Market Overview

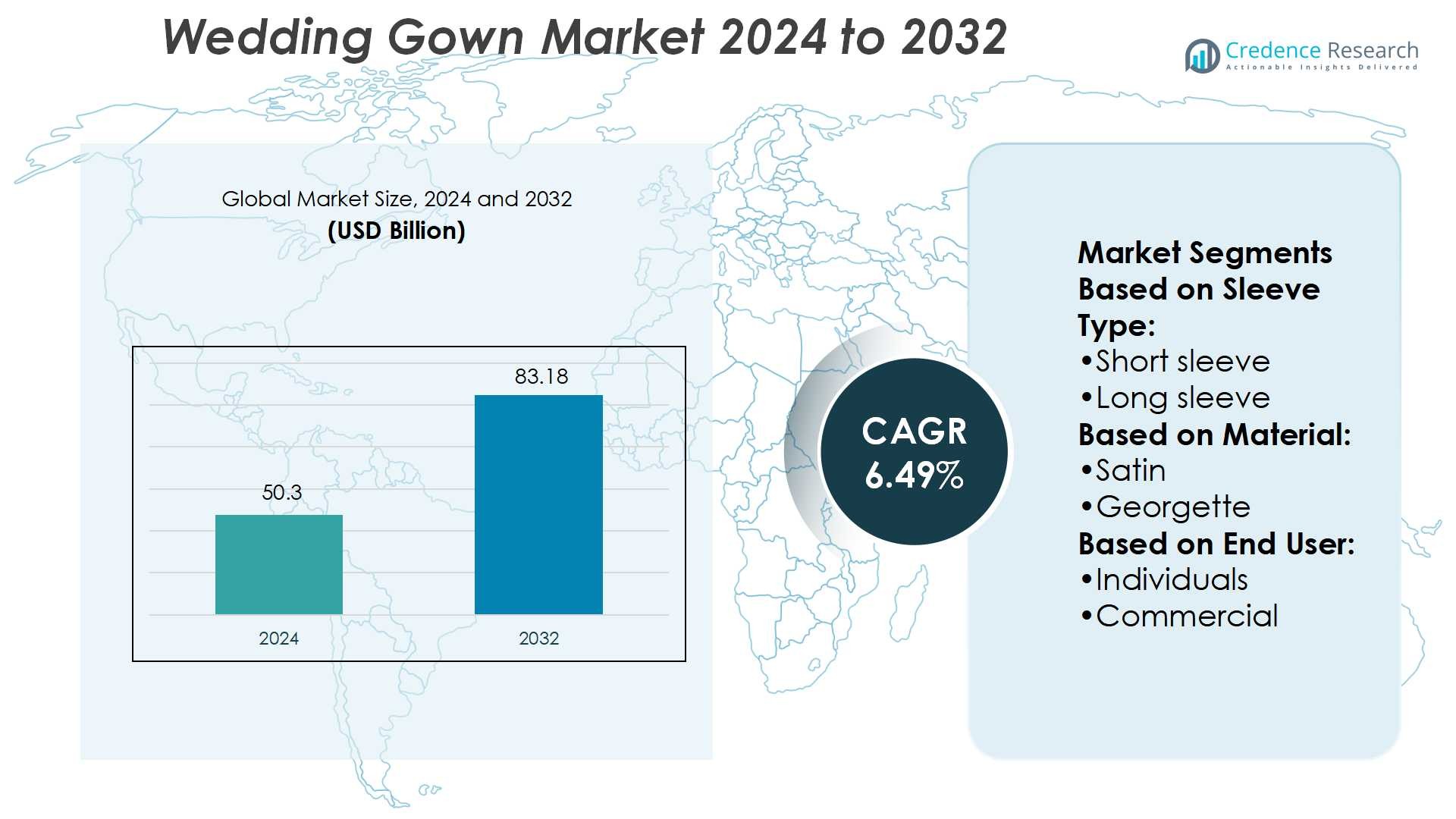

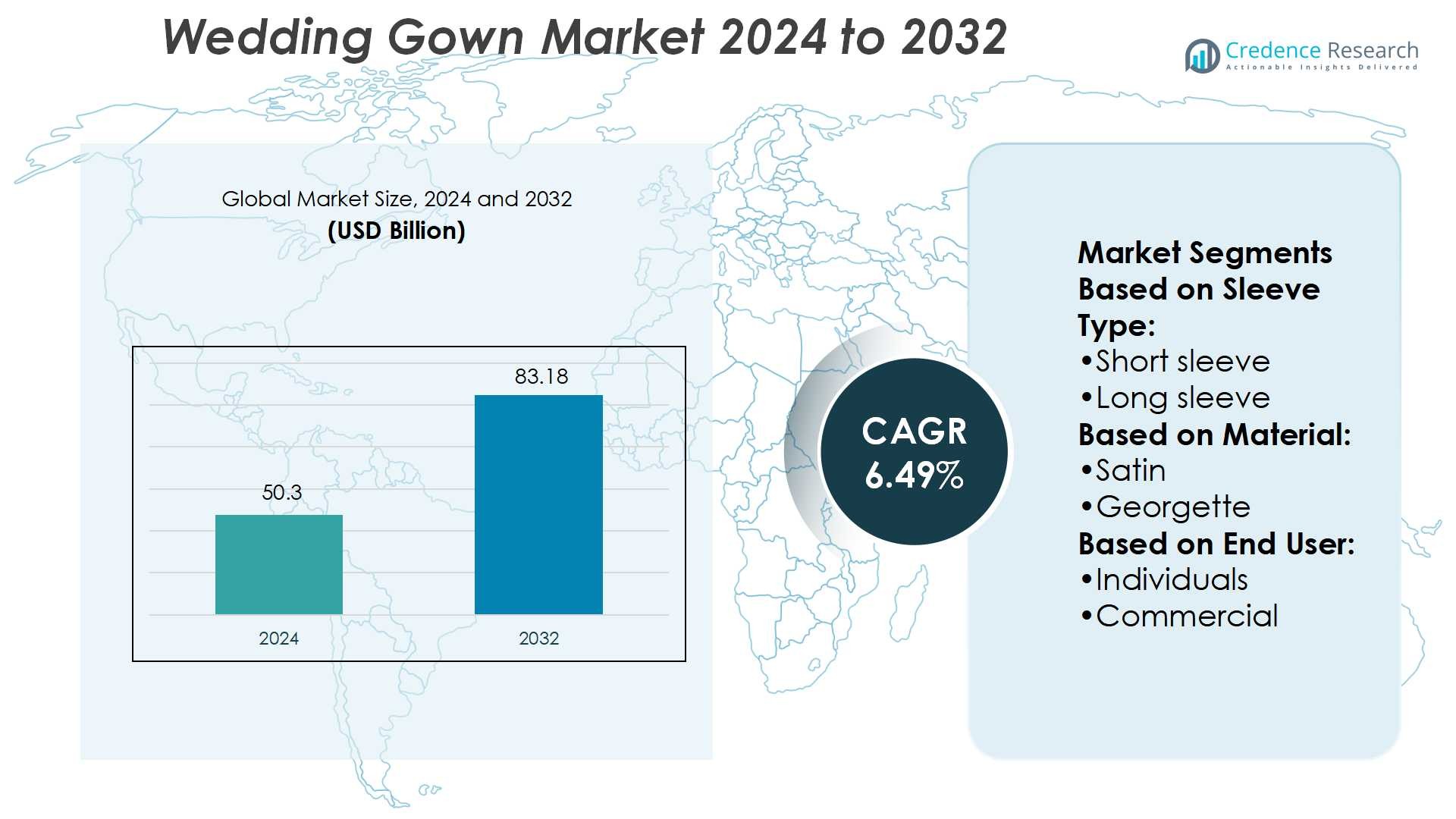

Wedding Gown Market size was valued USD 50.3 billion in 2024 and is anticipated to reach USD 83.18 billion by 2032, at a CAGR of 6.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wedding Gown Market Size 2024 |

USD 50.3 Billion |

| Wedding Gown Market, CAGR |

6.49% |

| Wedding Gown Market Size 2032 |

USD 83.18 Billion |

The wedding gown market is shaped by leading players including Jenny Packham, Maggie Sottero Designs, Hayley Paige, Monique Lhuillier, Marchesa, Allure Bridals, Carolina Herrera, La Spose di Gio, David’s Bridal, and Amsale. These companies compete across luxury, mid-range, and mass-market segments through innovation, design diversity, and strong retail or digital presence. Premium brands emphasize couture craftsmanship and exclusivity, while mass-market retailers focus on affordability and accessibility. North America leads the global market with a 34% share, driven by high consumer spending, strong presence of designer boutiques, and growing influence of celebrity weddings and digital bridal retail platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The wedding gown market size was USD 50.3 billion in 2024 and is projected to reach USD 83.18 billion by 2032, growing at a CAGR of 6.49%.

- Rising demand for customized gowns, sustainable fabrics, and digital shopping platforms are key drivers enhancing market growth.

- Trends include the expansion of online bridal retail, the growth of rental and resale services, and the influence of celebrity weddings shaping consumer choices.

- Competitive intensity remains high, with premium brands focusing on exclusivity while mass-market players emphasize affordability, though high gown prices and market seasonality act as restraints.

- North America leads with a 34% share, followed by Europe at 28% and Asia-Pacific at 25%, while sleeveless gowns dominate the sleeve-type segment and satin remains the leading material choice across global markets.

Market Segmentation Analysis:

By Sleeve Type

Sleeveless gowns hold the dominant share in the wedding gown market. Their popularity stems from versatility across body types and suitability for both modern and traditional designs. Fashion trends emphasizing minimalism and freedom of movement further drive adoption. Designers often highlight sleeveless styles in high-profile bridal collections, reinforcing consumer preference. Demand is also strong in warmer regions, where comfort plays a decisive role. Increasing customization options and availability across premium and mid-range segments continue to sustain the leadership of sleeveless gowns in this category.

- For instance, WeddingWire vendor platform the 280% figure was announced in an official press release from The Knot Worldwide, which owns both The Knot and WeddingWire.

By Material

Satin remains the leading material in the wedding gown market with the highest share. Brides favor satin for its smooth texture, lustrous finish, and elegant drape, making it a staple in luxury bridal fashion. Its ability to hold structured silhouettes like ball gowns and mermaid cuts adds to its dominance. Bridal designers showcase satin gowns in flagship collections, strengthening demand. Additionally, satin’s adaptability to embellishments such as lace overlays and beadwork enhances its appeal. Consistent association with timeless elegance continues to position satin as the top material choice.

- For instance, The Martina Liana style 1362 includes a detachable train, which balances dramatic effect with wearer comfort. The train connects at the back for an ethereal flourish, adding drama to the couture bridal look.

By End-User

Individuals account for the dominant share in the wedding gown market. Direct purchases by brides reflect the personal nature of the decision, as gowns are often customized to meet unique style preferences. Emotional significance and the desire for exclusivity drive this segment ahead of rental or commercial uses. Bridal boutiques and designer stores cater heavily to individual buyers, offering tailored fittings and premium experiences. Growing spending on weddings, particularly in emerging economies, also boosts direct purchases. This segment’s dominance is expected to persist due to cultural and emotional factors tied to weddings.

Key Growth Drivers

Rising Demand for Customized Bridal Wear

Customization is a key growth driver in the wedding gown market as brides increasingly prefer unique, tailored designs that reflect personal style. From bespoke fittings to embroidery and fabric selection, demand for one-of-a-kind gowns is rising globally. Luxury brands and boutique designers are leveraging digital platforms to offer virtual consultations and advanced customization options. This trend is further strengthened by cultural diversity, where regional bridal traditions influence gown designs. The desire for exclusivity and emotional value in weddings continues to accelerate demand for personalized bridal wear.

- For instance, Carolina Herrera’s atelier produced a custom gown for actress Kristen Stewart, which she wore for her role as Bella Swan. The dress featured 152 individually covered fabric buttons along its back and took six months to produce.

Expansion of Online Bridal Retail

E-commerce platforms are transforming the bridal wear industry by offering wide product accessibility, virtual try-ons, and easy price comparisons. Brides now explore global collections online, leading to increased cross-border purchases and exposure to diverse designs. Online bridal retailers also provide flexible payment methods and doorstep delivery, which enhance convenience. Technological tools like 3D fittings and AI-based size recommendations improve the shopping experience. The rising comfort with digital channels among younger consumers is a significant factor fueling online sales of wedding gowns and reshaping traditional retail channels.

- For instance, ProAmpac has launched ProActive Recyclable FibreSculpt, a thermoforming material which boasts over 90% fibre content. The product is compliant with OPRL guidelines in the UK and Ireland.

Influence of Celebrity Weddings and Social Media

Celebrity weddings and social media influence play a vital role in shaping bridal fashion trends. High-profile weddings often set new style benchmarks, leading to spikes in demand for similar designs. Platforms like Instagram and Pinterest serve as inspiration sources where brides visualize gowns before purchase. Designers gain global exposure through viral bridal collections shared online. The aspirational effect of influencer-led bridal fashion drives demand across premium and mid-tier segments. This influence continues to expand as younger consumers heavily rely on social media for wedding planning decisions.

Key Trends & Opportunities

Sustainable and Eco-Friendly Gowns

Sustainability has emerged as a significant trend, with growing interest in eco-friendly fabrics like organic cotton, bamboo, and recycled polyester. Brides are increasingly aware of environmental impact, pushing demand for ethical production practices. Designers are experimenting with biodegradable materials and waste-reducing techniques to align with green initiatives. Brands offering sustainable bridal collections can capture environmentally conscious consumers. This shift presents opportunities for differentiation in a market that has historically focused on luxury and tradition, adding long-term value to eco-friendly wedding gowns.

- For instance, OceanPoly® packaging material contains a minimum of 25% post-consumer plastic waste collected from coastal pollution source areas such as beaches and waterways.

Growth of Rental and Resale Platforms

The rising cost of weddings and changing attitudes toward ownership have boosted rental and resale wedding gown platforms. Brides view rental services as cost-effective while still accessing designer labels. Resale channels provide additional value by enabling post-wedding monetization of gowns. Digital marketplaces and specialized boutiques offering rental packages are expanding in both developed and emerging economies. This trend opens opportunities for businesses to tap into new revenue streams while catering to brides seeking affordability and sustainability without compromising on style or brand recognition.

- For instance, Dow developed RHOBARR™ 320 Polyolefin Dispersion, which is an aqueous dispersion coating that can be applied to paper or board, delivering barrier protection for hot and cold liquid contact while maintaining repulpability.

Integration of Technology in Bridal Fashion

Technology is reshaping the bridal shopping experience through innovations such as augmented reality (AR) fitting rooms, 3D dress visualizations, and AI-driven styling tools. Virtual platforms allow brides to experiment with styles before physical trials, saving time and enhancing convenience. Digital customization tools empower designers to collaborate with clients globally, offering real-time alterations and previews. E-commerce platforms incorporating these technologies improve customer engagement and drive higher conversion rates. The fusion of fashion and technology represents a major opportunity for companies to modernize bridal retail and meet evolving consumer expectations.

Key Challenges

High Cost of Premium Wedding Gowns

The high price of luxury wedding gowns remains a significant barrier for many consumers. Designer gowns often range in thousands of dollars, limiting access to affluent buyers. This creates a challenge for brands to balance exclusivity with affordability while addressing middle-income demand. The rising cost of raw materials and labor further contributes to price escalation. As a result, many brides are exploring rental services or budget-friendly alternatives, forcing premium designers to rethink pricing strategies or introduce secondary collections targeting wider consumer segments.

Seasonal Dependence and Market Saturation

The wedding gown market is highly seasonal, with demand peaking during traditional wedding months. This creates fluctuations in sales and inventory management challenges for retailers. Market saturation, especially in developed regions, adds to competitive pressure as numerous brands offer similar designs. Smaller players struggle to differentiate in a crowded marketplace dominated by established luxury labels. This seasonality and saturation require companies to innovate consistently, expand into new markets, or diversify offerings like rental services to maintain growth and reduce reliance on limited peak wedding seasons.

Regional Analysis

North America

North America holds the leading position in the wedding gown market with a 34% share. The region benefits from high consumer spending on weddings and strong demand for luxury bridal wear. The U.S. dominates due to the presence of prominent designers, established bridal boutiques, and a robust e-commerce landscape. Growing popularity of destination weddings and increasing adoption of customized gowns further support growth. Canada also contributes through rising disposable income and demand for eco-friendly bridal wear. High visibility of celebrity weddings and social media influence continue to reinforce North America’s leadership in the global wedding gown market.

Europe

Europe accounts for 28% of the global wedding gown market, driven by its deep-rooted bridal fashion heritage. Countries like Italy, France, and Spain are home to luxury bridal designers that set international trends. The region emphasizes high-quality fabrics such as lace and satin, strengthening demand for premium gowns. The rise of cultural and themed weddings enhances market diversity across major economies. Western Europe dominates, while Eastern Europe is witnessing growth through expanding middle-class spending. Strong fashion traditions and frequent adoption of sustainable bridal fabrics help Europe maintain its strong share in the global wedding gown industry.

Asia-Pacific

Asia-Pacific represents 25% of the global wedding gown market and is the fastest-growing region. China and India lead growth due to large wedding volumes and rising preference for western-style gowns alongside traditional attire. Increasing urbanization, growing middle-class income, and greater influence of international fashion trends drive demand. Bridal e-commerce platforms in countries like Japan and South Korea further expand accessibility. Cultural shifts toward grand, themed weddings also fuel growth. The rising presence of global bridal brands and expansion of rental services strengthen the region’s position, making Asia-Pacific a dynamic contributor to the wedding gown market.

Latin America

Latin America holds a 7% share of the global wedding gown market, driven by vibrant wedding traditions and rising urban middle-class populations. Brazil and Mexico are the largest contributors, where cultural emphasis on elaborate ceremonies supports strong gown demand. Increasing interest in imported designer labels and expanding local boutiques enhance availability. However, economic volatility and price sensitivity influence consumer choices, making rental and resale platforms attractive alternatives. Growing digital adoption and online bridal retail also improve accessibility across the region. Latin America’s cultural richness and rising consumer aspirations continue to support steady demand in the wedding gown market.

Middle East & Africa

The Middle East & Africa account for 6% of the global wedding gown market, with steady growth driven by cultural significance of weddings. Gulf countries, particularly the UAE and Saudi Arabia, contribute strongly due to high expenditure on luxury bridal wear. Premium designer boutiques and preference for elaborate gowns with intricate embellishments dominate demand. Africa is witnessing gradual growth, supported by increasing urbanization and modern wedding trends. However, limited distribution channels and price sensitivity in certain areas remain challenges. The combination of luxury demand in the Middle East and emerging opportunities in Africa supports future market expansion.

Market Segmentations:

By Sleeve Type:

By Material:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the wedding gown market features leading players such as Jenny Packham, Maggie Sottero Designs, Hayley Paige, Monique Lhuillier, Marchesa, Allure Bridals, Carolina Herrera, La Spose di Gio, David’s Bridal, and Amsale. The competitive landscape of the wedding gown market is defined by a mix of global luxury houses, boutique designers, and mass-market retailers, each targeting different consumer segments. Luxury and couture brands focus on exclusivity, intricate craftsmanship, and celebrity-driven trends, appealing to affluent brides seeking premium experiences. Mid-range labels emphasize affordability while maintaining style and elegance, often blending traditional and modern elements. Mass-market players strengthen their position through wide retail networks, online platforms, and rental or resale services, catering to price-sensitive buyers. Across all segments, sustainability, digital innovation, and customization remain central strategies shaping competition in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jenny Packham

- Maggie Sottero Designs

- Hayley Paige

- Monique Lhuillier

- Marchesa

- Allure Bridals

- Carolina Herrera

- La Spose di Gio

- David’s Bridal

- Amsale

Recent Developments

- In November 2024, Matrimony.com has launched WeddingLoan.com, a fintech platform specifically designed to provide wedding loans. This initiative aims to address the financial challenges faced by couples planning their weddings by offering tailored loan solutions.

- In July 2024, the wedding services startup Meragi successfully raised in a Series A funding round led by Accel, with the aim of enhancing and expanding their innovative wedding planning solutions.

- In July 2024, The Knot Worldwide, a prominent player in the wedding industry, completed the acquisition of an online elopement platform, further diversifying its offerings and expanding its digital services.

- In April 2023, Conrad Pune, Hilton Worldwide’s flagship luxury hotel in India, launched its Wedding Studio, a venue designed for couples seeking customized wedding planning experience.

Report Coverage

The research report offers an in-depth analysis based on Sleeve Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The wedding gown market will continue shifting toward customized and personalized designs.

- Sustainable fabrics and eco-friendly production will gain stronger adoption among designers.

- Online bridal platforms will expand further with advanced virtual try-on technologies.

- Rental and resale services will increase in demand due to affordability and sustainability.

- Premium couture gowns will remain dominant in luxury-focused regions with high spending power.

- Social media and celebrity weddings will drive global fashion trends and consumer choices.

- Emerging markets in Asia-Pacific and Latin America will see accelerated growth in demand.

- Bridal brands will invest more in digital marketing and global e-commerce expansion.

- Hybrid collections combining traditional and modern styles will attract culturally diverse consumers.

- Strategic collaborations between designers and fashion-tech companies will reshape the bridal shopping experience.