Market Overview

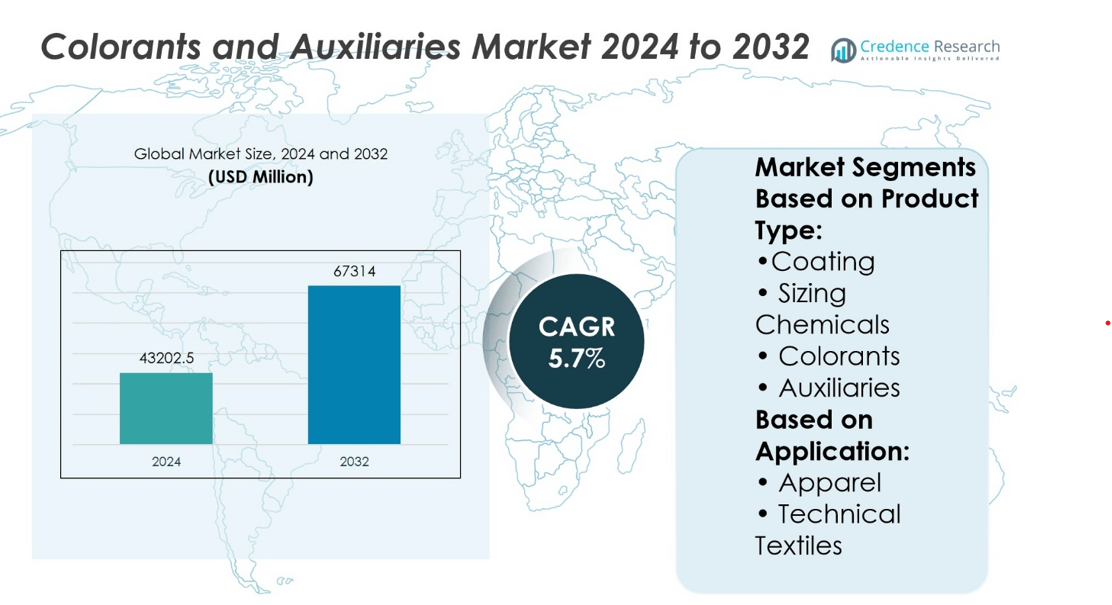

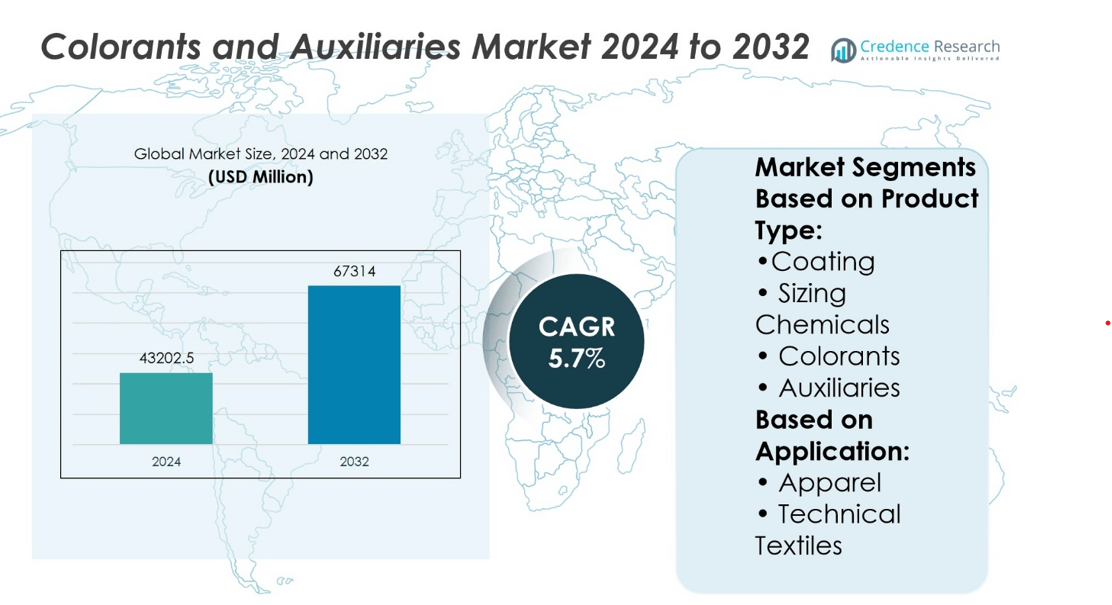

Colorants and Auxiliaries Market size was valued at USD 43202.5 million in 2024 and is anticipated to reach USD 67314 million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Colorants and Auxiliaries Market Size 2024 |

USD 43202.5 million |

| Colorants and Auxiliaries Market, CAGR |

5.7% |

| Colorants and Auxiliaries Market Size 2032 |

USD 67314 million |

The Colorants and Auxiliaries Market is driven by rising demand from the textile, packaging, and plastics industries, supported by rapid industrialization and evolving consumer preferences. It benefits from increasing adoption of sustainable and high-performance formulations, encouraged by strict environmental regulations and growing awareness of eco-friendly products. Technological advancements in digital printing and functional additives continue to shape product development. The market also reflects a strong shift toward bio-based and non-toxic solutions, with manufacturers investing in innovation to meet regulatory and performance requirements. Growth in emerging economies and demand for customized applications further support long-term market expansion.

The Colorants and Auxiliaries Market sees strong geographical presence in Asia Pacific, which leads with high production and consumption, followed by Europe and North America with a focus on sustainability and innovation. Latin America and the Middle East & Africa show steady growth supported by industrial expansion. Key players include BASF SE, Clariant AG, DuPont de Nemours, Inc., Huntsman Corporation, Archroma Management GmbH, DyStar Group, LANXESS AG, Evonik Industries AG, The Chemours Company, and Ferro Corporation.

Market Insights

- The Colorants and Auxiliaries Market was valued at USD 43,202.5 million in 2024 and is expected to reach USD 67,314 million by 2032, growing at a CAGR of 5.7%.

- Rising demand from textile, packaging, and plastics industries continues to drive overall market growth.

- Strict environmental regulations and growing demand for eco-friendly products support the shift toward sustainable and high-performance solutions.

- Advancements in digital printing and functional additives are influencing product development and customization.

- Asia Pacific leads in production and consumption, while Europe and North America focus on innovation and regulatory compliance.

- Key players maintain competitive advantage through global reach, diversified portfolios, and sustained investment in R&D.

- Market growth faces restraints from raw material price volatility, strict compliance costs, and infrastructure limitations in developing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Surging Demand from Textile and Apparel Industry Supports Market Expansion

The Colorants and Auxiliaries Market benefits significantly from strong demand in the textile and apparel sector. Rising consumer interest in fashion, combined with fast-changing trends, fuels the need for vibrant and diverse coloration. Manufacturers increasingly rely on colorants and auxiliaries to enhance fabric appearance, durability, and functionality. Growth in emerging economies with expanding textile industries further supports this trend. Technological developments in dyeing processes allow faster production cycles, meeting bulk demand efficiently. The market continues to evolve in response to both aesthetic and performance requirements from textile manufacturers.

- For instance, DyStar Group’s reactive dyes segment saw the commercialization of over 120 new reactive dye shades in the past five years, tailored specifically for high-efficiency textile coloration across Asia and Europe.

Robust Growth in Packaging and Plastics Sector Strengthens Market Prospects

The Colorants and Auxiliaries Market gains traction from rising applications in the packaging and plastics industries. Colored packaging helps brands differentiate products and attract consumers, especially in food, cosmetics, and personal care segments. Demand for flexible packaging solutions pushes producers to innovate with colorant formulations that suit diverse material types. It supports product integrity, visual appeal, and brand identity across competitive retail environments. Growth in plastic production, particularly in developing regions, fuels the consumption of pigment and dye additives. It drives the need for both visual enhancement and performance optimization.

- For instance, Clariant introduced a range of 25 organic pigments tailored for biodegradable and compostable polymers conforming to EN 13432 standards, enabling vivid coloration in eco‑friendly packaging materials

Stringent Environmental Regulations Encourage Development of Eco-Friendly Products

The Colorants and Auxiliaries Market sees increased focus on sustainability due to growing regulatory scrutiny. Authorities in Europe, North America, and parts of Asia impose restrictions on harmful chemicals, prompting innovation in non-toxic and biodegradable formulations. It pushes manufacturers to invest in research for bio-based colorants and greener auxiliaries. Brands seek certifications and compliance to maintain global market access, leading to demand for cleaner alternatives. Environmental awareness among consumers also contributes to a shift toward sustainable textile and plastic production. It encourages the development and adoption of low-impact chemical solutions.

Technological Advancements and Customization Drive Product Innovation

The Colorants and Auxiliaries Market benefits from advancements in nanotechnology, digital printing, and high-performance formulations. These innovations enable precise color matching, improved dispersion, and enhanced resistance properties across substrates. It empowers end users in textiles, plastics, and coatings to achieve specific visual and functional goals. Growing interest in customized and high-value applications fosters demand for tailored solutions. New manufacturing techniques improve consistency and reduce waste, increasing operational efficiency. It positions the market for long-term growth through value-driven innovation.

Market Trends

Shift Toward Sustainable and Bio-Based Colorant Solutions Gains Momentum

The Colorants and Auxiliaries Market reflects a clear shift toward sustainable and eco-friendly alternatives. Manufacturers focus on reducing environmental impact by developing plant-based dyes and biodegradable auxiliaries. It aligns with increasing regulatory pressure and growing consumer preference for greener products. Textile and plastic industries seek cleaner inputs to meet global sustainability targets. Companies invest in research to create formulations free from heavy metals and hazardous substances. This trend promotes innovation in renewable feedstocks and green chemistry.

- For instance, since its launch in 2017, Archroma’s EarthColors® technology has upcycled over 50 tons of plant-based waste into dyes, coloring nearly 20 million textile articles.

High Demand for Functional Colorants Enhances Product Differentiation

The Colorants and Auxiliaries Market shows rising demand for functional colorants that go beyond aesthetics. End-use sectors such as automotive, electronics, and packaging seek pigments with added properties like UV resistance, heat stability, and anti-microbial effects. It enables product differentiation and longer material lifespan across applications. Industries require colorants that support both performance and regulatory compliance. Brands adopt smart packaging solutions that incorporate thermochromic or photochromic features. Functional pigments continue to gain relevance in value-added segments.

- For instance, Clariant produced over 1.1 million metric tons of plastic colorants globally in 2024, illustrating their scale in supplying high-performance pigments for functional applications across various sectors.

Increased Adoption of Digital Printing Accelerates Innovation in Color Dispersions

The Colorants and Auxiliaries Market is influenced by growing digital printing applications in textiles, ceramics, and packaging. This shift drives demand for high-purity, fine-dispersed colorants compatible with inkjet technologies. It supports shorter production runs, faster turnaround, and greater design flexibility. Digital printing requires colorants with excellent solubility, print accuracy, and minimal residue. Producers focus on advanced dispersion technologies to meet these specifications. This trend fosters technical collaboration between chemical suppliers and printing equipment manufacturers.

Emergence of Asia Pacific as a Key Production and Consumption Hub

The Colorants and Auxiliaries Market experiences strong growth in the Asia Pacific region due to rising industrial output and infrastructure investment. It benefits from low-cost manufacturing, skilled labor, and expanding textile and plastic sectors. Countries like China, India, and Vietnam see increased domestic demand along with export growth. Local players and global manufacturers expand capacity to serve regional markets more effectively. Government incentives and supportive policies attract further investment. This regional trend shapes global supply chain strategies and competitive dynamics.

Market Challenges Analysis

Stringent Environmental Regulations and Compliance Requirements Limit Market Flexibility

The Colorants and Auxiliaries Market faces mounting pressure from strict environmental and safety regulations. Regulatory bodies in Europe, North America, and parts of Asia enforce bans or restrictions on hazardous chemicals, compelling manufacturers to reformulate or replace existing products. It leads to increased R&D costs and delays in product approvals. Small and medium enterprises struggle to adapt due to limited resources and lack of technical capabilities. Compliance with REACH, EPA, and other standards reduces operational flexibility and market access. Companies must invest in continuous testing and certification to remain competitive.

Volatility in Raw Material Prices and Supply Chain Disruptions Challenge Stability

The Colorants and Auxiliaries Market remains vulnerable to fluctuations in raw material availability and pricing. Dependence on petrochemical derivatives and mineral sources exposes manufacturers to cost volatility and procurement risks. It creates uncertainty in production planning and squeezes profit margins, especially during periods of global supply disruptions. Logistics delays and geopolitical tensions further strain the value chain, particularly for international trade. Smaller producers often face disadvantages in securing stable raw material contracts. These challenges hinder consistent output and delay product delivery across end-use industries.

Market Opportunities

Growing Demand for Sustainable and High-Performance Solutions Opens New Avenues

The Colorants and Auxiliaries Market holds strong growth potential through the rising demand for eco-friendly and high-performance formulations. Brands across textile, packaging, and plastics sectors actively seek solutions that meet environmental standards without compromising product quality. It creates space for innovations in natural dyes, low-VOC auxiliaries, and water-efficient processing agents. Regulatory support for sustainable manufacturing enhances the appeal of green chemical solutions. Companies that develop biodegradable, non-toxic products can secure long-term partnerships with environmentally conscious clients. This shift toward responsible sourcing and cleaner production methods presents a clear path for product and market differentiation.

Rapid Industrialization in Emerging Economies Creates Expansion Opportunities

The Colorants and Auxiliaries Market benefits from increasing industrial growth across emerging economies, particularly in Asia Pacific, Latin America, and Africa. Rising disposable income, urbanization, and infrastructure development drive demand for colored textiles, plastics, coatings, and construction materials. It fuels local production and encourages foreign investment in regional manufacturing facilities. Governments promote industrial clusters and offer incentives for chemical sector development. Companies entering these markets early can build strong distribution networks and local partnerships. Expanding consumer bases and diversified application segments support long-term revenue generation.

Market Segmentation Analysis:

By Product:

The Colorants and Auxiliaries Market, when segmented by product, includes coating & sizing chemicals and colorants & auxiliaries. The colorants & auxiliaries segment dominates due to its broad application across textiles, packaging, plastics, and construction. It plays a critical role in enhancing the visual appeal, texture, and functionality of materials. The demand for high-performance and sustainable colorants continues to rise, particularly in textiles and industrial coatings. Coating & sizing chemicals also hold a significant share, especially in textile processing, where they improve fabric strength, reduce friction, and prepare surfaces for dye uptake. Growth in technical textiles and performance fabrics supports increased use of advanced coating and sizing agents.

- For instance, Archroma’s EarthColors® line includes 37 dyes certified at the Material Health Certified Gold level by the Cradle to Cradle (C2C) Product Innovation Institute, specifically suited for safe fabric contact in consumer apparel.

By Application:

Based on application, the apparel segment leads due to the consistent global demand for fashion and lifestyle clothing. The Colorants and Auxiliaries Market serves this segment with a wide range of vibrant, durable, and fast-acting dyes and processing chemicals. It supports efficient production cycles and meets evolving consumer preferences in color, texture, and fabric performance. Technical textiles represent a growing application area, driven by industrial, medical, automotive, and protective use cases. The segment requires specialized auxiliaries and functional colorants that offer properties like flame retardancy, UV resistance, and anti-microbial effects. Market participants develop tailored chemical solutions to meet strict performance and compliance standards in this segment. Both application areas present distinct opportunities for innovation and value-driven growth.

- For instance, since its launch in 2017, Archroma’s EarthColors® technology has successfully upcycled more than 50 tons of plant-based agricultural and herbal waste into dyes. This innovative technology uses waste materials like almond shells and rosemary leaves to create a range of sustainable dyes for textiles, replacing traditional petroleum-based dyes.

Segments:

Based on Product Type:

- Coating

- Sizing Chemicals

- Colorants

- Auxiliaries

Based on Application:

- Apparel

- Technical Textiles

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America represents 20% of the global Colorants and Auxiliaries Market, characterized by advanced technology adoption and demand for high-value applications. The United States leads regional growth, followed by Canada and Mexico, with significant demand coming from automotive, construction, and homecare sectors. It emphasizes performance-driven formulations with properties such as UV resistance, flame retardance, and antimicrobial effects. Stringent environmental regulations from the EPA and growing awareness of sustainability continue to influence product development. The region’s focus on automation and smart production methods encourages the adoption of precision chemical solutions in textile processing and plastic coloring. Despite supply chain vulnerabilities, North America remains a vital market for innovation and premium-grade products.

Europe

Europe accounts for about 24% of the global Colorants and Auxiliaries Market, backed by advanced research infrastructure and strong environmental regulations. The region emphasizes sustainable manufacturing practices, with strict regulatory compliance under frameworks like REACH and the European Green Deal. Countries such as Germany, France, and Italy are home to leading specialty chemical producers focused on high-performance, non-toxic formulations. It sees strong demand from technical textiles, automotive coatings, and high-end fashion segments, all requiring premium and tailored solutions. The European market values product quality, safety, and environmental responsibility, which drives consistent investment in biodegradable and bio-based chemical innovations. Despite high operational costs, the region maintains competitiveness through product differentiation and sustainability leadership.

Asia Pacific

Asia Pacific holds the largest share in the Colorants and Auxiliaries Market, accounting for approximately 38% of the global revenue. This dominance stems from the region’s strong industrial base, particularly in textiles, packaging, and plastics manufacturing. Countries such as China, India, Bangladesh, and Vietnam continue to serve as global hubs for textile production, driving high consumption of dyes, pigments, and processing chemicals. It benefits from cost-effective labor, raw material availability, and government support through export incentives and manufacturing schemes. China leads in both production and consumption, supported by robust R&D capabilities and a vast domestic market. India follows with its rapidly growing textile sector and increasing focus on eco-friendly dye technologies. Rising urbanization, middle-class expansion, and growth in retail and apparel segments across Southeast Asia further support market momentum in this region.

Latin America

Latin America contributes around 10% of the global Colorants and Auxiliaries Market. Brazil and Mexico drive regional demand due to their strong textile and consumer goods industries. It benefits from growing urban populations, expanding retail networks, and regional trade agreements that support industrial output. Brazil’s textile exports and Mexico’s position in the North American supply chain help sustain market activity. However, the region faces challenges such as infrastructure limitations and regulatory inconsistencies, which affect manufacturing efficiency and investment inflows. Still, increased focus on local sourcing and rising demand for affordable colorant solutions support steady growth.

Middle East and Africa

The Middle East and Africa hold an 8% share of the global Colorants and Auxiliaries Market. Demand is rising in countries like the UAE, Saudi Arabia, South Africa, and Egypt, where industrial diversification and infrastructure development are key growth drivers. It sees expanding applications in textiles, construction, and consumer packaging. The region benefits from government-backed economic diversification programs and rising investment in local manufacturing. However, limited access to raw materials, skilled labor shortages, and logistical challenges restrict market expansion. Despite these barriers, the region presents long-term potential, especially with increasing demand for consumer goods and processed textiles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DyStar Group

- The Chemours Company

- Huntsman Corporation

- Clariant AG

- LANXESS AG

- Ferro Corporation

- Evonik Industries AG

- BASF SE

- Archroma Management GmbH

- DuPont de Nemours, Inc.

Competitive Analysis

The Colorants and Auxiliaries Market include BASF SE, Clariant AG, DuPont de Nemours, Inc., Huntsman Corporation, Archroma Management GmbH, DyStar Group, LANXESS AG, Evonik Industries AG, The Chemours Company, and Ferro Corporation. The Colorants and Auxiliaries Market is highly competitive, driven by innovation, product performance, and regulatory compliance. Companies compete through diversified portfolios, global distribution, and a focus on sustainable, high-performance solutions. Innovation remains central, with strong investments in R&D to develop bio-based dyes, low-VOC formulations, and multifunctional auxiliaries. Strategic collaborations, acquisitions, and regional expansions further strengthen market presence. Firms emphasize compliance with environmental regulations and seek to reduce ecological impact while maintaining product quality. Price remains a competitive factor, but differentiation through technical support, customization, and regulatory alignment provides a distinct advantage. The market continues to evolve with sustainability and innovation as core growth strategies.

Recent Developments

- In April 2024, BASF SE announced its new portfolio of sustainable polyamides for the textile industry, specifically PA6 and PA6.6, which are certified under the Recycled Claim Standard (RCS).

- In January 2024, Devan Chemicals, a provider of sustainable textile finishes, is excited to announce its upcoming participation in Heimtextil 2024.

- In February 2023, Archroma acquired Huntsman Corporation’s Textile Effects. This move will help Archroma enhance its existing business. The company is set to form a new division known as Archroma Textile Effects.

Market Concentration & Characteristics

The Colorants and Auxiliaries Market shows a moderately consolidated structure, with a mix of global leaders and regional players competing across various end-use sectors. It features strong product diversification, driven by applications in textiles, plastics, packaging, and construction. Large multinational firms maintain a dominant presence due to their extensive distribution networks, advanced R&D capabilities, and ability to meet stringent regulatory standards. It reflects a high degree of specialization, with companies focusing on tailored formulations, sustainability, and functional performance. The market operates under strong regulatory influence, particularly in Europe and North America, where chemical safety and environmental compliance shape product development. Demand patterns vary by region, with Asia Pacific driving volume growth and Europe leading in sustainable innovation. Continuous product innovation, technical expertise, and customer support define the competitive characteristics of this market.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness growing demand for eco-friendly and bio-based colorant solutions across textiles and plastics.

- Companies will increase investment in R&D to develop high-performance, multifunctional auxiliaries.

- Asia Pacific will continue to lead in production and consumption due to its strong manufacturing base.

- Regulatory frameworks will push manufacturers toward safer, non-toxic chemical formulations.

- Digital printing technologies will drive demand for precision color dispersions and compatible auxiliaries.

- End-user industries will prioritize products with enhanced durability, UV resistance, and antimicrobial properties.

- Strategic collaborations and acquisitions will shape global expansion and portfolio diversification.

- Consumer preferences will influence the adoption of sustainable and certified colorant products.

- Local sourcing and regional supply chains will gain importance to mitigate logistics disruptions.

- Market players will focus on customization and technical service to strengthen customer relationships.