Market Overview

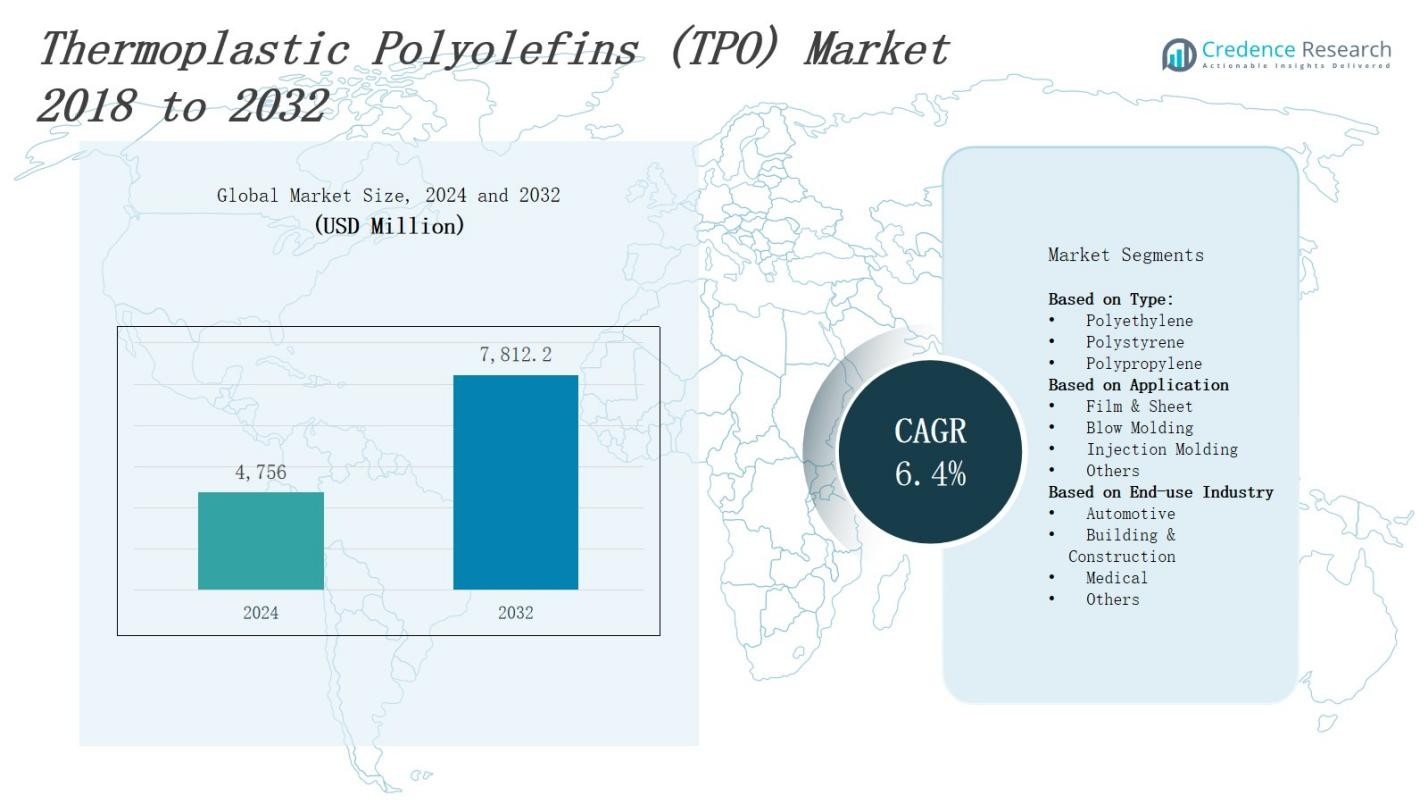

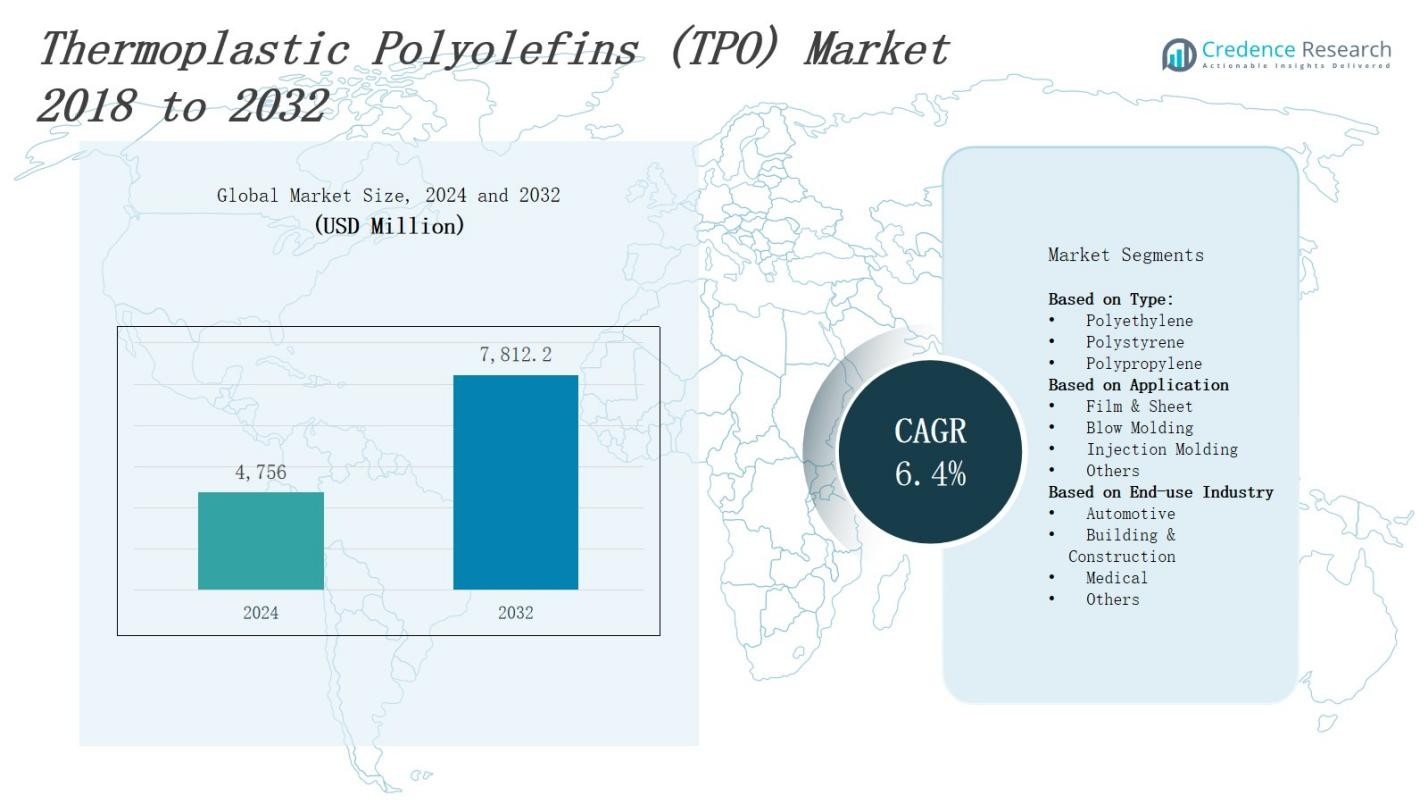

The thermoplastic polyolefins (TPO) market is projected to grow from USD 4,756 million in 2024 to USD 7,812.2 million by 2032, expanding at a CAGR of 6.4%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thermoplastic Polyolefins (TPO) Market Size 2024 |

USD 4,756 Million |

| Thermoplastic Polyolefins (TPO) Market, CAGR |

6.4% |

| Thermoplastic Polyolefins (TPO) Market Size 2032 |

USD 7,812.2 Million |

The thermoplastic polyolefins (TPO) market grows driven by increasing demand for lightweight, durable, and cost-effective materials in automotive and construction industries. Rising emphasis on sustainability encourages TPO adoption due to its recyclability and low environmental impact. Innovations in material formulations enhance weather resistance, flexibility, and thermal stability, expanding application scope. Growing automotive production, especially electric vehicles, and infrastructure development further boost market demand. Additionally, manufacturers focus on process efficiency and compatibility with various substrates, supporting broader industrial use. The trend toward replacing traditional materials with TPOs in packaging and consumer goods also contributes to sustained market growth.

The thermoplastic polyolefins (TPO) market features intense competition among leading chemical manufacturers and polymer producers. Key players focus on expanding production capacities and investing in advanced research to develop high-performance, sustainable TPO grades. Companies emphasize strategic partnerships and collaborations to strengthen their market presence across automotive, construction, and packaging sectors. Innovation in material formulations and cost optimization remain critical to maintaining competitive advantage. Firms also pursue geographic expansion to tap into emerging markets with growing demand for recyclable and lightweight materials. Strong branding and customer support enhance loyalty in this evolving market. Overall, competition drives continuous improvement and diversification of TPO product portfolios, ensuring alignment with stringent industry standards and evolving end-user requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The thermoplastic polyolefins (TPO) market will grow from USD 4,756 million in 2024 to USD 7,812.2 million by 2032 at a CAGR of 6.4%.

- Demand rises for lightweight, durable, and cost-effective materials in automotive and construction industries, fueling market expansion.

- Sustainability drives adoption due to TPO’s recyclability and low environmental impact, supported by stricter regulations and corporate commitments.

- Innovations improve weather resistance, flexibility, and thermal stability, broadening TPO applications in packaging, automotive, and consumer goods.

- Growth in automotive production, particularly electric vehicles, and infrastructure development boost demand across regions.

- Competition intensifies as key players invest in capacity expansion, research, and partnerships to develop high-performance, sustainable TPO grades.

- North America (31%), Europe (28%), Asia-Pacific (29%), and Rest of the World (12%) lead market growth, driven by regulatory support, urbanization, and industrialization.

Market Drivers

Rising Demand for Lightweight and Durable Materials

The thermoplastic polyolefins (TPO) market benefits from increasing demand for lightweight, durable materials across automotive and construction sectors. TPOs offer superior impact resistance and flexibility compared to traditional polymers, making them ideal for vehicle parts and roofing membranes. Their ability to reduce overall product weight supports fuel efficiency in vehicles and lowers transportation costs. Growing urbanization and infrastructure projects further drive the use of TPOs in construction applications, expanding its market presence globally. Manufacturers continuously improve TPO formulations to meet evolving performance requirements.

- For instance, Exxon Mobil leverages its robust production capacity to provide TPOs applied in automotive exterior panels and roofing membranes, supporting fuel efficiency and longer product lifespan through its extensive product portfolio.

Focus on Sustainability and Environmental Regulations

Sustainability trends significantly influence the thermoplastic polyolefins market growth. It appeals to industries seeking recyclable and environmentally friendly alternatives to conventional materials. Strict regulations on emissions and waste management promote TPO adoption due to its recyclability and reduced carbon footprint during production. Corporate commitments to sustainability encourage the replacement of less eco-friendly plastics with TPOs. This shift not only meets regulatory demands but also aligns with consumer preference for greener products, driving market expansion across multiple regions.

- For example, Ford has integrated recyclable TPO components in vehicle interiors to reduce plastic waste and support sustainability goals.

Technological Advancements and Product Innovation

Technological progress accelerates the thermoplastic polyolefins market by enhancing material properties and application scope. Innovations improve thermal stability, UV resistance, and chemical durability, allowing TPOs to perform in harsh environments. Enhanced formulations enable compatibility with various substrates, expanding usage in packaging, automotive interiors, and consumer goods. Manufacturers invest in research to develop high-performance TPO grades that meet stringent industry standards. These advancements support product differentiation and open new application segments, fueling market growth steadily.

Growth in Automotive and Construction Industries

The thermoplastic polyolefins market growth correlates closely with rising automotive production and construction activities worldwide. It serves as a preferred material for automotive bumpers, door panels, and trim components due to its strength and lightweight nature. Expansion of electric vehicle manufacturing further boosts demand, as TPOs improve battery enclosure safety and reduce vehicle weight. In construction, TPOs dominate roofing membranes and waterproofing solutions, driven by infrastructure development and renovation projects. Strong industrial demand ensures steady market momentum across these key sectors.

Market Trends

Increasing Adoption of TPOs in Automotive Lightweighting Initiatives

The thermoplastic polyolefins (TPO) market experiences strong growth from the automotive sector’s focus on lightweight materials. It replaces heavier metals and traditional plastics to enhance fuel efficiency and reduce emissions. Manufacturers favor TPOs for exterior and interior components due to their impact resistance and design flexibility. The shift toward electric vehicles further drives demand for TPOs in battery enclosures and thermal management systems. This trend supports sustainability goals and compliance with stringent regulatory standards worldwide.

- For instance, LyondellBasell Industries offers high-performance TPO compounds widely used in automotive exterior panels and interior components, prized for their strength and lightweight nature.

Expansion of TPO Use in Construction and Roofing Applications

The construction industry drives the thermoplastic polyolefins market through increasing use in roofing membranes and waterproofing solutions. It offers excellent weather resistance, UV stability, and durability compared to conventional materials. Growing infrastructure development in emerging economies fuels demand for reliable, cost-effective roofing solutions made from TPOs. Renovation and retrofit projects in developed regions also boost consumption. Manufacturers develop customized TPO formulations to meet regional climate conditions and application-specific requirements, broadening market penetration.

- For instance, Elevate’s UltraPly TPO membrane has been widely used since 1996, covering hundreds of millions of square meters globally in climates ranging from extreme cold to intense heat, offering robust resistance to UV radiation, ozone, and chemical exposure while supporting green and solar roof applications.

Advancements in Material Formulations to Enhance Performance

Innovation in thermoplastic polyolefins formulations strengthens market position by improving mechanical properties and environmental resistance. It now incorporates additives that increase UV protection, chemical stability, and flexibility, expanding its application potential. Enhanced thermal stability allows TPOs to perform in demanding automotive and industrial environments. These developments enable manufacturers to meet stricter industry standards and customer demands. Continuous improvement in TPO grades supports diversification into packaging, consumer goods, and electrical applications.

Rising Focus on Sustainability and Circular Economy Practices

The thermoplastic polyolefins market aligns with global sustainability trends emphasizing recyclable and eco-friendly materials. It offers an alternative to non-recyclable plastics, reducing environmental impact in end-use sectors. Industry players invest in developing TPOs compatible with recycling processes to support circular economy initiatives. Consumer awareness about sustainable products encourages brands to adopt TPOs in packaging and automotive components. Regulatory pressures to minimize plastic waste accelerate the transition toward TPO-based solutions across regions.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Constraints

The thermoplastic polyolefins (TPO) market faces challenges due to fluctuations in raw material prices, primarily driven by changes in crude oil and petrochemical costs. It impacts production expenses and profit margins for manufacturers. Supply chain disruptions caused by geopolitical tensions, logistics delays, and limited availability of key feedstocks further constrain market growth. These factors increase operational costs and create uncertainties in meeting demand. Manufacturers must optimize procurement strategies and explore alternative sourcing to mitigate risks associated with raw material volatility.

Performance Limitations in High-Temperature and Specialized Applications

The thermoplastic polyolefins market encounters limitations in applications requiring high thermal resistance and extreme mechanical performance. It exhibits reduced stability at elevated temperatures compared to engineering plastics and metals, restricting use in certain automotive and industrial environments. Specialized applications demand materials with superior heat tolerance and chemical resistance, areas where TPOs currently face constraints. Manufacturers focus on research to enhance performance properties, but overcoming inherent material limitations remains a significant challenge impacting broader adoption in high-end sectors.

Market Opportunities

Growth Potential in Electric Vehicle and Automotive Lightweighting Segments

The thermoplastic polyolefins (TPO) market presents significant opportunities driven by the accelerating shift toward electric vehicles (EVs) and lightweight automotive components. It supports manufacturers in reducing vehicle weight, improving energy efficiency, and enhancing battery safety through advanced enclosure designs. Growing regulatory pressure to lower emissions fuels demand for lightweight materials like TPOs. Expansion of EV production globally offers a broad application landscape for TPOs in interiors, exteriors, and under-the-hood components. Investment in developing specialized TPO grades tailored to EV requirements can unlock substantial market potential.

Emerging Applications in Construction and Sustainable Packaging Solutions

The thermoplastic polyolefins market can capitalize on increasing infrastructure development and the rising focus on sustainable packaging alternatives. It offers durable and weather-resistant solutions for roofing and waterproofing in growing construction markets, particularly in emerging economies. Sustainable packaging trends favor TPOs due to their recyclability and ability to replace traditional plastics with lower environmental impact. Collaborations between manufacturers and end-users to develop eco-friendly TPO-based packaging products open new revenue streams. Expanding awareness of circular economy principles further supports the adoption of TPO materials across diverse industries.

Market Segmentation Analysis:

By Type

The thermoplastic polyolefins (TPO) market divides into polyethylene, polystyrene, and polypropylene types. Polyethylene dominates due to its excellent balance of flexibility, chemical resistance, and cost-effectiveness. It suits diverse applications from automotive parts to construction membranes. Polypropylene gains traction in applications requiring higher stiffness and thermal resistance. Polystyrene maintains a niche presence, mainly in specialized products. Continuous innovation in polymer blends and copolymers strengthens these segments, allowing manufacturers to tailor properties to specific industry needs.

- For instance, BASF partnered with Jaguar Land Rover to make front-end carriers for the electric SUV I-Pace using a recycled polyamide, cutting CO2 emissions while maintaining high performance.

By Application

The thermoplastic polyolefins market segments applications into film & sheet, blow molding, injection molding, and others. Film & sheet applications lead due to widespread use in packaging, roofing membranes, and automotive interiors. Blow molding supports production of lightweight containers and automotive fuel tanks, enhancing market scope. Injection molding serves complex components requiring precision and strength, especially in automotive and medical sectors. Emerging applications in extrusion and rotational molding expand opportunities for TPOs across industries.

- For instance, Dow Chemical Company offers TPO products prominently used in automotive interiors and exterior parts, packaging, and construction materials. The company focuses on sustainability and innovation in performance materials and coatings for diverse industries

By End-use Industry

The thermoplastic polyolefins market targets automotive, building & construction, medical, and other industries. The automotive sector remains the largest end-user, driven by demand for lightweight, durable, and cost-efficient materials in vehicle exteriors and interiors. Building & construction sectors leverage TPOs for roofing, waterproofing, and insulation solutions. The medical industry uses TPOs for flexible, biocompatible components in devices and packaging. Growth in emerging industries and specialized applications continues to diversify market demand.

Segments:

Based on Type:

- Polyethylene

- Polystyrene

- Polypropylene

Based on Application

- Film & Sheet

- Blow Molding

- Injection Molding

- Others

Based on End-use Industry

- Automotive

- Building & Construction

- Medical

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a significant share of 31% in the thermoplastic polyolefins (TPO) market due to its advanced automotive and construction industries. It supports demand through stringent environmental regulations encouraging lightweight and recyclable materials. The region benefits from strong R&D infrastructure, driving innovation in high-performance TPO grades. Rising electric vehicle production and infrastructure development further stimulate market growth. Major manufacturers actively invest in capacity expansion to meet evolving customer requirements. Growing consumer awareness about sustainability also boosts adoption across various end-use sectors.

Europe

Europe commands 28% of the thermoplastic polyolefins market, driven by extensive construction activities and strict regulatory frameworks promoting eco-friendly materials. It leads in adopting sustainable practices, encouraging TPO usage in automotive lightweighting and building applications. The region’s focus on reducing carbon emissions propels demand for recyclable polymers like TPOs. Investments in advanced manufacturing technologies and collaborations between industry stakeholders support innovation. Emerging trends in green packaging and medical applications provide additional growth avenues. Strong government policies enhance market stability and expansion prospects.

Asia-Pacific

Asia-Pacific accounts for 29% of the thermoplastic polyolefins market, fueled by rapid industrialization and urbanization in countries like China and India. It experiences robust growth in automotive production and infrastructure projects. The expanding middle-class population increases demand for consumer goods and construction materials incorporating TPOs. Local manufacturers increasingly adopt advanced polymer technologies to compete globally. Government initiatives supporting sustainable development encourage the use of recyclable materials. Market penetration in emerging economies creates substantial opportunities for new entrants and established players alike.

Rest of the World

The Rest of the World region holds 12% of the thermoplastic polyolefins market share, with growing demand from Latin America, the Middle East, and Africa. Infrastructure development and expanding automotive sectors in these areas contribute to market growth. Emerging environmental regulations push manufacturers to explore sustainable alternatives like TPOs. Challenges related to supply chain and technology access limit rapid expansion but create opportunities for targeted investments. Increasing awareness of lightweight and recyclable materials gradually transforms market dynamics, paving the way for future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitsui Chemicals, Inc.

- Covestro AG

- LyondellBasell Industries N.V.

- Arkema S.A.

- Sumitomo Chemical Co., Ltd.

- INEOS Olefins & Polymers Europe

- ExxonMobil Corporation

- The Dow Chemical Company (Dow Inc.)

- Celanese Corporation

- Borealis AG

Competitive Analysis

The thermoplastic polyolefins (TPO) market features intense competition among leading chemical manufacturers and polymer producers. Key players focus on expanding production capacities and investing in advanced research to develop high-performance, sustainable TPO grades. Companies emphasize strategic partnerships and collaborations to strengthen their market presence across automotive, construction, and packaging sectors. Innovation in material formulations and cost optimization remain critical to maintaining competitive advantage. Firms also pursue geographic expansion to tap into emerging markets with growing demand for recyclable and lightweight materials. Strong branding and customer support enhance loyalty in this evolving market. Overall, competition drives continuous improvement and diversification of TPO product portfolios, ensuring alignment with stringent industry standards and evolving end-user requirements.

Recent Developments

- In April 2024,Versalis, Eni’s chemical subsidiary, completed the acquisition of Tecnofilm S.p.A., an Italian company specializing in functionalized polyolefins and thermoplastic compounds for footwear and technical goods.

- In March 2024, McClarin Plastics LLC integrated Materia Inc.’s polyolefin thermoset molding facilities, enhancing its capabilities in high-performance composites and molded thermosets with innovative resin technology.

- On January 17, 2024, Siplast, a subsidiary of Standard Industries, introduced Parasolo TPX, its first thermoplastic polyolefin (TPO) membrane.

Market Concentration & Characteristics

The thermoplastic polyolefins (TPO) market exhibits a moderately concentrated structure dominated by leading chemical manufacturers and polymer producers. Key players maintain competitive positions through continuous investment in research and development, capacity expansion, and strategic partnerships. It emphasizes innovation to enhance product performance, sustainability, and cost efficiency, addressing diverse end-user requirements across automotive, construction, and packaging sectors. The market’s characteristics include high entry barriers due to significant capital investment and technical expertise needed for advanced TPO formulations. Strong brand reputation and extensive distribution networks further reinforce the position of established companies. Market dynamics encourage firms to focus on developing customized solutions and expanding geographically to capture emerging demand. It operates in a highly regulated environment, which drives compliance and sustainability initiatives, shaping product portfolios and competitive strategies. The balance between innovation and operational efficiency defines market leadership and influences long-term growth prospects.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The thermoplastic polyolefins (TPO) market will expand due to growing demand for lightweight automotive materials.

- Increasing infrastructure development will drive TPO adoption in construction applications.

- Sustainability concerns will push industries to prefer recyclable TPO products.

- Advancements in TPO formulations will improve thermal and chemical resistance.

- Electric vehicle production will create new opportunities for TPO components.

- Manufacturers will invest more in R&D to develop high-performance TPO grades.

- Emerging economies will become key growth markets for TPO materials.

- Regulatory frameworks will encourage the use of eco-friendly TPO solutions.

- Expansion in packaging and consumer goods sectors will boost TPO demand.

- Strategic collaborations among key players will strengthen global market presence.