Market Overview:

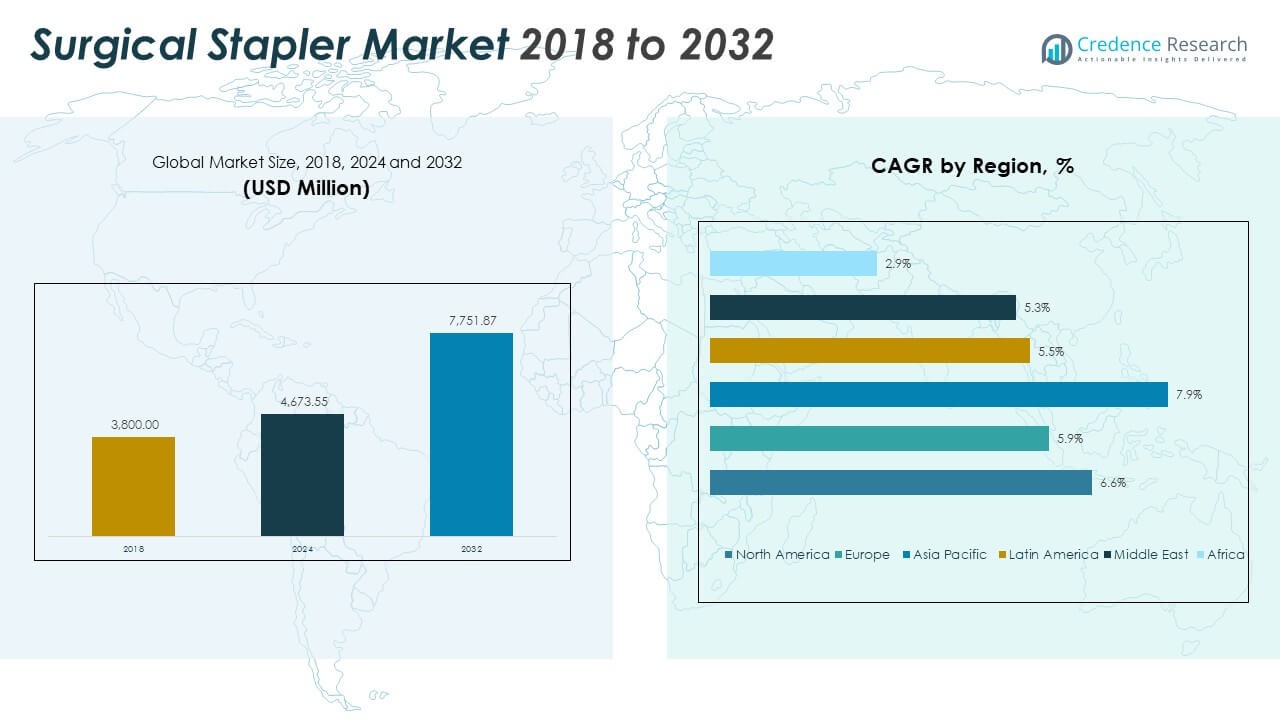

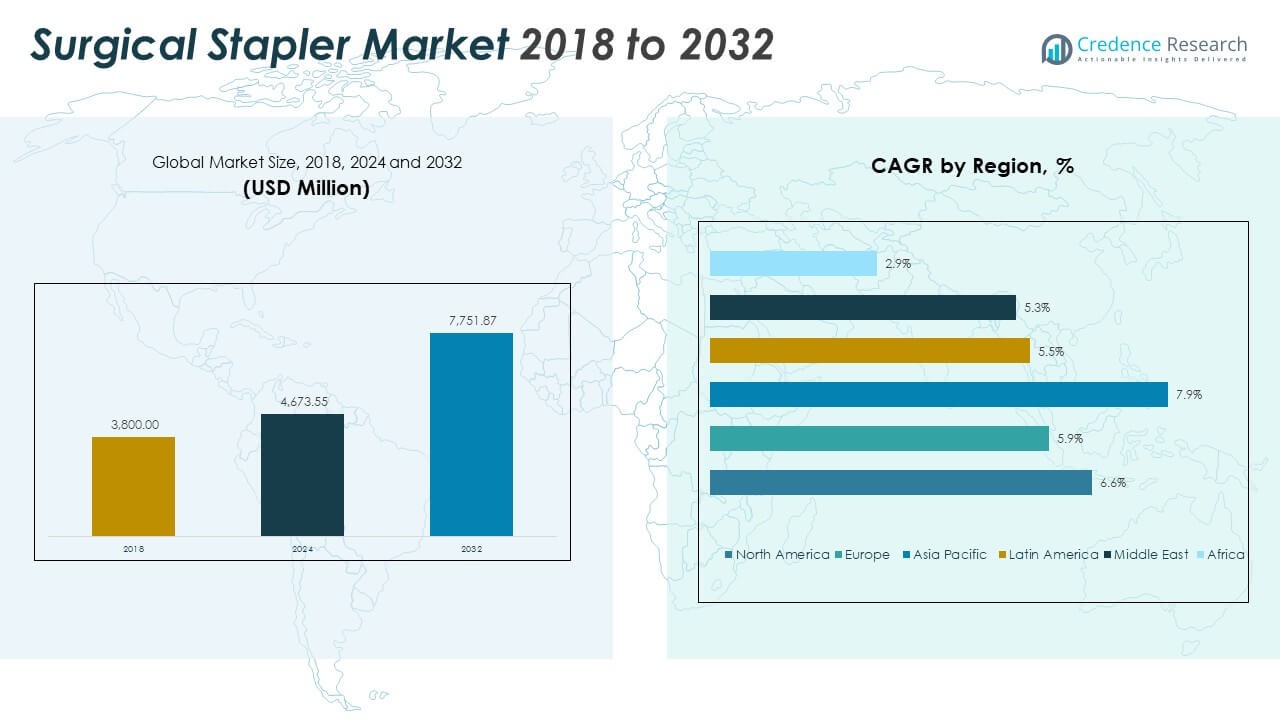

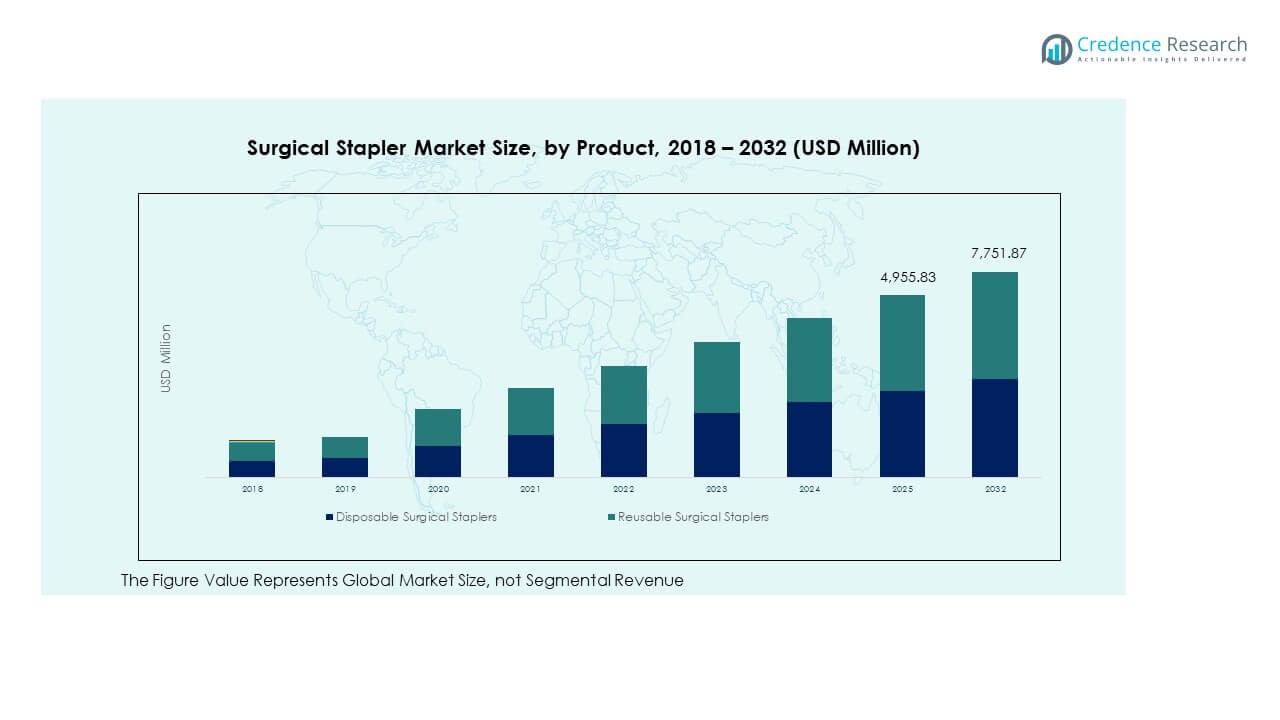

The Global Surgical Stapler Market size was valued at USD 3,800.00 million in 2018 to USD 4,673.55 million in 2024 and is anticipated to reach USD 7,751.87 million by 2032, at a CAGR of 6.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Global Surgical Stapler Market Size 2024 |

USD 4,673.55 Million |

| Global Surgical Stapler Market, CAGR |

6.60% |

| Global Surgical Stapler Market Size 2032 |

USD 7,751.87 Million |

The Global Surgical Stapler Market is growing due to the rising number of surgical procedures and demand for minimally invasive techniques. Hospitals prefer staplers over sutures for faster wound closure and reduced infection risks. The adoption of powered and disposable staplers enhances precision and reduces human error, driving higher adoption rates. Increasing awareness of advanced surgical technologies and favorable reimbursement policies further accelerate market growth.

Geographically, North America leads the market due to strong healthcare infrastructure and high adoption of advanced medical tools. Europe follows with steady growth supported by increasing bariatric and cardiac surgeries. The Asia-Pacific region is emerging rapidly, driven by expanding healthcare access, medical tourism, and rising investments in hospital facilities. Latin America and the Middle East & Africa are witnessing gradual growth, supported by improving healthcare systems and growing surgical volumes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Surgical Stapler Market size was valued at USD 3,800 million in 2018, increased to USD 4,673.55 million in 2024, and is projected to reach USD 7,751.87 million by 2032, growing at a CAGR of 6.6% during the forecast period.

- North America (30%), Asia Pacific (29%), and Europe (23%) dominate the market due to advanced surgical infrastructure, strong healthcare funding, and presence of major manufacturers. These regions lead innovation and adoption of powered and disposable staplers.

- Asia Pacific, the fastest-growing region with a 7.9% CAGR, is driven by expanding hospital infrastructure, rising healthcare access, and medical tourism growth in China, India, and Southeast Asia.

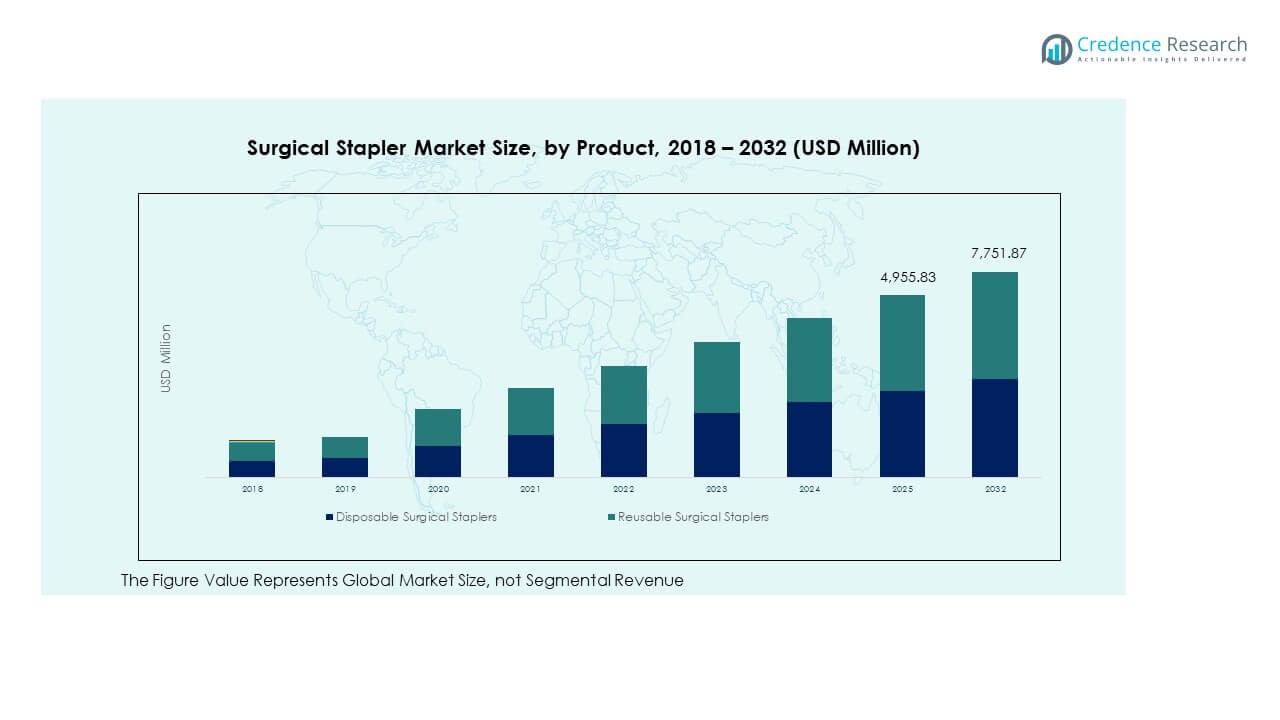

- Disposable surgical staplers hold about 65% of the market share due to higher demand for infection control and single-use convenience.

- Reusable surgical staplers account for around 35%, supported by their cost efficiency and adoption in high-volume hospitals with established sterilization facilities.

Market Drivers:

Rising Demand for Minimally Invasive Surgeries Enhancing Adoption of Surgical Staplers

The Global Surgical Stapler Market is driven by the growing shift toward minimally invasive surgical procedures. Patients prefer these procedures due to faster recovery, less pain, and minimal scarring. Hospitals are adopting staplers for their efficiency in closing wounds and reducing operative time. The technology ensures precise tissue approximation, improving post-surgical outcomes. It supports complex operations, including gastrointestinal, bariatric, and thoracic surgeries. Surgeons favor powered staplers for consistent performance and enhanced safety. Rising healthcare awareness and accessibility further support this shift. Increasing government initiatives to modernize surgical infrastructure also reinforce adoption.

- For instance, Medtronic’s Signia Circular Stapler features Adaptive Compression technology, generating 164% greater perfusion into the staple line and enabling up to 55% lower compressive forces compared to similar powered staplers, which facilitates better wound healing and shorter hospital stays during colorectal and bariatric procedures.

Technological Advancements Improving Surgical Precision and Efficiency

Innovation in stapling devices fuels market expansion by improving precision and usability. Modern devices integrate ergonomic designs, powered mechanisms, and reloadable cartridges. These features reduce surgeon fatigue and improve accuracy during critical procedures. Smart staplers equipped with sensor feedback systems enhance tissue compression and staple line integrity. Hospitals benefit from improved patient outcomes and reduced complications. It helps in minimizing blood loss and shortening hospital stays. Companies are focusing on R&D to develop next-generation staplers for diverse applications. Growing demand for efficient wound closure systems across specialties continues to strengthen market growth.

- For instance, Ethicon’s ECHELON CIRCULAR Powered Stapler was associated with a 74% reduction in anastomotic leak rates (1.8% vs. 6.9%) and a 44% reduction in 30-day hospital readmission rates (6.1% vs. 10.8%) after colorectal surgery compared to manual circular staplers, based on a real-world study of over 1,500 patients.

Rising Global Surgical Volumes and Expanding Hospital Infrastructure

An increasing number of surgeries across cardiovascular, orthopedic, and general disciplines fuels demand for surgical staplers. Growing healthcare infrastructure, especially in developing economies, supports market expansion. Hospitals and clinics are investing in advanced surgical tools to improve operational efficiency. It drives greater use of staplers over traditional sutures for their speed and reliability. The market benefits from government programs improving access to healthcare facilities. Rising disposable income and insurance coverage also encourage elective surgeries. The growing prevalence of obesity and chronic diseases boosts bariatric and gastrointestinal procedures. These factors collectively sustain market momentum across both developed and emerging regions.

Shift Toward Disposable Devices Promoting Safety and Infection Control

The demand for disposable surgical staplers is increasing due to their role in infection control. Hospitals prefer single-use staplers to reduce cross-contamination risks. Disposable products eliminate the need for sterilization, saving time and cost. It helps ensure consistent performance in sterile environments. The shift is supported by stricter regulatory standards emphasizing patient safety. Manufacturers are focusing on cost-effective materials without compromising quality. The transition toward disposable devices aligns with modern hospital protocols. Rising awareness about surgical hygiene continues to encourage adoption globally.

Market Trends:

Sustainability-Focused Developments in Surgical Stapler Manufacturing

Manufacturers are increasingly focusing on sustainable materials and eco-friendly packaging. Environmental regulations encourage companies to reduce plastic waste and improve recyclability. It promotes innovation in biodegradable stapler components and efficient production processes. Hospitals prefer suppliers committed to environmental responsibility. The trend aligns with the broader shift toward green healthcare operations. Leading firms are exploring reusable cartridge systems to balance cost and sustainability. The focus on cleaner production also enhances brand value in regulated markets. Growing emphasis on sustainability is shaping procurement policies and influencing long-term growth strategies.

- For instance, B. Braun’s Vasofix Safety IV Catheter is manufactured PVC-, DEHP-, and latex-free and incorporates a passive, fully automatic needlestick protection system, along with reusable materials—showcased in the 2024 revision of its European product catalog.

Expansion of Ambulatory Surgery Centers Driving Stapler Adoption

The rising number of ambulatory surgical centers (ASCs) is creating new growth avenues for stapler adoption. ASCs offer quicker, cost-effective procedures compared to traditional hospitals. It increases demand for portable, user-friendly stapling devices. Staplers enable faster recovery and discharge, aligning with ASC operational goals. Manufacturers are designing compact, efficient devices tailored for outpatient settings. Growing preference for day-care surgeries in orthopedics and general procedures supports demand. The trend reflects broader healthcare decentralization and cost optimization. Increasing healthcare reforms worldwide encourage outpatient care, driving this expansion.

- For instance, Medtronic’s bedside Signia staplers are used in robotic-assisted surgery and show 32 minutes less operative room time, 17.2 times fewer ICU visits, and a 37% lower likelihood of bleeding compared to SureForm robotic staplers, providing quantifiable benefits in ambulatory surgical centers.

Market Challenges Analysis:

High Cost of Advanced Stapling Systems and Limited Accessibility in Emerging Markets

The Global Surgical Stapler Market faces challenges due to the high cost of advanced stapling devices. Hospitals in developing regions struggle to adopt powered or robotic-assisted staplers. It restricts accessibility, especially in low-resource healthcare systems. The price of consumables such as reload cartridges adds to operational costs. Smaller hospitals often rely on manual suturing to control expenses. Limited reimbursement policies for stapling procedures also slow adoption. Manufacturers need to balance innovation with affordability to expand market reach. Addressing pricing barriers is essential to achieve equitable access and long-term market stability.

Device Malfunctions, Regulatory Constraints, and Skilled Usage Requirements

The risk of stapler misfires or tissue damage remains a key challenge for manufacturers. It creates concerns about patient safety and post-surgical complications. Regulatory agencies enforce strict approval standards to ensure product reliability. Meeting these standards increases development time and cost. Surgeons require proper training to operate advanced staplers safely. Lack of standardized usage protocols in some regions leads to inconsistent results. Frequent recalls or device errors can affect brand credibility and trust. Strengthening training programs and regulatory compliance will be crucial to sustain confidence in the market.

Market Opportunities:

Expanding Applications Across Specialized and Cosmetic Surgical Procedures

The Global Surgical Stapler Market holds strong opportunities in specialized fields such as reconstructive, thoracic, and plastic surgeries. The demand for staplers in aesthetic and dermatological applications is rising rapidly. It helps surgeons achieve cleaner closure lines and superior cosmetic results. Growing patient preference for quick recovery fuels this adoption. The development of staplers suitable for delicate tissues expands their usability. Hospitals are integrating these devices into new surgical categories. The trend enhances market diversity and long-term growth potential across specialized care segments.

Rising Healthcare Investments and Emerging Market Penetration

Expanding healthcare investments in Asia-Pacific, Latin America, and the Middle East create new market opportunities. Governments are increasing funding for surgical infrastructure and hospital modernization. It supports adoption of advanced stapling devices in public healthcare systems. Global players are entering untapped regions through partnerships and distribution networks. The growing number of training programs helps local professionals adopt these technologies. Rising patient awareness about modern surgical solutions boosts acceptance. The ongoing expansion of healthcare facilities strengthens market penetration in emerging economies.

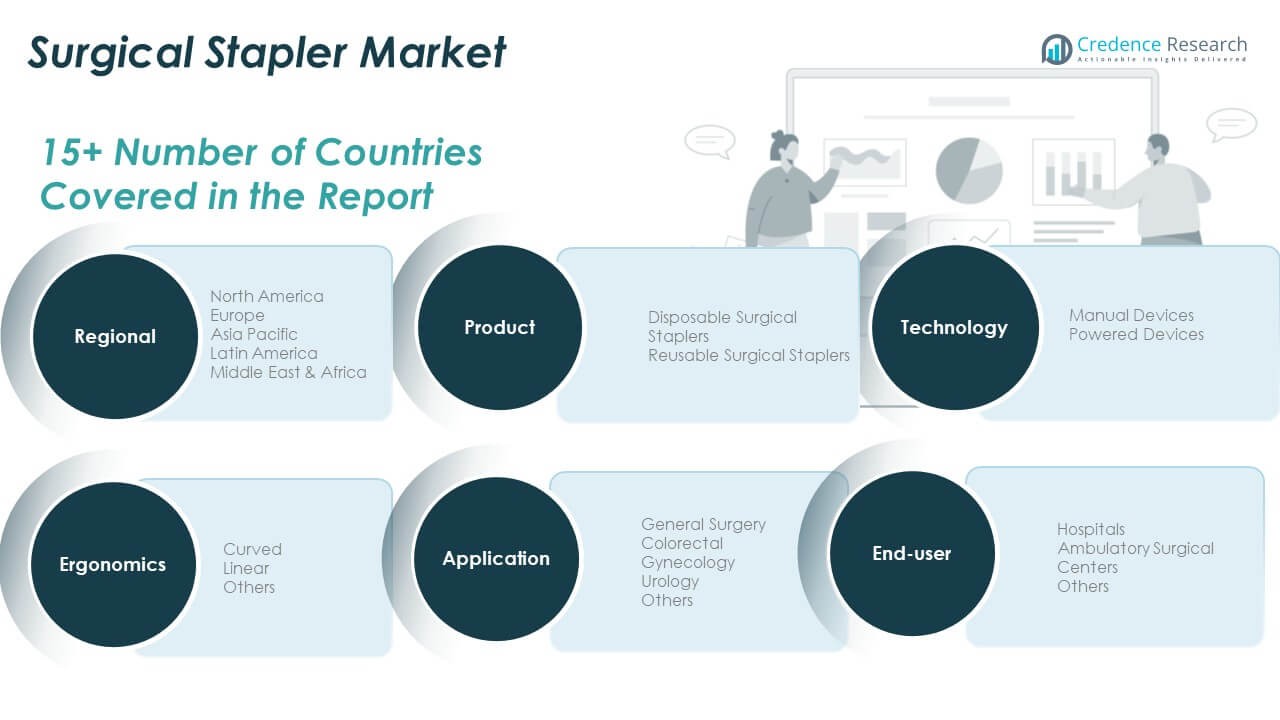

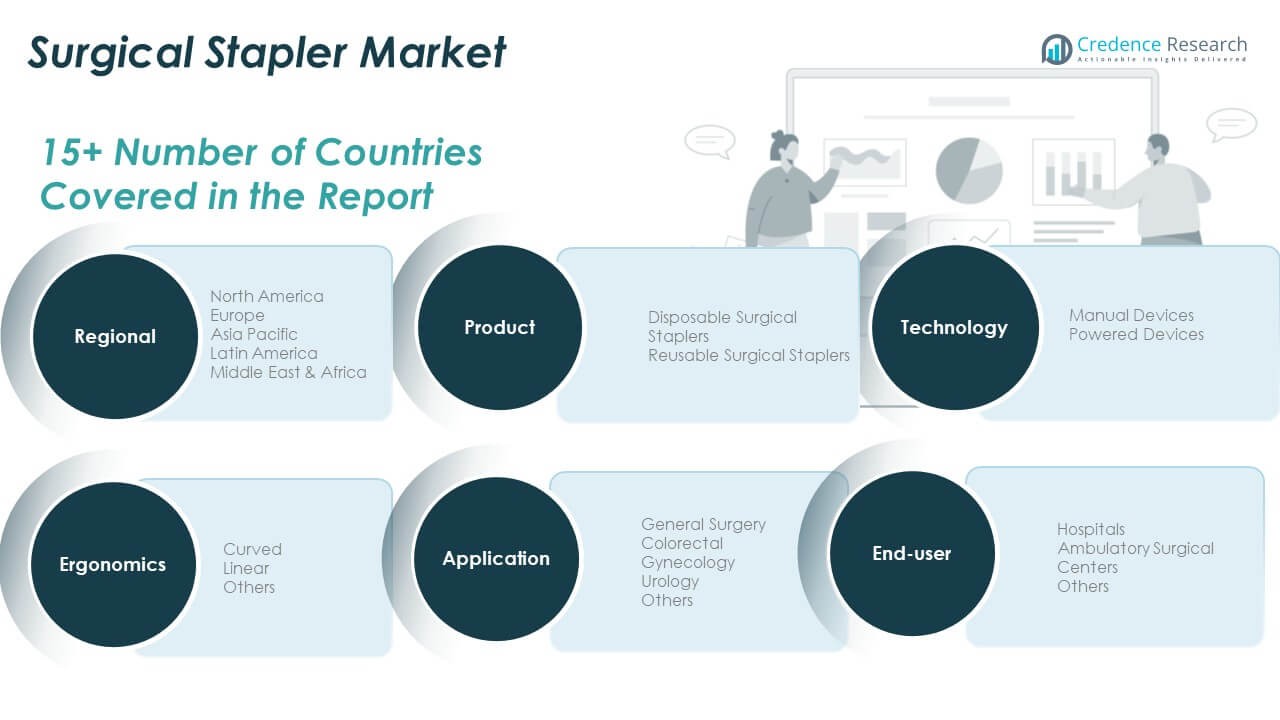

Market Segmentation Analysis:

By Product Type

The Global Surgical Stapler Market is segmented into disposable and reusable staplers. Disposable staplers dominate due to their high demand in infection control and single-use convenience. Hospitals favor these devices to eliminate sterilization needs and reduce contamination risks. Reusable staplers, though cost-efficient long-term, require strict maintenance and sterilization procedures. It caters to high-volume surgical centers with advanced cleaning protocols. Growing awareness of safety standards boosts disposable adoption. Manufacturers are improving materials and cartridge quality for both types. Both segments continue to evolve with ergonomic and powered features to enhance surgical outcomes.

By Application

The market spans general surgery, colorectal, gynecology, urology, and other procedures. General surgery holds the major share due to wide applicability in wound closure and tissue resection. Colorectal and gynecology surgeries are increasing with the rise in lifestyle diseases and reproductive health awareness. Urology applications are expanding due to the prevalence of prostate and bladder surgeries. It supports complex tissue management with accuracy and efficiency. Hospitals use different stapler types to match tissue thickness and procedure complexity. The growing preference for minimally invasive surgeries further strengthens this segment’s performance.

- For instance, Ethicon’s ECHELON CIRCULAR Powered Stapler demonstrated a postoperative anastomotic leak rate as low as 1.7% in recent clinical studies of left-sided colorectal resections, compared to rates up to 11.8% for manual staplers, highlighting significant improvements in outcomes for general and colorectal surgeries.

By Technology

The technology segment includes manual and powered devices. Manual staplers remain widely used for their affordability and reliability in routine procedures. Powered staplers, however, are gaining ground due to superior control and precision. They minimize hand fatigue and provide consistent staple line integrity. Hospitals prefer powered systems for complex and lengthy operations. It enhances accuracy while reducing operative time and complications. The increasing integration of smart feedback technology supports powered device growth. Continuous product innovation continues to expand both sub-segments’ clinical reach.

By Ergonomics and End User

Ergonomically, staplers are classified as curved, linear, and others. Curved types offer flexibility in confined spaces, while linear staplers ensure uniform tissue closure. Hospitals remain the dominant end user due to higher surgical volumes and advanced infrastructure. Ambulatory surgical centers represent a fast-growing segment, driven by outpatient surgeries and shorter recovery needs. Other end users, including specialty clinics, are adopting compact, efficient staplers for targeted applications. It strengthens market accessibility and supports faster procedural throughput across varied healthcare environments.

Segmentation:

By Product Type

- Disposable Surgical Staplers

- Reusable Surgical Staplers

By Application

- General Surgery

- Colorectal

- Gynecology

- Urology

- Others

By Technology

- Manual Devices

- Powered Devices

By Ergonomics

By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Surgical Stapler Market size was valued at USD 1,463.00 million in 2018 to USD 1,778.72 million in 2024 and is anticipated to reach USD 2,946.50 million by 2032, at a CAGR of 6.6% during the forecast period. North America accounts for 30% of the global market share, supported by advanced healthcare infrastructure and high adoption of innovative surgical tools. The region benefits from the presence of major manufacturers and strong reimbursement frameworks. It experiences growing demand for minimally invasive surgeries and powered staplers in bariatric, thoracic, and orthopedic procedures. The U.S. remains the key contributor due to rising obesity rates and a large volume of elective surgeries. Canada and Mexico follow with expanding hospital networks and increasing surgical volumes. It continues to lead innovation through R&D investments and product upgrades. The market outlook remains strong due to technology integration and favorable clinical outcomes.

Europe

The Europe Global Surgical Stapler Market size was valued at USD 999.40 million in 2018 to USD 1,181.35 million in 2024 and is anticipated to reach USD 1,850.78 million by 2032, at a CAGR of 5.9% during the forecast period. Europe captures 23% of the global market share, driven by an increase in gastrointestinal, bariatric, and cardiovascular procedures. The region focuses on patient safety and quality standards in surgical practices. Germany, the UK, and France are major contributors, supported by high healthcare spending. It benefits from strong regulations promoting precision and hygiene in medical devices. The demand for disposable staplers is growing due to strict infection control policies. Hospitals adopt powered staplers to reduce complications and improve recovery time. Aging populations and chronic disease prevalence sustain procedural growth across Europe. Continuous innovation and surgeon training programs strengthen regional competitiveness.

Asia Pacific

The Asia Pacific Global Surgical Stapler Market size was valued at USD 923.40 million in 2018 to USD 1,186.36 million in 2024 and is anticipated to reach USD 2,172.86 million by 2032, at a CAGR of 7.9% during the forecast period. Asia Pacific holds 29% of the global market share and is the fastest-growing region due to rising healthcare investments and expanding hospital capacity. China, Japan, and India lead adoption, supported by increasing surgical volumes and improving insurance coverage. It benefits from rapid urbanization and growing awareness about advanced surgical tools. Medical tourism in countries like Thailand and India enhances market penetration. Local manufacturers are expanding product portfolios to cater to cost-sensitive markets. Technological advancements and collaborations with global firms improve accessibility. The region continues to attract investments for powered and disposable stapler production.

Latin America

The Latin America Global Surgical Stapler Market size was valued at USD 220.40 million in 2018 to USD 268.21 million in 2024 and is anticipated to reach USD 409.84 million by 2032, at a CAGR of 5.5% during the forecast period. Latin America represents 9% of the global market share, supported by improving surgical infrastructure and growing healthcare expenditure. Brazil and Argentina dominate the regional market, driven by an increase in laparoscopic and cosmetic procedures. Hospitals are shifting toward disposable staplers to reduce infection risks. It experiences growing partnerships with global suppliers for advanced surgical equipment. Rising government focus on healthcare quality fuels modernization across public hospitals. Economic recovery and foreign investment in healthcare technology contribute to regional expansion. The market outlook remains positive with continuous development of private surgical centers.

Middle East

The Middle East Global Surgical Stapler Market size was valued at USD 147.82 million in 2018 to USD 170.55 million in 2024 and is anticipated to reach USD 255.85 million by 2032, at a CAGR of 5.3% during the forecast period. The region accounts for 6% of the global market share, supported by expanding hospital infrastructure and medical tourism. Gulf Cooperation Council (GCC) countries lead adoption due to high per capita healthcare spending. It benefits from an increasing number of bariatric and general surgeries across Saudi Arabia and the UAE. Hospitals are adopting powered staplers to ensure surgical precision and shorter operating times. Government initiatives to improve healthcare accessibility strengthen market growth. Surgeons are being trained on advanced stapling systems to ensure consistent quality outcomes. Strategic collaborations between regional distributors and global manufacturers improve market penetration.

Africa

The Africa Global Surgical Stapler Market size was valued at USD 45.98 million in 2018 to USD 88.35 million in 2024 and is anticipated to reach USD 116.04 million by 2032, at a CAGR of 2.9% during the forecast period. Africa holds 3% of the global market share, limited by low healthcare spending and slow technology adoption. South Africa remains the key contributor with modern surgical facilities and private healthcare growth. Other regions such as Egypt and Nigeria show potential due to rising public health investments. It faces challenges like limited training, low awareness, and high device costs. International aid and partnerships are helping bridge gaps in equipment accessibility. The demand for disposable staplers is increasing in tertiary hospitals for infection control. Expansion of healthcare infrastructure and capacity-building programs are expected to improve market prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Medtronic PLC

- Becton, Dickinson and Company

- Ethicon Inc. (Subsidiary of Johnson & Johnson)

- Braun Melsungen AG

- Smith & Nephew

- CONMED Corporation

- Dextera Surgical Inc.

- Meril Life Sciences Pvt. Ltd.

- Frankenman International Limited

- XNY Medical

Competitive Analysis:

The Global Surgical Stapler Market is highly competitive with strong participation from global and regional manufacturers. It is dominated by established players focusing on technological advancements and product innovation. Leading companies such as Medtronic, Ethicon Inc. (Johnson & Johnson), and Becton, Dickinson and Company maintain leadership through extensive product portfolios and distribution networks. Strategic mergers, acquisitions, and partnerships are shaping market dynamics. Firms emphasize powered and smart stapling systems to enhance surgical precision and safety. It shows increasing investment in R&D and training programs for surgeons. Competitive differentiation is driven by pricing, reliability, and performance consistency. Emerging players from Asia are expanding reach through cost-effective devices and strategic collaborations.

Recent Developments:

- In September 2025, B. Braun Melsungen AG executed a full acquisition of True Digital Surgery (TDS), a leader in digital robotic-assisted 3D surgical microscopy based in Goleta, California. This strategic move aims to boost B. Braun’s technological capabilities and expand its market share in digital microsurgery, especially through its Aesculap division which benefits from TDS’s expertise. The deal reflects B. Braun’s commitment to advancing digital surgical solutions and strengthening its presence in neurosurgery, spinal surgery, and ENT surgery sectors.

- On June 18, 2025, Smith & Nephew announced a new strategic partnership with Standard Health to support the development and operation of the first Orthopaedic Ambulatory Surgery Centre in the UK. The centre will provide NHS and private patients access to innovative joint repair and replacement technologies. Smith & Nephew is responsible for supplying its portfolio of medical devices, while Standard Health manages site operations. Additional centres are planned across the UK, leveraging efficient ambulatory surgery models for orthopaedic care.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, technology, ergonomics, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will experience steady expansion driven by increasing surgical procedures worldwide.

- Rising demand for powered staplers will reshape the technology landscape.

- Hospitals will continue dominating due to advanced surgical infrastructure.

- Asia Pacific will remain the fastest-growing region due to improving healthcare access.

- Disposable staplers will gain more traction for infection control and safety.

- Technological integration with digital feedback systems will enhance precision.

- R&D collaboration among global and regional players will accelerate innovation.

- Medical tourism will boost adoption across emerging economies.

- Sustainability initiatives will drive eco-friendly material usage in production.

- Market strategies will increasingly focus on surgeon training and clinical education