Market Overview:

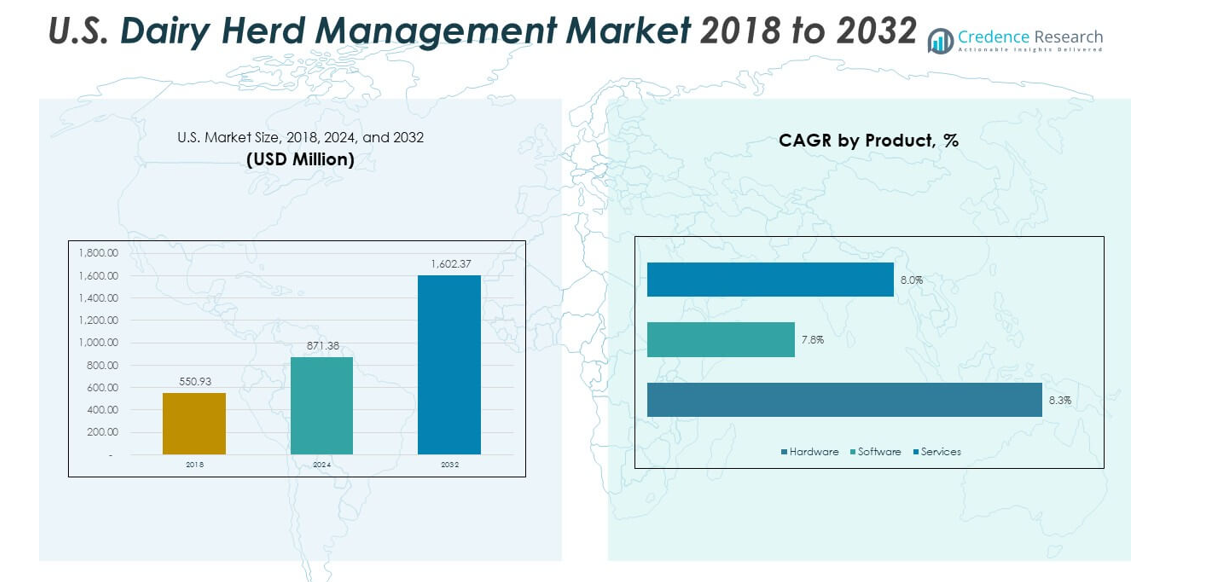

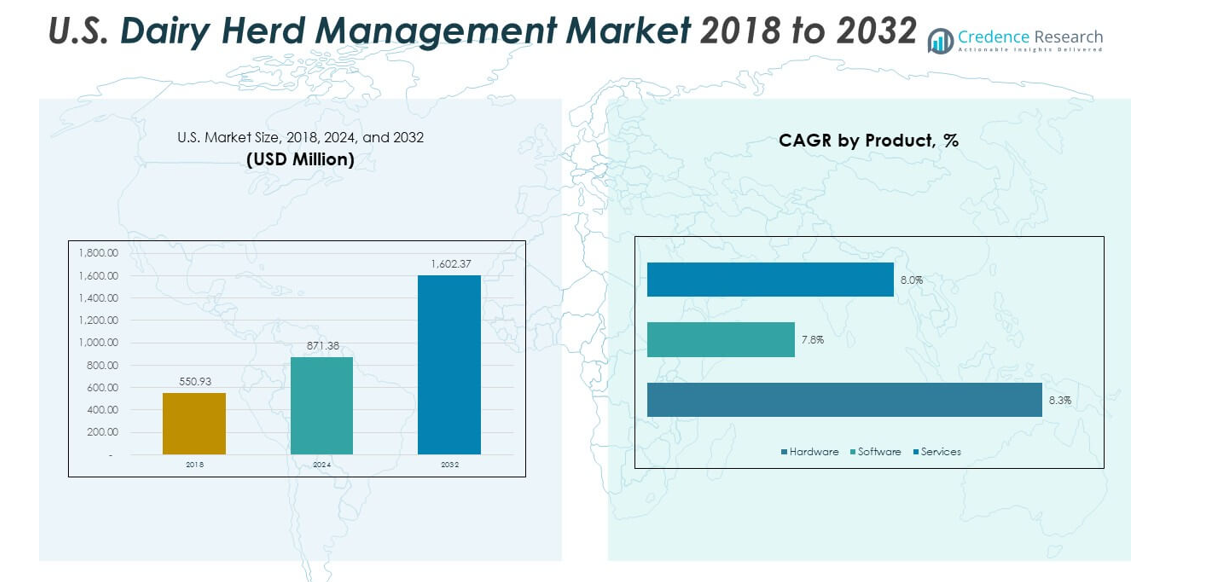

The U.S. Dairy Herd Management Market size was valued at USD 550.93 million in 2018 to USD 871.38 million in 2024 and is anticipated to reach USD 1,602.37 million by 2032, at a CAGR of 7.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Dairy Herd Management Market Size 2024 |

USD 871.38 million |

| U.S. Dairy Herd Management Market, CAGR |

7.80% |

| U.S. Dairy Herd Management Market Size 2032 |

USD 1,602.37 million |

Growth in the market is supported by rising demand for precision livestock farming solutions. Farmers are adopting automated systems to improve productivity, animal welfare, and resource efficiency. Increasing pressure to meet milk demand, coupled with the need for reducing operational costs, drives technology adoption. Advancements in data analytics, sensors, and monitoring tools further support herd management efficiency. Consumers’ growing focus on sustainable dairy practices adds to the adoption of these systems.

The market is well established across developed dairy-producing states in the U.S., with regions having larger commercial farms leading adoption. States in the Midwest and Northeast dominate due to advanced farm structures and higher investments in automation. Emerging adoption is visible in smaller farms located in southern regions, driven by rising awareness and government support for modernized practices. This geographical spread highlights a balance between mature markets and regions beginning to embrace smart dairy herd solutions.

Market Insights:

- The U.S. Dairy Herd Management Market was valued at USD 550.93 million in 2018, reached USD 871.38 million in 2024, and is projected to hit USD 1,602.37 million by 2032, registering a CAGR of 7.80% during the forecast period.

- The Midwest led with 40% share in 2024, driven by large commercial farms, advanced infrastructure, and strong cooperative networks. The Northeast held 25%, supported by premium dairy production and high-quality standards, while the West contributed 20%, anchored by California’s large-scale dairy operations.

- The Southern region, holding 15% share in 2024, is the fastest-growing, fueled by expanding dairy infrastructure in Texas and New Mexico and adoption of climate-adaptive technologies like comfort and heat stress management systems.

- By product segmentation, hardware accounted for 45% of the U.S. Dairy Herd Management Market in 2024, driven by robotic milking systems, sensors, and feeding equipment.

- Software and services together held 55% share, reflecting the rising role of digital platforms, predictive analytics, and maintenance support in improving herd productivity and operational efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Precision Farming and Smart Dairy Technologies

The U.S. Dairy Herd Management Market is witnessing strong adoption of precision farming tools that enhance productivity and efficiency. Farmers are deploying smart sensors, automated feeding systems, and health monitoring devices to optimize herd performance. These technologies help reduce feed waste, monitor cow health in real time, and increase milk yield. Rising operational costs are pushing farmers toward automation to minimize human error. It strengthens herd profitability while ensuring better resource utilization. Government initiatives that support smart farming are boosting adoption. Consumer preference for quality milk also encourages investment in advanced herd solutions. It positions the market as a technology-driven segment.

- For instance, Merck Animal Health’s SenseHub Dairy technology monitors over 2 million cows in the U.S., enabling producers to optimize labor and improve herd productivity with real-time health and activity data, resulting in feed cost reductions up to 25% and milk yield increases of 10-20% per cow.

Growing Emphasis on Animal Health and Welfare Standards

Regulations and consumer expectations are elevating the importance of animal health and welfare in dairy operations. Farmers are integrating herd management systems to track cow activity, detect illness early, and improve veterinary care. The U.S. Dairy Herd Management Market is benefiting from rising awareness around sustainable and ethical farming. It supports better reproductive management, ensures higher milk quality, and reduces mortality. The industry sees this focus as a tool to retain consumer trust. Larger farms invest in herd analytics to meet strict standards and avoid penalties. This driver aligns profitability with animal well-being. It ensures sustainable growth across different farm sizes.

- For instance, CowManager’s health monitoring system uses advanced sensors to detect sickness early, reducing veterinary costs by up to $500 per cow annually through timely interventions and improving reproductive success rates significantly.

Increasing Need for Productivity Enhancement in Large-Scale Dairy Farms

Large dairy farms across the U.S. are under pressure to improve yield and efficiency. With growing herd sizes, manual monitoring becomes inefficient and costly. Farmers turn to advanced herd management platforms to streamline operations. The U.S. Dairy Herd Management Market gains traction from the scale of dairy production and the need for reliable systems. It enables predictive analytics, automated reporting, and digital integration across facilities. These systems reduce labor dependency and provide actionable insights. Rising global milk demand is pushing U.S. producers to adopt scalable technologies. Investments are directed at maintaining competitiveness and sustaining long-term profitability.

Rising Focus on Cost Efficiency and Sustainable Dairy Operations

Cost efficiency remains a leading driver for dairy farmers facing fluctuating feed and labor expenses. Automated milking, smart feed management, and data-driven systems help farms cut costs. The U.S. Dairy Herd Management Market is leveraging sustainability initiatives to meet consumer and regulatory demands. It ensures reduced carbon footprint, energy efficiency, and waste control. Farmers use these systems to achieve compliance while improving financial margins. Sustainability-driven practices align with eco-conscious consumer preferences. It positions dairy farms to benefit from long-term operational stability. Farmers see these tools as essential for competitiveness in global dairy supply chains.

Market Trends:

Adoption of Digital Platforms and Cloud-Based Herd Management Systems

The U.S. Dairy Herd Management Market is experiencing a transition toward cloud-based and digital platforms. Farmers increasingly rely on mobile applications and remote dashboards to manage herds. It supports real-time decision-making across feeding, health, and reproduction management. Cloud integration reduces data storage costs and enables predictive analytics. Adoption is further driven by increasing internet connectivity in rural areas. This trend allows farms to track long-term performance and optimize strategies. It ensures enhanced collaboration between farmers and veterinarians. The market is shifting toward interconnected and fully digital dairy ecosystems.

- For instance, DeLaval’s cloud-based herd management platform enables large farms to access herd data remotely, improving decision-making speed and accuracy, with farms reporting reduction in manual data entry errors and enhanced reproductive cycle tracking.

Integration of Artificial Intelligence and Data-Driven Decision Tools

Artificial intelligence plays a growing role in optimizing herd productivity and performance. Farmers are applying AI-based algorithms to analyze milk yield patterns, feed intake, and reproductive cycles. The U.S. Dairy Herd Management Market is advancing with predictive solutions that minimize losses and enhance herd health. It helps identify trends that humans may overlook, improving operational efficiency. AI-enabled automation reduces labor dependency and improves time-sensitive decision-making. Farms adopting these systems benefit from consistent profitability. The integration also supports early disease detection through data analysis. It builds a stronger foundation for smarter dairy farming practices.

- For instance, Texas A&M’s research on AI-powered tools has demonstrated earlier disease detection capabilities leading to fewer illness-related production losses and optimized feeding schedules that elevate milk yield.

Shift Toward Automated Milking and Robotics in Large Dairy Farms

Automation and robotics are transforming dairy herd management in the U.S. The U.S. Dairy Herd Management Market is seeing rapid adoption of robotic milking systems and automated feeding solutions. It reduces labor shortages and increases efficiency in larger farms. Robotic systems maintain consistency in milking schedules, improving cow comfort and output. Adoption is supported by rising demand for higher yields and time savings. Farmers recognize automation as a long-term investment despite high upfront costs. Robotics improve traceability and streamline production workflows. This trend ensures modern farms remain competitive in global dairy supply.

Expansion of Sustainability-Oriented and Eco-Friendly Farm Practices

Sustainability is shaping trends in herd management through eco-friendly technologies and practices. Farmers focus on waste management, energy savings, and responsible water use. The U.S. Dairy Herd Management Market is adapting to consumer expectations of green dairy production. It integrates renewable energy solutions into automated systems to cut emissions. Farms using eco-certified practices benefit from better branding and premium pricing. Adoption of climate-smart practices supports resilience against environmental regulations. It creates long-term benefits for both farms and consumers. Sustainability has become a market differentiator and growth driver for dairy operations.

Market Challenges Analysis:

High Initial Investment and Affordability Concerns Among Small Farms

The U.S. Dairy Herd Management Market faces challenges with high initial investment requirements. Many small and mid-sized farms struggle to justify spending on advanced systems. It creates a gap between large commercial farms and smaller operations. Financing options remain limited, slowing adoption rates across rural regions. Affordability concerns prevent small farmers from accessing productivity-enhancing technologies. This imbalance impacts market penetration and creates slower growth segments. Vendors are pressured to design cost-effective solutions. The challenge highlights the need for scalable models to expand adoption.

Complexity in System Integration and Lack of Skilled Workforce

Another major challenge lies in the complexity of integrating new systems into existing farm structures. The U.S. Dairy Herd Management Market requires farms to manage data, hardware, and software seamlessly. It often demands skilled workers and technical knowledge, which are limited in rural areas. Training gaps prevent effective system utilization and lead to underperformance. Farmers hesitate to adopt technologies when support systems are weak. Complexity also raises maintenance costs for farms with limited resources. Vendors must offer simplified solutions to overcome these barriers. Addressing workforce skill gaps remains a critical issue for long-term adoption.

Market Opportunities:

Advancement in AI, IoT, and Data-Driven Dairy Ecosystems

Emerging technologies such as IoT and AI present strong opportunities for market expansion. The U.S. Dairy Herd Management Market can leverage predictive analytics, smart sensors, and connected devices to enhance operations. It opens pathways for real-time decision-making, disease prevention, and resource optimization. Startups and established vendors are developing scalable digital solutions tailored for farms. Integration of blockchain also promises greater transparency in dairy supply chains. The trend positions farms to gain a competitive edge globally. It creates opportunities for strategic collaborations and innovations.

Rising Demand for Sustainable and Ethical Dairy Practices

Sustainability-focused initiatives create strong opportunities for the U.S. Dairy Herd Management Market. It benefits from eco-friendly herd management solutions that align with consumer values. Farmers adopting sustainable practices gain long-term profitability and brand loyalty. Regulatory bodies continue to support greener farming methods, opening funding opportunities. Markets value sustainable milk production as a differentiator in global trade. Dairy farms adopting eco-certified practices position themselves as premium suppliers. The trend will expand investment in sustainable herd management across the U.S.

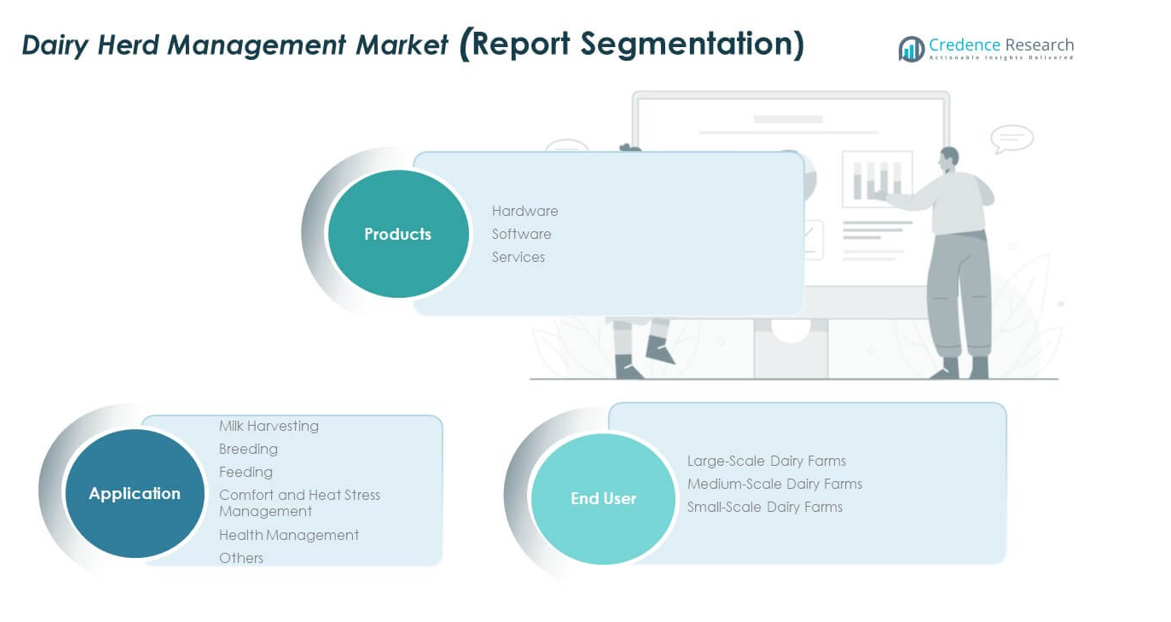

Market Segmentation Analysis:

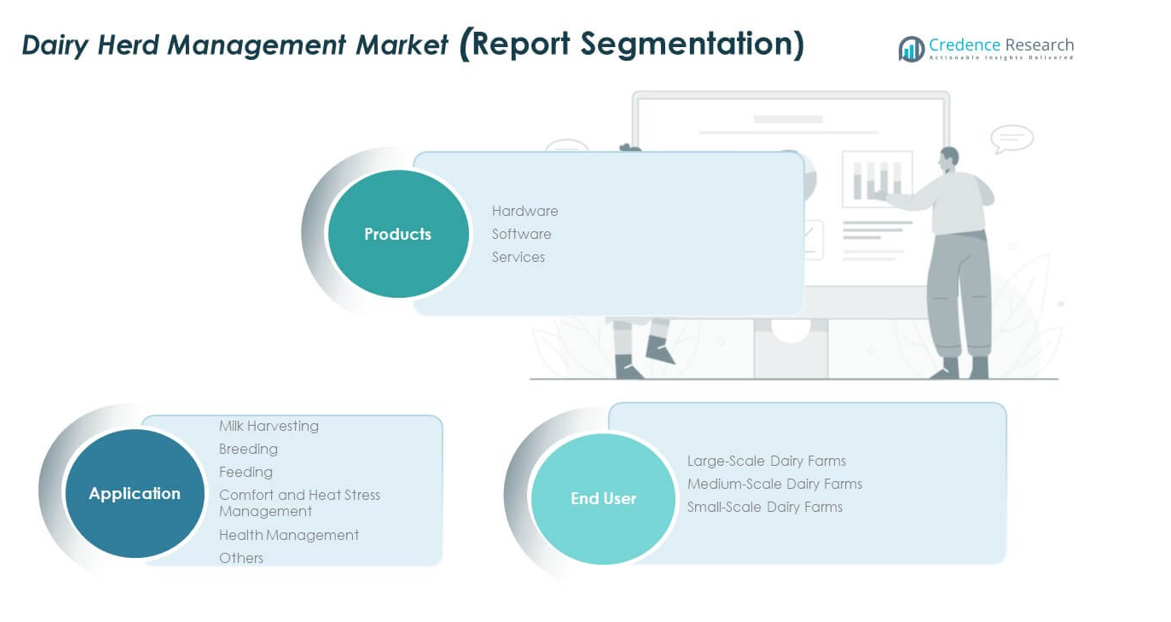

By Product Segment

The U.S. Dairy Herd Management Market is segmented into hardware, software, and services. Hardware solutions such as automated milking systems, sensors, and feeding equipment hold a significant share due to their role in improving efficiency. Software platforms drive data-driven insights, enabling predictive analysis and herd tracking. Services play a growing role as farms rely on maintenance, consultancy, and integration support. It benefits from the combination of hardware and software adoption, ensuring comprehensive herd management solutions.

- For instance, Lely’s automated milking systems reduce labor needs by up to 50% and maintain consistent milk output per cow, allowing farms to scale operations without proportional increases in staffing.

By Application Segment

Applications include milk harvesting, breeding, feeding, comfort and heat stress management, health management, and others. Milk harvesting remains dominant as it directly impacts farm productivity and revenue. Breeding and feeding solutions are increasingly important for herd genetics and nutrition optimization. Health management systems are expanding as farms focus on early disease detection and welfare standards. Comfort and heat stress management solutions are gaining traction, reflecting climate-related challenges. It highlights the wide scope of adoption across daily farm operations.

By End User Segment

End users are divided into large-scale, medium-scale, and small-scale dairy farms. Large-scale farms dominate due to higher budgets and demand for integrated automation. Medium-scale farms are adopting modular solutions that balance cost and efficiency. Small-scale farms face affordability barriers but are gradually exploring low-cost digital tools. The U.S. Dairy Herd Management Market supports all end-user groups by offering scalable and adaptable solutions. It continues to expand as technology adoption spreads across diverse farm sizes.

Segmentation:

- By Product Segment

- Hardware

- Software

- Services

- By Application Segment

- Milk Harvesting

- Breeding

- Feeding

- Comfort and Heat Stress Management

- Health Management

- Others

- By End User Segment

- Large-Scale Dairy Farms

- Medium-Scale Dairy Farms

- Small-Scale Dairy Farms

Regional Analysis:

Dominance of the Midwest Dairy Belt

The U.S. Dairy Herd Management Market is strongly anchored in the Midwest, which accounts for nearly 40% of the total share. States like Wisconsin, Minnesota, and Michigan lead adoption due to the concentration of large commercial dairy farms. The region benefits from advanced infrastructure, skilled labor, and higher investment capacity in automation. Farmers here deploy milking robots, precision feeding systems, and advanced software platforms to maximize efficiency. It is also supported by strong dairy cooperatives and research programs that promote innovation. The Midwest continues to set benchmarks for modern dairy herd practices across the country.

Northeast Region Driving Premium Adoption

The Northeast holds about 25% share, driven by a mix of traditional dairy farms and technologically advanced facilities. States such as New York, Pennsylvania, and Vermont are known for producing premium dairy products, pushing demand for high-quality herd management systems. It benefits from regulatory standards and consumer preference for ethically produced milk. Farmers are investing in animal health monitoring, comfort management, and breeding technologies to maintain premium positioning. The regional dairy sector values quality certifications, making digital and automated systems essential. The Northeast remains a hub for innovative adoption in mid-sized and family-owned farms.

Emerging Growth Across the West and Southern Regions

The Western and Southern regions together contribute about 35% share, reflecting both large-scale and small farm structures. California leads the West with its massive dairy production, where farms adopt automation to manage herd sizes efficiently. Texas and New Mexico drive the Southern market, supported by expanding dairy infrastructure and favorable policies. It reflects a growing emphasis on climate-adaptive technologies, including comfort and heat stress management systems. Smaller farms in the South are gradually adopting affordable software-based tools. The West and South represent growth zones where technology penetration is expected to accelerate in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- DeLaval

- BouMatic

- VAS

- Merck & Co., Inc.

- Afimilk Ltd.

- GEA Group Aktiengesellschaft

- Fullwood JOZ

- C & C Farmers Supply

- Pearson Milking Technology

- Livestock Veterinary Services

Competitive Analysis:

The U.S. Dairy Herd Management Market is characterized by strong competition among global and domestic players focusing on automation and precision technologies. Leading companies such as DeLaval, GEA Group, BouMatic, and Afimilk dominate through integrated hardware and software offerings. It remains competitive due to consistent innovation in health monitoring, robotic milking, and data-driven solutions. Smaller firms and niche technology providers contribute by offering cost-effective systems for mid and small-scale farms. Partnerships and acquisitions are common strategies to expand product portfolios and regional presence. Companies also emphasize customer service and after-sales support, which enhances long-term relationships. The market’s competitive dynamics continue to evolve with sustainability and digital integration driving differentiation.

Recent Developments:

- In September 2025, DeLaval introduced an advanced series of milking automation control systems for parlor farms, offering models such as the MA100, MA200, and MA500 that deliver real-time data insights, scalable functionality, and enhanced cloud connectivity to help optimize dairy operations in the U.S..

- In July 2025, BouMatic announced a strategic brand merger with SAC, signifying the integration of SAC’s product lines, dealer networks, and expertise into BouMatic by the end of the year—a move designed to streamline solutions and expand innovative offerings for North American dairy producers.

- In July 2024, Afimilk partnered with IBA/ADS in the U.S., whereby IBA/ADS became an authorized Afimilk dealer covering Colorado, Kansas, and Wyoming, enhancing the region’s access to Afimilk’s advanced herd management technology and support.

- In July 2025, GEA Group opened its New Food Application and Technology Center (ATC) in Janesville, Wisconsin. The new facility is designed to help clients scale alternative protein production and includes technologies for pilot-scale dairy processing and bioreactor operations, strengthening GEA’s North American presence.

- In August 2025, C & C Farmers Supply continued its commitment to provide reliable dairy farm supplies, equipment installation, repair, and cattle management services in Harrisonburg, VA—though no new launches, partnerships, or acquisitions were reported.

Report Coverage:

The research report offers an in-depth analysis based on product, application, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for smart dairy technologies will accelerate across large and medium-scale farms.

- Robotic milking systems will see wider adoption as labor shortages persist.

- Data-driven health monitoring solutions will gain importance in disease prevention.

- Breeding management tools will expand to improve genetic selection and herd productivity.

- Cloud-based herd management platforms will grow due to lower IT costs and flexibility.

- Sustainability-driven practices will shape product development and investment priorities.

- Integration of IoT and AI will transform dairy farm operations into predictive ecosystems.

- Services such as training, consultancy, and maintenance will expand in market share.

- Midwestern states will remain dominant, with growing opportunities in the West and South.

- Competitive strategies will emphasize partnerships, mergers, and customer-centric innovation.