Market Overview

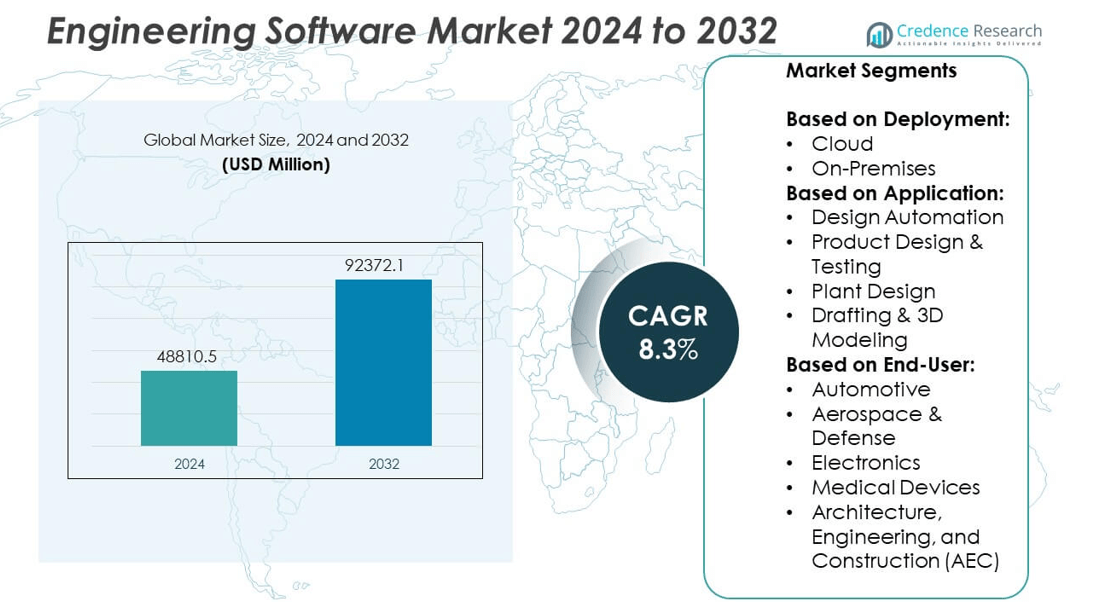

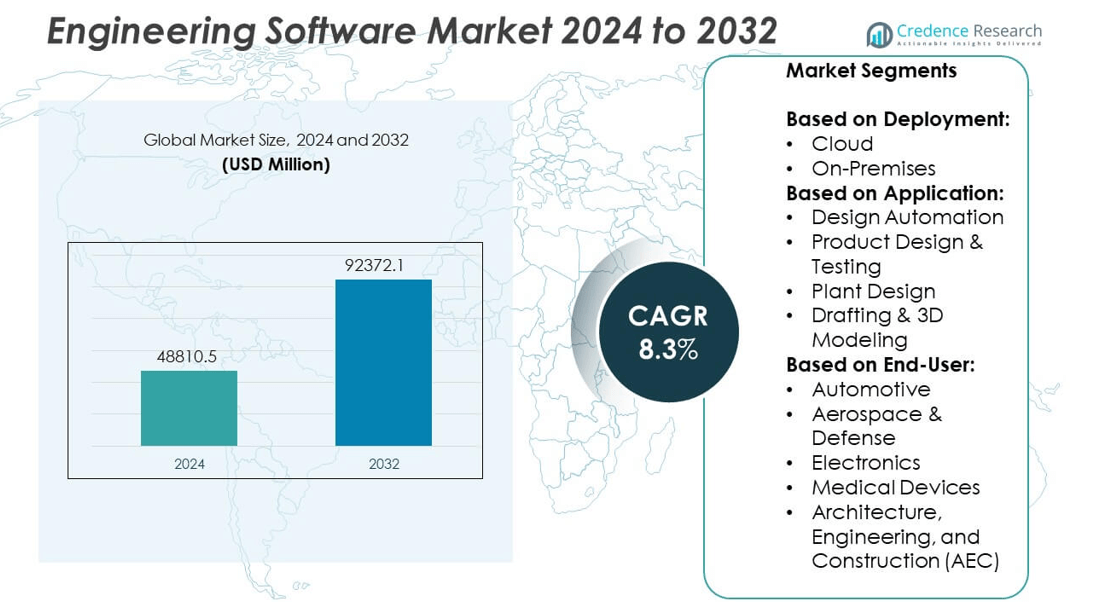

The engineering software market size was valued at USD 48,810.5 million in 2024 and is anticipated to reach USD 92,372.1 million by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Engineering Software Market Size 2024 |

USD 48,810.5 million |

| Engineering Software Market, CAGR |

8.3% |

| Engineering Software Market Size 2032 |

uSD 92,372.1 million |

The engineering software market grows steadily, driven by rising demand for product lifecycle management, advanced simulation tools, and cloud-based platforms that enable efficient collaboration. Industries adopt it to accelerate design cycles, improve accuracy, and reduce costs through automation and AI-powered optimization. Digital twin technology, predictive analytics, and sustainable design solutions shape evolving market trends. Increasing integration with IoT devices enhances real-time monitoring and decision-making. Organizations prioritize scalable, secure, and data-driven platforms to meet complex project requirements. Strong adoption across automotive, aerospace, electronics, and construction sectors reinforces its role as a critical enabler of innovation and operational efficiency.

North America leads the engineering software market with strong adoption in automotive, aerospace, and electronics, supported by advanced R&D capabilities. Europe follows with a focus on sustainable design, digital transformation, and precision engineering in manufacturing and AEC sectors. Asia-Pacific shows rapid growth driven by industrial expansion, smart manufacturing, and rising automation in China, India, and Japan. Key players influencing the market include Autodesk, Inc., Siemens Digital Industries Software, Dassault Systèmes, and ANSYS, Inc., each offering innovative solutions in design, simulation, and lifecycle management. These companies expand through cloud platforms, AI integration, and strategic partnerships to meet evolving industry needs.

Market Insights

- The engineering software market was valued at USD 48,810.5 million in 2024 and is projected to reach USD 92,372.1 million by 2032, registering a CAGR of 8.3% during the forecast period.

- The market benefits from increasing demand for product lifecycle management solutions, advanced simulation tools, and automation capabilities that enhance design accuracy and reduce production costs.

- Key trends include the integration of digital twin technology, AI-powered generative design, cloud-native platforms, and sustainable engineering practices to support energy-efficient product development.

- Competition is shaped by global players such as Autodesk, Inc., Siemens Digital Industries Software, Dassault Systèmes, ANSYS, Inc., and PTC Inc., who expand offerings through cloud deployment, AI integration, and industry-specific solutions.

- High implementation costs, complex integration with legacy systems, and data security risks present challenges to adoption, particularly for small and mid-sized enterprises with limited budgets.

- North America remains a leading region due to advanced R&D and strong industry adoption, Europe focuses on sustainable and precision engineering, Asia-Pacific experiences rapid growth from industrial expansion, while Latin America and the Middle East & Africa show steady potential through infrastructure and industrial modernization.

- Growing opportunities emerge from expanding industrial sectors in emerging economies, increased adoption of cloud platforms, and the convergence of engineering software with IoT, AR, and AI to deliver real-time monitoring, predictive analytics, and improved collaboration across global teams.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Product Lifecycle Management Solutions in Complex Manufacturing Environments

The engineering software market benefits from the rising adoption of product lifecycle management (PLM) tools in industries that handle complex design and production processes. Manufacturers in automotive, aerospace, and electronics seek solutions that integrate design, simulation, and maintenance data. It enables faster innovation cycles and improves collaboration across teams and geographies. PLM systems reduce errors and rework by providing a single source of truth for product information. Companies deploy these tools to support regulatory compliance and traceability requirements. The demand strengthens with the expansion of Industry 4.0 and the integration of digital twins into product development strategies.

- For instance, Siemens Energy used NX, Simcenter, and Teamcenter to implement model-based 3D PMI and digital twin workflows, raising machine tool overall equipment efficiency from 65 percent to 85 percent and cutting part machining time by 25–36 percent while achieving nearly 26 percent CAx cost savings.

Integration of Advanced Simulation and Analysis Tools to Enhance Design Accuracy

Engineering software gains traction through the use of advanced simulation and analysis capabilities that reduce the need for costly physical prototypes. Industries require solutions that model stress, fluid dynamics, and thermal performance under varied conditions. It empowers engineers to validate designs early in the development cycle, lowering costs and time to market. The shift toward electric vehicles and renewable energy systems further drives the need for precise simulations. Organizations value tools that integrate seamlessly with CAD platforms for a unified workflow. Vendors continue to expand capabilities to support multiphysics modeling and cloud-based simulation.

- For instance, Ansys Fluent’s GPU solver, using four NVIDIA L40 GPUs, ran a 14.4-million-cell landing-gear LES simulation 10.5× faster than 120 Intel Xeon Gold CPU cores.

Expansion of Cloud-Based Platforms to Support Remote Collaboration and Scalability

The engineering software market experiences strong momentum from the shift toward cloud-based deployment models. Cloud solutions enable remote teams to access design files, collaborate in real time, and manage version control without infrastructure constraints. It reduces upfront IT investments and offers scalability to match project needs. Organizations appreciate subscription-based pricing models for predictable budgeting. Cloud platforms also enhance integration with IoT devices, allowing real-time performance monitoring. This trend accelerates adoption in small and mid-sized enterprises that require flexibility and global collaboration capabilities.

Rising Focus on Automation and AI-Driven Design Optimization

Automation and artificial intelligence reshape the engineering software landscape by enabling data-driven design improvements. AI-powered tools optimize component shapes, material usage, and manufacturing processes to achieve higher efficiency. It reduces human error and supports consistent quality across projects. Companies leverage AI to analyze large datasets from simulations and field performance, enabling predictive maintenance and informed decision-making. Generative design techniques provide multiple optimized design alternatives within minutes. This capability supports rapid prototyping and aligns with sustainability objectives in manufacturing.

Market Trends

Adoption of Digital Twin Technology for Real-Time Asset Monitoring and Optimization

The engineering software market witnesses increased integration of digital twin technology to improve operational efficiency. Digital twins create a virtual replica of physical assets, enabling real-time performance tracking and predictive analysis. It allows organizations to simulate different scenarios and make data-driven adjustments before implementing changes. Industries such as aerospace, automotive, and energy deploy this technology to reduce downtime and extend asset life. Integration with IoT sensors enhances data accuracy and decision-making capabilities. Vendors invest in expanding interoperability between digital twin platforms and existing engineering software systems.

- For instance, Autodesk’s Fusion 360 platform supports over 2 million active users worldwide with cloud-based CAD, simulation, and collaboration tools that have reduced design iteration cycles by up to 30 percent in engineering teams.

Shift Toward Cloud-Native Engineering Platforms for Greater Accessibility and Scalability

Cloud-native solutions gain prominence in the engineering software sector as enterprises seek flexible and collaborative environments. These platforms provide secure access to design files and tools from any location, improving global team coordination. It supports scalability, enabling organizations to handle varying project loads without hardware limitations. Real-time data synchronization improves productivity and reduces version conflicts. Subscription models make advanced tools accessible to smaller enterprises with limited capital budgets. Providers focus on enhancing security features to address data privacy concerns in cloud deployments.

- For instance, Siemens Digital Industries Software’s AI-driven generative design reduced the weight of automotive components by 4.5 kilograms and shortened development time by 6 months in recent projects.

Integration of Artificial Intelligence for Predictive and Generative Design

The engineering software market incorporates artificial intelligence to streamline design workflows and optimize outputs. AI-driven generative design tools produce multiple design alternatives based on performance and cost constraints. It shortens development cycles and reduces dependency on trial-and-error methods. Predictive analytics enhance maintenance schedules by identifying potential failures before they occur. Industries benefit from AI’s ability to analyze vast datasets from simulations and operational feedback. Continuous improvements in machine learning algorithms expand the potential applications across engineering disciplines.

Emphasis on Sustainable Design Solutions and Energy-Efficient Engineering Practices

Sustainability trends influence the development priorities of engineering software providers. Companies integrate features that evaluate environmental impact, material efficiency, and energy usage during the design phase. It enables compliance with evolving environmental regulations and supports corporate sustainability goals. Tools with lifecycle assessment capabilities help manufacturers choose materials with lower carbon footprints. Renewable energy projects and eco-friendly infrastructure initiatives further drive adoption of sustainability-focused tools. Vendors enhance capabilities to model green technologies such as wind turbines and solar systems with high precision.

Market Challenges Analysis

High Implementation Costs and Complexity of Integration with Legacy Systems

The engineering software market faces challenges from the high costs associated with deployment and customization. Large enterprises often require tailored solutions to integrate with existing workflows and legacy infrastructure, which demands significant time and resources. It becomes more complex when older systems lack compatibility with modern cloud or AI-based platforms. Smaller companies struggle to justify these expenses, delaying adoption despite potential efficiency gains. The need for skilled professionals to manage integration further increases costs. Vendors must address these barriers with more adaptable and cost-effective deployment options.

Data Security Risks and Compliance Pressures in Connected Environments

The widespread adoption of cloud-based and IoT-integrated engineering software introduces heightened concerns about data security. Sensitive design files and intellectual property remain vulnerable to cyber threats, making robust protection measures critical. It becomes a pressing issue in industries handling defense, aerospace, or critical infrastructure projects. Meeting strict regulatory and compliance requirements across multiple jurisdictions adds further complexity. Cybersecurity breaches can lead to operational disruptions, legal liabilities, and reputational damage. Vendors must continuously invest in encryption, authentication protocols, and compliance tools to build user trust.

Market Opportunities

Expansion Potential in Emerging Economies with Rapid Industrialization

The engineering software market holds significant growth potential in regions undergoing rapid industrial development. Emerging economies in Asia-Pacific, Latin America, and parts of Africa invest heavily in infrastructure, manufacturing, and energy projects. It creates demand for advanced design, simulation, and project management tools to enhance efficiency and quality. Local industries seek solutions that meet global standards while addressing regional requirements. Government initiatives promoting smart manufacturing and digital transformation further accelerate adoption. Vendors can gain a competitive edge by offering localized interfaces, language support, and tailored pricing models.

Opportunities from Integration with Advanced Technologies and Sustainable Practices

The convergence of engineering software with AI, IoT, and augmented reality opens new possibilities for innovation. It enables real-time monitoring, predictive analytics, and immersive design experiences that improve accuracy and reduce development cycles. Growing focus on sustainable design practices drives the need for tools that evaluate energy efficiency, material usage, and environmental impact. Industries transitioning to renewable energy systems require specialized modeling and simulation capabilities. Strategic partnerships with hardware providers and cloud service companies enhance value propositions. Vendors that align with sustainability and digital innovation trends can capture new market segments.

Market Segmentation Analysis:

By Deployment:

The engineering software market is segmented into cloud and on-premises deployment models. Cloud-based solutions gain strong traction due to their scalability, remote accessibility, and lower upfront costs. It enables distributed teams to collaborate in real time and manage version control efficiently. Cloud platforms appeal to small and mid-sized enterprises seeking advanced tools without heavy infrastructure investment. On-premises deployment remains relevant for industries requiring strict data security and control, such as defense and aerospace. Organizations with established IT infrastructure often prefer on-premises systems for their customization and integration flexibility.

- For instance, Siemens Digital Industries Software’s Teamcenter on-premises deployment supported a global automotive manufacturer in reducing product data management time by 15,000 man-hours annually through automated workflows and enhanced data integration.

By Application:

Key applications include design automation, product design and testing, plant design, and drafting & 3D modeling. Design automation streamlines repetitive engineering tasks, reducing errors and improving efficiency. Product design and testing tools support virtual prototyping, enabling engineers to validate concepts before physical production. It improves cost control and accelerates time-to-market. Plant design software serves industries such as oil, gas, and power generation, where accurate layouts and safety compliance are critical. Drafting & 3D modeling tools remain essential across sectors for visualizing and refining complex structures.

- For instance, Siemens Digital Industries Software’s Teamcenter on-premises deployment at BMW Group led to a reduction of over 15,000 annual engineering hours through improved data management and workflow automation, supporting over 40,000 users globally.

By End-User:

End-users span automotive, aerospace & defense, electronics, medical devices, and architecture, engineering, and construction (AEC). The automotive sector leverages engineering software for vehicle design, safety simulations, and electric vehicle development. Aerospace & defense industries depend on it for precision engineering, compliance, and lifecycle management. Electronics manufacturers use it for PCB design, thermal analysis, and component optimization. Medical device companies apply these tools to ensure regulatory compliance, patient safety, and design precision. The AEC sector benefits from BIM (Building Information Modeling) and 3D modeling capabilities that improve project planning, cost estimation, and execution efficiency.

Segments:

Based on Deployment:

Based on Application:

- Design Automation

- Product Design & Testing

- Plant Design

- Drafting & 3D Modeling

Based on End-User:

- Automotive

- Aerospace & Defense

- Electronics

- Medical Devices

- Architecture, Engineering, and Construction (AEC)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the engineering software market, accounting for approximately 36% of the global revenue in 2024. The region benefits from strong adoption of advanced design, simulation, and product lifecycle management solutions across automotive, aerospace, and electronics industries. It maintains a leadership position due to the presence of key market players and high R&D investment levels. Industries in the United States and Canada actively adopt AI, IoT, and cloud-based platforms to enhance engineering workflows. The demand is further supported by rapid electric vehicle development, defense modernization programs, and infrastructure upgrades. Government funding for smart manufacturing initiatives strengthens the region’s competitive advantage. Vendors expand cloud and subscription-based offerings to meet the needs of small and mid-sized enterprises alongside large corporations.

Europe

Europe represents around 29% of the global engineering software market share in 2024. The region demonstrates strong demand for software solutions in aerospace, automotive, and architecture, engineering, and construction (AEC) sectors. It benefits from a mature manufacturing base, stringent environmental regulations, and a push for sustainable design practices. Germany, France, and the United Kingdom lead in adoption, with advanced capabilities in digital twin technology, plant design, and lifecycle management. It sees growing investments in renewable energy projects, which require precision engineering and modeling tools. The European Union’s emphasis on digital transformation in manufacturing boosts demand for cloud and AI-driven platforms. Collaboration between software providers and industry leaders drives innovation and market expansion.

Asia-Pacific

Asia-Pacific accounts for approximately 25% of the global engineering software market share in 2024 and exhibits the fastest growth rate among all regions. Rapid industrialization, infrastructure expansion, and the rise of manufacturing hubs in China, India, Japan, and South Korea drive market demand. It benefits from increasing adoption of automation, 3D modeling, and product testing tools to enhance competitiveness. Governments across the region support Industry 4.0 adoption and invest in smart factories, boosting demand for engineering software. The growing presence of electronics and automotive manufacturing clusters accelerates usage of design and simulation platforms. Cloud deployment models gain significant traction in small and mid-sized enterprises seeking cost-effective solutions.

Latin America

Latin America captures around 6% of the global engineering software market share in 2024. The region’s demand is driven by infrastructure modernization, mining projects, and the expansion of manufacturing in Brazil, Mexico, and Argentina. It experiences steady adoption of drafting, plant design, and product testing tools across energy, automotive, and construction industries. Government initiatives to enhance digital capabilities in industrial sectors contribute to gradual market penetration. The availability of localized solutions and competitive pricing models supports adoption among mid-sized enterprises. Cloud-based platforms find growing acceptance in markets with improving internet infrastructure.

Middle East & Africa

The Middle East & Africa region holds roughly 4% of the global engineering software market share in 2024. Demand is fueled by large-scale infrastructure projects, oil and gas facility upgrades, and renewable energy initiatives. It benefits from increased investment in smart city projects and industrial modernization programs in the Gulf Cooperation Council (GCC) countries. South Africa and parts of North Africa witness rising adoption in the construction and energy sectors. Engineering software supports efficient project execution, compliance, and cost control in complex projects. Vendors explore partnerships with local technology providers to expand their reach and adapt to regional requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MathWorks, Inc.

- Altair Engineering, Inc.

- Bentley Systems, Incorporated

- Synopsys, Inc.

- MSC Software Corporation

- Dassault Systèmes

- Aspen Technology, Inc.

- PTC Inc.

- AVEVA Group plc

- Trimble Inc.

- ANSYS, Inc.

- Autodesk, Inc.

- Hexagon AB

- Cadence Design Systems, Inc.

- Siemens Digital Industries Software

Competitive Analysis

The engineering software market features strong competition among leading players such as Autodesk, Inc., Siemens Digital Industries Software, Dassault Systèmes, ANSYS, Inc., PTC Inc., and Bentley Systems, Incorporated. These companies compete through innovation, technological integration, and industry-specific solutions tailored to automotive, aerospace, electronics, construction, and energy sectors. They focus on expanding product portfolios with advanced simulation, generative design, and cloud-based platforms that support remote collaboration and scalability. Strategic acquisitions and partnerships help them enhance capabilities and enter new market segments. Continuous investment in AI, IoT integration, and digital twin technology strengthens their competitive positioning. Pricing strategies, flexible subscription models, and localized solutions enable penetration into emerging markets. Product differentiation is achieved through specialized features such as multiphysics simulation, real-time collaboration tools, and sustainable design analytics. Strong R&D capabilities and robust technical support networks further increase customer retention. The market’s competitive landscape remains dynamic, with companies accelerating digital transformation initiatives to address evolving industrial demands and regulatory compliance needs worldwide.

Recent Developments

- In July 2025, PTC expanded collaboration with NVIDIA by integrating NVIDIA Omniverse technologies into its Creo CAD and Windchill PLM solutions. This enables real-time, photorealistic simulation and immersive design environments, improving collaboration and accelerating product development especially for AI infrastructure hardware.

- In April 2025, Mathworks successfully concluded MATLAB EXPO 2025 India, focusing on software-defined products, scaling AI models, electrification, and next-gen wireless systems, with over 800 participants.

- In June 2023, Hexagon AB introduced the Reality Cloud Studio, featuring HxDR technology. This software-as-a-service application democratizes access to reality capture data, seamlessly blending Hexagon’s advanced technologies with automation. It simplifies data processing, ensuring user-friendliness while maintaining high-quality professional outcomes.

- In February 2022, Dassault Systèmes and Cadence Design Systems, Inc. revealed a partnership, integrating Dassault Systèmes’ 3DEXPERIENCE platform with the Cadence Allegro platform.

Market Concentration & Characteristics

The engineering software market displays a moderately concentrated structure, with a few global leaders holding significant influence through extensive product portfolios and established customer bases. It is characterized by continuous innovation, high R&D investment, and strong integration of emerging technologies such as AI, IoT, and digital twin solutions. The market serves diverse industries, including automotive, aerospace, electronics, medical devices, and construction, each requiring specialized applications. Cloud deployment models, subscription pricing, and scalable platforms shape purchasing decisions, while customization capabilities drive competitive differentiation. It demands compliance with industry-specific regulations and data security standards, influencing solution design and deployment strategies. Competition remains dynamic, with established players leveraging acquisitions, partnerships, and technological advancements to expand market reach and meet evolving global demand.

Report Coverage

The research report offers an in-depth analysis based on Deployment, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing adoption of cloud-based engineering platforms.

- AI-driven design optimization will become a core feature in product development workflows.

- Digital twin technology will see wider use across manufacturing, infrastructure, and energy sectors.

- Sustainability-focused design tools will gain importance to meet environmental regulations.

- Integration with IoT devices will enhance real-time monitoring and predictive maintenance.

- Emerging economies will drive demand through rapid industrialization and infrastructure projects.

- Subscription-based pricing models will continue to replace traditional licensing.

- Cross-industry collaboration will accelerate innovation in engineering applications.

- Cybersecurity features will advance to address growing data protection concerns.

- Augmented and virtual reality will play a larger role in immersive design and simulation.