| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| US Construction Adhesives Market Size 2023 |

USD 4,007.32 Million |

| US Construction Adhesives Market, CAGR |

4.83% |

| US Construction Adhesives Market Size 2032 |

USD 4,007.32 Million |

Market Overview:

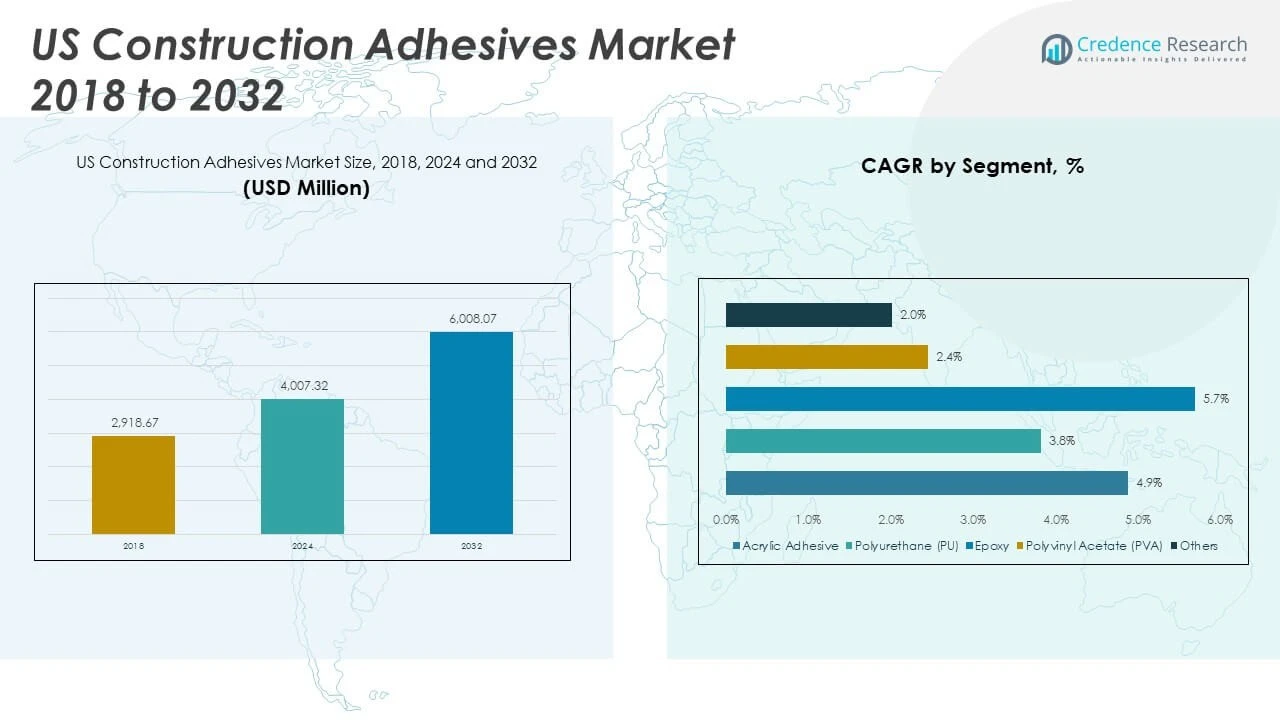

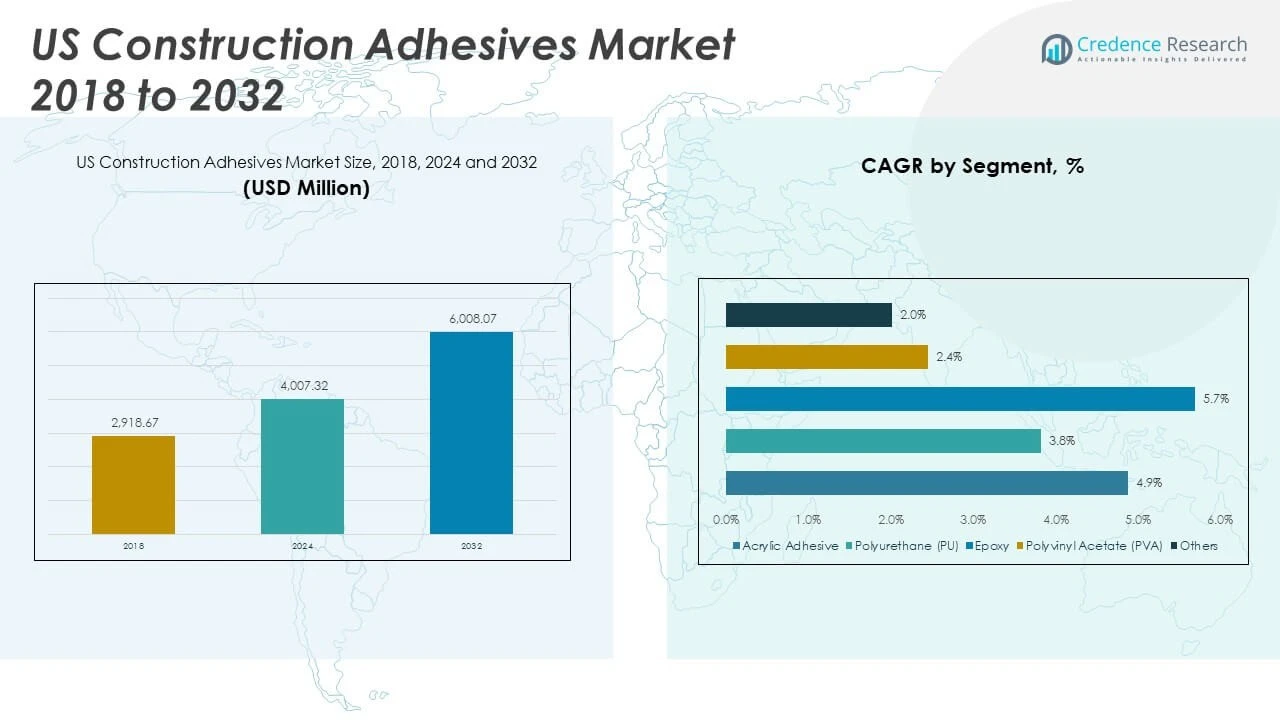

The US Construction Adhesives Market size was valued at USD 2,918.67 million in 2018 to USD 4,007.32 million in 2024 and is anticipated to reach USD 6,008.07 million by 2032, at a CAGR of 4.83%during the forecast period.

The U.S. construction adhesives market experiences robust growth due to several key factors. Technological advancements play a pivotal role, with innovations such as hybrid adhesives and nanotechnology enhancing bonding strength, durability, and application versatility. These developments allow adhesives to meet the increasing demands of modern construction projects. Sustainability trends also drive the market, as manufacturers shift toward eco-friendly, low volatile organic compound (VOC) adhesives that comply with green building standards and promote healthier indoor environments. Significant infrastructure investments, supported by government initiatives, fuel demand for reliable adhesives across transportation, water management, and energy projects. Additionally, the expansion of residential housing and commercial infrastructure creates a steady need for adhesives in flooring, insulation, and paneling applications, further propelling market growth.

The U.S. construction adhesives market displays distinct regional dynamics shaped by local construction activities and economic trends. The Northeast region maintains steady demand driven by ongoing urban development and large-scale infrastructure projects concentrated in metropolitan hubs. In the Midwest, a balanced demand spans residential, commercial, and industrial sectors, supported by economic stability and manufacturing presence. The South region experiences rapid growth fueled by population increases and urbanization in states such as Texas and Florida, leading to heightened construction activity and adhesive consumption. Meanwhile, the West Coast benefits from a strong focus on sustainability and technological innovation, which encourages the adoption of advanced, eco-friendly adhesives in new construction projects. These regional variations highlight the market’s responsiveness to localized economic drivers and regulatory environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The US Construction Adhesives Market grew from USD 2,918.67 million in 2018 to USD 4,007.32 million in 2024 and is expected to reach USD 6,008.07 million by 2032, with a CAGR of 4.83%

- Technological innovations like hybrid adhesives and nanotechnology improve bonding strength, durability, and versatility, meeting modern construction demands.

- Sustainability trends push demand for eco-friendly, low-VOC adhesives, aligning with green building standards and promoting healthier indoor environments.

- Significant government infrastructure investments in transportation, energy, and water projects drive demand for reliable, high-performance adhesives.

- Expanding residential and commercial construction sectors increase the need for adhesives in flooring, insulation, and paneling applications.

- Regulatory compliance challenges and environmental restrictions require continuous innovation to meet VOC limits, impacting product development costs.

- Raw material price volatility and supply chain disruptions introduce instability, compelling manufacturers to optimize sourcing and inventory management.

Market Drivers:

Technological Innovations Enhancing Performance and Versatility in Construction Adhesives

The US Construction Adhesives Market benefits significantly from continuous technological innovations. Advanced formulations such as hybrid adhesives and the integration of nanotechnology improve bonding strength and durability across diverse substrates. These improvements enable adhesives to perform effectively in demanding applications like flooring, roofing, and insulation. Innovations also focus on faster curing times and enhanced resistance to environmental factors such as moisture and temperature fluctuations. These technological advances increase the efficiency and reliability of construction projects. Manufacturers continuously invest in research to develop products that meet evolving construction standards. It allows contractors and builders to select adhesives that optimize project timelines and long-term structural integrity.

- For example, ITW Performance Polymers launched Plexus MA8105, an adhesive featuring fast room-temperature curing and excellent mechanical properties, specifically designed for a broad range of construction applications.

Sustainability Initiatives Driving Demand for Eco-Friendly Adhesive Solutions

Sustainability concerns strongly influence the US Construction Adhesives Market’s growth trajectory. The construction industry increasingly prioritizes products with low volatile organic compound (VOC) emissions to comply with environmental regulations and green building certifications. Water-based and low-VOC adhesives gain traction due to their reduced environmental impact and safer indoor air quality. It aligns with the rising adoption of sustainable construction practices and government incentives promoting eco-friendly materials. Manufacturers respond by expanding their product portfolios to include greener adhesive options that maintain high performance. This shift meets the growing demand from environmentally conscious contractors and building owners. It supports broader industry goals for reducing carbon footprints and enhancing occupant health.

- BASF, for instance, offers solvent-free UV-curable acrylic hotmelts under the acResin® brand, which can reduce the carbon footprint of adhesive applications by the equivalent of 5,000 trees when replacing solvent-based adhesives.

Government Infrastructure Investments Boosting Construction Adhesives Consumption

The US Construction Adhesives Market experiences strong support from substantial government infrastructure investments. Federal programs allocating billions of dollars toward transportation, energy, and water infrastructure projects stimulate demand for reliable adhesive products. These projects require adhesives that ensure robust bonding and longevity under harsh operating conditions. It creates opportunities for manufacturers to supply high-performance solutions tailored for large-scale applications. Infrastructure spending also encourages innovation to meet specific regulatory and safety standards. Contractors rely on adhesives to accelerate construction processes and reduce maintenance costs over project lifecycles. This investment environment reinforces steady market expansion and product development.

Growth in Residential and Commercial Construction Fueling Adhesive Demand

The expanding residential housing and commercial construction sectors contribute prominently to the US Construction Adhesives Market’s growth. Population growth and urbanization increase the need for new housing units, driving demand for adhesives in flooring, paneling, and insulation applications. Commercial real estate development further supports the market by requiring advanced adhesives for office buildings, retail spaces, and industrial facilities. It encourages the adoption of modern adhesive technologies that provide strong bonding and ease of application. Builders and developers seek products that improve efficiency while complying with building codes and safety standards. The ongoing construction activity across these sectors sustains continuous demand for innovative adhesive solutions. This dynamic environment prompts manufacturers to offer diverse products that cater to varying construction needs.

Market Trends:

Increasing Adoption of Sustainable and Low-VOC Adhesives in Construction Applications

The US Construction Adhesives Market exhibits a strong trend toward sustainability with growing adoption of low volatile organic compound (VOC) adhesives. Manufacturers focus on producing water-based and bio-based adhesives that reduce environmental impact and improve indoor air quality. This shift aligns with stricter regulatory requirements and increased demand for green building certifications such as LEED and WELL. It encourages builders and contractors to specify eco-friendly adhesives without compromising on performance. Sustainable adhesive formulations gain acceptance in both residential and commercial construction projects. These products address concerns about occupant health and contribute to reducing the carbon footprint of construction activities. The market reflects a clear movement toward materials that balance environmental responsibility with technical excellence.

- For instance, the U.S. Green Building Council has set LEED certification requirements that specifically encourage the use of water-based adhesives in construction projects, supporting the market’s move toward eco-friendly products.

Integration of Advanced Technologies to Enhance Adhesive Functionality and Efficiency

Technological integration drives key trends in the US Construction Adhesives Market by enhancing product functionality and application efficiency. Innovations such as hybrid polymer technology and nanomaterial additives improve adhesive strength, flexibility, and resistance to environmental stressors. These advancements enable adhesives to bond a wider range of substrates, including difficult-to-adhere materials. It supports faster curing times and simplifies application processes, reducing labor costs on construction sites. The incorporation of smart features, like temperature-activated curing, also gains traction. Manufacturers invest in R&D to develop adhesives that optimize workflow and durability. This technological progression shapes the market by meeting evolving construction demands.

- 3M, for instance, offers structural adhesives that utilize advanced polymer formulations, providing high load-bearing capacity and improved flexibility for demanding applications.

Rising Demand for Specialized Adhesives in Infrastructure and Industrial Construction

Specialized adhesives represent a growing trend in the US Construction Adhesives Market, driven by the expanding infrastructure and industrial construction sectors. These adhesives must meet stringent requirements for chemical resistance, load-bearing capacity, and longevity in harsh environments. It creates opportunities for high-performance products tailored for applications such as bridge construction, pipeline repairs, and heavy equipment assembly. Manufacturers develop formulations designed to withstand extreme temperatures, moisture, and mechanical stress. The focus on infrastructure rehabilitation and modernization further stimulates demand for durable adhesives. Contractors prefer solutions that enhance structural integrity and minimize maintenance needs. This trend highlights the increasing complexity and specialization of construction adhesive applications.

Expansion of Distribution Channels and Digital Marketing Strategies to Reach End Users

Distribution and marketing strategies evolve notably within the US Construction Adhesives Market to expand customer reach and improve product accessibility. Manufacturers and suppliers increasingly leverage digital platforms and e-commerce to connect with contractors, architects, and distributors. Online portals facilitate easier product selection, technical support, and procurement, enhancing customer experience. It enables rapid dissemination of product information, safety data, and usage guidelines. The rise of mobile applications supports on-site decision-making and real-time communication with suppliers. Direct-to-consumer sales models and partnerships with construction retailers strengthen market penetration. These strategic shifts respond to changing buyer behaviors and drive competitive advantage in a crowded marketplace.

Market Challenges Analysis:

Stringent Regulatory Compliance and Environmental Restrictions Impacting Product Development

The US Construction Adhesives Market faces challenges related to increasingly stringent regulatory requirements and environmental restrictions. Manufacturers must ensure that adhesive formulations comply with federal and state regulations regarding volatile organic compounds (VOC) and hazardous chemicals. It limits the use of certain solvents and raw materials, creating pressure to innovate while maintaining product performance. The cost and complexity of meeting these standards can slow down new product development and increase production expenses. It also requires ongoing investment in testing, certification, and documentation to satisfy regulatory bodies. Failure to comply risks penalties and market exclusion, making adherence a critical but challenging aspect of business operations. These regulatory demands constrain flexibility in formulation and sourcing decisions.

- For instance, in 2023, the California Air Resources Board (CARB) updated its VOC limits for architectural coatings, requiring adhesives to contain less than 30 grams per liter of VOCs in many categories-a standard that directly impacts product formulations.

Volatility in Raw Material Prices and Supply Chain Disruptions Affecting Market Stability

The US Construction Adhesives Market encounters significant challenges from raw material price volatility and supply chain disruptions. Key raw materials such as polymers, resins, and solvents are subject to fluctuations due to geopolitical tensions, trade policies, and global demand shifts. It increases production costs unpredictably, affecting pricing strategies and profit margins. Supply chain interruptions caused by transportation delays, labor shortages, and manufacturing bottlenecks further complicate timely product delivery. Manufacturers must manage inventory carefully and explore alternative sourcing to mitigate risks. These challenges limit the ability to maintain consistent supply and respond swiftly to market demand changes. The resulting instability poses risks for both suppliers and end-users in construction projects.

Market Opportunities:

The US Construction Adhesives Market stands to benefit from the growing emphasis on green building and sustainable construction practices. Increasing adoption of eco-friendly materials and low-emission products drives demand for innovative adhesives that comply with environmental standards. It encourages manufacturers to develop water-based, bio-based, and recyclable adhesive formulations that reduce carbon footprints and enhance indoor air quality. Green certifications such as LEED and WELL influence purchasing decisions, creating opportunities for products that meet rigorous sustainability criteria. Growing awareness among contractors and developers about environmental impact further supports this trend. It positions the market to capitalize on evolving regulatory frameworks and consumer preferences favoring sustainable construction solutions.

Technological progress offers significant opportunities in the US Construction Adhesives Market to create advanced, high-performance products tailored for specialized construction needs. Innovations in polymer chemistry and nanotechnology improve bonding strength, flexibility, and durability under extreme conditions. It enables adhesives suitable for infrastructure projects, industrial facilities, and complex architectural designs. Manufacturers can leverage these advancements to differentiate their product lines and enter niche markets requiring customized solutions. Increasing investments in research and development support continuous product enhancement. The ability to address diverse substrate materials and challenging environments expands application possibilities. These technological opportunities drive market growth by meeting precise construction demands.

Market Segmentation Analysis:

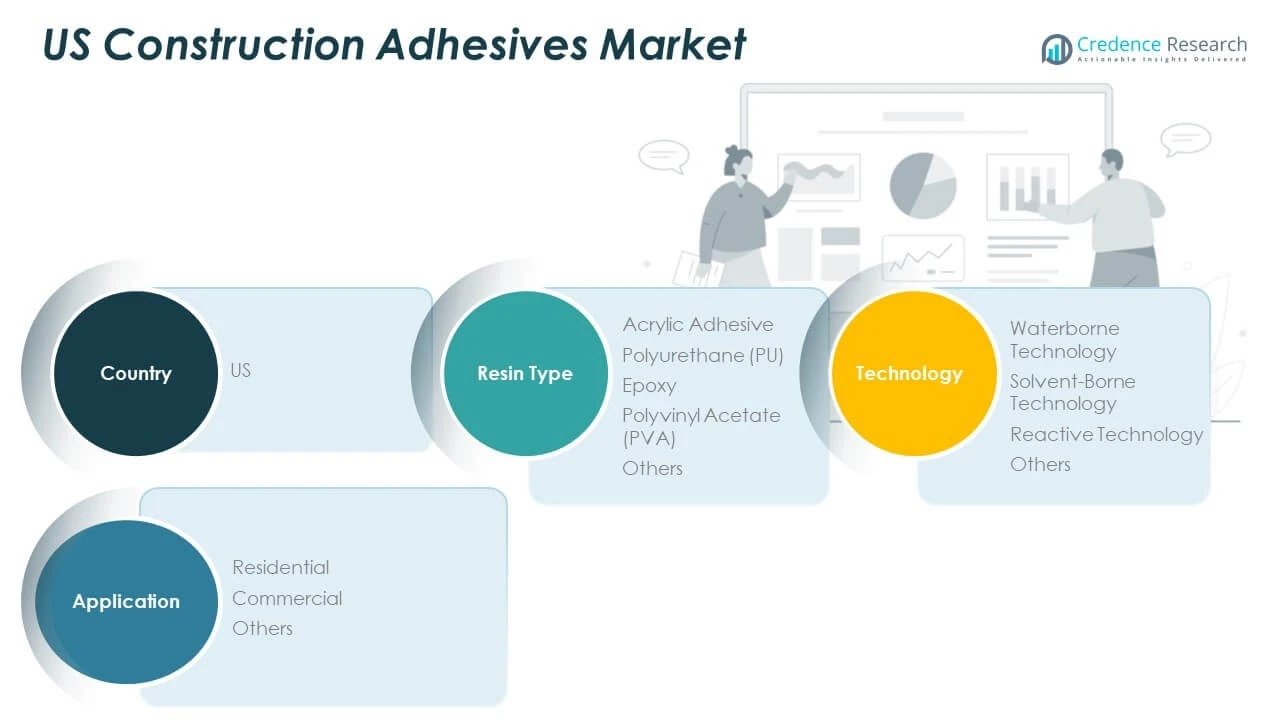

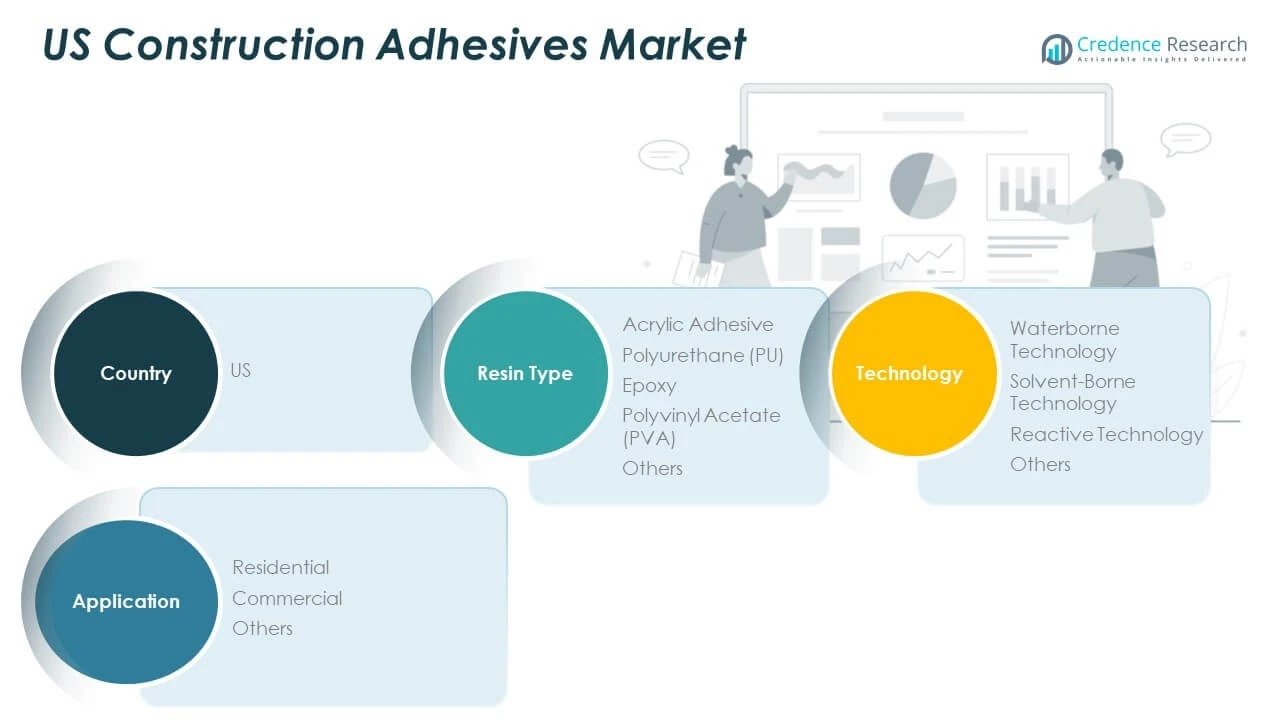

The US Construction Adhesives Market segments its offerings based on resin type, technology, and application to address diverse construction needs.

By resin type segment, acrylic adhesives lead due to their strong bonding capabilities and versatility across substrates. Polyurethane (PU) adhesives gain traction for their flexibility and durability in demanding environments. Epoxy adhesives serve specialized applications requiring superior chemical resistance and structural strength. Polyvinyl Acetate (PVA) adhesives find use primarily in woodworking and interior applications. Other resin types contribute to niche markets with tailored properties.

By technology, waterborne adhesives dominate the US Construction Adhesives Market owing to their low volatile organic compound (VOC) emissions and compliance with environmental regulations. Solvent-borne technologies maintain demand where rapid curing and strong adhesion are critical. Reactive technology adhesives offer high-performance bonding through chemical reactions during application, suitable for complex construction scenarios. Other technologies cater to specific functional requirements, supporting market diversity.

By application segment splits into residential, commercial, and others. Residential construction drives demand for adhesives used in flooring, paneling, and insulation, reflecting ongoing housing growth. Commercial construction requires adhesives with enhanced durability and performance for offices, retail, and industrial facilities. The others category covers infrastructure and specialty applications that require customized adhesive solutions. The segmentation structure allows the market to respond efficiently to evolving industry trends and customer demands.

Segmentation:

By Resin Type Segment:

- Acrylic Adhesive

- Polyurethane (PU)

- Epoxy

- Polyvinyl Acetate (PVA)

- Others

By Technology Segment:

- Waterborne Technology

- Solvent-Borne Technology

- Reactive Technology

- Others

By Application Segment:

- Residential

- Commercial

- Others

Regional Analysis:

The US Construction Adhesives Market demonstrates varied regional dynamics shaped by economic activity, construction demand, and regulatory environments. The South region leads the market, capturing roughly 35% of the total revenue. Rapid population growth and urbanization in states such as Texas, Florida, and Georgia drive high demand for residential and commercial construction adhesives. This region experiences significant investments in housing developments, infrastructure projects, and commercial real estate, which collectively fuel demand for adhesives used in flooring, paneling, insulation, and roofing applications. Contractors in the South favor products that offer fast curing, durability, and environmental compliance to meet stringent building codes and tight project schedules.

The West region holds the second-largest share, approximately 27%, supported by strong economic growth, technological innovation, and a growing emphasis on sustainable construction. California, Washington, and Oregon represent major contributors due to their advanced construction markets and focus on green building practices. The West Coast’s adoption of low volatile organic compound (VOC) and eco-friendly adhesives aligns with regional environmental regulations and green certification standards like LEED. Growth in high-tech industries, commercial construction, and infrastructure modernization further stimulate adhesive demand. Manufacturers in this region emphasize product innovation to meet the increasing performance requirements of sustainable and energy-efficient buildings.

The Northeast region accounts for about 20% of the US Construction Adhesives Market. It benefits from ongoing urban redevelopment and infrastructure upgrades in metropolitan centers such as New York, Boston, and Philadelphia. The Northeast market demands adhesives that provide strong bonding and long-term durability in both new construction and renovation projects. It also sees demand from commercial and residential sectors focusing on historic preservation and energy efficiency. The presence of several large construction firms and suppliers contributes to steady market activity. Regional regulations on emissions and safety influence the preference for waterborne and low-VOC adhesive products.

The Midwest holds the remaining 18% share, driven by a stable industrial base and balanced construction activity across residential, commercial, and industrial segments. States like Illinois, Ohio, and Michigan show consistent demand for adhesives in manufacturing facilities, warehouses, and housing projects. The Midwest market values cost-effective adhesives that maintain quality and comply with environmental standards. Investments in infrastructure rehabilitation and industrial expansion create opportunities for specialized adhesive solutions. Regional manufacturers and distributors work closely with contractors to meet localized construction needs, ensuring market stability.

Key Player Analysis:

- B. Fuller Company

- 3M

- Sika AG

- Dow Inc.

- Bostik (Arkema Group)

- Henkel AG & Co. KGaA

- Franklin International, Inc.

- Avery Dennison Corporation

- Illinois Tool Works Incorporation

- DAP Products Inc.

Competitive Analysis:

The US Construction Adhesives Market features intense competition among established manufacturers and emerging players. Leading companies focus on product innovation, sustainability, and expanding distribution networks to gain market share. It encourages investment in research and development to deliver high-performance, eco-friendly adhesives that meet evolving construction standards. Strategic partnerships and acquisitions enable companies to broaden their product portfolios and geographic reach. Competitive pricing and customer service also play critical roles in securing contracts across residential, commercial, and infrastructure projects. Companies emphasize compliance with environmental regulations to address growing demand for low-VOC and water-based adhesives. The market’s competitive landscape drives continuous improvement in product quality and application versatility. It compels manufacturers to differentiate through technology and responsiveness to customer needs, maintaining a dynamic environment within the US Construction Adhesives Market.

Recent Developments:

- In April 2025, Sika Corporation launched SikaWall®-3000 Rapid Bond, a one-component polyurethane foam adhesive designed to speed up and enhance the durability of exterior insulation and finish systems (EIFS) installations in construction projects.

- In September 2024, Henkel introduced a new product to the US construction adhesives market with the launch of Pattex No More Nails Stick & Peel, a high-performing removable construction adhesive designed specifically for the DIY segment. This innovative adhesive is notable for being the first removable construction adhesive on the market capable of holding up to 6 kilograms on various surfaces, and it features a patented technology that allows for both strong bonding and easy removability.

Market Concentration & Characteristics:

The US Construction Adhesives Market exhibits a moderately concentrated competitive landscape dominated by a few key players that control a significant market share. It features well-established companies that leverage extensive distribution networks, advanced R&D capabilities, and strong brand recognition to maintain leadership. The market values innovation, particularly in eco-friendly and high-performance adhesive solutions, which drives continuous product development. Smaller and regional players contribute by focusing on niche applications and customized solutions. It operates in a dynamic environment influenced by regulatory compliance, sustainability demands, and evolving construction technologies. Customer preferences for quality, durability, and environmental safety shape market characteristics. The competitive intensity fosters technological advancement and strategic collaborations, enabling companies to expand their presence across residential, commercial, and infrastructure sectors within the US Construction Adhesives Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on resin type, technology, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of sustainable, low-VOC adhesives will drive market growth.

- Technological advancements will enhance adhesive performance and application efficiency.

- Increasing investments in residential and commercial construction will boost demand.

- Infrastructure development projects will create opportunities for specialized adhesives.

- Growing emphasis on green building certifications will influence product preferences.

- Expansion of DIY home improvement trends will support market penetration.

- Integration of smart technologies in construction materials will promote innovative adhesives.

- Regulatory policies will continue shaping formulation standards and product development.

- Supply chain optimization will improve product availability and reduce costs.

- Strategic partnerships and mergers will strengthen competitive positioning and market reach.