Market Overview

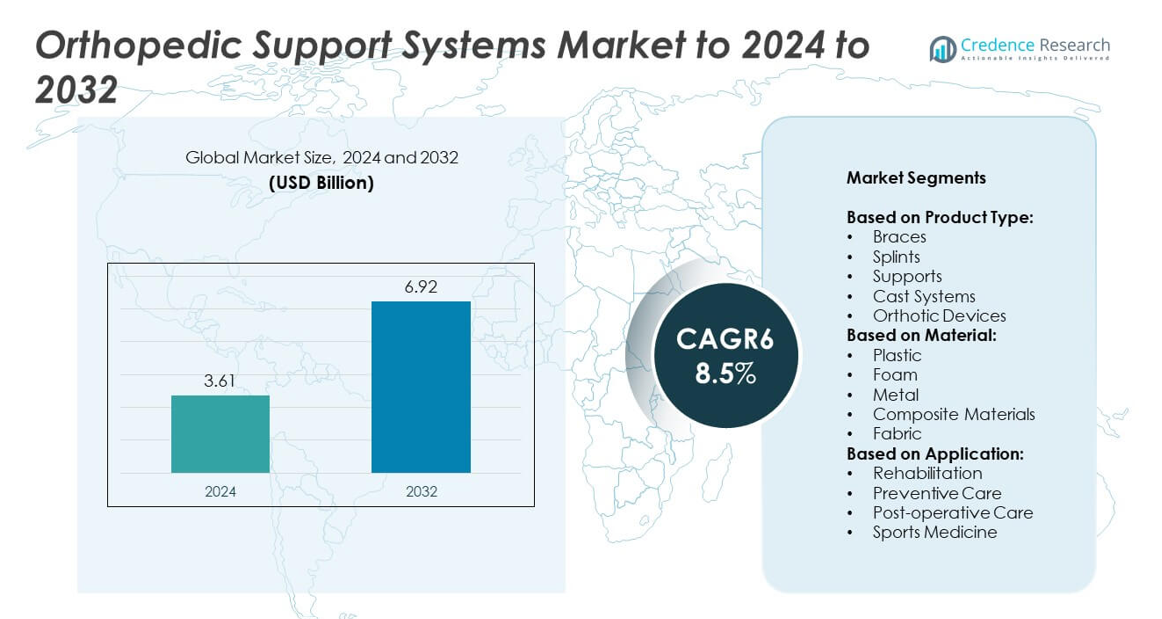

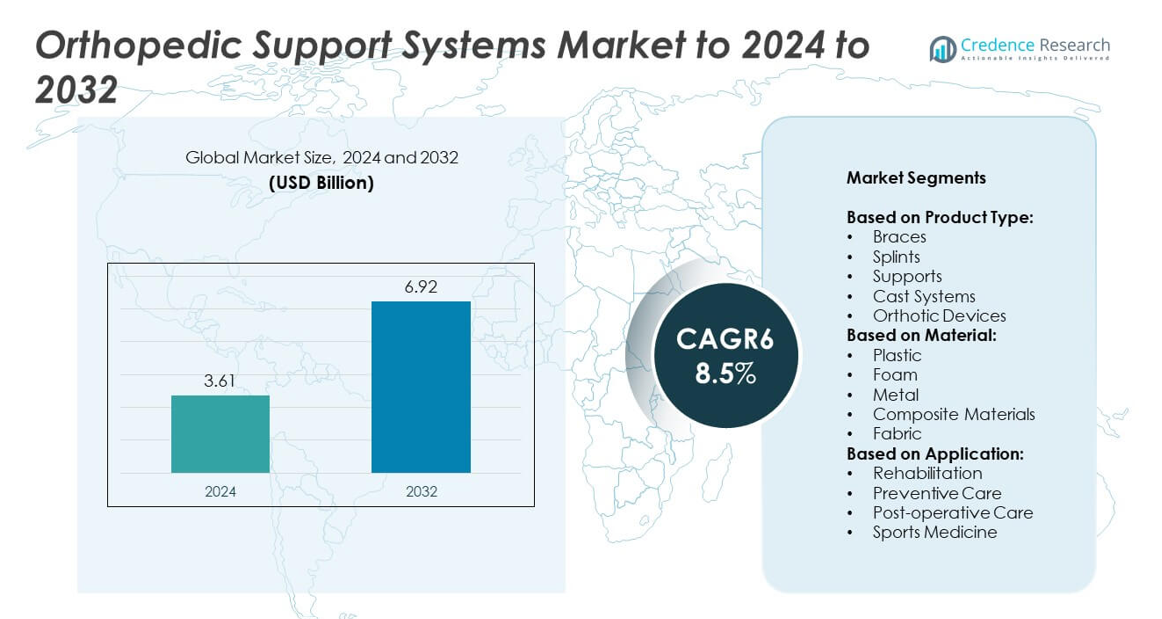

Orthopedic Support Systems Market size was valued at USD 3.61 billion in 2024 and is anticipated to reach USD 6.92 billion by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthopedic Support Systems Market Size 2024 |

USD 3.61 billion |

| Orthopedic Support Systems Market, CAGR |

8.5% |

| Orthopedic Support Systems Market Size 2032 |

USD 6.92 billion |

The orthopedic support systems market is driven by major players including Otto Bock, Stryker Corporation, DJO Global, Zimmer Biomet, Medtronic, Smith Nephew, B. Braun Melsungen, DePuy Synthes, and Orthofix International. These companies focus on product innovation, advanced materials, and strategic collaborations to expand their global footprint. North America led the market in 2024 with a 34% share, supported by high healthcare spending, strong adoption of advanced orthopedic devices, and a growing elderly population. Europe followed with a 28% share, driven by rising incidences of musculoskeletal disorders and emphasis on preventive and rehabilitative care solutions.

Market Insights

- The orthopedic support systems market was valued at USD 3.61 billion in 2024 and is projected to reach USD 6.92 billion by 2032, expanding at a CAGR of 8.5%.

- Rising prevalence of musculoskeletal disorders, growing elderly population, and increasing sports injuries are the key drivers accelerating adoption of braces, supports, and orthotic devices.

- Market trends highlight growing demand for customized and smart devices, with 3D printing and sensor-based technologies gaining traction, while preventive care supports see rising adoption in daily activities.

- The competitive landscape is fragmented with global players focusing on innovation, ergonomic designs, and partnerships, while cost-effective product lines are being developed to capture emerging market demand.

- Regionally, North America led with 34% share in 2024, followed by Europe at 28% and Asia Pacific at 23%, while braces dominated the product segment with over 35% share due to widespread usage in rehabilitation and corrective care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Braces dominated the orthopedic support systems market in 2024 with over 35% share. Their widespread use in treating musculoskeletal conditions, sports injuries, and post-surgical recovery supports this leadership. Braces provide adjustable stability, pain relief, and mobility assistance, making them the first choice for both preventive and corrective care. Rising sports participation and the increasing prevalence of joint-related disorders further fuel demand. Splints and supports are growing steadily due to rising rehabilitation needs, while orthotic devices are gaining momentum through advanced designs improving patient comfort and compliance.

- For instance, Össur reported that in 2023, its Bracing & Supports sales grew by 3 % organically.

By Material

Plastic-based products held the largest share of more than 30% in 2024, owing to their versatility, lightweight nature, and cost-effectiveness. Plastics allow easy molding, making them suitable for customized braces, splints, and cast systems. The segment benefits from advancements in polymer composites that improve strength and durability. Foam-based supports also witness strong adoption due to comfort and cushioning features, particularly in long-term rehabilitation. Metal and composite materials remain vital for high-strength applications in orthopedic devices, while fabrics are increasingly used in flexible supports designed for preventive care and sports medicine.

- For instance, Zimmer Biomet’s ComposiTCP suture anchors, available in various sizes, are made of DuoSorb®, a proprietary biocomposite material composed of 30% \(\beta \)-Tricalcium Phosphate (\(\beta \)-TCP) and 70% Polylactic Acid (PLDL), which balances strength and elasticity similar to cortical bone.

By Application

Rehabilitation accounted for the largest market share of around 40% in 2024, driven by the rising prevalence of orthopedic injuries and post-trauma therapies. Patients recovering from fractures, joint replacements, and spinal conditions require extensive support systems to restore function and mobility. Preventive care is another significant segment, supported by growing awareness of musculoskeletal health and the demand for wearable supports in daily activities. Post-operative care continues to expand as surgical procedures increase globally, while sports medicine sees strong growth due to higher injury incidences among professional athletes and recreational participants.

Key Growth Drivers

Rising Prevalence of Musculoskeletal Disorders

The growing incidence of arthritis, osteoporosis, and joint injuries is a major driver for the orthopedic support systems market. Aging populations in developed regions and increasing lifestyle-related disorders globally have led to higher demand for braces, supports, and orthotic devices. This segment benefits from improved awareness of non-invasive treatment options, which provide effective pain management and mobility support. With musculoskeletal conditions ranked among the leading causes of disability, the demand for orthopedic support systems continues to expand significantly across healthcare and rehabilitation settings.

- For instance, Breg, a leading provider of orthopedic bracing and support solutions, reports that its products serve over 5 million patients annually. As of April 2024, the company had formed a strategic alliance with RevSpring, which integrated with Breg’s software at more than 2,500 U.S. clinics.

Expanding Sports and Fitness Activities

The rising participation in sports and recreational activities has increased injury rates, fueling adoption of orthopedic braces, supports, and splints. Professional athletes and fitness enthusiasts are highly reliant on preventive and corrective support systems for faster recovery and injury prevention. Sports medicine has become a critical application segment, especially with advanced support designs catering to high-performance needs. Growing awareness about preventive healthcare among younger demographics further supports this trend. This surge in sports-related injuries makes orthopedic supports a key solution for active individuals worldwide.

- For instance, Enovis (DonJoy) reports that over 2 million Defiance braces have been prescribed. Furthermore, DonJoy braces are used by every team in the AP Top 25 college football rankings, according to an Enovis social media post from December 2024.

Technological Advancements in Orthopedic Devices

Innovation in material science and product design significantly drives market expansion. Lightweight, durable, and customizable materials such as composites and advanced plastics enhance patient comfort and compliance. Digitalization has introduced 3D printing for tailored orthotic devices, allowing precision fitting for individual patients. Additionally, integration of smart technologies, including sensor-based monitoring, provides real-time rehabilitation data. These advancements improve treatment outcomes and reduce long-term healthcare costs. Such technological progress positions orthopedic support systems as more effective and patient-friendly solutions, accelerating adoption across hospitals and homecare.

Key Trends & Opportunities

Growing Focus on Preventive Care

Preventive orthopedic support systems are gaining traction as consumers become more health-conscious. Increasing demand for supports and braces in daily life and workplace settings highlights this shift. Lightweight and fabric-based supports are particularly popular, offering comfort for long-term use. Companies are introducing ergonomically designed products that prevent musculoskeletal stress before injuries occur. This preventive trend presents opportunities for expansion in both developed and emerging markets, as awareness campaigns and digital retail platforms make orthopedic supports more accessible to a wider consumer base.

- For instance, Medi GmbH & Co. KG manufactures a wide range of orthopedic products, including the medi ROM Walker and protect.4 sports braces, and exports to more than 90 countries worldwide.

Rising Demand for Customized and Smart Devices

Personalized orthopedic support systems are an emerging trend, with 3D printing enabling patient-specific braces and orthotics. Customization ensures better fit, comfort, and therapeutic efficiency, driving adoption in rehabilitation and post-operative care. Additionally, the integration of smart sensors provides opportunities for real-time monitoring of mobility, compliance, and recovery progress. These connected devices are gaining acceptance in sports medicine and homecare due to their ability to provide data-driven insights. The trend toward customized and smart orthopedic supports reflects the growing emphasis on digital health and patient-centric solutions.

- For instance, as of September 2023, 62 CUVIS systems had been installed across India. Later, in 2024, Meril launched a new robotic system, MISSO, which quickly achieved over 50 installations in India within a short period.”

Key Challenges

High Cost of Advanced Orthopedic Supports

One of the major challenges in the market is the high cost of advanced support systems. Devices with customized features, smart sensors, or advanced materials remain expensive, limiting accessibility in low-income regions. Many patients prefer low-cost traditional alternatives, slowing adoption of innovative solutions. Reimbursement limitations in several healthcare systems also restrict patient access. This cost barrier creates disparities between developed and emerging markets, where affordability plays a critical role in adoption. Addressing price sensitivity is crucial for wider market penetration and sustained growth.

Limited Awareness and Compliance Issues

Despite their effectiveness, orthopedic support systems often face limited adoption due to lack of awareness in emerging economies. Patients may underuse or misuse supports, reducing their therapeutic effectiveness. Compliance is another challenge, as bulky or uncomfortable devices discourage prolonged use. Inadequate patient education and cultural perceptions of mobility aids further add to the issue. Healthcare providers must prioritize awareness campaigns and training to ensure proper usage. Overcoming these compliance barriers is essential to unlocking the full potential of orthopedic support systems.

Regional Analysis

North America

North America held the largest share of 34% in the orthopedic support systems market in 2024. The region benefits from advanced healthcare infrastructure, high awareness about musculoskeletal health, and strong adoption of innovative orthopedic devices. The growing elderly population and high prevalence of arthritis and sports-related injuries continue to drive demand. Strong reimbursement frameworks and the presence of leading manufacturers also support growth. The United States remains the dominant contributor within the region, supported by high healthcare spending, increasing orthopedic surgeries, and widespread use of preventive and rehabilitative care systems across hospitals and homecare settings.

Europe

Europe accounted for 28% of the global orthopedic support systems market in 2024, driven by strong adoption in countries like Germany, France, and the United Kingdom. Rising demand is supported by the growing geriatric population, coupled with higher incidences of bone and joint disorders. The region emphasizes preventive care, with government initiatives promoting early diagnosis and non-invasive treatments. Sports medicine is also expanding due to higher participation in professional and recreational activities. European manufacturers focus on product innovation and regulatory compliance, ensuring steady demand for braces, orthotics, and rehabilitation devices across hospitals and homecare environments.

Asia Pacific

Asia Pacific captured a market share of 23% in 2024 and is expected to show the fastest growth. The rising burden of osteoporosis, arthritis, and trauma injuries in countries such as China, India, and Japan is fueling adoption. Expanding healthcare access, increasing investments in hospitals, and a growing focus on sports and fitness are key growth drivers. Affordable manufacturing and distribution have also improved accessibility of orthopedic devices in the region. Additionally, rapid urbanization and lifestyle changes are increasing the demand for preventive orthopedic supports, while multinational companies are strengthening their presence through regional partnerships and product localization.

Latin America

Latin America represented 8% of the orthopedic support systems market in 2024, with Brazil and Mexico serving as the largest contributors. The market is growing due to increasing healthcare expenditure, expanding private hospital networks, and greater awareness of musculoskeletal disorders. Sports injuries and road accidents are major contributors to the rising demand for braces, splints, and supports. However, cost sensitivity limits the adoption of advanced devices, creating demand for affordable options. The region is expected to benefit from government efforts to modernize healthcare services and partnerships with global manufacturers to expand product availability and patient outreach.

Middle East and Africa

The Middle East and Africa accounted for 7% of the global orthopedic support systems market in 2024. Growth is driven by the rising prevalence of orthopedic conditions, particularly in countries with expanding healthcare infrastructure such as the United Arab Emirates, Saudi Arabia, and South Africa. Demand is also supported by higher incidences of trauma injuries and an increasing focus on post-operative rehabilitation. Limited awareness and affordability issues remain challenges, particularly in lower-income parts of Africa. However, the region is witnessing gradual adoption of orthopedic support systems due to urbanization, improved hospital facilities, and growing investments in healthcare.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type:

- Braces

- Splints

- Supports

- Cast Systems

- Orthotic Devices

By Material:

- Plastic

- Foam

- Metal

- Composite Materials

- Fabric

By Application:

- Rehabilitation

- Preventive Care

- Post-operative Care

- Sports Medicine

By Geography:

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The orthopedic support systems market is shaped by leading players such as Otto Bock, Stryker Corporation, DJO Global, B. Braun Melsungen, Tynor Orthotics, Zimmer Biomet, DePuy Synthes, Kinetec, Orthofix International, Smith Nephew, Medtronic, Hanger Inc, United Orthopedic Corporation, and Acelity. These companies collectively drive growth through continuous innovation, product diversification, and expansion into emerging regions. The market is highly competitive, with firms focusing on advanced materials, ergonomic designs, and smart technologies to improve patient outcomes. Strategic collaborations, acquisitions, and distribution partnerships strengthen global presence and enhance supply chains. Rising demand for customized and preventive orthopedic solutions encourages investment in research and development. Many players are expanding their product portfolios to target rehabilitation, preventive care, and sports medicine applications. Regional expansions, cost-effective product lines, and focus on digital platforms also play a key role in market positioning. The competitive landscape remains dynamic, with innovation and affordability serving as critical differentiators.

Key Player Analysis

- Otto Bock

- Stryker Corporation

- DJO Global

- Braun Melsungen

- Tynor Orthotics

- Zimmer Biomet

- DePuy Synthes

- Kinetec

- Orthofix International

- Smith Nephew

- Medtronic

- Hanger Inc

- United Orthopedic Corporation

- Acelity

Recent Developments

- In 2024, Hanger Inc. Launched its “Hanger Ventures” program to invest in and support innovative orthotic and prosthetic solutions from entrepreneurs and small businesses.

- In 2023, Tynor Orthotics: Inaugurated a new manufacturing facility in Mohali, Punjab, India. The new plant, equipped with advanced technology like ultrasonic welding and robotic systems, positions Tynor as a frontrunner in orthopedic appliance manufacturing.

- In 2023, DePuy Synthes (a Johnson & Johnson company) launched the VELYS Robotic-Assisted Solution in Europe.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, supported by rising orthopedic surgeries worldwide.

- Growing aging populations will drive long-term demand for braces and supports.

- Sports-related injuries will continue boosting adoption of preventive and corrective devices.

- Technological innovation in lightweight materials will improve patient comfort and compliance.

- 3D printing will enable personalized orthotic solutions tailored to individual patient needs.

- Smart sensor integration will support real-time monitoring in rehabilitation and homecare.

- Preventive care awareness will encourage adoption of supports in non-clinical settings.

- Emerging markets will experience faster growth due to expanding healthcare infrastructure.

- Partnerships between global players and local distributors will strengthen regional penetration.

- Digital retail channels will enhance accessibility of orthopedic support products to wider consumers.