Market Overview

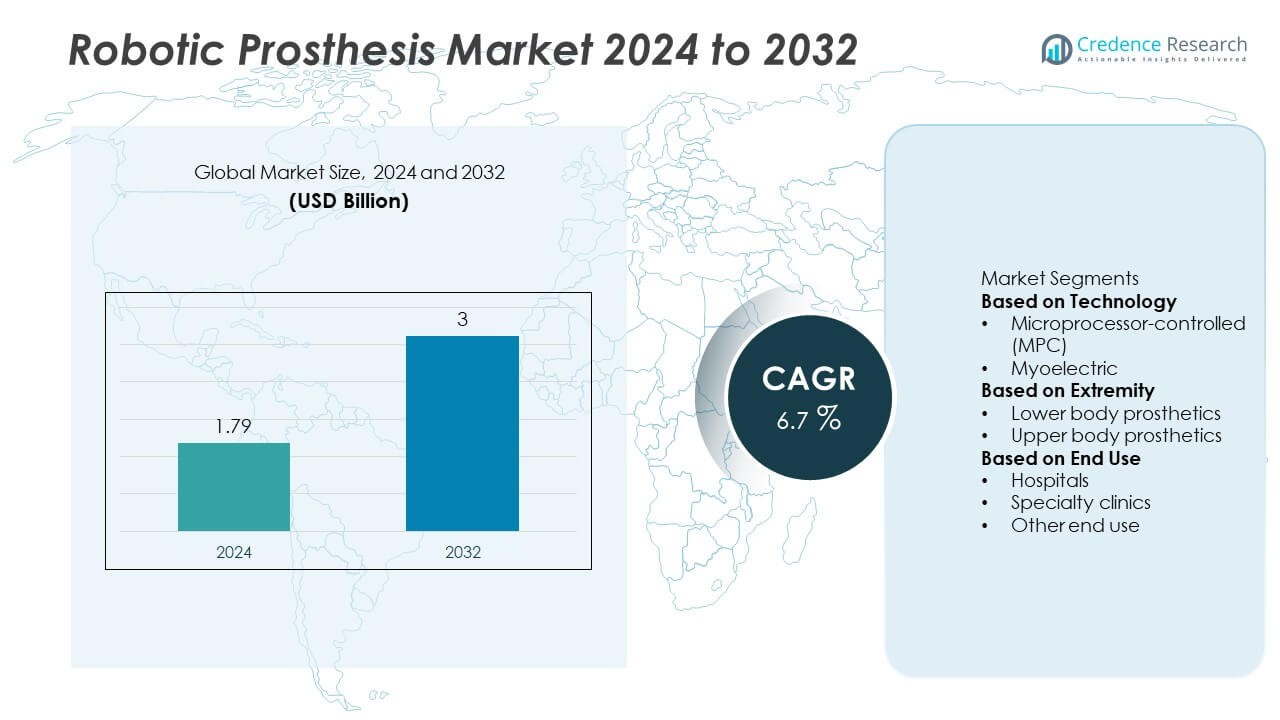

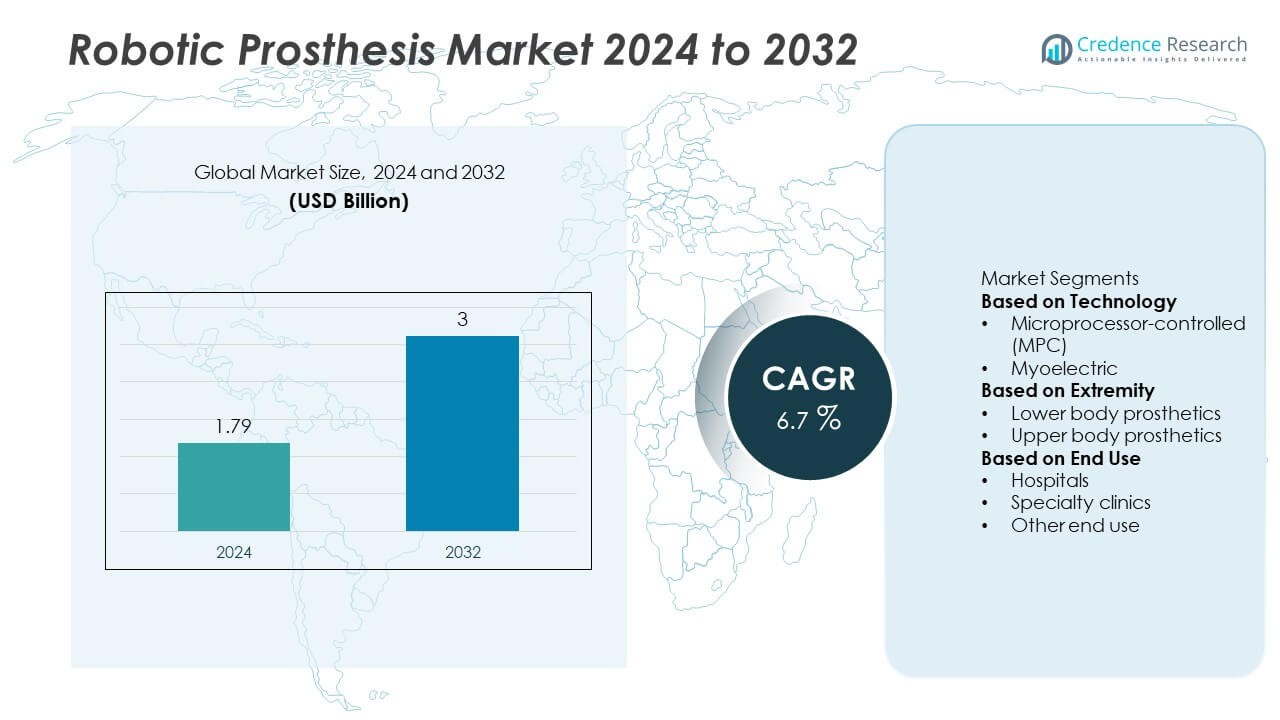

The Robotic Prosthesis market was valued at USD 1.79 billion in 2024 and is projected to reach USD 3 billion by 2032, growing at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotic Prosthesis market Size 2024 |

USD 1.79 Billion |

| Robotic Prosthesis market, CAGR |

6.7% |

| Robotic Prosthesis market Size 2032 |

USD 3 Billion |

The robotic prosthesis market is led by major players such as Brain Robotics, Fillauer LLC, Open Bionics, Myomo, Ottobock, Axile Bionics, Mobius Bionics, Blatchford Group, Motorica, and Ossur. These companies dominate through technological innovation, smart sensor integration, and AI-based motion control systems that enhance user mobility and comfort. North America led the market with a 39% share in 2024, driven by advanced healthcare infrastructure and strong research investments. Europe followed with a 29% share, supported by government-funded rehabilitation programs, while Asia-Pacific accounted for 23%, fueled by rising healthcare investments and increasing adoption of bionic technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The robotic prosthesis market was valued at USD 1.79 billion in 2024 and is projected to reach USD 3.00 billion by 2032, growing at a CAGR of 6.7%.

- Market growth is driven by rising cases of limb loss, increasing adoption of bionic technologies, and continuous advancements in sensor-based and AI-integrated prosthetics.

- Key trends include the development of neuro-controlled systems, lightweight material integration, and miniaturized actuators for enhanced comfort and functionality.

- The market is moderately consolidated, with companies such as Ottobock, Ossur, Myomo, and Open Bionics leading innovation through R&D, strategic partnerships, and global distribution expansion.

- North America led the market with a 39% share in 2024, followed by Europe with 29% and Asia-Pacific with 23%; among technologies, microprocessor-controlled prosthetics held a 58% share due to their adaptive motion and precision control capabilities.

Market Segmentation Analysis:

By Technology

The microprocessor-controlled (MPC) segment dominated the robotic prosthesis market with a 58% share in 2024. This dominance is driven by the ability of MPC prosthetics to provide adaptive motion, real-time adjustments, and improved stability for users. These systems utilize onboard sensors and algorithms to mimic natural limb movement, enhancing mobility and comfort. Increasing demand for intelligent and energy-efficient prosthetics in rehabilitation centers supports segment growth. Continuous R&D investments in advanced gait recognition and balance control technologies further strengthen the adoption of MPC systems worldwide.

- For instance, Ottobock developed the C-Leg 4 microprocessor-controlled knee equipped with 3,200 Hz sensor sampling frequency, allowing real-time motion adjustments on variable terrains.

By Extremity

Lower body prosthetics held the largest 63% share of the robotic prosthesis market in 2024. The segment’s growth is fueled by a high prevalence of lower limb amputations due to diabetes, vascular diseases, and trauma injuries. Advancements in knee and ankle joint mechanisms, coupled with integration of AI-based motion learning, have improved gait dynamics and user comfort. Increasing deployment of sensor-driven prosthetics for military veterans and accident survivors further accelerates demand. Manufacturers are prioritizing lightweight materials and energy recovery systems to enhance walking efficiency and endurance.

- For instance, Fillauer LLC has introduced advanced prosthetic feet, like the AllPro XTS, which features adjustable torsion and vertical shock reduction for lower limb amputees.

By End Use

Hospitals accounted for a 49% share of the robotic prosthesis market in 2024, emerging as the leading end-use segment. The growth is supported by expanding adoption of advanced rehabilitation technologies and the availability of skilled professionals for prosthetic fitting and maintenance. Hospitals are increasingly integrating robotic-assisted rehabilitation programs to improve patient outcomes. Collaborations with medical technology firms and research institutions have led to wider accessibility of smart prosthetic devices. Specialty clinics follow closely, driven by personalized patient care and increasing use of custom-designed robotic limbs for faster rehabilitation.

Key Growth Drivers

Increasing Adoption of Advanced Bionic Technologies

The growing preference for smart prosthetic systems integrated with sensors, actuators, and AI algorithms is driving market growth. These technologies enhance user comfort, motion accuracy, and responsiveness by mimicking natural limb movement. Advancements in neuroprosthetics and myoelectric control systems are helping amputees regain functional independence. Continuous R&D investments by medical device manufacturers are accelerating the commercialization of lightweight, high-performance robotic prostheses tailored for both upper and lower extremity rehabilitation needs.

- For instance, BrainCo developed an AI-driven prosthetic hand that allows users to perform customized gestures by training the device with brain waves and muscle signals, showcased at CES 2020.

Rising Incidence of Limb Amputations and Trauma Injuries

The global rise in limb loss cases due to diabetes, vascular diseases, and road accidents significantly fuels demand for robotic prostheses. Increased awareness about advanced rehabilitation solutions and government initiatives to support amputees are boosting adoption rates. Military veterans and trauma survivors are increasingly opting for robotic limbs for improved mobility and quality of life. Healthcare systems are prioritizing early prosthetic intervention programs to enhance patient recovery outcomes and reduce long-term dependency.

- For instance, Blatchford Group’s Linx integrated limb system synchronizes foot and knee sensors processing 400 inputs per second to optimize joint coordination during rehabilitation of trauma and military patients.

Growing Healthcare Investment and Rehabilitation Infrastructure

Expanding healthcare infrastructure and rising investments in rehabilitation technologies are strengthening market expansion. Hospitals and specialized prosthetic clinics are adopting robotic-assisted devices to improve therapy precision and patient outcomes. Governments and private organizations are supporting prosthetic innovation through funding and public-private partnerships. This financial support encourages the production of cost-effective and durable robotic prosthetics, especially in emerging economies. The growing presence of advanced rehabilitation centers globally continues to accelerate prosthesis adoption.

Key Trends & Opportunities

Integration of AI and Neuro-Controlled Systems

The integration of artificial intelligence and brain-computer interface technologies is transforming robotic prosthetics. These systems interpret neural signals to provide real-time control and adaptive movement, improving user experience. Manufacturers are focusing on predictive motion algorithms that allow smoother and more natural mobility. The development of AI-driven feedback mechanisms creates new opportunities for high-precision prostheses suitable for complex rehabilitation environments and long-term use.

- For instance, Mobius Bionics commercialized the LUKE Arm, originally developed by DEKA Research and Development under the U.S. DARPA program. The system features up to 10 powered joints and an intuitive control system that uses input devices such as surface EMG electrodes or foot-mounted inertial sensors to provide greater dexterity for amputees.

Miniaturization and Lightweight Material Advancements

Advancements in carbon fiber composites, lightweight alloys, and 3D printing technologies are leading to more comfortable and durable prosthetics. The shift toward compact actuators and efficient battery systems supports longer usage time and better balance. These innovations reduce fatigue and improve user confidence, especially in lower-limb prosthetics. The miniaturization trend also opens opportunities for customized prosthetic designs optimized for mobility and patient-specific ergonomics.

- For instance, Open Bionics adopted HP Multi Jet Fusion 3D printing to create the Hero Arm’s robust hand and frame from tough Nylon 12, resulting in a full prosthesis that weighs less than 1 kg (2.2 lbs) while maintaining structural strength for daily wear.

Key Challenges

High Cost and Limited Accessibility

The high cost of robotic prosthetic devices remains a major barrier to widespread adoption. Integration of advanced sensors, actuators, and AI systems significantly increases production and maintenance expenses. Many low- and middle-income countries face challenges in providing affordable access to such technologies. The lack of reimbursement policies and limited healthcare coverage further restrict adoption among patients requiring long-term rehabilitation support.

Complexity in Maintenance and User Training

Robotic prostheses require regular calibration, software updates, and maintenance to ensure reliable performance. The complexity of operation and the need for user training often delay full adoption. Patients must undergo extended adaptation periods to learn proper control and coordination. Additionally, limited availability of skilled technicians and rehabilitation specialists poses operational challenges, particularly in remote healthcare facilities.

Regional Analysis

North America

North America held the largest share of 39% in the robotic prosthesis market in 2024. The region’s leadership is attributed to advanced healthcare infrastructure, early technology adoption, and strong government support for rehabilitation programs. The United States drives growth with high investment in bionic research and extensive availability of advanced prosthetic care centers. Strategic collaborations between medical device companies and research institutions promote continuous innovation. The increasing prevalence of limb amputations, coupled with favorable reimbursement frameworks, continues to boost the adoption of robotic prosthetic solutions across hospitals and specialized clinics.

Europe

Europe accounted for a 29% share of the robotic prosthesis market in 2024. Growth in this region is fueled by strong healthcare infrastructure, supportive regulatory policies, and rapid integration of robotics in rehabilitation services. Countries such as Germany, the United Kingdom, and France are leading adopters of advanced prosthetic technologies. Government-backed funding programs and insurance coverage improvements are enhancing patient accessibility. European manufacturers are also focusing on lightweight designs and AI-based control systems to improve user comfort. Continuous advancements in biomechanical engineering and clinical research further strengthen the region’s market position.

Asia-Pacific

Asia-Pacific captured a 23% share of the robotic prosthesis market in 2024. The region’s growth is driven by rising healthcare investments, growing awareness of advanced rehabilitation devices, and an increasing number of trauma-related amputations. Countries such as Japan, China, and India are investing in domestic manufacturing and technology partnerships to expand access. The rise in diabetic limb loss cases and an aging population are fueling long-term demand. Favorable government initiatives supporting affordable prosthetic development and expanding prosthetic clinics in urban centers contribute significantly to regional market expansion.

Middle East & Africa

The Middle East & Africa region accounted for a 6% share of the robotic prosthesis market in 2024. The growth is supported by government healthcare reforms, increasing investments in rehabilitation centers, and improved access to advanced prosthetic solutions. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are introducing prosthetic care programs for trauma and military amputees. The presence of international prosthetic manufacturers and training partnerships enhances regional expertise. However, high device costs and limited healthcare funding in some African nations continue to restrict widespread adoption.

Latin America

Latin America represented a 3% share of the robotic prosthesis market in 2024. The region’s expansion is driven by rising healthcare awareness, improvements in prosthetic service accessibility, and technological collaborations with international providers. Brazil and Mexico lead adoption due to ongoing healthcare modernization and government initiatives supporting rehabilitation for amputees. Increasing private investment in prosthetic clinics and the growing presence of specialized rehabilitation centers further aid growth. However, limited reimbursement frameworks and high equipment costs pose barriers, keeping adoption rates moderate compared to developed regions.

Market Segmentations:

By Technology

- Microprocessor-controlled (MPC)

- Myoelectric

By Extremity

- Lower body prosthetics

- Upper body prosthetics

By End Use

- Hospitals

- Specialty clinics

- Other end use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the robotic prosthesis market is defined by key players such as Brain Robotics, Fillauer LLC, Open Bionics, Myomo, Ottobock, Axile Bionics, Mobius Bionics, Blatchford Group, Motorica, and Ossur. These companies focus on product innovation, neuro-integration, and AI-driven motion control to improve functionality and user experience. Leading manufacturers are investing in advanced sensor technologies, lightweight materials, and energy-efficient actuators to enhance mobility and comfort. Strategic partnerships with hospitals, research institutions, and rehabilitation centers are expanding market reach and clinical adoption. Continuous R&D in neural feedback systems, battery life optimization, and personalized 3D-printed designs further strengthens competitiveness. The market remains moderately consolidated, with established players prioritizing global distribution expansion, affordability, and user-centered prosthetic solutions to meet growing demand from medical and rehabilitation sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Fillauer LLC was named the primary U.S. distributor of Aether Biomedical’s Zeus S prosthetic hand.

- In April 2025, Össur hf. and BASF SE showcased the Pro-Flex Terra foot prosthesis, based on a three-step Cellasto® foam design for enhanced shock and energy response.

- In March 2025, Ottobock SE & Co. KGaA invested in innovative implant technologies via its subsidiary partnerships, including an implant interface aimed at enabling intuitive movement of bionic limbs.

- In 2025, Össur hf.’s powered prosthetic knee platform (POWER KNEE) was studied with an advanced control algorithm at the University of Michigan, showing improved gait symmetry and reduced user fatigue.

Report Coverage

The research report offers an in-depth analysis based on Technology, Extremity, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for robotic prostheses will rise with advancements in AI and neuro-integrated systems.

- Manufacturers will focus on developing lightweight, durable, and energy-efficient prosthetic materials.

- Integration of brain-computer interfaces will enhance natural limb movement and responsiveness.

- Custom 3D-printed prosthetics will gain popularity for personalized fit and design flexibility.

- Healthcare institutions will expand rehabilitation programs using robotic-assisted prosthetic training.

- Collaboration between medical device companies and research institutes will accelerate innovation.

- Wireless connectivity and smart sensors will improve real-time motion control and feedback.

- Asia-Pacific will emerge as a major growth hub driven by expanding healthcare access.

- Increasing affordability and insurance coverage will make robotic prostheses more accessible globally.

- Continuous R&D investment will drive breakthroughs in adaptive mobility and user comfort.