Market Overview

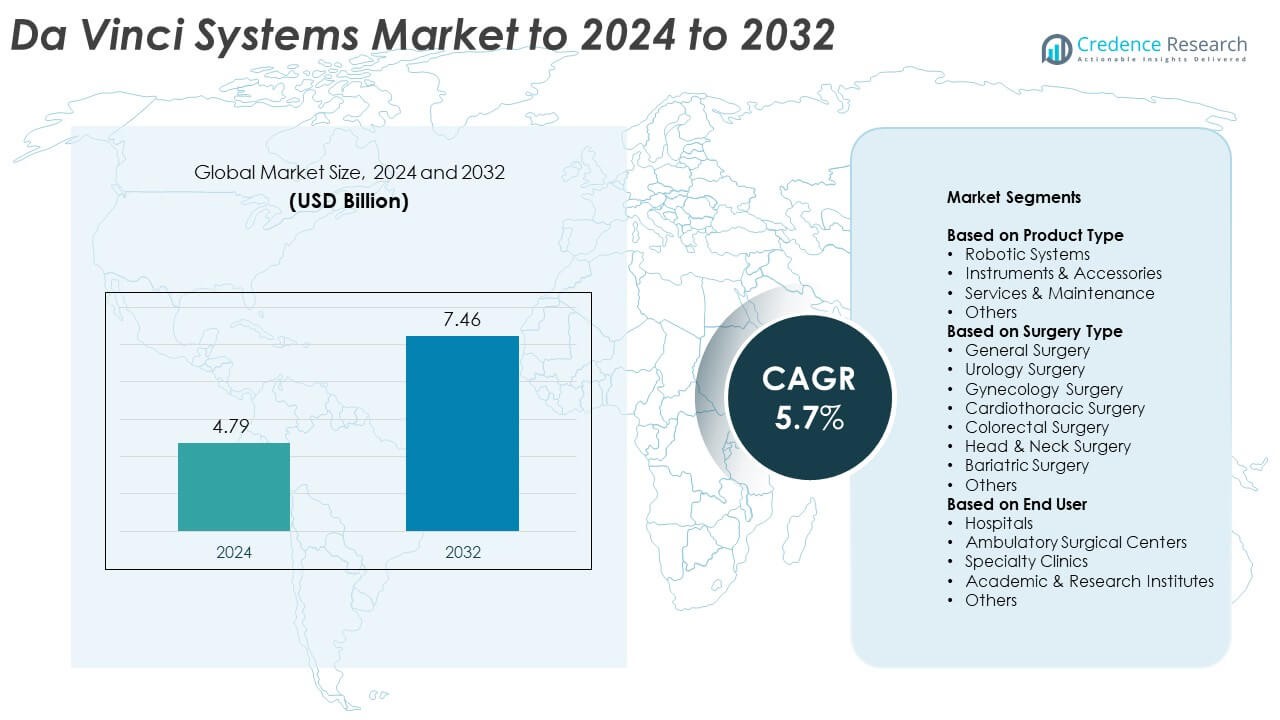

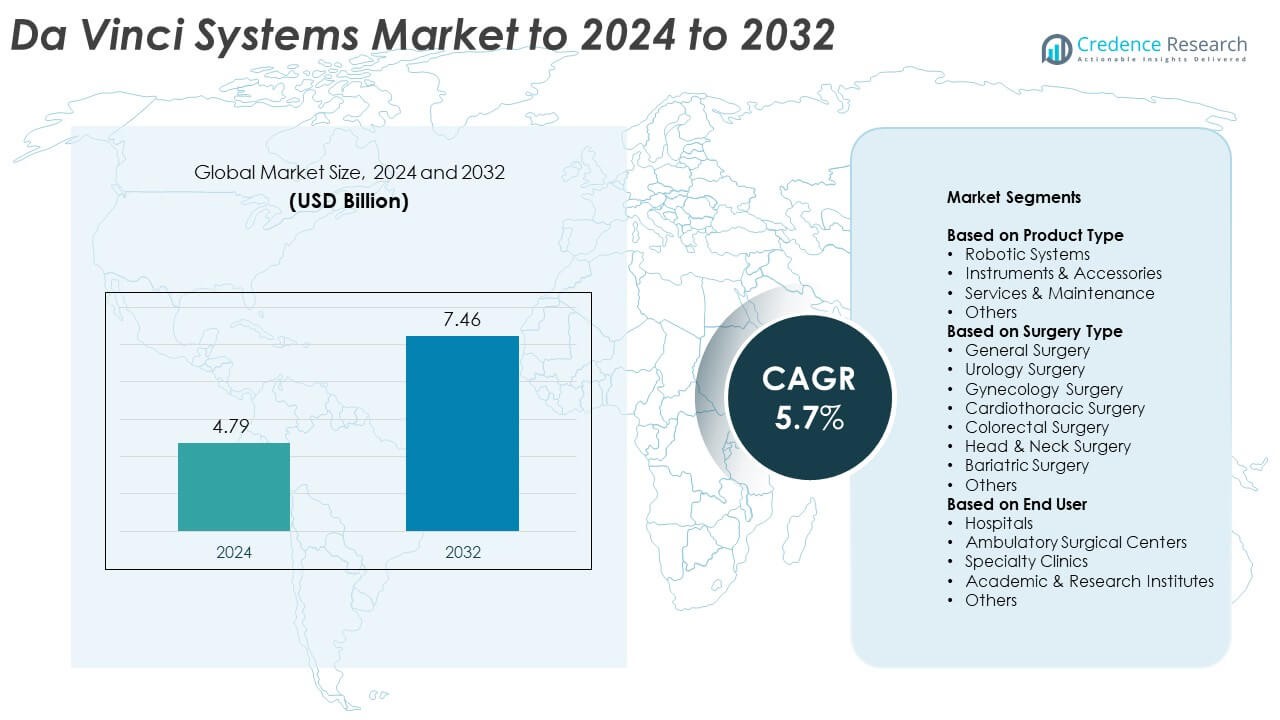

Da Vinci Systems Market size was valued USD 4.79 billion in 2024 and is anticipated to reach USD 7.46 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Da Vinci Systems Market Size 2024 |

USD 4.79 Billion |

| Da Vinci Systems Market, CAGR |

5.7% |

| Da Vinci Systems Market Size 2032 |

USD 7.46 Billion |

The Da Vinci Systems market features strong competition among major players including Intuitive Surgical, Stryker, Medtronic, Smith & Nephew, THINK Surgical, Mazor Robotics, Medrobotics, Renishaw, Moon Surgical, and Hansen Medical. These companies are investing heavily in robotic-assisted surgical innovation, focusing on AI integration, 3D visualization, and advanced motion control technologies. The market’s growth is driven by continuous system upgrades and expanding applications across surgical specialties. North America leads the global market with a 41% share, supported by high adoption in hospitals and established training programs. Europe follows with a 29% share, while Asia-Pacific holds a 23% share, reflecting rapid healthcare modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Da Vinci Systems market was valued at USD 4.79 billion in 2024 and is projected to reach USD 7.46 billion by 2032, growing at a CAGR of 5.7%.

- Rising demand for minimally invasive surgeries and growing preference for robotic-assisted procedures are key market drivers.

- Advancements in AI, imaging precision, and compact robotic systems are shaping emerging market trends.

- The market remains highly competitive, with major players investing in R&D, training programs, and hospital partnerships to expand adoption.

- North America led with a 41% share in 2024, followed by Europe at 29% and Asia-Pacific at 23%, while the instruments and accessories segment dominated with a 54% share globally.

Market Segmentation Analysis:

By Product Type

The instruments and accessories segment dominated the Da Vinci Systems market with a 54% share in 2024. This segment leads due to continuous demand for replacement parts and single-use components essential for every surgical procedure. Growth is further supported by rising procedure volumes and recurring revenue models adopted by hospitals. Robotic systems follow, driven by technological improvements in 3D visualization and multi-arm precision. Service and maintenance offerings also gain traction as healthcare facilities prioritize uptime and operational reliability of robotic systems to ensure consistent performance.

- For instance, Intuitive Surgical’s da Vinci X and Xi EndoWrist instruments were historically limited to 10 uses but an “Extended Use Program,” launched in late 2020 and 2021, expanded the use limit of some instruments to 12 to 18 uses.

By Surgery Type

General surgery accounted for the largest share of 38% in 2024, making it the dominant category in the Da Vinci Systems market. The demand stems from high adoption in procedures such as hernia repair, cholecystectomy, and colorectal resections. Growing surgeon preference for minimally invasive techniques and faster patient recovery are key drivers. Urology and gynecology surgeries are also expanding rapidly with increasing prostatectomy and hysterectomy procedures. The adoption of robotic-assisted surgeries in cardiothoracic and bariatric operations is rising, supported by improved precision and reduced post-operative complications.

- For instance, CMR Surgical’s Versius surpassed 30,000 procedures globally, and in 2024 received FDA De Novo clearance for cholecystectomy.

By End User

Hospitals held the dominant share of 63% in 2024 in the Da Vinci Systems market. This leadership is attributed to large-scale installations, comprehensive surgical facilities, and higher budgets for advanced robotic systems. Increasing patient inflow for complex procedures and the growing focus on robotic-assisted surgery programs further strengthen this segment. Ambulatory surgical centers are showing fast growth, supported by lower operational costs and rising outpatient robotic surgeries. Specialty clinics and academic institutes are increasingly investing in robotic systems for specialized procedures and training, enhancing overall adoption across healthcare ecosystems.

Key Growth Drivers

Rising Adoption of Minimally Invasive Surgeries

Growing demand for minimally invasive procedures is a primary driver for the Da Vinci Systems market. Surgeons increasingly prefer robotic-assisted systems for their precision, smaller incisions, and faster recovery times. Hospitals are expanding robotic surgery programs to enhance patient outcomes and reduce hospital stays. The adoption is further supported by technological improvements in 3D visualization and wristed instrumentation, enabling surgeons to perform complex operations with enhanced dexterity and accuracy.

- For instance, Stryker notes 1.5+ million Mako procedures performed across 45 countries, indicating strong surgeon uptake of robotic MIS.

Advancements in Robotic Technology and AI Integration

Continuous advancements in robotic technology and integration of artificial intelligence significantly drive market expansion. Enhanced motion scaling, real-time data analytics, and automation features improve surgical precision and safety. AI-assisted learning modules also help surgeons optimize performance and reduce procedural errors. Integration of advanced haptic feedback and imaging systems boosts the system’s capability in complex procedures, strengthening hospital preference for robotic-assisted surgeries worldwide.

- For instance, As of June 12, 2025, Moon Surgical’s Maestro system had supported over 1,500 procedures globally. Over 1,300 of these procedures occurred within the past year.

Expanding Applications Across Surgical Specialties

Da Vinci Systems are now being adopted across multiple surgical specialties, expanding their overall usage. Initially focused on urology and gynecology, these systems are increasingly used in general, colorectal, cardiothoracic, and head and neck surgeries. This diversification of applications is accelerating system installations in hospitals and ambulatory centers. Growing clinical evidence of improved outcomes and faster patient recovery supports adoption in new surgical domains, contributing to steady market penetration.

Key Trends & Opportunities

Development of Compact and Cost-Effective Systems

The emergence of compact and cost-efficient robotic systems creates major opportunities for healthcare institutions. Manufacturers are focusing on scalable models suitable for mid-sized hospitals and surgical centers. These systems reduce installation space and maintenance costs, making robotic surgery more accessible. Lower system pricing and flexible financing models are encouraging smaller healthcare facilities to invest in robotic technology, enhancing market reach across developing economies.

- For instance, SS Innovations has installed over 125 SSi Mantra systems across six countries, with over 6,000 surgical procedures performed as of September 30, 2025. The total includes more than 310 cardiac and 60 telesurgery procedures.

Growth of Training and Simulation Programs

Surgeon training and simulation platforms represent a strong growth trend in the market. Global institutions are partnering with robotic system providers to create virtual and augmented reality-based training centers. These programs improve procedural accuracy, reduce learning curves, and promote surgeon confidence. Increased availability of certified training programs encourages broader adoption of robotic-assisted surgery, especially among new entrants in emerging healthcare systems.

- For instance, the European Commission records about 1,250 individuals trained at Orsi Academy in 2019, with an expectation of 2,000 in 2021; additionally, the ERUS kidney-transplant course at Orsi trained 87 surgeons from 23 countries during 2016–2023.

Key Challenges

High System and Maintenance Costs

The substantial initial investment and ongoing maintenance costs of Da Vinci Systems remain major barriers. Smaller hospitals and clinics often face budget constraints, limiting adoption. The high expense of consumables, service contracts, and specialized training further adds to operational costs. Although manufacturers are introducing financing and leasing options, affordability continues to restrict access in cost-sensitive regions.

Limited Skilled Workforce and Training Gaps

A shortage of trained surgeons proficient in robotic systems poses a critical challenge. Many hospitals lack structured robotic surgery training programs, leading to underutilization of installed systems. The steep learning curve and limited access to simulation-based education delay skill development. Expanding certified training networks and continuous education programs are essential to address this gap and ensure efficient system utilization.

Regional Analysis

North America

North America dominated the Da Vinci Systems market with a 41% share in 2024. The region’s leadership is driven by advanced healthcare infrastructure, high robotic surgery adoption, and strong reimbursement systems. The United States contributes the majority of revenue due to extensive installations in hospitals and training centers. Increasing preference for minimally invasive procedures and a growing aging population boost demand further. Continuous product innovation by key manufacturers and increasing procedural approvals from regulatory bodies support the sustained market expansion in the region.

Europe

Europe accounted for a 29% share in 2024, supported by growing investments in robotic-assisted surgery technologies. Major countries such as Germany, the United Kingdom, and France are leading in adoption due to strong public healthcare systems. Rising government funding for modern surgical equipment and the growing emphasis on reducing post-operative complications drive market demand. Increasing surgeon training programs and expanding hospital robotic infrastructure further strengthen Europe’s position in the global market. Partnerships between healthcare providers and medical technology companies continue to enhance accessibility across the region.

Asia-Pacific

Asia-Pacific held a 23% share in the Da Vinci Systems market in 2024, showing the fastest growth potential. Rising healthcare expenditure, expanding hospital networks, and the growing middle-class population drive adoption. China, Japan, and South Korea are key contributors due to rapid technological advancements and government support for medical innovation. Increasing awareness of minimally invasive procedures and the growing number of trained robotic surgeons are accelerating installations. Strategic partnerships between global manufacturers and regional healthcare institutions enhance affordability and access across emerging markets.

Latin America

Latin America captured a 4% share of the Da Vinci Systems market in 2024. The region’s growth is driven by increasing adoption of advanced surgical technologies in Brazil, Mexico, and Argentina. Rising healthcare modernization efforts and the expansion of private hospital networks contribute to the market’s development. Growing awareness of robotic-assisted procedures and efforts to improve patient care quality are boosting system installations. However, limited reimbursement policies and high system costs remain barriers, though ongoing government initiatives aim to improve access to robotic surgery.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share in 2024, supported by growing investments in advanced healthcare facilities. The United Arab Emirates and Saudi Arabia lead adoption, driven by national healthcare transformation programs. Increasing partnerships with international robotic surgery firms are improving availability in high-end hospitals. Rising demand for precision-based surgeries and government efforts to modernize healthcare infrastructure fuel market expansion. Despite slower growth in parts of Africa, expanding private healthcare sectors and training collaborations are expected to create new opportunities.

Market Segmentations:

By Product Type

- Robotic Systems

- Instruments & Accessories

- Services & Maintenance

- Others

By Surgery Type

- General Surgery

- Urology Surgery

- Gynecology Surgery

- Cardiothoracic Surgery

- Colorectal Surgery

- Head & Neck Surgery

- Bariatric Surgery

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Academic & Research Institutes

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Da Vinci Systems market is led by major players such as Intuitive Surgical, Stryker, Medtronic, Smith & Nephew, THINK Surgical, Mazor Robotics, Medrobotics, Renishaw, Moon Surgical, and Hansen Medical. These companies focus on developing advanced robotic-assisted surgical platforms that offer higher precision, flexibility, and safety. The competitive environment is shaped by strong investments in R&D, aiming to enhance system intelligence, haptic control, and real-time imaging capabilities. Many manufacturers are also pursuing strategic collaborations with hospitals and research institutions to expand adoption across surgical specialties. Continuous product upgrades and global training programs help increase system efficiency and surgeon proficiency. The growing trend toward compact, cost-efficient robotic systems and AI integration further drives differentiation among leading players. Competitive strategies emphasize expanding product portfolios, improving after-sales services, and strengthening distribution networks to maintain technological leadership and capture the growing demand for minimally invasive robotic surgery worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Intuitive Surgical received FDA clearance for the da Vinci 5 and began a limited release in the U.S. to initial collaborators and hospitals with mature robotic surgery programs

- In 2024, Medtronic announced the introduction of 14 new AI-driven algorithms across surgical workflow, instrument.

- In 2024, Moon Surgical Received FDA clearance for the commercial version of its Maestro soft tissue robotic system. The system was used for over 200 soft tissue procedures in Europe and was powered by NVIDIA Holoscan to enable real-time AI algorithms in the operating room.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Surgery Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Da Vinci Systems market will expand with rising adoption of minimally invasive surgeries.

- Hospitals will continue to dominate installations due to higher patient volumes and budgets.

- Integration of artificial intelligence will enhance surgical precision and decision-making.

- Compact and affordable robotic models will increase accessibility in mid-sized hospitals.

- Training and simulation programs will become standard for surgeon certification.

- Asia-Pacific will record the fastest growth driven by expanding healthcare infrastructure.

- Partnerships between manufacturers and hospitals will improve affordability and service support.

- Advancements in haptic feedback and imaging will improve surgical outcomes.

- Broader adoption across new surgical specialties will boost overall system utilization.

- Continuous innovation and favorable healthcare policies will sustain long-term market growth.