Market Overview

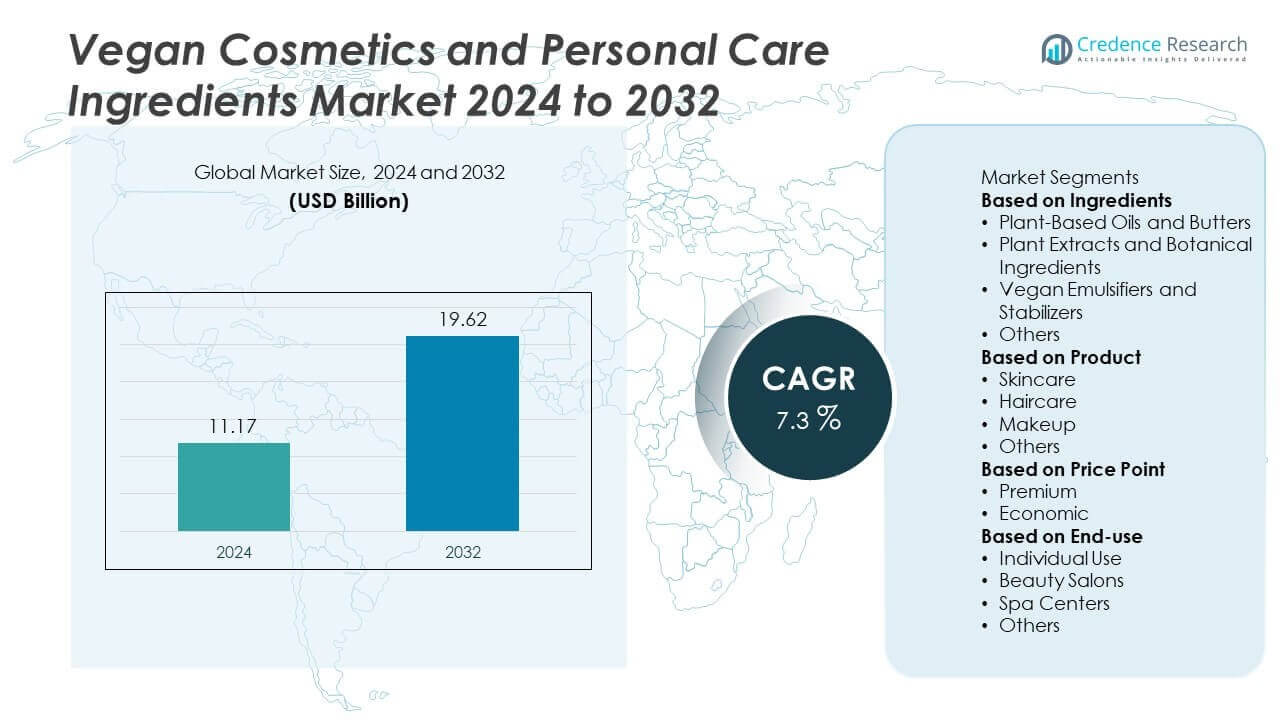

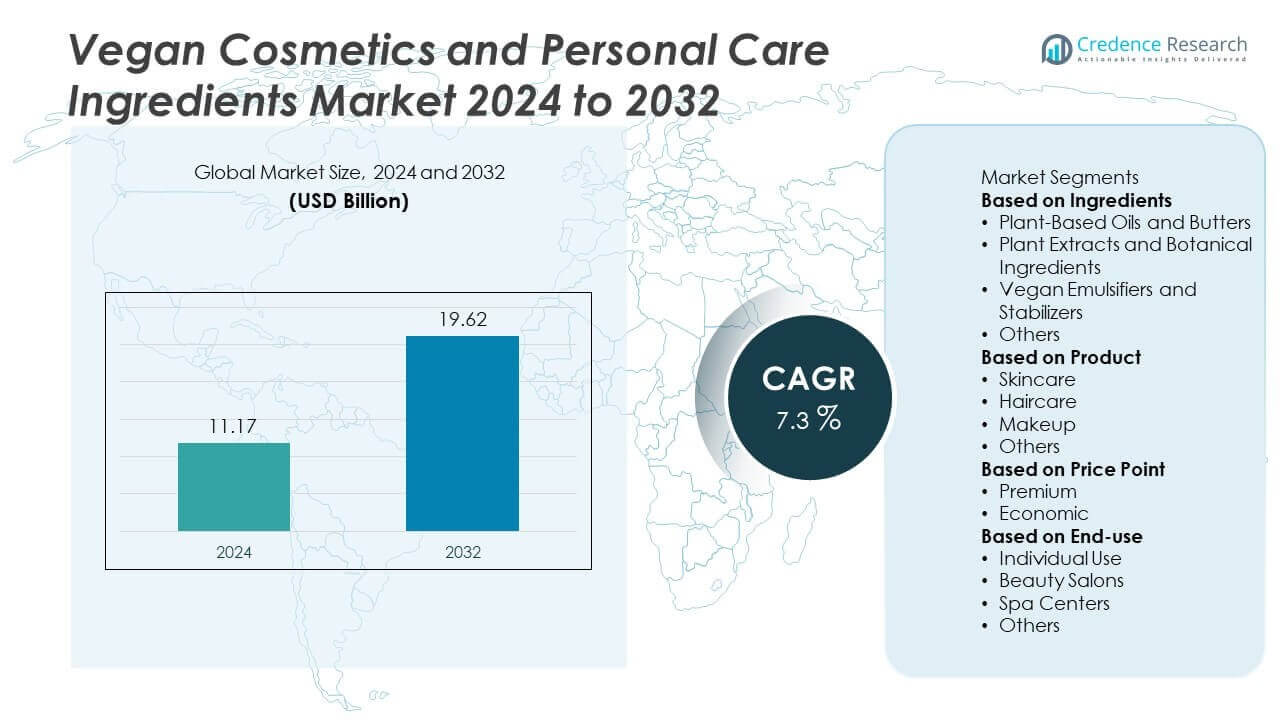

The vegan cosmetics and personal care ingredients market was valued at USD 11.17 billion in 2024 and is projected to reach USD 19.62 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vegan Cosmetics and Personal Care Ingredients Market Size 2024 |

USD 11.17 Billion |

| Vegan Cosmetics and Personal Care Ingredients Market, CAGR |

7.3% |

| Vegan Cosmetics and Personal Care Ingredients Market Size 2032 |

USD 19.62 Billion |

The vegan cosmetics and personal care ingredients market is led by major players including Solvay SA, Evonik Industries AG, Lonza Group Ltd., Symrise AG, Dow Inc., Croda International Plc, Ashland, Eastman Chemical Company, BASF SE, and Givaudan SA. These companies are driving growth through innovation in plant-based oils, botanical extracts, and sustainable emulsifiers that meet clean beauty standards. North America held 32% share in 2024, supported by strong consumer demand for cruelty-free and premium products. Europe accounted for 30% share, driven by stringent animal testing bans and sustainable packaging initiatives, while Asia-Pacific captured 28% share, fueled by rapid e-commerce expansion, K-beauty trends, and growing consumer preference for vegan and natural formulations.

Market Insights

Market Insights

- The vegan cosmetics and personal care ingredients market was valued at USD 11.17 billion in 2024 and is projected to reach USD 19.62 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

- Rising demand for cruelty-free, clean beauty products and natural formulations is driving market growth, supported by increasing consumer awareness of ethical sourcing and sustainability.

- Key trends include innovation in plant-based formulations, adoption of sustainable and recyclable packaging, and expansion of e-commerce channels to reach conscious consumers.

- The market is competitive with players like Solvay SA, Evonik Industries AG, Lonza Group Ltd., Symrise AG, and BASF SE focusing on sustainable sourcing, R&D investments, and certified vegan product portfolios to strengthen market presence.

- North America led with 32% share, followed by Europe at 30% and Asia-Pacific at 28%; by ingredients, plant-based oils and butters dominated with over 40% share, highlighting their role in skincare and haircare formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Ingredients

Plant-based oils and butters dominated the vegan cosmetics and personal care ingredients market in 2024, holding over 40% share due to their versatility and nourishing properties. Ingredients such as shea butter, coconut oil, and jojoba oil are widely used in moisturizers, balms, and hair care products for their emollient benefits. Growing consumer preference for natural, chemical-free formulations is driving demand. Plant extracts and botanical ingredients are also gaining traction, supported by rising interest in antioxidant-rich and anti-inflammatory skincare solutions that align with the clean beauty movement.

- For instance, Garnier (L’Oréal) launched the Ultra Doux solid shampoo bars in 2024 across Europe, formulated with 94% plant-based ingredients and packaged in zero-plastic FSC-certified cardboard, with each bar lasting up to 40 washes.

By Product

Skincare was the leading product category, accounting for more than 45% share in 2024, supported by rising awareness of skin health and demand for cruelty-free, natural formulations. Vegan serums, creams, and cleansers are increasingly popular among health-conscious consumers seeking eco-friendly alternatives. Haircare is another significant segment, fueled by demand for sulfate-free, plant-based shampoos and conditioners. The makeup segment is growing steadily with innovations in vegan lipsticks, foundations, and mascaras that match performance standards of conventional products while meeting ethical and sustainable expectations.

- For instance, in March 2024, Ilia launched its Skin Rewind Complexion Stick, a vegan and cruelty-free facial cosmetic combining makeup and skincare. Available in 42 shades, the product uses a blend of naturally derived mineral dyes and safe synthetics, rather than exclusively plant pigments, to achieve its color stability.

By Price Point

Premium products captured over 55% share in 2024, driven by consumer willingness to pay more for sustainable, high-quality, and ethically sourced ingredients. Brands offering certified vegan and organic labels are attracting a growing segment of environmentally conscious buyers. The economic segment is expanding as mainstream personal care brands introduce affordable vegan product lines, making cruelty-free options accessible to mass markets. This dual availability of premium and economic offerings is broadening the consumer base and accelerating overall market adoption across developed and emerging economies.

Key Growth Drivers

Rising Demand for Cruelty-Free and Ethical Products

Growing consumer awareness of animal welfare and sustainability is a major driver for vegan cosmetics and personal care ingredients. Shoppers prefer products with cruelty-free certifications such as Leaping Bunny and PETA-approved logos. Millennials and Gen Z are leading this shift, favoring brands that align with ethical and eco-conscious values. Retailers are also dedicating shelf space to vegan and clean beauty products, boosting accessibility. This trend is supported by social media campaigns and influencer endorsements that educate consumers about the benefits of plant-based formulations over traditional animal-derived ingredients.

- For instance, in March 2021, Unilever launched an expanded vegan range under its Hourglass brand featuring a proprietary plant-based pigment alternative to carmine, a red dye traditionally derived from insects. This innovation, named “Red 0,” was featured in a special-edition lipstick and was the result of a three-year collaborative research and development effort.

Growing Popularity of Clean and Natural Beauty

The rising preference for clean beauty products with minimal synthetic chemicals is fueling demand for plant-based oils, butters, and botanical extracts. Consumers are increasingly choosing products with transparent ingredient lists and claims such as paraben-free, sulfate-free, and eco-friendly. Brands are reformulating existing lines to include vegan-friendly ingredients and launching new product ranges targeting health-conscious buyers. The clean beauty movement is particularly strong in developed markets like North America and Europe, where regulatory support and consumer education are driving consistent growth in vegan personal care adoption.

- For instance, in October 2024, Givaudan Active Beauty introduced the [N.A.S.] Vibrant Collection of hybrid makeup ingredients offering color stability and long-wear performance, measured at over 8 hours lasting time in controlled consumer testing across five prototype vegan botanical extract-infused cosmetic products.

Expansion of E-commerce and Digital Marketing Channels

Online retail platforms and direct-to-consumer (D2C) brands are accelerating the growth of vegan cosmetics and personal care ingredients. E-commerce allows niche vegan brands to reach global audiences without heavy retail investment. Digital marketing campaigns highlighting sustainability, ingredient sourcing, and cruelty-free claims are increasing brand visibility and consumer trust. Subscription boxes and influencer partnerships are creating awareness and encouraging trials. This online presence helps brands quickly respond to emerging trends, introduce personalized products, and capture a loyal customer base across both premium and economic segments.

Key Trends & Opportunities

Innovation in Plant-Based Formulations

Manufacturers are developing advanced formulations using novel plant-based actives, such as adaptogens, algae extracts, and bio-fermented botanicals. These ingredients deliver targeted benefits like anti-aging, hydration, and pollution protection, matching or exceeding the performance of synthetic alternatives. Opportunities lie in creating multifunctional products that combine skincare, sun protection, and wellness benefits. Investment in research and technology is enabling high-performance vegan formulations that appeal to both mainstream and luxury beauty consumers seeking efficacy alongside sustainability.

- For instance, in late 2021, Biossance introduced its Squalane + Copper Peptide Rapid Plumping Serum, which utilizes a bio-fermented squalane from sugarcane and vegan copper peptides. According to a 28-day consumer study of 31 women, the serum delivered an instant boost of hydration for 100% of participants. The vegan copper peptides are known to be naturally blue, giving the serum its distinctive color.

Rising Demand for Sustainable Packaging

Sustainability is influencing not just formulations but also packaging choices in the vegan cosmetics market. Brands are adopting biodegradable, refillable, and recyclable packaging solutions to reduce environmental impact. This shift is appealing to eco-conscious buyers who consider packaging waste when selecting products. Opportunities exist for companies that can deliver zero-waste or carbon-neutral solutions, further differentiating their offerings. Collaborations with packaging innovators and government incentives for sustainable manufacturing are expected to accelerate adoption across the industry.

- For instance, Lush, a cosmetics company known for its “naked” (packaging-free) solid shampoo bars and other products, continues its long-standing focus on waste reduction. In 2024, the company processed over 1,700 tonnes of materials at its Green Hub facility in the UK, including 42.9 tonnes of plastic packaging returned by customers through its “Bring It Back” recycling scheme, contributing to circular economy efforts.

Key Challenges

High Production and Ingredient Costs

Sourcing high-quality plant-based ingredients and maintaining certifications such as organic or vegan can significantly increase production costs. This often results in higher retail prices, which can limit adoption in price-sensitive markets. Brands must balance cost efficiency with quality and sustainability commitments to remain competitive. Investment in scalable supply chains and local sourcing partnerships is becoming essential to manage costs and ensure consistent ingredient availability while keeping products affordable for mass-market consumers.

Limited Shelf Life and Stability Issues

Vegan and natural formulations can have shorter shelf lives and stability concerns compared to synthetic alternatives. The absence of strong chemical preservatives can lead to faster product degradation, affecting texture, color, and efficacy. This poses challenges in maintaining product quality during storage and transportation. Manufacturers are investing in natural preservation systems and advanced formulation technologies to improve product stability without compromising on vegan claims, ensuring a positive consumer experience and reducing product returns or wastage.

Regional Analysis

North America

North America held 32% share of the vegan cosmetics and personal care ingredients market in 2024, supported by strong consumer demand for cruelty-free, clean beauty products and advanced retail infrastructure. The U.S. leads the region due to high adoption of vegan skincare and haircare products, backed by influencer marketing and wellness trends. Canada is also contributing steadily with a growing preference for eco-friendly formulations and sustainable packaging. Regulatory support for transparent labeling and ingredient disclosure is strengthening consumer trust, further driving market growth and encouraging new product launches in both premium and mid-range categories.

Europe

Europe accounted for 30% share in 2024, driven by stringent regulations supporting animal welfare and ingredient transparency. Countries such as Germany, France, and the UK are leading markets with strong demand for organic and certified vegan beauty products. The European Union’s ban on animal testing continues to boost adoption, while retailers dedicate prominent shelf space to vegan brands. The region is witnessing significant growth in premium and luxury vegan skincare, supported by eco-conscious consumers and sustainable packaging initiatives. Innovation in botanical extracts and active ingredients is further fueling demand across both online and offline retail channels.

Asia-Pacific

Asia-Pacific captured 28% share of the global market in 2024, making it one of the fastest-growing regions. Rising disposable incomes, urbanization, and growing awareness of cruelty-free beauty are fueling demand in China, Japan, South Korea, and India. The popularity of K-beauty and J-beauty trends has accelerated the introduction of plant-based skincare and makeup products. E-commerce growth and social media influence are enabling vegan brands to reach younger consumers quickly. Local manufacturers are expanding product portfolios with affordable vegan lines, making the region a key growth engine for global players seeking to capture emerging market opportunities.

Latin America

Latin America held 6% share of the vegan cosmetics and personal care ingredients market in 2024, led by Brazil and Mexico. Growing interest in natural and organic formulations is driving adoption, supported by rising middle-class incomes and increasing awareness of animal cruelty issues. Regional brands are expanding vegan product lines across skincare and haircare, often using locally sourced botanical ingredients such as Amazonian oils. Social media campaigns promoting ethical beauty and the availability of international vegan brands in retail stores are boosting market visibility. Economic recovery and urbanization trends are expected to sustain steady growth in this region.

Middle East & Africa

The Middle East & Africa region accounted for 4% share in 2024, with growth driven by rising awareness of clean and cruelty-free beauty. The UAE and Saudi Arabia are key markets, with strong demand for premium vegan skincare and makeup products among younger, affluent consumers. Local retailers are expanding vegan offerings, supported by the popularity of international brands and e-commerce platforms. Africa is showing gradual adoption, led by South Africa, where wellness trends and natural product demand are increasing. Government efforts promoting sustainable development are expected to further support growth in this niche but expanding market.

Market Segmentations:

By Ingredients

- Plant-Based Oils and Butters

- Plant Extracts and Botanical Ingredients

- Vegan Emulsifiers and Stabilizers

- Others

By Product

- Skincare

- Haircare

- Makeup

- Others

By Price Point

By End-use

- Individual Use

- Beauty Salons

- Spa Centers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the vegan cosmetics and personal care ingredients market is shaped by key players such as Solvay SA, Evonik Industries AG, Lonza Group Ltd., Symrise AG, Dow Inc., Croda International Plc, Ashland, Eastman Chemical Company, BASF SE, and Givaudan SA. These companies focus on developing innovative, plant-based ingredients including oils, botanical extracts, and vegan emulsifiers to meet growing demand for cruelty-free formulations. Strategic efforts include partnerships with cosmetic brands, investments in sustainable sourcing, and expanding R&D capabilities to deliver high-performance, eco-friendly solutions. Many players are launching certified vegan product portfolios and prioritizing green chemistry practices to align with regulatory requirements and consumer expectations. Digitalization and collaboration with e-commerce platforms are also helping suppliers strengthen their global presence. The market remains highly competitive, with innovation, sustainability credentials, and supply chain reliability being key factors for differentiation and long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Dow introduced carbon-neutral silicone elastomers and expanded bio-based beauty ingredients at NYSCC.

- In April 2025, Solvay (via Syensqo) launched Naternal Care XTRA, a fenugreek-based conditioning polymer for cleaner, plant-powered beauty.

- In April 2025, Evonik highlighted vegan ingredients at in-cosmetics Global, including Tegosoft BC MB and biotech vegan collagen.

- In March 2025, Symrise launched Mindera, a 100% plant-based preservation platform for leave-on cosmetics.

Report Coverage

The research report offers an in-depth analysis based on Ingredients, Product, Price Point, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for vegan cosmetics and personal care ingredients will grow with rising preference for cruelty-free products.

- Plant-based oils and butters will remain the dominant ingredient category in product formulations.

- Skincare will continue leading product demand, supported by growing focus on clean and natural beauty.

- Premium product offerings will expand as consumers pay more for certified and sustainable solutions.

- Innovation in bio-based emulsifiers and botanical actives will enhance product performance and stability.

- E-commerce and direct-to-consumer channels will drive faster market penetration and global reach.

- Europe and North America will maintain strong demand due to strict animal testing bans and sustainability focus.

- Asia-Pacific will see the fastest growth with increasing adoption of vegan beauty trends in emerging markets.

- Sustainable and recyclable packaging will become standard across product categories.

- Collaborations between ingredient suppliers and cosmetic brands will boost innovation and product diversification.

Market Insights

Market Insights