Market Overview:

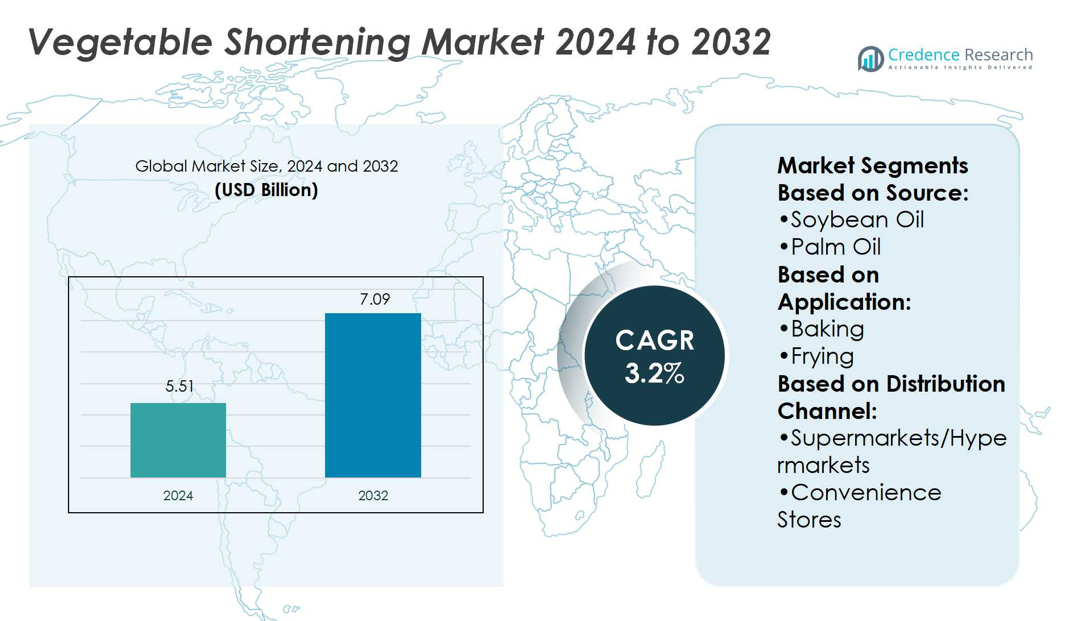

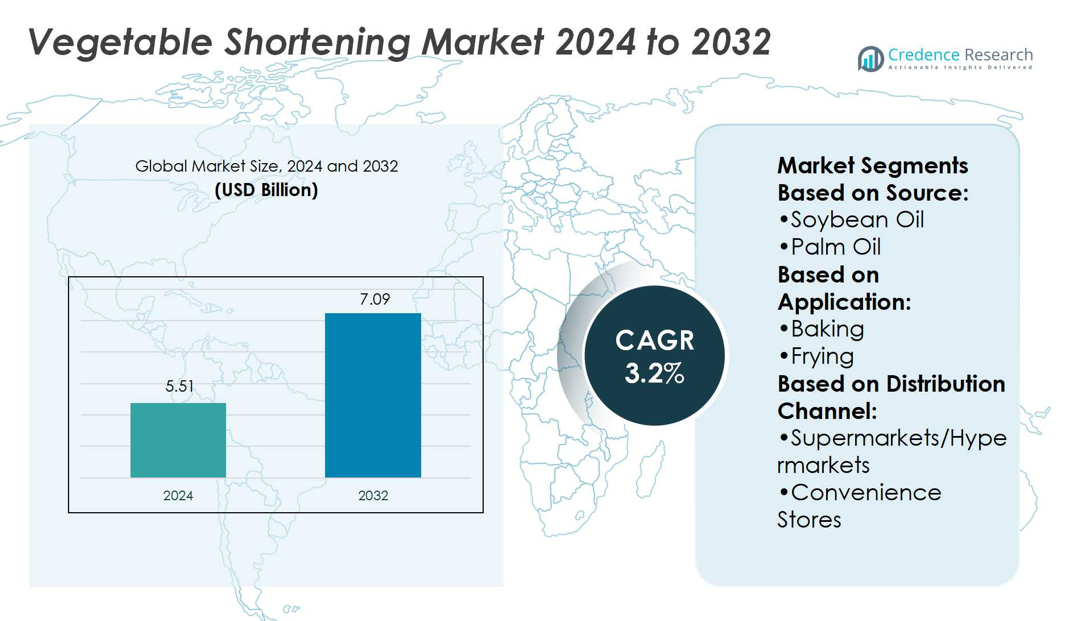

Vegetable Shortening Market size was valued USD 5.51 billion in 2024 and is anticipated to reach USD 7.09 billion by 2032, at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vegetable Shortening Market Size 2024 |

USD 5.51 billion |

| Vegetable Shortening Market, CAGR |

3.2% |

| Vegetable Shortening Market Size 2032 |

USD 7.09 billion |

The vegetable shortening market is shaped by leading players including FMC Corporation, East-West Seeds, BASF SE, Enza Zaden, KWS SAAT SE, Bayer AG, Groupe Limagrain, Corteva Agriscience, DLH, and Kaveri Seeds. These companies focus on innovation, sustainable sourcing, and product diversification to meet the growing demand for trans-fat–free and plant-based shortenings. They strengthen competitiveness through R&D investments, supply chain resilience, and strategic collaborations across global markets. Regionally, North America leads the market with a 34% share in 2024, supported by strong consumption in bakery, confectionery, and packaged food sectors, along with advanced retail and e-commerce penetration.

Market Insights

- The Vegetable Shortening Market size was USD 5.51 billion in 2024 and will reach USD 7.09 billion by 2032, growing at a CAGR of 3.2%.

- Rising demand from bakery and confectionery industries drives market growth, supported by the shift toward trans-fat–free and healthier shortening formulations.

- The market shows strong trends in sustainable sourcing and plant-based alternatives, with key players investing in innovation, supply chain resilience, and product diversification to strengthen competitiveness.

- Volatility in raw material prices and strict regulatory frameworks on fat content remain major restraints, challenging profit margins and increasing compliance costs.

- Regionally, North America leads with a 34% share in 2024, driven by high consumption in packaged foods and advanced retail channels, while baking holds the largest application share at 38%, supported by growing demand for bread, cakes, and pastries in both industrial and artisanal production across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

Soybean oil leads the vegetable shortening market with a 42% share in 2024. Its dominance stems from abundant availability, competitive pricing, and functional versatility across bakery and frying applications. Soybean oil–based shortenings provide desirable texture and stability, making them popular among industrial and commercial food processors. The shift toward trans-fat–free formulations has further boosted demand for soybean-based shortenings due to their adaptability to hydrogenation alternatives. Palm oil and cottonseed oil remain significant, driven by strong use in confectionery and snacks, while sunflower oil appeals to health-conscious consumers seeking clean-label products.

- For instance, East-West Seed’s SmartFarm solution has digitized over 24,000 acres of seed-production farmland and enabled real-time monitoring of over 400 seed varieties by more than 300 field staff, boosting on-time completion of field activities to 96%.

By Application

Baking holds the largest market share at 38% in 2024, reflecting the strong role of vegetable shortening in bread, cakes, and pastries. Its ability to enhance crumb softness, increase volume, and extend shelf life drives adoption across industrial bakeries and artisanal producers. Frying represents the second-largest sub-segment, supported by rising fast-food consumption and demand for stable frying oils. Confectionery and snack applications continue to expand with innovations in texture and flavor enhancement. Food processors increasingly rely on shortenings to achieve consistency, which sustains growth across multiple packaged food categories.

- For instance, Enza Zaden explicitly states that it invests more than 30% of its revenue into research and development, and this investment leads to the introduction of approximately two new vegetable varieties per week.

By Distribution Channel

Supermarkets and hypermarkets dominate distribution with a 46% share in 2024, benefiting from wide product availability and established consumer trust. Large retail chains provide extensive shelf space for multiple brands and price ranges, ensuring visibility and accessibility. Convenience stores capture urban demand for smaller pack sizes, while specialty stores cater to premium and health-oriented consumer segments. Online retail is the fastest-growing channel, driven by e-commerce penetration and direct-to-consumer strategies by leading manufacturers. These platforms allow wider reach, personalized marketing, and subscription-based models, which appeal to younger, digitally engaged consumers.

Market Overview

Rising Demand from Bakery Industry

The bakery industry significantly drives the vegetable shortening market, holding strong demand for cakes, pastries, biscuits, and bread. Shortening improves texture, enhances flavor, and extends shelf life, making it an essential bakery ingredient. Industrial and artisanal bakeries rely on shortening for consistent results in large-scale production. The global growth of convenience foods and ready-to-eat bakery products further boosts usage. With urban consumers seeking indulgent and affordable bakery items, manufacturers expand product offerings, strengthening vegetable shortening’s role in the global bakery sector.

- For instance, Bayer’s Precision Breeding platform uses an automated greenhouse facility of 300,000 square feet at Marana, AZ, incorporating seed-chipping, marker technology, and data science to accelerate development of corn genetic lines.

Shift Toward Trans-Fat–Free Products

Increasing health awareness and stricter food regulations are pushing the adoption of trans-fat–free vegetable shortening. Consumers demand healthier options without compromising taste or functionality, and shortening reformulations with alternative hydrogenation methods are meeting these needs. Manufacturers invest in R&D to enhance nutritional profiles while maintaining stability and performance in cooking and baking. This regulatory push combined with consumer preference for clean-label and healthier products strongly supports market growth. Companies focusing on healthier shortenings gain a competitive advantage across developed and emerging markets.

- For instance, Limagrain’s R&D has marketed about 6,000 varieties across field and vegetable seed lines and has increased its research investment by more than 50% over the last ten years.

Expansion of Packaged and Processed Food Sector

The rising demand for packaged and processed foods supports consistent growth in the vegetable shortening market. Shortening is widely used in snacks, fried products, and confectionery to deliver texture, crispness, and longer shelf stability. With busy lifestyles and growing urbanization, consumers increasingly prefer convenient, ready-to-cook, and ready-to-eat food products. Food manufacturers scale up shortening use to meet these consumption patterns while ensuring consistent quality. The increasing penetration of modern retail and online distribution further amplifies demand, ensuring strong revenue opportunities for market players globally.

Key Trends & Opportunities

Growth of Sustainable and Plant-Based Sources

Sustainability is a key trend shaping the vegetable shortening market, with rising demand for plant-based, eco-friendly raw materials. Companies shift toward responsibly sourced palm oil, non-GMO soybean oil, and sunflower oil to align with environmental goals and consumer preferences. Brands that highlight traceability and responsible sourcing gain stronger appeal among conscious buyers. This trend not only reduces environmental impact but also opens premium opportunities in clean-label and organic product categories. As plant-based diets expand, sustainable shortenings create long-term growth opportunities in food applications.

- For instance, Corteva commits that 100% of newly-developed solutions in its product pipeline meet its internal sustainability criteria. Corteva also reports that about 90% of new crop protection products and all new seed products comply with those sustainability criteria.

E-Commerce and Direct-to-Consumer Expansion

The growing influence of e-commerce creates new opportunities for vegetable shortening brands. Online platforms allow manufacturers to directly engage consumers through product customization, targeted marketing, and subscription-based sales models. This channel ensures broader reach, especially in regions with limited access to specialty retail outlets. With rising digital adoption, brands can build stronger customer relationships and drive loyalty by offering convenience and competitive pricing. Online sales of vegetable shortening also enable smaller producers and niche brands to compete with established players effectively.

- For instance, DLH secured a 46.9 million task order over a three-year period to provide cloud, cybersecurity, and software development services to NIH, supporting approximately 7,000 end-customers under that contract.

Key Challenges

Health Concerns and Regulatory Restrictions

Health concerns regarding fat consumption and regulatory restrictions on trans-fat levels challenge the vegetable shortening market. Governments impose strict labeling and formulation rules to safeguard public health. These measures increase compliance costs and push companies toward reformulating products to meet evolving standards. At the same time, health-conscious consumers are reducing fat intake, preferring alternative oils or healthier spreads. Such challenges limit traditional product demand, requiring industry players to continuously innovate. Companies unable to adapt to these shifting dynamics risk losing market share.

Volatility in Raw Material Prices

Price fluctuations of key raw materials, such as soybean oil and palm oil, pose a significant challenge to vegetable shortening manufacturers. Weather changes, trade policies, and geopolitical factors directly impact oilseed production and pricing, creating uncertainty for producers. Rising costs pressure profit margins, particularly for small and mid-sized companies lacking hedging strategies. Unstable input prices also affect supply chain planning and long-term contracts with food processors. This volatility forces manufacturers to explore alternative sourcing strategies and efficiency improvements to remain competitive.

Regional Analysis

North America

North America holds a 34% share of the vegetable shortening market in 2024, driven by strong demand from bakery, confectionery, and snack industries. The U.S. leads consumption due to high adoption of packaged and convenience foods. Regulatory pressure on trans-fat reduction has accelerated the shift toward healthier, trans-fat–free shortenings. Manufacturers in the region invest in innovation to meet clean-label and plant-based product demand. Canada and Mexico show growing usage in bakery and quick-service restaurants, further strengthening regional demand. Established retail channels and rising e-commerce platforms ensure consistent product availability across diverse consumer segments.

Europe

Europe accounts for 28% of the vegetable shortening market, with Germany, France, and the UK as leading contributors. The region emphasizes sustainable sourcing, favoring sunflower and non-GMO soybean oils over palm oil. Strict EU food safety and labeling regulations drive demand for trans-fat–free shortenings. Bakery and confectionery industries dominate applications, supported by strong consumer preference for premium baked goods. Growing plant-based diets also fuel demand for healthier formulations. Retail supermarkets and specialty stores remain dominant distribution channels. The shift toward eco-friendly and clean-label products positions Europe as a leader in sustainable innovation within the market.

Asia-Pacific

Asia-Pacific leads with a 30% share in 2024, supported by rising consumption in China, India, and Southeast Asia. Expanding middle-class populations, urbanization, and growing demand for bakery and processed foods fuel strong market growth. Palm oil remains the dominant source, favored for its cost efficiency and wide availability. Foodservice expansion and quick-service restaurant growth also boost shortening usage in frying and snack applications. Regional manufacturers benefit from abundant raw material supply and cost advantages. Increasing penetration of modern retail and online platforms accelerates adoption, making Asia-Pacific the fastest-growing market for vegetable shortening globally.

Latin America

Latin America represents a 5% share of the vegetable shortening market, with Brazil and Mexico as key contributors. Growing bakery consumption, particularly bread and pastries, drives demand for shortenings in urban centers. Palm and soybean oil–based shortenings dominate due to regional availability and lower cost. Foodservice expansion and packaged snack industries further support market growth. Despite slower adoption compared to developed markets, improving retail infrastructure and e-commerce platforms provide opportunities. Increasing awareness of healthier trans-fat–free formulations is gradually influencing consumption patterns, with multinational players investing in product diversification to meet evolving consumer preferences.

Middle East & Africa

The Middle East & Africa account for 3% of the global vegetable shortening market in 2024. The region shows rising demand for shortenings in bakery, confectionery, and fried food applications, supported by expanding urban populations and growing quick-service restaurant chains. Gulf countries lead consumption due to higher disposable incomes and preference for processed food products. Palm oil–based shortenings dominate due to cost efficiency and strong import reliance. Limited local production and dependency on imports create supply challenges. However, growing retail modernization and increasing consumer demand for packaged and convenient foods present opportunities for gradual market expansion.

Market Segmentations:

By Source:

By Application:

By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the vegetable shortening market players such as FMC Corporation, East-West Seeds, BASF SE, Enza Zaden, KWS SAAT SE, Bayer AG, Groupe Limagrain, Corteva Agriscience, DLH, and Kaveri Seeds. The vegetable shortening market is defined by continuous innovation, regulatory compliance, and shifting consumer preferences toward healthier and sustainable options. Companies focus heavily on developing trans-fat–free and plant-based formulations to align with clean-label trends and evolving dietary habits. Investments in research and development strengthen product performance while ensuring cost efficiency and longer shelf stability. Strategic expansions through partnerships, acquisitions, and e-commerce platforms enhance market penetration across developed and emerging economies. Sustainability also plays a central role, with firms adopting responsibly sourced raw materials and eco-friendly packaging to differentiate themselves and capture long-term consumer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FMC Corporation

- East-West Seeds

- BASF SE

- Enza Zaden

- KWS SAAT SE

- Bayer AG

- Groupe Limagrain

- Corteva Agriscience

- DLH

- Kaveri Seeds

Recent Developments

- In February 2025, Namdhari Seeds announced the acquisition of 100% of the open field vegetable seed business of Axia Vegetable Seeds. The acquisition included crops such as tomatoes, peppers, melons, and cucumbers, marketed under the US Agriseeds brand in multiple regions. As part of the deal, Catalyst Seeds, New World Seeds, and California Hybrids became part of Namdhari Seeds.

- In January 2025, Syngenta Crop Protection announced the divestment of its FarMore Technology Vegetable Seed Treatment Platform in the U.S. to Gowan SeedTech LLC. The transaction included the transfer of trademarks, recipes, registrations, and other assets, with Syngenta agreeing to continue supplying its proprietary seed treatment products to Gowan.

- In October 2024, BASF’s vegetable seed business, Nunhems, expanded its distribution partnership with TS&L Seed Company to include spinach, lettuce, watermelon, and melon seeds in California, Arizona, and Nevada. This move strengthened their 20-year collaboration, building on previous agreements involving tomatoes, onions, and peppers. Holaday Seed Company continued to distribute Nunhems lettuce and spinach seeds.

- In July 2024, Takii introduced a refreshed brand identity for its Sahin portfolio, which includes vegetable seed varieties aimed at home gardeners and specialty growers. The new branding emphasises quality, reliability, and innovation while preserving Sahin’s legacy in non‑GMO, open‑pollinated seeds

Report Coverage

The research report offers an in-depth analysis based on Source, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for bakery and confectionery products.

- Trans-fat–free and healthier formulations will gain stronger consumer acceptance.

- Plant-based and sustainable raw materials will shape future product development.

- Online retail channels will increase product accessibility and brand visibility.

- Quick-service restaurants and foodservice industries will drive consistent demand.

- Innovation in clean-label and non-GMO shortenings will enhance market competitiveness.

- Emerging economies will witness faster adoption due to urbanization and processed food growth.

- Volatility in raw material prices will continue to influence profit margins.

- Regulatory compliance on fat content will guide product reformulation strategies.

- Strategic partnerships and acquisitions will strengthen global market presence.