| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vietnam Office Market Size 2024 |

USD 18,442.05 Million |

| Vietnam Office Market, CAGR |

8.40% |

| Vietnam Office Market Size 2032 |

USD 49,673.82 Million |

Market Overview

Vietnam Office Market size was valued at USD 12,200.00 million in 2018 to USD 18,442.05 million in 2024 and is anticipated to reach USD 49,673.82 million by 2032, at a CAGR of 13.32% during the forecast period.

Rising foreign investment, robust economic growth, and the expanding presence of multinational corporations continue to drive demand for premium office space in Vietnam. Rapid urbanization, a thriving startup ecosystem, and the development of the technology and financial sectors support sustained absorption rates, especially in key urban centers like Ho Chi Minh City and Hanoi. Flexible workspace solutions and coworking models gain popularity among both domestic and international firms seeking agility and cost efficiency. Key trends include the shift toward green and sustainable office buildings, increased adoption of smart building technologies, and heightened expectations for health and safety features in response to evolving workforce needs. The growing influence of remote and hybrid work models is shaping office design, leading to a focus on collaborative spaces and amenities that enhance tenant experience. As Vietnam’s business landscape matures, the office market remains dynamic, fueled by innovation, changing corporate priorities, and ongoing infrastructure upgrades.

The geographical analysis of the Vietnam Office Market highlights the concentration of high-quality office developments in key urban centers such as Ho Chi Minh City and Hanoi, where robust economic activity and strong demand for premium spaces drive continuous investment in new projects. These cities act as primary business hubs, attracting multinational corporations and domestic enterprises seeking modern office environments with advanced amenities and strategic locations. Da Nang is also emerging as an important regional player, offering opportunities for expansion beyond traditional metropolitan areas. Among the leading companies shaping the competitive landscape are Vin Group, Novaland Group, and Dat Xanh Group, each recognized for their extensive real estate portfolios and commitment to innovative office developments. International firms like JLL further strengthen the market by providing property management and consultancy services, supporting ongoing growth and professionalization within Vietnam’s dynamic office sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Vietnam Office Market is projected to grow from USD 18,442.05 million in 2024 to USD 49,673.82 million by 2032, reflecting a CAGR of 13.32%.

- Strong economic growth and rising foreign direct investment are driving demand for modern office spaces in major urban centers.

- Flexible workspaces, smart building technologies, and green-certified offices are key trends shaping new office developments.

- Leading players such as Vin Group, Novaland Group, and Dat Xanh Group dominate the competitive landscape with extensive portfolios and ongoing investment in premium properties; JLL provides international expertise in property management and consultancy.

- Supply-demand imbalances in certain segments and rising land and construction costs present notable market restraints, challenging developers to maintain profitability and efficient project delivery.

- Southeast Vietnam, led by Ho Chi Minh City, remains the primary hub for office space, while Hanoi in Northern Vietnam and Da Nang in Central Vietnam are rapidly growing as alternative business destinations.

- The market outlook remains positive, fueled by infrastructure development, regulatory reforms, and evolving tenant expectations for flexible leasing terms, advanced amenities, and sustainable work environments.

Report Scope

This report segments the Vietnam Office Market as follows:

Market Drivers

Economic Expansion and Increased Foreign Investment Stimulate Market Growth

The Vietnam Office Market benefits from robust economic expansion and an influx of foreign direct investment. Consistent GDP growth attracts multinational corporations seeking new regional headquarters and operational bases. It welcomes global enterprises looking for strategic access to Southeast Asia’s supply chain and consumer markets. Favorable government policies and trade agreements enhance Vietnam’s appeal, encouraging businesses to establish long-term operations. Investment from sectors such as finance, technology, and manufacturing spurs demand for modern office spaces. Ho Chi Minh City and Hanoi remain primary destinations for international and domestic investors targeting premium locations. The market’s ongoing growth trajectory reflects Vietnam’s rising profile in the global business environment.

For instance, Hanoi led the country in attracting foreign investment in the first half of 2023, with over $13.43 billion in newly registered and adjusted capital.

Urbanization and Demographic Shifts Drive Demand for Modern Office Spaces

Urbanization in major Vietnamese cities continues to transform the real estate landscape. Rapid population growth and migration to urban centers create a vibrant environment for office development. The Vietnam Office Market sees strong demand for Grade A and Grade B office buildings, particularly from expanding domestic firms and multinational organizations. Young and skilled workforce demographics support the country’s competitiveness, making it an attractive destination for international companies. Infrastructure development projects, including transportation upgrades and urban planning initiatives, contribute to the supply of high-quality office space. Developers invest in smart buildings and sustainable design to attract discerning tenants. The market evolves in response to shifting demographics and urban expansion.

For instance, urban areas contribute over 50% of Vietnam’s GDP and generate approximately 80% of industrial and service jobs.

Technology Adoption and the Rise of Flexible Workspace Solutions

Technology plays a pivotal role in shaping the Vietnam Office Market, driving demand for flexible and innovative workspace solutions. The growth of the digital economy and startup culture stimulates interest in coworking spaces and serviced offices. Businesses prioritize agility and scalability, choosing flexible leasing models to adapt to market fluctuations. It responds by offering smart building management, high-speed connectivity, and digital amenities tailored to modern tenants. Companies value integrated technology infrastructure to enhance productivity and employee satisfaction. The adoption of PropTech solutions streamlines operations for landlords and occupiers alike. The market’s technology-driven transformation meets evolving business needs.

Focus on Sustainability, Health, and Wellness in Modern Office Design

Sustainability and employee well-being emerge as critical factors in the Vietnam Office Market. Developers incorporate green building standards and eco-friendly materials to meet global sustainability benchmarks. Corporate tenants seek office environments that promote health, productivity, and safety, prompting investments in advanced HVAC, touchless systems, and wellness-focused amenities. The emphasis on healthy workspaces grows in response to changing workforce expectations. It attracts forward-thinking companies committed to environmental responsibility and corporate social responsibility. Certification programs such as LEED and WELL gain traction among new and existing developments. The pursuit of sustainability and well-being shapes the future of office real estate in Vietnam.

Market Trends

Growing Preference for Flexible Workspace and Coworking Models

A significant trend shaping the Vietnam Office Market is the increasing adoption of flexible workspace solutions and coworking models. It responds to evolving business needs by offering agile leasing terms and customizable office layouts. Startups, SMEs, and multinational firms value the scalability and cost-efficiency these spaces provide, leading to rapid expansion of domestic and international coworking brands in key cities. Operators focus on amenities such as collaborative zones, event spaces, and community engagement initiatives to attract a diverse tenant base. Demand remains high in urban centers, where office flexibility supports dynamic workforce requirements. Flexible workspaces also allow companies to adapt quickly to economic shifts. The Vietnam Office Market adapts to these trends by fostering innovation in workspace design and service delivery.

For instance, the Vietnamese coworking market is growing exponentially, with post-pandemic transformations accelerating the shift toward flexible workspaces.

Increased Integration of Technology and Smart Office Features

Technology integration defines the next phase of evolution for the Vietnam Office Market. It embraces digital transformation through advanced building management systems, high-speed connectivity, and IoT-enabled solutions. Landlords and developers prioritize the adoption of PropTech to enhance operational efficiency and tenant experience. Smart offices feature automated access control, intelligent lighting, and digital platforms that streamline communication between occupants and building managers. The market sees a growing emphasis on data-driven insights to optimize space utilization and maintenance. Tenant expectations for seamless connectivity and digital amenities drive competition among office providers. The Vietnam Office Market maintains its relevance by investing in technology-driven enhancements.

For instance, smart office solutions in Vietnam are increasingly incorporating IoT devices, automation systems, and intelligent sensors to optimize space utilization and energy consumption.

Emphasis on Sustainability and Green Building Certifications

Sustainability emerges as a central trend in the Vietnam Office Market, reflecting global priorities for environmental responsibility. Developers pursue green building certifications such as LEED and WELL, using eco-friendly materials and energy-efficient systems. Occupiers increasingly seek offices that align with corporate social responsibility goals, prompting demand for sustainable features like solar panels, efficient HVAC, and water conservation systems. It supports tenant attraction and retention by promoting healthy and eco-conscious work environments. Sustainable design also provides cost savings over the long term, reinforcing its value proposition for both landlords and occupiers. The Vietnam Office Market positions itself as a leader in sustainable real estate development.

Evolving Tenant Expectations for Health, Safety, and Well-Being

Tenant expectations for health, safety, and well-being have intensified in the Vietnam Office Market. It incorporates advanced air filtration, touchless technologies, and wellness amenities into modern office buildings. Organizations prioritize spaces that support employee productivity, comfort, and mental health, driving innovation in workspace design. The market’s response includes the provision of green spaces, relaxation areas, and ergonomic furniture to enhance workplace satisfaction. Health-focused initiatives extend to flexible work arrangements, allowing occupiers to create adaptive environments for hybrid teams. Building certifications centered on wellness standards gain popularity among premium developments. The Vietnam Office Market evolves to meet rising standards for holistic employee well-being.

Market Challenges Analysis

Supply-Demand Imbalance and Rising Development Costs Impact Market Stability

The Vietnam Office Market faces persistent challenges related to supply-demand imbalance, especially in major urban centers. It often experiences periods of oversupply in the Grade B and C segments, leading to downward pressure on rental yields for less competitive properties. High demand for Grade A office space outpaces new supply, causing vacancy rates to diverge between premium and secondary properties. Developers contend with escalating land acquisition and construction costs, which complicate project feasibility and profit margins. Limited availability of prime land in city centers further intensifies competition among new entrants. Navigating regulatory complexities can slow the approval process for new developments. The market’s ability to balance growth with sustainable supply remains a central concern for stakeholders.

For instance, Ho Chi Minh City recorded the highest office space absorption rate in a decade in Q1 2025, signaling strong tenant demand despite vacancy rates remaining in double digits.

Evolving Workplace Preferences and Economic Uncertainties Create Strategic Risks

Changing workplace preferences and global economic uncertainties pose additional challenges for the Vietnam Office Market. It must adapt to new tenant expectations for flexible leasing, hybrid work models, and enhanced digital infrastructure. Unpredictable shifts in occupier demand may complicate long-term planning for developers and investors. Economic headwinds such as inflation, currency volatility, or global trade disruptions can dampen investor sentiment and delay new projects. The market faces pressure to deliver high-value amenities while containing operational costs, putting margins under scrutiny. Increased competition from coworking and flexible workspace providers also affects traditional landlords. Addressing these evolving risks is critical to maintaining the Vietnam Office Market’s competitive edge and long-term growth prospects.

Market Opportunities

Expansion of Premium Office Spaces and International Investment Attracts New Entrants

The Vietnam Office Market presents significant opportunities for expansion in the premium office segment, particularly in fast-growing urban centers. It draws the attention of multinational corporations and regional headquarters looking for high-quality office environments. Developers can capitalize on rising demand by delivering Grade A office buildings that offer advanced amenities, sustainable features, and modern design. Foreign investment inflows, supported by Vietnam’s stable economic outlook and favorable regulatory climate, provide fresh capital for innovative office projects. Opportunities exist for joint ventures and strategic partnerships with global real estate firms seeking to enter the Vietnamese market. Strong tenant demand for premium office space allows investors to achieve attractive yields and long-term value appreciation. The market remains positioned to attract new entrants focused on quality and innovation.

Growing Demand for Flexible Workspaces and Tech-Enabled Office Solutions

Rising interest in flexible workspace models and technology-enabled office environments opens new avenues for growth in the Vietnam Office Market. It can benefit from serving startups, SMEs, and multinational companies seeking agility through coworking spaces, serviced offices, and short-term leasing options. Technology adoption offers a competitive edge, enabling landlords to integrate smart building management systems and digital tenant services. Tenants increasingly value adaptable workspaces that support hybrid work arrangements and foster collaboration. There are opportunities to leverage PropTech for operational efficiency and enhanced tenant experience. The evolving needs of the modern workforce create strong demand for innovative, tech-forward office solutions. The market’s ability to deliver flexibility and connectivity will shape its future trajectory.

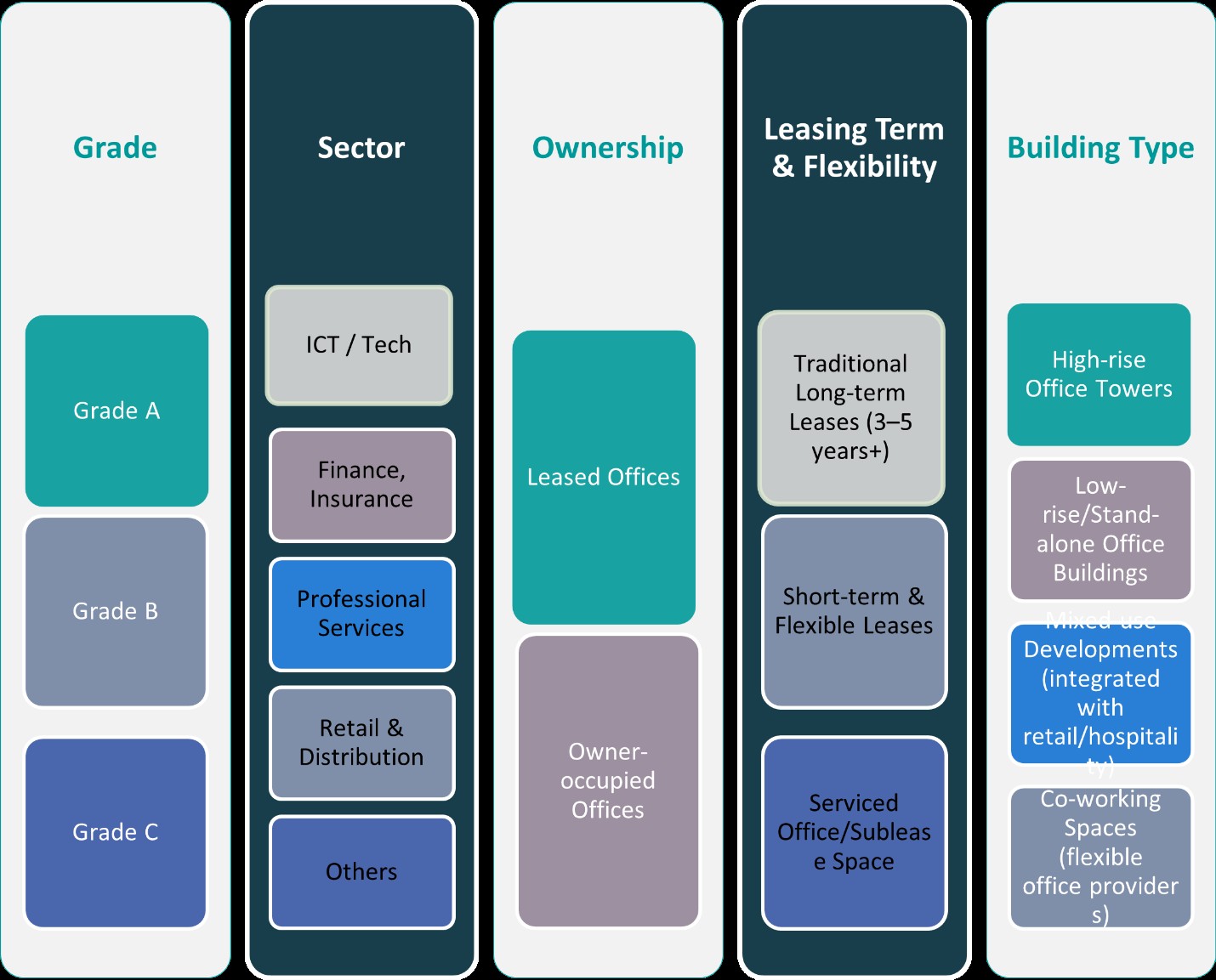

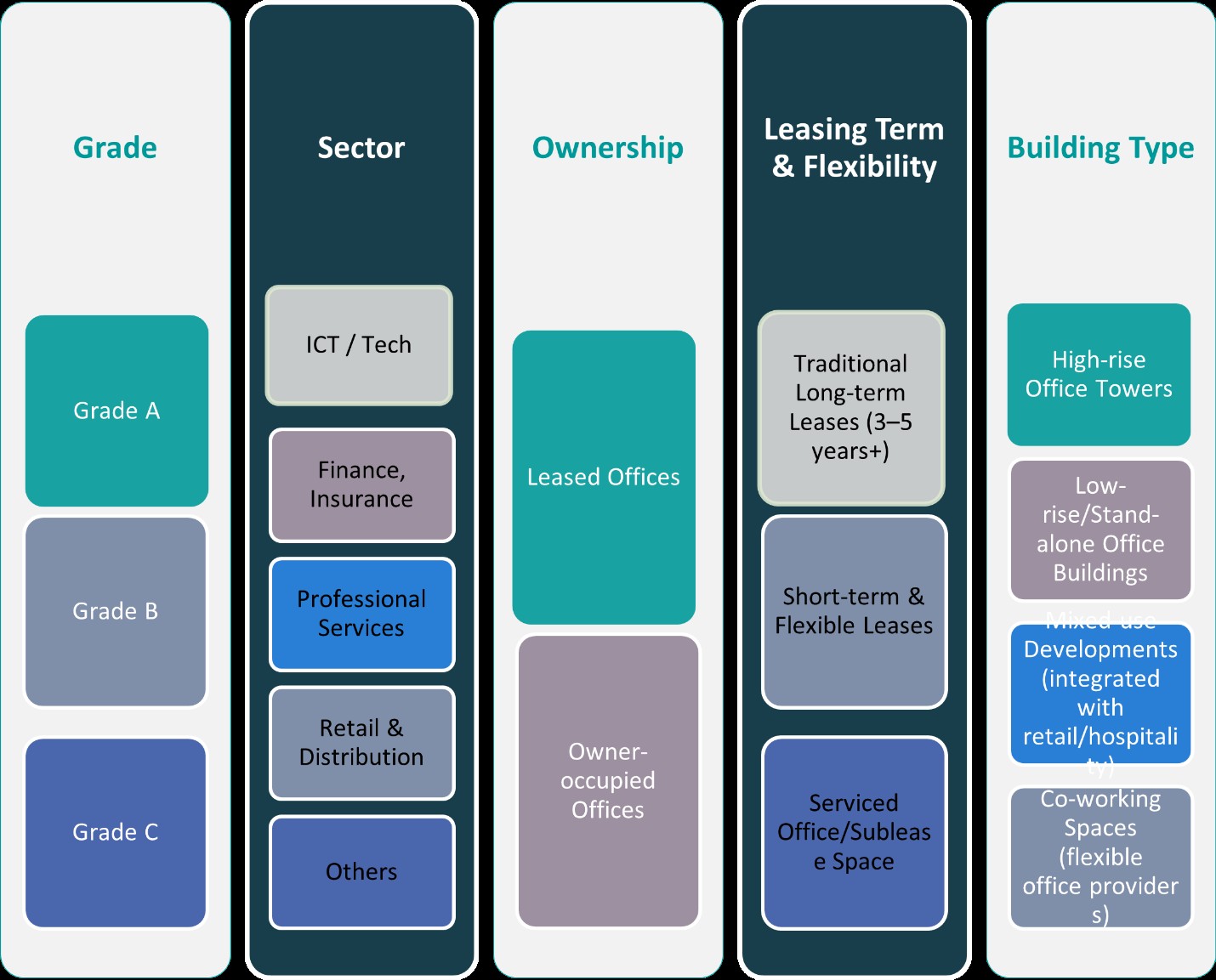

Market Segmentation Analysis:

By Grade:

The Vietnam Office Market demonstrates a clear hierarchy across Grade A, Grade B, and Grade C office spaces. Grade A offices dominate prime urban districts, appealing to multinational corporations and high-profile tenants seeking superior amenities, sustainable features, and prestigious addresses. These premium properties command higher rental rates and lower vacancy levels, reflecting strong demand among companies prioritizing brand image and operational efficiency. Grade B spaces attract mid-sized businesses and local firms looking for a balance between quality and cost, while Grade C offices cater to startups and cost-sensitive enterprises. It responds to a diverse tenant mix by maintaining an ample supply across all grades, though Grade A and B segments continue to see the most robust absorption in Ho Chi Minh City and Hanoi.

By Sector:

Sector segmentation within the Vietnam Office Market highlights ICT/Tech and Finance, Insurance as leading drivers of demand. Rapid digitalization and a thriving technology ecosystem make ICT and tech companies key occupants of modern office towers, especially those outfitted with advanced connectivity and flexible design. Finance and insurance firms remain significant contributors, drawn to buildings offering high security, professional environments, and convenient access to business districts. Professional services, including legal, consulting, and accounting firms, occupy significant space, valuing locations that enhance client access and workforce productivity. Retail and distribution sectors seek offices with logistics advantages, while a diverse “Others” segment includes education, healthcare, and creative industries, each influencing evolving space requirements.

By Ownership:

Ownership segmentation is defined by the prevalence of leased offices versus owner-occupied properties. Leased offices dominate the Vietnam Office Market, reflecting the preference for flexibility among both multinational and local firms. It allows tenants to adapt to shifting market conditions without the capital constraints of property ownership. Owner-occupied offices, though less common, are favored by established enterprises seeking long-term operational stability and greater control over their working environment. Demand for leased space continues to grow alongside economic expansion and business diversification. Developers and investors focus on high-quality leased assets to meet the needs of dynamic occupiers, reinforcing the market’s orientation toward flexibility and growth.

Segments:

Based on Grade:

Based on Sector:

- ICT / Tech

- Finance, Insurance

- Professional Services

- Retail & Distribution

- Others

Based on Ownership:

- Leased Offices

- Owner-occupied Offices

Based on Leasing Term & Flexibility:

- Traditional Long-term Leases (3–5 years+)

- Short-term & Flexible Leases

- Serviced Office/Sublease Space

Based on Building Type:

- High-rise Office Towers

- Low-rise/Stand-alone Office Buildings

- Mixed-use Developments (integrated with retail/hospitality)

- Co-working Spaces (flexible office providers)

Based on the Geography:

- Southeast Vietnam

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Regional Analysis

Southeast Vietnam

Southeast Vietnam commands the largest share of the Vietnam Office Market, accounting for approximately 56% of total market revenue. Ho Chi Minh City, the economic hub of the country, anchors this region with a high concentration of Grade A and Grade B office buildings. International corporations, regional headquarters, and domestic enterprises prioritize this area due to its superior infrastructure, access to financial services, and a vibrant business ecosystem. The market continues to benefit from strong foreign direct investment, extensive urban development, and robust demand for premium office space. It attracts technology firms, financial institutions, and a growing number of startups, all seeking modern work environments with advanced amenities and flexible leasing options. The rising trend of coworking spaces and green-certified office towers further elevates the region’s profile, supporting sustainable growth and reinforcing Southeast Vietnam’s dominant position within the national market.

Northern Vietnam

Northern Vietnam captures around 27% of the Vietnam Office Market, driven primarily by Hanoi, the nation’s capital. This region has witnessed rapid expansion in both office supply and demand, underpinned by government initiatives, infrastructure upgrades, and the emergence of new business districts. Multinational corporations and large domestic companies are increasingly establishing headquarters in Hanoi, seeking proximity to administrative centers and regulatory bodies. Grade A and Grade B office properties remain in high demand, particularly in central and western districts where modern developments are reshaping the urban landscape. The market appeals to a diverse tenant base, including finance, insurance, technology, and professional services. It continues to attract significant foreign investment, supporting ongoing construction of high-quality office towers. Northern Vietnam’s market is set for further growth, with new projects aiming to meet the evolving needs of occupiers and reinforce the region’s status as a key commercial gateway.

Central Vietnam

Central Vietnam holds a market share of about 9%, marking it as an emerging region within the national office landscape. Da Nang stands out as the primary commercial hub, offering strategic advantages for companies seeking to access both northern and southern markets. The region’s office market remains less mature compared to Hanoi and Ho Chi Minh City but displays strong growth potential due to rising interest from technology, tourism, and logistics sectors. It benefits from government incentives for investment and ongoing improvements in transportation and infrastructure. Developers are focusing on constructing Grade B and flexible office spaces to meet the needs of SMEs and expanding enterprises. The market’s affordable rents and improving business climate make Central Vietnam an attractive option for companies looking to establish a presence outside the traditional metropolitan areas. It continues to evolve, supported by demographic trends and regional development policies.

Southern Vietnam

Southern Vietnam accounts for approximately 8% of the Vietnam Office Market, comprising provinces and cities beyond Ho Chi Minh City. While its share is smaller compared to other regions, it plays a crucial role in supporting the broader economic ecosystem, particularly through connections to industrial zones, ports, and logistics corridors. The market serves a diverse range of tenants, from manufacturing companies to service providers, who value access to transport infrastructure and labor pools. It features a mix of Grade B, Grade C, and serviced office offerings tailored to the needs of regional businesses. Demand in this area is steadily increasing, supported by ongoing investment in industrial and urban development projects. It positions itself as a complementary market, enabling business expansion and decentralization from major urban centers. Southern Vietnam’s strategic location and improving infrastructure provide a foundation for future growth, with new office projects expected to cater to evolving business requirements.

Key Player Analysis

- Vin Group

- Novaland Group

- Dat Xanh Group

- FLC Group

- JLL

- Deli Vietnam

- MaxPro Stationery

- An Binh Group

Competitive Analysis

The Vietnam Office Market features a competitive landscape shaped by a combination of established domestic developers and international service providers. Leading players such as Vin Group, Novaland Group, Dat Xanh Group, and JLL maintain a dominant presence by leveraging strong capital bases, diverse real estate portfolios, and a focus on innovative office projects. Companies compete by investing in high-quality office projects located in strategic urban areas, focusing on modern designs, sustainable construction, and advanced amenities that attract a diverse tenant base. The most successful market participants emphasize flexible leasing solutions, digital infrastructure, and wellness-focused environments to respond to evolving occupier demands. The push toward smart building technologies and green certifications creates new benchmarks for operational efficiency and tenant satisfaction. Competitive differentiation relies on the ability to deliver innovative office concepts, optimize asset management, and adapt to changes in regulatory and market conditions. The pursuit of professional property management and advisory services also elevates service quality and transparency. This competitive landscape fosters ongoing investment and innovation, ensuring that Vietnam’s office market remains responsive, resilient, and attractive to both local and international businesses.

Recent Developments

In March 2024, 3M launched a world-first invention that will help reinvent how goods are packed, shipped, and sold across all industries, using the power of best-in-class materials science. 3M launched the first padded, paper-based curbside recyclable mailer material, which businesses can use to automate their packaging processes.

Market Concentration & Characteristics

The Vietnam Office Market exhibits moderate to high market concentration, with a significant share of premium office supply concentrated in major urban centers such as Ho Chi Minh City and Hanoi. It is characterized by the dominance of a few large domestic developers and select international service providers, who set benchmarks in quality, design, and operational standards. The market offers a diverse range of office solutions, including Grade A, Grade B, and flexible workspaces to accommodate both multinational corporations and local enterprises. Strong demand for high-quality office environments drives continuous investment in smart technologies, green building features, and wellness-oriented amenities. Competition is intense among leading players, which accelerates the adoption of innovation and elevates service quality across the sector. The Vietnam Office Market remains dynamic, responsive to shifting tenant expectations, and committed to maintaining international standards to attract global business and investment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Grade, Sector, Ownership, Leasing Term & Flexibility, Building Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Vietnam Office Market is projected to experience substantial growth, driven by economic expansion and increasing demand for modern office spaces.

- Flexible work arrangements and the rise of hybrid work models are prompting a shift towards adaptable office solutions, including co-working spaces and serviced offices.

- Sustainable and green-certified buildings are gaining prominence, with developers focusing on energy efficiency and environmental standards to meet tenant expectations.

- Technological advancements are influencing office design, with smart building features and digital infrastructure becoming standard in new developments.

- Foreign direct investment continues to play a significant role, attracting multinational corporations seeking regional headquarters in Vietnam’s major cities.

- Urban centers like Ho Chi Minh City and Hanoi remain primary hubs for office development, while emerging cities such as Da Nang are attracting attention for future expansion.

- Government initiatives aimed at improving infrastructure and business-friendly policies are creating a conducive environment for office market growth.

- The demand for Grade A office spaces is expected to rise, reflecting the needs of high-end tenants and international firms seeking premium facilities.

- Challenges such as rising construction costs and regulatory complexities may impact project timelines and investment decisions.

- Overall, the Vietnam Office Market is poised for dynamic growth, supported by economic resilience, evolving workplace trends, and strategic urban development.