be resource-intensive and may hinder innovation cycles. Addressing these challenges requires significant investment in cleaner technologies and lifecycle management strategies, which may not be feasible for all market participants.

Market Opportunities:

The U.S. industrial catalyst market presents substantial growth opportunities driven by the nation’s accelerating transition toward clean energy and sustainable manufacturing. As industries pivot toward low-carbon technologies, the demand for innovative catalysts capable of supporting energy-efficient and environmentally responsible processes continues to rise. Emerging sectors such as green hydrogen production, carbon capture and storage (CCS), and biomass conversion present new avenues for catalyst application. Catalysts play a critical role in these advanced processes, particularly in enhancing reaction efficiency and reducing energy consumption. The growing emphasis on decarbonization, supported by federal incentives and clean energy funding, is expected to create a strong demand for catalysts tailored to these applications.

In addition to clean energy, the increasing investment in specialty and fine chemical production across the U.S. provides another promising opportunity. The need for high-precision and cost-effective catalytic processes is growing in pharmaceuticals, agrochemicals, and advanced material synthesis. Companies are seeking catalysts that offer improved selectivity, higher yields, and the ability to operate under milder conditions, all of which contribute to more sustainable and economically viable production. Furthermore, advancements in catalyst recycling and regeneration technologies are opening new markets for circular economy solutions. As the industry continues to evolve, collaboration between catalyst manufacturers, research institutions, and industrial end-users is expected to unlock innovative products and processes. This collaborative environment positions the U.S. industrial catalyst market to capture significant value in both traditional and emerging application segments.

Market Segmentation Analysis:

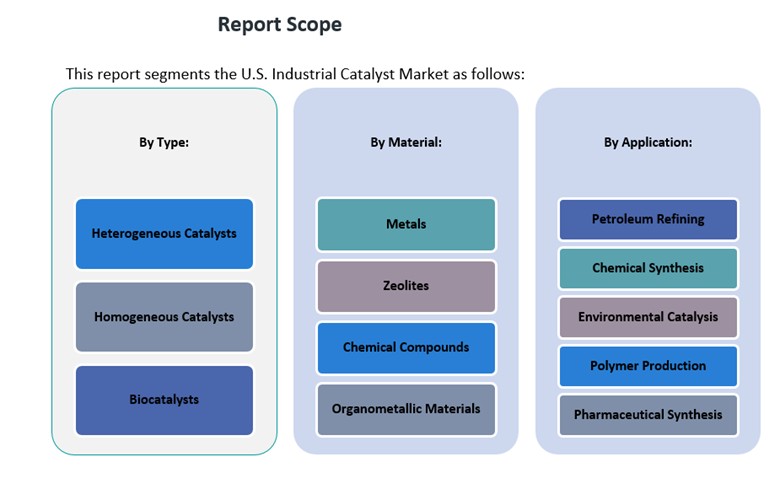

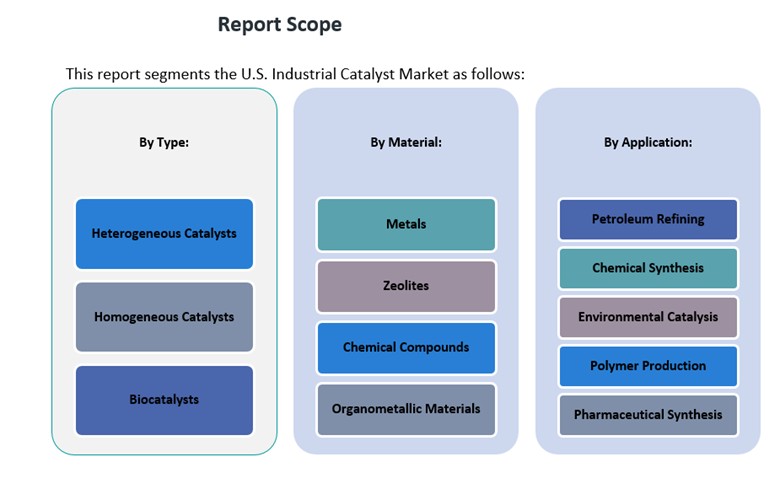

The U.S. industrial catalyst market is segmented by type, application, and material, with each segment playing a significant role in shaping market dynamics.

By type, heterogeneous catalysts dominate the market due to their extensive use in petroleum refining, environmental catalysis, and chemical manufacturing. Their ease of separation and reuse makes them the preferred choice across various industries. Homogeneous catalysts, while less prevalent, hold notable significance in specialty chemical and fine chemical production due to their high selectivity. Biocatalysts are emerging as a promising segment, particularly in pharmaceutical synthesis and environmentally sustainable processes, driven by advancements in biotechnology and green chemistry.

By application, petroleum refining represents the largest segment, driven by the U.S.’s strong refining infrastructure and continued demand for cleaner fuels. Chemical synthesis follows closely, supported by growth in specialty and commodity chemicals. Environmental catalysis is gaining momentum amid stricter emission regulations and increasing focus on sustainability, prompting the adoption of catalysts in emissions control and waste treatment systems. Polymer production and pharmaceutical synthesis also contribute significantly, as demand for high-performance materials and life sciences products continues to expand.

By material, metals remain the most widely used, particularly platinum group metals, due to their superior catalytic properties in high-temperature and high-pressure environments. Zeolites are gaining traction for their role in hydrocracking and fluid catalytic cracking. Chemical compounds and organometallic materials also show growing adoption, particularly in specialized applications requiring tailored catalytic activity.

Segmentation:

By Type Segment

- Heterogeneous Catalysts

- Homogeneous Catalysts

- Biocatalysts

By Application Segment

- Petroleum Refining

- Chemical Synthesis

- Environmental Catalysis

- Polymer Production

- Pharmaceutical Synthesis

By Material Segment

- Metals

- Zeolites

- Chemical Compounds

- Organometallic Materials

Regional Analysis:

The U.S. industrial catalyst market exhibits a geographically diverse landscape, with certain regions playing dominant roles due to their concentration of industrial activity, energy production, and chemical manufacturing. The Gulf Coast region leads the market, accounting for 42% of the total market share in 2024. This dominance is largely attributed to the region’s extensive network of oil refineries, petrochemical complexes, and natural gas processing plants. States such as Texas and Louisiana serve as key hubs for catalyst consumption, driven by robust downstream activities and ongoing investments in refinery upgrades and capacity expansions. The presence of major industry players and favorable infrastructure further reinforces the Gulf Coast’s pivotal position in the market.

The Midwest region holds approximately 23% of the U.S. industrial catalyst market, supported by a strong manufacturing base and a well-established presence of chemical, fertilizer, and metal processing industries. States including Illinois, Ohio, and Indiana are witnessing increased adoption of catalytic technologies aimed at optimizing industrial processes and reducing emissions. Additionally, the growing emphasis on industrial automation and sustainable manufacturing practices is driving demand for advanced catalyst systems in the region. Public and private sector initiatives focused on cleaner production techniques also support market expansion in the Midwest.

The West region, comprising California, Washington, and Oregon, contributes 19% to the market. This region is characterized by a progressive regulatory environment and a strong focus on green technologies. California, in particular, has emerged as a key market for catalysts used in environmental applications, such as emission control and renewable fuel production. The rise of clean energy initiatives, including hydrogen and biofuel projects, is creating new opportunities for catalyst deployment across the western states.

Lastly, the Northeast region accounts for 16% of the market, driven by advanced pharmaceutical and specialty chemical industries concentrated in states like New Jersey, Massachusetts, and Pennsylvania. The demand for high-performance catalysts in fine chemical synthesis and research-driven production processes is growing steadily. Academic and institutional collaborations, along with a focus on innovation and precision manufacturing, contribute to the region’s consistent market presence.

Key Player Analysis:

- BASF SE

- Johnson Matthey

- Albemarle Corporation

- ExxonMobil Chemical Company

- W. R. Grace & Co.

- Dow Inc.

- Honeywell UOP

- Chevron Phillips Chemical Company

- PQ Corporation

- Arkema Inc.

Competitive Analysis:

The U.S. industrial catalyst market is characterized by the presence of several well-established players competing on the basis of technological innovation, product performance, and application-specific expertise. Key companies such as BASF Corporation, W.R. Grace & Co., Albemarle Corporation, and Johnson Matthey maintain strong market positions through extensive R&D capabilities and diversified catalyst portfolios. These players focus on developing advanced catalysts that offer higher efficiency, lower emissions, and longer operational life to meet evolving industrial demands. Strategic partnerships, acquisitions, and investments in sustainable catalyst technologies are commonly employed to enhance market reach and competitiveness. Emerging companies are also gaining traction by offering niche and customized solutions, particularly in biocatalysis and nanocatalysis. With increasing demand across sectors such as refining, chemicals, and environmental applications, competition is intensifying, prompting firms to prioritize innovation and operational scalability. As regulatory pressures mount, companies are expected to further invest in green and compliant catalyst technologies to maintain their market edge.

Recent Developments:

- In Jan 2023, Catalyst Pharmaceuticals announced its acquisition of U.S. commercial rights to FYCOMPA® (Perampanel) CIII from Eisai Co., Ltd. This strategic move expands Catalyst’s portfolio with an established neurology product and includes an exclusive option to evaluate and negotiate for a rare epilepsy compound under Eisai’s pipeline.

- In January 2025, Honeywell UOP expanded its catalyst production capacity to meet rising demand within the U.S. refinery catalyst market. This expansion reflects the industry’s focus on cleaner fuel production and improved energy efficiency through advanced catalytic technologies.

- In February 2025, Johnson Matthey entered into a long-term collaboration with Bosch to develop catalyst-coated membranes (CCMs) for hydrogen fuel cell stacks. This partnership focuses on advancing zero-emission hydrogen technology for commercial vehicles.

Market Concentration & Characteristics:

The U.S. industrial catalyst market exhibits a moderately concentrated structure, with a few dominant players holding a significant share of the total market value. Leading companies such as BASF Corporation, Albemarle Corporation, and W.R. Grace & Co. maintain a competitive edge through robust technological capabilities, broad product lines, and established client relationships across key industrial sectors. The market is characterized by high entry barriers due to the capital-intensive nature of catalyst development, stringent regulatory requirements, and the complexity of proprietary technologies. Innovation, performance reliability, and regulatory compliance are critical differentiators in this space. Additionally, the market is marked by long product life cycles and strong customer loyalty, especially in high-risk industrial applications. Customization and technical support play a central role in supplier selection, reinforcing the importance of deep industry knowledge. As environmental and efficiency standards evolve, the market continues to shift toward sustainable, high-performance catalytic solutions tailored to specific end-use needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, Application Segment and Material Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Continued growth in clean energy initiatives will drive demand for catalysts in hydrogen production and carbon capture technologies.

- Advancements in nanocatalyst and bio-based catalyst technologies will open new industrial applications.

- Rising environmental regulations will encourage adoption of catalysts that support low-emission manufacturing processes.

- Integration of AI and data analytics will enhance catalyst design, process optimization, and predictive maintenance.

- Expanding specialty chemical and pharmaceutical sectors will increase the need for high-selectivity and precision catalysts.

- Growing investments in sustainable refining and petrochemical infrastructure will support market expansion.

- Strategic collaborations between research institutions and manufacturers will accelerate innovation in catalyst development.

- Demand for customized catalytic solutions will rise to meet the unique operational needs of end-use industries.

- Catalyst recycling and regeneration technologies will gain traction due to cost and sustainability considerations.

- Market competition will intensify, prompting firms to invest in next-generation catalyst materials and digital tools.