| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vietnam Retail Pharmacy Market Size 2024 |

USD 4,983.79 Million |

| Vietnam Retail Pharmacy Market, CAGR |

12.91% |

| Vietnam Retail Pharmacy Market Size 2032 |

USD 7,368.63 Million |

Market Overview

The Vietnam Retail Pharmacy Market is projected to grow from USD 4,983.79 million in 2024 to an estimated USD 7,368.63 million by 2032, with a compound annual growth rate (CAGR) of 5.01% from 2025 to 2032. This growth is driven by increasing healthcare demand, a growing aging population, and rising consumer awareness about health and wellness.

Key drivers for the market include the growing middle-class population, increased healthcare spending, and an expanding private healthcare sector. Additionally, the rise of chronic diseases and health conditions, such as diabetes and hypertension, is boosting the demand for over-the-counter medications and prescription drugs. Advancements in digital health technologies and e-commerce platforms are also reshaping the retail pharmacy landscape, providing customers with more convenient access to products.

Geographically, the market is concentrated in major cities such as Hanoi and Ho Chi Minh City, where healthcare infrastructure is more advanced and consumer spending is higher. The retail pharmacy sector is characterized by the presence of both domestic and international players. Key players in the market include Pharmacity, Guardian Vietnam, and Medicare, which are expanding their presence and strengthening their competitive position through retail network expansion and digital initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Vietnam Retail Pharmacy Market is projected to grow from USD4,983.79 million in 2024 to USD7,368.63 million by 2032, with a CAGR of 5.01%.

- The Global Retail Pharmacy Market is expected to grow from USD 14,45,920.00 million in 2024 to USD 19,65,958.05 million by 2032, at a CAGR of 3.92% from 2025 to 2032.

- Key drivers include an aging population, rising healthcare spending, and increasing awareness about health and wellness, fueling demand for pharmaceutical products.

- Regulatory challenges and competition from online pharmacies may hinder market growth, particularly for smaller, independent pharmacies.

- The market is concentrated in urban centers like Ho Chi Minh City and Hanoi, with rural areas showing growing potential due to government healthcare initiatives.

- The expansion of major retail pharmacy chains, such as Pharmacity and Guardian Vietnam, is driving increased market penetration and accessibility.

- The rise of digital health platforms and online pharmacies is transforming the market, providing consumers with greater access to healthcare products.

- The increasing prevalence of chronic diseases like diabetes and hypertension is pushing the demand for both prescription and over-the-counter medications.

Report Scope

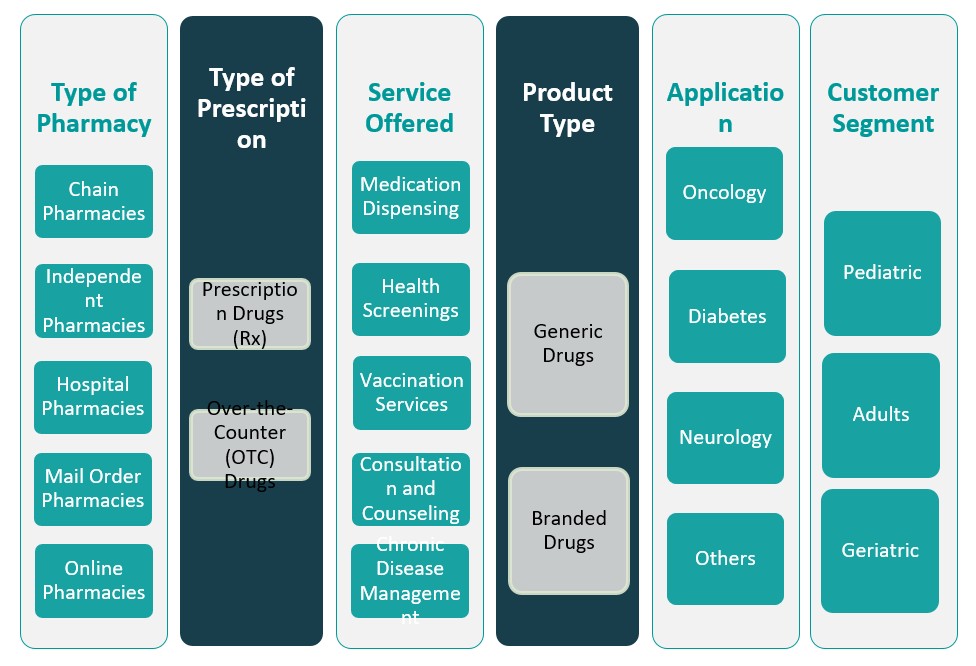

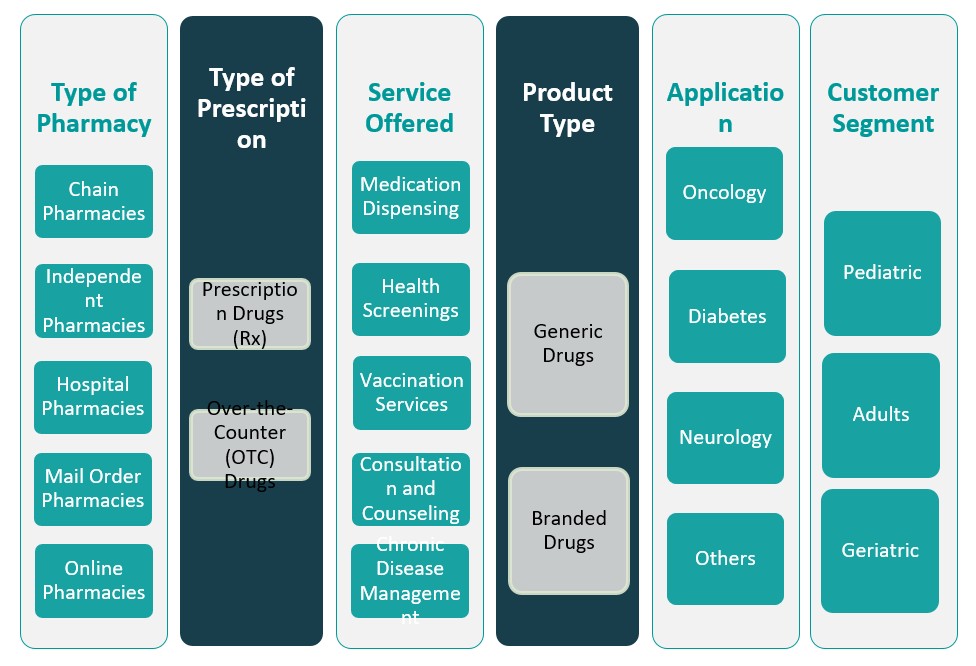

This report segments the Vietnam Retail Pharmacy Market as follows:

Market Drivers

Increasing Healthcare Expenditure and Government Support

The growing healthcare expenditure in Vietnam is a significant driver of the retail pharmacy market. The Vietnamese government has consistently prioritized healthcare reforms to enhance public health infrastructure, which includes increasing the funding for both public and private healthcare services. For instance, this includes initiatives to improve medical access and affordability, which in turn creates a larger customer base for pharmacies. The government’s support in the form of regulations that promote the distribution of affordable healthcare products also stimulates demand within the retail pharmacy market. Furthermore, the rise in the number of private healthcare facilities and the expansion of pharmacies nationwide are closely aligned with government policies aimed at reducing the pressure on public healthcare systems and ensuring the wider distribution of essential medicines. As healthcare spending continues to increase, both public and private entities are investing more in retail pharmacy networks, ensuring that more consumers have access to pharmaceutical products.

Growing Middle-Class Population and Urbanization

One of the most important factors propelling the Vietnam retail pharmacy market is the expanding middle class, which is increasingly aware of health and wellness. For instance, over the last few decades, Vietnam has witnessed rapid urbanization, with the urban population growing to 36% in 2019. By 2030, it is projected that 44% of Vietnam’s population will reside in urban areas. This trend has contributed to greater disposable income and increased demand for healthcare services, including pharmaceuticals. The rising purchasing power of the middle class is leading to increased spending on both prescription and over-the-counter medications, vitamins, and healthcare products. Urban consumers are also more inclined to invest in preventive healthcare measures, driving growth in the retail pharmacy sector. Pharmacies are benefitting from this shift, as consumers are becoming more health-conscious and seeking products that support a healthy lifestyle. The increased access to disposable income means that consumers are not only purchasing essential medications but also opting for higher-quality healthcare solutions, creating further growth opportunities for retail pharmacies.

Rising Prevalence of Chronic Diseases and Aging Population

The aging population and the increasing prevalence of chronic diseases in Vietnam are key factors driving demand in the retail pharmacy market. Vietnam’s demographic shift, marked by a rapidly aging population, is leading to greater healthcare needs, particularly for chronic conditions such as diabetes, hypertension, and cardiovascular diseases. The World Health Organization (WHO) has reported a steady rise in non-communicable diseases (NCDs) in Vietnam, which now account for a large proportion of the population’s healthcare concerns. This trend is contributing significantly to the demand for both prescription medications and over-the-counter drugs aimed at managing long-term conditions. Retail pharmacies, with their wide range of medications and wellness products, are increasingly seen as essential points of access for consumers managing chronic diseases. Additionally, an aging population is more likely to suffer from conditions that require ongoing medication, further expanding the customer base for pharmacies. With more people living longer, there is an increasing need for products that cater to the elderly population, such as those for mobility, cognitive health, and age-related conditions, offering pharmacies a niche market within the broader retail space.

Expansion of Online and Digital Health Platforms

The rise of e-commerce and digital health platforms has transformed the retail pharmacy landscape in Vietnam. As internet penetration and smartphone usage continue to grow in the country, consumers are increasingly turning to online pharmacies and digital health platforms for their pharmaceutical needs. The convenience of online shopping, coupled with the availability of home delivery services, is becoming a key factor in consumer preferences. Online platforms enable customers to browse for products, access health consultations, and purchase medicines from the comfort of their homes. This trend is especially significant for younger, tech-savvy consumers who value convenience and fast service. Additionally, digital tools are being used to offer personalized health solutions, making it easier for consumers to track their health needs and get tailored medication recommendations. The rise of online retail pharmacy services is compelling traditional brick-and-mortar pharmacies to enhance their digital presence, fostering a competitive market and ensuring that consumers have more access points to purchase pharmaceutical products. With growing trust in online healthcare solutions, this shift is likely to continue driving market expansion in the coming years.

Market Trends

Digital Transformation and E-Commerce Integration

The Vietnam Retail Pharmacy Market is increasingly witnessing a shift towards digital transformation, with e-commerce playing a pivotal role. Online pharmacies and digital platforms are becoming a primary channel for consumers to purchase pharmaceutical products, health supplements, and personal care items. For instance, 53% of Vietnamese consumers used online platforms to purchase healthcare products in 2024. With the growing penetration of the internet and mobile phones, more consumers are turning to digital channels for convenience and speed. Online platforms provide access to a wide range of medications, personalized health advice, and even home delivery services. E-commerce also allows consumers to compare prices, read reviews, and consult with pharmacists remotely. This digital shift is encouraging traditional brick-and-mortar pharmacies to establish online presences and integrate digital payment systems, making it easier for consumers to shop online while maintaining physical store operations. As consumer demand for convenience and accessibility grows, digitalization will continue to play a critical role in expanding the market.

Rising Popularity of Health and Wellness Products

There is an increasing consumer focus on health and wellness, leading to an uptick in demand for vitamins, supplements, and organic health products. As the awareness around preventive healthcare rises, consumers are more proactive in seeking products that promote general well-being and immunity. For instance, a survey conducted by Nielsen Vietnam in 2024 revealed that 68% of urban consumers preferred purchasing organic health products over conventional options. Retail pharmacies are responding by expanding their product offerings to include natural supplements, herbal medicines, and organic skincare. This trend is also aligned with the growing health-consciousness of the Vietnamese population, particularly among urban dwellers. Pharmacies are enhancing their in-store displays, training staff on wellness products, and increasing their shelf space for such items. The demand for holistic health solutions, alongside traditional medicines, is shaping a broader retail pharmacy experience that goes beyond just dispensing prescriptions.

Expansion of Pharmacy Chains and Franchising

The retail pharmacy landscape in Vietnam is undergoing significant consolidation and expansion. Large pharmacy chains such as Pharmacity, Guardian Vietnam, and Medicare are rapidly growing their networks across the country, driven by an increasing demand for easily accessible pharmaceutical products. These chains are enhancing their service offerings by integrating advanced technologies and expanding into smaller towns and rural areas to meet the needs of a wider population. Additionally, franchising has become a popular business model, allowing international pharmacy brands to penetrate the market quickly while benefiting from local knowledge and resources. This expansion not only improves access to healthcare but also raises competition among local and international players, resulting in improved services and customer satisfaction. The trend of pharmacy chain expansion, coupled with increased investment in branding and customer loyalty programs, is contributing to the sector’s growth.

Regulatory and Quality Assurance Improvements

Vietnam’s government has been actively enhancing regulations around drug safety and quality standards in retail pharmacies. As part of the country’s ongoing healthcare reforms, there has been an increasing focus on ensuring the quality of medicines and the professionalism of pharmacy operations. New regulations require pharmacies to comply with updated standards for drug distribution, storage, and patient safety. Additionally, there is growing demand for pharmacists to offer professional services, including consultations on medication management, drug interactions, and side effects. With the rise of counterfeit drugs in the market, consumers are becoming more concerned about the authenticity of the products they purchase. Pharmacies that comply with high standards and offer transparency in their operations are gaining consumer trust. These regulatory and quality assurance improvements not only ensure better health outcomes for patients but also strengthen the competitiveness of pharmacies that prioritize compliance and patient safety.

Market Challenges

Regulatory and Compliance Challenges

One of the major challenges facing the Vietnam Retail Pharmacy Market is the evolving regulatory environment and the need for strict compliance with drug safety and distribution laws. While the Vietnamese government has made significant strides in improving healthcare regulations, the pharmacy sector continues to face complex and sometimes inconsistent regulatory standards, especially in the areas of drug imports, distribution, and retail operations. For instance, according to the Ministry of Health, Vietnam issued over 1,000 new regulations related to pharmaceutical management between 2020 and 2023. Retail pharmacies must navigate a web of regulations that cover everything from product approvals to pricing controls, all while ensuring adherence to quality assurance standards. This can be particularly difficult for smaller and independent pharmacies that may lack the resources to fully comply with these requirements. Additionally, the rise in counterfeit drugs and substandard medications has heightened scrutiny from both regulatory authorities and consumers. As the government continues to introduce more stringent regulations, retailers are faced with the challenge of balancing operational costs with the need for compliance, which can result in increased overheads and operational complexity. Pharmacies that fail to meet regulatory requirements risk penalties, loss of consumer trust, and even business shutdowns, making regulatory compliance a significant barrier to sustainable growth in the market.

Intense Competition from Online Pharmacies and E-Commerce Platforms

The growing presence of online pharmacies and e-commerce platforms presents a significant challenge to traditional retail pharmacies in Vietnam. As digital healthcare solutions gain popularity, many consumers now prefer the convenience of purchasing medicines and wellness products online. The ability to compare prices, access detailed product information, and benefit from home delivery services has led to a shift in consumer behavior, favoring e-commerce over physical stores. While larger pharmacy chains are increasingly investing in their digital presence to remain competitive, small independent pharmacies are often unable to compete with the convenience, pricing, and accessibility offered by online platforms. Moreover, the rapid growth of online pharmacy platforms is intensifying the competition for both customers and market share. Consumers, particularly younger, tech-savvy individuals, are more inclined to use digital channels, which reduces foot traffic to physical stores. This shift puts pressure on traditional retail pharmacies to enhance their service offerings, invest in digital capabilities, and adopt new business models to stay relevant. However, the transition from offline to online requires significant investment in technology, logistics, and cybersecurity, which can be a challenge for smaller players with limited budgets. Consequently, the rise of e-commerce platforms poses a major competitive threat, requiring retail pharmacies to adapt quickly or risk losing market relevance.

Market Opportunities

Expansion into Rural and Underserved Areas

One of the significant opportunities for growth in the Vietnam Retail Pharmacy Market lies in expanding access to pharmacy services in rural and underserved areas. As urban centers like Hanoi and Ho Chi Minh City continue to experience a surge in retail pharmacy networks, the need for pharmaceutical services in smaller towns and rural regions remains largely unmet. These areas present a growing consumer base with increasing healthcare needs, driven by rising disposable incomes, awareness of health and wellness, and the government’s ongoing efforts to improve healthcare infrastructure. By establishing retail pharmacy outlets in these regions, companies can tap into an underserved market and build a loyal customer base. This expansion will also contribute to the improvement of healthcare access across the country, helping to bridge the gap between urban and rural populations. Retail pharmacies that invest in logistics, local supply chains, and tailored product offerings for rural areas stand to benefit from this market opportunity, as demand for both essential and over-the-counter medications continues to rise.

Growth of Personalized and Preventative Healthcare Solutions

Another promising opportunity within the Vietnam Retail Pharmacy Market is the increasing consumer shift towards personalized and preventive healthcare solutions. As the Vietnamese population becomes more health-conscious, there is a growing demand for wellness products, supplements, and services that promote long-term health and prevent disease. Retail pharmacies can capitalize on this trend by offering personalized health consultations, tailored medication recommendations, and specialized wellness products aimed at improving immunity, managing chronic conditions, and enhancing overall well-being. Additionally, partnerships with digital health platforms, telemedicine services, and wearable health technology can further enhance the personalized care offering. By diversifying into these areas, retail pharmacies can not only increase revenue streams but also position themselves as trusted healthcare providers in the community, fostering stronger customer loyalty and capturing a larger share of the wellness market.

Market Segmentation Analysis

By Type of Pharmacy

The Vietnam Retail Pharmacy Market is segmented into several types of pharmacies, including chain pharmacies, independent pharmacies, hospital pharmacies, mail order pharmacies, and online pharmacies. Chain pharmacies are experiencing significant growth due to their ability to offer a wide range of products and services, often supported by strong branding, extensive networks, and convenience for consumers. Independent pharmacies, while facing tough competition, continue to cater to local markets with personalized services and more flexible pricing. Hospital pharmacies play a crucial role in dispensing prescribed medications to patients within hospital settings and are closely linked to healthcare systems. Mail order pharmacies are gaining popularity due to their convenience, particularly for consumers in remote areas, offering medication delivery services directly to homes. Online pharmacies have seen rapid growth, driven by digital transformation, offering easy access to a variety of medicines and health products, with home delivery options gaining traction.

By Type of Prescription

The market is also divided based on prescription type into Prescription Drugs (Rx) and Over-the-Counter (OTC) Drugs. Prescription drugs are crucial in treating more complex or chronic conditions, contributing significantly to revenue in the retail pharmacy market. With a rising prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular diseases, the demand for prescription drugs is increasing. Over-the-counter drugs, on the other hand, are widely used for more common ailments like colds, headaches, and digestive issues. The OTC drug segment has seen a substantial boost, fueled by consumer self-medication trends and the growing preference for accessibility and convenience in purchasing healthcare products without needing a doctor’s prescription.

Segments

Based on Type of Pharmacy

- Chain Pharmacies

- Independent Pharmacies

- Hospital Pharmacies

- Mail Order Pharmacies

- Online Pharmacies

Based on Type of prescription

- Prescription Drugs (Rx)

- Over-the-Counter (OTC) Drugs

Based on Service offered

- Medication Dispensing

- Health Screenings

- Vaccination Services

- Consultation and Counseling

- Chronic Disease Management

Based on Product Type

- Generic Drugs

- Branded Drugs

Based on Application

- Oncology

- Diabetes

- Neurology

- Others

Based on Customer

- Paediatric

- Adults

- Geriatric

Based on Region

- North Vietnam

- Central Vietnam

- South Vietnam

Regional Analysis

South Vietnam (50%)

South Vietnam dominates the retail pharmacy market, accounting for the largest share of approximately 50% of the total market revenue. This region is home to the country’s economic hub, Ho Chi Minh City, which is the largest city and a key commercial and healthcare center. The rapid urbanization, growing disposable incomes, and high healthcare awareness in this region contribute significantly to the demand for both prescription and over-the-counter medications. The presence of major retail pharmacy chains like Pharmacity, Guardian, and Medicare further drives the market’s growth in this region. Additionally, South Vietnam is home to a high proportion of the aging population, which increases demand for chronic disease management and healthcare products.

North Vietnam (30%)

North Vietnam, including Hanoi, accounts for approximately 30% of the Vietnam Retail Pharmacy Market. While it is second in terms of market share, the region is experiencing rapid growth, especially with the expansion of modern healthcare facilities and retail pharmacy chains. The increasing healthcare spending in Hanoi and other major cities in the north is contributing to the rising demand for pharmaceutical products. Furthermore, government initiatives aimed at improving healthcare access and quality are driving pharmacy growth in this region. However, North Vietnam still lags behind the south in terms of retail pharmacy chain penetration, leaving room for expansion opportunities in underserved areas.

Key players

- Pharmacity

- Long Chau

- Guardian

- Medicare

- Phano Pharmacy

- An Khang

Competitive Analysis

The Vietnam Retail Pharmacy Market is highly competitive, with both local and international players striving to capture significant market share. Pharmacity stands out as one of the leading pharmacy chains in the country, leveraging an extensive network of stores and strong brand recognition to dominate the market. Their focus on convenience and expanding into both urban and suburban areas has positioned them as a market leader. Guardian, an international brand, has strengthened its presence in Vietnam by offering a wide range of healthcare products and personal care items, focusing on customer experience and digital integration. Medicare, another major player, benefits from its established reputation and diverse product offerings in both pharmaceutical and wellness categories. Long Chau, Phano Pharmacy, and An Khang are also strong competitors, with Long Chau focusing on personalized service and product quality, while Phano Pharmacy and An Khang prioritize local reach and competitive pricing. The competition is intensifying as players seek to expand their physical and digital footprints, innovate with value-added services, and build strong customer loyalty programs.

Recent Developments

- As of March 31, 2024, Apollo Pharmacy operated 6,030 stores across approximately 1,200 cities and towns in 22 states and 5 union territories. The company continues to expand its digital healthcare platform, offering services like online medicine delivery and virtual doctor consultations.

- In October 2024, Caring Pharmacy Retail Management Sdn Bhd, a 75%-owned unit of 7-Eleven Malaysia Holdings Bhd, announced acquisitions of equity interest and business assets in several pharmaceutical outlets for a combined cash consideration of RM48.86 million.

- In June 2024, the Australian Competition and Consumer Commission (ACCC) expressed concerns that the proposed acquisition of Chemist Warehouse by Sigma Healthcare could substantially lessen competition in pharmacy retailing, potentially leading to higher prices and reduced service quality.

- In January 2025, Watsons Philippines ended 2024 with 1,166 stores, expanding its community pharmacy format. The company opened more than 50 stores outside of Metro Manila.

Market Concentration and Characteristics

The Vietnam Retail Pharmacy Market exhibits moderate concentration, with a few dominant players such as Pharmacity, Guardian, and Medicare capturing a significant share of the market. These key players operate large retail networks and benefit from brand recognition, extensive product offerings, and advanced customer service models. However, the market also remains fragmented, with a considerable number of independent pharmacies and regional players serving local communities, particularly in rural areas. The market characteristics are influenced by the growing demand for healthcare products, rising consumer awareness about wellness, and increasing urbanization. As competition intensifies, both large chains and smaller independent pharmacies are adapting by expanding their services, enhancing product portfolios, and adopting digital platforms to better serve the evolving needs of customers. Additionally, the market is witnessing a shift toward personalized healthcare services, such as chronic disease management and wellness consultations, further diversifying the competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmacy, Type of prescription, Service offered, Product Type, Application, Customer and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Large retail pharmacy chains will continue to expand their networks, especially in underserved rural areas, to increase market penetration and accessibility.

- The rise of e-commerce will continue to reshape the market, with more consumers opting for online pharmacies due to their convenience and home delivery options.

- With rising health awareness, there will be a greater emphasis on wellness products, such as supplements, organic medicines, and preventive healthcare solutions.

- As Vietnam’s population ages, the demand for medications and services tailored to chronic conditions and age-related health issues will significantly increase.

- Ongoing healthcare reforms and government initiatives to improve accessibility will drive growth in the retail pharmacy market, particularly in rural areas.

- Retail pharmacies will increasingly adopt advanced technologies like digital health platforms and e-prescriptions to enhance service offerings and customer convenience.

- The rising incidence of chronic diseases, such as diabetes and hypertension, will fuel demand for both prescription and over-the-counter medications in retail pharmacies.

- Price-sensitive consumers will drive pharmacies to implement competitive pricing strategies, which will help attract a wider customer base, especially in lower-income regions.

- The growing preference for personalized healthcare will lead pharmacies to offer tailored services like medication counseling, health screenings, and chronic disease management.

- Pharmacies will likely form partnerships with health insurance providers to offer more affordable medications and services, making healthcare more accessible to a broader population.