Market Overview

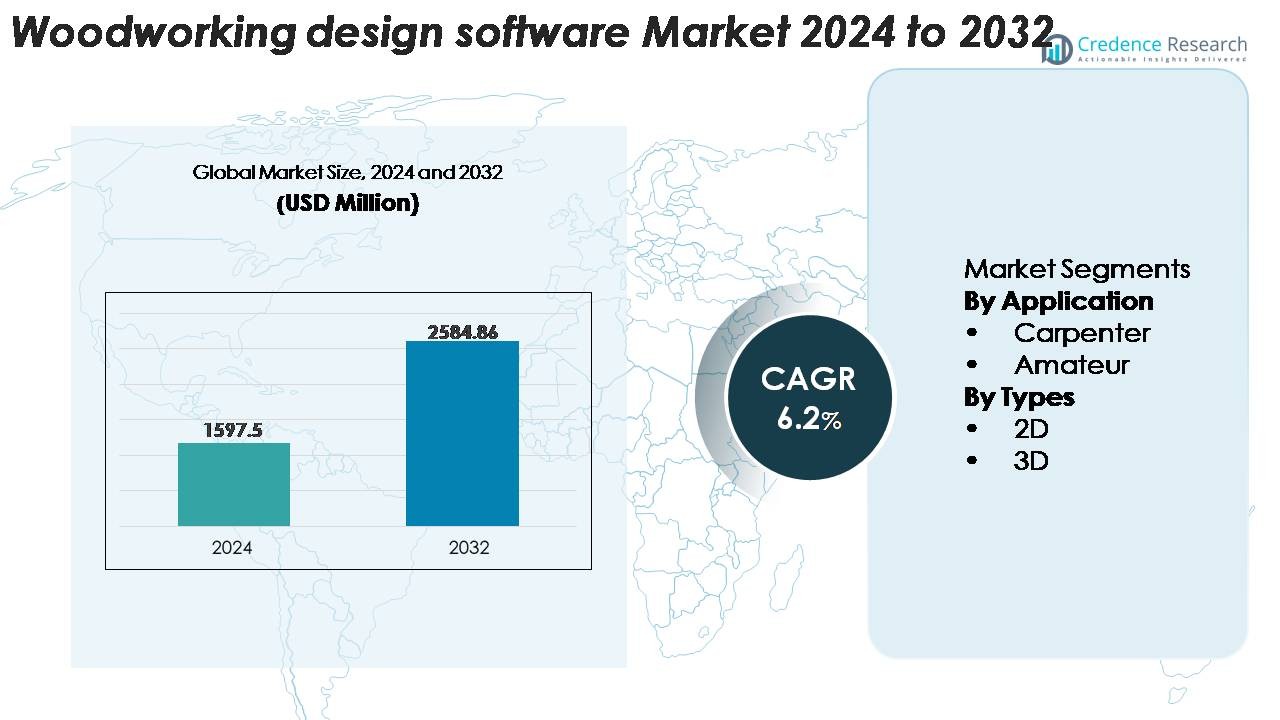

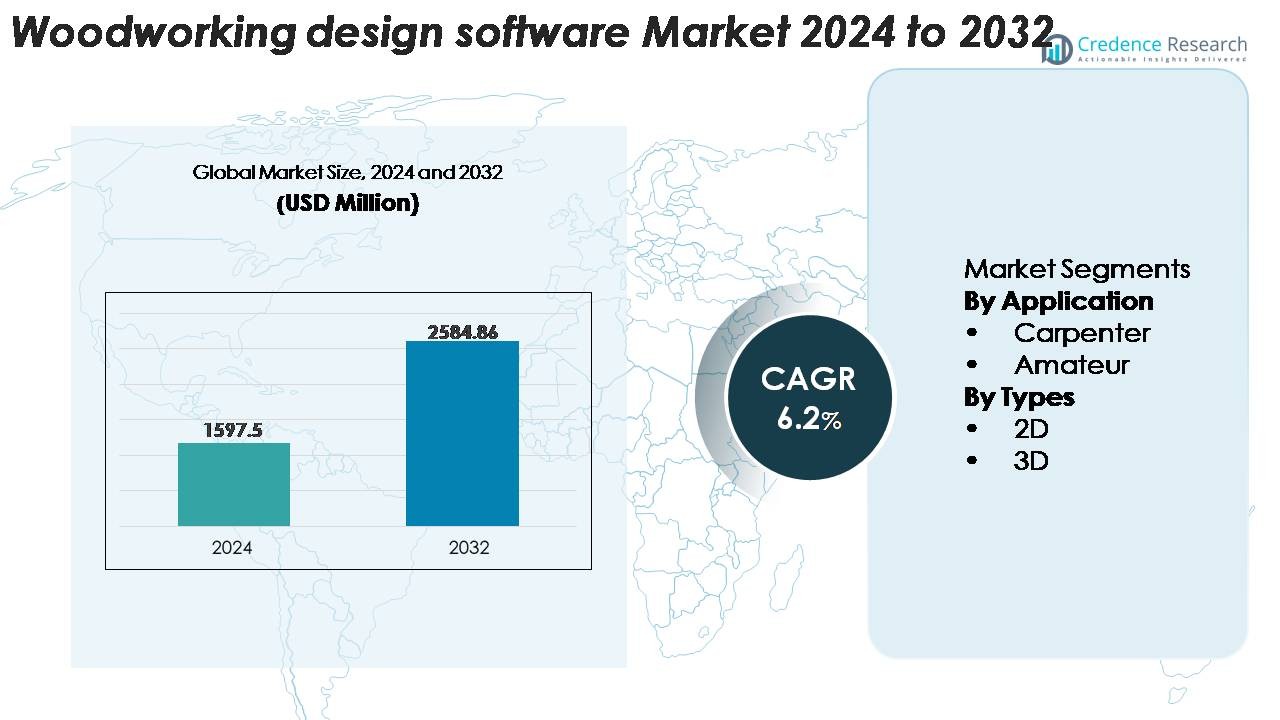

The Woodworking Design Software Market was valued at USD 1,597.5 million in 2024 and is anticipated to reach USD 2,584.86 million by 2032, reflecting a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Woodworking Design Software Market Size 2024 |

USD 1,597.5 Million |

| Woodworking Design Software Market, CAGR |

6.2% |

| Woodworking Design Software Market Size 2032 |

USD 2,584.86 Million |

The woodworking design software market is shaped by a mix of advanced CAD/CAM vendors and timber-engineering specialists, led by companies such as DIETRICH’S, TEKLA, MiTek, Data Design System, GRAITEC, Metsä Wood, Artlantis, BOCAD Service International, Dlubal, and FINE. These players compete by offering parametric modeling, CNC-ready outputs, structural analysis, and integrated material-optimization tools tailored for furniture manufacturing, millwork, and timber construction. North America dominates with 34% market share, driven by strong digital adoption and CNC automation. Europe follows with 29%, supported by advanced engineering workflows, while Asia-Pacific holds 27%, propelled by rapid manufacturing expansion and modular furniture production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The woodworking design software market was valued at USD 1,597.5 million in 2024 and is anticipated to reach USD 2,584.86 million by 2032, reflecting a CAGR of 6.2% during the forecast period. supported by rising digitalization across woodworking and interior design ecosystems.

- Strong market drivers include increased adoption of CNC-integrated CAD/CAM workflows, growing demand for custom cabinetry, and rapid uptake of cloud-based collaboration tools among furniture manufacturers and woodworking studios.

- Key trends include the expansion of AI-driven parametric modeling, AR/VR visualization for client approvals, and sustainability-focused material-optimization tools. Leading players strengthen competitiveness through CNC partnerships and advanced automation features.

- Market restraints stem from high software licensing costs, integration challenges with legacy machines, and limited digital skills among small woodworking workshops, hindering full-scale adoption across developing markets.

- Regionally, North America holds 34%, Europe 29%, Asia-Pacific 27%, while Latin America and MEA jointly account for the remainder. By segment, CNC-integrated CAD/CAM solutions command nearly 48% share, reflecting strong fabrication-driven demand.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Application

Within the application category, carpenters represent the dominant sub-segment, accounting for the largest share due to their extensive reliance on digital tools for precision joinery, custom cabinetry, and complex woodworking layouts. Professionals increasingly adopt advanced modeling functions, automated cut-list generation, and CNC-ready design exports to reduce manual errors and accelerate production cycles. Amateur users form a steadily expanding group driven by accessible interfaces, template libraries, and low-cost subscription models that simplify hobby-level project planning. The “others” segment including educators, craft studios, and design learners leverages simplified programs to support training, prototyping, and basic project visualization.

- For instance, Woodwork for Inventor by Celi APS integrates with Autodesk Inventor and supports automated CNC output directly from 3D assemblies. The platform generates machining data, part lists, and material layouts without manual re-modeling, which helps reduce design-to-production errors in furniture manufacturing.

By Types

In the type-based segmentation, the 3D design software sub-segment holds the leading market share, propelled by its strong utility in visualizing assemblies, simulating material behavior, and integrating with CNC routers, laser cutters, and automated milling platforms. Woodworking firms favor 3D tools for photorealistic rendering, parametric modeling, and accurate bill-of-material generation that enhance both client approval cycles and production precision. Meanwhile, 2D solutions remain relevant among cost-conscious or small workshop users who require essential drafting, basic layout mapping, and straightforward dimensional planning. However, industry-wide digital fabrication trends continue to shift momentum decisively toward 3D platforms.

- For instance, Dlubal’s RFEM 6 Timber Design add-on supports full 3D FEA modeling of timber beams, panels, and complex assemblies with automatic generation of load combinations for ultimate, serviceability, and fire-resistance checks. The module handles advanced behaviors such as anisotropic material response, stability verification, creep effects, and reduced cross-section fire design, offering simulation depth that is not possible in 2D drafting tools.

Key Growth Drivers

Rising Demand for Precision Manufacturing and Custom Woodwork

Growing demand for personalized furniture, modular cabinetry, and architect-grade millwork continues to push woodworking professionals toward digital precision tools. As consumers seek bespoke designs with shorter turnaround cycles, design studios and carpentry workshops increasingly adopt CAD-driven platforms to automate measurements, visualize 3D concepts, and eliminate iterative manual drafting. Woodworking design software enhances dimensional accuracy, reduces waste through optimized cutting layouts, and supports error-free project planning critical advantages for both large-scale manufacturers and independent artisans. Integration with CNC routers and automated saw systems further accelerates adoption, enabling smooth transitions from virtual designs to machine-ready instructions. The push toward mass customization, just-in-time production, and reduced material scrap reinforces the need for these intelligent tools. Growing adoption among interior designers, bespoke carpenters, and modular furniture producers strengthens market momentum as woodworkers prioritize efficiency, accuracy, and customer-ready visualization outputs.

· For instance, Metsä Wood’s Finnwood® calculation software provides verified structural design capabilities for Kerto® LVL beams, panels, and rafters based on Eurocode standards. The tool supports 3D analysis of long-span engineered timber members and automatically checks bending, shear, stability, and deflection criteria for accurate architectural wood modeling.

Rapid Adoption of CNC Automation and Digital Fabrication Workflows

The woodworking industry’s shift toward CNC machining covering routers, milling machines, edgebanders, and automated cutters has created strong demand for software ecosystems that support seamless digital-to-physical fabrication. Manufacturers increasingly rely on design software capable of generating parametric models, tool paths, and machine-ready G-code to eliminate manual programming errors. Software platforms with built-in libraries, nesting capabilities, and material-specific parameters enable smoother workflow synchronization between design, production planning, and cutting operations. As smart factories adopt Industry 4.0 frameworks, the demand for integrated CAM modules and workflow automation continues rising. Automatic updating of cut-lists, simulated machining previews, and real-time optimization significantly reduce production downtime. These advancements make precision fabrication accessible even for small workshops, accelerating the uptake of woodworking design software as a central component of digitally connected woodworking operations.

- For instance, HOMAG’s woodWOP 8 supports automated CNC program generation for 3-, 4-, and 5-axis machining centers and includes full 3D surface processing for complex milling tasks. The platform reads solid models, assigns machining features, and produces machine-ready programs that integrate directly with HOMAG’s CNC routers for precise furniture and panel production.

Expansion of Cloud-Based Collaboration and Remote Project Management

The shift toward cloud-based design and collaboration tools drives substantial market growth by enabling distributed teams, designers, and clients to interact seamlessly. Cloud-native woodworking design platforms support real-time editing, centralized asset libraries, remote access to project files, and instant sharing of 2D/3D models allowing design changes to be reviewed and approved without physical site meetings. This improvement in workflow efficiency is particularly valuable for interior design studios, multi-location furniture manufacturers, and contractors who coordinate with architects or builders. Cloud deployment also reduces upfront costs and supports automatic updates, version control, and scalable storage. Mobile-friendly features expand access to design data on job sites, allowing measurements, notes, and changes to be integrated instantly. These capabilities strengthen cross-functional alignment from design to installation and improve turnaround times for customized woodwork projects, driving broader adoption across both SME and enterprise segments.

Key Trends & Opportunities

Integration of AR/VR for Immersive Client Visualization

Augmented and virtual reality technologies create new opportunities for woodworking design software providers to elevate client engagement and improve approval cycles. AR-enabled applications allow customers to preview cabinetry, wardrobes, wooden fixtures, and custom furniture within their actual living or commercial spaces at true scale. VR environments offer immersive walkthroughs of detailed interior woodwork designs, helping identify aesthetic or dimensional adjustments early in the design phase. These tools reduce design ambiguity, accelerate project finalization, and strengthen customer confidence in bespoke solutions. As hardware becomes more affordable and intuitive, software vendors increasingly integrate AR/VR modules as premium features. This trend positions immersive visualization as a competitive differentiator, opening opportunities for vendors to partner with interior design firms, home improvement retailers, and modular furniture brands seeking high-impact customer experiences.

· For instance, Artlantis by Abvent supports VR Object rendering and 360° panorama exports, allowing woodworking and interior studios to produce immersive previews of wood textures, grain finishes, and millwork configurations. The platform’s material-mapping tools enable accurate visualization of veneers, laminates, and furniture surfaces for client-ready presentations.

Growth of AI-Driven Automation in Woodworking Design

AI-enabled features are reshaping how designers and manufacturers create, optimize, and modify woodwork concepts. Intelligent algorithms can auto-suggest design layouts, detect structural inconsistencies, recommend joint types, and generate optimized nesting plans based on available materials. AI-powered dimensioning tools reduce repetitive tasks, while generative design engines allow creative exploration of multiple furniture variations. Predictive analytics support accurate project costing and resource planning, reducing margin variability. As woodworkers increasingly demand time-saving automation, software providers integrate AI-driven features that improve design accuracy, accelerate modeling, and reduce revisions. The ability of AI tools to enhance creativity while maintaining structural feasibility presents significant opportunities for innovation. Vendors offering hybrid AI-CAM platforms stand to benefit as digitalization accelerates across both artisan and industrial woodworking segments.

Rising Adoption of Sustainability-Focused Design and Material Optimization

Sustainability concerns are driving adoption of software that helps minimize material waste, optimize board usage, and validate environmentally responsible designs. Advanced cutting-optimization tools maximize yield from raw boards or panels while reducing offcuts. Software with built-in material databases allows designers to compare the environmental impact, durability, and sourcing options of hardwoods, veneers, composites, and engineered panels. Green building certifications increasingly require detailed documentation, pushing software vendors to incorporate sustainability reporting capabilities. As eco-friendly furniture, modular wood structures, and renewable timber products gain traction, design platforms that enable sustainable decision-making gain a competitive advantage. This trend creates opportunities for vendors to collaborate with green-certification bodies, material suppliers, and sustainable architecture companies to drive adoption across professional woodworking ecosystems.

- For instance, Vectorworks’ Nomad app supports AR-based field measurements powered by ARKit and ARCore sensor frameworks, allowing installers to capture room dimensions with accuracy consistent with typical mobile-depth systems. The app syncs measurements and 3D model views to Vectorworks Cloud Services, helping cabinetry and millwork teams align on-site data with their design files.

Key Challenges

High Software Costs and Limited Adoption Among Small Workshops

Despite strong market growth, high licensing fees, annual subscriptions, and hardware requirements pose significant barriers for small carpentry businesses and independent artisans. Many smaller workshops rely on manual drafting or low-cost generic design tools, delaying migration to industry-specific platforms that offer advanced features. Training requirements, limited digital literacy, and the cost of upgrading PCs or CNC equipment further hinder adoption. Additionally, some features such as parametric modeling, material-specific simulation, and CAM integration are underutilized by micro-enterprises, making software investments seem disproportionate to their production scale. The challenge is amplified in cost-sensitive markets, where budget constraints slow the shift toward digital workflows. Vendors must address these barriers through tiered pricing, simplified interfaces, and market-specific localization to widen the adoption base.

Integration Complexity with Diverse CNC Equipment and Legacy Systems

Woodworking operations often rely on a mix of legacy machines, third-party CNC routers, proprietary controllers, and older design tools making seamless digital integration difficult. Ensuring compatibility between design software and heterogeneous machine environments requires extensive customization, post-processor updates, and vendor-specific configuration. Misalignment between software-generated tool paths and machine capabilities can cause production delays, errors, or tool wear. Small workshops with older machinery face additional challenges integrating advanced CAM modules or cloud-based systems. Moreover, interoperability issues between different design formats limit collaboration across contractors, designers, and manufacturers. These integration complexities create operational friction that slows digital adoption, reinforcing the need for standardized machine interfaces, improved plug-and-play compatibility, and robust technical support networks.

Regional Analysis

North America

North America holds approximately 34% of the market, driven by strong digital adoption across furniture manufacturing, cabinetry, and architectural millwork sectors. High spending on home remodeling, advanced CNC automation, and widespread cloud-CAD usage strengthen the region’s leadership. The U.S. market benefits from mature woodworking industries, robust demand for customized furniture, and rapid integration of AR/VR visualization tools in design studios. Strong adoption among modular furniture manufacturers and woodworking job shops further accelerates growth. Additionally, extensive use of AI-driven design optimization and mature integration with CNC routers solidifies North America as a technologically advanced market.

Europe

Europe accounts for roughly 29% of the market, supported by strong woodworking traditions, high-quality furniture manufacturing clusters, and increasing investment in digital design workflows. Germany, Italy, and the Nordics lead adoption through advanced CNC-enabled production and emphasis on precision engineering. Sustainability-focused design driven by EU regulations boosts demand for material-optimization features in woodworking software. The region’s mature carpentry SMEs are progressively adopting cloud platforms to streamline collaboration with architects and interior designers. Growing interest in parametric design, premium custom joinery, and digital twin models continues to reinforce Europe’s position as a major innovation hub.

Asia-Pacific

Asia-Pacific represents approximately 27% of the market and is the fastest-growing region, propelled by rapid urbanization, rising disposable incomes, and expansion of modular furniture manufacturing in China, India, and Southeast Asia. The region’s strong woodworking export ecosystem, combined with widespread CNC automation, fuels demand for specialized design software. Growing adoption of cloud-based platforms enables scalable collaboration across multi-location manufacturers and design firms. Increasing investment in smart furniture factories and Industry 4.0 systems further accelerates adoption. APAC’s competitive manufacturing environment pushes software vendors to offer cost-efficient, high-performance design solutions tailored for large-volume production.

Latin America

Latin America captures around 6% of the market, supported by expanding residential construction, growth in mid-range furniture production, and rising interest in custom cabinetry for urban households. Brazil and Mexico lead adoption as manufacturers invest in digital tools to improve precision and reduce waste. Cost sensitivity remains high, pushing demand for entry-level CAD solutions and hybrid pricing models. Growing use of CNC routers in local workshops stimulates the need for design-to-machine integration. Although the region’s digital maturity is lower than that of North America or Europe, steady modernization of woodworking workflows supports incremental growth.

Middle East & Africa

The Middle East & Africa region holds nearly 4% of the market, driven by growing interior design activities, luxury fit-out projects, and modern woodworking workshops in the GCC. Demand for high-quality custom furniture in residential and commercial developments increases the adoption of digital design tools. However, limited access to advanced CNC equipment and higher software costs hinder adoption across smaller workshops. In Africa, woodworking digitalization is emerging gradually, supported by rising SME interest in affordable CAD tools. Despite its smaller base, the region presents long-term potential as construction-led demand and digital capabilities expand.

Market Segmentations:

By Application

By Types

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The woodworking design software market is characterized by a diverse competitive landscape comprising specialized CAD/CAM providers, structural design software companies, and vendors offering integrated digital fabrication ecosystems. Key players including DIETRICH’S, TEKLA, MiTek, Data Design System, GRAITEC, Metsä Wood, Artlantis, BOCAD Service International, Dlubal, and FINE compete by enhancing modeling accuracy, parametric design capabilities, and compatibility with CNC machining workflows. Vendors increasingly integrate smart automation, AI-driven layout optimization, and cloud-based collaboration features to streamline project coordination between designers, fabricators, and contractors. Partnerships with timber engineering firms, modular construction companies, and woodworking machinery manufacturers further strengthen platform adoption. As digital transformation accelerates across furniture manufacturing, millwork production, and timber construction, software providers focus on advanced visualization, material-optimization tools, and seamless interoperability to maintain competitive differentiation and expand their user base across global woodworking ecosystems.

Key Player Analysis

- DIETRICH’S

- TEKLA

- MiTek

- GRAITEC

- Metsä Wood

- Artlantis

- BOCAD Service International

- Dlubal

- FINE

Recent Developments

- In April 2025, TopSolid’Wood (by TopSolid) unveiled its 2025 version update — announcing new features aimed at improving woodworking project design, manufacturing planning, and workshop management across CAD and CAM workflows.

- In July 2025, SWOOD (by EFICAD) published a new release enhancing 3D CAD workflows for custom furniture and millwork, streamlining CNC-ready output and material management for complex wood projects.

- In November 2024, Siemens announced a collaboration with Homag Group to align woodworking machinery with Siemens Digital Industries Software, improving digital factory performance for woodworking applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud-native woodworking design platforms will see wider adoption as manufacturers and designers prioritize real-time collaboration and remote project access.

- AI-driven automation will increasingly support parametric modeling, error detection, nesting optimization, and automated cut-list generation.

- AR/VR visualization tools will become standard for client approvals, enabling immersive previews of cabinetry, millwork, and interior woodwork layouts.

- Integration between design software and CNC machinery will deepen, improving workflow synchronization from modeling to machine execution.

- Sustainability requirements will drive greater use of material-optimization algorithms and eco-certified digital material libraries.

- Small and mid-size workshops will adopt lightweight, subscription-based platforms as pricing flexibility improves.

- Digital twin adoption will expand within timber engineering and modular construction to enhance structural planning and lifecycle assessment.

- Mobile design applications will grow to support on-site measurements, project edits, and installation verification.

- Vendor ecosystems will strengthen through partnerships with furniture OEMs, timber processors, and machinery manufacturers.

- Regional adoption will accelerate in Asia-Pacific as large-scale manufacturing and modular furniture production continue to digitalize.

Market Segmentation Analysis:

Market Segmentation Analysis: