Market Overview

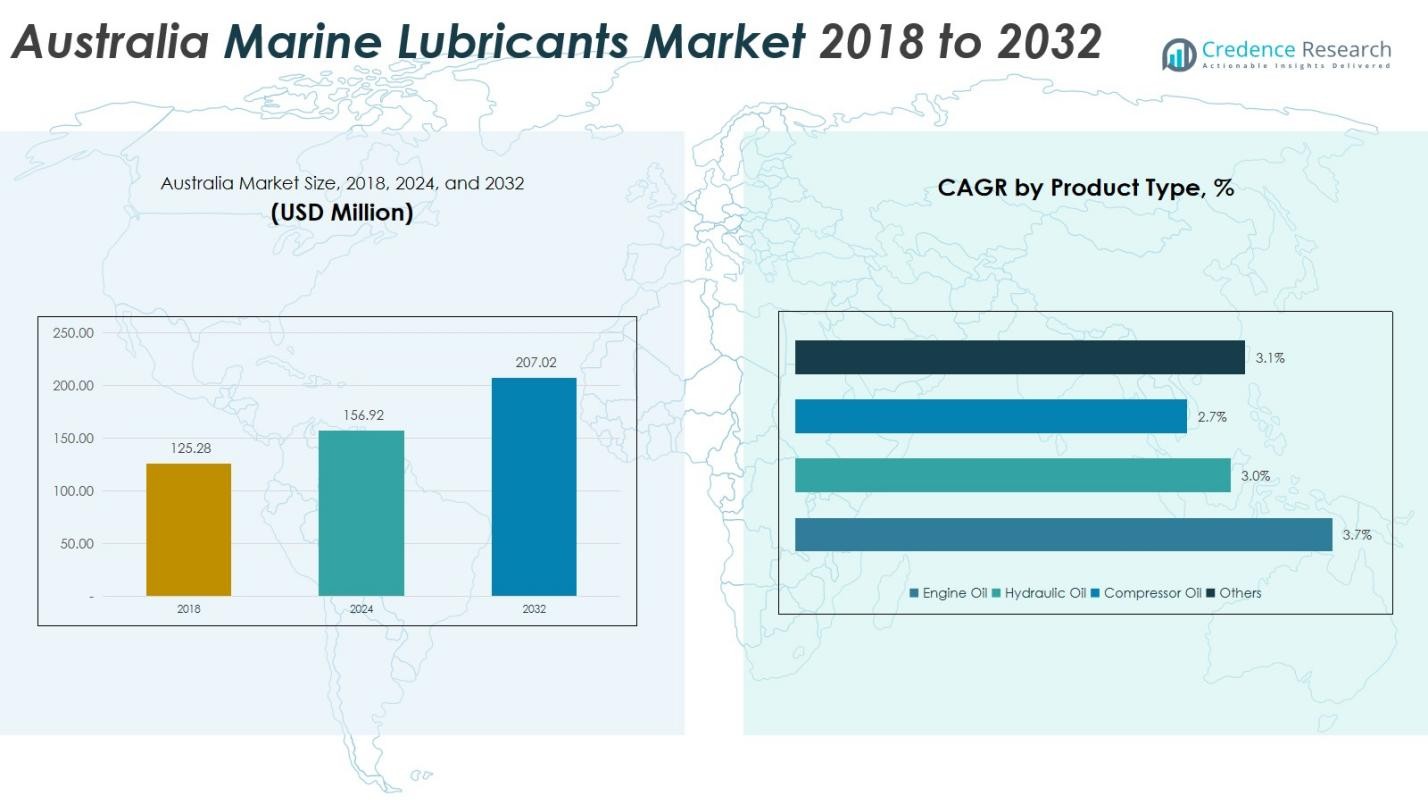

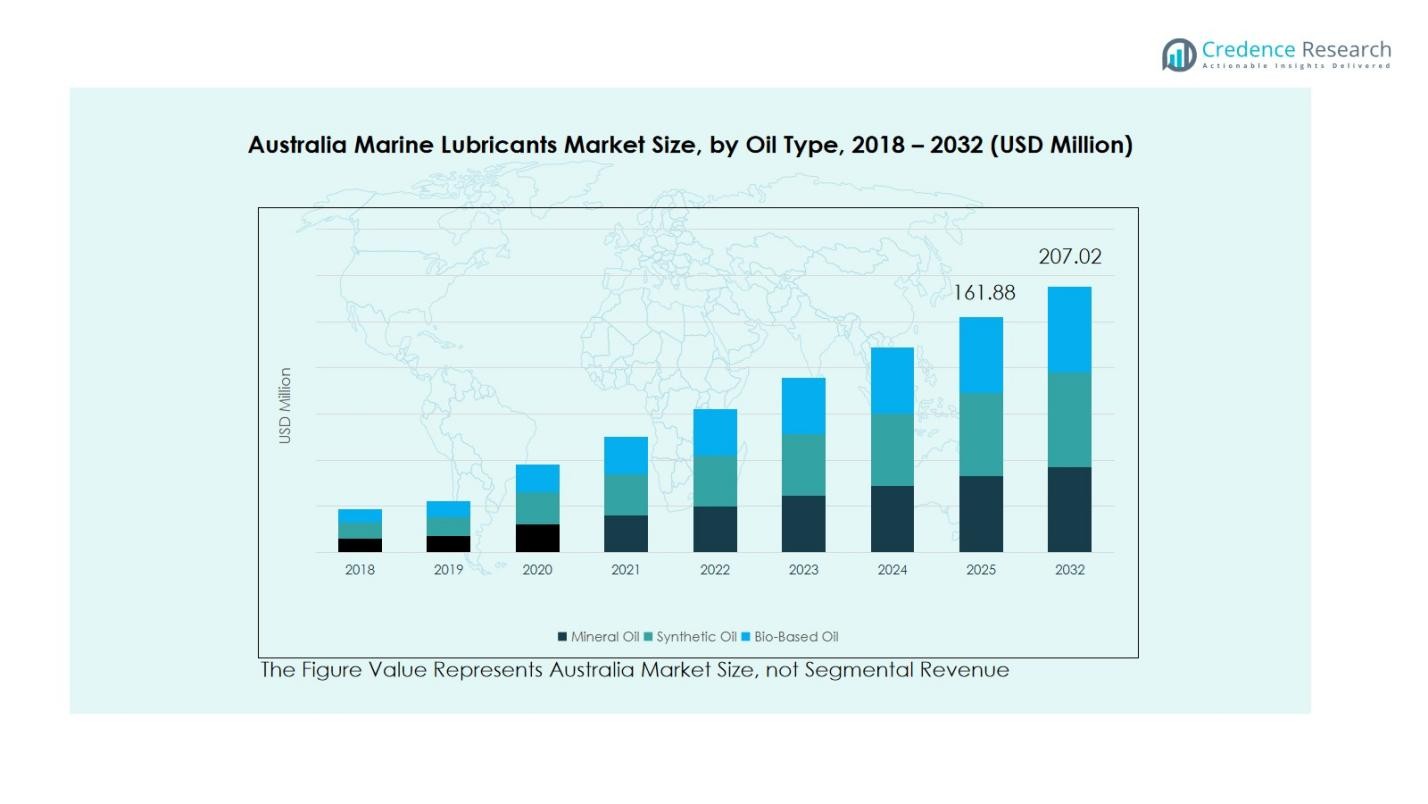

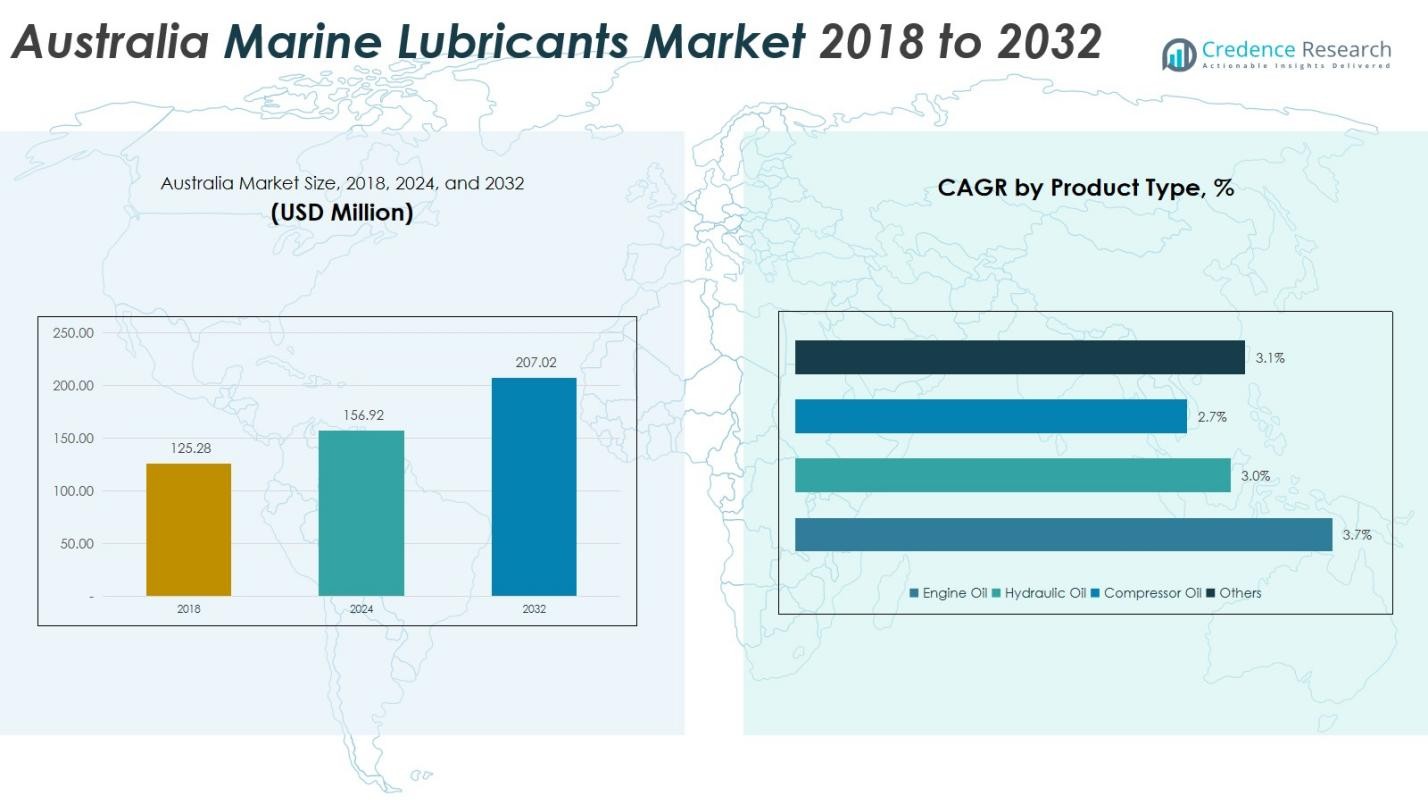

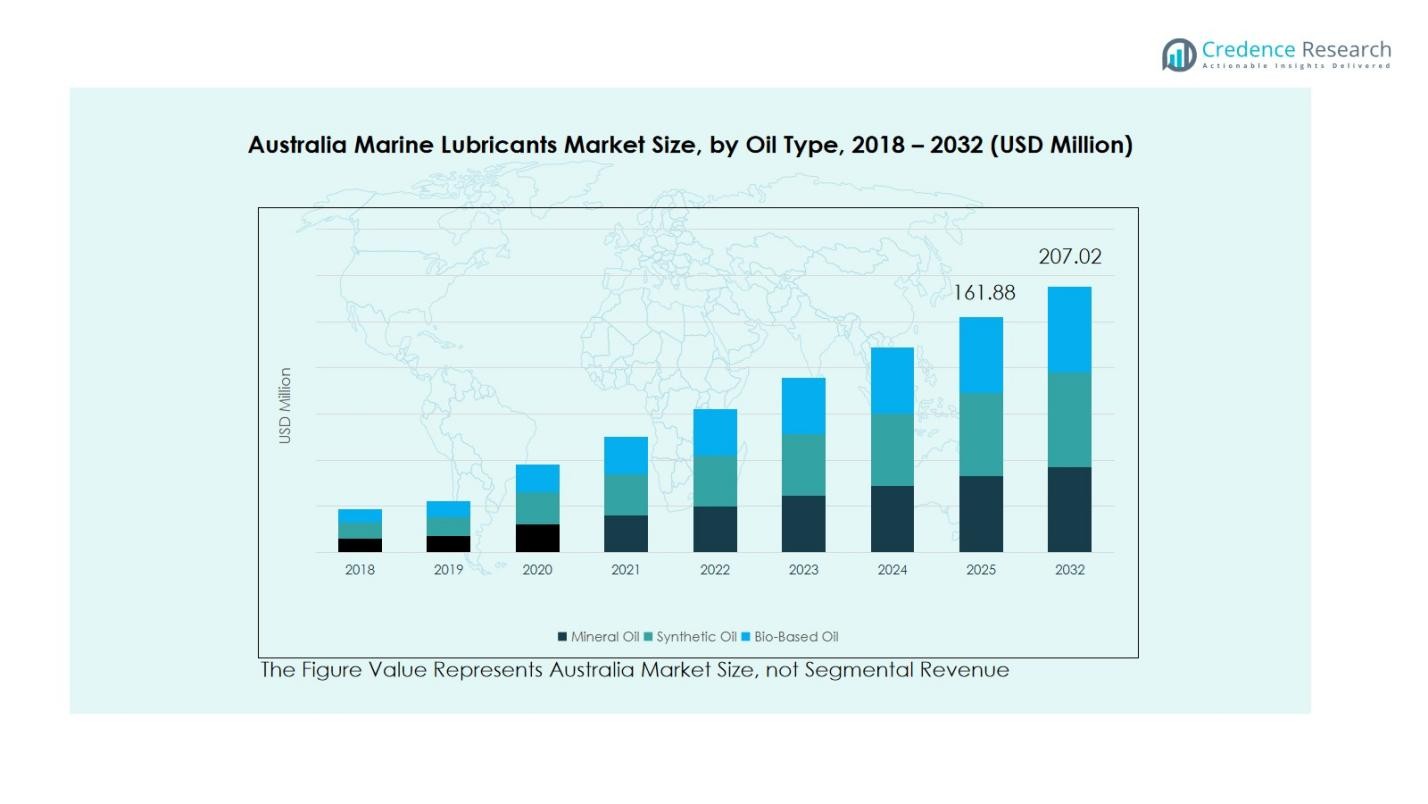

Australia Marine Lubricants Market size was valued at USD 125.28 million in 2018, growing to USD 156.92 million in 2024, and is anticipated to reach USD 207.02 million by 2032, at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Marine Lubricants Market Size 2024 |

USD 156.92 Million |

| Australia Marine Lubricants Market, CAGR |

3.5% |

| Australia Marine Lubricants Market Size 2032 |

USD 207.02 Million |

The Australia Marine Lubricants Market is dominated by major global and regional players, including BP p.l.c., ExxonMobil Marine Limited, Chevron Corporation, TotalEnergies, PetroChina Co. Ltd., Gulf Oil International, Klüber Lubrication, Goldenstone Oils, and Pennzoil. These companies lead through strong distribution networks, advanced lubricant formulations, and strategic collaborations with shipping operators and port authorities. They focus on developing high-performance, low-emission, and bio-based lubricants to meet environmental standards and enhance engine efficiency. New South Wales emerges as the leading region in the market, accounting for 28% of the total share, driven by robust port infrastructure, high vessel traffic, and government-backed sustainability initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Marine Lubricants Market was valued at USD 156.92 million in 2024 and is projected to reach USD 207.02 million by 2032, growing at a CAGR of 3.5% during the forecast period.

- Market growth is driven by expanding maritime trade, fleet modernization, and rising demand for high-performance lubricants that enhance engine efficiency and reduce maintenance costs.

- A key trend includes increasing adoption of synthetic and bio-based lubricants due to stricter environmental regulations and the shift toward sustainable marine operations.

- The competitive landscape features major players such as BP p.l.c., ExxonMobil Marine Limited, Chevron Corporation, TotalEnergies, and Gulf Oil International focusing on R&D and strategic partnerships to strengthen their presence.

- Regionally, New South Wales holds the largest share of 28%, while by segment, mineral oil leads with 70% market share, supported by cost-effectiveness and high demand across bulk carriers and container ships.

Market Segmentation Analysis:

By Oil Type

In the Australia marine lubricants market, the mineral oil segment holds the dominant position, accounting for 70 % of the segment share. Its strong presence is driven by cost-effectiveness and wide availability of mineral base stocks, which make it the preferred choice for large fleets and bulk shipping operations requiring high-volume lubrication. Synthetic oils follow with a smaller share due to higher formulation costs, while bio-based oils remain niche (but growing) thanks to rising environmental regulations and sustainability demands, offering lower toxicity and better biodegradability.

For instance, TotalEnergies SE introduced its “EcoProtect” marine lubricant line incorporating bio-based components and high-performance additives.

By Product Type

Within the product type segmentation, engine oil emerges as the dominant sub-segment with 46 % share of value globally (and similarly leading in Australia). This dominance stems from the critical role of engine oils in ensuring propulsion systems’ reliability, longevity and regulatory compliance in marine vessels. Hydraulic oil and compressor oil capture lower shares given their more auxiliary roles, and the “others” category fills remaining demand across gear oils, turbine oils and specialty fluids.

For instance, Chevron Corporation expanded its marine lubrication portfolio with the “Taro Ultra HD” series engineered for dual-fuel engines (including LNG) operating under high load conditions.

By Application

For vessel applications, bulk carriers represent the leading end-use category, contributing 41 % of market share globally and capturing a similarly dominant position in Australia’s marine lubricant consumption. The large tonnage and high operational hours of bulk carriers drive continuous lubricant demand across engines, gearboxes and stern tubes. Container ships and oil tankers hold smaller shares due to comparatively lower volumes or different lubrication regimes, while “others” (such as passenger vessels, reefers, etc.) underpin the residual market.

Key Growth Drivers

Expansion of Maritime Trade and Fleet Modernization

Australia’s growing maritime trade volumes and fleet modernization efforts are key drivers for marine lubricant demand. The steady increase in bulk commodity exports—particularly coal, iron ore, and LNG has led to higher vessel utilization and maintenance needs. Shipping operators are investing in advanced engines and propulsion systems that require premium lubricants to enhance performance and durability. This modernization trend is reinforcing demand for high-performance mineral and synthetic lubricants that can withstand harsh marine environments and extended operating cycles.

For instance, ExxonMobil Marine reported that on one cargo vessel the oil drain interval for the main engine was extended from 500 hours to 1,000 hours when their Mobilgard 312 oil was used.

Rising Focus on Engine Efficiency and Maintenance Optimization

The emphasis on improving vessel engine efficiency and reducing downtime has significantly driven lubricant consumption in Australia. Ship operators are prioritizing advanced lubrication solutions that extend oil drain intervals and improve energy efficiency. Technological advancements, including condition-based monitoring and lubricant performance analytics, are enabling more precise maintenance strategies. As a result, the adoption of high-quality marine lubricants designed for better wear protection, corrosion resistance, and thermal stability is increasing, ensuring smoother operations and lower total ownership costs for fleet operators.

For instance, PETRONAS Lubricants International offered a marine engine customer an oil formulation that extended the drain interval up to 350 hours (from a previous interval of 150 hours) under challenging biodiesel blend fuel conditions.

Environmental Compliance and Shift Toward Sustainable Lubricants

Stringent environmental regulations and sustainability goals are fostering demand for eco-friendly marine lubricants in Australia. The enforcement of IMO 2020 sulfur limits and regional marine emission standards has prompted shipping companies to adopt low-sulfur fuels and compatible lubricant solutions. Additionally, growing awareness of environmental protection around ports and coastal zones is encouraging the use of biodegradable and bio-based lubricants. These eco-lubricants not only meet compliance requirements but also enhance brand image for operators committed to responsible and sustainable marine operations.

Key Trends & Opportunities

Adoption of Digital Monitoring and Smart Lubrication Systems

The integration of digital technologies in vessel maintenance is emerging as a major trend in the Australian marine lubricants market. Ship operators are adopting Internet of Things (IoT)-enabled systems for real-time oil condition monitoring and predictive maintenance. These digital solutions optimize lubricant usage, reduce waste, and extend machinery life. The adoption of smart lubrication management offers significant opportunities for suppliers to develop customized solutions, enhancing operational efficiency while reducing costs for shipping companies and port service providers.

For instance, Shell Marine’s LubeMonitor service has been rolled out to over 300 vessels, providing fleet-level insights across cylinders and engines to support maintenance decisions.

Growing Potential for Bio-Based and Low-Emission Lubricants

Sustainability-focused innovation is creating new opportunities in bio-based and low-emission lubricants. Increasing regulatory support for green shipping and Australia’s commitment to reducing maritime emissions are accelerating this transition. Marine lubricant manufacturers are investing in R&D to develop biodegradable formulations that perform efficiently under extreme marine conditions. As shipowners pursue carbon neutrality targets, the market for bio-lubricants is expected to expand rapidly, supported by incentives, port sustainability programs, and partnerships aimed at promoting cleaner marine operations.

For instance, Castrol introduced its Bio Range of EAL (Environmentally Acceptable Lubricants) products for marine applications that meet the US Vessel Incidental Discharges Act 2018 criteria and have been designated as carbon neutral for sales by the company’s timeline.

Key Challenges

High Operational Costs and Volatile Crude Oil Prices

Fluctuating crude oil prices remain a major challenge affecting lubricant production costs and pricing stability in Australia. Since most marine lubricants are derived from petroleum base oils, volatility in crude markets directly impacts profit margins and procurement budgets for shipping operators. Additionally, high operating and transportation costs within Australia’s maritime logistics network intensify financial pressure on lubricant suppliers. Managing price competitiveness while maintaining quality standards continues to be a critical challenge for market participants.

Stringent Environmental Regulations and Compliance Burden

While sustainability regulations create long-term opportunities, they also pose short-term challenges for marine lubricant manufacturers and users. Compliance with IMO emission norms and local environmental restrictions requires extensive testing, product reformulation, and certification, which increase R&D and operational costs. Smaller suppliers face difficulties adapting to these complex standards, limiting their market participation. Furthermore, ensuring consistent lubricant performance with new low-sulfur fuels adds another layer of technical complexity for the industry.

Regional Analysis

New South Wales

New South Wales accounts for 28% of the Australia marine lubricants market, driven by strong shipping and port activities centered around Sydney and Port Kembla. The region’s high vessel traffic in bulk carriers and container ships sustains steady lubricant consumption. Growing trade volumes, combined with an expanding coastal fleet, are increasing demand for premium engine and hydraulic oils. Additionally, government investments in port modernization and sustainability initiatives are supporting the adoption of low-emission and bio-based lubricants, strengthening New South Wales’ position as a key hub for marine lubricant distribution and usage.

Queensland

Queensland holds a 25% share of the marine lubricants market, supported by its extensive coastline and major export ports such as Brisbane and Gladstone. The region’s dominance in LNG and mineral exports generates continuous demand for high-performance marine lubricants used in cargo and tanker vessels. The growing fleet of offshore service vessels also contributes to lubricant consumption. As environmental regulations tighten, ship operators in Queensland are shifting toward synthetic and bio-based formulations to meet compliance and enhance operational efficiency, creating new opportunities for lubricant suppliers and distributors.

Western Australia

Western Australia represents 22% of the Australia marine lubricants market, largely driven by its robust maritime trade related to mining and energy exports from ports like Fremantle and Port Hedland. The high intensity of bulk carrier operations in this region fuels consistent lubricant demand, particularly for engine and compressor oils. Increasing exploration and offshore drilling activities further stimulate market growth. Western Australia’s adoption of advanced vessel maintenance systems and focus on sustainable marine operations are encouraging the use of synthetic lubricants that deliver improved fuel economy and longer service life.

Victoria

Victoria contributes 15% of the national marine lubricants market, supported by the strategic importance of the Port of Melbourne—Australia’s largest container and cargo port. The region’s lubricant demand is primarily driven by container ships and cargo carriers engaged in domestic and international trade. Increasing automation in port logistics and vessel monitoring systems is driving demand for specialized, high-efficiency lubricant solutions. Moreover, government sustainability targets are encouraging shipping operators to incorporate environmentally friendly lubricants, especially for short-haul coastal operations and ferry fleets, ensuring Victoria remains a vital node in Australia’s marine network.

South Australia and Others

South Australia and other minor coastal regions collectively account for 10% of the Australia marine lubricants market. The ports of Adelaide and Whyalla support moderate maritime traffic, primarily involving dry bulk and general cargo vessels. Although the overall market size is smaller, these regions are witnessing steady growth driven by local manufacturing exports and regional shipping services. The increasing adoption of bio-based and synthetic lubricants, supported by government environmental policies, is creating gradual shifts in lubricant preferences. Expansion in coastal tourism and small vessel operations further adds to regional consumption.

Market Segmentations:

By Oil Type

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Product Type

- Engine Oil

- Hydraulic Oil

- Compressor Oil

- Others

By Application

- Bulk Carriers

- Container Ships

- Oil Tankers

- Others

By Region

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Others

Competitive Landscape

The competitive landscape of the Australia marine lubricants market is characterized by the presence of leading global and regional players such as BP p.l.c., ExxonMobil Marine Limited, Chevron Corporation, TotalEnergies, PetroChina Co. Ltd., Gulf Oil International, Klüber Lubrication, Goldenstone Oils, and Pennzoil. These companies compete on product performance, pricing, distribution reach, and technological innovation. Major players focus on expanding their portfolios with high-performance synthetic and bio-based lubricants to meet tightening environmental standards. Strategic partnerships with shipping companies and port operators strengthen their market presence and service efficiency. Continuous investment in R&D enables the development of low-emission and fuel-efficient lubricant formulations tailored to Australian maritime conditions. Additionally, the integration of digital monitoring systems and predictive maintenance solutions provides a competitive edge by enhancing operational reliability and cost-effectiveness for customers, reinforcing the dominance of established multinational brands in Australia’s evolving marine lubricants industry.

Key Player Analysis

- BP p.l.c.

- ExxonMobil Marine Limited

- Chevron Corporation

- PetroChina Co. Ltd.

- Klüber Lubrication

- Goldenstone Oils

- TotalEnergies

- Gulf Oil International

- Pennzoil

- Other Key Players

Recent Developments

- On 4 June 2025, Redox announced a distribution agreement with Kangtai to supply high-performance lubricant additives across Australia and New Zealand.

- In October 2025, Viva Energy commissioned a new lubricants and grease facility in Karratha, Western Australia, aimed at strengthening supply capabilities for marine, mining, and oil & gas sectors across the region.

- In September 2025, Turvo Oil launched its new range of marine-grade engine oils in Australia, targeting shipping, fishing, and offshore service markets, particularly in New South Wales.

- In April 2023, Lanotec introduced its “MGX” marine-specific lubricant line, offering sustainable, lanolin-based products designed to protect against corrosion and meet environmental standards in marine operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Oil Type, Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Australia marine lubricants market is expected to grow steadily, supported by expanding maritime trade and fleet modernization.

- Rising demand for high-performance lubricants will drive the adoption of synthetic and semi-synthetic formulations.

- Environmental regulations will accelerate the shift toward biodegradable and low-sulfur lubricant products.

- Increasing investments in port infrastructure will enhance lubricant distribution and storage capabilities.

- The integration of digital monitoring and predictive maintenance will improve lubricant efficiency and usage optimization.

- Offshore oil and gas exploration activities will continue to create consistent demand for marine lubricants.

- Strategic partnerships between lubricant manufacturers and shipping operators will strengthen supply reliability.

- Growing emphasis on energy efficiency will encourage the use of advanced engine oils and condition-based lubrication systems.

- Regional suppliers are likely to expand their product portfolios to compete with global brands.

- The overall market outlook remains positive, driven by sustainability goals and evolving marine operational standards.