| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| U.S. Medical Device Contract Manufacturing Market Size 2024 |

USD 19,860.60 million |

| U.S. Medical Device Contract Manufacturing Market, CAGR |

11.69% |

| U.S. Medical Device Contract Manufacturing Market Size 2032 |

USD 48,090.95 million |

Market Overview

The U.S. Medical Device Contract Manufacturing Market is projected to grow from USD 19,860.60 million in 2024 to an estimated USD 48,090.95 million by 2032, with a compound annual growth rate (CAGR) of 11.69% from 2024 to 2032. This significant growth reflects the increasing reliance on contract manufacturers for the production of medical devices, driven by the need for cost-effective solutions and advanced manufacturing capabilities. The market encompasses a wide range of services, including product design and development, prototyping, regulatory compliance, and full-scale manufacturing, catering to the diverse needs of medical device companies aiming to bring innovative products to market efficiently.

Several key drivers and trends are propelling the growth of the U.S. Medical Device Contract Manufacturing Market. The rising prevalence of chronic diseases and an aging population are increasing the demand for medical devices, thereby driving the need for contract manufacturing services. Additionally, advancements in medical technology and the push for miniaturized and wearable medical devices are creating new opportunities for contract manufacturers with specialized capabilities. Outsourcing manufacturing allows medical device companies to focus on core competencies such as research and development, marketing, and sales, while leveraging the expertise and economies of scale offered by contract manufacturers. Trends such as the adoption of Industry 4.0 technologies, including automation and digitalization, are also enhancing manufacturing efficiencies and product quality.

Geographically, the U.S. Medical Device Contract Manufacturing Market is concentrated in regions with a high density of medical device companies and manufacturing facilities, including California, Massachusetts, and Minnesota. These regions benefit from a robust ecosystem of suppliers, skilled labor, and proximity to key customers and regulatory bodies. Key players in the market include leading contract manufacturing organizations such as Jabil Inc., Flex Ltd., and Sanmina Corporation, which offer comprehensive services spanning the entire product lifecycle. These companies are continuously investing in advanced manufacturing technologies and expanding their capabilities to meet the evolving needs of the medical device industry, ensuring their competitive edge in a rapidly growing market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increasing Prevalence of Chronic Diseases and Aging Population

The growing incidence of chronic diseases are significantly driving the demand for medical devices. For instance, the growing incidence of chronic diseases such as diabetes, cardiovascular diseases, and cancer in the U.S. has led to a significant increase in the demand for medical devices. As the population ages, the prevalence of these conditions is expected to rise, necessitating a broader array of medical devices for diagnosis, monitoring, and treatment. Contract manufacturers play a crucial role in meeting this demand by offering scalable and efficient production solutions. Their ability to quickly ramp up production and ensure high-quality outputs helps medical device companies address the needs of a growing patient population without the substantial capital investments associated with in-house manufacturing. This trend is particularly pronounced in the U.S., where healthcare systems are continuously evolving to cater to an older demographic.

Technological Advancements and Innovation in Medical Devices

The medical device industry is characterized by rapid technological advancements and a constant push towards innovation. For instance, developments in areas such as minimally invasive surgical devices, wearable health monitoring systems, and smart medical implants are creating new market opportunities. Contract manufacturers with specialized expertise in these advanced technologies are in high demand. Their capabilities in precision engineering, microfabrication, and integration of digital health technologies enable them to produce complex medical devices that meet stringent regulatory standards. Additionally, the shift towards personalized medicine and patient-specific devices is driving the need for flexible manufacturing processes that can accommodate customization. Contract manufacturers are at the forefront of adopting and implementing cutting-edge technologies to meet these evolving requirements.

Cost Efficiency and Focus on Core Competencies

Outsourcing manufacturing to specialized contract manufacturers allows medical device companies to achieve significant cost savings and operational efficiencies. By leveraging the economies of scale and specialized expertise of contract manufacturers, companies can reduce production costs, shorten time-to-market, and improve overall product quality. This strategic outsourcing enables medical device companies to focus on their core competencies, such as research and development, regulatory affairs, and marketing. The competitive nature of the medical device industry necessitates continuous innovation and rapid product development cycles. Contract manufacturers, with their established manufacturing infrastructures and regulatory compliance expertise, provide a critical support system that allows companies to remain agile and responsive to market demands. This focus on core competencies drives the growth of the contract manufacturing market as companies seek to optimize their resources and maintain a competitive edge.

Regulatory Compliance and Quality Assurance

The medical device industry is highly regulated, with stringent requirements for product safety, efficacy, and quality. Navigating the complex regulatory landscape is a significant challenge for medical device companies. Contract manufacturers bring valuable expertise in regulatory compliance and quality assurance, ensuring that products meet the necessary standards set by bodies such as the U.S. Food and Drug Administration (FDA). Their experience in handling regulatory submissions, managing quality systems, and conducting rigorous testing and validation processes is crucial in minimizing the risk of non-compliance and product recalls. This expertise not only helps medical device companies expedite the approval process but also enhances their reputation for delivering safe and effective products. The assurance of regulatory compliance provided by contract manufacturers is a key driver for their services, as companies seek to mitigate risks and ensure market access for their products.

Report Scope

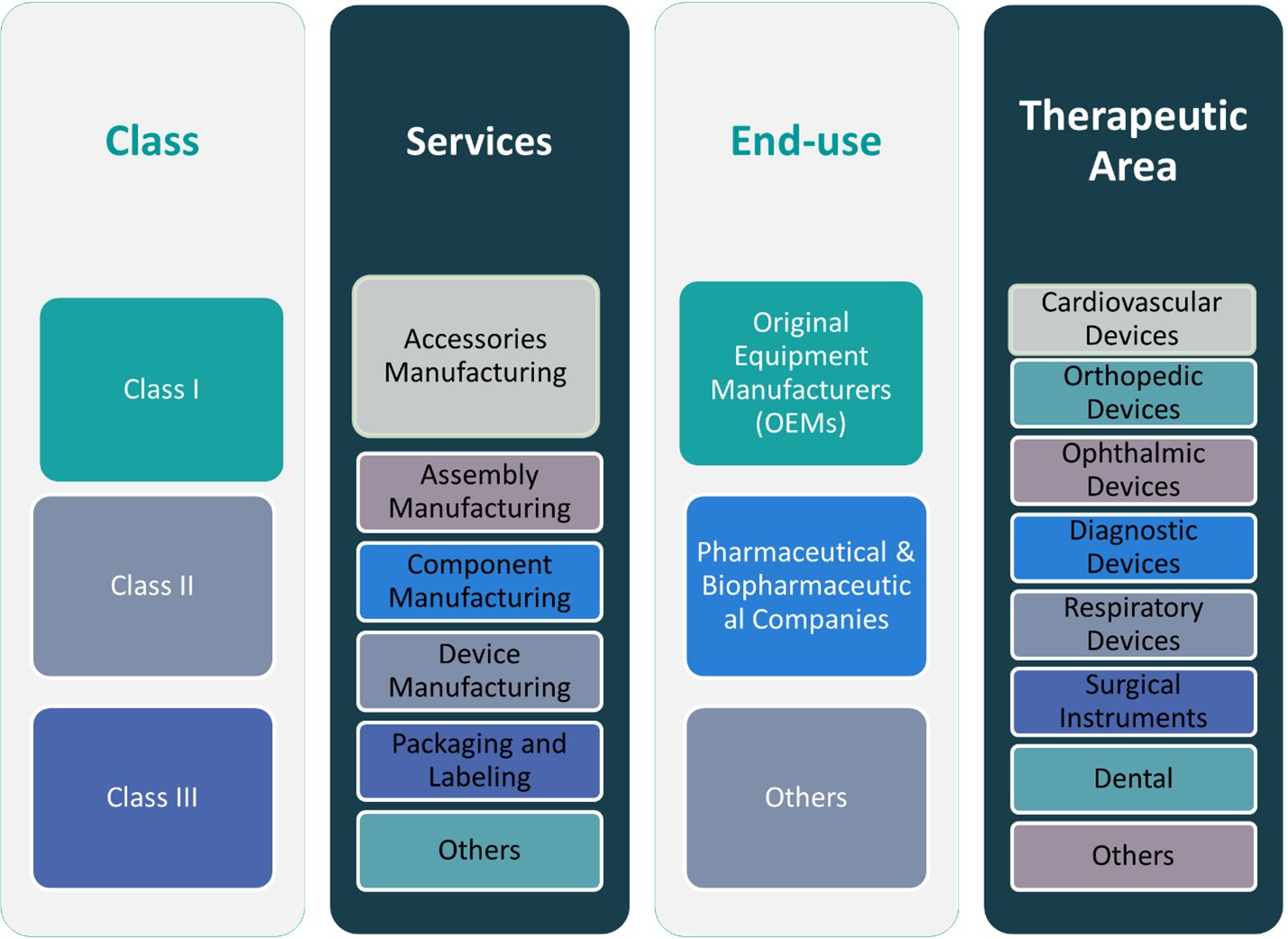

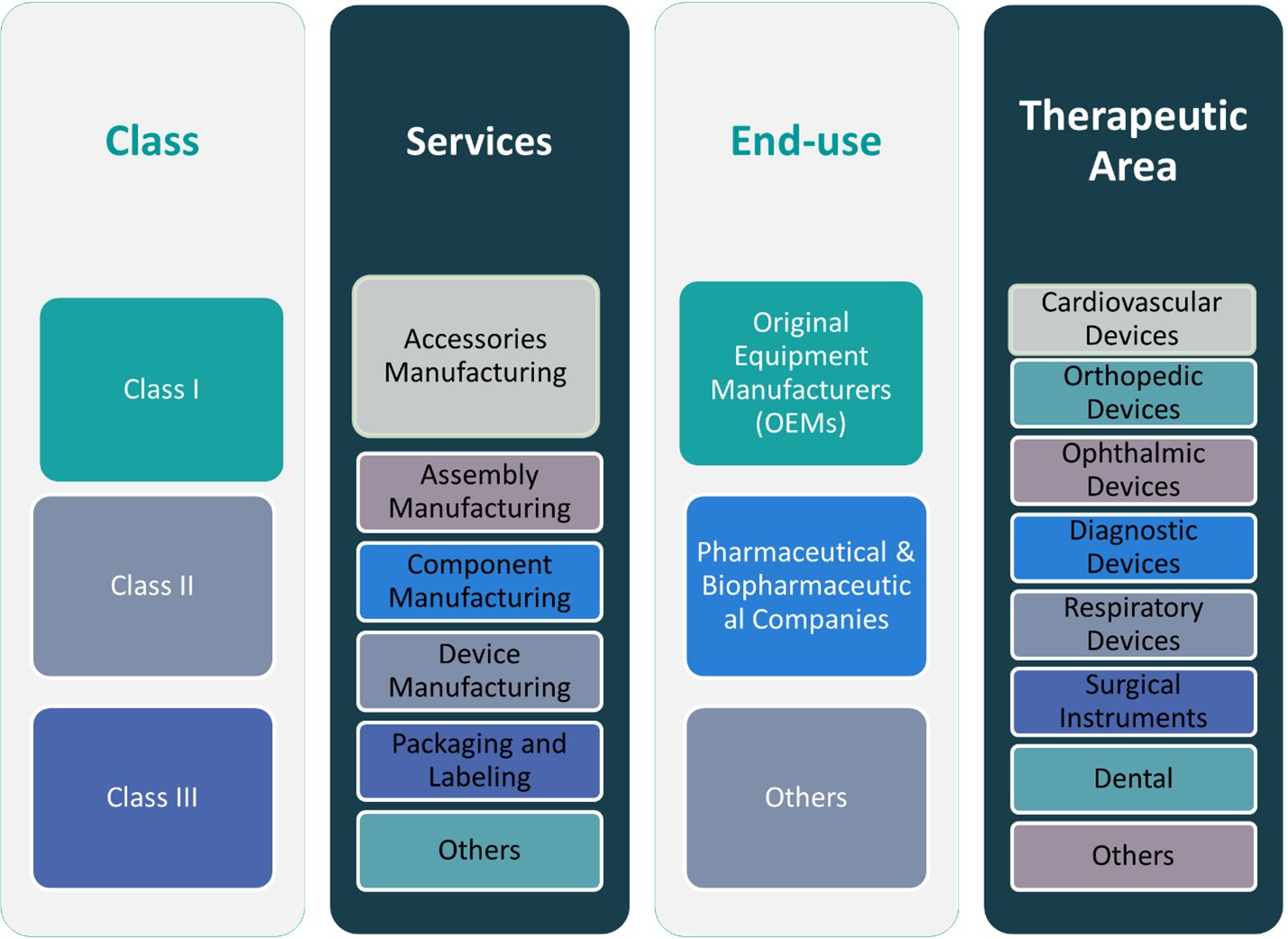

This report segments the U.S. Medical Device Contract Manufacturing market as follows:

Market Trends

Adoption of Industry 4.0 Technologies

Industry 4.0 technologies, including automation, robotics, and the Internet of Things (IoT), are increasingly being integrated into the medical device manufacturing processFor instance, many contract manufacturers are integrating automation and robotics into their assembly lines to streamline the manufacturing process. Automation and robotics streamline assembly lines and ensure precision, while IoT devices enable real-time monitoring and predictive maintenance of manufacturing equipment. This trend towards digitalization and smart manufacturing is transforming the industry, making it more responsive and adaptive to market demands.

Emphasis on Miniaturization and Wearable Devices

The demand for smaller, more portable medical devices and wearable health monitors is on the rise. Contract manufacturers are focusing on developing miniaturized components and integrating advanced sensor technologies into compact devices. For instance, the demand for smaller, more portable medical devices and wearable health monitors has led contract manufacturers to focus on developing miniaturized components. This trend is driven by the growing preference for wearable devices that provide continuous health monitoring and real-time data collection. These devices are becoming increasingly popular for managing chronic conditions and promoting preventive healthcare, leading contract manufacturers to innovate and adapt their processes to produce these highly specialized products.

Growth of Personalized Medicine

Personalized medicine, which tailors treatments to individual patients based on their genetic, environmental, and lifestyle factors, is gaining traction. This approach necessitates the production of customized medical devices, such as patient-specific implants and prosthetics. Contract manufacturers are responding to this trend by offering flexible manufacturing processes that accommodate customization and small-batch production. Advanced technologies like 3D printing and additive manufacturing are being utilized to create bespoke medical devices that meet the unique needs of individual patients, driving further growth in the market.

Focus on Regulatory Compliance and Quality Management

Stringent regulatory requirements and the need for high-quality standards are shaping the medical device contract manufacturing landscape. For instance, contract manufacturers are investing heavily in quality management systems and compliance frameworks to ensure their products meet the rigorous standards set by regulatory bodies like the FDA. This focus on compliance and quality assurance helps contract manufacturers build trust with their clients and navigate the complex regulatory environment, ultimately supporting the successful commercialization of medical devices.

Expansion of Service Offerings

Contract manufacturers are expanding their service offerings to provide end-to-end solutions that cover the entire product lifecycle. In addition to manufacturing, these services include product design and development, prototyping, regulatory consulting, and post-market support. By offering comprehensive solutions, contract manufacturers can better serve their clients’ needs and establish long-term partnerships. This trend towards full-service capabilities allows medical device companies to streamline their operations and focus on their core competencies.

Sustainability and Eco-friendly Manufacturing Practices

Increasing awareness of environmental sustainability is influencing the medical device contract manufacturing market. Manufacturers are adopting eco-friendly practices, such as reducing waste, optimizing energy use, and selecting sustainable materials. These initiatives not only help in meeting regulatory requirements but also appeal to environmentally conscious consumers and healthcare providers. Sustainability is becoming a key differentiator for contract manufacturers, driving them to innovate and implement green manufacturing practices.

Strategic Partnerships and Collaborations

Collaboration between medical device companies and contract manufacturers is becoming more strategic and integrated. These partnerships often involve co-development agreements and shared risk models, enabling both parties to leverage each other’s strengths and expertise. Strategic alliances help accelerate innovation, reduce time-to-market, and enhance product development capabilities. As the industry becomes more competitive, such collaborations are essential for driving growth and achieving mutual success.

Market Restraints and Challenges

Stringent Regulatory Requirements

One of the most significant challenges faced by the U.S. medical device contract manufacturing market is the stringent regulatory landscape. The U.S. Food and Drug Administration (FDA) imposes rigorous standards for the safety, efficacy, and quality of medical devices. Navigating these complex regulations requires substantial resources and expertise. Contract manufacturers must invest heavily in regulatory compliance, quality assurance, and documentation to ensure their products meet all necessary standards. Any lapse in compliance can lead to costly delays, product recalls, and damage to reputation, making regulatory adherence both a critical and challenging aspect of the business.

High Initial Capital Investment

Establishing and maintaining state-of-the-art manufacturing facilities involves significant capital investment. Advanced technologies, such as automation, robotics, and precision engineering equipment, are expensive and require continuous upgrades to keep pace with industry advancements. Small and medium-sized contract manufacturers often struggle to secure the necessary funding to invest in these technologies, limiting their ability to compete with larger, more established players. Additionally, the ongoing costs of maintaining these facilities, including staff training and equipment maintenance, add to the financial burden.

Intellectual Property (IP) Concerns

Intellectual property issues present a considerable challenge in the contract manufacturing landscape. Medical device companies are often wary of sharing proprietary information with third-party manufacturers due to the risk of IP theft or misuse. Ensuring the confidentiality and security of sensitive data is paramount, yet difficult to guarantee completely. This concern can hinder collaboration and trust between medical device companies and contract manufacturers, potentially slowing down the innovation and development process.

Supply Chain Disruptions

The medical device contract manufacturing market is highly dependent on a complex and global supply chain. Disruptions in the supply chain, whether due to geopolitical issues, natural disasters, or pandemics, can severely impact production schedules and lead to delays. The COVID-19 pandemic, for instance, highlighted the vulnerabilities in global supply chains, causing significant bottlenecks and shortages of critical components. Contract manufacturers must develop robust supply chain strategies and contingency plans to mitigate these risks, but doing so can be both challenging and costly.

Intense Competition

The U.S. medical device contract manufacturing market is highly competitive, with numerous players vying for market share. This intense competition can lead to price pressures, squeezing profit margins for contract manufacturers. Companies must continuously innovate and improve their service offerings to differentiate themselves from competitors. However, the rapid pace of technological advancements means that staying ahead of the curve requires ongoing investment in research and development, further adding to the financial strain.

Skilled Labor Shortage

The industry faces a shortage of skilled labor, particularly in specialized areas such as precision engineering, quality control, and regulatory affairs. Attracting and retaining qualified professionals is a persistent challenge for contract manufacturers. The lack of skilled workers can lead to operational inefficiencies, quality control issues, and increased training costs. Companies must invest in workforce development and training programs to bridge the skills gap, which can be both time-consuming and expensive.

Market Segmentation Analysis

By Device

The U.S. medical device contract manufacturing market is experiencing significant growth across various segments. The demand for In Vitro Diagnostic (IVD) devices is fueled by the increasing prevalence of chronic diseases and the need for early diagnosis, resulting in a surge in manufacturing activities. Advancements in imaging technologies and an aging population drive the production of diagnostic imaging devices. The rising incidence of cardiovascular diseases boosts the market for stents, pacemakers, and other cardiovascular devices. Innovations in drug delivery methods, such as wearable injectors and auto-injectors, create a need for specialized manufacturing services. The increasing number of orthopedic surgeries and the popularity of minimally invasive procedures drive demand for orthopedic devices. Heightened awareness of respiratory conditions, especially due to COVID-19, has led to increased manufacturing of respiratory care devices. The growing elderly population and advancements in vision care technology propel the demand for ophthalmology devices. Continuous innovations in surgical instruments contribute to a steady demand for surgical devices. The rising incidence of diabetes fuels the need for glucose monitoring and insulin delivery devices. Increased focus on oral health and cosmetic dentistry boosts the market for dental devices. Minimally invasive surgical procedures drive the demand for endoscopy and laparoscopy devices. Rising incidences of gynecological and urological disorders augment the demand for specialized devices. Growing consumer awareness and an aging population increase the market for personal care devices. The prevalence of neurological disorders propels the need for devices like deep brain stimulators and neuroprosthetics. The shift towards remote and continuous patient monitoring spurs growth in patient monitoring devices. The aging population and advancements in assistive technologies drive the demand for patient assistive devices. Additionally, the market for other niche devices grows with advancements in medical technology.

By Class of Device

Class I medical devices, which are low-risk and include simple medical supplies, consistently see strong demand due to their broad usage. Moderate-risk devices, categorized as Class II, such as infusion pumps and surgical drapes, drive substantial contract manufacturing activities. High-risk Class III devices, like implantable pacemakers, necessitate stringent manufacturing processes, thereby increasing reliance on specialized contract manufacturers.

By Service

Device development and manufacturing services dominate the market due to the need for specialized skills and advanced manufacturing capabilities. Stringent regulatory requirements and the demand for high-quality standards propel the need for comprehensive quality management services. Additionally, the necessity for sterile and secure packaging solutions boosts the market for packaging and assembly services. Other essential services, including logistics and supply chain management, support the end-to-end manufacturing process.

Segments

Based on Device

- IVD Devices

- Diagnostic Imaging Devices

- Cardiovascular Devices

- Drug Delivery Devices

- Orthopedic Devices

- Respiratory Care Devices

- Ophthalmology Devices

- Surgical Devices

- Diabetes Care Devices

- Dental Devices

- Endoscopy and Laparoscopy Devices

- Gynecology and Urology Devices

- Personal Care Devices

- Neurology Devices

- Patient Monitoring Devices

- Patient Assistive Devices

- Other Devices

Based on Class of Device

- Class I Medical Device

- Class II Medical Device

- Class III Medical Device

Based on Service

- Device Development and Manufacturing Services

- Quality Management Services

- Packaging and Assembly Services

- Other Services

Regional Analysis

California (30%):

California is a leading region in the U.S. medical device contract manufacturing market, holding approximately 30% of the market share. The state is home to Silicon Valley, a global hub for technology and innovation, which drives substantial advancements in medical device technologies. California boasts a robust ecosystem of medical device companies, research institutions, and skilled labor, which collectively foster an environment conducive to innovation and growth. Leading contract manufacturers in this region leverage state-of-the-art facilities and cutting-edge technologies to produce high-quality medical devices. The proximity to major research universities and a dynamic venture capital scene further fuels the development and commercialization of new medical technologies.

Massachusetts (20%):

Massachusetts holds around 20% of the market share and is another critical region for medical device contract manufacturing. The state is known for its concentration of prestigious academic institutions and research centers, such as Harvard University and the Massachusetts Institute of Technology (MIT). These institutions contribute significantly to the region’s strong emphasis on medical research and innovation. Boston, in particular, is a major hub for the life sciences and healthcare industries, attracting top talent and investment. Contract manufacturers in Massachusetts benefit from this vibrant ecosystem, providing advanced manufacturing solutions for a wide range of medical devices, from diagnostic tools to complex therapeutic devices.

Key players

- Sanmina Corporation

- Plexus Corp.

- Integer Holdings Corporation

- West Pharmaceutical Services, Inc.

- Benchmark Electronics Inc.

- Kimball Electronics Inc.

- Nortech Systems, Inc.

- Viant Medical Holdings, Inc.

- Tecomet, Inc.

- SMC Ltd.

- Phillips-Medisize Corporation

- Tessy Plastics Corp.

- Nolato GW, Inc.

- Tekni-Plex

Competitive Analysis

The U.S. Medical Device Contract Manufacturing Market is characterized by intense competition among established players, each striving to enhance their technological capabilities and expand their service offerings. Companies such as Sanmina Corporation and Plexus Corp. are recognized for their comprehensive manufacturing services, spanning from product design to full-scale production. Integer Holdings Corporation and West Pharmaceutical Services, Inc. specialize in high-precision manufacturing, catering to complex medical devices and drug delivery systems. Benchmark Electronics Inc. and Kimball Electronics Inc. leverage their extensive electronics manufacturing experience to produce advanced medical devices. Emerging players like Viant Medical Holdings, Inc. and Tecomet, Inc. are focusing on innovation and specialized manufacturing techniques to carve out niche markets. Strategic investments in automation, regulatory compliance, and quality assurance are critical for maintaining competitive advantage in this rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

In 2024, Integer Holdings Corporation (U.S.), a prominent medical device outsourcing company, acquired PULSE TECHNOLOGIES, INC. (U.S.), a specialized contract manufacturer renowned for its expertise in complex micromachining of medical device components. This strategic acquisition is aimed at enhancing Integer’s capabilities in producing high-precision medical devices, particularly in high-growth sectors such as structural heart, heart pump, electrophysiology, leadless pacing, and neuromodulation.

In 2023, Tinicum Incorporated (U.S.) acquired Greene Group Industries (U.S.), a leading manufacturer of components for minimally invasive and robotic-assisted surgeries, as well as other medical applications. This acquisition aligns with Tinicum’s strategy to expand its portfolio in the medical technology sector, leveraging Greene Group’s advanced manufacturing capabilities to meet the increasing demand for innovative surgical components.

In November 2023, Jabil Inc. announced the successful acquisition of Retronix, an innovative provider specializing in the reclamation and refurbishment of electronic components. Completed earlier in the year, this acquisition strengthens Jabil’s capabilities in sustainable manufacturing practices and enhances its service offerings in the electronics sector, providing comprehensive solutions for the lifecycle management of electronic components.

In January 2023, Integer announced the acquisition of Pulse Technologies, Inc., a privately held company known for its technology, engineering, and contract manufacturing services focused on complex micromachining of medical device components. This acquisition targets high-growth markets such as structural heart, heart pump, electrophysiology, leadless pacing, and neuromodulation, bolstering Integer’s position in these critical medical sectors.

Market Concentration and Characteristics

The U.S. Medical Device Contract Manufacturing Market is characterized by a moderate to high level of market concentration, dominated by a few large players such as Sanmina Corporation, Plexus Corp., and Integer Holdings Corporation. These companies possess advanced technological capabilities and extensive manufacturing infrastructures, allowing them to cater to the diverse and complex needs of medical device manufacturers. The market is distinguished by its emphasis on quality assurance, regulatory compliance, and innovation, with firms continuously investing in cutting-edge technologies like automation, IoT, and advanced materials. Despite the dominance of major players, the market also provides opportunities for smaller, specialized firms that offer niche services and customized solutions, thereby contributing to a dynamic and competitive landscape.

Report Coverage

The research report offers an in-depth analysis based on Device Type, Class of Device and Service. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see continued integration of advanced technologies such as AI, IoT, and robotics, enhancing manufacturing precision and efficiency.

- The growing popularity of wearable medical devices for health monitoring will drive demand for specialized contract manufacturing services.

- The rise of personalized medicine will necessitate flexible and customizable manufacturing processes to produce patient-specific medical devices.

- There will be a greater focus on eco-friendly manufacturing practices, with companies adopting sustainable materials and reducing waste to meet regulatory and consumer demands.

- The regulatory landscape will continue to evolve, requiring manufacturers to stay updated with compliance requirements and invest in quality management systems.

- Medical device companies will increasingly outsource manufacturing to focus on core competencies like R&D and marketing, driving growth in the contract manufacturing sector.

- The market will witness a rise in mergers and acquisitions as companies seek to enhance their capabilities and expand their service offerings.

- The demand for smaller, more portable medical devices will drive innovation in miniaturization technologies within the contract manufacturing industry.

- Additive manufacturing, including 3D printing, will become more prevalent, enabling rapid prototyping and production of complex medical device components.

- Contract manufacturers will look to expand their operations into emerging markets to capitalize on the growing global demand for medical devices and diversify their client base.