| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vietnam Industrial Fasteners Market Size 2024 |

USD 278.74 Million |

| Vietnam Industrial Fasteners Market, CAGR |

6.75% |

| Vietnam Industrial Fasteners Market Size 2032 |

USD 470.09 Million |

Market Overview:

The Vietnam Industrial Fasteners Market is projected to grow from USD 278.74 million in 2024 to an estimated USD 470.09 million by 2032, with a compound annual growth rate (CAGR) of 6.75% from 2024 to 2032.

Several key factors are driving the growth of the Vietnam industrial fasteners market. The expansion of the automotive sector is significantly increasing demand for advanced fastening solutions, as manufacturers seek durable and high-performance components to enhance vehicle safety and efficiency. Additionally, the rapid growth of the construction industry, fueled by ongoing urbanization and infrastructure development, is creating a substantial need for a variety of fasteners used in residential, commercial, and industrial projects. The electronics and machinery sectors are also contributing to market momentum, with an increasing requirement for precision fasteners in the assembly of consumer electronics and industrial equipment. Moreover, Vietnam’s efforts to improve its manufacturing standards and align with global quality benchmarks are enhancing the competitiveness of locally produced fasteners in international markets, encouraging further industry expansion.

Regionally, Vietnam has emerged as a significant hub within the Asia-Pacific industrial fasteners landscape. The country’s growing export capabilities have strengthened its presence in major international markets, including Germany, the United States, and Japan. Vietnam benefits from strong bilateral trade agreements and its strategic location, which facilitate efficient supply chain operations across the region. Domestically, industrial development zones and manufacturing clusters across cities such as Ho Chi Minh City, Hanoi, and Da Nang are driving local demand for industrial fasteners. Additionally, Vietnam’s reliance on imports from neighboring countries like China, Japan, and South Korea for specialized fasteners reflects a balanced and dynamic trade environment. Ongoing improvements in logistics infrastructure and manufacturing technology are expected to further reinforce Vietnam’s role as a competitive player in the global fasteners industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Vietnam Industrial Fasteners Market is projected to grow from USD 278.74 million in 2024 to an estimated USD 470.09 million by 2032, with a compound annual growth rate (CAGR) of 6.75% from 2024 to 2032. driven by the country’s expanding automotive, construction, and electronics sectors.

- The automotive industry’s expansion is increasing the demand for high-performance fasteners, especially in the production of electric vehicles and lightweight materials.

- Rapid urbanization and government investments in infrastructure development are fueling the demand for durable fasteners in construction projects such as bridges, roadways, and utility systems.

- The electronics and machinery sectors in Vietnam are driving the need for precision fasteners due to their essential role in assembling complex components and machinery.

- Vietnam’s increasing focus on meeting international quality standards and participation in global trade agreements is enhancing its competitiveness in the fasteners export market.

- Price volatility of raw materials like steel and aluminum remains a significant challenge, affecting production costs and profit margins for fastener manufacturers.

- Intense competition from low-cost imports, particularly from China and India, pressures local manufacturers to lower prices while maintaining product quality, challenging smaller producers.

Market Drivers:

Expansion of the Automotive Industry

The automotive industry is a major driver of the Vietnam industrial fasteners market. As Vietnam continues to establish itself as a growing automotive manufacturing hub in Southeast Asia, the demand for high-performance fasteners has risen significantly. For instance, OCHIAI VIETNAM CO., LTD. manufactures automotive fasteners and holds IATF 16949 certification, an international quality standard required by leading North American and European automobile manufacturers. Local and international manufacturers are expanding production facilities, spurred by favorable government policies and increasing domestic consumption of vehicles. Fasteners play a critical role in ensuring structural integrity, safety, and performance in automobiles, creating a sustained need for advanced fastening solutions. With the rising adoption of electric vehicles and lightweight materials, the market for specialized, corrosion-resistant, and lightweight fasteners is expected to grow further, reinforcing the automotive sector’s influence on the fasteners market.

Infrastructure Development and Construction Growth

Vietnam’s robust infrastructure development and booming construction activities are key contributors to the fasteners market expansion. For example, Rawlplug Vietnam’s factory production control system was audited and confirmed to meet the requirements for Construction Products Regulations (CPR) certification, ensuring stable production and the maintenance of declared performance for fasteners used in construction projects. Rapid urbanization, population growth, and the government’s investments in transportation networks, residential complexes, commercial buildings, and industrial zones have significantly increased the consumption of fastening products. Fasteners are indispensable in various construction applications, including steel structures, bridges, roadways, and utility systems. As construction projects grow in scale and complexity, the need for durable, high-strength fasteners that can endure diverse environmental conditions becomes more pronounced. The emphasis on sustainable and resilient infrastructure further supports the adoption of high-quality fastening solutions across the construction industry.

Growth of the Electronics and Machinery Sectors

The electronics and machinery industries are playing an increasingly vital role in driving the Vietnam industrial fasteners market. Vietnam has become a leading destination for electronics manufacturing, attracting major multinational companies that produce smartphones, consumer electronics, and industrial equipment. Precision fasteners are essential for assembling delicate electronic components and ensuring the reliability of machinery operations. As technological advancements continue to accelerate and product designs become more intricate, the demand for specialized fasteners that offer miniaturization, heat resistance, and enhanced durability is rising. The machinery manufacturing sector, which supplies various industries such as agriculture, energy, and logistics, further boosts the need for robust fastening systems tailored to specific operational requirements.

Emphasis on Quality Standards and Export Potential

Vietnam’s growing focus on meeting international quality standards is another significant driver of the industrial fasteners market. As domestic manufacturers aim to compete in global markets, there is a heightened emphasis on producing fasteners that comply with stringent technical specifications and industry certifications. This trend has encouraged investments in advanced manufacturing technologies, quality control processes, and research and development activities. In addition, Vietnam’s strategic participation in global trade agreements has expanded export opportunities, particularly to markets in Europe, North America, and Asia. The pursuit of higher quality standards not only strengthens the domestic market but also positions Vietnam as a competitive exporter of industrial fasteners worldwide.

Market Trends:

Rising Demand for Lightweight and High-Performance Fasteners

One of the notable trends shaping the Vietnam industrial fasteners market is the growing demand for lightweight and high-performance fastening solutions. Industries such as aerospace, automotive, and electronics increasingly seek fasteners that contribute to overall weight reduction while maintaining strength and durability. For example, Bulten Group, a leading global fastener manufacturer, is establishing operations in Vietnam to meet the rising demand for domestically produced micro screws among international consumer electronics manufacturers. This shift is driven by the pursuit of enhanced fuel efficiency, lower production costs, and improved product performance. Manufacturers are investing in the development of fasteners made from advanced materials such as titanium alloys, carbon fiber composites, and specialized stainless steel variants. The trend towards miniaturization in sectors like electronics further propels innovation in lightweight fastening technologies tailored for complex, compact assemblies.

Technological Advancements in Fastener Manufacturing

Technological innovation is transforming the industrial fasteners manufacturing landscape in Vietnam. For instance, Smart Vietnam, for instance, utilizes industry-standard CAD/CAM software such as SolidWorks, AutoCAD, and Mastercam to create detailed 2D and 3D designs, optimize material usage, and generate precise toolpaths for CNC machines. The integration of automation, robotics, and precision engineering techniques has enabled manufacturers to produce fasteners with higher accuracy, consistency, and customization options. Modern production facilities increasingly adopt cold forging, heat treatment, and surface coating technologies to enhance the performance characteristics of fasteners. Additionally, the application of Computer-Aided Design (CAD) and simulation tools allows companies to design fasteners optimized for specific industrial applications. These technological advancements not only improve product quality but also shorten production cycles and reduce manufacturing costs, strengthening Vietnam’s competitiveness in the global fasteners supply chain.

Shift Towards Eco-Friendly Fastening Solutions

Sustainability concerns are increasingly influencing the fasteners market in Vietnam. Manufacturers are responding to environmental regulations and customer expectations by adopting eco-friendly production processes and materials. The use of recyclable metals, biodegradable coatings, and energy-efficient manufacturing techniques is becoming more common across the industry. Companies are also investing in research to develop fastening systems that minimize environmental impact over their lifecycle, from production to disposal. This trend aligns with broader global movements towards sustainable manufacturing and positions Vietnamese fastener suppliers to meet the evolving requirements of environmentally conscious industries such as renewable energy, green construction, and electric vehicles.

Customization and Specialized Fastener Demand

The rising complexity of end-user applications is driving a significant trend towards customization and specialized fasteners. Industries such as medical devices, telecommunications, and precision machinery increasingly require fastening solutions tailored to specific technical parameters, including unique sizes, specialized thread designs, and corrosion resistance in extreme environments. Standardized, mass-produced fasteners are no longer sufficient for many critical applications. As a result, Vietnamese fastener manufacturers are expanding their capabilities to offer customized solutions, often developed in close collaboration with clients. This focus on tailored offerings not only enhances customer satisfaction but also creates higher-margin opportunities for manufacturers aiming to differentiate themselves in a competitive market landscape.

Market Challenges Analysis:

Fluctuating Raw Material Prices

One of the major restraints impacting the Vietnam industrial fasteners market is the volatility in raw material prices. Fasteners are heavily dependent on metals such as steel, aluminum, and alloys, whose prices are subject to global market fluctuations. Factors such as supply chain disruptions, geopolitical tensions, and changes in trade policies often lead to unpredictable material costs. This volatility directly affects production costs, pricing strategies, and profit margins for manufacturers, making it challenging to maintain consistent supply agreements and long-term contracts with customers.

Intense Competitive Pressure from Low-Cost Imports

The market faces significant challenges from the influx of low-cost fasteners imported from countries like China and India. These imports often offer aggressive pricing, putting pressure on domestic manufacturers to lower their costs, sometimes at the expense of quality or profitability. While Vietnam’s local producers are focusing on enhancing quality standards, price competition remains intense, especially in the low- to mid-tier product segments. This competitive environment creates barriers for smaller manufacturers seeking to expand their market share and sustain profitability.

Limited Technological Capabilities in Smaller Enterprises

Although technological advancements are reshaping the fasteners industry, many small and medium-sized enterprises (SMEs) in Vietnam still face limitations in adopting advanced manufacturing technologies. High capital investment requirements for automation, precision engineering, and quality assurance systems act as significant hurdles for smaller players. As a result, these enterprises struggle to meet international standards or produce specialized fasteners, which restricts their participation in high-value global supply chains and limits growth opportunities in premium market segments.

Regulatory and Certification Challenges

Compliance with stringent international regulations and certification standards poses an additional challenge for Vietnamese fastener manufacturers. Markets such as Europe and North America require adherence to complex quality, safety, and environmental standards. Obtaining and maintaining certifications like ISO, ASTM, and RoHS can be costly and resource-intensive, particularly for SMEs. For example, the new Vietnamese QCVN regulation on RoHS will require all electric and electronic products to obtain type approval certification starting January 1, 2026, with conformity certification and factory audits mandated for both domestic and imported products. Failure to comply not only limits export opportunities but also undermines competitiveness in increasingly quality-conscious domestic and international markets.

Market Opportunities:

The Vietnam industrial fasteners market presents strong growth opportunities driven by the country’s increasing role as a manufacturing hub in Southeast Asia. As global companies seek to diversify their supply chains away from traditional centers, Vietnam’s stable political environment, competitive labor costs, and improving industrial infrastructure position it as an attractive destination for investment. This trend is creating new demand for a wide range of industrial fasteners across industries such as automotive, electronics, construction, and machinery manufacturing. Additionally, the rise of electric vehicle production and the expansion of renewable energy projects offer promising avenues for fastener manufacturers specializing in lightweight, corrosion-resistant, and high-strength fastening solutions. Companies that invest in advanced production technologies and offer tailored, high-performance products will be well-placed to capitalize on these emerging opportunities.

Moreover, Vietnam’s active participation in numerous free trade agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA), provides enhanced access to key international markets. These agreements not only reduce tariffs but also promote higher standards of production, encouraging local manufacturers to upgrade their capabilities. There is significant opportunity for domestic producers to increase their export potential by aligning with global quality and certification requirements. In parallel, the growing trend toward sustainable construction and green manufacturing practices opens new market segments for eco-friendly fasteners. Companies that innovate in sustainability and precision engineering are poised to benefit from Vietnam’s evolving industrial landscape and rising global demand for specialized fastening solutions.

Market Segmentation Analysis:

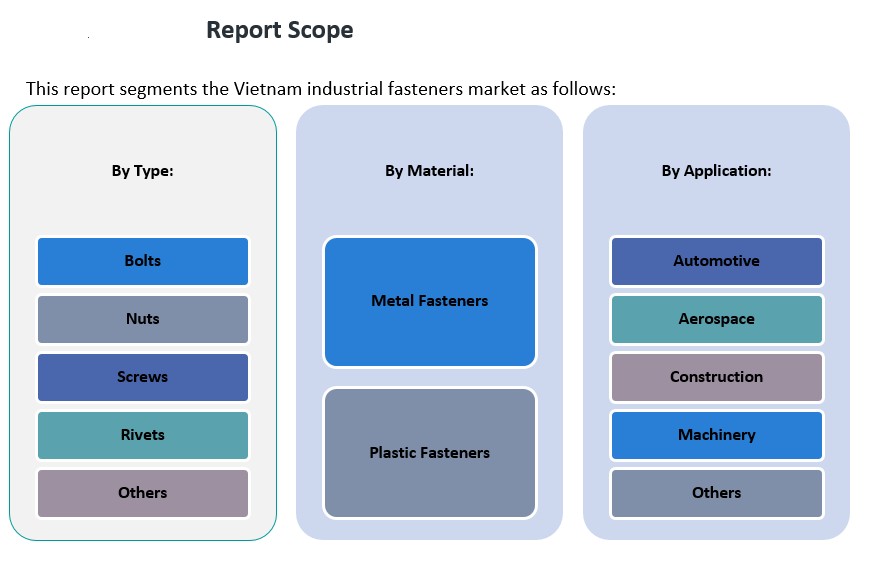

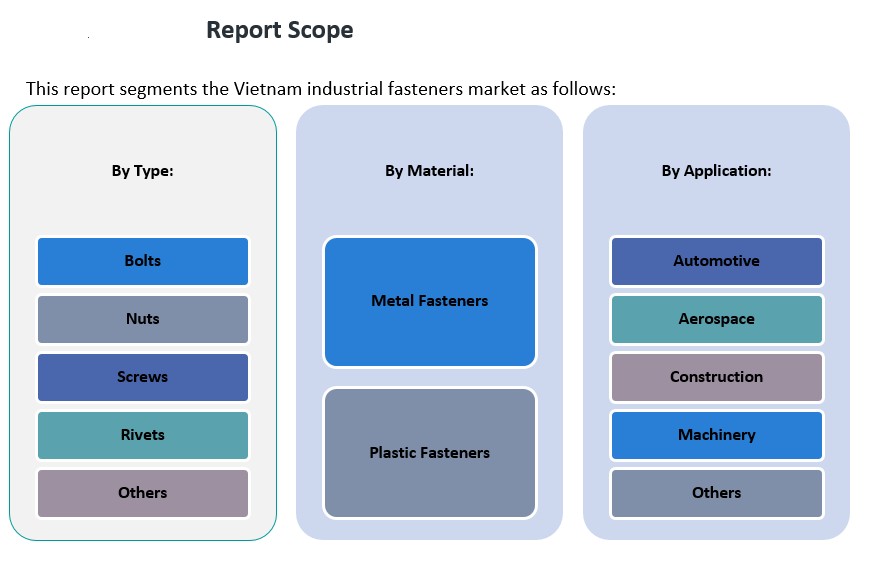

The Vietnam industrial fasteners market is segmented by type, application, and material, reflecting the diverse needs of end-user industries.

By type, bolts represent a significant share due to their widespread use in construction, automotive assembly, and heavy machinery manufacturing. Nuts and screws also contribute substantially, offering essential fastening solutions across residential, commercial, and industrial projects. Rivets, favored for their strength and reliability in permanent joints, are seeing growing demand in aerospace and automotive sectors. The “Others” category, which includes washers, pins, and anchors, supports specialized applications requiring customized fastening systems.

By application, the automotive sector dominates the market, driven by Vietnam’s expanding vehicle manufacturing and assembly capabilities. Construction also accounts for a large portion of demand, fueled by rapid urbanization and infrastructure development projects. Machinery applications are growing steadily, with industrial expansion requiring robust fastening solutions for manufacturing equipment. Although aerospace remains a niche sector, it presents a rising opportunity as Vietnam strengthens its participation in regional aviation supply chains. The “Others” segment includes electronics, furniture, and consumer goods industries, each contributing to the market’s diversification.

By material, metal fasteners hold the majority share, valued for their superior strength, durability, and performance under demanding conditions. Steel, stainless steel, and aluminum remain the preferred choices across critical industries. However, plastic fasteners are gaining popularity in applications that require corrosion resistance, weight reduction, and electrical insulation, particularly within electronics and automotive interiors. This evolving material preference indicates a gradual shift towards innovative fastening solutions tailored to specific industrial needs.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

The Vietnam industrial fasteners market is regionally segmented into Northern Vietnam, Central Vietnam, and Southern Vietnam, each contributing distinctively to the market’s overall landscape.

Northern Vietnam

Northern Vietnam, encompassing major cities like Hanoi and Hai Phong, serves as a significant industrial and manufacturing hub. The region benefits from its proximity to China, facilitating cross-border trade and supply chain efficiencies. The presence of numerous industrial parks and export processing zones has attracted substantial foreign direct investment, particularly in the automotive, electronics, and machinery sectors. This industrial concentration drives the demand for various types of fasteners, including bolts, screws, and rivets, essential for assembly and maintenance operations. Additionally, the government’s initiatives to improve infrastructure and transportation networks further bolster the region’s industrial activities, thereby enhancing the consumption of industrial fasteners.

Central Vietnam

Central Vietnam, with key cities such as Da Nang and Hue, is emerging as a growing market for industrial fasteners. The region’s strategic location along the East-West Economic Corridor enhances its connectivity with neighboring countries, promoting trade and industrial collaboration. The development of industrial zones and the expansion of the construction sector contribute to the increasing demand for fasteners in this region. Moreover, the growth of the shipbuilding industry along the central coast necessitates specialized fasteners capable of withstanding marine environments, thereby diversifying the market’s product requirements.

Southern Vietnam

Southern Vietnam, particularly the Ho Chi Minh City metropolitan area, represents a dynamic and rapidly expanding segment of the industrial fasteners market. The region’s robust economic activities, driven by a mix of manufacturing, construction, and services, create a substantial demand for a wide array of fasteners. The presence of numerous industrial parks and export-oriented manufacturing units, especially in sectors like textiles, electronics, and consumer goods, necessitates a steady supply of high-quality fasteners. Furthermore, the ongoing urbanization and infrastructure development projects, including transportation and residential constructions, amplify the consumption of construction-grade fasteners.

Key Player Analysis:

- Nifco Inc.

- Shanghai Prime Machinery Co. Ltd.

- Meidoh Co. Ltd.

- Sundram Fasteners Limited

- Agrati Group

- HIL Ltd.

- Bhansali Fasteners

- Zhejiang Huantai Fastener Co., Ltd.

- Kyocera Corporation

- Nippon Industrial Fasteners Company (Nifco)

Competitive Analysis:

The Vietnam industrial fasteners market is highly competitive, with both domestic and international players vying for market share. Leading global fastener manufacturers such as Stanley Black & Decker, Fastenal, and Bossard Group have established a presence in Vietnam, capitalizing on the country’s expanding manufacturing base and industrial growth. These companies benefit from advanced production technologies, extensive product portfolios, and global supply chains, allowing them to cater to a wide range of industries, including automotive, aerospace, and construction. Local players, such as Vietnam Fastener Joint Stock Company (VIFACO) and Dong Anh Mechanical Engineering Company, are also prominent in the market, offering competitive pricing and products tailored to regional needs. These companies emphasize cost-effective solutions while ensuring product reliability, making them key players in Vietnam’s fastener market. Additionally, the rising trend of sustainable manufacturing practices is prompting companies to invest in environmentally friendly and innovative fastening solutions to meet both local and international demands.

Recent Developments:

- In January 2025, BECK Fastener Group introduced its latest product, the LIGNOLOC wooden nail, expanding its lineup following the success of its collated wooden nails. This innovative product launch highlights BECK’s ongoing commitment to sustainable fastening solutions within the global industrial fasteners market

- In December 2024, Bulten, a leading global fastener manufacturer, announced plans to establish operations in Vietnam through a joint venture with ZJK Vietnam Precision Components Co., Ltd, a subsidiary of the Chinese fastener company ZJK Precision Parts. The agreements between the parties aim to commence production in Vietnam in 2025. This move follows Bulten’s earlier joint venture in late 2023 with ZJK and Indian Radium Fasteners Private Ltd for micro screw manufacturing.

- In September 2023, MW Components completed the acquisition of Elgin Fastener Group, a manufacturer specializing in fasteners. This strategic acquisition enhances MW Components’ capabilities and strengthens its position in the industrial fasteners sector, enabling the company to offer a broader range of products and solutions to its customers.

Market Concentration & Characteristics:

The Vietnam industrial fasteners market is characterized by moderate concentration, with a mix of multinational corporations and local players shaping the competitive landscape. Global leaders such as Stanley Black & Decker and Fastenal dominate the higher-value segments, leveraging advanced manufacturing capabilities and established distribution networks. These companies focus on premium fasteners for industries like automotive, aerospace, and machinery. However, local players, such as Vietnam Fastener Joint Stock Company (VIFACO), are significant contributors in the lower-cost segments, offering cost-effective products for the construction and electronics sectors. The market is highly fragmented, with numerous small and medium-sized enterprises (SMEs) catering to regional demands. Companies in the sector generally focus on delivering reliable and durable fastening solutions, often emphasizing customization and customer-specific requirements. As Vietnam’s industrialization continues, the market is expected to see increased competition and a shift toward innovation, with growing emphasis on quality and sustainability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Vietnam industrial fasteners market is expected to expand as the country’s manufacturing sector continues to grow.

- Increasing demand from the automotive and electronics industries will drive the need for high-performance fasteners.

- Technological advancements in fastener manufacturing will lead to more efficient and precise production processes.

- Sustainability trends will prompt manufacturers to adopt eco-friendly materials and production techniques.

- The expansion of infrastructure projects will fuel the demand for construction-grade fasteners in both urban and rural areas.

- The rise of electric vehicles will create new opportunities for lightweight and corrosion-resistant fasteners.

- The market will see increased participation from local players, challenging established multinational companies.

- Export opportunities will grow as Vietnam strengthens its position as a manufacturing hub in Southeast Asia.

- The adoption of automation and smart manufacturing in fastener production will enhance quality and reduce costs.

- Increased regulatory standards will push manufacturers to invest in certifications and higher-quality products to meet global demands.