Market Overview

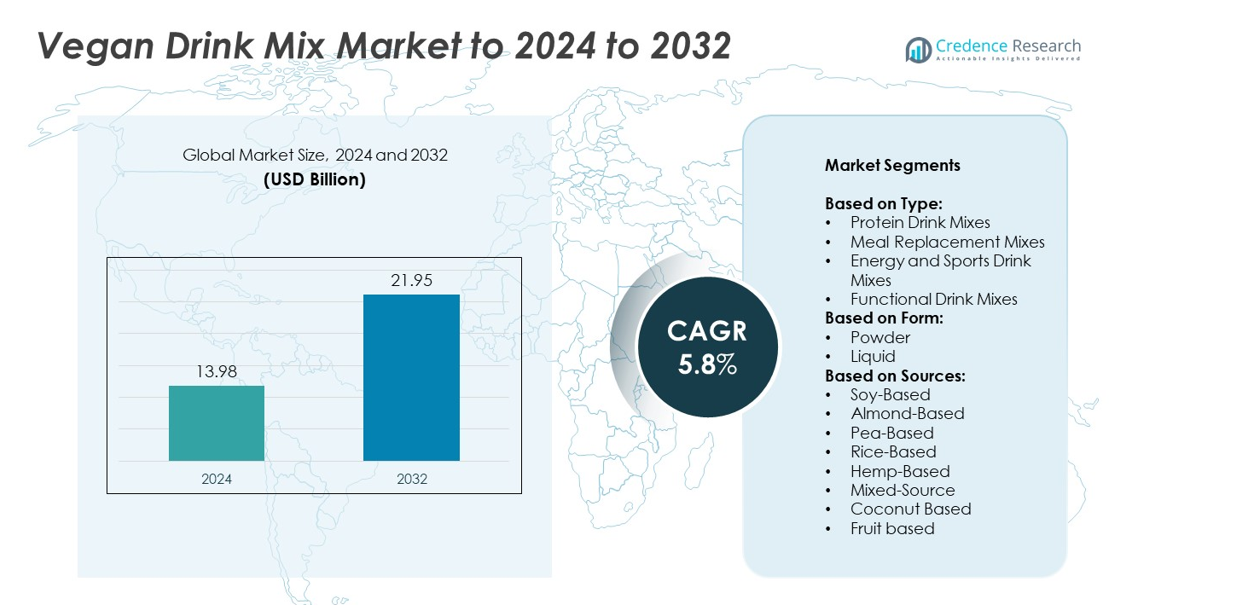

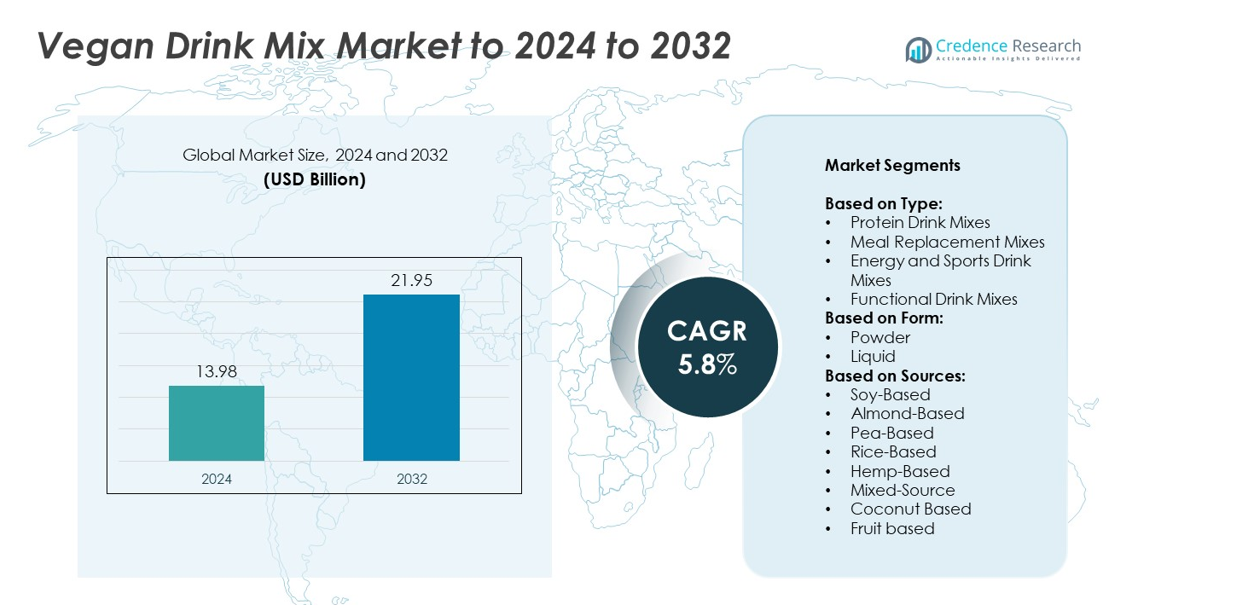

Vegan Drink Mix market size was valued at USD 13.98 Billion in 2024 and is anticipated to reach USD 21.95 Billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vegan Drink Mixes Market Size 2024 |

USD 13.98 billion |

| Vegan Drink Mixes Market, CAGR |

5.8% |

| Vegan Drink Mixes Market Size 2032 |

USD 21.95 billion |

The vegan drink mix market is driven by leading players such as Glanbia Nutritionals, Sunwarrior, Strive, Nuzest, True Nutrition, Vega, Garden of Life, Bob’s Red Mill, Orgain, and Plant Fusion, who focus on product innovation and clean-label offerings to capture a growing consumer base. These companies emphasize functional formulations, unique flavors, and sustainable sourcing to strengthen market positioning. North America emerged as the leading region in 2024, accounting for around 35% of the global market share, supported by strong retail networks, rising vegan and flexitarian populations, and a growing preference for plant-based nutrition across urban and health-conscious demographics.

Market Insights

- The vegan drink mix market was valued at USD 13.98 Billion in 2024 and is expected to reach USD 21.95 Billion by 2032, growing at a CAGR of 5.8%.

- Rising adoption of plant-based diets and increasing focus on health and wellness are key drivers boosting demand.

- Market trends include innovation in flavors, fortified formulations, and the rise of e-commerce and direct-to-consumer subscription models.

- Competition is intense with major players investing in product diversification, influencer marketing, and research to improve taste and texture.

- North America led the market with 35% share in 2024, followed by Europe at 28% and Asia-Pacific at 25%, while protein drink mixes dominated by type with over 38% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Protein drink mixes dominated the vegan drink mix market in 2024, holding over 38% market share. Their popularity stems from rising demand for plant-based protein among fitness enthusiasts and health-conscious consumers. These mixes are preferred for muscle recovery, weight management, and daily nutrition support. Meal replacement mixes also see growth due to busy lifestyles and convenience-driven consumption. Energy and sports drink mixes attract athletes seeking plant-based alternatives to dairy-based products. Functional drink mixes with added probiotics, vitamins, and adaptogens are gaining traction, supported by rising interest in holistic wellness and immunity-boosting formulations.

- For instance, Huel Ltd. has sold over 500 million meals since its founding in 2015. The company reported £214 million in revenue for the financial year ending July 31, 2024.

By Form

Powder form accounted for the largest share, capturing nearly 65% of the market in 2024. Consumers prefer powders for their longer shelf life, easy portability, and ability to customize serving sizes. Powdered drink mixes are more economical for bulk purchases, making them popular in gyms, retail stores, and online subscriptions. Liquid formats are growing steadily, driven by the ready-to-drink (RTD) trend and urban consumers seeking convenience. RTD formats particularly appeal to millennials and Gen Z who value on-the-go nutrition, clean labels, and innovative flavors.

- For instance, The Simply Good Foods Company acquired OWYN for $280 million in cash. A definitive agreement for the acquisition was announced in late April 2024, and the transaction was completed in mid-June 2024.

By Sources

Soy-based mixes dominated the source segment, holding about 30% market share in 2024, due to their complete amino acid profile and cost-effectiveness. Soy protein remains a trusted ingredient for vegan consumers seeking high-quality nutrition. Almond- and pea-based mixes are growing quickly as they cater to allergen-sensitive and clean-label preferences. Rice- and hemp-based products attract niche segments focused on hypoallergenic and sustainable sources. Mixed-source and coconut-based blends are gaining favor for offering balanced nutrition and improved taste profiles, while fruit-based mixes benefit from rising demand for naturally flavored, antioxidant-rich beverages.

Market Overview

Rising Plant-Based Lifestyle Adoption

The major growth driver is the increasing global shift toward plant-based diets, driven by ethical, environmental, and health concerns. Consumers are replacing dairy and animal-derived beverages with vegan alternatives to lower cholesterol and improve gut health. Social media awareness, celebrity endorsements, and vegan lifestyle campaigns are accelerating adoption. The growing vegan and flexitarian population is pushing food manufacturers to expand their vegan product portfolios. This rising demand is compelling retailers and e-commerce platforms to increase availability, further fueling market expansion worldwide.

- For instance, Soylent, a prominent brand in the meal replacement and adult nutrition sector, was acquired by Starco Brands in February 2023. According to market data from Unify+ Panel for the 52 weeks ending May 19, 2024, Soylent achieved the highest adult nutrition repurchase rate. The data showed that 62.9% of Soylent consumers purchased products two or more times, outperforming competitors such as Boost (61.9%), OWYN (57%), Orgain (54.5%), and Ensure (48.2%).

Expanding Fitness and Wellness Trends

The growing fitness and wellness culture is fueling demand for vegan protein and functional drink mixes. Gyms, health clubs, and fitness influencers promote plant-based nutrition for muscle building and recovery. Clean-label, non-GMO, and allergen-free claims are attracting health-conscious buyers seeking natural and safe ingredients. Consumers prefer vegan mixes with added benefits like omega-3s, probiotics, and superfoods. This focus on holistic health is increasing repeat purchases, strengthening market penetration across urban centers and among younger demographics globally.

- For instance, Vital Proteins offers a Matcha Collagen product that combines collagen peptides with high-quality Japanese matcha green tea. This blend is marketed to provide benefits for hair, skin, nail, bone, and joint health. The product includes L-theanine for a calm energy boost, along with 50 milligrams of caffeine per serving. It is designed to be mixed easily into hot or cold liquids, though some customer reviews suggest that using a blender or shaker bottle is more effective for dissolving the powder completely in cold beverages.

Innovation in Flavors and Formulations

Continuous product innovation is a key driver boosting market growth. Brands are introducing unique flavors such as matcha, turmeric, and berry blends to appeal to adventurous consumers. Enhanced formulations with fortified vitamins, minerals, and adaptogens meet specific health needs like energy, immunity, and stress relief. The use of advanced processing technologies ensures better texture, solubility, and taste. These innovations are helping companies differentiate themselves in a competitive market and expand their target audience, encouraging higher consumption rates.

Key Trends & Opportunities

Growth of E-Commerce and D2C Channels

E-commerce is emerging as a critical opportunity for vegan drink mix brands, offering direct access to global consumers. Direct-to-consumer (D2C) models allow personalized subscriptions and targeted marketing campaigns. Digital platforms enable smaller brands to compete with large players through influencer partnerships and social media promotions. Consumers prefer online purchases for access to wider flavor ranges, discount bundles, and convenience. This trend is boosting brand visibility and helping companies rapidly test and launch innovative product lines.

- For instance, Ritual, a certified B Corp and direct-to-consumer health and wellness brand, is known for its subscription model. In 2022, its gut health supplement, Synbiotic+, gained over 50,000 subscribers within its first year.

Premiumization and Functional Benefits

A key trend is the premiumization of vegan drink mixes with functional benefits. Consumers are willing to pay more for organic, sustainably sourced, and nutrient-rich products. Functional claims like gut health support, energy enhancement, and skin benefits are driving product differentiation. This opens opportunities for collaborations with nutraceutical companies and wellness brands. Premium packaging, clean labels, and certifications such as USDA Organic or Non-GMO Project Verified are becoming major purchase influencers among health-conscious buyers.

- For instance, Califia Farms launched a new product called “Califia Farms Complete,” a plant-based milk formulated from a blend of pea, chickpea, and fava bean proteins, in February 2024. This product, with 8 grams of protein per serving, became available nationwide at major retailers like Target and Walmart. The company has previously offered dairy-free probiotic yogurt drinks with 10 billion live, active cultures, but this was a separate product launch years earlier in 2018.

Key Challenges

Higher Production and Ingredient Costs

One of the key challenges is the high cost of sourcing quality plant-based ingredients such as pea, hemp, or almond proteins. Production costs for maintaining clean-label, non-GMO, and allergen-free standards further increase retail prices. This price gap compared to conventional dairy-based mixes limits adoption among price-sensitive consumers. Manufacturers face pressure to optimize supply chains and invest in cost-effective processing technologies to maintain competitiveness without compromising quality or nutrition.

Taste and Texture Limitations

Taste and texture remain major barriers to wider adoption of vegan drink mixes. Some plant proteins have earthy or gritty profiles that discourage repeat purchases. Achieving dairy-like creaminess and flavor consistency is challenging, requiring advanced formulation techniques. Brands must invest in research and development to improve palatability and solubility without adding artificial additives. Overcoming these sensory limitations is critical for attracting mainstream consumers and expanding beyond niche vegan communities.

Regional Analysis

North America

North America held the largest share of the vegan drink mix market in 2024, accounting for around 35%. The region benefits from high awareness of plant-based nutrition, strong retail distribution networks, and a large base of health-conscious consumers. The United States drives demand, supported by rising vegan and flexitarian populations and innovations in protein-rich and functional mixes. E-commerce and subscription-based sales channels are growing rapidly, making products easily accessible. Increasing investments by key players in new flavors and fortified formulations further strengthen market expansion, particularly in urban areas where wellness trends and sustainable product preferences remain strong.

Europe

Europe accounted for nearly 28% of the global vegan drink mix market in 2024. Growth is fueled by strict regulations supporting clean-label, plant-based products and rising demand for sustainable nutrition solutions. Countries like Germany, the U.K., and France lead adoption, driven by expanding vegan populations and preference for allergen-free and organic drink mixes. Supermarkets and specialty health stores are offering a wider variety of vegan mixes, supporting mainstream acceptance. Innovation in protein blends and fortified options, along with government-backed health initiatives, is helping manufacturers target diverse consumer needs and capture larger shares of this competitive regional market.

Asia-Pacific

Asia-Pacific captured about 25% market share in 2024 and is the fastest-growing region. Rising disposable incomes, urbanization, and growing awareness of health benefits are fueling demand for plant-based beverages. China, India, and Japan are leading contributors, supported by government campaigns encouraging healthier diets. Local players and global brands are launching affordable, flavored, and nutritionally enhanced mixes to appeal to a wide consumer base. Expansion of e-commerce platforms and improved retail infrastructure make these products more accessible. The region offers strong potential due to its large population base and increasing adoption of vegan lifestyles among younger demographics.

Latin America

Latin America held a market share of nearly 7% in 2024, with Brazil and Mexico being key growth markets. Demand is supported by increasing health awareness, rising lactose intolerance cases, and growing adoption of plant-based diets. Regional manufacturers are focusing on affordable soy- and rice-based mixes to meet price-sensitive demand. Distribution through supermarkets and online channels is improving, expanding product reach. Partnerships between international and local brands are driving innovation and strengthening supply chains. Although relatively small, the region offers opportunities for players focusing on clean-label, nutrient-rich, and culturally preferred flavors to capture growing consumer interest.

Middle East & Africa

The Middle East & Africa region accounted for about 5% of the market share in 2024. Growth is driven by rising urbanization, health-conscious consumers, and increasing availability of plant-based nutrition products. The United Arab Emirates and South Africa are leading markets, supported by strong retail presence and high demand for premium health products. Adoption is also driven by expatriate populations seeking vegan alternatives. Manufacturers are expanding distribution networks and introducing flavored and fortified mixes tailored to regional preferences. While the market is still emerging, its growth potential remains strong due to rising awareness of plant-based health benefits.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type:

- Protein Drink Mixes

- Meal Replacement Mixes

- Energy and Sports Drink Mixes

- Functional Drink Mixes

By Form:

By Sources:

- Soy-Based

- Almond-Based

- Pea-Based

- Rice-Based

- Hemp-Based

- Mixed-Source

- Coconut Based

- Fruit based

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The vegan drink mix market is characterized by strong competition, with key players including Glanbia Nutritionals, Sunwarrior, Strive, Nuzest, True Nutrition, Vega, Garden of Life, Bob’s Red Mill, Orgain, and Plant Fusion leading the space. These companies compete through continuous innovation, offering products with improved taste, texture, and nutritional profiles to capture health-conscious consumers. Strategic focus on clean-label formulations, organic certifications, and allergen-free options is strengthening brand positioning. Many players are expanding their global reach through e-commerce, subscription models, and retail partnerships. Product diversification, including functional mixes with added vitamins, adaptogens, and superfoods, is driving differentiation in a crowded market. Marketing campaigns leveraging fitness influencers and social media are boosting consumer engagement and brand visibility. Investment in research and development is enabling companies to address taste challenges and enhance solubility, while mergers and collaborations are helping to streamline supply chains and accelerate product innovation.

Key Player Analysis

Recent Developments

- In 2025, Bob’s Red Mill debuted its new Overnight Protein Oats at Natural Products Expo West.

- In 2024, Orgain rolled out its Simple Plant Protein™ line, which featured a minimalist, five-ingredient formula. This launch was specifically designed to appeal to “clean-label” consumers who prefer products with a limited number of recognizable ingredients.

- In 2024, Garden of Life introduced a new line of sports nutrition products. The launches included organic and Non-GMO Project Verified products with added functional ingredients targeting areas like digestive and skin health.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by rising adoption of plant-based diets.

- Demand for protein-rich and functional drink mixes will continue to rise globally.

- E-commerce and direct-to-consumer models will expand product reach to new customers.

- Brands will focus on improving taste, texture, and solubility to boost acceptance.

- Innovation in flavors and fortification will attract health-conscious and premium buyers.

- Asia-Pacific will witness the fastest growth due to urbanization and shifting diets.

- Collaborations with fitness and wellness influencers will strengthen brand visibility.

- Sustainability and clean-label certifications will influence purchasing decisions more strongly.

- Technological advancements in processing will lower production costs over time.

- Product launches targeting niche segments like keto and allergen-free consumers will rise.