Market Overview:

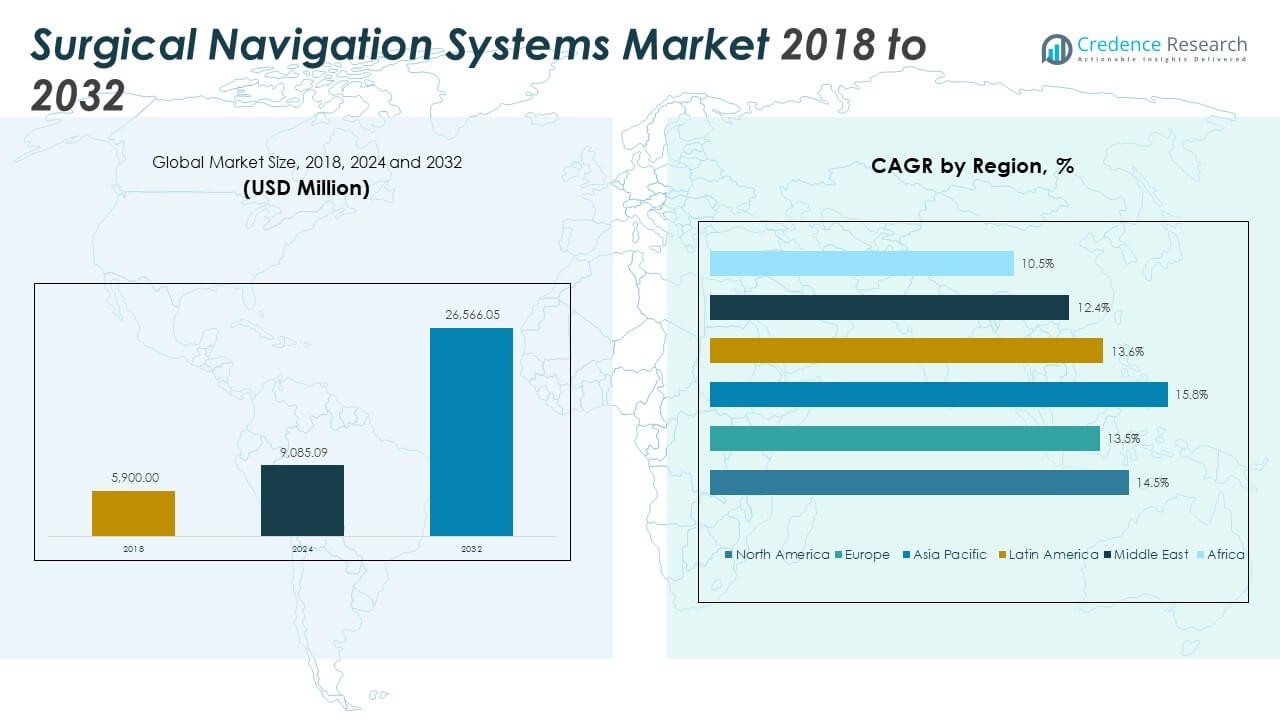

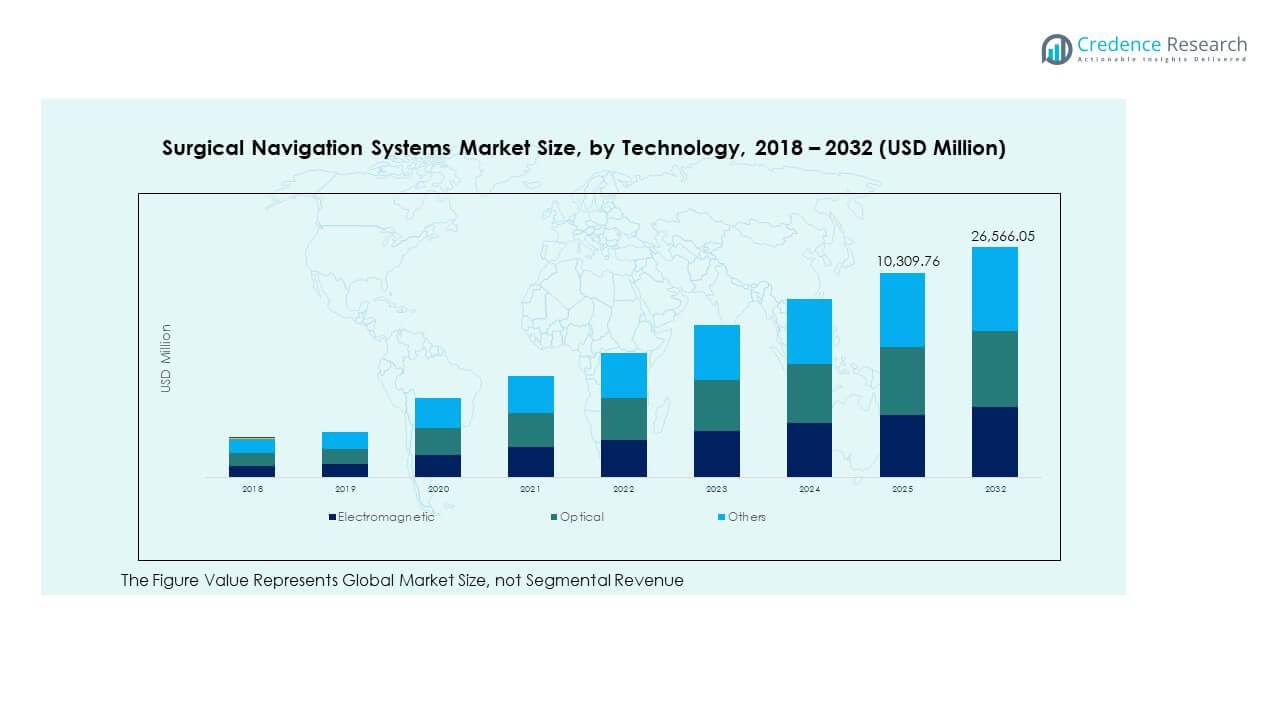

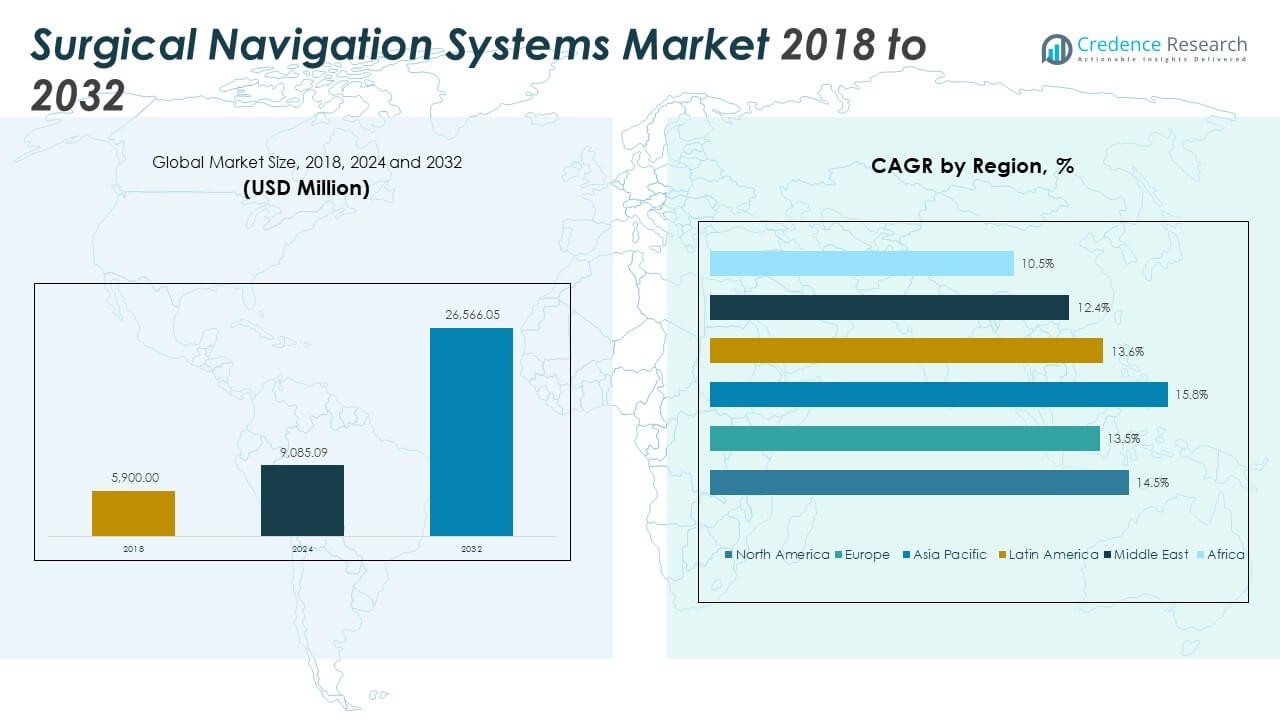

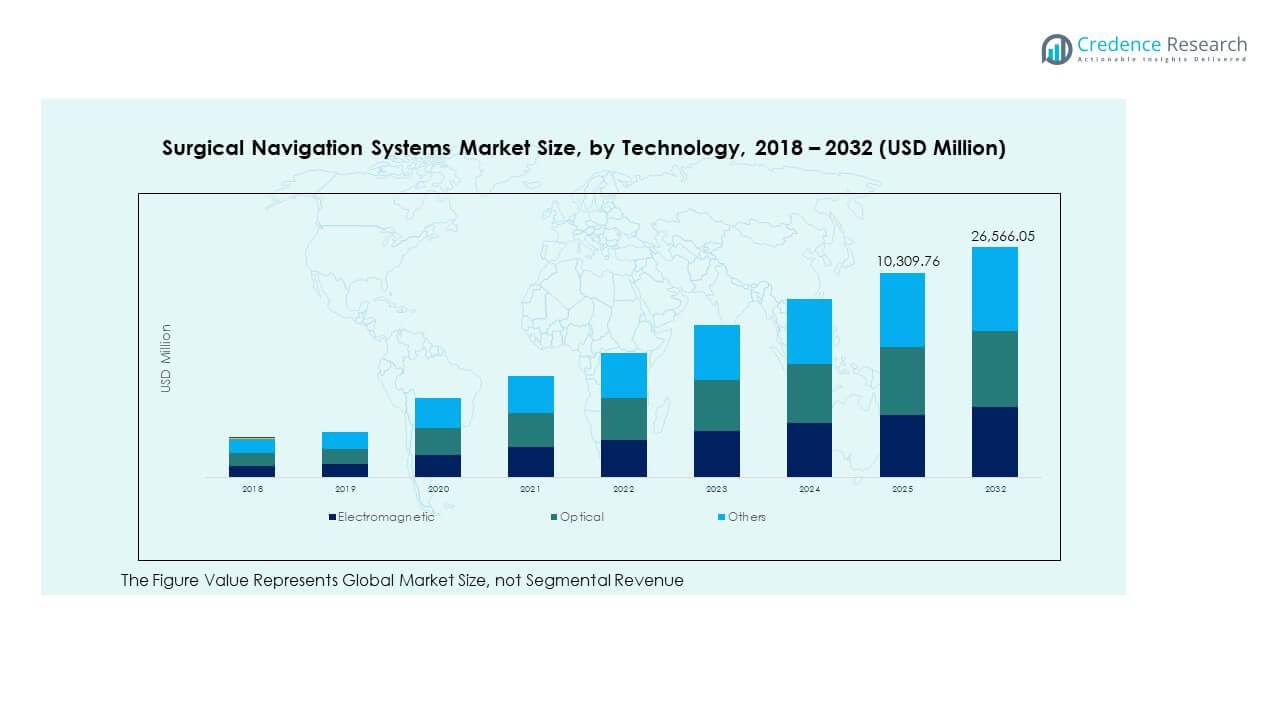

The Global Surgical Navigation Systems Market size was valued at USD 5,900.00 million in 2018 to USD 9,085.09 million in 2024 and is anticipated to reach USD 26,566.05 million by 2032, at a CAGR of 14.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Global Surgical Navigation Systems Market Size 2024 |

USD 9,085.09 Million |

| Global Surgical Navigation Systems Market , CAGR |

14.48% |

| Global Surgical Navigation Systems Market Size 2032 |

USD 26,566.05 Million |

The market is driven by the rising demand for accurate surgical procedures, growth in minimally invasive surgeries, and increasing technological advancements. Hospitals are adopting advanced navigation systems to reduce surgical errors and improve patient outcomes. Rising cases of neurological and orthopedic disorders further fuel the need for these systems. Integration of AI, robotics, and real-time imaging supports precise intraoperative decisions, enhancing surgeon confidence and recovery speed.

North America leads the Global Surgical Navigation Systems Market due to its strong healthcare infrastructure, early technology adoption, and significant R&D investments. Europe follows with high adoption in orthopedic and ENT surgeries. Asia Pacific is emerging as the fastest-growing region, driven by expanding healthcare access, increasing medical tourism, and government investments in advanced medical devices. Latin America and the Middle East & Africa show gradual growth, supported by rising healthcare spending and infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Surgical Navigation Systems Market was valued at USD 5,900 million in 2018, reached USD 9,085.09 million in 2024, and is projected to attain USD 26,566.05 million by 2032, registering a CAGR of 14.48% during the forecast period.

- North America holds the largest regional share of 34%, driven by advanced healthcare infrastructure, higher surgical volumes, and early adoption of navigation technologies. Europe follows with 25% due to strong R&D and regulatory support, while Asia Pacific contributes 27%, supported by large patient populations and healthcare expansion.

- Asia Pacific is the fastest-growing region with a 15.8% CAGR, fueled by rising medical tourism, digital healthcare investments, and increased adoption of AI-assisted surgical systems in China, Japan, and India.

- Based on technology, optical navigation systems dominate with around 42% share due to their superior accuracy and visualization in complex surgeries.

- Electromagnetic systems account for nearly 36% of the market, favored for flexibility and precision in orthopedic and neurosurgical applications, while other emerging technologies represent the remaining 22%.

Market Drivers:

Growing Preference for Minimally Invasive Surgical Procedures

The Global Surgical Navigation Systems Market benefits from the rising adoption of minimally invasive surgeries. Surgeons use navigation systems to improve accuracy and reduce recovery time. Patients prefer these methods for their smaller incisions and reduced trauma. Hospitals and clinics invest in advanced systems to enhance procedural efficiency. The integration of image-guided tools reduces the risk of complications. It helps surgeons perform complex procedures with greater confidence. Growing awareness about patient safety strengthens market adoption. The combination of technology and precision drives continuous demand growth.

- For instance, Medtronic’s StealthStation S8 navigation system, using an optical tracking system, was shown in a 2024 comparative retrospective study involving 50 patients to enable reduced totaloperation time and lower intraoperative fluoroscopy counts compared to the Tinavi robot for upper cervical pedicle screw fixation surgeries. However, the study also revealed a longer time for single-screw implantation with the StealthStation and found no significant difference in recovery outcomes, such as length of stay, between the two groups.

Increasing Prevalence of Neurological and Orthopedic Disorders

The rising burden of neurological and orthopedic conditions fuels the need for precise navigation systems. Chronic disorders such as Parkinson’s disease and osteoarthritis lead to higher surgical volumes. These systems enable accurate localization during delicate brain and joint surgeries. The aging population further contributes to procedural demand. It ensures better postoperative outcomes through precise targeting. Manufacturers develop tailored systems for spine and neuro navigation. The demand expands across developed and emerging regions alike. Growing cases of trauma injuries also boost the adoption rate globally.

- For instance, Brainlab’s Curve navigation system is used in conjunction with other technologies to achieve high precision in image-guided surgeries. While the exact number of procedures is proprietary, the technology has supported tens of thousands of orthopedic cases annually and is a standard tool in many of the top hospitals for neurosurgery. The system helps surgeons increase accuracy by using 3D images and tracking instruments in real-time, but specific sub-millimeter precision claims require independent verification.

Technological Advancements and Integration of AI in Surgical Platforms

Continuous innovation supports the evolution of surgical navigation platforms. AI and machine learning improve visualization and real-time decision-making. The integration of 3D imaging and robotics enhances surgical control and accuracy. It enables surgeons to plan procedures with detailed anatomical mapping. Cloud connectivity allows data sharing and performance tracking. The market sees rapid improvements in software and hardware synchronization. Hospitals prioritize systems offering predictive analytics for better surgical guidance. Innovation keeps the industry highly competitive and dynamic.

Growing Investments in Healthcare Infrastructure and Digitalization

Expanding healthcare infrastructure boosts the adoption of advanced surgical tools. Governments invest in digital healthcare systems to modernize surgical operations. The Global Surgical Navigation Systems Market benefits from this transition toward smart operating rooms. It supports hospitals in reducing surgery time and improving clinical efficiency. Training programs enhance surgeon competence in new technologies. Increased funding encourages private and public partnerships. The emphasis on patient-centered outcomes drives system standardization. Widespread digital transformation sustains long-term growth momentum.

Market Trends:

Integration of Augmented Reality and Virtual Reality in Surgical Navigation

The adoption of AR and VR technologies transforms surgical navigation experiences. Surgeons visualize complex anatomical structures in 3D during operations. It improves depth perception and enhances preoperative planning accuracy. The Global Surgical Navigation Systems Market witnesses strong traction from these immersive tools. Hospitals adopt AR-enabled headsets to guide surgical pathways. Real-time overlays assist in safer and faster decision-making. Start-ups and tech firms collaborate with device manufacturers for integration. The trend marks a shift toward digitally enhanced surgical environments.

- For instance, a 2025 clinical study showed that AR-assisted surgical navigation reduced intraoperative fluoroscopic radiation and time, boosting accuracy by decreasing user-induced registration errors that typically cause up to 33% inaccuracy, supporting safer and streamlined surgical workflows.

Shift Toward Portable and Compact Navigation Devices

The market is shifting from bulky systems to compact, mobile devices. Portability helps in deployment across varied surgical departments. It provides cost efficiency for small and mid-sized hospitals. The systems offer flexible configurations for operating room integration. It reduces setup time and enhances user convenience. The demand for handheld and wireless systems is increasing rapidly. Manufacturers focus on ergonomic design and simplified interfaces. Compact solutions make navigation technology accessible to more healthcare providers.

Growing Adoption of Robotics-Assisted Navigation Systems

The integration of robotics with navigation software is accelerating global adoption. Robots equipped with navigation systems enable superior precision and repeatability. The Global Surgical Navigation Systems Market benefits from hybrid robotic-navigation platforms. Hospitals invest in these technologies for spine and orthopedic applications. The systems assist surgeons in delicate placements and alignments. Continuous development improves real-time accuracy and reduces human error. Robotic-assisted navigation is becoming a core component of modern surgery. Its growth reshapes procedural efficiency and outcomes.

Increased Use of Cloud-Based and AI-Powered Data Platforms

Cloud computing supports advanced data sharing and case tracking in surgical navigation. It allows surgeons to analyze previous cases and improve future accuracy. AI enhances system performance through predictive insights and pattern recognition. The trend drives digital connectivity across operating rooms. The Global Surgical Navigation Systems Market aligns with this move toward smart healthcare networks. Hospitals adopt centralized dashboards to manage procedural data. Integration with hospital information systems ensures seamless workflow. The cloud-based model accelerates scalability and cost efficiency.

Market Challenges Analysis:

High Cost of Installation and Maintenance of Surgical Navigation Systems

The Global Surgical Navigation Systems Market faces cost-related challenges in adoption. The systems involve expensive software, sensors, and imaging tools. High initial setup costs limit accessibility in low-income hospitals. Maintenance and calibration expenses add to operational burdens. Many healthcare facilities in developing regions lack funds for integration. It restricts overall market penetration despite rising clinical demand. Reimbursement issues further discourage quick adoption. Cost-effective and scalable solutions are needed to widen market reach.

Lack of Skilled Surgeons and Limited Awareness in Emerging Markets

The successful use of navigation systems depends on trained surgical professionals. A shortage of skilled surgeons hampers market growth across several regions. Many hospitals lack structured training programs for technology integration. Limited awareness about navigation system benefits reduces adoption rates. It affects clinical confidence in using these systems effectively. The Global Surgical Navigation Systems Market must overcome this skill gap. Collaborative workshops and simulation-based training can address the issue. Expanding educational outreach remains critical for sustainable market expansion.

Market Opportunities:

Rising Demand in Emerging Economies Due to Expanding Healthcare Access

Emerging markets present strong opportunities for future expansion. Governments are investing in advanced healthcare systems and modern surgical units. The Global Surgical Navigation Systems Market benefits from these developments. Increased medical tourism in Asia and the Middle East drives equipment demand. Local manufacturers introduce cost-effective solutions to attract hospitals. Growth in private hospitals and specialized surgical centers supports adoption. Expanding access to modern facilities ensures greater technology penetration.

Product Innovation and Strategic Partnerships Among Global Players

Leading manufacturers are investing in new product development and cross-industry collaborations. AI-driven navigation tools, robotics integration, and imaging improvements offer growth prospects. The Global Surgical Navigation Systems Market benefits from joint ventures between med-tech and software firms. Partnerships help companies expand reach and enhance interoperability. Integration with wearable and cloud systems opens new opportunities. R&D investments in precision imaging and intuitive interfaces drive differentiation. This focus on innovation strengthens long-term competitiveness in the global market.

Market Segmentation Analysis:

Type

Electromagnetic systems dominate due to superior adaptability in spine and neurosurgical procedures. The Global Surgical Navigation Systems Market witnesses strong adoption of optical systems for precise line-of-sight imaging and reliability. It supports real-time visualization and ensures enhanced accuracy in critical applications. The “Others” segment includes hybrid and novel sensor-based navigation systems. These innovations address specific surgical requirements across complex cases. Advancements in tracking algorithms further improve procedural outcomes. Growing hospital investments in hybrid optical-electromagnetic platforms enhance market reach.

- For instance, Fiagon’s electromagnetic navigation system provides submillimeter accuracy (~0.5 mm) in paranasal sinus surgeries during image-guided procedures, while KARL STORZ’s optical video endoscopy systems offer high-definition imaging enhancing line-of-sight reliability and surgical visualization in minimally invasive interventions.

End-Use

Hospitals represent the largest end-use segment due to their infrastructure and multidisciplinary teams. The Global Surgical Navigation Systems Market benefits from rising hospital investments in modern operating rooms. It ensures the seamless integration of imaging, navigation, and robotic assistance. Ambulatory surgical centers are growing rapidly due to their cost-effective setup and shorter recovery cycles. These centers focus on orthopedic and ENT procedures where navigation precision is crucial. The “Others” category includes specialized clinics and research institutions expanding their navigation capabilities. Rising patient preference for outpatient surgeries strengthens demand across all segments.

- For instance, Cleveland Clinic performed the nation’s second robot-assisted hip revision using Mako SmartRobotics™, reducing manual assessment and enabling precise robotic-arm guided surgeries that improve implant positioning and recovery outcomes.

Application

Orthopedic and spine applications hold a significant share driven by the high number of joint and spinal procedures. The Global Surgical Navigation Systems Market gains traction in neurology due to the need for precision in brain surgeries. It records steady growth in ENT and dental surgeries due to increasing adoption in implant and sinus operations. The “Others” segment covers trauma and reconstructive procedures that benefit from real-time navigation. The growing emphasis on outcome-based surgeries supports broad application diversification.

Segmentation:

By Type:

- Electromagnetic

- Optical

- Others.

By End-Use:

- Hospitals

- Ambulatory Surgical Centers

- Others.

By Application:

- ENT

- Orthopedic and Spine

- Neurology

- Dental

- Others.

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Surgical Navigation Systems Market size was valued at USD 2,466.20 million in 2018 to USD 3,757.54 million in 2024 and is anticipated to reach USD 10,974.48 million by 2032, at a CAGR of 14.5% during the forecast period. It holds nearly 34% of the total market share. The Global Surgical Navigation Systems Market in North America benefits from advanced healthcare infrastructure and high technology integration. The U.S. leads with strong adoption of robotic and image-guided surgery platforms. Favorable reimbursement policies and an emphasis on patient safety promote steady demand. Canada contributes through digital healthcare expansion and skilled clinical professionals. It gains further traction from hospital upgrades and AI-based surgical platforms. Consistent R&D investments and partnerships with device makers support continuous innovation across the region.

Europe

The Europe Surgical Navigation Systems Market size was valued at USD 1,256.70 million in 2018 to USD 1,842.21 million in 2024 and is anticipated to reach USD 5,014.41 million by 2032, at a CAGR of 13.5% during the forecast period. It accounts for around 25% of the global market share. The Global Surgical Navigation Systems Market in Europe grows due to strong regulatory standards and clinical research programs. Germany, the UK, and France dominate through advanced hospital facilities. Western Europe focuses on precision medicine and minimally invasive techniques. It records significant adoption of portable and hybrid navigation devices. Eastern Europe witnesses gradual growth supported by healthcare reforms and modernization. Government initiatives promoting digitalization improve surgical safety and accuracy. The increasing need for orthopedic and ENT surgeries sustains consistent regional progress.

Asia Pacific

The Asia Pacific Surgical Navigation Systems Market size was valued at USD 1,503.32 million in 2018 to USD 2,413.42 million in 2024 and is anticipated to reach USD 7,759.96 million by 2032, at a CAGR of 15.8% during the forecast period. It contributes about 27% of the global share and remains the fastest-growing region. The Global Surgical Navigation Systems Market gains momentum from rising surgical volumes in China, Japan, and India. Expanding healthcare infrastructure and increasing private investments enhance adoption. It benefits from government initiatives promoting advanced surgical technologies. Medical tourism across Southeast Asia boosts system deployment in multispecialty hospitals. Local manufacturers offer affordable solutions to increase accessibility. Skilled professionals and improved training programs accelerate technology adoption. Rapid urbanization and higher healthcare spending ensure robust regional growth.

Latin America

The Latin America Surgical Navigation Systems Market size was valued at USD 436.60 million in 2018 to USD 666.75 million in 2024 and is anticipated to reach USD 1,829.60 million by 2032, at a CAGR of 13.6% during the forecast period. It holds nearly 7% of the global market share. The Global Surgical Navigation Systems Market in Latin America benefits from growing awareness of image-guided surgery. Brazil and Mexico lead adoption supported by infrastructure investments. Hospitals invest in digital systems to enhance surgical precision. It records rising collaborations between regional distributors and international OEMs. Government initiatives to modernize surgical facilities support steady expansion. Rising orthopedic and neurological surgeries strengthen product utilization. Emerging training programs improve adoption among surgeons across the region.

Middle East

The Middle East Surgical Navigation Systems Market size was valued at USD 165.20 million in 2018 to USD 232.52 million in 2024 and is anticipated to reach USD 587.26 million by 2032, at a CAGR of 12.4% during the forecast period. It represents about 4% of global market share. The Global Surgical Navigation Systems Market in the Middle East grows due to strong healthcare investments in Saudi Arabia, the UAE, and Israel. Governments emphasize advanced surgical capabilities within public hospitals. Private healthcare expansion encourages adoption of navigation platforms. It gains strength from strategic partnerships with global medical technology providers. Rising demand for orthopedic and neurosurgical procedures accelerates growth. Regional training centers enhance medical professional expertise. The market remains supported by modernization of hospital infrastructure and robotic surgery units.

Africa

The Africa Surgical Navigation Systems Market size was valued at USD 71.98 million in 2018 to USD 172.65 million in 2024 and is anticipated to reach USD 400.33 million by 2032, at a CAGR of 10.5% during the forecast period. It captures nearly 3% of the total market share. The Global Surgical Navigation Systems Market in Africa expands gradually due to improving medical infrastructure. South Africa and Egypt lead regional adoption due to stronger healthcare systems. It benefits from increased government and NGO funding for advanced surgical equipment. Partnerships with global device manufacturers enhance accessibility and training. Limited skilled professionals and affordability constraints slow wider penetration. Hospitals focus on patient safety and precision, boosting gradual adoption. Urban healthcare development projects across key nations promise long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Medtronic

- Corin Group

- Amplitude Surgical

- Siemens Healthineers AG

- DePuy Synthes

- KARL STORZ SE & CO.KG

- Braun Melsungen AG

- Zimmer Biomet

- Smith+Nephew

- Stryker

Competitive Analysis:

The Global Surgical Navigation Systems Market is highly competitive, driven by innovation and strategic expansion. Key players focus on developing AI-powered and robotic-assisted systems to improve accuracy and workflow. It emphasizes clinical integration and smart imaging capabilities. Medtronic, Stryker, Siemens Healthineers, and Zimmer Biomet lead with strong product portfolios and global distribution. New entrants target niche applications and cost-effective systems for smaller hospitals. It maintains competition through product differentiation and service excellence. Partnerships and R&D investments remain critical for market leadership.

Recent Developments:

- On October 7, 2025, Zimmer Biomet finalized its acquisition of Monogram Technologies, a next-generation robotics firm. This move positions Zimmer Biomet to launch the first fully autonomous orthopedic surgical robotic platform and significantly broadens its navigation technology suite—pressing forward the frontiers in AI-driven surgical autonomy.

- In September 2025, Siemens Healthineers formed a strategic partnership with Stryker to develop a robotic system for neurovascular navigation, combining imaging expertise with neurovascular technologies to create a comprehensive procedural ecosystem for stroke and aneurysm treatments. Earlier, in April 2025, they announced a 10-year “Value Partnership” with Tower Health to modernize diagnostic imaging and digital navigation across Pennsylvania hospitals, further embedding advanced Siemens technologies into clinical workflows.

- In September 2025, Medtronic announced a strategic partnership with IRCAD North America, integrating its advanced surgical navigation technologies such as the Hugo™ robotic-assisted surgery system and AiBLE™ smart ecosystem for training and innovation at the newly opened Charlotte, North Carolina site, furthering global knowledge transfer in minimally invasive surgery. Also in September, Medtronic doubled its London AI and surgical robotics hub, launching hundreds of AI algorithms to help surgeons with analytics and real-time collaboration, enhancing global operating room capabilities.

- On July 29, 2025, Amplitude Surgical saw the completion of its acquisition by Zydus Lifesciences Limited, establishing a controlling stake that is expected to advance innovation and expand Amplitude’s international surgical navigation footprint in lower limb orthopedic technologies.

- On August 2, 2024, DePuy Synthes launched the VELYS™ SPINE system—a dual-use active robotics and navigation platform designed to improve planning and placement for complex spinal fusion surgeries. The system received FDA 510(k) clearance and marked DePuy Synthes’ entry into spine surgery robotics with a commercial rollout expected in 2025.

Report Coverage:

The research report offers an in-depth analysis based on Type, End-Use, and Application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise for AI-integrated navigation systems across orthopedic and neurosurgery.

- Hospitals will adopt cloud-based and interoperable systems for better data management.

- Robotic-assisted procedures will drive accuracy and reduce human error.

- Emerging economies will become major adoption hubs due to infrastructure expansion.

- Portable and wireless systems will gain traction among ambulatory surgical centers.

- Manufacturers will focus on hybrid optical-electromagnetic systems for broader applications.

- Strategic collaborations between med-tech and software firms will strengthen innovation.

- Training programs will expand to address skill gaps among surgeons.

- Regulatory support for digital health will accelerate system approvals.

- Continuous product differentiation will define long-term market competitiveness.