Market Overview:

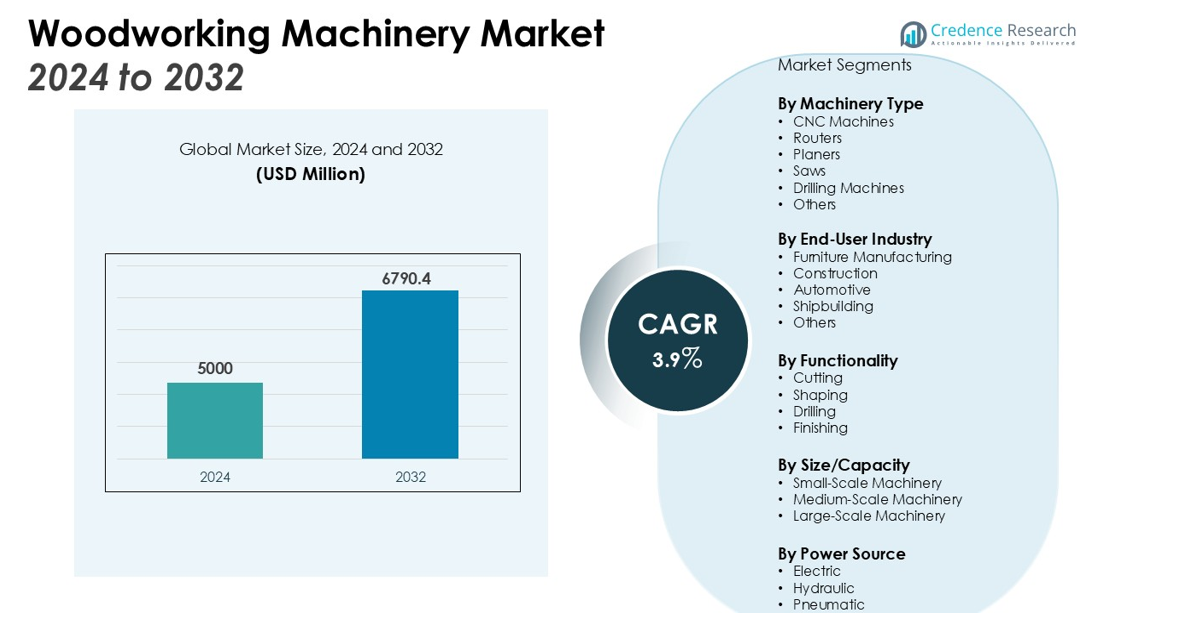

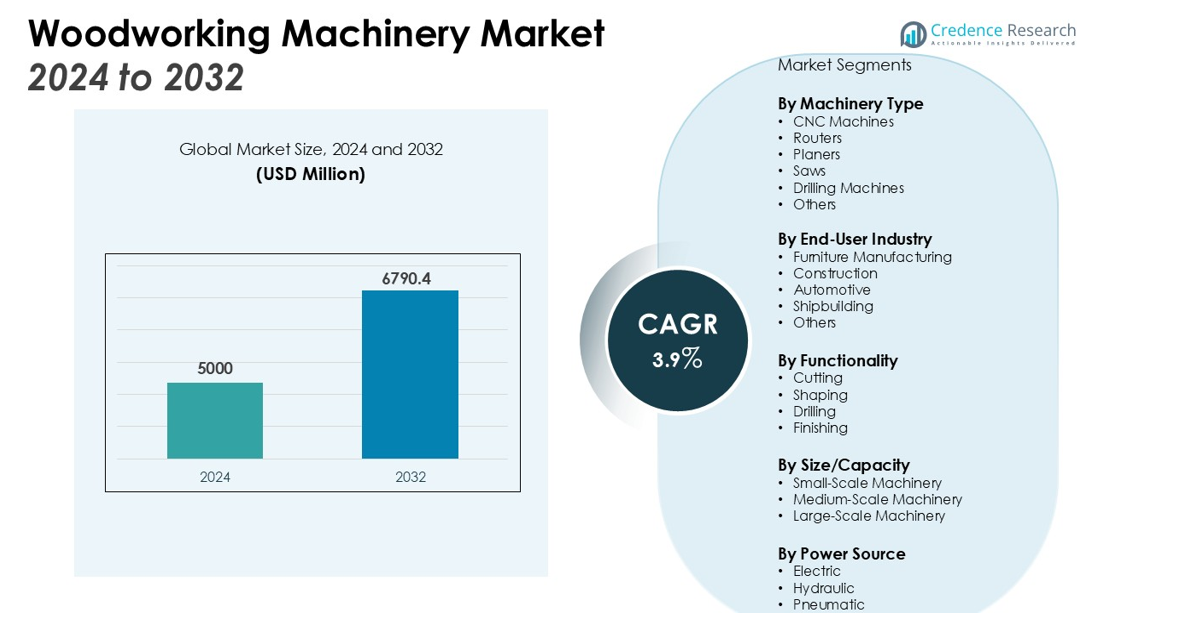

The Woodworking Machinery Market size was valued at USD 5000 million in 2024 and is anticipated to reach USD 6790.4 million by 2032, at a CAGR of 3.9% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Woodworking Machinery Market Size 2024 |

USD 5000 million |

| Woodworking Machinery Market, CAGR |

3.9% |

| Woodworking Machinery Market Size 2032 |

USD 6790.4 million |

Growth in this market is driven by rising demand for customized furniture, increasing residential and commercial construction projects, and the adoption of automation in manufacturing processes. Advanced CNC machines and automated cutting, drilling, and finishing tools enable higher productivity and reduced labor costs, making them attractive to both small-scale and large-scale manufacturers. Environmental concerns are also boosting the use of sustainable wood-processing technologies, further shaping market growth.

Regionally, Asia Pacific dominates the woodworking machinery market due to strong growth in housing, infrastructure, and furniture manufacturing in China, India, and Southeast Asia. Europe maintains steady growth, supported by high-quality furniture exports and strict environmental regulations promoting efficient machinery. North America shows consistent demand, driven by technological innovation and modernization of production facilities. Meanwhile, Latin America and the Middle East are emerging markets, expanding with urbanization and increased investments in construction and housing projects. Increasing government support for advanced manufacturing and smart factory adoption further strengthens regional market expansion.

Market Insights:

- The Woodworking Machinery Market was valued at USD 5000 million and will reach USD 6790.4 million by 2032, growing at a CAGR of 3.9%.

- Asia Pacific leads with 42% share, driven by rapid urbanization, infrastructure growth, and strong furniture manufacturing.

- Europe holds 28% share, supported by premium furniture exports, sustainability regulations, and digital manufacturing investments.

- North America accounts for 20% share, with demand supported by modernization of facilities and customized furniture needs.

- Latin America and the Middle East together represent 7% share, reflecting growth through urbanization and rising construction projects.

- Rising demand for customized furniture and expanding residential and commercial projects continue to accelerate machinery adoption.

- High initial costs and regulatory pressures challenge adoption, but automation, eco-friendly designs, and Industry 4.0 technologies offer strong opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Customized Furniture and Interior Solutions

The Woodworking Machinery Market is strongly driven by the growing preference for customized furniture and interior solutions. Consumers and businesses increasingly seek personalized designs that align with modern lifestyles and functional needs. This trend pushes manufacturers to adopt advanced machinery that supports flexibility and precision. It encourages investment in equipment capable of handling diverse designs and materials efficiently.

- For instance, Biesse, a global leader in the field, has successfully exported 10,000 woodworking machines from its Indian facility to over 75 countries, demonstrating its capacity to meet diverse, customized manufacturing demands worldwide.

Expansion of Residential and Commercial Construction Projects

Rapid urbanization and infrastructure development fuel demand for woodworking equipment in construction and furnishing activities. The rising number of residential and commercial projects increases the need for large-scale furniture production and interior fittings. It supports steady growth for machinery used in cutting, shaping, and finishing wooden components. Growing investments in real estate across emerging economies further accelerate machinery adoption.

- For instance, Biesse, a global leader in woodworking machinery, achieved a significant milestone by exporting 10,000 of its “Made-in-India” machines to more than 75 countries, showcasing the global reach and technological capabilities of its production.

Automation and Technological Advancements in Manufacturing

The integration of automation and CNC-based technologies plays a critical role in shaping the Woodworking Machinery Market. Automated cutting, drilling, and milling tools improve accuracy, reduce production cycles, and lower dependency on manual labor. It strengthens competitiveness by enabling higher output at reduced costs. Continuous technological upgrades also support manufacturers in delivering sustainable and innovative designs.

Focus on Sustainability and Eco-Friendly Wood Processing

Rising environmental concerns encourage industries to adopt eco-friendly woodworking machinery that minimizes waste and optimizes raw material usage. Governments and regulatory bodies promote sustainable production practices through strict guidelines. It drives manufacturers to innovate machinery that aligns with energy efficiency and environmental standards. The focus on green technology strengthens the market’s long-term growth outlook.

Market Trends:

Increasing Integration of Automation, CNC, and Digital Manufacturing Technologies

The Woodworking Machinery Market is experiencing a major shift toward automation and digital manufacturing. Companies are adopting CNC machines, robotic arms, and advanced cutting tools to enhance speed, precision, and efficiency. This integration reduces errors, optimizes material use, and minimizes labor costs. It supports consistent production quality, which is critical for both mass production and custom furniture applications. Growing interest in Industry 4.0 technologies, such as IoT-enabled equipment and real-time monitoring systems, further drives adoption. Manufacturers focus on developing connected machinery that allows predictive maintenance and data-driven decision-making. This transition toward smart factories is reshaping traditional woodworking practices across global markets.

- For instance, the woodworking firm Cardinal Millwork utilizes a CNC machine with a 20-foot bed, allowing it to handle large-scale custom projects with high precision.

Rising Popularity of Sustainable Solutions and Advanced Material Processing Capabilities

Sustainability has become a defining trend in the Woodworking Machinery Market, with manufacturers prioritizing energy-efficient designs and eco-friendly processes. Companies are innovating machinery that supports sustainable wood processing, recycling, and reduced emissions. It aligns with global regulatory standards and the growing preference for environmentally responsible products. At the same time, advanced machinery capable of handling engineered wood, composites, and lightweight materials is gaining traction. This trend enables flexibility for manufacturers to serve diverse end-use industries, including construction, automotive interiors, and modular furniture. The growing use of hybrid materials in modern furniture and interior design is further driving demand for versatile woodworking machines. Together, these factors highlight the shift toward greener, smarter, and more adaptive solutions across the industry.

- For instance, Boarke Machine Co., Ltd. helps drive the green building movement by developing high-precision machinery for prefabricated timber systems that require a component accuracy of within ±0.1 mm to ensure structural integrity and minimize material waste.

Market Challenges Analysis:

High Initial Investment Costs and Operational Complexity

The Woodworking Machinery Market faces challenges due to the high upfront investment required for advanced equipment. Small and medium-sized manufacturers often struggle to allocate capital for CNC systems, automated tools, and digital solutions. It limits adoption in price-sensitive markets where traditional machinery remains dominant. Operational complexity also creates barriers, as skilled operators are needed to manage modern systems effectively. Training requirements and maintenance expenses increase the total cost of ownership. These factors can slow adoption, particularly in developing regions where budget constraints are significant.

Fluctuating Raw Material Supply and Regulatory Pressures

Volatility in raw material supply and prices directly affects the Woodworking Machinery Market. The furniture and construction industries depend heavily on timber availability, which is impacted by environmental regulations and sustainability policies. It creates uncertainty for machinery manufacturers who must adapt to changing material trends. Regulatory pressures regarding emissions and energy efficiency further increase compliance costs. Manufacturers are compelled to redesign machines that meet strict international standards. This challenge requires continuous investment in research and innovation, straining resources for smaller companies. Combined, these issues create persistent hurdles for market expansion.

Market Opportunities:

Expansion of Smart Manufacturing and Industry 4.0 Adoption

The Woodworking Machinery Market presents strong opportunities through the adoption of smart manufacturing and Industry 4.0 technologies. Growing demand for CNC systems, IoT-enabled machines, and automated solutions is creating new revenue streams for manufacturers. It supports predictive maintenance, real-time monitoring, and higher production efficiency, making advanced machinery attractive to large and medium-scale industries. Integration of robotics and AI-driven design tools further enhances customization and flexibility in production lines. Rising interest in digital twin technology also enables better planning and simulation of manufacturing processes. These advancements create a favorable environment for companies to expand their product portfolios and strengthen competitiveness.

Rising Demand for Sustainable Solutions and Emerging Market Growth

Sustainability and eco-friendly production methods provide significant growth opportunities for the Woodworking Machinery Market. Machinery designed to optimize material use, reduce emissions, and improve energy efficiency is gaining traction across industries. It allows manufacturers to align with regulatory frameworks and consumer demand for environmentally responsible products. Expanding construction and furniture markets in Asia Pacific, Latin America, and the Middle East offer strong potential for advanced machinery adoption. Urbanization and rising disposable incomes in these regions are fueling investment in modern housing and customized furniture. This creates a pathway for manufacturers to establish stronger regional presence and capture long-term growth opportunities.

Market Segmentation Analysis:

By Machinery Type

The Woodworking Machinery Market is segmented into CNC machines, routers, planers, saws, and others. CNC machines lead the segment due to their precision, automation, and ability to support mass production. Routers and saws continue to register steady demand for small-scale and customized applications. It reflects a strong balance between advanced and traditional machinery across industries.

- For instance, Grex Power Tools was recognized for its GCP650, a cordless 2-inch 23-gauge headless pinner, showcasing technological achievement in precision tools for woodworking.

By End-User Industry

Furniture manufacturing dominates the Woodworking Machinery Market, supported by rising demand for modular and customized furniture. The construction sector also plays a significant role, driven by increasing residential and commercial projects. Automotive interiors and shipbuilding contribute to niche demand, requiring advanced finishing and shaping tools. It highlights the versatility of woodworking machinery across multiple sectors.

- For instance, the Spanish woodworking machinery company Comeva introduced its NICRON 5X CNC machine series to boost productivity for furniture manufacturers, enabling high-precision, automated machining for intricate and customized designs.

By Functionality

Cutting, shaping, drilling, and finishing functions define the core operations of woodworking machinery. Cutting tools hold a strong share, followed by shaping and drilling machines essential in furniture and panel production. Finishing machines are gaining demand with the rising preference for high-quality surface treatments. It demonstrates the industry’s emphasis on efficiency, accuracy, and superior product aesthetics.

Segmentations:

By Machinery Type

- CNC Machines

- Routers

- Planers

- Saws

- Drilling Machines

- Others

By End-User Industry

- Furniture Manufacturing

- Construction

- Automotive

- Shipbuilding

- Others

By Functionality

- Cutting

- Shaping

- Drilling

- Finishing

By Size/Capacity

- Small-Scale Machinery

- Medium-Scale Machinery

- Large-Scale Machinery

By Power Source

- Electric

- Hydraulic

- Pneumatic

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Strong Growth in Asia Pacific Driven by Construction and Furniture Manufacturing

Asia Pacific held 42% share of the Woodworking Machinery Market, leading globally. The region’s dominance is supported by rapid urbanization, industrial growth, and strong construction activity. China, India, and Southeast Asia contribute significantly due to large-scale furniture and housing projects. It is further strengthened by government programs that promote smart manufacturing adoption. Rising disposable incomes and growing preference for modular furniture continue to boost machinery demand. These factors establish Asia Pacific as the fastest-growing regional market.

Steady Expansion in Europe Supported by Sustainability and High-Quality Exports

Europe accounted for 28% share of the Woodworking Machinery Market, ranking second globally. Its growth is driven by a strong base of premium furniture manufacturers and export competitiveness. Countries including Germany, Italy, and Poland remain leading hubs for advanced woodworking solutions. It benefits from strict sustainability regulations that encourage energy-efficient machinery use. Investments in automation and digital production systems support long-term regional competitiveness. Export-focused strategies strengthen Europe’s position in the global landscape.

Consistent Demand in North America with Emerging Potential in Other Regions

North America captured 20% share of the Woodworking Machinery Market, maintaining steady demand. The United States leads the region, supported by modernized facilities and strong innovation capabilities. It benefits from rising demand for customized furniture and high-value construction activities. Latin America and the Middle East recorded a combined 7% share, reflecting growing potential through urbanization. Expanding housing projects and industrial adoption of advanced machinery support their progress. Africa also shows early opportunities, backed by industrial development and gradual modernization of construction practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SOCOMEC S.R.L. (Italy)

- Solidea Srl (Italy)

- Biesse Group (Italy)

- KTCC WOODWORKING MACHINERY (Taiwan)

- HOLYTEK INDUSTRIAL CORP. (Taiwan)

- SCM Group (Italy)

- Dürr Group (Germany)

- Gongyou Group Co., Ltd. (China)

- Cantek America Inc. (U.S.)

- IMA Schelling Group GmbH (Germany)

- Michael Weinig AG (Germany)

- Oliver Machinery Company (U.S.)

- Nihar Industries (India)

- CKM (Taiwan)

- RS WOOD S.R.L. (Italy)

Competitive Analysis:

The Woodworking Machinery Market is highly competitive, shaped by global and regional players offering diverse product portfolios. Leading companies focus on CNC machines, automated solutions, and digital integration to enhance precision and efficiency. It drives strong investment in research and development to support innovation and sustainability. European manufacturers emphasize high-quality engineering and export leadership, while Asian players benefit from cost competitiveness and expanding domestic demand. North American firms maintain a strong edge in automation and advanced technology adoption, targeting high-value construction and customized furniture sectors. Strategic partnerships, mergers, and expansion into emerging regions remain common growth approaches. Competition is further intensified by rising demand for eco-friendly and energy-efficient solutions, pushing companies to align with strict environmental standards. The landscape reflects a mix of established global leaders and agile regional firms, each striving to capture market share through technological differentiation and service excellence.

Recent Developments:

- In May 2025 Biesse launched Biesse Technic, a new brand focused on integrated production lines for processing wood, glass, and stone.

- In June 2025 Dürr Group agreed to sell its environmental technology business to Stellex Capital Management, a move intended to allow the company to focus on its core business in automation technology.

Report Coverage:

The research report offers an in-depth analysis based on Machinery Type, End-User Industry, Functionality, Size/Capacity, Power Source and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Woodworking Machinery Market will continue to expand with rising demand for customized and modular furniture.

- Automation and CNC technologies will play a central role in increasing precision and production efficiency.

- Smart manufacturing adoption and IoT-enabled machinery will enhance predictive maintenance and real-time monitoring.

- Sustainability trends will push manufacturers to design energy-efficient and eco-friendly woodworking machines.

- Emerging economies in Asia Pacific, Latin America, and the Middle East will drive new growth opportunities.

- Demand for compact and flexible machinery will rise among small and medium-scale manufacturers.

- Advanced finishing equipment will gain traction with growing interest in high-quality surface aesthetics.

- Strategic partnerships and mergers among global and regional players will shape competitive dynamics.

- Skilled workforce development will remain critical to managing modern machinery and automation systems.

- Continuous investment in research and development will foster innovation and strengthen long-term industry competitiveness.