Market overview

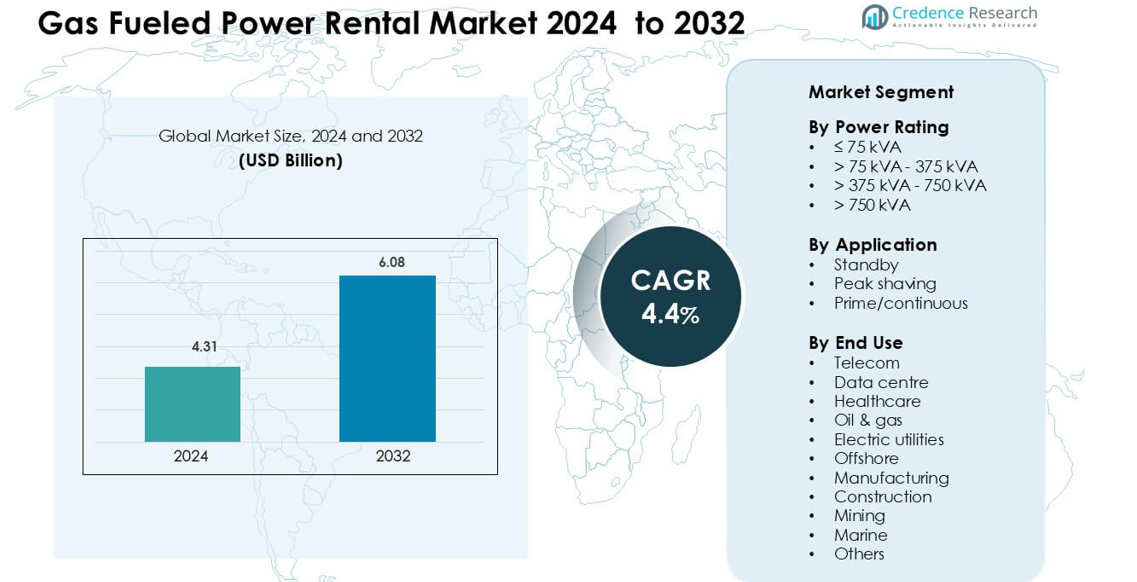

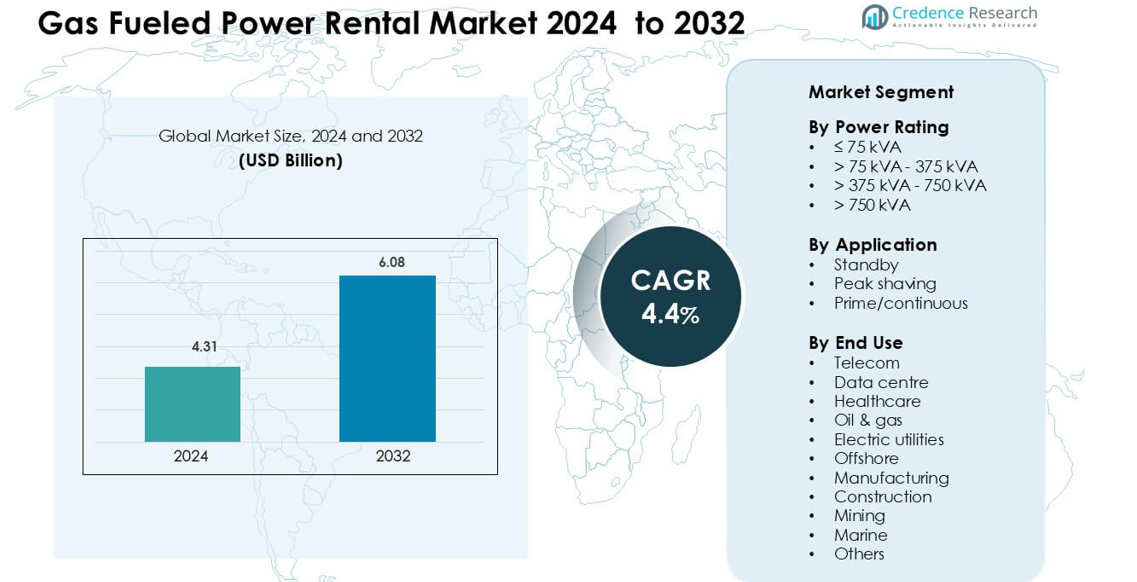

Gas Fueled Power Rental Market was valued at USD 4.31 billion in 2024 and is anticipated to reach USD 6.08 billion by 2032, growing at a CAGR of 4.4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fueled Power Rental Market Size 2024 |

USD 4.31 billion |

| Gas Fueled Power Rental Market, CAGR |

4.4% |

| Gas Fueled Power Rental Market Size 2032 |

USD 6.08 billion |

The gas-fueled power rental market features prominent players such as Caterpillar, Byrne Equipment Rental, Generac Power Systems, HIMOINSA, Aggreko, GMMCO, Bredenoord, Cummins, Ashtead Group, and Herc Rentals. These companies lead through advanced product portfolios, extensive service networks, and expertise in deploying modular and hybrid generator systems. Strategic focus on fuel efficiency, digital monitoring, and emission compliance strengthens their global footprint across industrial, construction, and energy sectors. North America dominates the market with a 34.6% share in 2024, supported by strong industrial demand, expanding LNG infrastructure, and widespread adoption of sustainable power rental solutions.

Market Insights

- The gas-fueled power rental market was valued at USD 4.31 billion in 2024 and is projected to reach USD 6.08 billion by 2032, growing at a CAGR of 4.4%.

- Market growth is driven by rising demand for cleaner, reliable temporary power solutions across industries such as oil & gas, construction, and manufacturing.

- Increasing adoption of hybrid and digitally monitored rental systems is a key trend, enhancing efficiency and lowering emissions in large-scale operations.

- The market is moderately consolidated, with key players like Caterpillar, Aggreko, and Cummins focusing on technological innovation, hybrid solutions, and regional expansion to maintain competitiveness.

- North America leads the market with a 34.6% share, followed by Asia-Pacific at 28.9%, while the >375–750 kVA segment dominates by power rating, accounting for 33.4% of total revenue.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Rating

The > 375 kVA–750 kVA segment dominates the gas-fueled power rental market, accounting for 33.4% of total revenue in 2024. This range is widely used in large-scale industrial and utility operations that demand stable and continuous power supply. Its popularity stems from higher fuel efficiency, lower emissions, and superior load-handling capacity. Industries such as mining, oil & gas, and construction rely on these generators for both prime and standby applications. The growing shift toward cleaner temporary power solutions further accelerates demand in this power range across developing economies.

- For instance, Modern Hiring Service in India offers gas‑generator rentals in the 500 kVA and 625 kVA class, citing the superior load‑handling capacity of these sets for construction and industrial sites.

By Application

The prime/continuous segment holds the largest share of 42.1% in the global market, driven by expanding industrial and remote-site operations. This application ensures uninterrupted power for facilities with limited grid access, particularly in mining, oil & gas, and utilities. Increasing adoption of long-duration rental contracts by project-based industries supports sustained demand. Additionally, advancements in dual-fuel and hybrid generator technologies enhance efficiency and lower operational costs. The rise of decentralized energy systems and grid instability across emerging regions further propels growth of prime/continuous power rentals.

- For instance, Cummins produces QSK 60 series generators which are used in industrial applications globally, including data centers and large commercial buildings in India.

By End Use

The oil & gas segment leads the market with 27.8% share in 2024, fueled by widespread use in drilling, production, and offshore projects. Gas-fueled generators provide reliable power in remote exploration zones and ensure compliance with emission standards. The industry’s growing focus on reducing carbon intensity encourages replacement of diesel-based rental units with natural gas alternatives. Moreover, high demand from midstream and downstream operations, along with investments in liquefied natural gas (LNG) infrastructure, strengthens segment growth. Data centers and manufacturing sectors are emerging as fast-growing secondary end users.

Key Growth Drivers

Rising Demand for Cleaner and Reliable Temporary Power

The growing emphasis on reducing carbon emissions is driving adoption of gas-fueled rental generators across industries. Unlike diesel units, gas-powered systems produce lower nitrogen oxide, carbon monoxide, and particulate emissions, aligning with global sustainability targets. Industrial and commercial users increasingly prefer these systems for temporary or continuous operations to ensure compliance with environmental regulations. The growing penetration of liquefied natural gas (LNG) and compressed natural gas (CNG) networks enables convenient access to cleaner fuels, supporting large-scale deployments. The need for uninterrupted power supply in sectors such as data centers, construction, and oil & gas further enhances demand.

- For instance, Aggreko PLC is a global supplier of mobile, modular, and rapid-deployment power solutions, including gas and dual-fuel generators for temporary sites.

Expansion of Oil & Gas and Construction Activities

Rising investments in oil exploration, drilling, and infrastructure development projects are significantly boosting gas-fueled power rental demand. Remote locations often lack reliable grid access, making gas-based generators vital for field operations. Construction sites, refineries, and offshore platforms utilize rental power for lighting, drilling, and heavy equipment. The flexibility of rental solutions allows contractors to meet temporary power requirements without major capital expenditure. Moreover, increasing shale gas extraction and LNG terminal development across North America, the Middle East, and Asia-Pacific further strengthen market prospects. These factors collectively enhance the uptake of gas generator rentals for both short-term and long-term energy needs.

- For instance, Oil & Gas Development Company Limited (OGDCL) issued a tender for a 600 kVA gas generator set on rental for its Sadqal oil field in Attock, Pakistan—specifying that the unit must be not older than 05 years and operate on prime service duty.

Technological Advancements and Hybrid System Integration

Technological innovations in generator efficiency, digital monitoring, and hybrid configurations are reshaping the gas-fueled power rental market. Advanced control systems, real-time telemetry, and predictive maintenance solutions enhance operational performance and reduce downtime. Hybrid generator systems combining natural gas with battery storage or renewable sources deliver higher fuel efficiency and lower emissions. Rental companies are integrating smart energy management platforms to optimize load distribution and fuel consumption. Additionally, modular and scalable generator designs enable rapid deployment across diverse sites. The adoption of intelligent automation and IoT-driven diagnostics further supports cost efficiency and reliability, encouraging broader market adoption.

Key Trends & Opportunities

Growth of Distributed Energy and Microgrids

The global transition toward decentralized energy systems is creating new opportunities for gas-fueled power rentals. Microgrids and distributed generation models rely on flexible, cleaner power sources to support grid resilience. Gas-fueled rental generators serve as backup or supplementary units, ensuring stability in remote or grid-constrained regions. Governments and utilities are adopting modular rental setups to balance peak demand and integrate renewables efficiently. This approach reduces reliance on diesel and supports hybrid microgrid development. As distributed energy projects expand across developing economies, rental providers gain long-term growth prospects through scalable and portable gas-based solutions.

- For instance, Aggreko has developed modular rental microgrid deployments for the oil & gas sector in which their combinations of gas‑fuelled generator sets with battery storage are configured to scale from a few megawatts up to multi‑10 MW capacities.

Rising LNG Infrastructure and Fuel Accessibility

Expanding LNG terminals and pipeline networks are enhancing the accessibility of natural gas for rental power applications. Countries investing in LNG import capacity, such as India, China, and Brazil, are driving a shift from diesel to gas-based rentals. The availability of cleaner fuel supports compliance with emission norms while ensuring reliable energy supply for industries. Rental providers increasingly adopt dual-fuel or dedicated gas engines to leverage this transition. Furthermore, the use of LNG in mobile power systems reduces refueling frequency and operating costs, strengthening the economic appeal of gas-fueled rental generators in global markets.

- For instance, Shell Energy India Pvt Ltd secured environmental clearance to expand its Hazira LNG Terminal in Gujarat from 6.28 MMTPA (million metric tonnes per annum) to 26.2 MMTPA of capacity.

Key Challenges

Limited Gas Supply Infrastructure in Remote Areas

Despite strong demand, the lack of adequate gas distribution networks in remote or developing regions hampers market expansion. Many project sites, especially in mining, construction, and oil exploration, remain disconnected from main gas pipelines. Transporting LNG or CNG to such areas involves logistical complexities and higher costs, reducing operational feasibility. In regions where diesel supply chains are well established, gas generators face adoption barriers. Overcoming this challenge requires strategic investment in small-scale LNG facilities, mobile refueling systems, and decentralized gas storage. Without infrastructure improvement, the market’s full growth potential remains constrained.

High Initial Cost and Operational Complexity

Gas-fueled rental generators involve higher capital and setup costs compared to conventional diesel units. Advanced combustion systems, pressure control mechanisms, and emission-reduction technologies increase installation expenses. Operators require technical expertise for gas handling, safety, and maintenance, adding to operational challenges. In price-sensitive markets, the cost gap between diesel and gas options limits customer preference. Furthermore, fluctuations in natural gas prices and supply reliability create uncertainty for rental service providers. To address this, manufacturers are focusing on modular and hybrid designs that minimize upfront costs and improve long-term return on investment.

Regional Analysis

North America

North America leads the global gas-fueled power rental market with a 34.6% share in 2024, driven by high industrial energy demands and stringent emission regulations. The U.S. dominates regional revenue through expanding oil and gas projects, data centers, and manufacturing facilities requiring continuous power supply. Widespread LNG infrastructure and strong presence of key rental providers, including Aggreko and United Rentals, enhance market maturity. The region’s focus on sustainable and hybrid power solutions, coupled with the integration of digital monitoring systems, continues to strengthen the adoption of gas-fueled generators across industrial and commercial applications.

Europe

Europe accounts for 25.3% of the global market share, supported by the region’s aggressive decarbonization policies and transition toward low-emission temporary power systems. Countries such as Germany, the U.K., and France are replacing diesel-based rentals with natural gas and biogas alternatives. The growing emphasis on renewable integration and microgrid deployment fosters demand for gas-powered units. Rental companies benefit from robust environmental regulations that encourage the use of cleaner fuels in standby and peak-shaving applications. Continued infrastructure upgrades and energy transition investments across the European Union sustain long-term market growth.

Asia-Pacific

Asia-Pacific holds a 28.9% share of the gas-fueled power rental market, fueled by rapid industrialization, infrastructure development, and power shortages in emerging economies. China, India, and Indonesia are key contributors due to expanding construction, oil & gas, and manufacturing sectors. Increasing investments in LNG import terminals and gas pipeline projects enhance fuel accessibility for rental operators. Governments in the region are promoting gas-based generation as a cleaner alternative to coal and diesel. The presence of global and regional players focusing on modular, cost-efficient rental solutions further drives sustained market expansion.

Latin America

Latin America captures a 6.5% market share, driven by rising power rental needs in oil & gas, mining, and construction sectors. Brazil and Mexico lead demand owing to industrial growth and expanding LNG infrastructure. The region faces frequent grid reliability issues, prompting industries to adopt gas-based rental units for prime and standby power applications. Efforts to replace diesel generators with cleaner options align with regional sustainability goals. Increasing participation from international rental providers and ongoing energy diversification projects create growth opportunities for gas-fueled generator deployment across Latin America.

Middle East & Africa

The Middle East & Africa region accounts for 4.7% of the total market share in 2024, with strong demand from oil-producing nations such as Saudi Arabia, the UAE, and Nigeria. Large-scale construction projects, drilling operations, and temporary utility requirements drive market growth. The abundance of natural gas reserves supports local supply and reduces dependence on diesel-based systems. However, limited infrastructure in parts of Sub-Saharan Africa poses challenges to widespread adoption. Government investments in gas network expansion and the region’s ongoing shift toward cleaner energy solutions are expected to accelerate future growth.

Market Segmentations

By Power Rating

- ≤ 75 kVA

- > 75 kVA – 375 kVA

- > 375 kVA – 750 kVA

- > 750 kVA

By Application

- Standby

- Peak shaving

- Prime/continuous

By End Use

- Telecom

- Data center

- Healthcare

- Oil & gas

- Electric utilities

- Offshore

- Manufacturing

- Construction

- Mining

- Marine

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The gas-fueled power rental market is moderately consolidated, with key players focusing on expanding their rental fleets, enhancing fuel efficiency, and integrating digital monitoring technologies. Leading companies such as Caterpillar, Byrne Equipment Rental, Generac Power Systems, HIMOINSA, Aggreko, GMMCO, Bredenoord, Cummins, Ashtead Group, and Herc Rentals dominate through strong regional presence and broad service networks. These firms emphasize hybrid generator systems, real-time telemetry, and modular configurations to meet diverse industrial demands. Strategic collaborations with energy infrastructure providers and oil & gas operators enhance project-based deployments. Companies also invest in low-emission engine technologies and LNG-compatible models to comply with tightening environmental regulations. Continuous product innovation, long-term rental contracts, and expansion into emerging economies remain central to sustaining market competitiveness and profitability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Generac Power Systems launched a new line of large‑capacity emergency standby generators (2.25 MW to 3.25 MW) designed for data centers, including natural‑gas units.

- In September 2024, Byrne Equipment Rental: Byrne announced participation in the Saudi Infrastructure Expo (Sept 24‑26) to showcase sustainable technologies including advanced rental solutions for energy sector projects

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for gas-fueled rental generators will rise with growing focus on cleaner energy solutions.

- Hybrid power systems combining gas engines and battery storage will gain wider adoption.

- Expansion of LNG and CNG infrastructure will improve fuel accessibility for remote operations.

- Technological advancements in digital monitoring will enhance operational efficiency and reliability.

- Industrial and commercial sectors will increasingly prefer gas rentals over diesel due to emission norms.

- Asia-Pacific will emerge as a key growth hub with strong industrial and infrastructure development.

- Rental companies will focus on modular, scalable power solutions for flexible deployment.

- Strategic partnerships between generator manufacturers and energy firms will drive market penetration.

- Investments in decentralized energy systems and microgrids will boost gas-based rental applications.

- Continuous innovation in low-emission engines will strengthen compliance with global environmental standards.