CHAPTER NO. 1 : INTRODUCTION 18

1.1. Report Description 18

Purpose of the Report 18

USP & Key Offerings 18

1.2. Key Benefits for Stakeholders 18

1.3. Target Audience 19

1.4. Report Scope 19

CHAPTER NO. 2 : EXECUTIVE SUMMARY 20

2.1. U.S. Pea Proteins Market Snapshot 20

2.2. U.S. Pea Proteins Market, 2018 – 2032 (Metric Tons) (USD Million) 22

2.3. Insights from Primary Respondents 23

CHAPTER NO. 3 : U.S. PEA PROTEINS MARKET – INDUSTRY ANALYSIS 24

3.1. Introduction 24

3.2. Market Drivers 25

3.3. Rising Cases of Obesity as Well as Increasing Public Awareness 25

3.4. Rise in Social Media Marketing 26

3.5. Market Restraints 27

3.6. Availability of Low-Cost Substitutes 27

3.7. Market Opportunities 28

3.8. Market Opportunity Analysis 28

3.9. Porter’s Five Forces Analysis 29

CHAPTER NO. 4 : ANALYSIS COMPETITIVE LANDSCAPE 30

4.1. Company Market Share Analysis – 2023 30

4.1.1. U.S. Pea Proteins Market: Company Market Share, by Volume, 2023 30

4.1.2. U.S. Pea Proteins Market: Company Market Share, by Revenue, 2023 31

4.1.3. U.S. Pea Proteins Market: Top 6 Company Market Share, by Revenue, 2023 31

4.1.4. U.S. Pea Proteins Market: Top 3 Company Market Share, by Revenue, 2023 32

4.2. U.S. Pea Proteins Market Company Volume Market Share, 2023 33

4.3. U.S. Pea Proteins Market Company Revenue Market Share, 2023 34

4.4. Company Assessment Metrics, 2023 35

4.4.1. Stars 35

4.4.2. Emerging Leaders 35

4.4.3. Pervasive Players 35

4.4.4. Participants 35

4.5. Start-ups /SMEs Assessment Metrics, 2023 35

4.5.1. Progressive Companies 35

4.5.2. Responsive Companies 35

4.5.3. Dynamic Companies 35

4.5.4. Starting Blocks 35

4.6. Strategic Developments 36

4.6.1. Acquisitions & Mergers 36

New Product Launch 36

Regional Expansion 36

4.7. Key Players Product Matrix 37

CHAPTER NO. 5 : PESTEL & ADJACENT MARKET ANALYSIS 38

5.1. PESTEL 38

5.1.1. Political Factors 38

5.1.2. Economic Factors 38

5.1.3. Social Factors 38

5.1.4. Technological Factors 38

5.1.5. Environmental Factors 38

5.1.6. Legal Factors 38

5.2. Adjacent Market Analysis 38

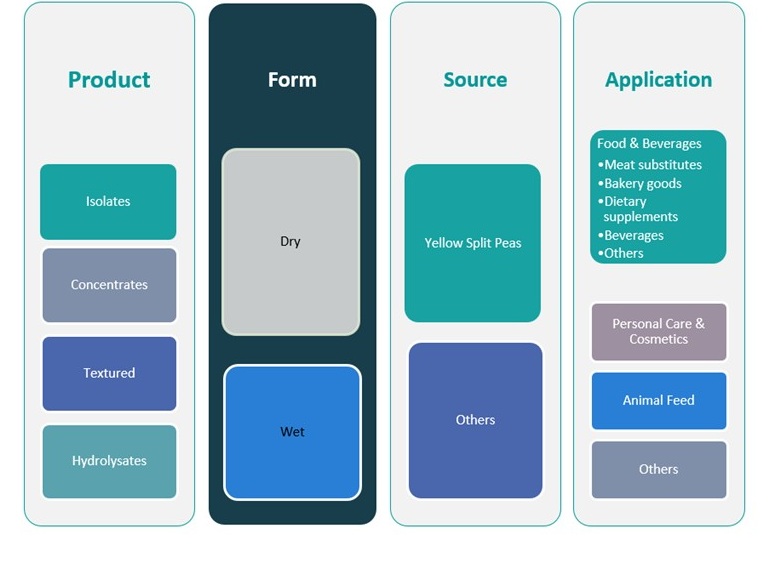

CHAPTER NO. 6 : U.S. PEA PROTEINS MARKET – BY PRODUCT SEGMENT ANALYSIS 39

6.1. U.S. Pea Proteins Market Overview, by Product Segment 39

6.1.1. U.S. Pea Proteins Market Volume Share, By Product, 2023 & 2032 40

6.1.2. U.S. Pea Proteins Market Revenue Share, By Product, 2023 & 2032 40

6.1.3. U.S. Pea Proteins Market Attractiveness Analysis, By Product 41

6.1.4. Incremental Revenue Growth Opportunity, by Product, 2024 – 2032 41

6.1.5. U.S. Pea Proteins Market Revenue, By Product, 2018, 2023, 2027 & 2032 42

6.2. Isolates 43

6.3. Concentrates 44

6.4. Textured 45

6.5. Hydrolysates 46

CHAPTER NO. 7 : U.S. PEA PROTEINS MARKET – BY APPLICATION SEGMENT ANALYSIS 47

7.1. U.S. Pea Proteins Market Overview, by Application Segment 47

7.1.1. U.S. Pea Proteins Market Volume Share, By Application, 2023 & 2032 48

7.1.2. U.S. Pea Proteins Market Revenue Share, By Application, 2023 & 2032 48

7.1.3. U.S. Pea Proteins Market Attractiveness Analysis, By Application 49

7.1.4. Incremental Revenue Growth Opportunity, by Application, 2024 – 2032 49

7.1.5. U.S. Pea Proteins Market Revenue, By Application, 2018, 2023, 2027 & 2032 50

7.2. Food & Beverages 51

7.2.1. Meat substitutes 52

7.2.2. Bakery goods 53

7.2.3. Dietary supplements 54

7.2.4. Beverages 55

7.2.5. Others 56

7.3. Personal Care & Cosmetics 57

7.4. Animal Feed 58

7.5. Others 59

CHAPTER NO. 8 : U.S. PEA PROTEINS MARKET – BY FORM SEGMENT ANALYSIS 60

8.1. U.S. Pea Proteins Market Overview, by Form Segment 60

8.1.1. U.S. Pea Proteins Market Volume Share, By Form, 2023 & 2032 61

8.1.2. U.S. Pea Proteins Market Revenue Share, By Form, 2023 & 2032 61

8.1.3. U.S. Pea Proteins Market Attractiveness Analysis, By Form 62

8.1.4. Incremental Revenue Growth Opportunity, by Form, 2024 – 2032 62

8.1.5. U.S. Pea Proteins Market Revenue, By Form, 2018, 2023, 2027 & 2032 63

8.2. Dry 64

8.3. Wet 65

CHAPTER NO. 9 : U.S. PEA PROTEINS MARKET – BY SOURCE SEGMENT ANALYSIS 66

9.1. U.S. Pea Proteins Market Overview, by Source Segment 66

9.1.1. U.S. Pea Proteins Market Volume Share, By Source, 2023 & 2032 67

9.1.2. U.S. Pea Proteins Market Revenue Share, By Source, 2023 & 2032 67

9.1.3. U.S. Pea Proteins Market Attractiveness Analysis, By Source 68

9.1.4. Incremental Revenue Growth Opportunity, by Source, 2024 – 2032 68

9.1.5. U.S. Pea Proteins Market Revenue, By Source, 2018, 2023, 2027 & 2032 69

9.2. Yellow Split Peas 70

9.3. Others 71

CHAPTER NO. 10 : U.S. PEA PROTEINS MARKET – ANALYSIS 72

10.1.1. U.S. Pea Proteins Market Volume, By Product, 2018 – 2023 (Metric Tons) 72

10.1.2. U.S. Pea Proteins Market Revenue, By Product, 2018 – 2023 (USD Million) 73

10.1.3. U.S. Pea Proteins Market Volume, By Application, 2018 – 2023 (Metric Tons) 74

10.1.4. U.S. Pea Proteins Market Revenue, By Application, 2018 – 2023 (USD Million) 75

10.1.5. U.S. Pea Proteins Market Volume, By Form, 2018 – 2023 (Metric Tons) 76

10.1.6. U.S. Pea Proteins Market Revenue, By Form, 2018 – 2023 (USD Million) 77

10.1.7. U.S. Pea Proteins Market Volume, By Source, 2018 – 2023 (Metric Tons) 78

10.1.8. U.S. Pea Proteins Market Revenue, By Source, 2018 – 2023 (USD Million) 79

CHAPTER NO. 11 : COMPANY PROFILES 80

11.1. The Scoular Company 80

11.1.1. Company Overview 80

11.1.2. Product Portfolio 80

11.1.3. Swot Analysis 80

11.1.4. Business Strategy 80

11.1.5. Financial Overview 81

11.2. DuPont de Nemours, Inc. 82

11.3. Ingredion Incorporated 82

11.4. Archer Daniels Midland Company 82

11.5. Cargill, Incorporated 82

11.6. Company 6 82

11.7. Company 7 82

11.8. Company 8 82

11.9. Company 9 82

11.10. Company 10 82

11.11. Company 11 82

11.12. Company 12 82

11.13. Company 13 82

11.14. Company 14 82

List of Figures

FIG NO. 1. U.S. Pea Proteins Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 23

FIG NO. 2. Porter’s Five Forces Analysis for U.S. Pea Proteins Market 30

FIG NO. 3. Company Share Analysis, 2023 31

FIG NO. 4. Company Share Analysis, 2023 32

FIG NO. 5. Company Share Analysis, 2023 32

FIG NO. 6. Company Share Analysis, 2023 33

FIG NO. 7. U.S. Pea Proteins Market – Company Volume Market Share, 2023 34

FIG NO. 8. U.S. Pea Proteins Market – Company Revenue Market Share, 2023 35

FIG NO. 9. U.S. Pea Proteins Market Volume Share, By Product, 2023 & 2032 41

FIG NO. 10. U.S. Pea Proteins Market Revenue Share, By Product, 2023 & 2032 41

FIG NO. 11. Market Attractiveness Analysis, By Product 42

FIG NO. 12. Incremental Revenue Growth Opportunity by Product, 2024 – 2032 42

FIG NO. 13. U.S. Pea Proteins Market Revenue, By Product, 2018, 2023, 2027 & 2032 43

FIG NO. 14. U.S. Pea Proteins Market for Isolates, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 44

FIG NO. 15. U.S. Pea Proteins Market for Concentrates, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 45

FIG NO. 16. U.S. Pea Proteins Market for Textured, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 46

FIG NO. 17. U.S. Pea Proteins Market for Hydrolysates, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 47

FIG NO. 18. U.S. Pea Proteins Market Volume Share, By Application, 2023 & 2032 49

FIG NO. 19. U.S. Pea Proteins Market Revenue Share, By Application, 2023 & 2032 49

FIG NO. 20. Market Attractiveness Analysis, By Application 50

FIG NO. 21. Incremental Revenue Growth Opportunity by Application, 2024 – 2032 50

FIG NO. 22. U.S. Pea Proteins Market Revenue, By Application, 2018, 2023, 2027 & 2032 51

FIG NO. 23. U.S. Pea Proteins Market for Food & Beverages, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 52

FIG NO. 24. U.S. Pea Proteins Market for Meat substitutes, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 53

FIG NO. 25. U.S. Pea Proteins Market for Bakery goods, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 54

FIG NO. 26. U.S. Pea Proteins Market for Dietary supplements, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 55

FIG NO. 27. U.S. Pea Proteins Market for Beverages, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 56

FIG NO. 28. U.S. Pea Proteins Market for Others, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 57

FIG NO. 29. U.S. Pea Proteins Market for Personal Care & Cosmetics, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 58

FIG NO. 30. U.S. Pea Proteins Market for Animal Feed, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 59

FIG NO. 31. U.S. Pea Proteins Market for Others, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 60

FIG NO. 32. U.S. Pea Proteins Market Volume Share, By Form, 2023 & 2032 62

FIG NO. 33. U.S. Pea Proteins Market Revenue Share, By Form, 2023 & 2032 62

FIG NO. 34. Market Attractiveness Analysis, By Form 63

FIG NO. 35. Incremental Revenue Growth Opportunity by Form, 2024 – 2032 63

FIG NO. 36. U.S. Pea Proteins Market Revenue, By Form, 2018, 2023, 2027 & 2032 64

FIG NO. 37. U.S. Pea Proteins Market for Dry, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 65

FIG NO. 38. U.S. Pea Proteins Market for Wet, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 66

FIG NO. 39. U.S. Pea Proteins Market Volume Share, By Source, 2023 & 2032 68

FIG NO. 40. U.S. Pea Proteins Market Revenue Share, By Source, 2023 & 2032 68

FIG NO. 41. Market Attractiveness Analysis, By Source 69

FIG NO. 42. Incremental Revenue Growth Opportunity by Source, 2024 – 2032 69

FIG NO. 43. U.S. Pea Proteins Market Revenue, By Source, 2018, 2023, 2027 & 2032 70

FIG NO. 44. U.S. Pea Proteins Market for Yellow Split Peas, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 71

FIG NO. 45. U.S. Pea Proteins Market for Others, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 72

List of Tables

TABLE NO. 1. : U.S. Pea Proteins Market: Snapshot 21

TABLE NO. 2. : Drivers for the U.S. Pea Proteins Market: Impact Analysis 26

TABLE NO. 3. : Restraints for the U.S. Pea Proteins Market: Impact Analysis 28

TABLE NO. 4. : U.S. Pea Proteins Market Volume, By Product, 2018 – 2023 (Metric Tons) 73

TABLE NO. 5. : U.S. Pea Proteins Market Volume, By Product, 2024 – 2032 (Metric Tons) 73

TABLE NO. 6. : U.S. Pea Proteins Market Revenue, By Product, 2018 – 2023 (USD Million) 74

TABLE NO. 7. : U.S. Pea Proteins Market Revenue, By Product, 2024 – 2032 (USD Million) 74

TABLE NO. 8. : U.S. Pea Proteins Market Volume, By Application, 2018 – 2023 (Metric Tons) 75

TABLE NO. 9. : U.S. Pea Proteins Market Volume, By Application, 2024 – 2032 (Metric Tons) 75

TABLE NO. 10. : U.S. Pea Proteins Market Revenue, By Application, 2018 – 2023 (USD Million) 76

TABLE NO. 11. : U.S. Pea Proteins Market Revenue, By Application, 2024 – 2032 (USD Million) 76

TABLE NO. 12. : U.S. Pea Proteins Market Volume, By Form, 2018 – 2023 (Metric Tons) 77

TABLE NO. 13. : U.S. Pea Proteins Market Volume, By Form, 2024 – 2032 (Metric Tons) 77

TABLE NO. 14. : U.S. Pea Proteins Market Revenue, By Form, 2018 – 2023 (USD Million) 78

TABLE NO. 15. : U.S. Pea Proteins Market Revenue, By Form, 2024 – 2032 (USD Million) 78

TABLE NO. 16. : U.S. Pea Proteins Market Volume, By Source, 2018 – 2023 (Metric Tons) 79

TABLE NO. 17. : U.S. Pea Proteins Market Volume, By Source, 2024 – 2032 (Metric Tons) 79

TABLE NO. 18. : U.S. Pea Proteins Market Revenue, By Source, 2018 – 2023 (USD Million) 80

TABLE NO. 19. : U.S. Pea Proteins Market Revenue, By Source, 2024 – 2032 (USD Million) 80