| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Single Use Assemblies Market Size 2023 |

USD 723.37 Million |

| U.S. Single Use Assemblies Market, CAGR |

12.3% |

| U.S. Single Use Assemblies Market Size 2032 |

USD 2,056.09 Million |

Market Overview:

U.S. Single Use Assemblies Market size was valued at USD 723.37 million in 2023 and is anticipated to reach USD 2,056.09 million by 2032, at a CAGR of 12.3% during the forecast period (2023-2032).

The growth of the U.S. single-use assemblies market is driven by several key factors. The increasing adoption of single-use technologies in biopharmaceutical manufacturing has been a major catalyst, as these systems offer significant advantages such as reducing the risk of cross-contamination, lowering operational costs, and providing greater flexibility compared to traditional stainless-steel systems. Technological advancements in single-use systems, including the development of 2D and 3D bag assemblies, have further enhanced their efficiency and scalability, making them attractive for large-scale production. Additionally, the growing demand for biologics and biosimilars, fueled by the rising prevalence of chronic diseases and an aging population, has heightened the need for more efficient and cost-effective manufacturing solutions. The regulatory environment in the U.S. has also supported the adoption of single-use systems, as the FDA and other regulatory bodies encourage the use of such technologies in the biopharmaceutical industry to streamline production processes and ensure product quality.

North America, with the U.S. at the forefront, holds the largest share of the global single-use assemblies market. The U.S. benefits from a well-established pharmaceutical and biotechnology sector, making it a hub for biopharmaceutical production. The country’s extensive healthcare infrastructure, strong research and development activities, and supportive regulatory frameworks contribute to the widespread adoption of single-use technologies. Major pharmaceutical companies and contract manufacturing organizations (CMOs) operating in the U.S. further boost demand for single-use assemblies as they seek efficient, flexible, and contamination-free manufacturing solutions. While the U.S. remains the dominant player, other regions, particularly Asia Pacific, are expected to experience strong growth as investments in biopharmaceutical manufacturing increase, along with the rising demand for biologics. This regional expansion highlights the growing global acceptance of single-use technologies in biopharmaceutical manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Single Use Assemblies Market was valued at USD 723.37 million in 2023 and is projected to reach USD 2,056.09 million by 2032, growing at a CAGR of 12.3%.

- The Global Single-Use Assemblies Market was valued at USD 2,480.91 million in 2023 and is expected to reach USD 6,991.12 million by 2032, growing at a CAGR of 12.2% from 2023 to 2032

- The adoption of single-use technologies in biopharmaceutical manufacturing is a key driver, offering reduced risk of cross-contamination, lower operational costs, and greater flexibility compared to traditional systems.

- Technological advancements, including the development of 2D and 3D bag assemblies, are enhancing the scalability and efficiency of single-use systems, further driving their adoption in large-scale production.

- The growing demand for biologics and biosimilars, fueled by chronic diseases and an aging population, is increasing the need for efficient manufacturing solutions that single-use assemblies provide.

- The U.S. benefits from a robust pharmaceutical and biotechnology sector, providing a strong foundation for the widespread use of single-use technologies in biopharmaceutical production.

- Regulatory support from agencies like the FDA promotes the integration of single-use systems into manufacturing processes, streamlining production and ensuring product quality.

- While North America dominates the market, regions like Asia Pacific are expected to experience strong growth due to rising investments in biopharmaceutical manufacturing and increasing demand for biologics.

Market Drivers:

Rising Demand for Biologics and Biosimilars

The growing prevalence of chronic diseases, such as diabetes, cancer, and cardiovascular conditions, has significantly increased the demand for biologics and biosimilars. As these therapies require specialized manufacturing processes, there is a growing need for advanced production technologies that ensure scalability, efficiency, and flexibility. Single-use assemblies provide the ideal solution by offering quicker turnaround times and reduced risk of cross-contamination, critical for biologics production. The U.S. market, with its well-established biopharmaceutical sector, is increasingly adopting single-use systems to meet the rising demand for these therapies. This trend is expected to continue, as both large pharmaceutical companies and emerging biotech firms seek to streamline their manufacturing processes to deliver life-saving biologics more efficiently.

Cost-Effectiveness and Operational Efficiency

One of the primary reasons for the rapid adoption of single-use assemblies in the U.S. is their ability to reduce production costs. Traditional stainless-steel systems require significant investment in cleaning, sterilization, and maintenance, all of which add to operational expenses. In contrast, single-use systems eliminate the need for these costly processes, as they are designed for one-time use, reducing the time and resources spent on cleaning and revalidation. Furthermore, single-use assemblies help reduce the overall footprint of manufacturing operations, which translates into savings on space and utilities. As cost-efficiency continues to be a priority in the biopharmaceutical industry, the demand for single-use systems will only grow, further driving the U.S. market.

Technological Advancements and Innovation

Technological advancements have played a pivotal role in expanding the capabilities of single-use assemblies. The development of more sophisticated systems, such as 2D and 3D bag assemblies, has made it easier for manufacturers to scale up production without compromising on product quality. Sartorius, for example, launched its Flexsafe® 3D bags, which are designed for high-volume bioprocessing and have been validated for use in both upstream and downstream applications. These innovations enable better process control, enhanced flexibility, and improved performance, all of which are essential for the production of complex biopharmaceuticals. Additionally, advancements in the integration of single-use systems with process automation have made it easier to manage large-scale operations, further streamlining production workflows. These technological innovations continue to position single-use assemblies as a superior solution for biopharmaceutical manufacturing, ensuring sustained growth in the U.S. market.

Supportive Regulatory Environment

The U.S. regulatory environment has significantly contributed to the growth of the single-use assemblies market. For instance, agencies such as the U.S. Food and Drug Administration (FDA) have supported the adoption of single-use technologies by providing clear guidelines and regulatory frameworks that ensure their safe and effective use in biopharmaceutical manufacturing. The FDA’s favorable stance on single-use systems has made it easier for companies to incorporate these technologies into their manufacturing processes without facing extensive regulatory hurdles. Furthermore, the industry’s move towards compliance with Good Manufacturing Practices (GMP) and other quality standards is well-supported by single-use systems, which help ensure consistency and traceability in production. As the regulatory environment continues to evolve in favor of these technologies, the U.S. single-use assemblies market is expected to see sustained demand and growth.

Market Trends:

Increased Adoption of Disposable Bioprocessing Systems

The U.S. single-use assemblies market is witnessing an increased shift towards disposable bioprocessing systems, driven by the growing need for flexible, scalable, and cost-effective solutions in pharmaceutical manufacturing. For instance, Thermo Fisher Scientific reports that its single-use bioprocessing systems have transformed the cell culture industry by enabling quick, economical, and scalable production at every stage from buffer and media preparation through filling and shipment, and from small- to large-scale production. Unlike traditional multi-use systems, disposable bioprocessing systems offer several advantages, such as reduced risk of cross-contamination, shorter production times, and simplified regulatory compliance. Manufacturers are adopting these systems to enhance production efficiency and meet the rising demand for personalized medicine and small-batch production. This trend is expected to continue, with the demand for disposable systems likely to increase across various stages of biomanufacturing, including cell culture, filtration, and mixing, further contributing to the growth of the single-use assemblies market.

Integration of Smart Technologies

The integration of smart technologies into single-use assemblies is a key trend shaping the U.S. market. The incorporation of sensors, data analytics, and Internet of Things (IoT) connectivity into single-use systems allows for real-time monitoring of critical process parameters such as temperature, pressure, and pH levels. This not only improves the accuracy and control of bioprocessing operations but also enhances the overall efficiency of manufacturing processes. The ability to collect and analyze data from single-use systems in real-time enables manufacturers to optimize their processes, reduce downtime, and improve product quality. As the demand for data-driven manufacturing solutions grows, the integration of smart technologies into single-use systems will become increasingly prevalent in the U.S. market.

Shift Toward Modular Manufacturing Solutions

A notable trend in the U.S. single-use assemblies market is the shift toward modular manufacturing solutions. Modular systems offer flexibility by enabling manufacturers to configure their operations based on specific needs, allowing for easier upgrades and scalability. These systems are particularly advantageous in facilities focused on the production of biologics and biosimilars, where production demands can vary significantly. Modular single-use assemblies support greater customization and adaptability, which is essential for companies aiming to increase their production capabilities while maintaining cost efficiency. For example, Cytiva launched X-platform bioreactors in April 2023 to enhance upstream bioprocessing efficiency, demonstrating how advanced single-use systems can boost production capability and streamline supply chain operations. As demand for personalized and small-scale biopharmaceuticals rises, the preference for modular systems is expected to grow, driving further adoption of single-use assemblies in the U.S. market.

Focus on Sustainability and Environmental Impact

Sustainability is becoming an increasingly important consideration in the U.S. single-use assemblies market, as both manufacturers and consumers are placing greater emphasis on reducing environmental footprints. Single-use technologies, which were initially criticized for contributing to plastic waste, have seen innovations aimed at improving their environmental sustainability. Manufacturers are now exploring ways to recycle and reduce the environmental impact of single-use assemblies, such as using biodegradable materials or designing systems that minimize waste during production. As sustainability continues to be a key focus in the biopharmaceutical industry, the development of more environmentally friendly single-use systems will likely drive market trends in the coming years, aligning with broader global goals of reducing environmental impact.

Market Challenges Analysis:

High Operational Costs

One of the key challenges in the U.S. single-use assemblies market is the high operational costs associated with their widespread adoption. While single-use systems offer several advantages, such as reducing cleaning and sterilization requirements, the initial investment in these technologies can be significant. For example, the implementation of GMP Annex 1 has required companies to adopt risk-based approaches and more stringent validation for single-use systems, particularly in fluid management processes. For smaller manufacturers, the upfront costs of transitioning to single-use systems may be prohibitive, as these systems often require specialized equipment, materials, and training. Additionally, the ongoing costs of purchasing disposable components for each production batch can accumulate, especially when compared to traditional multi-use systems that can be reused over an extended period. This financial barrier can hinder broader adoption among certain segments of the market.

Environmental Concerns

Another restraint facing the U.S. single-use assemblies market is the environmental impact of disposable systems. Despite innovations in the design of eco-friendly single-use technologies, the widespread use of plastic materials in these systems remains a concern. The disposal of used single-use assemblies contributes to plastic waste, raising sustainability issues within the biopharmaceutical manufacturing sector. As public awareness of environmental issues grows, there is increasing pressure on manufacturers to adopt more sustainable practices and explore alternatives to traditional plastic-based single-use systems. Companies are being pushed to balance the operational benefits of single-use technologies with the need for more environmentally responsible solutions, which can be a complex challenge to address.

Regulatory and Compliance Hurdles

The evolving regulatory landscape for single-use technologies presents another challenge for manufacturers. Although the FDA and other regulatory bodies have provided guidelines for the use of single-use systems, the regulatory environment can still be complex and time-consuming for manufacturers to navigate. Ensuring compliance with Good Manufacturing Practices (GMP) and other industry-specific regulations can require significant effort and resources, especially as regulations around single-use systems continue to evolve. This can lead to delays in product development and increase costs associated with regulatory compliance, hindering the speed at which new technologies are adopted in the U.S. market.

Market Opportunities:

The U.S. single-use assemblies market offers significant opportunities driven by the increasing demand for biologics and biosimilars. As the healthcare landscape continues to evolve with a rising prevalence of chronic diseases and an aging population, the need for efficient, scalable, and flexible biopharmaceutical manufacturing solutions is growing. Single-use assemblies offer a cost-effective alternative to traditional stainless-steel systems, reducing contamination risks and lowering operational costs. The continued expansion of the biologics market presents an opportunity for companies to meet the increasing demand for high-quality production solutions, enabling faster and more efficient manufacturing processes. Additionally, as biopharmaceutical companies strive for more sustainable and environmentally friendly solutions, single-use technologies that reduce waste and energy consumption are gaining significant traction.

Technological advancements in the development of 2D and 3D bag assemblies, along with the integration of smart technologies like sensors and IoT, further enhance the capabilities of single-use systems. This enables real-time monitoring, which improves process control, efficiency, and product quality. The trend toward personalized medicine and small-batch production is also fueling demand for flexible and adaptable manufacturing solutions, making single-use assemblies an attractive option. Furthermore, with regulatory bodies like the FDA supporting the adoption of single-use technologies, the market is poised for continued growth. Companies that can innovate and offer customized solutions to meet the unique needs of biopharmaceutical manufacturers are well-positioned to capture a larger market share in the U.S. single-use assemblies market.

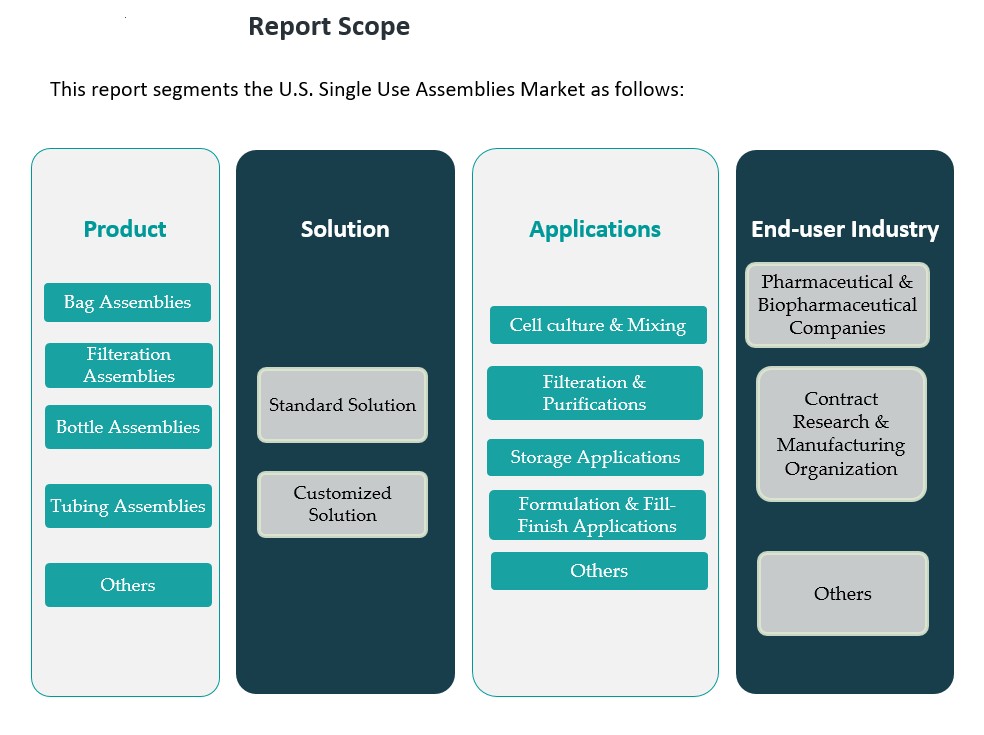

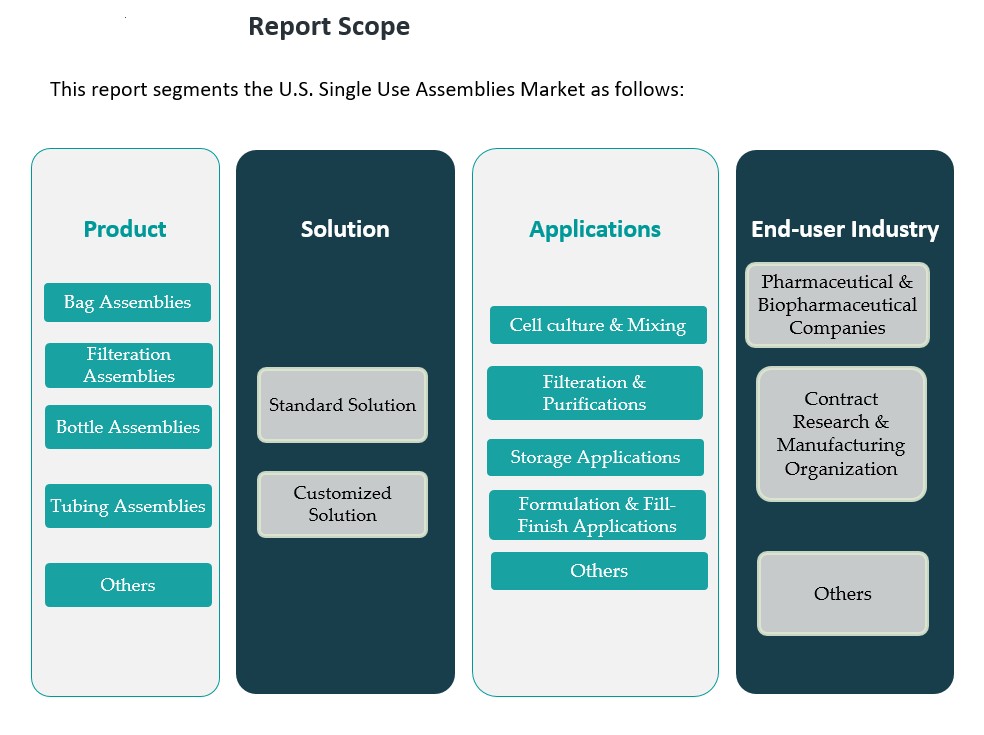

Market Segmentation Analysis:

The U.S. single-use assemblies market is segmented into several categories, each addressing specific needs within the biopharmaceutical manufacturing sector.

By Product Segment: The product segment of the market includes bag assemblies, filtration assemblies, bottle assemblies, tubing assemblies, and others. Bag assemblies dominate the market due to their versatility and widespread use in various bioprocessing applications, including cell culture, mixing, and storage. Filtration assemblies are also in high demand, driven by the need for contamination-free production environments. Bottle and tubing assemblies are essential for liquid transfer and storage processes, while the ‘Others’ category includes various custom components tailored for specific biomanufacturing needs.

By Solution Segment: The market is also divided into standard solutions and customized solutions. Standard solutions offer pre-designed, off-the-shelf systems that are widely used in routine manufacturing processes, providing reliability and cost efficiency. Customized solutions, on the other hand, are tailored to meet the unique needs of specific applications or processes, offering flexibility and precision, particularly for complex biopharmaceutical manufacturing operations.

By Applications Segment: The application segment includes cell culture and mixing, filtration and purification, storage applications, and formulation and fill-finish applications. Cell culture and mixing are crucial in the production of biologics, while filtration and purification ensure the removal of contaminants during the production process. Storage applications cater to the safe and efficient storage of biological materials, while formulation and fill-finish applications support the final stages of drug production.

By End-User Segment: The end-user segment comprises pharmaceutical and biopharmaceutical companies, contract research and contract manufacturing organizations (CROs/CMOs), and academic and research institutes. Pharmaceutical and biopharmaceutical companies represent the largest market share, driving demand for single-use systems to meet the growing need for biologics. CROs and CMOs also contribute significantly to the market, as they require scalable and efficient solutions for biomanufacturing. Academic and research institutes use single-use systems for experimental and developmental purposes, further expanding market opportunities.

Segmentation:

By Product Segment:

- Bag Assemblies

- Filtration Assemblies

- Bottle Assemblies

- Tubing Assemblies

- Others

By Solution Segment:

- Standard Solutions

- Customized Solutions

By Applications Segment:

- Cell Culture & Mixing

- Filtration & Purifications

- Storage Applications

- Formulation and Fill-Finish Application

- Others

By End-User Segment:

- Pharmaceutical & Biopharmaceutical Companies

- Contract Research & Contract Manufacturing Organizations

- Academics & Research Institutes

Regional Analysis:

The U.S. single-use assemblies market is the largest and most prominent in the North American region, driving the overall market growth. North America holds a substantial share, accounting for more than 50% of the global market, with the U.S. contributing the majority. The U.S. market is propelled by a well-established pharmaceutical and biotechnology industry, which is increasingly adopting single-use technologies to enhance manufacturing flexibility, reduce costs, and ensure the safety of biopharmaceutical production. The presence of major pharmaceutical companies, contract manufacturing organizations (CMOs), and research institutions in the U.S. provides a robust foundation for the continued growth and demand for single-use assemblies.

The U.S. benefits from a highly developed healthcare infrastructure and is home to some of the world’s largest pharmaceutical companies, including Pfizer, Merck, and Johnson & Johnson. These companies have recognized the value of single-use technologies in addressing the growing demand for biologics and biosimilars, which require scalable and efficient manufacturing systems. Furthermore, the increasing focus on precision medicine and the rising prevalence of chronic diseases have significantly boosted the adoption of single-use systems in the biopharmaceutical sector. The regulatory environment in the U.S. is also supportive, with the FDA and other agencies providing clear guidelines that facilitate the use of single-use systems in biopharmaceutical manufacturing.

In addition to its strong presence in the pharmaceutical sector, the U.S. market is also witnessing growth in academic and research institutions that utilize single-use assemblies for experimental and development purposes. These institutions play a crucial role in advancing the field of biopharmaceutical manufacturing and contribute to the overall market demand for single-use solutions.

Although North America dominates the global market, other regions, such as Europe and Asia Pacific, are also experiencing notable growth. Europe holds a market share of approximately 25%, driven by a strong pharmaceutical and biotechnology industry that is increasingly adopting single-use technologies. In Asia Pacific, the market share is expected to grow significantly due to expanding pharmaceutical manufacturing capabilities, particularly in countries like China and India. As the U.S. continues to lead in market share, these regions are expected to become increasingly important as they adopt single-use technologies to meet the growing global demand for biologics and biosimilars.

Key Player Analysis:

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Danaher Corporation

- Merck KGaA

- Avantor, Inc.

- Parker-Hannifin Corporation

- Saint-Gobain S.A.

- Repligen Corporation

- Corning Incorporated

- Entegris

- L. Gore & Associates, Inc.

- NewAge Industries

- Antylia Scientific

- Intellitech Inc.

Competitive Analysis:

The U.S. single-use assemblies market is highly competitive, with several key players driving innovation and market growth. Major companies such as Thermo Fisher Scientific, Sartorius AG, and GE Healthcare are prominent in the market, offering a wide range of single-use solutions, including bag assemblies, filtration systems, and tubing. These companies leverage their extensive research and development capabilities to introduce new, advanced products designed to meet the evolving needs of biopharmaceutical manufacturing. Additionally, smaller specialized players are entering the market with customized solutions tailored to specific applications, contributing to a more diverse product offering. The competition is also intensifying as companies focus on expanding their market share through strategic partnerships, acquisitions, and investments in technology. Regulatory compliance, product quality, and the ability to provide scalable, cost-effective solutions are key factors that differentiate leading players. As the demand for biologics continues to rise, competition within the U.S. single-use assemblies market is expected to remain robust.

Recent Developments:

- In April 2024, SaniSure, a global provider of single-use bioprocessing products, launched Fill4Sure, a custom single-use filling assembly. This innovative product is designed to expedite drugs to market by enhancing security, efficiency, and repeatability in the drug product filling process.

- In September 2023, Repligen Corporation expanded its capabilities in the single-use assemblies market through the acquisition of Metenova AB, a company specializing in fluid management. This strategic acquisition strengthens Repligen’s portfolio in fluid management assemblies and complements its single-use technology business, positioning the company to better serve the growing demand for advanced bioprocessing solutions.

- In April 2023, Cytiva, a leading player in bioprocessing technologies, introduced the X-platform bioreactors to streamline upstream bioprocessing operations. These new bioreactors are designed to boost process efficiency by enhancing production capabilities and simplifying supply chain operations, further solidifying Cytiva’s role in advancing single-use systems for the biopharmaceutical industry.

Market Concentration & Characteristics:

The U.S. single-use assemblies market is moderately concentrated, with a few major players commanding a significant share. Leading companies such as Thermo Fisher Scientific, GE Healthcare, and Sartorius AG dominate the market due to their extensive product portfolios, strong brand recognition, and technological expertise. These companies invest heavily in research and development to introduce innovative, high-quality products that meet the growing demands of the biopharmaceutical sector. Despite the dominance of these key players, the market also includes numerous smaller and specialized companies that provide niche, customized solutions. This diversity in the market fosters innovation, particularly in the development of tailored products for specific applications in biologics production, purification, and storage. As a result, the market is characterized by a mix of large, established players and emerging companies, leading to both high competition and ongoing product differentiation. This dynamic environment is expected to drive continued growth and innovation in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Segment, Solution Segment, Applications Segment and End User Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. single-use assemblies market is projected to continue expanding due to rising demand for biologics and biosimilars.

- Increasing investments in biopharmaceutical manufacturing will drive the adoption of cost-efficient single-use systems.

- Technological advancements, such as the integration of smart sensors and IoT, will enhance system performance and monitoring capabilities.

- Regulatory support for single-use technologies will accelerate their integration into manufacturing processes.

- The shift toward personalized medicine and small-batch production will boost demand for scalable, flexible systems.

- Continuous innovations in product design will expand the application scope of single-use assemblies in bioprocessing.

- Emerging market players will introduce specialized solutions, increasing market fragmentation and product diversity.

- Demand for disposable bioprocessing systems will rise in both large-scale and contract manufacturing organizations.

- Environmental sustainability efforts will drive the development of eco-friendly single-use systems.

- Competition will intensify as major players seek to strengthen their market positions through strategic partnerships and acquisitions.