Market Overview

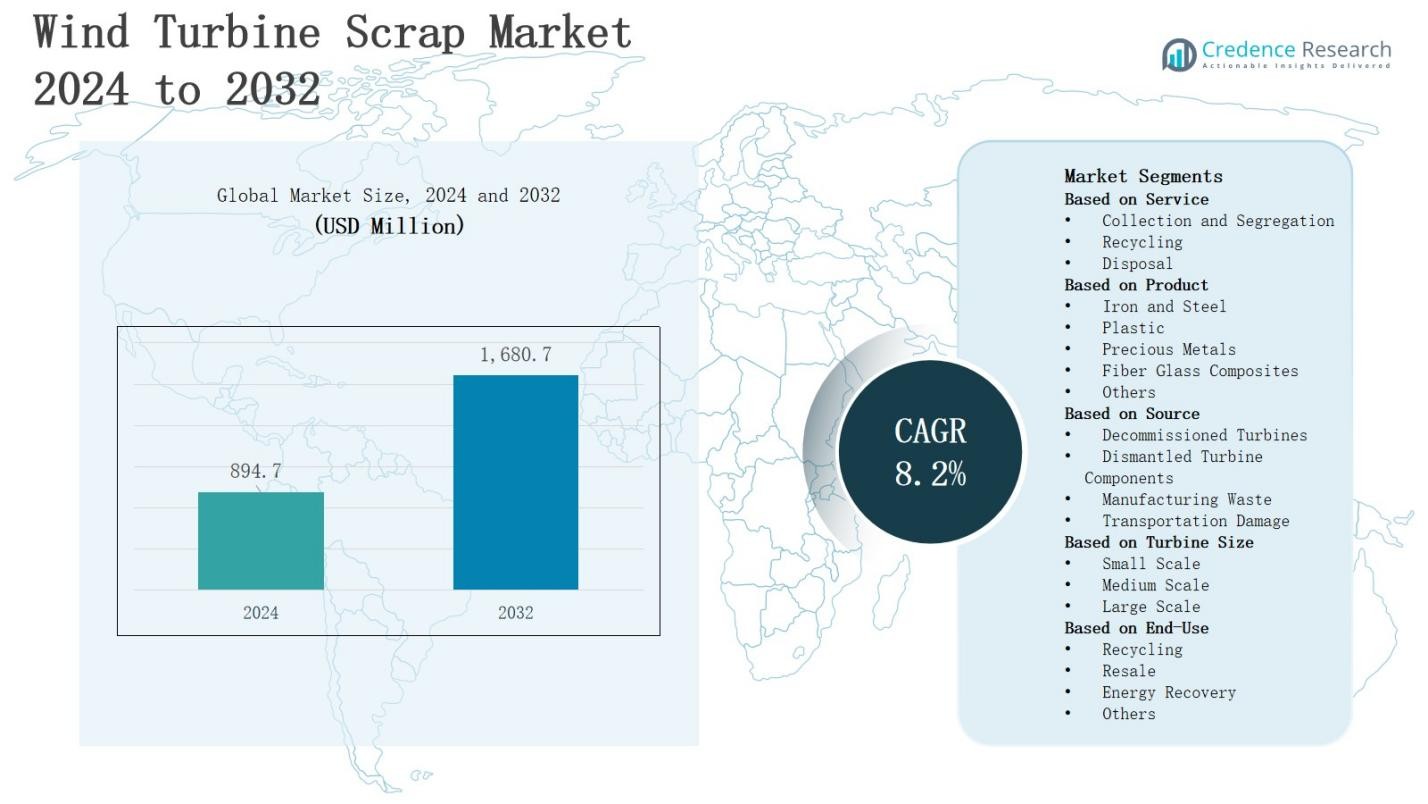

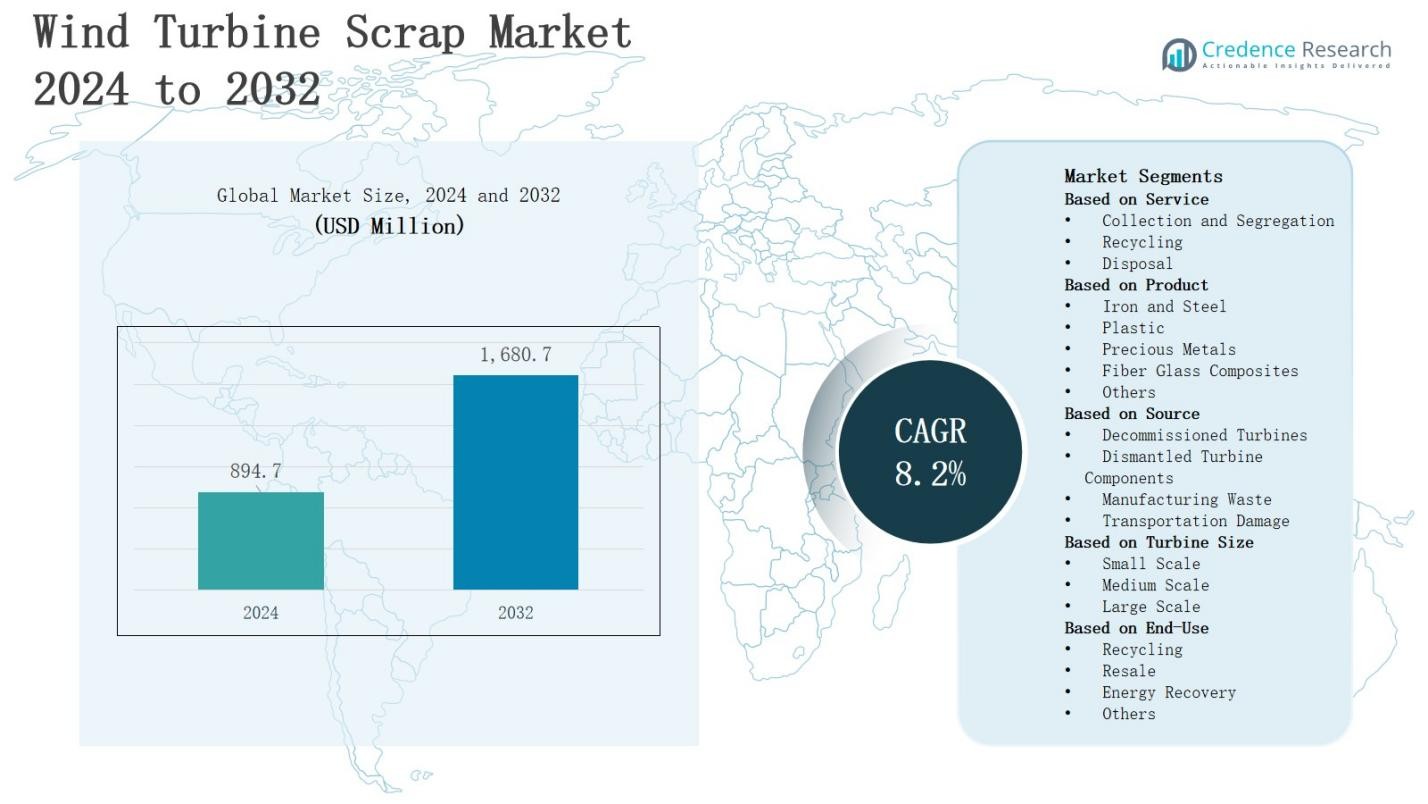

The wind turbine scrap market is projected to grow from USD 894.7 million in 2024 to USD 1,680.7 million by 2032, registering a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wind Turbine Scrap |

USD 894.7Million |

| Wind Turbine Scrap Market, CAGR |

8.2% |

| Wind Turbine Scrap Market Size 2032 |

USD 1,680.7 Million |

The wind turbine scrap market is driven by the increasing decommissioning of aging wind farms, growing emphasis on sustainable waste management, and rising demand for recyclable materials such as steel, copper, and rare earth elements. Stricter environmental regulations and industry initiatives to promote circular economy practices are accelerating adoption of advanced dismantling and recycling technologies. Trends include the development of specialized processing facilities, integration of automation for efficient material recovery, and collaboration between turbine manufacturers and recycling firms to design components with higher recyclability, ensuring economic viability and reducing environmental impact across the wind energy lifecycle.

The wind turbine scrap market spans North America, Europe, Asia-Pacific, and the Rest of the World, each contributing distinct growth drivers and challenges. North America benefits from mature wind infrastructure and advanced recycling systems, while Europe leads with strict environmental regulations and offshore decommissioning projects. Asia-Pacific sees rising scrap volumes from China, India, Japan, and South Korea, supported by policy-driven renewable expansion. The Rest of the World, including Latin America, the Middle East, and Africa, is building capacity. Key players include ACCIONA Energy, GE Renewable Energy, EDP Renewables, Goldwind, and Enercon.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The wind turbine scrap market is projected to grow from USD 894.7 million in 2024 to USD 1,680.7 million by 2032, registering a CAGR of 8.2% during the forecast period.

- Rising decommissioning of aging wind farms is creating large volumes of recyclable materials, driving demand for steel, copper, and rare earth element recovery.

- Growing global demand for recyclable metals and composites supports the economic viability of turbine scrap recovery operations.

- Strict environmental regulations and circular economy initiatives are pushing companies to adopt sustainable dismantling and advanced recycling technologies.

- Technological advancements, including automation, robotics, and AI-based sorting systems, are improving material recovery rates and operational efficiency.

- High transportation and logistics costs, along with complex material separation processes, remain key challenges for recyclers.

- Europe leads with 32% share, followed by North America at 28%, Asia-Pacific at 25%, and the Rest of the World at 15%, with key players including ACCIONA Energy, GE Renewable Energy, EDP Renewables, Goldwind, and Enercon.

Market Drivers

Rising Decommissioning of Aging Turbines

The wind turbine scrap market benefits from the growing number of aging wind farms reaching the end of their operational life. Many turbines installed during the early 2000s are now being decommissioned, generating significant volumes of recyclable materials. It creates opportunities for recovery of steel, copper, and rare earth elements. Industry stakeholders are investing in specialized dismantling processes to maximize resource recovery while meeting environmental regulations and optimizing cost efficiency in scrap management.

- For instance, Vattenfall AB, a leader in wind farm decommissioning, has been actively involved in repowering projects that focus on sustainable recycling and resource recovery.

Growing Demand for Recyclable Materials

The wind turbine scrap market experiences growth due to the rising global demand for recyclable metals and composites. Industries such as construction, automotive, and electronics increasingly source secondary raw materials to reduce costs and emissions. It supports the economic viability of turbine scrap recovery operations. The extraction of high-value rare earth elements from turbine magnets strengthens market potential, fostering investment in efficient material separation and processing technologies.

- For instance, Belson Steel recovered 4,950 tons of wind tower scrap from the Pyron Wind Farm in Texas in 2024, highlighting the increased efforts in scrap recovery from decommissioned turbines.

Stringent Environmental Regulations

The wind turbine scrap market is propelled by strict environmental regulations that require responsible disposal of decommissioned components. Governments enforce compliance with recycling targets, landfill restrictions, and safe waste handling standards. It encourages companies to adopt sustainable dismantling practices and invest in advanced recycling technologies. Regulatory frameworks incentivize manufacturers and operators to implement end-of-life strategies, aligning industry practices with broader environmental and circular economy objectives.

Technological Advancements in Recycling

The wind turbine scrap market is supported by innovations in dismantling, sorting, and recycling processes. Advanced machinery improves material recovery rates, particularly for complex composites and rare earth magnets. It enhances efficiency while lowering operational costs. Automation, robotics, and AI-based sorting systems are increasingly used to optimize recovery operations. These advancements strengthen profitability for recyclers, improve sustainability metrics, and expand the scope of materials that can be reclaimed from decommissioned turbines.

Market Trends

Expansion of Dedicated Recycling Infrastructure

The wind turbine scrap market is witnessing a rapid increase in purpose-built recycling facilities designed to handle turbine components. Specialized plants equipped with advanced shredding, separation, and material recovery systems are emerging in key wind energy regions. It enables higher recycling efficiency for metals, composites, and rare earth elements. Strategic investments from both private and public sectors are driving capacity expansion, reducing transportation costs, and improving local availability of processing solutions for decommissioned turbines.

- For instance, Regen Fiber in Fairfax, Iowa, operates a facility that recycles over 30,000 tons of wind turbine blades annually, producing recycled-content materials used in concrete and asphalt, enhancing their durability and sustainability.

Adoption of Circular Economy Practices

The wind turbine scrap market is aligning with global circular economy goals, with manufacturers and operators prioritizing component reuse and material recovery. Turbine designs are increasingly incorporating features that improve dismantling efficiency and recyclability. It fosters collaboration between engineering teams, recyclers, and policymakers to close material loops. Life-cycle assessments and sustainability certifications are becoming standard, influencing procurement decisions and encouraging eco-friendly practices across the wind energy value chain.

- For instance, LM Wind Power has committed to producing zero waste blades by 2030, aiming to eliminate manufacturing materials sent to landfill and incineration, and is developing next-generation blades that can be more easily recycled.

Innovation in Composite Blade Recycling

The wind turbine scrap market is experiencing advancements in recycling methods for composite blades, historically a major disposal challenge. New chemical and mechanical processes enable the recovery of fibers and resins for use in construction, automotive, and marine industries. It reduces landfill dependency and increases the economic value of scrap recovery. Partnerships between technology developers and recyclers are accelerating the commercialization of scalable, cost-effective solutions for large-scale blade processing.

Integration of Automation and Digital Technologies

The wind turbine scrap market is leveraging automation, robotics, and AI-driven sorting systems to enhance processing accuracy and efficiency. Digital tracking systems monitor scrap flows, ensuring compliance with environmental regulations and optimizing logistics. It improves material purity and reduces operational costs. Advanced monitoring tools also enable predictive maintenance of dismantling equipment, increasing uptime and throughput, while supporting data-driven decision-making for improved recovery strategies and profitability in scrap operations.

Market Challenges Analysis

Complexity of Material Separation and Recovery

The wind turbine scrap market faces significant challenges in separating and recovering diverse materials, especially from composite blades and integrated components. Turbines often contain bonded metals, resins, and rare earth magnets that require specialized processes to dismantle effectively. It increases operational complexity and processing costs, limiting profitability for recyclers. The lack of standardized dismantling methods across regions further complicates recovery efficiency. Operators must invest in advanced machinery and trained personnel to achieve high material purity and compliance with environmental standards.

High Transportation and Logistics Costs

The wind turbine scrap market is hindered by the high costs of transporting large, heavy turbine components from remote wind farm locations to recycling facilities. Many turbines are located in rural or offshore areas, requiring specialized equipment and logistical planning for safe dismantling and delivery. It raises the overall cost of scrap recovery and reduces economic viability, especially for smaller operators. Limited local recycling capacity forces long-distance hauling, adding both financial and environmental burdens to end-of-life turbine management.

Market Opportunities

Emergence of High-Value Material Recovery

The wind turbine scrap market presents strong opportunities through the recovery of high-value materials such as rare earth elements, specialty steels, and high-grade copper. Demand for these materials is rising in sectors like renewable energy, electronics, and electric vehicles. It enables recyclers to expand revenue streams by investing in advanced separation and refining technologies. Developing efficient recovery systems for composite blade fibers and resins further increases profitability. Strategic partnerships between recyclers and manufacturers can secure consistent supply channels for valuable recovered materials.

Growth Potential in Global Recycling Infrastructure

The wind turbine scrap market can benefit from the expansion of regional recycling hubs and processing facilities. Increasing wind farm decommissioning worldwide is creating demand for localized dismantling and recovery solutions. It offers opportunities for private investors and public entities to collaborate on building modern, high-capacity plants. Adoption of sustainable dismantling practices and integration of automation can enhance throughput and reduce costs. Emerging markets with growing wind capacity present significant prospects for establishing advanced recycling operations at an early stage.

Market Segmentation Analysis:

By Service

The wind turbine scrap market is segmented into collection and segregation, recycling, and disposal. Collection and segregation form the initial phase, ensuring efficient material sorting for downstream processes. Recycling holds the largest share, driven by the demand for recovered metals, composites, and rare earth elements. It benefits from technological advancements that improve recovery efficiency. Disposal remains a smaller but necessary segment, addressing non-recyclable materials under strict environmental compliance standards.

- For instance, Carbon Rivers has commercialized a fiberglass recycling process that recovers mechanically intact glass fiber from decommissioned blades, diverting thousands of tons from landfills while upcycling steel components.

By Product

The market includes iron and steel, plastic, precious metals, fiber glass composites, and others. Iron and steel dominate due to their significant share in turbine structures and high recycling value. Precious metals, though lower in volume, offer higher profit margins through rare earth element recovery. It also includes fiber glass composites, which present recycling challenges but growing reuse potential in construction and manufacturing. Plastics and other materials contribute to diverse recovery streams.

- For instance, Siemens Gamesa Renewable Energy developed the RecyclableBlade, the first commercially available wind turbine blade designed to be fully recyclable, helping to drive circular economy efforts in blade end-of-life management.

By Source

The market is categorized into decommissioned turbines, dismantled turbine components, manufacturing waste, and transportation damage. Decommissioned turbines account for the majority share, reflecting the rising number of aging wind farms. Dismantled components from repairs also contribute steadily to scrap availability. It further includes manufacturing waste and materials from transportation damage, which create consistent secondary supply channels. These sources collectively support continuous feedstock for recycling operations, ensuring stable market growth potential.

Segments:

Based on Service

- Collection and Segregation

- Recycling

- Disposal

Based on Product

- Iron and Steel

- Plastic

- Precious Metals

- Fiber Glass Composites

- Others

Based on Source

- Decommissioned Turbines

- Dismantled Turbine Components

- Manufacturing Waste

- Transportation Damage

Based on Turbine Size

- Small Scale

- Medium Scale

- Large Scale

Based on End-Use

- Recycling

- Resale

- Energy Recovery

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 28% share of the wind turbine scrap market, supported by a mature wind energy sector and a growing wave of turbine decommissioning projects. The United States leads with extensive wind farm installations from the early 2000s now reaching end-of-life stages. It benefits from established recycling infrastructure and strong environmental regulations that mandate sustainable disposal. Technological innovations in material recovery further strengthen the region’s market position. Canada contributes with its expanding wind capacity and government-backed renewable energy programs, creating consistent demand for collection, recycling, and specialized disposal services.

Europe

Europe accounts for 32% share of the wind turbine scrap market, driven by its early adoption of wind energy and large installed base. Countries such as Germany, Denmark, and the UK have well-developed dismantling and recycling systems. It is supported by strict EU waste directives and circular economy initiatives, ensuring high recovery rates for metals, composites, and rare earth elements. Ongoing investments in blade recycling technologies enhance processing efficiency. Offshore wind decommissioning in the North Sea region adds to scrap volumes, strengthening the continent’s role as a leader in turbine end-of-life management.

Asia-Pacific

Asia-Pacific holds 25% share of the wind turbine scrap market, with China and India at the forefront of wind energy expansion. Many turbines installed during the past two decades are nearing the end of their operational lifespan, creating a rising scrap stream. It is supported by government-led renewable energy policies and increasing private investment in recycling infrastructure. Japan and South Korea focus on high-value material recovery, particularly rare earth elements. Regional growth is accelerated by ongoing wind farm upgrades and repowering projects.

Rest of the World

The Rest of the World contributes 15% share of the wind turbine scrap market, with activity concentrated in Latin America, the Middle East, and Africa. Brazil, South Africa, and emerging Gulf states are developing recycling capabilities alongside expanding wind energy capacity. It faces challenges such as limited local processing infrastructure, leading to higher transportation costs for scrap materials. However, increasing investment from international recycling firms and renewable energy developers is improving operational capacity. Growing awareness of circular economy benefits supports future demand for sustainable turbine disposal solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The wind turbine scrap market is characterized by a mix of renewable energy operators, recycling specialists, and materials recovery companies competing to enhance efficiency, profitability, and sustainability in end-of-life turbine management. It features established renewable energy firms such as ACCIONA Energy, Acciona S.A, EDP Renewables, EDPR, GE Renewable Energy, China Longyuan Power Group, Enercon, Gamesa Electric, and Goldwind, which are actively integrating decommissioning and recycling strategies into their operations. Specialized recyclers like Belson Steel Center Scrap Inc and Global Fiberglass Solutions focus on advanced material recovery, particularly for steel, copper, and composite blades. Dewind Co. contributes through engineering expertise in dismantling and repowering projects. Companies are investing in blade recycling innovations, rare earth element extraction, and automation technologies to optimize resource recovery. Strategic partnerships between turbine manufacturers and recycling firms are expanding capacity and enabling compliance with strict environmental regulations. Competitive advantage increasingly depends on technological capabilities, operational scale, and the ability to deliver cost-efficient, high-value recovery solutions in a rapidly evolving circular economy framework.

Recent Developments

- In May 2025, Pacific Blue announced the planned decommissioning of the Codrington Wind Farm and initiated collaborations to recycle 14 turbines. The company is exploring creative reuse options, including converting blades into surfboards, glamping pods, and sneakers.

- In May 2025, REGEN Fiber unveiled a patent-pending process capable of recycling 100% of wind turbine blades into reinforcement fibers for concrete, asphalt, and composite products, expanding applications for recovered materials.

- In March 2025, ACCIONA partnered with professional surfer Josh Kerr and his brand Draft Surf to craft the world’s first surfboards made from decommissioned wind turbine blades, under its “Turbine Made” initiative.

- In June 2024, REGEN Fiber opened a new wind turbine blade recycling facility, creating a sustainable source of recycled content for concrete and asphalt producers.

Market Concentration & Characteristics

The wind turbine scrap market demonstrates a moderately fragmented structure with a mix of global renewable energy operators, specialized recyclers, and materials recovery firms. It is characterized by the presence of large-scale companies such as ACCIONA Energy, GE Renewable Energy, EDP Renewables, Goldwind, and Enercon, which integrate decommissioning and recycling into their operational strategies. Regional players and niche recyclers, including Belson Steel Center Scrap Inc and Global Fiberglass Solutions, focus on advanced material recovery from steel, composites, and rare earth elements. The market shows increasing consolidation through partnerships between turbine manufacturers and recycling specialists to enhance processing efficiency and regulatory compliance. It features high technological intensity, with automation, robotics, and AI-based sorting systems improving recovery rates. Environmental regulations, circular economy goals, and rising demand for secondary raw materials influence competition, pushing firms to expand capabilities, optimize logistics, and develop sustainable, high-value recovery solutions to strengthen market position.

Report Coverage

The research report offers an in-depth analysis based on Service, Prroduct, Source, Turbine Size, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced recycling technologies will increase to improve recovery of metals, composites, and rare earth elements.

- Decommissioning volumes will rise as more early-generation wind farms reach the end of their operational life.

- Manufacturers will design turbines with higher recyclability to align with circular economy principles.

- Partnerships between energy companies and recyclers will expand to enhance processing capacity.

- Investment in localized recycling facilities will grow to reduce transportation costs and emissions.

- Automation and AI-driven sorting systems will become standard in large-scale recycling operations.

- Regulatory frameworks will tighten, driving higher compliance requirements for turbine disposal.

- Blade recycling innovations will open new opportunities in construction, automotive, and marine industries.

- Emerging markets will develop recycling infrastructure alongside expanding wind energy capacity.

- High-value material recovery, particularly rare earth elements, will remain a key profitability driver for recyclers.