| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vietnam Pea Proteins Market Size 2024 |

USD 6.29 Million |

| Vietnam Pea Proteins Market, CAGR |

12.91% |

| Vietnam Pea Proteins Market Size 2032 |

USD 16.61 Million |

Market Overview:

The Vietnam Pea Proteins Market is projected to grow from USD 6.29 million in 2024 to an estimated USD 16.61 million by 2032, with a compound annual growth rate (CAGR) of 12.91% from 2024 to 2032.

The Vietnam pea protein market is primarily driven by increasing health-consciousness among consumers. As awareness about the health risks associated with animal-based protein sources rises, consumers are shifting towards plant-based alternatives. Pea protein, which is hypoallergenic, gluten-free, and rich in essential amino acids, is gaining popularity as a healthier choice. Additionally, sustainability concerns are fueling demand, as pea protein is an environmentally friendly alternative with a lower ecological footprint compared to animal-based proteins. The growing trend of plant-based diets, supported by both environmental and health motivations, is a significant factor driving the adoption of pea protein in the Vietnamese market. Furthermore, innovations in food technology have led to the development of pea protein-based meat substitutes, dairy alternatives, and snacks, broadening the scope of its applications and appealing to a wide range of consumers.

In Vietnam, the demand for pea protein is largely concentrated in urban areas, particularly in Ho Chi Minh City and Hanoi, where health trends are more prominent, and there is greater access to plant-based food products. The rising awareness about the benefits of plant-based proteins, supported by an increase in disposable income and improved living standards in these regions, is propelling the market forward. The government’s focus on promoting sustainable agriculture and dietary diversification also aligns with the growing interest in plant-based alternatives. As the trend of flexitarianism grows, with more consumers adopting plant-based diets without entirely eliminating meat, the market for pea protein in Vietnam is expected to expand, offering considerable opportunities for both local and international producers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Vietnam Pea Proteins Market is projected to grow from USD 6.29 million in 2024 to USD 16.61 million by 2032, with a CAGR of 12.91%.

- The Global pea proteins market is projected to grow from USD 2,229.15 million in 2024 to USD 5,618.92 million by 2032, at a CAGR of 12.25%.

- Increasing health consciousness is a key driver as consumers shift towards plant-based protein alternatives due to concerns over the health risks associated with animal-based proteins.

- Sustainability concerns are fueling demand for pea protein, which offers an environmentally friendly alternative with a lower ecological footprint than animal proteins.

- The growing trend of plant-based diets, driven by health and environmental motivations, is significantly boosting the adoption of pea protein in Vietnam.

- Innovation in food technology is expanding pea protein’s applications, including meat substitutes, dairy alternatives, and protein-enriched snacks, broadening its consumer base.

- Government support for sustainable agriculture and plant-based food options is encouraging market growth, aligning with the increasing demand for health-conscious and eco-friendly products.

- Despite the market’s growth, challenges such as high production costs, limited local supply, and consumer awareness hurdles remain significant barriers to market expansion.

Market Drivers:

Health and Wellness Trends

The growing shift towards health-conscious eating is one of the primary drivers of the Vietnam pea protein market. For example, NOW Organic Pea Protein Powder contains 15 grams of protein and 5 mg of iron per 20-gram serving, providing a nutrient-dense option for consumers seeking to boost muscle growth, support weight management, and promote heart health. With increasing awareness about the health risks associated with animal-based proteins, such as higher cholesterol and potential foodborne illnesses, consumers in Vietnam are turning towards plant-based protein alternatives. Pea protein, known for its hypoallergenic and easily digestible properties, is especially appealing to individuals with dietary restrictions, such as those avoiding gluten or soy. As more consumers prioritize health, the demand for nutrient-dense, plant-based proteins like pea protein continues to rise, making it a key driver for market expansion.

Sustainability and Environmental Considerations

Sustainability plays a crucial role in the growing demand for pea protein in Vietnam. As consumers become more environmentally conscious, they are increasingly seeking products with lower ecological footprints. Plant-based proteins, such as pea protein, require significantly fewer resources to produce compared to animal-based alternatives. They use less water, land, and energy, making them a more sustainable option for consumers looking to reduce their environmental impact. This growing preference for environmentally friendly products has been further bolstered by Vietnam’s focus on sustainable agriculture and the global shift towards eco-conscious consumption.

Product Innovation and Market Diversification

The continuous innovation in food products incorporating pea protein is another major driver of market growth. As consumer demand for plant-based options increases, food manufacturers in Vietnam are leveraging pea protein to develop a wide range of products, from meat substitutes to dairy alternatives. For instance, companies are introducing plant-based burgers, protein powders, bakery goods, vegan pizzas, and dairy alternatives to meet rising consumer demand for plant-based options. This innovation in product offerings, such as plant-based protein bars, ready-to-eat meals, and plant-based dairy, has expanded the applications of pea protein, meeting the needs of diverse consumer preferences. By introducing new and exciting products, manufacturers are able to capture the interest of a broader audience, including flexitarians and individuals seeking healthier dietary options.

Government Support and Consumer Awareness

Government initiatives promoting sustainable agriculture and plant-based food options are further contributing to the growth of the pea protein market in Vietnam. Policies aimed at reducing meat consumption and supporting the plant-based food sector are aligned with the increasing consumer demand for sustainable, health-focused alternatives. Additionally, educational campaigns aimed at raising awareness about the nutritional and environmental benefits of plant-based proteins have further fueled the shift in consumer preferences. As these initiatives gain traction, the market for pea protein is expected to see continued growth, driven by both supportive government policies and an increasingly informed and health-conscious consumer base.

Market Trends:

Rise of Flexitarian and Vegan Diets

One of the most significant trends shaping the Vietnam pea protein market is the growing adoption of flexitarian and vegan diets. As more consumers seek to reduce their meat consumption for health, ethical, and environmental reasons, the demand for plant-based protein alternatives like pea protein continues to rise. Flexitarianism, a diet that emphasizes plant-based foods while still including occasional animal products, is becoming increasingly popular in Vietnam. This trend is leading consumers to explore plant-based protein sources, particularly those that are versatile and easy to incorporate into various dishes. The increasing popularity of veganism and plant-based diets in urban centers further accelerates this trend, contributing to the growing consumption of pea protein.

Increased Focus on Clean Labels and Natural Ingredients

As consumer preferences continue to evolve, there is a marked shift towards clean-label products that feature simple, natural ingredients. Pea protein, being a plant-based and minimally processed ingredient, aligns perfectly with this growing demand for clean-label foods. For instance, Ingredion’s VITESSENCE® Pulse 1803C pea protein isolate, for example, is produced from yellow peas, is non-GMO, gluten-free, and processed without solvents like hexane, aligning with clean-label trends. Vietnamese consumers are increasingly looking for products that are free from artificial additives and preservatives, and pea protein’s natural profile makes it an attractive option for manufacturers aiming to cater to this demand. Clean-label products not only appeal to health-conscious individuals but also resonate with those who are concerned about food transparency and sustainability, further driving the adoption of pea protein in the market.

Innovation in Plant-Based Food Products

The Vietnamese pea protein market is experiencing significant innovation in product development, with manufacturers exploring new applications in both food and beverage categories. For instance, the IMARC Group reports that the availability of nutritious and delicious vegan alternatives, including plant-based meats and dairy substitutes, has made it increasingly convenient for consumers to embrace a plant-based lifestyle. From plant-based dairy products like milk, cheese, and yogurt to plant-based meat substitutes, pea protein is becoming a key ingredient in the creation of innovative, delicious, and nutritious alternatives. Additionally, the rise of ready-to-eat meals, protein bars, and snacks made from pea protein is offering consumers more convenient options to meet their dietary preferences. This innovation is not only broadening the scope of pea protein usage but also meeting the growing demand for plant-based products that cater to a variety of consumer needs and lifestyles.

Growing Role of E-commerce and Online Retail

The increasing role of e-commerce and online retail is another key trend influencing the Vietnam pea protein market. As consumers seek more convenient ways to purchase plant-based products, e-commerce platforms are becoming an important channel for distributing pea protein-based goods. Online retailers are seeing a rise in demand for plant-based foods, as they provide easy access to a wide variety of products, including those made with pea protein. The rise of health-focused and sustainable consumerism is being amplified by the ability to browse, compare, and purchase products online. This shift toward e-commerce is expected to continue fueling growth in the pea protein market, as more consumers opt for the convenience and variety offered by online platforms.

Market Challenges Analysis:

High Cost of Production

One of the primary challenges facing the Vietnam pea protein market is the relatively high cost of production compared to traditional animal-based proteins. For instance, extracting high-quality protein from peas involves multiple processing stages, such as dry fractionation and wet extraction, which are capital-intensive and energy-consuming. As a result, pea protein-based products tend to be more expensive than their animal-based counterparts, making them less accessible to price-sensitive consumers. This cost disparity can limit the widespread adoption of pea protein, particularly in lower-income demographics, and may hinder the growth of the market in the short term.

Supply Chain Limitations

Another challenge impacting the Vietnam pea protein market is the limited local supply of pea protein. While demand for plant-based proteins is increasing, the domestic cultivation of peas in Vietnam remains relatively small compared to other crops. This leads to a reliance on imports for raw pea protein, which can introduce challenges related to supply chain logistics, such as transportation delays and fluctuating prices due to international market conditions. These supply chain issues can lead to inconsistent availability of pea protein, affecting the ability of manufacturers to meet consumer demand and potentially increasing product prices.

Consumer Awareness and Acceptance

Despite the growing interest in plant-based proteins, there is still a need for increased consumer education regarding the benefits of pea protein. Many consumers in Vietnam remain unfamiliar with pea protein as a viable alternative to animal-based protein sources, which may limit the adoption of products containing it. Additionally, traditional dietary habits that are deeply ingrained in the culture can pose a challenge in shifting towards plant-based alternatives. Overcoming these barriers will require effective marketing and awareness campaigns to educate consumers on the nutritional and environmental benefits of pea protein, as well as its versatility in various food applications.

Regulatory and Infrastructure Challenges

The regulatory landscape for plant-based food products in Vietnam is still evolving. There is a need for clearer guidelines and standards for the production, labeling, and marketing of plant-based proteins like pea protein. Inconsistent regulations or slow adaptation to global standards can create obstacles for companies entering the market, potentially leading to delays in product launches or compliance issues. Furthermore, the infrastructure required for scaling up production and distribution of pea protein products is still developing, which may pose challenges for market growth.

Market Opportunities:

The Vietnam pea protein market presents significant growth opportunities driven by the increasing demand for plant-based alternatives. As more consumers shift towards flexitarian and vegan diets, there is a growing market for products made from plant-based proteins, including pea protein. Manufacturers can capitalize on this trend by developing a wide range of innovative products, such as plant-based meat substitutes, dairy alternatives, and protein-enriched snacks. The rising popularity of plant-based diets, coupled with health-conscious consumer behavior, provides a fertile ground for expanding the availability of pea protein-based products across both traditional retail channels and e-commerce platforms. This trend is expected to gain further momentum, providing companies with an opportunity to capture a growing share of the market.

Additionally, as sustainability continues to gain importance among consumers, the demand for environmentally friendly products like pea protein will likely increase. Pea protein’s lower environmental footprint compared to animal-based proteins positions it as an attractive option for eco-conscious consumers. With government policies supporting sustainable agricultural practices and promoting plant-based diets, there is also an opportunity for manufacturers to benefit from favorable regulatory frameworks. These market dynamics, combined with ongoing product innovations, offer a strong foundation for growth in the Vietnam pea protein market, creating opportunities for both local and international players to expand their product offerings and meet the increasing demand for plant-based food solutions.

Market Segmentation Analysis:

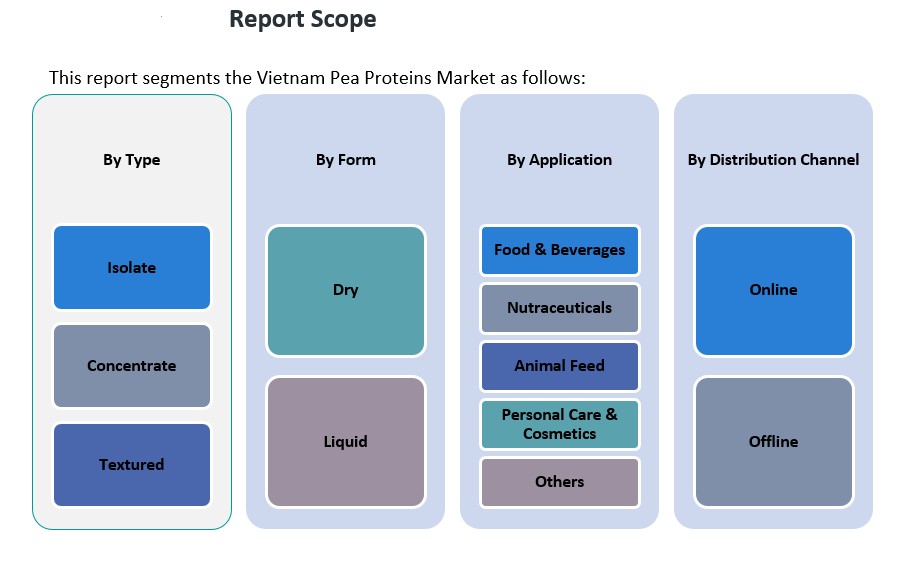

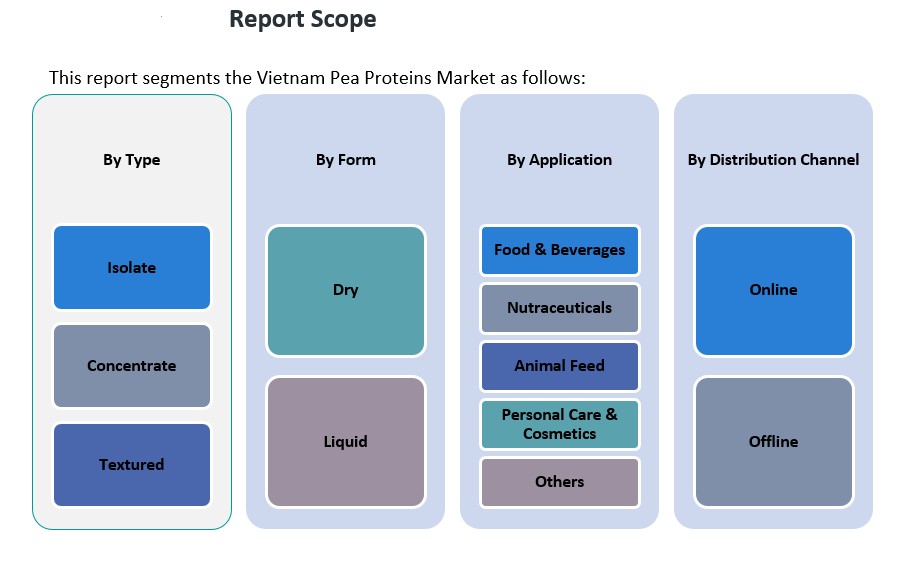

The Vietnam pea protein market can be segmented based on type, application, form, and distribution channel, each offering distinct opportunities for growth.

By Type, the market is primarily divided into Isolate, Concentrate, and Textured pea proteins. Isolate pea protein is the most sought-after due to its high protein content and versatility in a wide range of applications, particularly in plant-based food and beverage products. Concentrate pea protein, while lower in protein content compared to isolates, is gaining popularity in applications where cost-efficiency is a priority. Textured pea protein is increasingly used in meat analogs and plant-based food products, capitalizing on the growing demand for meat substitutes in the region.

By Application, pea protein is predominantly used in Food & Beverages, followed by Nutraceuticals, Animal Feed, Personal Care & Cosmetics, and other applications. The food and beverage sector accounts for the largest share due to the widespread use of pea protein in plant-based products such as dairy alternatives, meat substitutes, and protein bars. The Nutraceuticals sector is also expanding as consumers increasingly turn to pea protein for its health benefits, including weight management and muscle growth. Animal Feed applications are growing due to the rising adoption of plant-based feed ingredients.

By Form, pea protein is available in Dry and Liquid forms, with dry pea protein being more commonly used in food applications due to its longer shelf life and ease of use.

By Distribution Channel, both Online and Offline channels play significant roles in the market. The rise of e-commerce in Vietnam is contributing to the growth of online sales, while traditional retail outlets remain essential for broader consumer access.

Segmentation:

By Type

- Isolate

- Concentrate

- Textured

By Application

- Food & Beverages

- Nutraceuticals

- Animal Feed

- Personal Care & Cosmetics

- Others

By Form

By Distribution Channel

Regional Analysis:

The Vietnam pea protein market is experiencing dynamic growth, with regional variations influenced by economic development, urbanization, and consumer preferences. Understanding these regional distinctions is crucial for stakeholders aiming to navigate the market effectively.

Southern Vietnam: Market Leadership

Southern Vietnam, particularly Ho Chi Minh City, stands as the dominant region in the pea protein market. This area accounts for a significant portion of the market share, driven by its large urban population, higher disposable incomes, and greater exposure to global food trends. The presence of numerous supermarkets, health food stores, and a burgeoning plant-based food sector further bolsters the demand for pea protein products in this region. The trend towards flexitarian and vegan diets is more pronounced here, with consumers increasingly seeking plant-based protein alternatives due to health and environmental concerns.

Northern Vietnam: Emerging Potential

Northern Vietnam, encompassing Hanoi and surrounding provinces, is witnessing a gradual increase in the adoption of pea protein products. While the market share is currently smaller compared to the south, the growing middle class and rising health consciousness among consumers present significant opportunities for expansion. The northern region’s traditional dietary habits are evolving, with an increasing openness to plant-based diets, albeit at a slower pace than in the south. Retail channels are expanding, and consumer awareness initiatives are gaining traction, setting the stage for future market growth.

Central Vietnam: Developing Market

Central Vietnam, including cities like Da Nang and Hue, represents a developing segment of the pea protein market. The region’s market share remains limited, but there is a noticeable shift towards healthier eating habits and interest in plant-based products. The growth is supported by the region’s tourism industry, which introduces diverse dietary preferences and increases exposure to international food trends. However, the market is still in its nascent stages, with challenges such as limited retail infrastructure and lower consumer awareness hindering rapid expansion.

Key Player Analysis:

- Shandong Jianyuan Group

- Fenchem Biotek Ltd.

- Ingredion Incorporated

- Roquette Frères

- Yantai Shuangta Food Co., Ltd.

- ET Chem

- Cargill, Inc.

- DuPont (IFF)

- Nutraonly (Xi’an) Nutritions Inc.

- Burcon NutraScience Corporation

Competitive Analysis:

The Vietnam pea protein market is becoming increasingly competitive as both local and international players seek to capitalize on the growing demand for plant-based proteins. Key competitors include global pea protein manufacturers who are expanding their presence in the region, as well as emerging local companies that are focusing on catering to domestic demand for sustainable and healthy food options. International brands benefit from established production capabilities, research, and innovation in pea protein applications, such as meat substitutes and plant-based beverages. However, local players are gaining ground by leveraging their understanding of regional consumer preferences, lower production costs, and faster adaptation to local trends. The market’s competitive landscape is further shaped by collaborations between food manufacturers and pea protein suppliers, which allow for the development of new product lines. Companies that focus on product differentiation, such as clean-label, non-GMO, and allergen-free offerings, are well-positioned to lead in this rapidly growing market.

Recent Developments:

- In March 2025, Daily Harvest introduced its Organic Pea Protein Powder, designed to offer a clean, allergen-friendly protein boost for smoothies and breakfast bowls. This new product contains only USDA-certified organic pea protein, free from additives, fillers, artificial sweeteners, seed oils, and preservatives, and provides 24 grams of plant-based protein per serving. The powder is tested for heavy metals, is highly digestible, and is suitable for those with common allergies, continuing Daily Harvest’s commitment to clean, simple ingredients and meeting customer demand for high-quality, convenient protein options.

- In February 2024, Roquette expanded its NUTRALYS® plant protein range by launching four new multifunctional pea protein ingredients: NUTRALYS® Pea F853M (isolate), NUTRALYS® H85 (hydrolysate), NUTRALYS® T Pea 700FL (textured), and NUTRALYS® T Pea 700M (textured). These ingredients are designed to improve taste, texture, and application versatility in plant-based foods and high-protein nutritional products, enabling food manufacturers to develop innovative meat alternatives, nutritional bars, protein drinks, and dairy alternatives. This launch reflects Roquette’s ongoing investment in plant protein innovation and its mission to support food manufacturers in creating appealing plant-based products.

- In January 2024, Ingredion and Lantmännen announced a long-term partnership to develop and commercialize a portfolio of pea protein isolates for the European market. This collaboration aims to leverage Ingredion’s expertise in process engineering and product development alongside Lantmännen’s vertically integrated production capabilities, with the goal of delivering high-quality, sustainably sourced pea protein isolates that meet the evolving needs of the global market.

Market Concentration & Characteristics:

The Vietnam Pea Proteins Market exhibits moderate concentration, with a few key players driving the market dynamics. The market is characterized by an increasing number of local and international companies entering the market due to the growing demand for plant-based proteins. These players are actively investing in research and development to offer innovative pea protein-based products, catering to various consumer preferences in food, beverages, and nutraceutical applications. The presence of major global suppliers, alongside local manufacturers, enhances competition, leading to product diversification and improved quality standards. The market’s growth is further supported by an expanding consumer base interested in plant-based alternatives driven by health and sustainability trends. Despite the growing competition, market fragmentation is evident, with small and medium-sized enterprises playing a significant role in regional distribution. This evolving landscape presents opportunities for new entrants to capitalize on the increasing shift towards plant-based diets in Vietnam.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Vietnam pea protein market is expected to see continued robust growth driven by the increasing demand for plant-based protein alternatives.

- Urbanization and rising disposable incomes will fuel consumer adoption of plant-based diets, further driving market expansion.

- The growing health-conscious consumer base will boost the demand for hypoallergenic and gluten-free pea protein products.

- Innovations in food and beverage applications, such as plant-based meat substitutes and protein-enriched snacks, will diversify product offerings.

- The rise of e-commerce will provide an additional sales channel, enhancing product accessibility across the country.

- Local producers will focus on improving production capabilities and lowering costs to compete with international players.

- Government policies supporting sustainable agriculture and plant-based food options will create a favorable market environment.

- Consumer education on the health benefits of pea protein will enhance awareness and boost market acceptance.

- Increased investment in research and development will lead to new, improved pea protein formulations for various applications.

- The growing trend of flexitarianism will continue to expand the market as more consumers reduce meat consumption without eliminating it entirely.