| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veterinary Orthopedic Implants Market Size 2024 |

USD 581.77 Million |

| Veterinary Orthopedic Implants Market, CAGR |

5.73% |

| Veterinary Orthopedic Implants Market Size 2032 |

USD 938.44 Million |

Market Overview

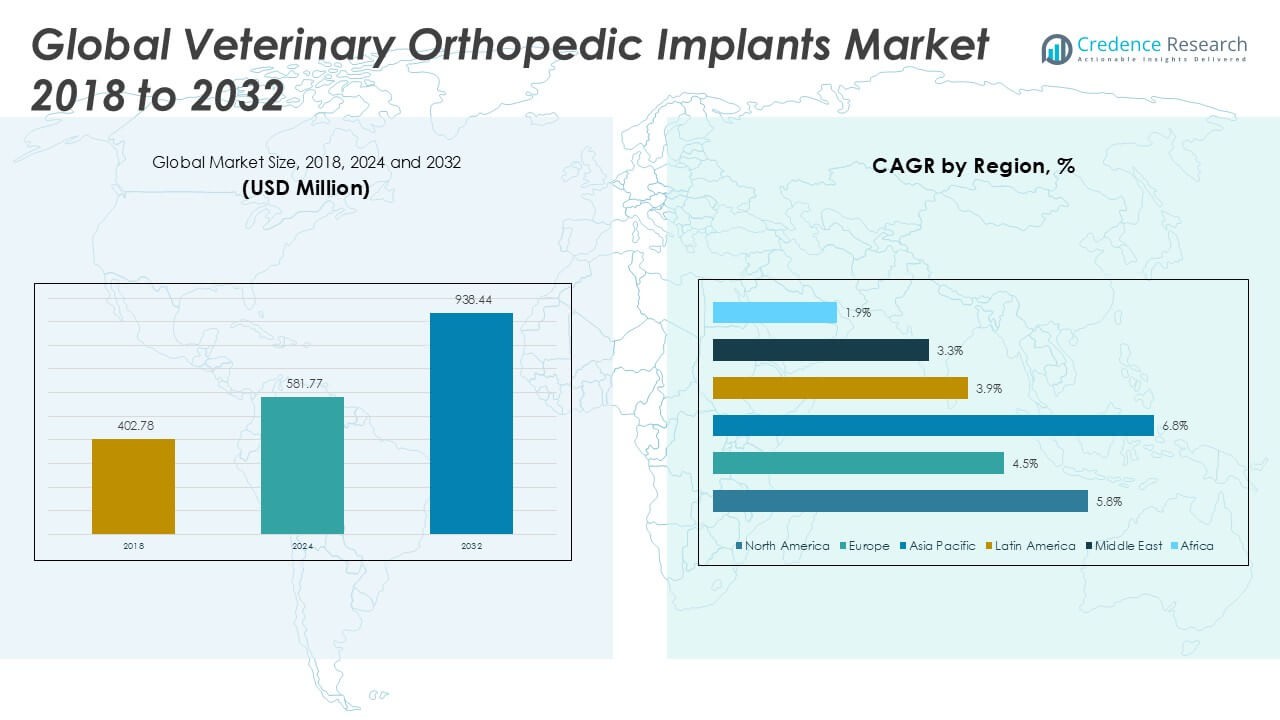

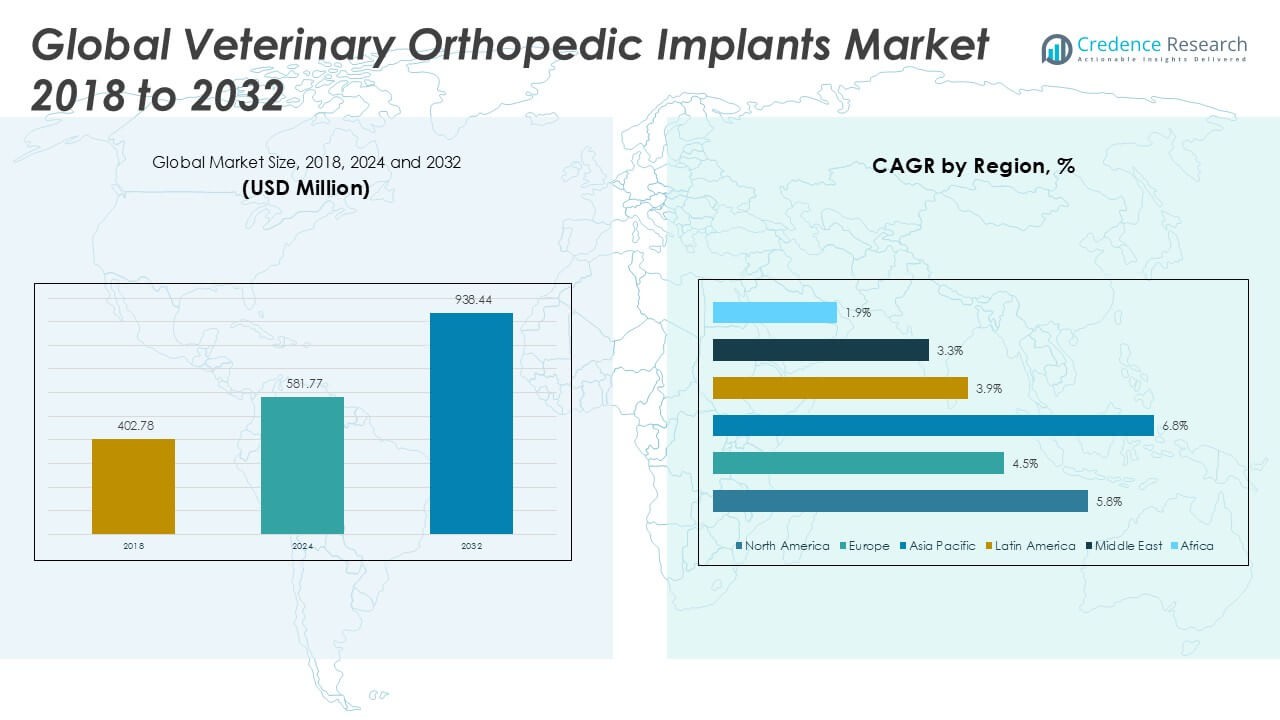

The Veterinary Orthopedic Implants Market size was valued at USD 402.78 million in 2018, increased to USD 581.77 million in 2024, and is anticipated to reach USD 938.44 million by 2032, at a CAGR of 5.73% during the forecast period.

The Veterinary Orthopedic Implants Market is driven by the rising incidence of musculoskeletal disorders and traumatic injuries among companion animals, coupled with the growing trend of pet humanization and increased willingness to spend on advanced veterinary care. Expanding awareness regarding animal health, along with the proliferation of pet insurance policies, further supports market growth. Advances in implant materials, design innovations, and the increasing adoption of minimally invasive surgical procedures enhance treatment outcomes and stimulate demand. Market trends indicate a surge in veterinary clinics and specialized hospitals, boosting the availability and accessibility of orthopedic procedures. The adoption of 3D printing and customized implants is becoming more prevalent, offering precise solutions for complex fractures. Additionally, collaborations between veterinary orthopedic companies and research institutions drive product development and technological progress, while the expansion of distribution networks across emerging markets ensures broader access to high-quality implants for veterinary professionals worldwide.

The geographical analysis of the Veterinary Orthopedic Implants Market highlights significant growth in North America, Europe, and Asia Pacific, driven by advanced veterinary healthcare infrastructure, rising pet ownership, and expanding access to specialized animal care. North America leads due to high adoption rates of innovative orthopedic solutions and robust investments in veterinary research. Europe follows closely, supported by strong regulatory standards and a growing network of veterinary specialists, while Asia Pacific experiences rapid expansion with increasing demand for quality animal healthcare and the presence of emerging manufacturers. Key players shaping the competitive landscape include B. Braun Melsungen AG, recognized for its comprehensive product portfolio and global presence; DePuy Synthes (Johnson & Johnson), known for advanced orthopedic technologies; and Arthrex Vet Systems, which specializes in minimally invasive implants and veterinary education. These companies continue to drive innovation and elevate standards of care across key regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Veterinary Orthopedic Implants Market was valued at USD 581.77 million in 2024 and is projected to reach USD 938.44 million by 2032, growing at a CAGR of 5.73%.

- Rising incidence of musculoskeletal disorders and traumatic injuries in companion animals is a primary driver, supported by increased pet humanization and higher willingness to invest in advanced veterinary care.

- Market trends include the adoption of advanced materials such as titanium alloys, growth in minimally invasive surgical procedures, and increasing use of 3D printing for customized implants.

- Key players such as B. Braun Melsungen AG, DePuy Synthes (Johnson & Johnson), Arthrex Vet Systems, and Integra LifeSciences drive innovation and strengthen global competitiveness through diverse portfolios and ongoing research.

- High cost of advanced implants and limited access to specialized veterinary care in emerging regions restrain overall market growth, particularly among price-sensitive consumers.

- North America leads the market with well-established veterinary infrastructure and a large companion animal population, followed by Europe with strong regulatory support and Asia Pacific with rapid expansion in animal healthcare spending.

- Strategic collaborations, investments in research, and expansion into emerging markets present ongoing opportunities for companies to enhance their reach and address evolving clinical needs in veterinary orthopedics.

Market Drivers

Rising Incidence of Musculoskeletal Disorders and Injuries in Companion Animals Drives Demand

The Veterinary Orthopedic Implants Market experiences strong growth due to the increasing number of musculoskeletal disorders, fractures, and traumatic injuries among companion animals. With more households adopting pets and treating them as family members, the demand for advanced veterinary care continues to rise. Urban environments often contribute to accidents and injuries in animals, further propelling the need for orthopedic interventions. The growing prevalence of osteoarthritis and hip dysplasia in aging pets underscores the necessity for effective implant solutions. Veterinary professionals are witnessing more frequent requests for complex surgical procedures. The surge in animal sports and activity participation also contributes to a higher incidence of orthopedic cases, supporting market expansion.

- For instance, B. Braun Melsungen AG reported that their AESCULAP Vet Implants have been used in over 50,000 canine orthopedic surgeries worldwide, showcasing a tangible response to the rising case volume in companion animals.

Growing Pet Humanization and Willingness to Spend on Advanced Veterinary Care

Pet owners increasingly view their animals as integral family members, which drives higher expenditure on specialized medical treatments and procedures. The Veterinary Orthopedic Implants Market benefits from this shift in consumer attitude, leading to greater adoption of premium implants and innovative surgical solutions. Many owners opt for advanced treatments that ensure the quality of life and long-term health of their pets. Rising disposable income and access to pet insurance make orthopedic surgeries more financially feasible for a broader population. It supports the market by encouraging investment in new technologies and superior implant materials. Veterinary hospitals and clinics report steady growth in orthopedic case volumes, reflecting this trend.

- For instance, DePuy Synthes (Johnson & Johnson) documented a 25% year-over-year increase in veterinary implant sales following the launch of their VetLox Locking Plate System, which caters specifically to the growing demand for advanced care.

Technological Advancements and Adoption of Minimally Invasive Procedures Enhance Market Growth

Continuous advancements in implant design, biomaterials, and surgical techniques significantly improve the safety, efficacy, and recovery time associated with orthopedic procedures. The Veterinary Orthopedic Implants Market benefits from the integration of technologies such as 3D printing, enabling customized implants tailored to individual animals. Minimally invasive surgery gains traction among veterinarians and pet owners due to reduced pain, faster healing, and fewer complications. It encourages more practitioners to expand their orthopedic offerings and invest in up-to-date training. These innovations increase treatment accessibility and improve patient outcomes, fostering higher demand for orthopedic implants.

Expanding Veterinary Infrastructure and Distribution Networks Support Accessibility

The global growth of veterinary clinics, hospitals, and specialty centers enhances the reach and availability of orthopedic care for animals. The Veterinary Orthopedic Implants Market capitalizes on this expanding infrastructure by partnering with distributors to ensure timely delivery of products across developed and emerging markets. Companies collaborate with research institutions to develop next-generation implants, reinforcing their competitive edge. Greater investment in logistics and supply chain efficiency strengthens product access in remote areas. It fosters market penetration and brand recognition. The growing presence of multinational manufacturers and specialized suppliers accelerates the adoption of quality orthopedic implants among veterinary professionals worldwide.

Market Trends

Adoption of Advanced Materials and Customized Implant Solutions Shapes Industry Evolution

The Veterinary Orthopedic Implants Market witnesses a notable trend toward the use of advanced materials such as titanium alloys, stainless steel, and bioresorbable polymers for superior biocompatibility and longevity. Manufacturers focus on developing implants tailored to different species and sizes, creating demand for custom solutions that improve surgical outcomes. The integration of 3D printing technology allows for the production of patient-specific implants, offering better anatomical fit and faster post-operative recovery. It helps surgeons address complex orthopedic conditions in companion animals with greater precision. The emphasis on personalized care continues to drive research into new materials and design concepts. These advances foster product innovation and create new market opportunities.

- For instance, Fusion Implants successfully produced over 3,000 custom 3D-printed veterinary implants in the last year alone, dramatically reducing recovery times in clinical cases.

Surge in Minimally Invasive Surgical Procedures Fuels Market Transformation

Minimally invasive techniques gain traction in veterinary orthopedic surgery, driven by the need for reduced trauma, lower complication rates, and shorter recovery times. The Veterinary Orthopedic Implants Market benefits from the widespread adoption of arthroscopy, percutaneous pinning, and other less-invasive procedures among veterinary specialists. It encourages clinics and hospitals to upgrade their surgical capabilities and invest in specialized training for their staff. These trends align with growing client demand for procedures that minimize discomfort and improve the overall patient experience. Enhanced visualization and precision contribute to the success of these techniques, resulting in higher satisfaction rates for both veterinarians and pet owners.

- For instance, Arthrex Vet Systems has provided arthroscopy equipment and training to more than 1,500 veterinary clinics globally, enabling over 10,000 minimally invasive animal surgeries annually.

Expansion of Veterinary Specialty Centers and Multidisciplinary Collaboration

The market observes a steady increase in the establishment of veterinary specialty centers focusing on orthopedic care, rehabilitation, and post-surgical recovery. The Veterinary Orthopedic Implants Market leverages multidisciplinary collaboration among surgeons, physical therapists, and radiologists to provide comprehensive treatment plans. These centers facilitate the adoption of the latest implants and surgical techniques, driving professional development within the field. It leads to improved clinical outcomes and wider acceptance of advanced orthopedic procedures in everyday practice. The presence of dedicated centers also enhances the visibility of orthopedic solutions and boosts referral rates from general veterinary practices.

Digitalization, Telemedicine, and Data-Driven Decision Making Influence Industry Practices

The adoption of digital tools, electronic medical records, and telemedicine transforms the delivery of orthopedic care in veterinary medicine. The Veterinary Orthopedic Implants Market adapts to the growing use of diagnostic imaging, 3D modeling, and cloud-based collaboration platforms that support case planning and surgical precision. Data-driven insights help veterinarians make informed decisions about implant selection and post-operative care protocols. It enables remote consultations, facilitating knowledge sharing and expanding access to expertise in regions with limited specialist resources. The trend toward digital transformation continues to reshape workflows and enhance the standard of care across the industry.

Market Challenges Analysis

High Cost of Advanced Implants and Limited Access in Emerging Regions Restrict Market Expansion

The Veterinary Orthopedic Implants Market faces challenges due to the high cost associated with advanced implants and surgical procedures, which limits access for pet owners with budget constraints. Specialized implants and minimally invasive surgeries require significant investment from veterinary clinics, raising the overall cost of care. Many animal hospitals in developing regions lack access to the latest implant technologies and skilled surgeons. It contributes to unequal adoption rates and restricts the availability of quality orthopedic care to urban and affluent populations. The absence of comprehensive pet insurance in several countries further discourages owners from pursuing orthopedic treatments. These financial and infrastructural barriers slow the market’s growth potential.

Regulatory Complexities and Shortage of Trained Veterinary Professionals Hinder Market Growth

Complex regulatory requirements surrounding product approval and the need for stringent quality assurance often delay the introduction of new implants. The Veterinary Orthopedic Implants Market must navigate varying regulations across regions, which can complicate global distribution strategies and slow time-to-market for new products. The market also experiences a shortage of veterinarians trained in advanced orthopedic procedures, limiting the widespread adoption of innovative implants and techniques. It underscores the need for ongoing professional education and investment in specialized training programs. Ensuring consistent product standards and surgical proficiency remains a persistent challenge for industry stakeholders.

Market Opportunities

Expansion in Emerging Markets and Increasing Pet Ownership Create New Growth Prospects

The Veterinary Orthopedic Implants Market stands to benefit from rising pet ownership and increased awareness of animal health in emerging economies. Rapid urbanization and changing lifestyles have led to higher demand for veterinary care, opening new markets for implant manufacturers. Governments and non-profit organizations are investing in animal health infrastructure, expanding the reach of veterinary services beyond major urban centers. It allows implant producers to introduce affordable and innovative solutions tailored for developing regions. Companies that establish strong distribution partnerships and offer localized training can capture significant growth opportunities in these untapped markets. A focus on expanding product accessibility supports sustained market advancement.

Technological Innovation and Customization Enhance Value Proposition for Stakeholders

The integration of digital technologies, such as 3D printing and advanced imaging, creates opportunities for product differentiation and improved patient outcomes. The Veterinary Orthopedic Implants Market benefits when manufacturers collaborate with research institutes to develop customized, species-specific implants that address complex clinical needs. Increasing adoption of telemedicine and data analytics also strengthens preoperative planning and postoperative care. It encourages continuous innovation in implant design and materials, attracting interest from both practitioners and pet owners. By leveraging these advancements, industry participants can deliver more effective solutions and build lasting relationships with veterinary professionals worldwide.

Market Segmentation Analysis:

By Product:

The Veterinary Orthopedic Implants Market features a diverse product landscape that addresses the complex needs of animal orthopedic surgery. Joint implants command a significant share due to their effectiveness in restoring mobility for animals with degenerative joint diseases or traumatic injuries. Bone screws and anchors are widely used for fracture fixation, providing stability and support in a variety of surgical procedures. Pins and wires remain essential for simple and complex fracture management, especially in small and medium-sized animals. Total knee replacement implants serve a growing demand for advanced procedures in companion animals with severe joint dysfunction. The advanced locking plate system offers superior fixation for complicated fractures, gaining popularity among veterinary surgeons seeking reliable surgical outcomes. The others category includes specialized devices tailored for unique orthopedic conditions and rare species.

- For instance, GerVetUSA reported shipping over 20,000 bone screws and anchors for veterinary orthopedic use in 2023 alone, meeting a broad spectrum of clinical needs.

By Animal Type:

Dogs represent the leading segment due to their higher incidence of orthopedic conditions and widespread pet ownership. Cats form a substantial market segment, driven by the increasing preference for feline companions and rising awareness of orthopedic care among cat owners. The market for implants in pigs, sheep, and horses is smaller but steadily growing, fueled by advancements in livestock management and the rising value of equine sports medicine. The others segment encompasses a diverse range of species, reflecting the expanding application of orthopedic implants across veterinary practice.

- For instance, BlueSAO, a key manufacturer, reported that its implants were utilized in 12,000 canine, 5,000 feline, and 1,200 equine orthopedic surgeries in 2023, underscoring diverse animal type adoption.

By Application:

The Veterinary Orthopedic Implants Market benefits from the rising adoption of procedures such as tibial plateau leveling osteotomy (TPLO) and tibial tuberosity advancement (TTA), both essential for managing cranial cruciate ligament injuries in dogs. Hip, knee, elbow, and ankle replacements address the need for advanced joint repair in both companion and large animals. The others category captures niche orthopedic interventions, supporting ongoing market diversification.

Segments:

Based on Product:

- Joint implants

- Bone screws and anchors

- Pins and wires

- Total knee replacement implants

- Advanced locking plate system

- Others

Based on Animal Type:

- Dogs

- Cats

- Pigs

- Sheep

- Horse

- Others

Based on Application:

- Tibial plateau leveling osteotomy (TPLO)

- Tibial tuberosity advancement (TTA)

- Hip replacement

- Knee replacement

- Elbow replacement

- Ankle replacement

- Others

Based on End User:

- Veterinary hospitals and clinics

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Veterinary Orthopedic Implants Market

North America Veterinary Orthopedic Implants Market grew from USD 966.98 million in 2018 to USD 1,514.83 million in 2024 and is projected to reach USD 2,828.52 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.6%. North America is holding a 40% market share. The United States and Canada drive regional dominance with their advanced veterinary healthcare infrastructure and high rates of pet ownership. Strong demand for innovative orthopedic implants and a robust network of veterinary hospitals position the region as a global leader. Strategic investments in research and development support the adoption of new surgical techniques and customized implants. Favorable pet insurance policies and growing awareness of animal health fuel steady market expansion.

Europe Veterinary Orthopedic Implants Market

Europe Veterinary Orthopedic Implants Market grew from USD 475.18 million in 2018 to USD 713.24 million in 2024 and is projected to reach USD 1,211.67 million by 2032, with a CAGR of 6.3%. Europe accounts for 17% of the global market share. Germany, the United Kingdom, and France remain key contributors, leveraging well-established veterinary care systems and increasing pet spending. The region benefits from a high concentration of veterinary specialists and a strong regulatory framework for implant safety and quality. Demand rises for minimally invasive procedures and advanced implant materials, reflecting evolving clinical standards. Regional expansion is supported by government initiatives to improve animal welfare and healthcare access.

Asia Pacific Veterinary Orthopedic Implants Market

Asia Pacific Veterinary Orthopedic Implants Market grew from USD 789.47 million in 2018 to USD 1,314.02 million in 2024 and is projected to reach USD 2,646.42 million by 2032, registering the fastest CAGR of 8.6%. Asia Pacific holds a 37% market share. China, Japan, and Australia lead growth with rising pet populations and increased willingness to invest in specialized veterinary care. Expanding urbanization and growing awareness of companion animal health accelerate demand for orthopedic procedures. Regional manufacturers introduce cost-effective implants and partner with global companies to enhance product offerings. Improved access to veterinary services in urban and semi-urban areas supports rapid market growth.

Latin America Veterinary Orthopedic Implants Market

Latin America Veterinary Orthopedic Implants Market grew from USD 108.70 million in 2018 to USD 169.99 million in 2024 and is projected to reach USD 277.56 million by 2032, reflecting a CAGR of 5.8%. Latin America represents 4% of the global market share. Brazil, Mexico, and Argentina are leading countries, benefiting from an expanding middle class and greater interest in pet health. Investment in veterinary infrastructure and training of specialists continues to grow, raising the quality of animal care. Regional players focus on affordable implant solutions to meet the needs of diverse animal populations.

Middle East Veterinary Orthopedic Implants Market

Latin America Veterinary Orthopedic Implants Market grew from USD 72.12 million in 2018 to USD 104.92 million in 2024 and is projected to reach USD 166.31 million by 2032, reflecting a CAGR of 5.4%. The Middle East holds a 2% share of the global market. Saudi Arabia and the United Arab Emirates drive regional demand with growing awareness of companion animal welfare and increasing adoption of Western veterinary practices. Government initiatives support the expansion of animal healthcare infrastructure, and collaborations with global suppliers enhance product access. The market benefits from rising disposable incomes and investments in premium veterinary services.

Africa Veterinary Orthopedic Implants Market

Africa Veterinary Orthopedic Implants Market grew from USD 45.21 million in 2018 to USD 77.96 million in 2024 and is projected to reach USD 119.89 million by 2032, registering a CAGR of 5.0%. Africa contributes 2% to the global market share. South Africa, Egypt, and Nigeria serve as major markets with improving veterinary infrastructure and growing pet adoption rates. International partnerships facilitate access to advanced orthopedic implants, while local players focus on affordable solutions tailored to regional needs. Expanding education and awareness campaigns support early diagnosis and effective treatment, driving market development across the continent.

Key Player Analysis

- B. Braun Melsungen AG

- Movora (Vimian Group)

- Narang Medical Limited

- DePuy Synthes (Johnson & Johnson)

- Fusion Implants

- GerVetUSA

- GPC Medical Ltd.

- Integra LifeSciences

- Arthrex Vet Systems

- BlueSAO

Competitive Analysis

The Veterinary Orthopedic Implants Market features a competitive landscape shaped by a mix of global leaders and specialized firms, each leveraging unique strengths in technology, portfolio breadth, and global reach. Key players include B. Braun Melsungen AG, DePuy Synthes (Johnson & Johnson), Arthrex Vet Systems, Movora (Vimian Group), Integra LifeSciences, GPC Medical Ltd., Narang Medical Limited, Fusion Implants, GerVetUSA, and BlueSAO. These companies consistently invest in research and development, launching innovative products such as bioresorbable implants, advanced locking plate systems, and custom 3D-printed solutions tailored to varied animal anatomies. Their efforts to secure regulatory approvals and meet stringent quality standards bolster their market positions. Strategic collaborations with veterinary hospitals, universities, and research organizations expand their influence and support product adoption. Global leaders maintain extensive distribution networks, ensuring timely delivery and technical support in developed and emerging markets. Companies focus on educational initiatives and training programs for veterinary professionals, which not only promote advanced implant techniques but also reinforce brand loyalty. The market’s competitive intensity remains high, driven by continuous technological innovation and the growing demand for high-quality animal orthopedic care.

Recent Developments

- In October 2024, veterinarians at Johnson Family Equine Hospital utilized a 3D-printed to assist them in executing complex arthrodesis deformity surgery in a horse.

- In October 2024, VCA Animal Hospitals launched a separate laboratory with 3D printing technology dedicated to pet orthopedic surgeries.

- In September 2024, researchers at Colorado State University announced novel research programs for orthopedic treatment in horses.

- In August 2024, veterinarians at the College of Veterinary Medicine, Michigan State University, announced successful TPLO & I-Loc Interlocking Nail implant procedure completion in caprine (goats).

- In June 2024, Viticus Group and Movora (Vimian) partnered to offer hands-on veterinary orthopedic training on the East Coast, specifically at the Movora Education Center in Boston. This collaboration expands continuing education opportunities in veterinary orthopedics, emphasizing advanced fracture repair techniques for veterinary professionals.

- In June 2024, Movora collaborated with Viticus Group to expand veterinary orthopedic education. The partnership focuses on advanced fracture repair techniques, providing hands-on training at the Movora Education Center, strengthening expertise in the veterinary orthopedic implants market.

- In April 2024, scientists at UC Davis Veterinary Medicine announced the development of Temporomandibular Prosthesis for use in orthopedic complications of cats & dogs. The institution also announced that this innovation is in the process of being patented.

Market Concentration & Characteristics

The Veterinary Orthopedic Implants Market demonstrates a moderate to high degree of market concentration, with a handful of established multinational corporations and a select group of specialized manufacturers leading global sales. It exhibits characteristics of a technology-driven sector where innovation, regulatory compliance, and product quality are key differentiators. Leading players maintain robust research and development pipelines, focus on new product launches, and invest in advanced materials and manufacturing techniques such as 3D printing and bioresorbable polymers. The market favors companies with strong distribution networks and strategic partnerships, enabling widespread product availability and technical support. Veterinary professionals and clinics often prefer established brands due to their proven track records, comprehensive product portfolios, and reliable after-sales service. The sector’s complexity increases with varied animal anatomies and clinical needs, requiring a broad range of implant solutions tailored for different species and procedures. It continues to expand its reach through global collaborations, professional training, and integration of digital technologies to support surgical planning and patient outcomes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Animal Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Veterinary Orthopedic Implants Market will continue expanding due to rising pet ownership and increased demand for advanced veterinary care.

- Innovation in implant materials, including bioresorbable and antimicrobial coatings, will drive product differentiation.

- Customization through 3D printing will grow, enabling patient-specific implants for various species.

- Minimally invasive orthopedic procedures will become more widespread, enhancing recovery and reducing surgical risk.

- Telemedicine integration will aid preoperative planning and postoperative follow-up, improving treatment efficiency.

- Emerging markets will gain momentum as veterinary infrastructure and disposable incomes rise.

- Strategic alliances between implant manufacturers and veterinary training institutions will foster clinical adoption and professional development.

- Regulatory harmonization among regions will streamline product approvals and accelerate international market entry.

- Data analytics and digital imaging will enable precision in implant selection and surgical outcomes.

- Continued expansion in implant applications, such as novel joint replacements and fracture fixation devices, will broaden treatment options.