Market Overview

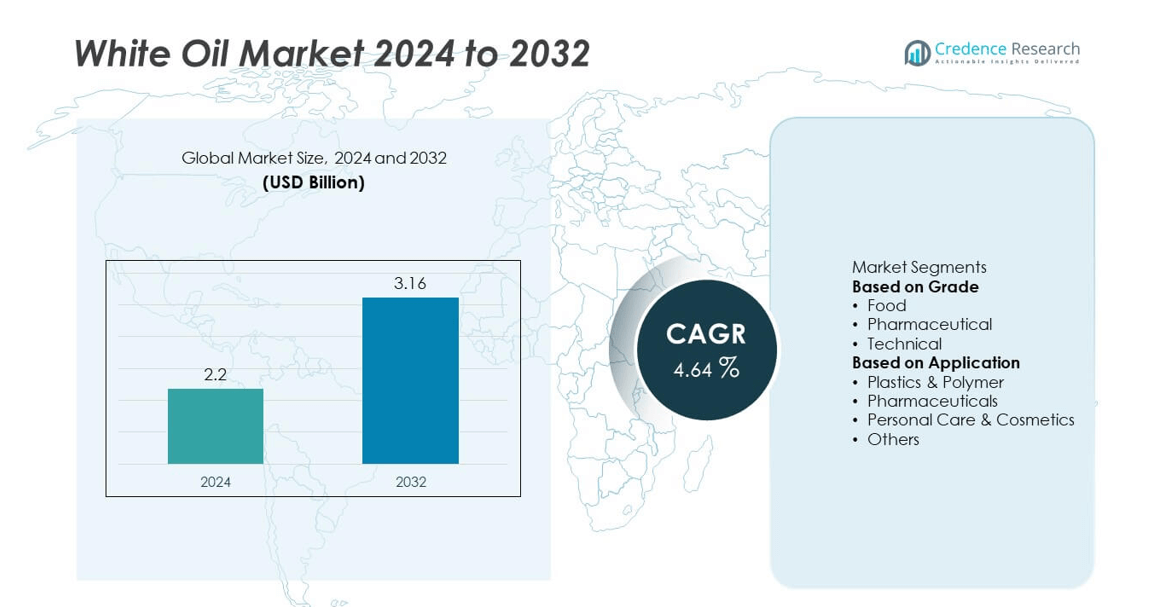

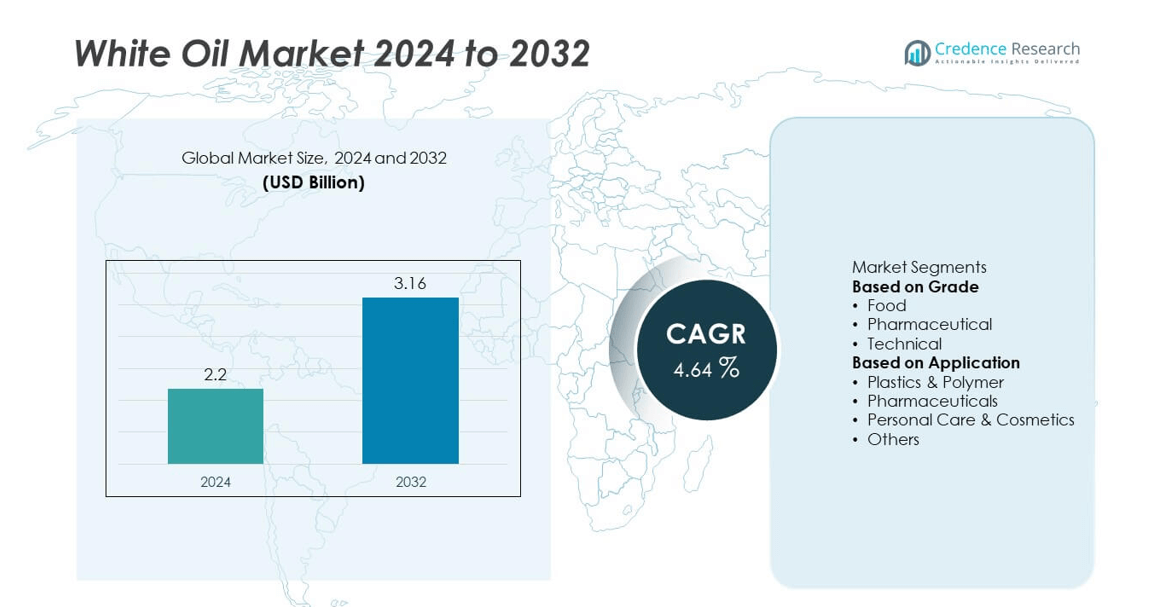

White Oil market size was valued at USD 2.2 billion in 2024 and is projected to reach USD 3.16 billion by 2032, registering a CAGR of 4.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| White Oil Market Size 2024 |

USD 2.2 billion |

| White Oil Market, CAGR |

4.64% |

| White Oil Market Size 2032 |

USD 3.16 billion |

The white oil market is driven by key players such as Sinopec Corporation, Nynas AB, ExxonMobil Fuels & Lubricants, Seojin Chemical, BASF SE, Royal Dutch Shell, ENEOS Corporation, Total SA, British Petroleum, and Suncor Energy. These companies focus on producing high-purity grades for pharmaceutical, food, and personal care applications while investing in refining technology and sustainability initiatives. North America leads the market with 32% share, supported by strong demand from healthcare, cosmetics, and polymer sectors. Asia Pacific follows with 29% share, driven by rapid industrialization and expanding polymer processing facilities, while Europe holds 27% share, backed by stringent quality regulations and a strong pharmaceutical base.

Market Insights

- The white oil market was valued at USD 2.2 billion in 2024 and is projected to reach USD 3.16 billion by 2032, growing at a CAGR of 4.64%.

- Rising demand from pharmaceuticals, personal care, and polymer industries is driving market growth, supported by strict quality standards such as USP and FDA compliance.

- Key trends include growing adoption of high-purity and bio-based white oils, along with increasing use in thermoplastic elastomers, PVC, and premium skincare formulations.

- The market is competitive with major players such as Sinopec Corporation, Nynas AB, ExxonMobil Fuels & Lubricants, BASF SE, and Royal Dutch Shell investing in R&D, capacity expansion, and sustainable refining technologies.

- North America leads with 32% share, followed by Asia Pacific at 29% and Europe at 27%, while pharmaceutical grade dominates with over 45% share due to its wide application in ointments, gels, and healthcare products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

Pharmaceutical grade white oil dominated the market in 2024, holding over 45% share. Its high purity, chemical stability, and compliance with USP and FDA standards make it the preferred choice in medicinal formulations, ointments, and laxatives. Rising demand from the pharmaceutical and personal care industries is driving steady growth. Food-grade white oil followed, supported by applications in food processing, baking, and packaging machinery lubrication. Technical grade accounted for the remaining share, driven by its use in plastics, textiles, and adhesives where lower purity levels are acceptable and cost efficiency is a priority.

- For instance, certain grades of food-grade white mineral oil, manufactured by companies like South Korea’s Seojin Chemical, are formulated to exhibit high purity and specific performance metrics for demanding food industry applications. These oils, such as Seojin’s KF-Series, are deeply refined paraffinic oils that meet or exceed stringent regulations.

By Application

Plastics and polymer applications accounted for over 35% share of the white oil market in 2024, driven by its critical role as a plasticizer, lubricant, and mold release agent in polymer compounding. Demand is particularly strong in thermoplastic elastomers and PVC production. The pharmaceutical segment held a significant share, fueled by the increasing production of ointments, gels, and syrups. Personal care and cosmetics followed closely, with growing use in baby oils, creams, and lotions. Other applications, including textiles, adhesives, and agriculture, continue to contribute steadily to market revenue.

- For instance, a number of leading producers, such as Apar Industries and Unicorn Petroleum, manufacture pharmaceutical-grade white oils that feature aromatic content well below 5 ppm. These high-purity, often paraffinic, oils typically meet stringent global standards like USP for use in medicinal products such as ointments and laxatives.

Market Overview

Rising Demand from Pharmaceutical and Personal Care Industries

Pharmaceutical and personal care sectors are driving white oil consumption due to its high purity and inert properties. It is used extensively in ointments, creams, gels, and baby oils, where safety and compliance with USP and FDA standards are critical. Growing healthcare spending and rising consumer focus on skincare and hygiene products are fueling demand globally. Emerging markets in Asia and Latin America are seeing rapid adoption, supported by increased pharmaceutical production and rising disposable incomes, which is expected to boost market growth during the forecast period.

- For instance, APAR Industries Limited’s POWEROIL PEARL series pharmaceutical-grade white oils comply with US FDA 21 CFR 172.878 and CFR 178.3620 (a) standards and meet USP, EP, BP, and Indian Pharmacopoeia requirements.

Growth in Polymer and Plastics Applications

Plastics and polymer manufacturing accounted for a major share of white oil consumption in 2024, with over 35% market share. White oil is widely used as a plasticizer, lubricant, and release agent in PVC, thermoplastic elastomers, and other compounds. Rising demand for automotive components, wires, cables, and consumer goods is driving growth in this segment. Industrialization in Asia Pacific and increased production capacity of polymer processing plants are creating strong opportunities for suppliers to expand their distribution networks and secure long-term partnerships with key manufacturers.

- For instance, Savita Oil Technologies offers its Savonol brand of white oils with viscosity grades ranging from 8 to 100 cSt and pour points ranging from -5°C to -30°C, meeting NF/USP, British Pharmacopoeia, and European Pharmacopoeia standards.

Increasing Adoption in Food-Grade Applications

Food-grade white oil demand is rising steadily due to its use as a lubricant and release agent in food processing equipment. Strict food safety regulations encourage manufacturers to adopt high-purity, non-toxic lubricants that meet FDA and NSF standards. Growth in packaged and processed food consumption is creating consistent demand. Expansion of modern food manufacturing facilities, especially in developing economies, is driving additional consumption. This segment also benefits from the rising trend toward cleaner and safer food-grade lubricants in bakery, confectionery, and beverage industries.

Key Trends & Opportunities

Shift Toward High-Purity and Sustainable Grades

Manufacturers are focusing on developing highly refined white oil grades with minimal sulfur and aromatic content to meet global purity standards. Demand for sustainable and bio-based white oils is growing, driven by environmental regulations and green chemistry initiatives. Suppliers investing in advanced refining technologies and cleaner production processes are likely to capture premium opportunities. This trend is also supported by rising consumer preference for safe, eco-friendly personal care and pharmaceutical products, creating a competitive edge for companies with certified, high-quality offerings.

- For instance, Chevron Lummus Global (CLG) launched in February 2024 a state-of-the-art hydroprocessing unit at Hongrun Petrochemical in Shandong, China. The new plant consists of two units: a 500,000 metric tons per annum (MTPA) nameplate capacity API Group III lubricating base oil unit, which has the capability to produce industrial-grade white oil, and a separate 200,000 MTPA unit for food-grade white oil.

Expansion in Emerging Economies

Asia Pacific and Latin America are witnessing strong demand growth due to rapid industrialization, rising disposable incomes, and expanding manufacturing bases. Local governments are promoting investments in healthcare, packaging, and automotive sectors, boosting white oil consumption. Opportunities are emerging for global suppliers to set up regional production units to reduce supply chain costs and meet local regulatory requirements. Partnerships with regional distributors and expansion into secondary cities will help capture untapped demand and strengthen market penetration in these high-growth regions.

- For instance, Gandhar Oil, a major producer of white oils, reported an annual installed manufacturing capacity of 597,403 KL in its 2023–24 annual report, as of March 31, 2024. The company did expand its Taloja facility in March 2024, contributing to its overall capacity. Gandhar Oil is a significant supplier of pharmaceutical and food-grade white oils to clients across India and globally, including brands like Procter & Gamble and Unilever. As of 2024, it was one of India’s largest manufacturers of white oil and was also ranked among the top five globally.

Key Challenges

Fluctuating Raw Material Prices

White oil production depends heavily on petroleum-based feedstock, making it sensitive to crude oil price volatility. Sudden fluctuations increase production costs and impact profit margins for manufacturers. This unpredictability also affects pricing strategies, creating challenges for long-term supply contracts. Companies are increasingly focusing on cost optimization, hedging strategies, and exploring alternative feedstocks to mitigate risks, but volatility remains a key restraint for stable market growth.

Stringent Regulatory Compliance

Compliance with international standards such as USP, FDA, and EU regulations is critical in pharmaceutical, food, and personal care applications. Achieving and maintaining these certifications requires continuous investment in quality control and advanced refining processes, raising production costs. Failure to comply may lead to product recalls, import restrictions, or reputational damage. This poses a barrier for smaller manufacturers and new entrants, limiting competition and market accessibility for players with limited capital resources.

Regional Analysis

North America

North America held 32% share of the white oil market in 2024, driven by strong demand from pharmaceuticals, personal care, and polymer industries. The U.S. leads the region due to its advanced healthcare sector, high consumption of skincare products, and extensive use of PVC and thermoplastic elastomers in construction and automotive applications. Stringent regulatory standards such as USP and FDA guidelines promote the adoption of high-purity grades. Continuous investment in R&D and the presence of major global suppliers strengthen regional growth. Rising focus on sustainable, food-grade lubricants further supports market expansion in the forecast period.

Europe

Europe accounted for 27% share of the white oil market in 2024, supported by robust demand in pharmaceutical and cosmetic manufacturing. Countries such as Germany, France, and the UK are key consumers due to strict quality regulations and the presence of leading personal care brands. The region is witnessing rising use of high-purity, low-aromatic grades to meet stringent REACH and EU standards. Growth in polymer production for automotive and industrial applications is further boosting demand. Increasing consumer preference for premium personal care and baby care products continues to create opportunities for suppliers to expand their market presence.

Asia Pacific

Asia Pacific captured 29% share of the white oil market in 2024, emerging as the fastest-growing region. China and India lead consumption, fueled by rapid industrialization, strong pharmaceutical manufacturing bases, and booming personal care product demand. Expansion in polymer processing facilities and rising construction activities are further driving growth. The availability of low-cost refining capacity and increasing foreign investments are strengthening regional supply chains. Growing middle-class population and rising disposable income levels are also supporting the adoption of skincare and healthcare products, making Asia Pacific a key growth driver during the forecast period.

Latin America

Latin America represented 7% share of the white oil market in 2024, with Brazil and Mexico leading demand. Growth is driven by expanding pharmaceutical manufacturing and rising production of personal care products tailored for local markets. The plastics and packaging sectors are also contributing significantly, with increasing use of PVC in construction and infrastructure projects. Government initiatives to support healthcare access and industrialization are encouraging steady market growth. Multinational players are expanding distribution networks and collaborating with regional partners to improve market penetration and address growing demand for high-quality and compliant white oil grades.

Middle East & Africa

Middle East & Africa accounted for 5% share of the white oil market in 2024, supported by industrial development and growing investments in healthcare and cosmetics. The UAE and South Africa are key markets, driven by rising demand for pharmaceutical products and beauty care formulations. Expansion of polymer processing facilities in the Gulf region is creating new growth avenues. However, limited local refining capacity and reliance on imports can restrict faster growth. Increasing focus on quality compliance and partnerships with global suppliers are expected to improve accessibility and market performance in the coming years.

Market Segmentations:

By Grade

- Food

- Pharmaceutical

- Technical

By Application

- Plastics & Polymer

- Pharmaceuticals

- Personal Care & Cosmetics

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the white oil market is shaped by leading players such as Sinopec Corporation, Nynas AB, ExxonMobil Fuels & Lubricants, Seojin Chemical, BASF SE, Royal Dutch Shell, ENEOS Corporation, Total SA, British Petroleum, and Suncor Energy. These companies focus on expanding refining capacities and developing high-purity grades to meet regulatory standards across pharmaceutical, personal care, and food applications. Strategic initiatives include mergers, acquisitions, and partnerships to strengthen global distribution networks and improve supply reliability. Investment in R&D for bio-based and sustainable white oil solutions is gaining momentum, driven by growing demand for environmentally friendly products. Market leaders also prioritize technological advancements in refining to enhance product quality and meet compliance with USP, FDA, and EU regulations. Expanding presence in emerging markets such as Asia Pacific and Latin America remains a key growth strategy to capture rising demand from polymer and packaging industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sinopec Corporation

- Nynas AB

- ExxonMobil Fuels & Lubricants

- Seojin Chemical

- BASF SE

- Royal Dutch Shell

- ENEOS Corporation

- Total SA

- British Petroleum

- Suncor Energy

Recent Developments

- June 2025 — Brenntag SE and ExxonMobil signed a distribution agreement to expand white oil coverage in Europe and adjacent markets, extending into Iberia, the Netherlands, and Israel.

- April 2025 — Calumet announced the sale of assets related to the industrial portion of its Royal Purple business for approximately USD 110 million, a portfolio move by a company that identifies as a leading producer of white oils and other specialty products.

- January 2024 — Chevron Lummus Global commissioned what it described as the world’s largest all‑hydroprocessing white oil unit for Hongrun Petrochemical in Weifang, Shandong, comprising a 500,000 MTPA API Group III unit capable of industrial‑grade white oil and a 200,000 MTPA food‑grade white oil unit using ISODEWAXING and ISOFINISHING technologies.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to rising demand from pharmaceutical and personal care industries.

- Adoption of high-purity and food-grade white oils will increase to meet regulatory standards.

- Asia Pacific will remain the fastest-growing region, driven by industrialization and polymer production.

- Investments in sustainable and bio-based white oil production will gain momentum.

- Demand from polymer and plastics applications will expand with growth in construction and automotive sectors.

- Global players will focus on capacity expansion and regional partnerships to strengthen supply chains.

- Technological advancements in refining will enhance product quality and regulatory compliance.

- Personal care and cosmetics consumption will rise, boosting demand for safe and skin-friendly white oil grades.

- Emerging economies will offer new opportunities with increased manufacturing and healthcare investments.

- Competitive pressure will drive innovation in product customization and cost-efficient production methods.