- Introduction

1.1. Report Description

1.2. Purpose of the Report

1.3. USP & Key Offerings

1.4. Key Benefits for Stakeholders

1.5. Target Audience

1.6. Report Scope

1.7. Regional Scope

- Scope and Methodology

2.1. Objectives of the Study

2.2. Stakeholders

2.3. Data Sources

2.3.1. Primary Sources

2.3.2. Secondary Sources

2.4. Market Estimation

2.4.1. Bottom-Up Approach

2.4.2. Top-Down Approach

2.5. Forecasting Methodology

- Executive Summary

- Introduction

4.1. Overview

4.2. Key Industry Trends

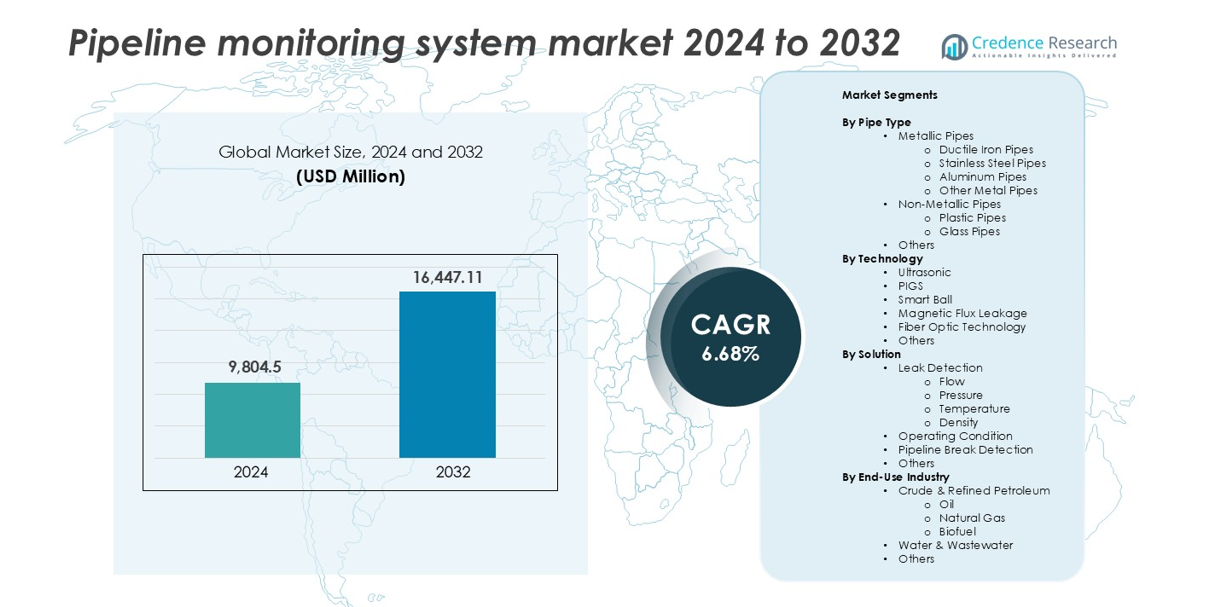

- Global Pipeline Monitoring System Market

5.1. Market Overview

5.2. Market Performance

5.3. Impact of COVID-19

5.4. Market Forecast

- Market Breakup by Pipe Type

6.1. Metallic Pipes

6.1.1. Ductile Iron Pipes

6.1.2. Stainless Steel Pipes

6.1.3. Aluminum Pipes

6.1.4. Other Metal Pipes

6.2. Non-Metallic Pipes

6.2.1. Plastic Pipes

6.2.2. Glass Pipes

6.2.3. Others

- Market Breakup by Technology

7.1. Ultrasonic

7.1.1. Market Trends

7.1.2. Market Forecast

7.1.3. Revenue Share

7.1.4. Revenue Growth Opportunity

7.2. PIGS

7.2.1. Market Trends

7.2.2. Market Forecast

7.2.3. Revenue Share

7.2.4. Revenue Growth Opportunity

7.3. Smart Ball

7.3.1. Market Trends

7.3.2. Market Forecast

7.3.3. Revenue Share

7.3.4. Revenue Growth Opportunity

7.4. Magnetic Flux Leakage

7.4.1. Market Trends

7.4.2. Market Forecast

7.4.3. Revenue Share

7.4.4. Revenue Growth Opportunity

7.5. Fiber Optic Technology

7.5.1. Market Trends

7.5.2. Market Forecast

7.5.3. Revenue Share

7.5.4. Revenue Growth Opportunity

7.6. Others

7.6.1. Market Trends

7.6.2. Market Forecast

7.6.3. Revenue Share

7.6.4. Revenue Growth Opportunity

- Market Breakup by Solution

8.1. Leak Detection

8.1.1. Market Trends

8.1.2. Market Forecast

8.1.3. Revenue Share

8.1.4. Revenue Growth Opportunity

8.2. Flow

8.2.1. Market Trends

8.2.2. Market Forecast

8.2.3. Revenue Share

8.2.4. Revenue Growth Opportunity

8.3. Pressure

8.3.1. Market Trends

8.3.2. Market Forecast

8.3.3. Revenue Share

8.3.4. Revenue Growth Opportunity

8.4. Temperature

8.4.1. Market Trends

8.4.2. Market Forecast

8.4.3. Revenue Share

8.4.4. Revenue Growth Opportunity

8.5. Density

8.5.1. Market Trends

8.5.2. Market Forecast

8.5.3. Revenue Share

8.5.4. Revenue Growth Opportunity

8.6. Operating Condition

8.6.1. Market Trends

8.6.2. Market Forecast

8.6.3. Revenue Share

8.6.4. Revenue Growth Opportunity

8.7. Pipeline Break Detection

8.7.1. Market Trends

8.7.2. Market Forecast

8.7.3. Revenue Share

8.7.4. Revenue Growth Opportunity

8.8. Others

8.8.1. Market Trends

8.8.2. Market Forecast

8.8.3. Revenue Share

8.8.4. Revenue Growth Opportunity

- Market Breakup by End-Use Industry

9.1. Crude & Refined Petroleum

9.1.1. Market Trends

9.1.2. Market Forecast

9.1.3. Revenue Share

9.1.4. Revenue Growth Opportunity

9.2. Oil

9.2.1. Market Trends

9.2.2. Market Forecast

9.2.3. Revenue Share

9.2.4. Revenue Growth Opportunity

9.3. Natural Gas

9.3.1. Market Trends

9.3.2. Market Forecast

9.3.3. Revenue Share

9.3.4. Revenue Growth Opportunity

9.4. Biofuel

9.4.1. Market Trends

9.4.2. Market Forecast

9.4.3. Revenue Share

9.4.4. Revenue Growth Opportunity

9.5. Water & Wastewater

9.5.1. Market Trends

9.5.2. Market Forecast

9.5.3. Revenue Share

9.5.4. Revenue Growth Opportunity

9.6. Others

9.6.1. Market Trends

9.6.2. Market Forecast

9.6.3. Revenue Share

9.6.4. Revenue Growth Opportunity

- Market Breakup by Region

10.1. North America

10.1.1. United States

10.1.1.1. Market Trends

10.1.1.2. Market Forecast

10.1.2. Canada

10.1.2.1. Market Trends

10.1.2.2. Market Forecast

10.2. Asia-Pacific

10.2.1. China

10.2.2. Japan

10.2.3. India

10.2.4. South Korea

10.2.5. Australia

10.2.6. Indonesia

10.2.7. Others

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. United Kingdom

10.3.4. Italy

10.3.5. Spain

10.3.6. Russia

10.3.7. Others

10.4. Latin America

10.4.1. Brazil

10.4.2. Mexico

10.4.3. Others

10.5. Middle East and Africa

10.5.1. Market Trends

10.5.2. Market Breakup by Country

10.5.3. Market Forecast

- SWOT Analysis

11.1. Overview

11.2. Strengths

11.3. Weaknesses

11.4. Opportunities

11.5. Threats

- Value Chain Analysis

- Porter’s Five Forces Analysis

13.1. Overview

13.2. Bargaining Power of Buyers

13.3. Bargaining Power of Suppliers

13.4. Degree of Competition

13.5. Threat of New Entrants

13.6. Threat of Substitutes

- Price Analysis

- Competitive Landscape

15.1. Market Structure

15.2. Key Players

15.3. Profiles of Key Players

15.3.1. ABB Ltd. (Switzerland)

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financials

15.3.1.4. SWOT Analysis

15.3.2. Atmos International (United Kingdom)

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financials

15.3.2.4. SWOT Analysis

15.3.3. Baker Hughes Company (United States)

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financials

15.3.3.4. SWOT Analysis

15.3.4. ClampOn AS (Norway)

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financials

15.3.4.4. SWOT Analysis

15.3.5. Emerson Electric Co. (United States)

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financials

15.3.5.4. SWOT Analysis

15.3.6. Enbridge Inc. (Canada)

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financials

15.3.6.4. SWOT Analysis

15.3.7. General Electric Company (United States)

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financials

15.3.7.4. SWOT Analysis

15.3.8. Honeywell International Inc. (United States)

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financials

15.3.8.4. SWOT Analysis

15.3.9. Perma-Pipe International Holdings, Inc. (United States)

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financials

15.3.9.4. SWOT Analysis

15.3.10. PSI AG (Germany)

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Financials

15.3.10.4. SWOT Analysis

15.3.11. Pure Technologies Ltd. (Canada)

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. Financials

15.3.11.4. SWOT Analysis

15.3.12. Rohrback Cosasco Systems (United States)

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. Financials

15.3.12.4. SWOT Analysis

15.3.13. Schneider Electric SE (France)

15.3.13.1. Company Overview

15.3.13.2. Product Portfolio

15.3.13.3. Financials

15.3.13.4. SWOT Analysis

15.3.14. Senstar Corporation (Canada)

15.3.14.1. Company Overview

15.3.14.2. Product Portfolio

15.3.14.3. Financials

15.3.14.4. SWOT Analysis

15.3.15. Siemens AG (Germany)

15.3.15.1. Company Overview

15.3.15.2. Product Portfolio

15.3.15.3. Financials

15.3.15.4. SWOT Analysis

15.3.16. TC Energy (formerly TransCanada Corporation) (Canada)

15.3.16.1. Company Overview

15.3.16.2. Product Portfolio

15.3.16.3. Financials

15.3.16.4. SWOT Analysis

15.3.17. Yokogawa Electric Corporation (Japan)

15.3.17.1. Company Overview

15.3.17.2. Product Portfolio

15.3.17.3. Financials

15.3.17.4. SWOT Analysis

- Research Methodology