Market Overview

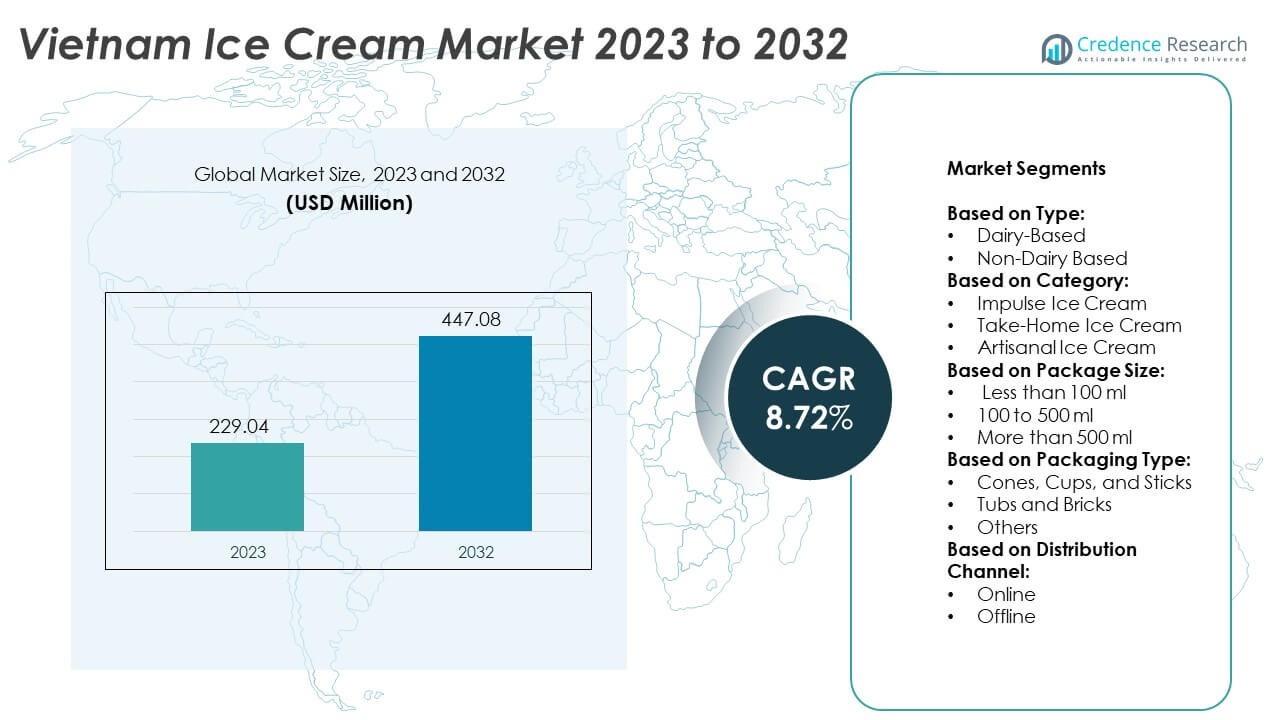

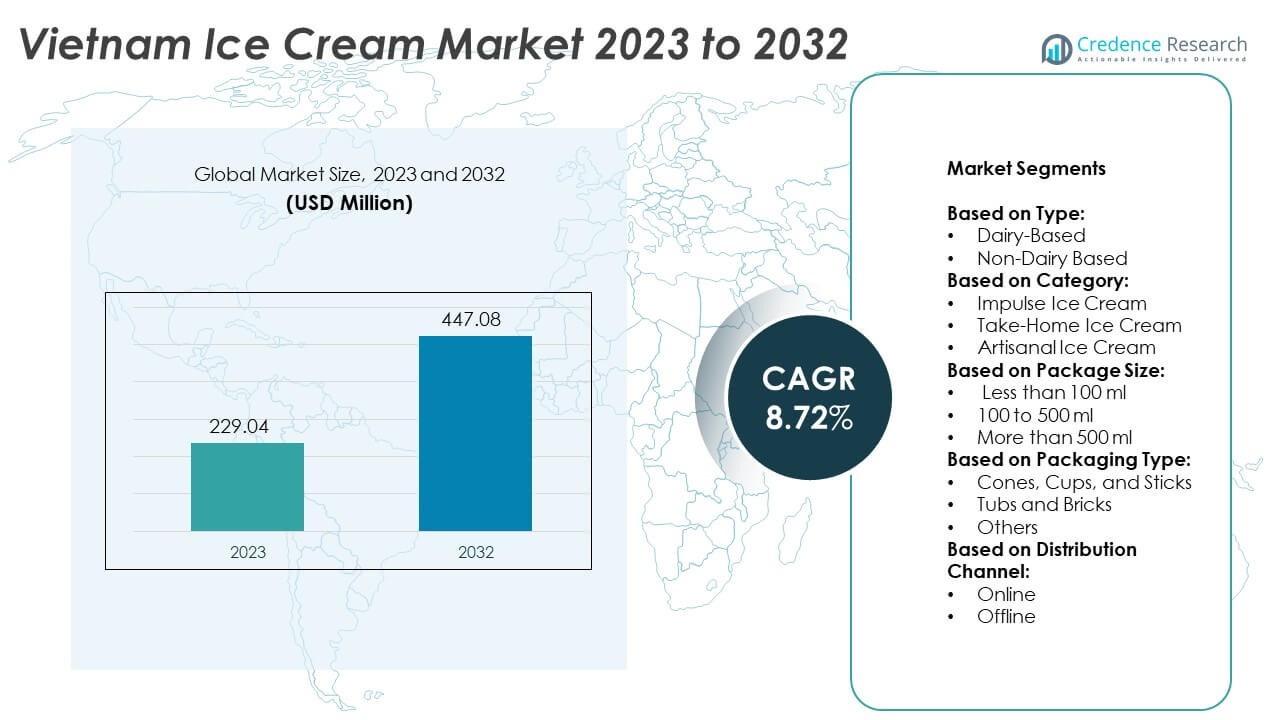

Vietnam Ice Cream Market size was valued at USD 229.04 million in 2024 and is anticipated to reach USD 447.08 million by 2032, at a CAGR of 8.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vietnam Ice Cream Market Size 2024 |

USD 229.04 Million |

| Vietnam Ice Cream Market, CAGR |

8.72% |

| Vietnam Ice Cream Market Size 2032 |

USD 447.08 Million |

The Vietnam Ice Cream market benefits from rising disposable income, urbanization, and growing consumer preference for indulgent and premium frozen treats. It experiences strong demand from younger demographics seeking diverse flavors, convenient formats, and health-oriented options such as low-sugar or plant-based variants. Expansion of modern retail channels, e-commerce platforms, and cold chain infrastructure supports broader product availability across urban and semi-urban regions. Innovation in artisanal and seasonal flavors drives repeat purchases and brand loyalty.

The Vietnam Ice Cream market shows strong regional variation, with Northern and Southern regions leading consumption due to urbanization, higher disposable income, and modern retail penetration. It experiences growing demand in Central Vietnam and emerging rural areas, supported by expanding cold chain infrastructure and tourism-driven sales. Key players such as Vinamilk, Nestlé Vietnam, Unilever Vietnam, and Lotte Confectionery Vietnam actively leverage these regional opportunities through targeted product launches, localized flavors, and enhanced distribution networks. Companies focus on retail, convenience stores, and e-commerce channels to maximize reach. Seasonal promotions and festival campaigns further strengthen engagement across diverse geographic segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Vietnam Ice Cream market was valued at USD 229.04 million in 2023 and is projected to reach USD 447.08 million by 2032, growing at a CAGR of 8.72% during the forecast period.

- Rising disposable income, urbanization, and changing lifestyles drive demand for indulgent and premium ice cream products.

- Consumers increasingly prefer diverse flavors, convenient packaging, and health-focused options such as low-sugar, plant-based, and protein-enriched variants.

- Innovation in artisanal, seasonal, and locally inspired flavors strengthens brand differentiation and encourages repeat purchases.

- Competitive intensity remains high with major players like Vinamilk, Nestlé Vietnam, Unilever Vietnam, and Lotte Confectionery Vietnam focusing on product innovation, promotions, and distribution expansion to capture market share.

- Challenges such as temperature sensitivity, high cold chain infrastructure costs, and price-sensitive consumer segments constrain rapid market growth and operational efficiency.

- Northern and Southern regions lead consumption due to urbanization, retail penetration, and tourism, while Central and rural regions provide growth potential through improved distribution, targeted products, and localized marketing campaigns.

Market Drivers

Rising Disposable Income and Changing Consumer Lifestyles Driving Vietnam Ice Cream Market Growth

The Vietnam Ice Cream market benefits from increasing disposable income among urban consumers, which encourages spending on premium and indulgent food products. Consumers prioritize convenience and enjoyment, leading to higher demand for ready-to-eat ice cream products across retail and foodservice channels. It supports the introduction of diverse product ranges, including gourmet, artisanal, and seasonal flavors. Rising exposure to international brands influences consumer preferences, creating opportunities for imported and local premium ice cream. Retail expansion in supermarkets, convenience stores, and modern trade outlets strengthens accessibility and visibility. The combination of higher purchasing power and lifestyle shifts continues to drive sales across multiple urban centers in Vietnam.

- For instance, Kido Group, Vietnam’s largest domestic ice cream producer, reported selling 90 million liters of ice cream in 2023, marking a significant increase in premium product consumption across urban centers.

Expanding Retail Infrastructure and Distribution Channels Enhancing Market Reach

The growth of modern retail infrastructure in Vietnam supports broader availability of ice cream products across the country. Hypermarkets, supermarkets, and convenience stores provide structured shelf space, enabling brands to target both urban and semi-urban consumers. It allows manufacturers to implement innovative marketing and in-store promotions, increasing product trial and repeat purchases. E-commerce platforms and online food delivery services complement traditional retail, providing direct-to-consumer access and wider reach. Efficient cold chain logistics ensure product quality during storage and transportation. Retail modernization continues to enhance market penetration and consumption frequency.

- For instance, ShopeeFood Vietnam reported ice cream order volume surpassing 1.5 million in 2023, with peak demand during summer months. Efficient cold chain logistics ensure product quality during storage and transportation.

Innovation in Flavors and Product Differentiation Stimulating Consumer Interest

Innovation in flavor development and product differentiation drives consumer engagement in the Vietnam Ice Cream market. Companies introduce local and international flavor variants to cater to diverse tastes, including tropical fruits, chocolate blends, and premium nut combinations. It encourages repeat purchases and strengthens brand loyalty. Packaging innovations that enhance portability, portion control, and visual appeal further attract younger demographics. Health-focused options, such as low-sugar or dairy-free products, respond to emerging consumer awareness of nutrition. Continuous product innovation positions brands competitively in the dynamic ice cream landscape.

Promotional Campaigns and Brand Visibility Boosting Market Demand

Marketing and promotional campaigns play a significant role in expanding Vietnam Ice Cream market demand. Targeted advertising across digital, social, and traditional media increases consumer awareness and drives trial purchases. It supports seasonal campaigns and festival-related promotions, which generate spikes in consumption. Collaborations with retail chains, foodservice operators, and influencers strengthen brand recognition. Loyalty programs and limited-edition offerings enhance consumer engagement and retention. Sustained investment in brand visibility reinforces market presence and drives long-term growth.

Market Trends

Rising Demand for Premium and Artisanal Ice Cream Driving Market Evolution

The Vietnam Ice Cream market demonstrates strong growth in premium and artisanal segments due to shifting consumer preferences toward high-quality and unique offerings. Consumers increasingly seek indulgent experiences, encouraging brands to introduce gourmet flavors and creative combinations. It supports differentiation through limited-edition products, seasonal specialties, and collaborations with culinary experts. Premium packaging enhances perceived value and attracts urban consumers. Retailers highlight these products in dedicated sections to boost visibility. This trend strengthens brand positioning and encourages repeat purchases.

- For instance, Unilever Vietnam sold 5 million low-sugar units of Wall’s and Magnum ice cream in the first six months, demonstrating the impact of targeted promotions and product visibility.

Expansion of Health-Conscious and Functional Ice Cream Options Shaping Consumer Choices

Health awareness influences trends in the Vietnam Ice Cream market, prompting the launch of low-sugar, reduced-fat, and dairy-free variants. Consumers seek indulgence without compromising nutritional goals, leading companies to adopt plant-based ingredients and natural sweeteners. It enables broader adoption among fitness-focused and diet-sensitive segments. Fortified products with vitamins, protein, or probiotics gain traction, offering functional benefits. Retailers emphasize nutritional labeling and health claims to build trust. The trend drives innovation in formulation and encourages diversified product portfolios.

- For instance, TH True Milk introduced 1.2 million liters of its plant-based coconut milk ice cream, targeting lactose-intolerant and health-conscious consumers. It enables broader adoption among fitness-focused and diet-sensitive segments. Fortified products with vitamins, protein, or probiotics gain traction, offering functional benefits.

Digital Engagement and E-Commerce Platforms Enhancing Market Reach

E-commerce growth and digital marketing campaigns redefine distribution and consumer engagement in the Vietnam Ice Cream market. Online grocery platforms, delivery apps, and social media channels enable brands to reach urban and semi-urban consumers efficiently. It facilitates direct-to-consumer sales, pre-orders for seasonal flavors, and rapid response to demand fluctuations. Social media campaigns, influencer collaborations, and interactive promotions increase brand awareness. Data analytics help companies track consumer preferences and optimize product offerings. This trend accelerates market penetration and strengthens customer loyalty.

Introduction of Innovative Flavors and Experiences Boosting Market Appeal

Innovation in flavors and experiential offerings remains a key trend in the Vietnam Ice Cream market. Companies experiment with fusion flavors, local fruits, and international dessert inspirations to attract adventurous consumers. It encourages product trial and drives social media buzz. In-store experiences, pop-up events, and tasting sessions create immersive engagement. Packaging innovations that enhance convenience and aesthetics complement product creativity. Retailers and brands continuously monitor emerging trends to stay competitive. This trend supports sustained growth and brand differentiation.

Market Challenges Analysis

High Sensitivity to Temperature Fluctuations and Supply Chain Constraints Limiting Market Expansion

The Vietnam Ice Cream market faces challenges due to temperature sensitivity and reliance on robust cold chain infrastructure. Maintaining product integrity during transportation and storage requires continuous investment in refrigeration and logistics management. It increases operational costs for manufacturers, distributors, and retailers. Limited cold storage facilities in semi-urban and rural areas restrict market penetration. Seasonal demand fluctuations create pressure on inventory management and distribution efficiency. Suppliers must ensure timely delivery to avoid spoilage and product loss. These constraints hinder consistent availability and limit expansion into less-developed regions.

Intense Competition and Price Sensitivity Affecting Profit Margins and Brand Positioning

Competition in the Vietnam Ice Cream market remains high, with numerous local and international players offering diverse products at varying price points. It pressures companies to balance quality, innovation, and cost-effectiveness to maintain consumer loyalty. Price-sensitive segments often prioritize affordability over premium features, reducing opportunities for high-margin products. Brand differentiation requires continuous marketing investment, promotional campaigns, and product innovation. Smaller manufacturers face challenges competing with well-established brands in visibility and distribution reach. Market consolidation and aggressive pricing strategies by major players intensify competitive pressure. These factors collectively constrain profitability and strategic growth opportunities.

Market Opportunities

Expansion into Untapped Rural and Emerging Urban Areas Creating Growth Potential

The Vietnam Ice Cream market presents opportunities through expansion into rural and emerging urban regions where consumption remains underdeveloped. It allows manufacturers and distributors to reach new consumer bases with tailored products and affordable options. Investment in cold chain infrastructure and local partnerships can improve accessibility and maintain product quality. Introducing smaller packaging sizes and convenient formats can cater to price-sensitive and on-the-go consumers. Regional festivals and local events provide platforms for promotional campaigns and product sampling. Targeting these areas can diversify revenue streams and strengthen brand presence across the country.

Introduction of Innovative Products and Health-Focused Variants Driving Consumer Engagement

Innovation in flavors, formats, and health-oriented offerings continues to create opportunities in the Vietnam Ice Cream market. Companies can leverage consumer interest in premium, artisanal, and functional ice creams to differentiate their portfolios. It supports product diversification, including plant-based, low-sugar, and fortified options to attract health-conscious and younger consumers. Collaborations with local suppliers and culinary experts enable unique and culturally relevant flavors. E-commerce platforms and digital marketing campaigns can enhance visibility and drive direct-to-consumer sales. Continuous product innovation fosters brand loyalty and positions companies for long-term market growth.

Market Segmentation Analysis:

By Type:

The Vietnam Ice Cream market demonstrates strong demand for dairy-based products due to their rich taste, creamy texture, and widespread consumer acceptance. It drives growth in both retail and foodservice channels, particularly in urban centers. Non-dairy ice cream gains traction among health-conscious consumers, lactose-intolerant individuals, and those seeking plant-based alternatives. Manufacturers introduce options made from soy, almond, coconut, and oat milk to cater to evolving dietary preferences. Product differentiation through flavor innovation and nutritional enhancements strengthens adoption across multiple consumer segments.

- For instance, Nestlé Vietnam produced 3.8 million liters of dairy-based ice cream, supplying supermarkets and convenience stores across Ho Chi Minh City and Hanoi. Non-dairy ice cream gains traction among health-conscious consumers, lactose-intolerant individuals, and those seeking plant-based alternatives

By Category:

Impulse ice cream continues to capture high-volume sales in convenience stores, kiosks, and street vendors, driven by on-the-go consumption and spontaneous purchase behavior. It supports smaller portion sizes and attractive packaging to appeal to younger demographics. Take-home ice cream remains popular among families, providing larger servings and variety packs for home consumption. It encourages repeat purchases and brand loyalty through seasonal flavors and multipack offerings. Artisanal ice cream represents a premium segment in the market, targeting consumers seeking unique flavors, natural ingredients, and gourmet experiences. It supports differentiation and enhances brand prestige.

- For instance, Baskin Robbins Vietnam produced 1.9 million multi-flavor packs of 500 ml ice cream in, encouraging repeat purchases and brand loyalty. Artisanal ice cream represents a premium segment in the market, targeting consumers seeking unique flavors, natural ingredients, and gourmet experiences.

By Packet Size:

Smaller packages under 100 ml cater to impulse buyers and children, promoting trial and convenience. It allows retailers to maintain affordable price points and quick turnover. Packages ranging from 100 to 500 ml dominate family consumption and single-household usage, balancing affordability and serving size. Products over 500 ml attract bulk buyers and frequent consumers, including larger households and specialty outlets. It encourages promotional offers and multi-flavor packs to increase consumer engagement. Package size segmentation enables companies to target diverse consumption occasions and maximize market penetration.

Segments:

Based on Type:

- Dairy-Based

- Non-Dairy Based

Based on Category:

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

Based on Package Size:

- Less than 100 ml

- 100 to 500 ml

- More than 500 ml

Based on Packaging Type:

- Cones, Cups, and Sticks

- Tubs and Bricks

- Others

Based on Distribution Channel:

Based on the Geography:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

- Mekong Delta and Rural Regions

Regional Analysis

Northern Vietnam

Northern Vietnam holds a significant portion of the Vietnam Ice Cream market, accounting for 38% of total consumption. Urban centers such as Hanoi drive demand due to higher disposable income, exposure to international food trends, and modern retail penetration. It supports both premium and mass-market segments, with retail chains, convenience stores, and foodservice outlets contributing to distribution. Seasonal variations in temperature influence sales, with warmer months witnessing higher purchases of impulse ice cream. Manufacturers focus on localized flavors and promotions to capture consumer attention. Expansion in semi-urban areas further strengthens market penetration and brand visibility.

Central Vietnam

Central Vietnam accounts for 22% of the Vietnam Ice Cream market, driven by growing urbanization in cities like Da Nang and Hue. It experiences steady demand through supermarkets, local retail stores, and tourism-driven sales in coastal regions. Ice cream consumption benefits from increasing disposable income and rising preference for on-the-go and take-home products. It encourages manufacturers to diversify flavor offerings and packaging formats to appeal to varied consumer preferences. Local events, festivals, and beach tourism create opportunities for impulse purchases. Efficient cold chain infrastructure remains critical to maintain product quality across this region.

Southern Vietnam

Southern Vietnam represents the largest share of the Vietnam Ice Cream market at 40%, primarily due to Ho Chi Minh City and surrounding industrial hubs. It benefits from high population density, rising middle-class spending, and strong presence of modern retail and e-commerce channels. It supports premium, artisanal, and non-dairy product segments, responding to sophisticated consumer preferences. Tourism, nightlife, and recreational activities further boost seasonal and impulse consumption. Retailers emphasize promotional campaigns and limited-edition products to capture attention. Continuous investment in cold chain logistics ensures widespread availability and consistent product quality.

Mekong Delta and Rural Regions

The Mekong Delta and rural regions account for 10% of the Vietnam Ice Cream market, reflecting growing but still emerging demand. It focuses primarily on affordable, small-package ice cream and local flavors tailored to regional tastes. Limited cold chain infrastructure and dispersed retail channels constrain rapid market expansion. Manufacturers leverage local distributors and small retail outlets to improve access and visibility. Seasonal spikes during festivals and agricultural cycles present opportunities for temporary demand growth. Expanding distribution networks and introducing cost-effective packaging can enhance penetration in these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nestlé Vietnam

- Baskin Robbins Vietnam

- Lotte Confectionery Vietnam

- Vinamilk

- Fanny Ice Cream

- Haagen-Dazs Vietnam

- Kido Group (KDC)

- Tràng Tiền Ice Cream

- TH True Milk

- Unilever Vietnam

Competitive Analysis

Key players in the Vietnam Ice Cream market include Nestlé Vietnam, Baskin Robbins Vietnam, Lotte Confectionery Vietnam, Vinamilk, Fanny Ice Cream, Haagen-Dazs Vietnam, Kido Group (KDC), Tràng Tiền Ice Cream, TH True Milk, and Unilever Vietnam.The market remains highly competitive, with domestic and international brands competing on product innovation, flavor diversity, and distribution reach. Companies focus on premium, artisanal, and health-oriented offerings to differentiate themselves and capture emerging consumer segments. It emphasizes quality, packaging, and seasonal promotions to drive brand loyalty. Retail and modern trade channels serve as primary platforms for visibility and sales, while e-commerce adoption strengthens direct-to-consumer engagement. Price competitiveness in mass-market segments challenges smaller players, compelling continuous marketing and product development investments.Innovation in flavors and formats remains a core strategy to attract younger and urban consumers. It leverages local tastes, limited-edition releases, and collaborations with culinary experts to sustain interest. Expansion into semi-urban and rural regions offers growth opportunities for companies with established cold chain infrastructure. The presence of established global brands intensifies competition, forcing local players to enhance operational efficiency and brand positioning. Overall, strategic differentiation, robust distribution, and targeted marketing define the competitive landscape of the Vietnam Ice Cream market.

Recent Developments

- In April 2025, Vinamilk introduced a line of low-sugar and high-protein ice cream variants to address the growing health-conscious segment.

- In April 2024, Unilever’s Magnum brand introduced the Magnum Pleasure Express, a trio of mood-inspired ice cream flavors that represent a significant innovation for the brand. The three new Magnum Pleasure Express flavors are Magnum Euphoria, a lemon ice cream with a raspberry sorbet core and white chocolate shell with popping candy; Magnum Wonder, toffee-flavored ice cream with a dated core, golden chocolate, and caramelized almonds; and Magnum Chill, a vegan option with vanilla-biscuit ice cream, blueberry sorbet core, cookie pieces, and vegan chocolate couverture. The launch of these ice creams is part of a comprehensive multi-channel customer journey, supported by Magnum’s award-winning advertisements and a media campaign featuring Magnum enthusiasts boarding the ‘Pleasure Express’ train.

- In April 2024, Cold Stone Creamery launched a limited-time offering called the Waffle Ice Cream Taco, available exclusively from April 30 to May 5, 2024, at its stores nationwide. This unique creation features Sweet Cream Ice Cream within a freshly made waffle taco shell, coated with rich chocolate and sprinkled with crunchy peanuts.

- In February 2024, Nestlé announced its 2024 range of sharing bags inspired by popular ice cream flavors. The new selection includes Aero Melts, a Neapolitan flavor, Munchies Cookie Dough Ice Cream, Raspberry Ripple, Milkybar Buttons, and ice cream-shaped Rowntree’s Randoms Foamies.

Market Concentration & Characteristics

The Vietnam Ice Cream market exhibits a moderately concentrated structure, with a mix of established domestic and international players driving competition. It is characterized by a combination of premium, artisanal, and mass-market offerings that cater to diverse consumer preferences across urban and semi-urban regions. Leading companies such as Vinamilk, Nestlé Vietnam, and Unilever Vietnam leverage strong brand recognition, extensive distribution networks, and innovative product portfolios to maintain market presence. It emphasizes differentiation through flavor innovation, health-oriented formulations, and seasonal promotions. Small and regional players focus on niche flavors and localized products to capture specific consumer segments. Retail chains, convenience stores, and e-commerce platforms serve as primary sales channels, supported by investments in cold chain infrastructure to ensure product quality. It responds to evolving consumer trends, including demand for plant-based options, low-sugar variants, and unique artisanal experiences. The market’s characteristics include high consumer engagement during festivals, summer months, and tourism seasons, creating seasonal spikes in sales. Strategic partnerships, limited-edition releases, and targeted marketing campaigns remain critical for maintaining competitive advantage. Overall, the Vietnam Ice Cream market combines brand-driven dominance with opportunities for niche innovation, reflecting a dynamic environment where quality, accessibility, and consumer-focused differentiation determine success.

Report Coverage

The research report offers an in-depth analysis based on Type, Category, Package Size, Packaging Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Vietnam Ice Cream market will witness sustained growth driven by urbanization and changing consumer lifestyles.

- Demand for premium, artisanal, and health-focused ice cream products will increase.

- Plant-based and low-sugar ice cream options will gain wider adoption among health-conscious consumers.

- Innovation in local and seasonal flavors will continue to attract repeat purchases and brand loyalty.

- E-commerce and online delivery channels will expand market reach and convenience for consumers.

- Cold chain infrastructure development will enhance distribution efficiency across urban and semi-urban regions.

- Small and regional players will leverage niche flavors and localized products to capture specific segments.

- Retail chains and modern trade outlets will remain primary sales channels, complemented by convenience stores.

- Seasonal promotions and festival-driven campaigns will continue to boost short-term sales peaks.

- Strategic collaborations, limited-edition offerings, and targeted marketing will strengthen competitive positioning.