Market Overview:

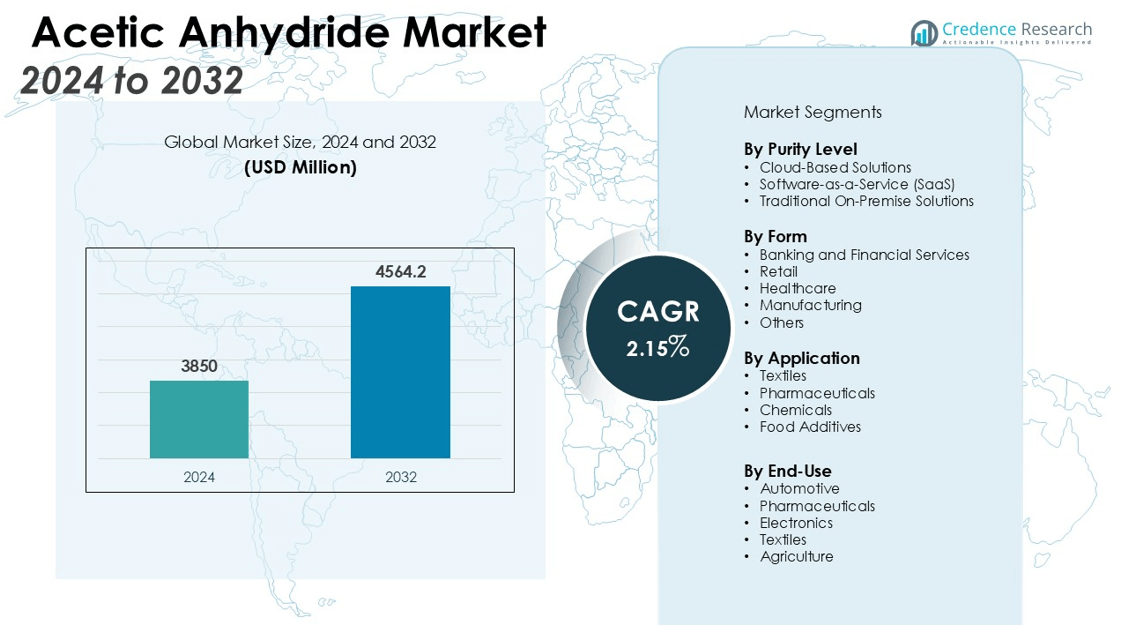

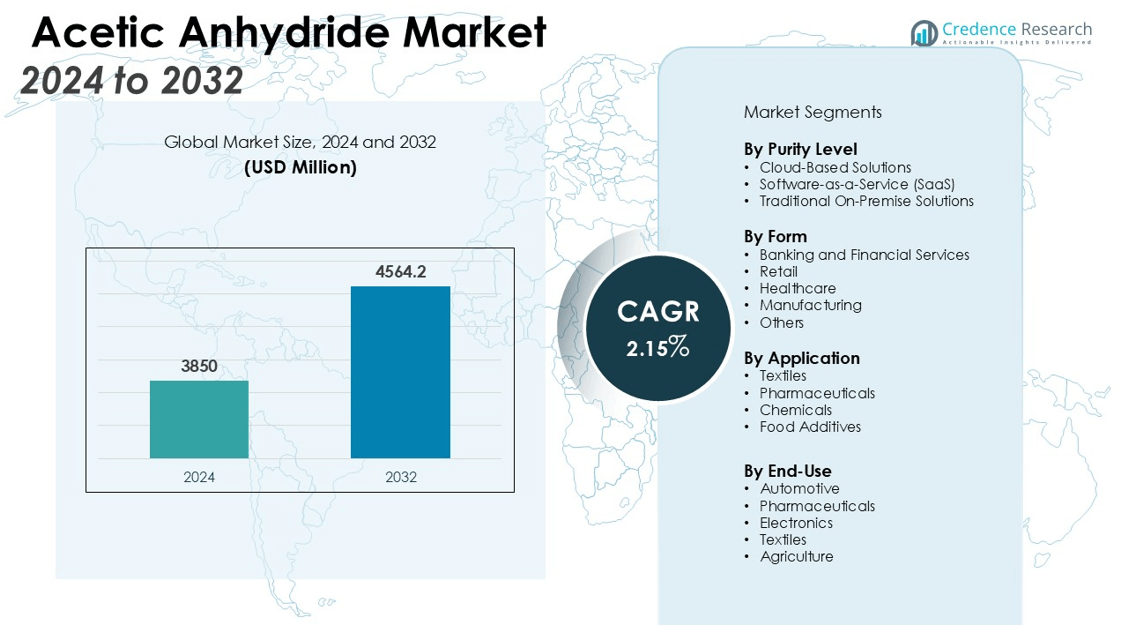

The Acetic Anhydride Market size was valued at USD 3850 million in 2024 and is anticipated to reach USD 4564.2 million by 2032, at a CAGR of 2.15% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Acetic Anhydride Market Size 2024 |

USD 3850 million |

| Acetic Anhydride Market, CAGR |

2.15% |

| Acetic Anhydride Market Size 2032 |

USD 4564.2 million |

Key drivers of the Acetic Anhydride Market include the rising demand for acetic acid derivatives, particularly in the production of plastics, solvents, and pharmaceuticals. The growing application of acetic anhydride in the manufacturing of acetate fibers, which are used in textiles, is also boosting market growth. Additionally, the increasing adoption of acetic anhydride in the production of coatings, adhesives, and other chemical products further supports the market’s expansion. The demand for environmentally friendly and cost-effective alternatives is likely to provide new growth opportunities. Furthermore, the rising global demand for bio-based products is creating new avenues for acetic anhydride in sustainable production processes.

Regionally, North America holds a significant share of the market due to its strong industrial base, particularly in chemicals and pharmaceuticals. The Asia-Pacific region is expected to experience the highest growth rate during the forecast period, driven by rapid industrialization, increasing manufacturing activities, and growing demand for acetic acid derivatives in emerging economies like China and India.

Market Insights:

- The Acetic Anhydride Market was valued at USD 3850 million in 2024 and is expected to reach USD 4564.2 million by 2032, growing at a CAGR of 2.15% during the forecast period.

- The rising demand for acetic acid derivatives in plastics, solvents, and pharmaceuticals drives market growth across sectors like textiles, automotive, and electronics.

- Acetic anhydride is increasingly used in the textile industry to produce acetate fibers, which are valued for their softness, shine, and dyeability.

- The pharmaceutical sector contributes significantly to market demand as acetic anhydride is essential for synthesizing active pharmaceutical ingredients like acetaminophen and aspirin.

- The shift towards sustainable and bio-based acetic anhydride is driven by increasing demand for eco-friendly production methods and renewable resources.

- Volatility in acetic acid prices, caused by geopolitical tensions and supply chain disruptions, impacts manufacturing costs and market stability.

- Stringent environmental regulations on chemical production and waste disposal require companies to adopt cleaner, more efficient production technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Acetic Acid Derivatives

The growing demand for acetic acid derivatives plays a crucial role in driving the expansion of the Acetic Anhydride Market. It is a key raw material for manufacturing a variety of chemicals, including acetate esters, which are essential in the production of plastics, solvents, and pharmaceuticals. Industries such as textiles, automotive, and electronics depend on these derivatives for the production of coatings, adhesives, and sealants. This consistent demand for acetic acid derivatives continues to strengthen the market’s growth prospects.

- For instance, to meet this industrial demand, the chemical company Eastman operates an acetic acid plant at its headquarters in Kingsport, Tennessee, which has a production capacity of 255,000 tonnes per year.

Expanding Applications in Textile Industry

Acetic anhydride is increasingly used in the production of acetate fibers, which are a primary material in the textile industry. Acetate fibers are favored for their softness, shine, and dyeability, making them ideal for producing high-quality fabrics. With the global textile market expanding, particularly in emerging economies, demand for these fibers continues to grow, propelling the need for acetic anhydride. It is expected that continued growth in textile production will further drive the market.

- For instance, through a joint venture with SK Chemicals, Eastman constructed a facility in Ulsan, South Korea, to produce cellulose acetate tow with an annual capacity of 27,000 metric tons.

Pharmaceutical and Healthcare Sector Growth

The pharmaceutical industry is another significant driver of the Acetic Anhydride Market. It is used in the synthesis of active pharmaceutical ingredients (APIs) and intermediate compounds, such as acetaminophen and aspirin. The increasing prevalence of chronic diseases and the growing need for medications are pushing the demand for acetic anhydride in pharmaceutical manufacturing. This trend is expected to remain a key factor contributing to the market’s growth in the coming years.

Shift Toward Sustainable Production

The global shift toward more sustainable and environmentally friendly production methods is boosting the demand for bio-based acetic anhydride. Companies are increasingly adopting eco-friendly solutions to reduce their carbon footprint and reliance on petroleum-based products. Acetic anhydride derived from renewable sources presents a viable alternative, meeting both regulatory and consumer demands for sustainability. This transition is anticipated to present new opportunities for growth within the market.

Market Trends:

Increasing Focus on Bio-Based Acetic Anhydride Production

One of the key trends shaping the Acetic Anhydride Market is the rising shift towards bio-based production methods. Companies are increasingly focusing on renewable resources to produce acetic anhydride, aligning with global sustainability goals and reducing reliance on fossil fuels. The adoption of bio-based acetic acid as a precursor material for acetic anhydride is gaining traction, driven by consumer demand for environmentally friendly products. This trend not only supports environmental objectives but also meets regulatory pressures for lower carbon footprints in industrial processes. The development of advanced production technologies that enable efficient conversion of renewable biomass to acetic anhydride further reinforces this trend. As this shift gains momentum, it is expected to open new avenues for market expansion, particularly in the pharmaceutical, automotive, and textiles sectors, where sustainable sourcing is becoming increasingly important.

- For instance, New Iridium achieved a significant technological milestone by running its oxidation flow reactor continuously for over 200 hours to create bio-based chemicals.

Expansion of Applications in Emerging Economies

The Acetic Anhydride Market is experiencing significant growth in emerging economies, driven by industrialization and expanding manufacturing capabilities. Countries such as China, India, and Brazil are seeing a surge in demand for acetic anhydride across various sectors, including textiles, pharmaceuticals, and chemicals. The rapid expansion of textile production in these regions increases the need for acetate fibers, which in turn drives the demand for acetic anhydride. The increasing availability of cost-effective production facilities and advancements in manufacturing technologies also contribute to this trend. As these economies continue to industrialize, they will likely remain key drivers of the acetic anhydride market, creating more opportunities for market participants to expand their reach in these high-growth regions.

- For instance, China’s total exports of textiles and garments reached a value of more than $301 billion in 2024, fueling demand for necessary production chemicals like acetic anhydride.

Market Challenges Analysis:

Volatility in Raw Material Prices

One of the primary challenges facing the Acetic Anhydride Market is the volatility in raw material prices, particularly acetic acid. Fluctuations in the cost of acetic acid, a key precursor in acetic anhydride production, significantly impact overall manufacturing costs. These price variations are often driven by factors such as supply chain disruptions, geopolitical tensions, and changes in global oil prices. The dependence on raw materials sourced from specific regions makes the market vulnerable to external price hikes and supply shortages. This volatility poses a challenge for manufacturers, who must find ways to manage costs without compromising on product quality or market competitiveness.

Stringent Environmental Regulations

The growing emphasis on environmental sustainability presents another challenge to the Acetic Anhydride Market. Stringent regulations governing the production, handling, and disposal of chemicals have increased the complexity of manufacturing processes. Companies face higher compliance costs and the need to adopt cleaner, more efficient production technologies. Meeting these regulations requires significant investment in research and development to improve environmental safety standards. As the market shifts toward more sustainable practices, companies must balance the demands of environmental responsibility with profitability, which could hinder growth for smaller manufacturers with limited resources.

Market Opportunities:

Growing Demand for Sustainable Solutions

The Acetic Anhydride Market is presented with significant opportunities due to the increasing demand for sustainable and eco-friendly production methods. With a global focus on reducing carbon footprints and minimizing environmental impacts, there is a growing preference for bio-based acetic anhydride. This shift toward renewable raw materials offers a lucrative opportunity for companies to develop and promote green production processes. As industries such as textiles, pharmaceuticals, and chemicals seek to adopt more sustainable practices, the demand for environmentally friendly acetic anhydride is likely to increase. Companies investing in eco-efficient technologies and renewable sources can capitalize on this trend and gain a competitive edge.

Expansion in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, represent a substantial growth opportunity for the Acetic Anhydride Market. These regions are experiencing rapid industrialization, urbanization, and growth in manufacturing activities. The demand for acetic anhydride in sectors such as textiles, automotive, and pharmaceuticals is expected to rise, driven by the expansion of production facilities and an increase in consumer demand for goods. As these markets continue to evolve, the Acetic Anhydride Market will see increased adoption across various industries, offering significant expansion prospects for market players. Developing a strong foothold in these regions can yield long-term growth for manufacturers.

Market Segmentation Analysis:

By Purity Level

The market is divided into low purity, medium purity, and high purity categories. High-purity acetic anhydride is in demand for industries such as pharmaceuticals and food additives, where stringent quality standards are essential. Medium and low-purity variants cater to sectors like textiles and chemicals, where purity requirements are less critical.

- For instance, a purification method patented by Eastman Chemical Company is capable of producing acetic anhydride that maintains its quality for a permanganate time of at least 30 minutes, a key test for purity.

By Form

The market is segmented into liquid and solid forms. Liquid acetic anhydride holds a larger market share, primarily due to its ease of handling, storage, and usage in industrial applications. Solid acetic anhydride is preferred in specific industries where stability and easy transport are crucial, particularly for long-distance shipping.

By Application

The key applications of acetic anhydride include textiles, pharmaceuticals, chemicals, and food additives. The textile industry uses acetic anhydride in the production of acetate fibers, while the pharmaceutical sector relies on it for synthesizing active ingredients. The chemical industry uses it for producing various chemicals, including plastics and solvents, contributing significantly to the market’s expansion. Food additives also utilize acetic anhydride for preservation and flavoring purposes.

- For instance, Jubilant Ingrevia Ltd. has expanded its production by commissioning a new plant that increases its overall annual acetic anhydride capacity to 210,000 metric tons, strengthening its position as a key supplier for essential medicines.

Segmentations:

By Purity Level

- Low Purity

- Medium Purity

- High Purity

By Form

By Application

- Textiles

- Pharmaceuticals

- Chemicals

- Food Additives

By End-Use

- Automotive

- Pharmaceuticals

- Electronics

- Textiles

- Agriculture

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a dominant share of the Acetic Anhydride Market, accounting for 35% of the global market. This is primarily driven by the region’s robust industrial base, particularly in chemicals, pharmaceuticals, and textiles. The United States, a major contributor to the market, benefits from a well-established manufacturing infrastructure and technological advancements in production processes. The region’s focus on sustainability is also influencing the adoption of bio-based acetic anhydride, providing further growth opportunities. The strong demand across key sectors such as plastics, textiles, and coatings continues to fuel market expansion in North America.

Asia-Pacific

The Asia-Pacific region commands a 40% share of the global Acetic Anhydride Market and is projected to experience the highest growth rate during the forecast period. Rapid industrialization in countries such as China, India, and Japan is a key driver of this market expansion. The demand for acetic anhydride is particularly strong in the textile industry, as these countries are major producers of acetate fibers. Additionally, increasing manufacturing activities in chemicals and pharmaceuticals further contribute to the region’s market share. With cost-effective production and growing consumer demand, Asia-Pacific offers substantial growth potential for market players.

Europe

Europe holds a 20% share of the Acetic Anhydride Market, with steady demand from industries such as chemicals, pharmaceuticals, and textiles. The region’s regulatory environment encourages manufacturers to adopt sustainable production methods, driving the demand for bio-based acetic anhydride. Key European countries like Germany, France, and the United Kingdom continue to invest in technological innovations that improve production efficiency while reducing environmental impact. As the market matures, Europe’s commitment to sustainability and technological advancements supports its position in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF

- LyondellBasell

- Eastman Chemical

- Mitsubishi Gas Chemical

- SABIC

- Vyntus

- Hindustan Organic Chemicals

- Ercros

- Daicel Corporation

- Celanese

- Oxea

- Shandong Huijin Chemical

- China National Petroleum Corporation

- Anhui Huamao Chemical

Competitive Analysis:

The Acetic Anhydride Market is highly competitive, with several key players striving for dominance through product innovation, strategic partnerships, and geographic expansion. Major companies like Eastman Chemical Company, BP, and Celanese Corporation are leading the market due to their strong manufacturing capabilities and extensive product portfolios. These players leverage advanced technologies to improve production efficiency and reduce costs, giving them a competitive edge. The market is also witnessing the entry of regional players who focus on catering to specific market needs in emerging economies. Companies are increasingly adopting sustainable production methods, including bio-based acetic anhydride, to meet growing environmental concerns and regulatory requirements. Strategic acquisitions and mergers are expected to further consolidate the market, with larger firms acquiring smaller players to enhance their market position. As the demand for eco-friendly products rises, companies are investing in R&D to develop innovative solutions for sustainable production.

Recent Developments:

- In March 2025, LyondellBasell launched Pro-faxEP649U, a new polypropylene impact copolymer created for the rigid packaging market.

- In June 2025, Eastman Chemical Co. launched Esmeri™ CC1N10, a high-performance, biodegradable cellulose ester micropowder for the color cosmetics industry.

- In March 2025, Mitsubishi Gas Chemical announced an agreement to charter a coastal methanol-transport vessel as part of an expansion of its methanol fuel supply system.

Market Concentration & Characteristics:

The Acetic Anhydride Market is moderately concentrated, with a few key players dominating the industry, including Eastman Chemical Company, BP, and Celanese Corporation. These companies hold a significant market share due to their established production capabilities, technological advancements, and strong distribution networks. The market exhibits characteristics of a mature industry, where large-scale producers benefit from economies of scale, enabling them to offer competitive pricing and maintain market leadership. While a few major players lead, there is also room for smaller, regional manufacturers to cater to niche demands, particularly in emerging economies. Sustainability and eco-friendly production practices are becoming increasingly important, influencing companies to invest in bio-based production methods. The market’s competitive landscape is expected to evolve as firms focus on product innovation and sustainable practices to meet regulatory standards and customer preferences.

Report Coverage:

The research report offers an in-depth analysis based on Purity Level, Form, Application, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Acetic Anhydride Market will continue to benefit from the increasing demand for bio-based products and sustainable production methods.

- Growing industrialization in emerging economies, particularly in Asia-Pacific, will drive market expansion, particularly in textiles and chemicals.

- Increased use of acetic anhydride in pharmaceuticals for active pharmaceutical ingredient synthesis will support steady growth in the healthcare sector.

- Rising demand for eco-friendly and cost-effective alternatives will lead to a higher adoption of bio-based acetic anhydride.

- The global shift towards sustainable production processes and the reduction of carbon footprints will create new opportunities for growth.

- The textile industry’s continued growth, particularly in countries like China and India, will drive the demand for acetate fibers.

- Rising regulatory pressures for sustainability and environmental responsibility will encourage companies to adopt cleaner production technologies.

- Advancements in production technologies will improve efficiency, reducing costs and boosting market competitiveness.

- The chemical industry’s increasing need for solvents and plastics will continue to be a major factor influencing acetic anhydride demand.

- Strategic partnerships, mergers, and acquisitions will help key players expand their reach and enhance production capabilities in the evolving market.