| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Data Center Containment Market Size 2024 |

USD 1,308.06 Million |

| U.S. Data Center Containment Market, CAGR |

11.24% |

| U.S. Data Center Containment Market Size 2032 |

USD 3,066.79 Million |

Market Overview

The U.S. Data Center Containment Market is projected to grow from USD 1,308.06 million in 2024 to an estimated USD 3,066.79 million by 2032, with a compound annual growth rate (CAGR) of 11.24% from 2025 to 2032. This growth is driven by the increasing demand for energy-efficient data centers, where containment systems are critical in optimizing airflow management and reducing operational costs.

Key drivers in the market include the rising adoption of cloud computing, the expansion of internet services, and the need for cost-effective energy management solutions. Data center operators are increasingly turning to containment systems to reduce cooling costs and ensure better utilization of resources. Furthermore, the demand for high-density computing systems is pushing the development of more sophisticated containment strategies. Trends such as the adoption of modular data center designs and increasing awareness of energy efficiency are expected to further drive the growth of the market.

Geographically, North America holds the largest share of the U.S. Data Center Containment Market, led by major tech hubs such as California and Texas. Key players in the market include companies like Schneider Electric, Rittal GmbH & Co. KG, Airedale International Air Conditioning Ltd., and STULZ USA. These companies are actively developing advanced containment solutions to cater to the increasing demand for more efficient and scalable data center operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Data Center Containment Market is projected to grow from USD 1,308.06 million in 2024 to USD 3,066.79 million by 2032, with a CAGR of 11.24% from 2025 to 2032.

- The market is driven by the increasing demand for energy-efficient data centers, adoption of cloud computing, and the growing need for cost-effective cooling and resource management solutions.

- The development of high-density computing systems and advanced cooling technologies, such as in-row cooling and liquid cooling, is fueling the demand for sophisticated containment solutions.

- High initial investment and integration complexities in retrofitting existing data centers with modern containment systems may limit adoption, especially in smaller organizations.

- North America, particularly regions like California and Texas, dominates the U.S. Data Center Containment Market due to high concentrations of tech companies and major data center developments.

- Increased emphasis on sustainability and regulatory compliance is pushing operators to adopt energy-efficient containment systems to reduce their environmental impact and comply with energy consumption regulations.

- Key players in the market, such as Schneider Electric, Rittal GmbH & Co. KG, and STULZ USA, are continuously innovating to provide scalable, energy-efficient containment solutions for data center operators.

Market Drivers

Technological Advancements and Innovation

Technological advancements in data center infrastructure, particularly the development of high-performance computing systems, have significantly contributed to the growth of the U.S. Data Center Containment Market. Data centers are increasingly adopting high-density computing equipment to meet the demands of data-heavy applications. However, as these systems require significantly more cooling and airflow management, containment systems have become a critical part of the infrastructure. The evolution of containment solutions, such as hot aisle/cold aisle containment, in-row cooling, and modular containment systems, is making it easier for data centers to integrate these systems into existing setups. These innovations in containment technology are expected to continue driving the market as data center operators seek cost-effective and efficient solutions for handling increased cooling demands.

Regulatory and Environmental Concerns

Increasing regulatory pressure and environmental concerns are also contributing to the growth of the data center containment market. Governments and regulatory bodies are implementing stricter environmental and energy efficiency standards to reduce the carbon footprint of industries, including data centers. The U.S. Environmental Protection Agency (EPA) and other local authorities are placing more emphasis on energy-efficient practices in the tech industry. Data centers, being energy-intensive facilities, are under scrutiny to adopt sustainable practices. Containment solutions, which directly contribute to reducing energy consumption and lowering operational costs, are seen as a key enabler in meeting these regulatory requirements. As environmental regulations become more stringent, the demand for energy-efficient containment systems that help reduce the carbon footprint is expected to increase.

Rising Demand for Energy-Efficient Solutions

One of the most significant drivers of the U.S. Data Center Containment Market is the increasing need for energy efficiency in data centers. With growing concerns over sustainability and rising energy costs, data center operators are under pressure to optimize their energy consumption. Containment systems play a pivotal role in this by improving airflow management and preventing the mixing of hot and cold air in data centers. This helps in reducing the load on cooling systems, thereby lowering energy consumption. For instance, companies like Google and Microsoft are investing heavily in energy-efficient technologies to reduce their carbon footprint and operational costs. As the need for energy-efficient solutions becomes more prominent, the adoption of containment strategies is expected to rise. According to various studies, energy-efficient systems can result in substantial savings, which is a key motivator for data center operators to integrate containment solutions into their infrastructure.

Increase in Data Traffic and Cloud Computing

The exponential growth in data traffic, driven by the rise of cloud computing, big data analytics, and the Internet of Things (IoT), is another key driver in the market. The volume of data generated globally continues to increase, and businesses are increasingly relying on data centers to store, process, and analyze this information. As the demand for cloud services and data storage solutions grows, data centers are becoming more densely packed with servers and other equipment. This results in higher heat generation, which can negatively impact operational efficiency and reliability. For instance, hyperscalers like Amazon Web Services (AWS) and Meta are expanding their data center infrastructure to meet the growing demand for cloud services, necessitating the use of containment solutions to manage heat effectively. Containment solutions, which separate hot and cold air within the data center environment, become essential to maintaining the optimal temperature for high-density servers. This trend is expected to continue driving the demand for containment solutions as organizations expand their data center capabilities to accommodate growing data needs.

Market Trends

Increased Focus on Sustainability and Environmental Compliance

Sustainability is a key driver in the evolution of the U.S. Data Center Containment Market. With rising energy costs, increasing environmental regulations, and a growing emphasis on corporate social responsibility, data centers are under increasing pressure to adopt more energy-efficient and sustainable practices. As part of this movement, data center operators are increasingly focusing on reducing their carbon footprint by adopting energy-efficient containment solutions. Containment systems are an essential component of this strategy because they help optimize cooling and airflow, which leads to significant reductions in energy consumption. Moreover, several regulatory bodies, such as the U.S. Environmental Protection Agency (EPA), are pushing for stricter guidelines on energy usage and emissions from data centers. The Energy Star certification for data centers, for example, encourages operators to reduce their energy consumption through efficient infrastructure solutions. Data centers that invest in containment solutions that align with sustainability goals can achieve both regulatory compliance and operational savings, making these solutions a critical part of a sustainable infrastructure strategy.

Rise in Data Center Consolidation and Edge Computing

The ongoing trend of data center consolidation is shaping the future of containment strategies in the U.S. market. As organizations seek to optimize their infrastructure, many are consolidating their data centers to improve efficiency, reduce operational costs, and simplify management. This consolidation process often leads to the need for more advanced containment solutions that can handle larger volumes of equipment in a more compact space. At the same time, the rise of edge computing is driving the demand for containment systems tailored to smaller, localized data centers. Edge computing requires distributed computing resources to be placed closer to the source of data generation, which leads to the creation of smaller, more agile data centers. These edge facilities must be equipped with containment systems that ensure efficient airflow and cooling in more constrained environments. As both data center consolidation and edge computing grow, there is a shift toward containment solutions that are versatile enough to meet the unique needs of both large, centralized data centers and smaller, decentralized edge data centers.

Adoption of Modular and Scalable Containment Solutions

One of the prominent trends in the U.S. Data Center Containment Market is the increasing adoption of modular and scalable containment solutions. As businesses continue to expand their data storage and computing needs, there is a growing demand for flexible containment systems that can be easily adjusted to accommodate changing infrastructure requirements. Modular containment systems offer the flexibility to be expanded or reconfigured without the need for a complete overhaul of the existing setup. These systems allow data center operators to scale their operations as needed, reducing the cost and complexity of upgrading or modifying containment solutions. For instance, companies are leveraging modular designs to create customized data center layouts that can adapt quickly to evolving technology and capacity needs. This trend is particularly relevant as companies embrace hybrid cloud strategies and expand their data center capacities to support more dynamic and distributed computing environments.

Integration of Advanced Cooling Technologies

The integration of advanced cooling technologies with containment systems is another growing trend in the U.S. data center market. As data centers continue to adopt high-density computing systems, there is a corresponding increase in heat generation. Traditional cooling methods, such as air conditioning and liquid cooling, are being complemented by innovative technologies like in-row cooling, liquid immersion cooling, and rear-door heat exchangers. These technologies, when integrated with containment strategies, ensure that cooling is localized where it’s needed most, improving efficiency and reducing energy consumption. For instance, government initiatives have been promoting the use of advanced cooling solutions to reduce energy consumption and carbon emissions in data centers. Liquid cooling, which uses water or other coolants, has also gained traction due to its ability to remove heat more effectively in high-density environments. These advanced cooling methods, paired with containment solutions, help reduce the environmental impact of data centers while also enabling operators to meet the stringent cooling demands of modern computing systems.

Market Challenges

High Initial Capital Investment and Implementation Costs

One of the significant challenges in the U.S. Data Center Containment Market is the high initial capital investment and implementation costs associated with adopting containment systems. While these systems are crucial for improving operational efficiency and reducing long-term energy costs, the upfront expenses required for purchasing and installing these solutions can be substantial. For instance, companies like Schneider Electric and Eaton have developed advanced modular containment solutions that optimize cooling and airflow management but require significant financial resources upfront to deploy. For many data center operators, particularly smaller businesses or those with tight budgets, the cost of integrating containment strategies can act as a barrier to entry. Additionally, existing data centers may face challenges in retrofitting their facilities with modern containment solutions due to infrastructure limitations, further driving up costs. This financial burden can delay or limit the adoption of containment systems, particularly in an industry that is already burdened with the substantial costs of maintaining and upgrading IT infrastructure. As a result, operators must carefully weigh the long-term energy savings and efficiency gains against the immediate capital expenditure needed to implement these solutions.

Complexity of Integration with Existing Infrastructure

Another significant challenge is the complexity involved in integrating data center containment solutions with existing infrastructure. Many data centers, especially older facilities, were not designed with modern containment strategies in mind, which means that retrofitting these systems into pre-existing setups can be challenging and time-consuming. This integration often requires careful planning and, in some cases, significant modifications to existing layouts or cooling systems. The complexity of integration also extends to ensuring compatibility with other cooling technologies, such as liquid cooling or in-row cooling, which may require additional adjustments to ensure optimal performance. The process of seamlessly integrating containment systems without disrupting ongoing operations can be a considerable hurdle for data center operators, especially in high-demand environments where downtime is costly. Consequently, the complexity and potential disruptions during installation can deter companies from pursuing containment solutions, limiting overall market growth.

Market Opportunities

Expansion of Cloud Computing and Big Data Applications

The rapid growth of cloud computing, big data analytics, and the Internet of Things (IoT) presents significant opportunities for the U.S. Data Center Containment Market. As enterprises continue to shift their operations to cloud-based platforms, the demand for data storage and processing capabilities increases, driving the need for more efficient data center operations. High-density computing systems, which are a result of these trends, generate substantial heat and require advanced containment solutions to optimize airflow and cooling. Data center operators will seek innovative containment strategies to address these challenges, creating substantial opportunities for solution providers. Additionally, as industries such as healthcare, finance, and manufacturing continue to rely on big data for operational decisions, the adoption of energy-efficient containment solutions will be critical in managing the rising demand for data storage and processing. Providers of containment systems have a clear opportunity to cater to these growing sectors by offering customized, scalable, and energy-efficient solutions that align with the evolving requirements of cloud computing and big data applications.

Government Regulations and Sustainability Initiatives

With increasing regulatory pressure surrounding energy consumption and environmental sustainability, there is a growing opportunity for containment solutions that help data centers reduce their carbon footprint. Governments, including the U.S. Environmental Protection Agency (EPA), are introducing more stringent regulations on energy efficiency, making it essential for data centers to adopt technologies that align with sustainability goals. Containment systems, which significantly reduce cooling costs and energy usage, offer an ideal solution for meeting these regulations. This shift towards greener practices presents an opportunity for manufacturers to innovate and offer solutions that not only improve operational efficiency but also support data centers in achieving sustainability certifications, such as Energy Star or LEED. As companies seek to reduce their environmental impact, the demand for energy-efficient containment solutions is poised to grow, providing a strong market opportunity for businesses in this space.

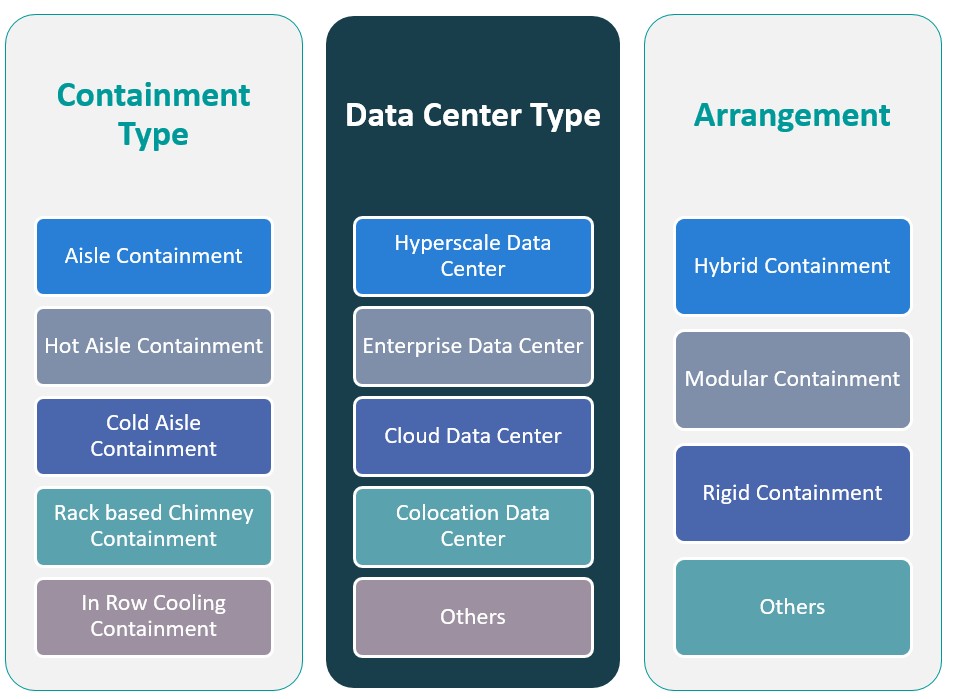

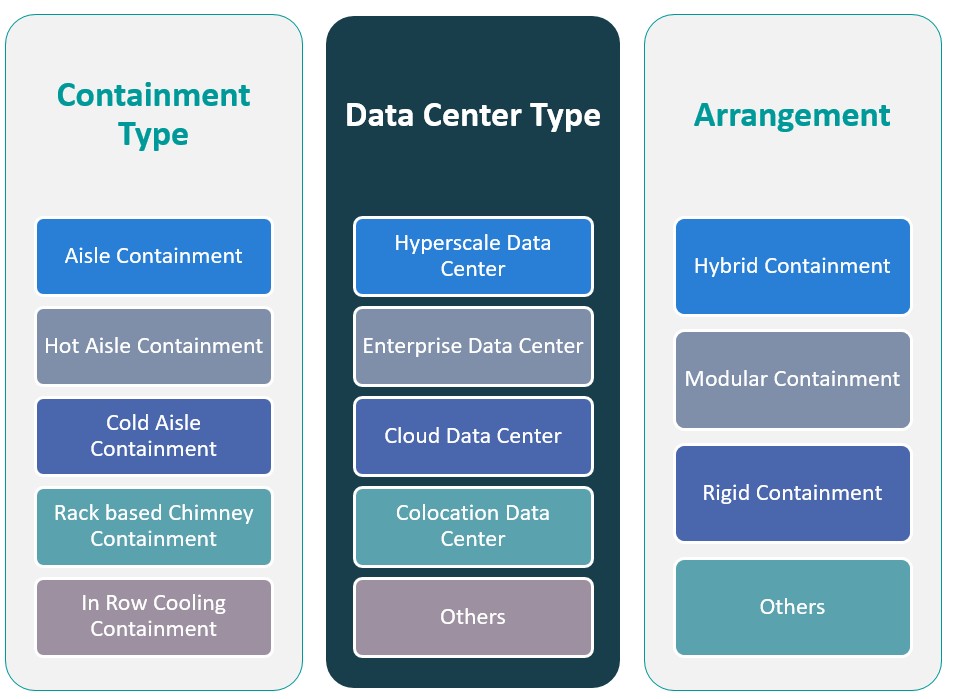

Market Segmentation Analysis

By Containment Type

The U.S. Data Center Containment Market is segmented by various containment strategies designed to optimize airflow and cooling efficiency. Hot Aisle Containment (HAC) is one of the most widely adopted systems, where hot air from servers is contained within a specific aisle, preventing it from mixing with cold air. This method enhances cooling efficiency and reduces energy consumption by directing airflow more effectively. HAC is particularly suited for high-density computing environments and is expected to continue dominating the market due to its cost-effectiveness and simplicity. Cold Aisle Containment (CAC), on the other hand, focuses on enclosing the cold aisle where servers intake cool air, preventing hot air from circulating within the data center. It is highly beneficial for high-density racks and reduces the load on cooling systems, making it ideal for energy-efficient operations. Additionally, Rack-based Chimney Containment systems, which direct the exhaust heat from servers to cooling systems, are increasingly popular in smaller or modular data centers where space optimization is critical. In-Row Cooling Containment places cooling units between server racks to directly target heat-producing equipment, ensuring efficient thermal management, particularly in high-density environments.

By Data Center Type

The market is also categorized by data center types, each with unique requirements for containment solutions. Hyperscale Data Centers, which support large-scale cloud services and IT infrastructure, are growing rapidly and demand scalable, efficient containment systems to manage massive data volumes. These centers are driving the adoption of advanced containment technologies. Enterprise Data Centers owned and operated by individual businesses are increasingly investing in containment systems to enhance energy efficiency and support their internal IT infrastructure. This segment is expected to expand as organizations seek more sustainable solutions for in-house data management. The Cloud Data Center segment, driven by the rise of cloud computing services, is also witnessing significant investments in containment technologies to support high-density environments and efficient cooling. Colocation Data Centers, where multiple clients rent space, are increasingly integrating containment technologies to optimize cooling for diverse users, further boosting the demand for these solutions. The Others category includes smaller, specialized data centers requiring tailored containment systems based on specific operational needs, catering to niche markets.

Segments

Based on Containment Type

- Aisle Containment

- Hot Aisle Containment

- Cold Aisle Containment

- Rack based Chimney Containment

- In Row Cooling Containment

Based on Data Center Type

- Hyperscale Data Center

- Enterprise Data Center

- Cloud Data Center

- Colocation Data Center

- Others

Based on Arrangement

- Hybrid Containment

- Modular Containment

- Rigid Containment

- Others

Based on Region

- California

- Texas

- Virginia

Regional Analysis

West Coast (35%)

The West Coast, particularly California, holds the largest market share in the U.S. Data Center Containment Market, accounting for approximately 35% of the total market. California is home to Silicon Valley, the epicenter of technology innovation, housing numerous hyperscale data centers, cloud providers, and major tech firms such as Google, Facebook, and Apple. The state’s dense population, along with its position as a hub for high-tech companies, drives a high demand for data storage, processing, and containment solutions. Furthermore, California’s commitment to sustainability and energy efficiency regulations encourages the adoption of advanced containment technologies to meet state-level energy standards and reduce operational costs.

Southwest (25%)

Texas follows as the second-largest region in the U.S. Data Center Containment Market, holding around 25% market share. Texas has become a major destination for data centers due to its business-friendly environment, affordable energy costs, and rapidly growing technology sector. Cities like Dallas, Austin, and Houston are attracting both hyperscale and enterprise data centers. The state’s large land availability and favorable regulatory environment make it a prime location for large-scale data storage facilities. As businesses increasingly migrate their operations to the cloud, the demand for efficient containment solutions in Texas is poised to grow significantly.

Key players

- Rittal Corporation

- RackSolutions

- Siemens

- Stulz USA

- Schneider Electric

Competitive Analysis

The U.S. Data Center Containment Market is characterized by a highly competitive landscape, with key players such as Rittal Corporation, RackSolutions, Siemens, Stulz USA, and Schneider Electric leading the charge. These companies provide a range of containment solutions designed to optimize cooling efficiency, reduce energy consumption, and meet growing data center demands. Rittal Corporation, known for its comprehensive portfolio, excels in providing scalable containment systems, while Schneider Electric and Siemens emphasize energy-efficient solutions, capitalizing on their global expertise in electrical and energy management. Stulz USA is a leader in integrated cooling and containment solutions, offering precision cooling systems alongside containment technology. RackSolutions stands out with its specialized approach to rack-based containment systems, catering to both large and small data centers. Together, these companies continuously innovate to meet the evolving needs of the data center industry, ensuring that energy efficiency, flexibility, and performance are prioritized in their product offerings.

Recent Developments

- In November 2023, Huawei introduced two new additions to its Smart Modular Data Center and SmartLi uninterruptible power supply (UPS) series – FusionModule2000 6.0, a modular small/medium-sized data center solution, and UPS2000-H, a small-footprint power supply solution running on SmartLi Mini.

- In February 2025, Trane Technologies expanded its data center solutions to include liquid cooling thermal management systems, introducing the Trane 1MW Coolant Distribution Unit for high-performance workloads.

- In 2025, Honeywell launched a data center management suite to improve efficiency and sustainability by integrating operational and IT infrastructure data.

- In March 2025, Vertiv introduced new solutions to support dense AI and high-performance computing workloads, including consolidated infrastructure management software and prefabricated modular overhead infrastructure.

- In March 2025, Siemens announced a $285 million investment in U.S. manufacturing, including establishing new facilities in California and Texas. This investment aims to enhance manufacturing capabilities and advance AI technologies, supporting sectors such as commercial, industrial, construction, and AI data centers.

Market Concentration and Characteristics

The U.S. Data Center Containment Market exhibits a moderate to high concentration, with several key players dominating the landscape, including Rittal Corporation, Siemens, Schneider Electric, Stulz USA, and RackSolutions. These companies leverage advanced technologies and extensive product portfolios to meet the growing demand for energy-efficient and scalable containment solutions. The market is characterized by a mix of large multinational corporations with a global reach and specialized players offering tailored solutions for specific data center needs. Additionally, the increasing focus on sustainability and energy efficiency is pushing companies to innovate and develop next-generation containment systems. The competition is driven by the need for flexibility, customization, and cost-effectiveness, with key players continuously enhancing their offerings to cater to a wide range of data center types, from hyperscale to enterprise and colocation facilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Containment Type, Data Center Type, Arrangement and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for energy-efficient solutions will remain a key driver in the U.S. Data Center Containment Market, as operators focus on reducing operational costs. Increased regulatory pressures on energy consumption will further encourage adoption.

- The expansion of hyperscale data centers will increase the need for advanced containment systems to manage high-density server environments. As cloud services continue to grow, so will the demand for scalable and efficient containment solutions.

- The growing adoption of cloud services and edge computing will create additional opportunities for containment providers. These technologies require highly efficient containment systems to handle localized data processing and storage.

- Innovations in cooling technologies, such as liquid cooling and in-row cooling, will drive the development of integrated containment systems. These advanced technologies will provide more precise cooling while minimizing energy consumption.

- The increasing emphasis on sustainability will push data centers to invest in energy-efficient containment systems. Achieving green certifications like Energy Star will become a competitive differentiator for data center operators.

- The demand for modular containment systems will continue to rise as businesses seek flexible and scalable solutions that can easily expand with growing data requirements. Modular designs offer cost-effective and adaptable containment.

- Smaller cities and regions outside traditional tech hubs will see increased data center development. These secondary markets will drive demand for containment solutions as local businesses and enterprises seek efficient infrastructure.

- The integration of artificial intelligence (AI) and Internet of Things (IoT) into containment systems will enable more intelligent monitoring and optimization of cooling and airflow management. Smart containment solutions will become increasingly prevalent.

- Colocation data centers will increasingly demand customized containment solutions to meet the diverse needs of multiple clients. This trend will create opportunities for providers to offer tailored solutions for different server configurations.

- Stricter government regulations on energy efficiency and carbon emissions will propel further growth in the data center containment market. Compliance with these regulations will require the adoption of advanced containment technologies that reduce energy consumption.