Market Overview

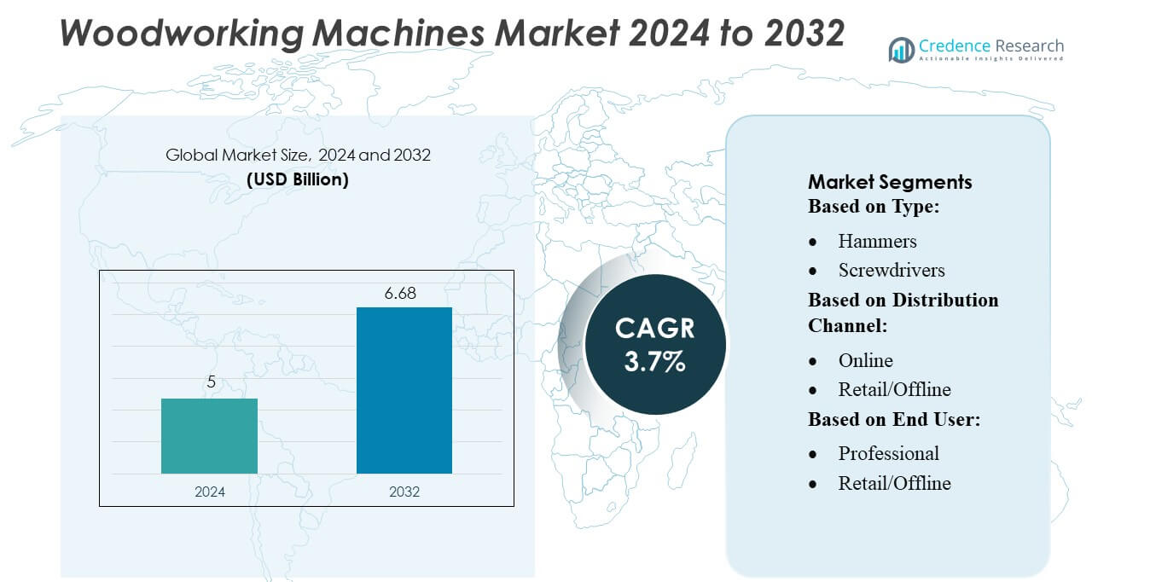

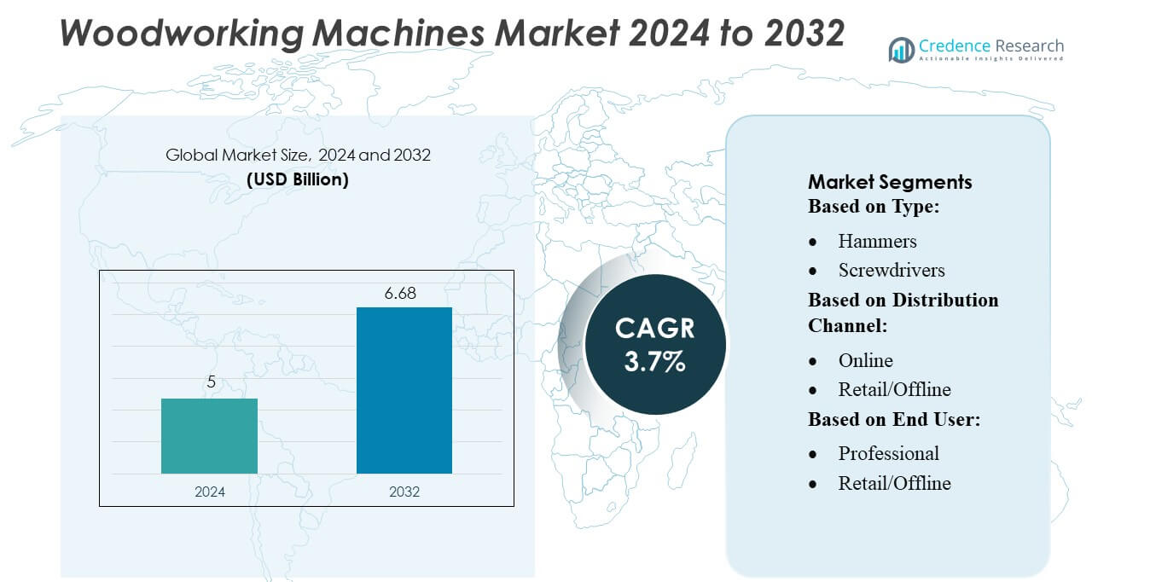

Woodworking Machines Market size was valued USD 5 billion in 2024 and is anticipated to reach USD 6.68 billion by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Woodworking Machines Market Size 2024 |

USD 5 billion |

| Woodworking Machines Market, CAGR |

3.7% |

| Woodworking Machines Market Size 2032 |

USD 6.68 billion |

The woodworking machines market is led by prominent companies focusing on innovation, quality, and wide distribution networks. Key players include Seaga Manufacturing Inc., Fuji Electric Co., Ltd., Orasesta S.p.A, Sellmat s.r.l., Westomatic Vending Services Limited, Royal Vendors, Inc., Azkoyen Group, Glory Ltd., Selecta Group, and Sanden Holding Corp. These companies emphasize advanced CNC and automated solutions, energy-efficient machines, and durable hand tools to meet professional and retail demand. They leverage strategic partnerships, product customization, and after-sales support to strengthen market presence. Regionally, Asia-Pacific emerges as the leading market, accounting for approximately 31% of the global share, driven by rapid industrialization, expanding construction and furniture manufacturing sectors, and increasing adoption of both semi-automated and fully automated woodworking machines. The combination of a growing professional user base and rising DIY interest further reinforces the region’s dominance.

Market Insights

- The woodworking machines market size was valued at USD 5 billion in 2024 and is projected to reach USD 6.68 billion by 2032, growing at a CAGR of 3.7% during the forecast period.

- Growth is driven by rising demand from professional carpentry workshops, furniture manufacturing, and increasing adoption of CNC and automated woodworking machines for higher precision and efficiency.

- Key trends include the adoption of energy-efficient and eco-friendly machines, rising DIY and home improvement activities, and integration of smart, IoT-enabled features for enhanced productivity.

- Competitive dynamics are shaped by major players such as Seaga Manufacturing Inc., Fuji Electric Co., Ltd., Orasesta S.p.A, Sellmat s.r.l., Westomatic Vending Services Limited, Royal Vendors, Inc., Azkoyen Group, Glory Ltd., Selecta Group, and Sanden Holding Corp., focusing on product innovation, partnerships, and regional expansion.

- Asia-Pacific leads the market with approximately 31% share, driven by industrialization, construction and furniture growth, while hand saws dominate the type segment, and retail/offline channels remain the preferred distribution method.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the woodworking machines market, hand tools dominate the type segment, with Hand Saws emerging as the leading sub-segment, capturing approximately 35–38% of market share. The dominance is driven by their versatility in cutting various wood types with precision, low maintenance requirements, and widespread availability across professional and DIY settings. Growth is further fueled by increasing adoption among small-scale workshops and hobbyists seeking cost-effective solutions. Rising demand for ergonomic designs and durable materials has also reinforced Hand Saws’ preference over other hand tools like hammers, screwdrivers, and pliers.

- For instance, Revlon established a 62,000-square-foot innovation center in Kenilworth, New Jersey, relocating its research and development operations to the Northeast Science and Technology (NEST) Center.

By Distribution Channel

The distribution channel segment is led by the Retail/Offline sub-segment, accounting for around 60–63% of the market. Traditional stores continue to dominate due to the hands-on experience they offer, enabling buyers to inspect product quality, feel the weight, and assess ergonomics before purchase. The channel’s growth is supported by established dealer networks and the prevalence of professional woodworking shops that rely on trusted offline sources. While online sales are rising, the tactile advantage and immediate product availability of retail outlets remain key drivers in this segment.

- For instance, Johnson & Johnson’s consumer health division revealed 16 new skincare research studies at the 2021 American Academy of Dermatology Virtual Meeting. The presentations, which included 3 oral publications and 13 poster presentations, highlighted targeted innovation in various aspects of skin health, including for women, cancer patients, and multicultural populations.

By End-user

Within the end-user segment, the Professional sub-segment commands the largest share, representing roughly 55–58% of the market. This dominance is driven by the consistent demand from carpentry workshops, furniture manufacturers, and construction firms that require high-precision, durable woodworking machines. Professionals prioritize advanced features, efficiency, and long-term reliability, which sustains demand for premium tools. Additionally, the trend toward skilled craftsmanship and specialized woodworking projects reinforces professional adoption, making this sub-segment a critical growth driver compared to general retail or hobbyist users.

Key Growth Drivers

Rising Demand for Professional Carpentry and Furniture Manufacturing

The woodworking machines market is propelled by increasing demand from professional carpentry workshops and furniture manufacturing units. Companies are investing in advanced machines to enhance precision, reduce production time, and meet growing consumer expectations for high-quality wood products. Expansion in residential and commercial construction projects further fuels the requirement for efficient woodworking equipment. Adoption of durable, ergonomically designed tools enables professionals to execute complex tasks with greater accuracy, reinforcing market growth across hand tools, power tools, and automated machinery segments.

- For instance, FOREO LUNA 4 cleansing device integrates 16 T-Sonic pulsation intensities and ultra-hygienic silicone touchpoints. It offers up to 600 uses per full charge, improving both cleansing precision and user longevity.

Technological Advancements and Automation

Integration of advanced technologies, such as CNC systems, laser-guided cutting, and IoT-enabled monitoring, is a significant growth driver. Automation enhances operational efficiency, reduces human error, and allows for precision in intricate woodworking tasks. Manufacturers increasingly adopt smart machines that streamline workflow, improve output consistency, and reduce labor dependency. This technological evolution attracts professional users and large-scale workshops aiming for cost-effective, high-quality production. Continuous innovation in machine design and features sustains the market’s expansion by meeting the evolving demands of skilled woodworkers and industrial users.

- For instance, L’Oréal’s new North America Research & Innovation Center spans 250,000 sq ft and houses a 26,000 sq ft modular lab, on-site mini factory, and capacity for daily user testing with up to 400 consumers.

Expansion of Online Distribution Channels

The proliferation of e-commerce platforms has expanded the market reach for woodworking machines. Online channels offer convenience, wider product selection, and competitive pricing, attracting both professional and retail consumers. Manufacturers leverage digital platforms to showcase advanced features, provide tutorials, and facilitate doorstep delivery, enhancing customer engagement and satisfaction. This growth driver is complemented by increased digital literacy and smartphone penetration, enabling smaller workshops and hobbyists to access professional-grade tools previously limited to offline retail, thereby broadening market adoption and fueling overall revenue growth.

Key Trends & Opportunities

Growing Adoption of Eco-friendly and Energy-efficient Machines

The market is witnessing a shift toward eco-friendly and energy-efficient woodworking machines. Manufacturers are introducing tools that reduce power consumption, minimize waste, and use sustainable materials, aligning with global sustainability trends. Professional workshops increasingly prefer machines with low environmental impact to meet regulatory compliance and corporate sustainability goals. This trend opens opportunities for innovation in green tool design, energy-saving motors, and recyclable components, providing manufacturers a competitive edge while addressing consumer preference for environmentally responsible woodworking solutions.

- For instance, Krones has deployed remote service over more than 20,000 machines worldwide via the CENTERSIGHT / Device Insight platform, enabling remote diagnostics and legally compliant access logging.

Rising DIY and Home Improvement Culture

The surge in DIY woodworking projects and home improvement initiatives presents a notable opportunity. Hobbyists and retail consumers are increasingly investing in versatile, user-friendly hand tools and compact machinery for personal projects. This trend encourages manufacturers to develop lightweight, portable, and multi-functional woodworking machines suitable for non-professional users. Retailers and online platforms benefit from offering bundled kits and instructional resources. By targeting this growing segment, the market can expand beyond professional users and capitalize on the increasing interest in personalized woodworking and creative home projects.

- For instance, PackSys Global emphasizes building modular and customizable machines and complete lines for the packaging industry. This specific product line exists for high-speed laminate tube production. The system is designed to achieve high output, specifically up to 300 tubes per minute.

Integration of Smart and IoT-enabled Features

Smart woodworking machines with IoT capabilities are gaining traction, enabling real-time monitoring, predictive maintenance, and remote operation. These features enhance productivity, minimize downtime, and allow for precise control, appealing to professional users seeking operational efficiency. The integration of digital interfaces and connectivity also facilitates data collection for performance optimization. As industries adopt Industry 4.0 practices, manufacturers have the opportunity to develop intelligent machines that cater to the evolving needs of modern workshops, driving differentiation and long-term market growth.

Key Challenges

High Initial Investment and Maintenance Costs

The significant upfront cost of advanced woodworking machines remains a key challenge, particularly for small-scale workshops and individual professionals. High investment in CNC systems, automated tools, and precision equipment can limit adoption despite their efficiency benefits. Additionally, ongoing maintenance, repairs, and the need for skilled operators contribute to operational expenses, creating barriers for cost-sensitive users. Manufacturers and distributors must address affordability and provide value-added services, such as financing options and after-sales support, to overcome this challenge and broaden market penetration.

Skilled Labor Shortage

A shortage of trained and experienced operators for complex woodworking machines poses a considerable challenge. Advanced tools and automated systems require skilled professionals to maximize performance and ensure safety. Insufficient training and technical expertise can result in operational inefficiencies, increased errors, and potential accidents, limiting productivity gains. Addressing this challenge necessitates investment in workforce development, training programs, and intuitive machine interfaces. Bridging the skills gap is essential for both professional and industrial users to fully leverage advanced woodworking technologies and sustain market growth.

Regional Analysis

North America

North America holds a significant share in the woodworking machines market, accounting for approximately 28–30% of the global market. Growth is driven by the presence of established furniture and construction industries, rising demand for precision woodworking tools, and adoption of advanced machinery with automation and CNC technology. The United States leads the region due to high investment in professional workshops and the popularity of DIY woodworking projects. Technological innovation, coupled with the availability of high-quality hand and power tools, supports consistent demand. Increasing infrastructure development and renovation projects further reinforce North America’s strong market position.

Europe

Europe represents around 25–27% of the woodworking machines market, driven by a mature industrial base, robust furniture manufacturing, and stringent quality standards. Germany, Italy, and France dominate due to their advanced machine tool industries and adoption of CNC and automated systems. Growth is fueled by rising demand for energy-efficient, durable, and eco-friendly machines and the strong presence of professional woodworking workshops. Additionally, regulatory compliance regarding safety and environmental impact encourages manufacturers to innovate, while rising DIY trends and home improvement activities in the region contribute to expanding adoption across both professional and retail segments.

Asia-Pacific

Asia-Pacific is the fastest-growing region, capturing approximately 30–33% of the global woodworking machines market. Growth is driven by expanding construction and furniture manufacturing industries in China, India, and Japan. Rising industrialization, urbanization, and infrastructure projects increase the demand for both hand tools and automated woodworking machines. Affordable labor, growing professional workshops, and adoption of semi-automated and CNC-enabled systems support market expansion. Additionally, government initiatives promoting skill development and industrial modernization facilitate market penetration. The region also witnesses rising DIY culture and online retail growth, further enhancing accessibility and driving woodworking machine adoption across professional and hobbyist users.

Latin America

Latin America holds roughly 7–8% of the woodworking machines market, supported by a growing construction sector and furniture manufacturing in Brazil, Mexico, and Argentina. The demand is primarily driven by professional workshops seeking cost-effective, durable, and high-performance machines. Limited penetration of advanced CNC systems constrains rapid growth, but rising adoption of semi-automated tools and online retail channels provides opportunities. Increasing infrastructure projects, urban housing development, and small-scale woodworking enterprises further fuel demand. Manufacturers focusing on affordability, after-sales support, and localized distribution are strategically positioned to capture market share in this region.

Middle East & Africa

The Middle East & Africa accounts for approximately 5–6% of the woodworking machines market. Growth is driven by expanding construction, real estate development, and commercial furniture demand in countries such as UAE, Saudi Arabia, and South Africa. The market is dominated by professional end-users investing in durable, high-efficiency woodworking machines, while retail adoption remains limited. Rising infrastructure projects and industrialization create opportunities for both local distributors and international manufacturers. However, high import costs and limited skilled labor availability pose challenges. Strategic partnerships, localized training programs, and competitive pricing are key factors for sustaining growth in this region.

Market Segmentations:

By Type:

By Distribution Channel:

By End User:

- Professional

- Retail/Offline

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The woodworking machines market is highly competitive, with key players including Seaga Manufacturing Inc., Fuji Electric Co., Ltd., Orasesta S.p.A, Sellmat s.r.l., Westomatic Vending Services Limited, Royal Vendors, Inc., Azkoyen Group, Glory Ltd., Selecta Group, and Sanden Holding Corp. The woodworking machines market is highly competitive, driven by continuous innovation, technological advancements, and expanding distribution channels. Companies are focusing on developing high-precision, durable, and energy-efficient machines to meet the growing demand from professional workshops and DIY consumers. Strategic initiatives such as mergers, acquisitions, and partnerships are commonly adopted to enhance production capabilities and broaden geographic reach. The integration of CNC technology, automation, and IoT-enabled features strengthens operational efficiency and product differentiation. Additionally, manufacturers are investing in after-sales support, training, and customization options to address regional demands, ensuring sustained market growth and maintaining a competitive edge in a rapidly evolving industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2024, Cantaloupe launched “Smart Stores”offering 24/7 self-service retail solutions as an alternative to traditional vending machines. These stores use advanced technology like weighted shelves and cameras to manage inventory and security, with features designed to provide a seamless customer experience and are being deployed in locations like residential buildings, fitness centers, and hotel pantries.

- In February 2024, Egypt finalized strategic partnerships with LUKOIL and Dragon Oil at the EGYPES 2024 conference to boost its oil production and global market position. LUKOIL signed an exploration and production (E&P) agreement for the West Esh El Mallaha field in the Eastern Desert, which includes plans to drill new wells to increase output.

- In January 2024, Phillips Machine Tools and Upanal CNC Solutions formed a strategic alliance to expand their market presence in South India by combining Upanal’s local experience with Phillips’s expertise in machining and complementary solutions

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated and CNC-enabled woodworking machines is expected to rise steadily.

- Adoption of energy-efficient and eco-friendly machines will increase across professional workshops.

- Online sales channels will continue to expand, improving accessibility for retail and small-scale users.

- Technological innovations, including IoT and smart machine integration, will drive productivity improvements.

- Growth in furniture manufacturing and construction sectors will sustain consistent market demand.

- DIY and home improvement trends will boost adoption among non-professional users.

- Manufacturers will focus on compact, portable, and multi-functional tools for versatile applications.

- Regional markets in Asia-Pacific will witness rapid expansion due to industrialization and urbanization.

- Training programs and skill development initiatives will support efficient utilization of advanced machines.

- Continuous R&D and product customization will enhance competitiveness and market differentiation.