Market Overview

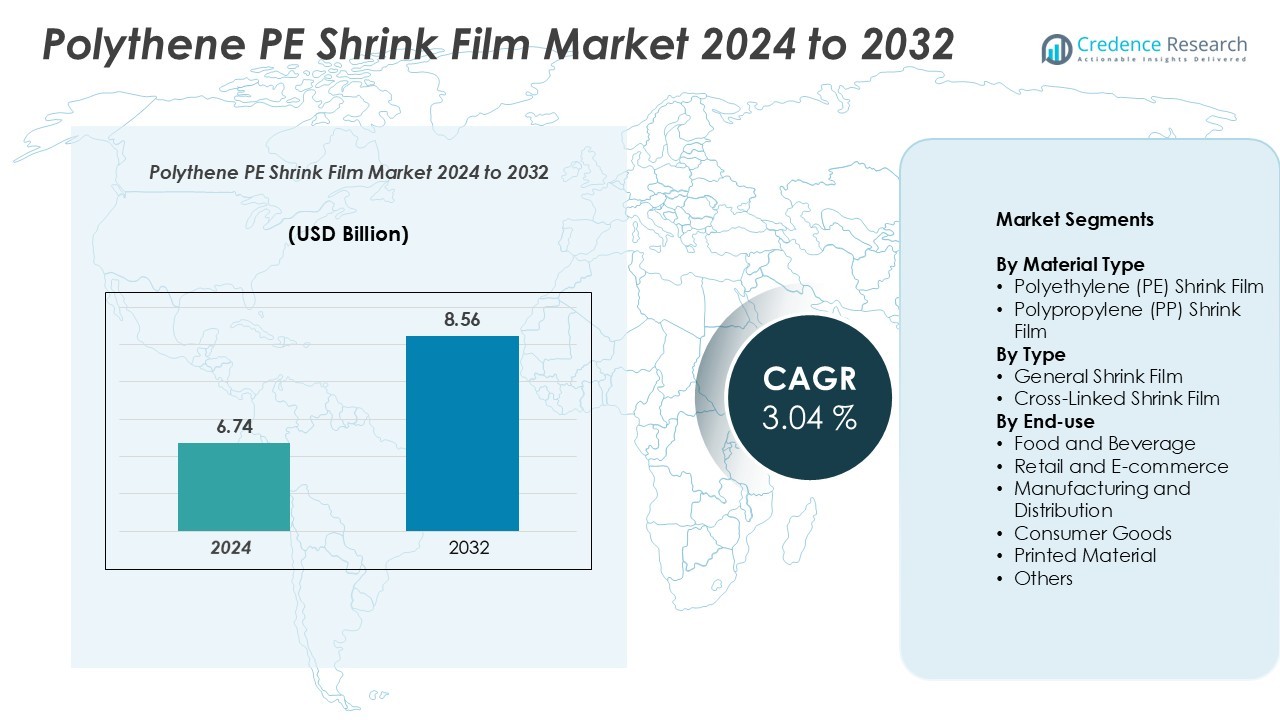

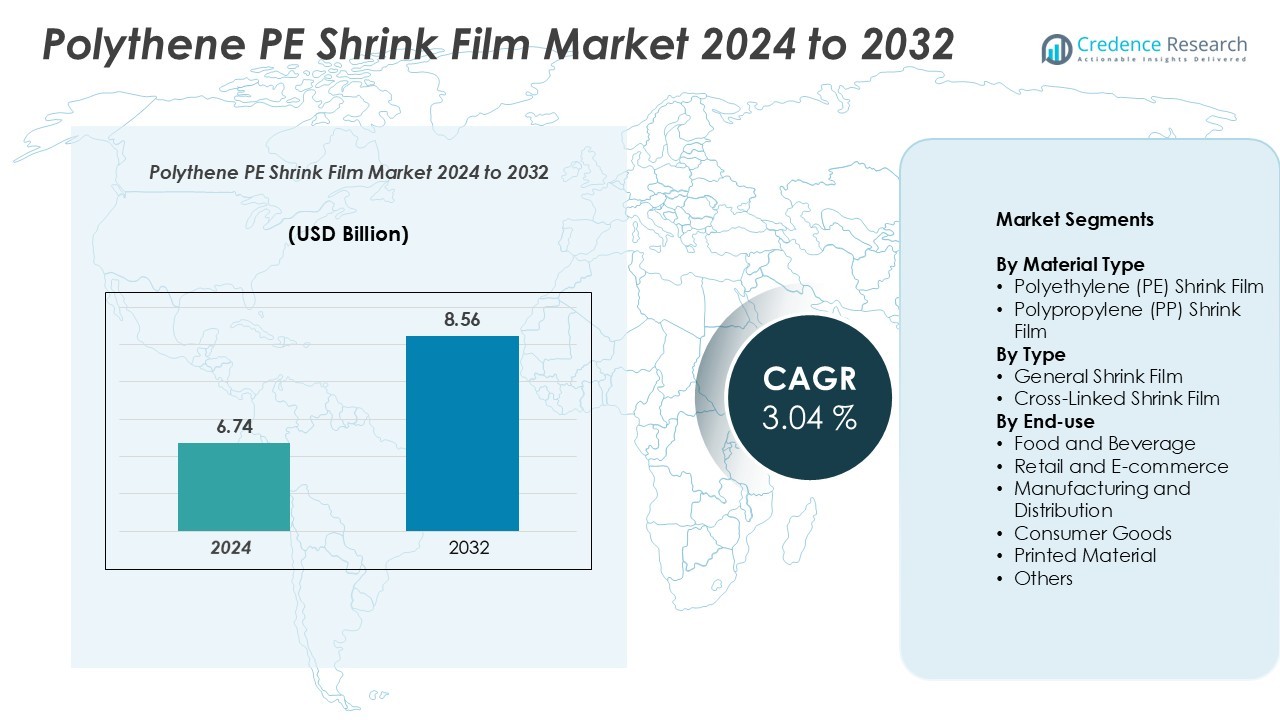

The Polythene PE Shrink Film Market size was valued at USD 6.74 billion in 2024 and is anticipated to reach USD 8.56 billion by 2032, at a CAGR of 3.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polythene PE Shrink Film Market Size 2024 |

USD 6.74 Billion |

| Polythene PE Shrink Film Market, CAGR |

3.04% |

| Polythene PE Shrink Film Market Size 2032 |

USD 8.56 Billion |

The polythene PE shrink film market is driven by strong competition among major players including Berry Global Group, Inc., Amcor plc, Intertape Polymer Group Inc., Sealed Air Corporation, Coveris Holdings S.A., Sigma Plastics Group, Bemis Company, Inc. (Part of Amcor), Ship-Pac, Inc., Bollore Group, and AEP Industries Inc. These companies dominate through large-scale production, advanced packaging technologies, and sustainable film innovations. North America leads the market with a 36% share, supported by strong packaging infrastructure and high consumption in food and beverage sectors. Europe holds 28%, driven by strict environmental regulations and advanced recycling systems. Asia Pacific follows with 25%, fueled by industrial growth, expanding retail networks, and rising demand for cost-effective packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The polythene PE shrink film market was valued at USD 6.74 billion in 2024 and is expected to reach USD 8.56 billion by 2032, growing at a CAGR of 3.04%.

- Strong demand from the food and beverage segment drives market growth, supported by high usage in multipack and retail packaging. Polyethylene (PE) shrink film holds the largest share among material types.

- Rising adoption of recyclable and downgauged films reflects a clear sustainability trend, with manufacturers investing in eco-friendly production and automation technologies.

- The market is competitive, with major players including Berry Global, Amcor, Intertape Polymer, and Sealed Air focusing on product innovation and capacity expansion, while regulatory pressure on plastic waste remains a restraint.

- North America leads with 36% of the market, followed by Europe at 28% and Asia Pacific at 25%, reflecting strong packaging infrastructure and growing demand across key end-use industries.

Market Segmentation Analysis:

By Material Type

Polyethylene (PE) shrink film dominates this segment with a major share. Its high clarity, flexibility, and cost-effectiveness make it the preferred choice across multiple industries. PE films offer excellent puncture resistance and strong sealing properties, which support efficient packaging operations. Their compatibility with automated machinery also drives adoption. Polypropylene (PP) shrink film is gaining attention for its superior gloss and heat resistance. However, its higher cost limits usage compared to PE. The growing demand for sustainable, recyclable materials further strengthens the position of PE films in the market.

- For instance, Berry Global incorporated an additional 4,386 metric tons of post-consumer recycled (PCR) polyethylene into its flexible film portfolio, including shrink-film applications.

By Type

General shrink film holds the dominant position in this segment. It is widely used in packaging applications due to its easy processing and compatibility with standard shrink systems. Industries prefer general shrink films for bundling and wrapping products like food trays, bottles, and cartons. Cross-linked shrink film is used in applications requiring high tensile strength and durability. Its enhanced tear resistance and superior optics make it suitable for high-speed packaging lines. Increasing automation in packaging is expected to support the demand for both types, with general shrink film leading.

- For instance, Sealed Air Corporation reports that its CRYOVAC® CT-700 series, designed for high-speed packaging, is compatible with fully automated systems.

By End-use

Food and beverage is the leading end-use segment, supported by rising demand for secure and durable packaging solutions. PE shrink film offers strong sealing and moisture resistance, making it ideal for beverage multipacks, frozen foods, and bakery items. Retail and e-commerce sectors also contribute significantly due to the growing need for product protection during transit. Manufacturing and distribution, consumer goods, and printed material segments use shrink film for unitizing products and enhancing shelf appeal. The food and beverage industry remains the largest consumer, driven by its high packaging volume and regulatory compliance needs.

Key Growth Drivers

Rising Demand from the Food and Beverage Industry

The food and beverage sector is a primary growth driver for the polythene PE shrink film market. Manufacturers rely on shrink films for secure, cost-effective, and visually appealing packaging solutions. These films provide strong sealing, moisture protection, and tamper evidence, making them ideal for beverage multipacks, frozen foods, bakery items, and ready-to-eat products. High transparency enhances product visibility on shelves, supporting retail sales. The rapid expansion of organized retail chains and e-commerce platforms is increasing the need for durable packaging materials. In addition, changing consumer preferences toward convenience packaging are pushing producers to adopt PE shrink films. Their recyclability and compliance with food safety standards further support growth across both developed and emerging markets.

- For instance, Amcor’s claim regarding its AmPrima™ PE shrink film is accurate, according to the company’s published case studies and product information. “Amcor plc s AmPrima™ PE shrink film with 30 % post-consumer recycled (PCR) content helped a bottled-beverage producer reduce non-renewable primary energy use by 24 % and their carbon footprint by 10 %.”

Growing Focus on Cost-Effective and Sustainable Packaging

PE shrink film offers an excellent balance of performance, affordability, and sustainability, driving its widespread adoption. Compared to alternative materials, PE shrink films provide lightweight packaging with reduced material usage, which helps lower logistics and handling costs. Manufacturers are increasingly shifting toward recyclable and downgauged PE films to meet regulatory standards and sustainability goals. This transition aligns with global efforts to reduce plastic waste and carbon footprints. The rising use of PE shrink films in high-volume packaging lines also improves operational efficiency and cost control. Moreover, its ability to integrate with automated packaging systems supports scalability for large manufacturers. As companies look to optimize production costs and adopt eco-friendly packaging solutions, PE shrink films are gaining a competitive edge.

- For instance, ExxonMobil Corporation, in collaboration with packaging converters, developed a 40-micron, 5-layer PE collation shrink film designed for 6 × 1.5 L bottle packs which includes up to 30 % recycled PE content.

Expansion of E-Commerce and Retail Distribution Networks

The rapid growth of e-commerce and modern retail channels is fueling the demand for durable and secure packaging solutions. PE shrink film provides product protection, tamper evidence, and easy handling during transit, which are essential for online and bulk retail shipments. Its flexibility allows manufacturers to package irregularly shaped products without compromising stability. Additionally, the growing number of distribution centers and retail warehouses increases the need for unitization and pallet wrapping solutions. E-commerce giants and logistics providers are adopting advanced shrink packaging technologies to reduce damage rates and enhance operational efficiency. These factors, combined with rising global retail activity, are boosting the consumption of PE shrink films in both developed and emerging economies.

Key Trends and Opportunities

Adoption of Recyclable and Bio-Based Shrink Films

Sustainability is becoming a central trend shaping the polythene PE shrink film market. Companies are investing in recyclable and bio-based PE films to comply with environmental regulations and reduce waste. Downgauging technologies allow producers to use thinner films while maintaining performance, lowering material consumption. Innovation in bio-based polyethylene offers opportunities to meet the growing demand for eco-friendly packaging. Many manufacturers are integrating post-consumer recycled (PCR) content into their shrink film production, enhancing their environmental credentials. This shift creates new opportunities for brands looking to align with circular economy principles and achieve sustainability goals, especially in food, beverage, and consumer goods packaging.

- For instance, Amcor plc introduced its AmPrima™ PE shrink film with 30% post-consumer recycled (PCR) content. When compared to a conventional, 100% virgin solution, this version achieved a 24% reduction in non-renewable primary energy demand and a 10% reduction in carbon footprint (greenhouse gas emissions). The film also achieved a 12% reduction in water consumption.

Automation and Technological Advancements in Packaging

Advances in packaging machinery and film extrusion technologies are enabling higher performance and operational efficiency. Modern PE shrink films are being engineered for better tensile strength, clarity, and shrink control, allowing faster packaging speeds with minimal waste. Integration with automated packaging systems enhances productivity in high-volume manufacturing environments. The adoption of smart packaging solutions and high-speed wrapping lines also expands applications in retail and logistics. Companies focusing on innovation in multi-layer film structures and barrier properties are gaining a strong competitive edge. This technological evolution is expected to create significant opportunities for film producers and packaging equipment manufacturers.

- For instance, Kühne Anlagenbau has produced lines using its Triple Bubble technology that achieve throughputs of up to 250 kg/h for advanced shrink-bag film. This output is directly correlated to an annual production of over 1,500 metric tons.

Key Challenges

Environmental Regulations and Plastic Waste Concerns

Strict environmental regulations and growing public concern over plastic waste pose a major challenge to the PE shrink film market. Governments worldwide are tightening rules on single-use plastics and non-recyclable materials. Producers must invest in recycling technologies and sustainable formulations to meet compliance requirements. The lack of advanced recycling infrastructure in many regions further complicates waste management. This regulatory pressure increases production costs and may restrict the use of conventional shrink films in some applications. Companies are under growing pressure to adopt circular economy practices to maintain market access and brand reputation.

Volatility in Raw Material Prices

Polyethylene resin prices are subject to significant fluctuations driven by crude oil market trends and supply chain disruptions. These price variations directly impact the production costs of PE shrink films, affecting profit margins for manufacturers. Unexpected spikes in raw material costs can make shrink film less competitive compared to alternative packaging materials. Global supply chain disruptions and geopolitical instability further add to pricing uncertainty. To mitigate this challenge, producers need to adopt flexible sourcing strategies, invest in recycling initiatives, and explore bio-based feedstocks. Price volatility remains a critical barrier to stable market growth and long-term planning.

Regional Analysis

North America

North America holds a 36% share of the global polythene PE shrink film market. The strong presence of advanced packaging industries and widespread adoption across food, beverage, and retail sectors support this leadership. High consumption of convenience and packaged foods drives demand for PE shrink films. Investments in automated packaging technologies further enhance market penetration. The U.S. dominates regional growth, backed by well-established e-commerce and logistics networks. Growing sustainability initiatives and regulatory compliance are also encouraging the adoption of recyclable and downgauged films, reinforcing the region’s position as a key revenue contributor.

Europe

Europe accounts for 28% of the global market, driven by strict packaging standards and strong sustainability regulations. The region leads in adopting recyclable and bio-based PE shrink films to meet circular economy goals. Demand is particularly strong in the food and beverage sector, supported by advanced retail distribution channels. Germany, France, and the U.K. are major markets due to their mature packaging industries. Increased use of eco-friendly packaging solutions is accelerating product innovation. The strong regulatory framework and commitment to sustainable packaging keep Europe a significant growth hub in the global PE shrink film market.

Asia Pacific

Asia Pacific holds a 25% market share and is the fastest-growing regional segment. Rapid industrialization, expanding retail networks, and rising packaged food consumption drive demand. Countries such as China, India, and Japan are major contributors due to high production capacities and growing consumer markets. E-commerce growth and increasing logistics activity further boost packaging requirements. Manufacturers are expanding production facilities to meet the rising demand for cost-effective, durable packaging solutions. The region’s shift toward sustainable materials also creates strong growth opportunities, making Asia Pacific a strategic manufacturing and consumption center for PE shrink films.

Latin America

Latin America represents 6% of the global market share, supported by steady growth in food processing and retail sectors. Brazil and Mexico lead the region with rising adoption of shrink films for beverage and consumer goods packaging. Increasing investments in packaging infrastructure and expansion of supermarket chains are key drivers. Growing awareness of packaging hygiene and product safety is accelerating the shift from traditional packaging to modern shrink solutions. However, economic fluctuations and limited recycling infrastructure pose challenges. Still, the region presents strong potential for market expansion, particularly in urbanizing economies.

Middle East & Africa

The Middle East & Africa account for 5% of the market, with growing demand from food, beverage, and manufacturing sectors. Expanding retail chains and infrastructure development are driving increased adoption of shrink film packaging. The UAE and South Africa are leading markets, supported by logistics and distribution network growth. The demand for durable, cost-efficient packaging solutions is encouraging investments in local production capacity. While the region still relies heavily on imports, rising industrialization is creating new opportunities. Regulatory reforms promoting sustainable materials are also likely to influence market adoption over the forecast period.

Market Segmentations:

By Material Type

- Polyethylene (PE) Shrink Film

- Polypropylene (PP) Shrink Film

By Type

- General Shrink Film

- Cross-Linked Shrink Film

By End-use

- Food and Beverage

- Retail and E-commerce

- Manufacturing and Distribution

- Consumer Goods

- Printed Material

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The polythene PE shrink film market is highly competitive, with leading players focusing on product innovation, capacity expansion, and sustainable packaging solutions. Major companies include Berry Global Group, Inc., Amcor plc, Intertape Polymer Group Inc., Sealed Air Corporation, Coveris Holdings S.A., Sigma Plastics Group, Bemis Company, Inc. (Part of Amcor), Ship-Pac, Inc., Bollore Group, and AEP Industries Inc. These companies invest heavily in R&D to develop downgauged, recyclable, and high-clarity shrink films that meet regulatory and consumer sustainability demands. Strategic moves such as mergers, acquisitions, and partnerships strengthen their market presence and global reach. Several players are expanding production facilities to enhance supply capabilities and reduce lead times. The focus on automation-compatible films and advanced barrier properties further supports competitive differentiation. Intense competition encourages continuous innovation, pushing companies to balance cost efficiency with performance and sustainability goals. This dynamic environment positions market leaders to capture long-term growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2024, Innovia Films launched floatable polyolefin shrink films. RayoFloat white APO is a low-density white polyolefin that maintains floatability when printed. Its opacity enhances light blocking, suitable for shrink sleeves for light-sensitive industries such as dairy, food supplements, nutritional products and cosmetics.

- In February 2024, IPG introduced polyolefin shrink film with 35% recycled content. ExlfilmPlus PCR features at least 10% certified PCR content and 25% certified PIR content. This design aligns with the increasing demand for eco-friendly packaging solutions that do not compromise on quality or performance. The film utilizes mechanically recycled post-consumer content sourced from consumer plastic waste and recycled into new resin.

- In May 2023, Innovia Films introduced APO45, a floatable and sustainable shrink sleeve material developed to boost PET recycling rates and support a circular economy for packaging. The product is suitable for use in all shrink sleeve applications in the household, laundry, personal care, food, dairy, and beverage markets, states the company.

- In April 2022, Amcor, a global leader in packaging solutions announced an investment to expand its medical packaging capabilities in Europe. This will strengthen Amcor’s leadership in the growing industry of sterile packaging.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for recyclable and downgauged shrink films will continue to rise globally.

- Food and beverage packaging will remain the largest end-use segment.

- Asia Pacific will record the fastest growth due to expanding retail and e-commerce.

- Manufacturers will invest more in automation-compatible shrink film solutions.

- Bio-based polyethylene will gain stronger adoption across developed regions.

- Strategic mergers and acquisitions will strengthen global production networks.

- Regulatory compliance will drive innovation in sustainable packaging solutions.

- High-performance shrink films with better barrier properties will see increased demand.

- North America and Europe will maintain strong market positions with stable consumption.

- Advancements in extrusion technology will enhance product quality and cost efficiency.