Market Overview:

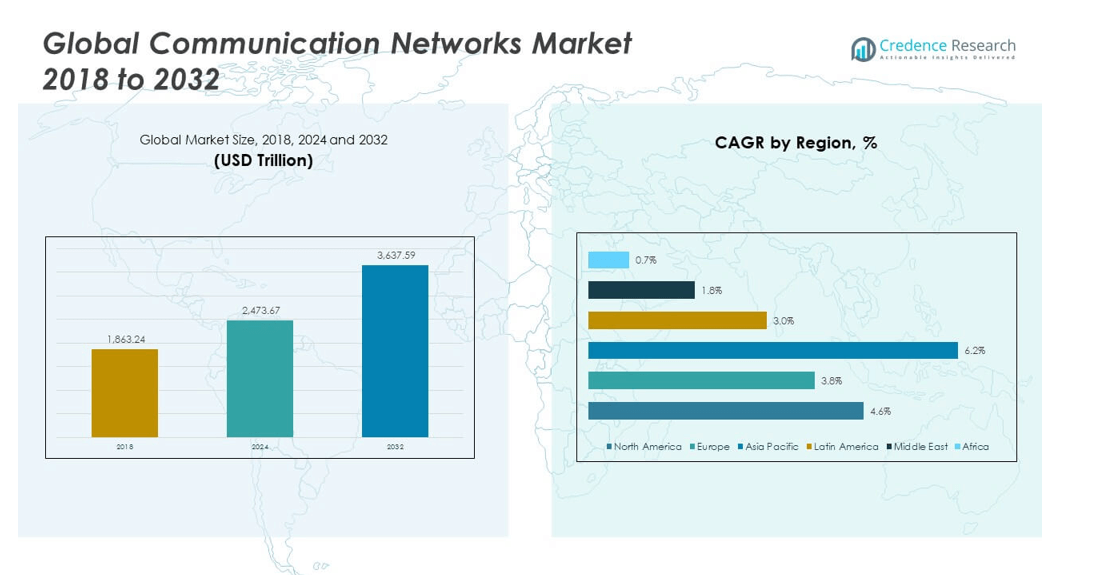

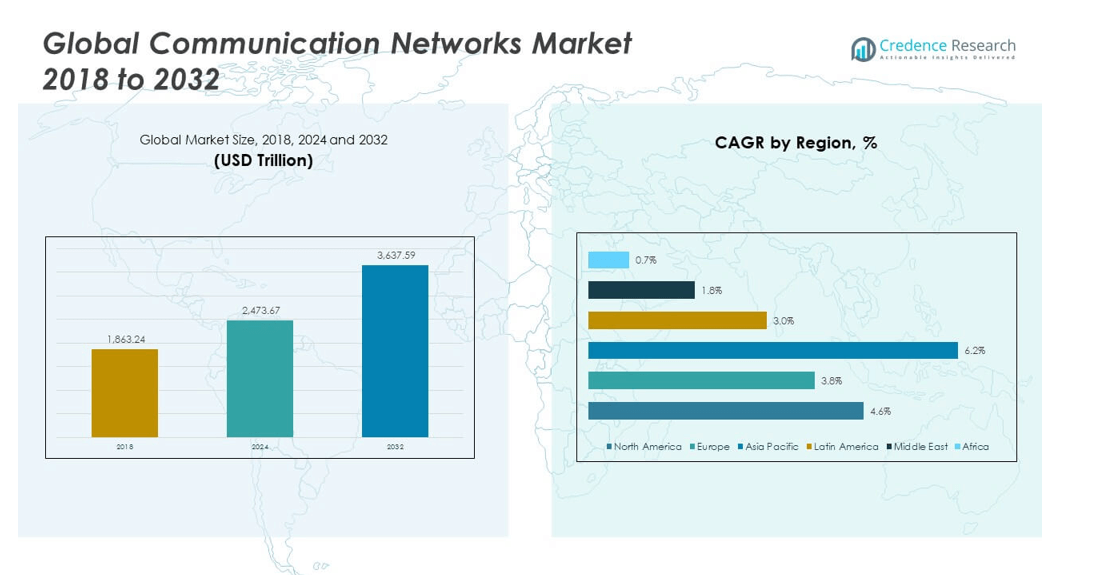

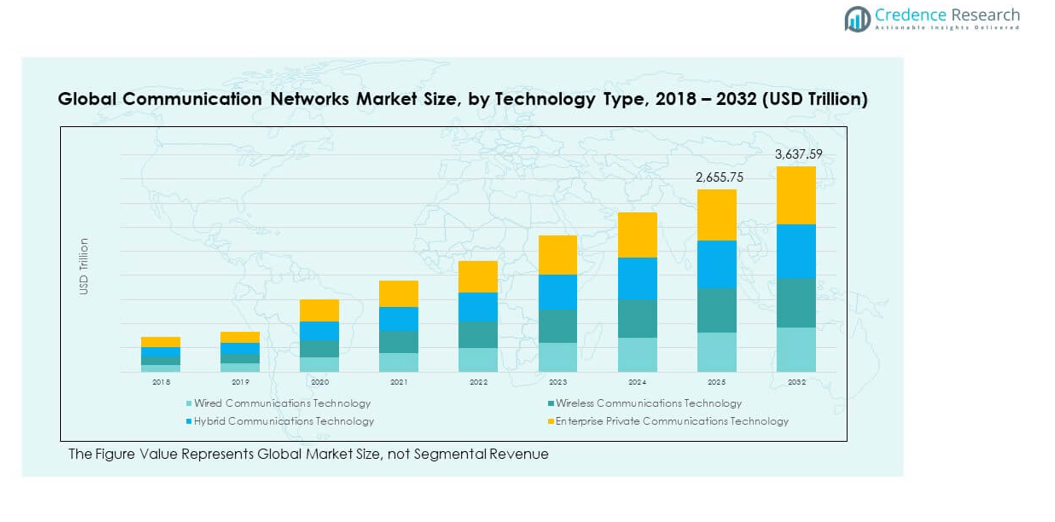

The Global Communication Networks Market size was valued at USD 1,863.24 million in 2018 to USD 2,473.67 million in 2024 and is anticipated to reach USD 3,637.59 million by 2032, at a CAGR of 4.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Communication Networks Market Size 2024 |

USD 2,473.67 million |

| Communication Networks Market, CAGR |

4.60% |

| Communication Networks Market Size 2032 |

USD 3,637.59 million |

The market is driven by rapid advancements in digital infrastructure, growing adoption of 5G networks, and increasing demand for high-speed connectivity across industries. Rising data traffic from IoT devices, cloud services, and streaming platforms is prompting investments in robust communication networks. Enterprises are upgrading to advanced network architectures to enhance reliability, scalability, and security, while governments are supporting nationwide broadband expansion. The push toward smart cities and Industry 4.0 further accelerates the deployment of next-generation communication solutions.

Regionally, North America leads due to its strong technological base, early adoption of advanced network solutions, and significant investments from telecom giants. Europe follows closely, driven by cross-border connectivity projects and digital transformation initiatives. Asia-Pacific is emerging as the fastest-growing region, supported by expanding mobile user bases, rapid urbanization, and government-backed infrastructure projects in countries like China and India. The Middle East and Africa are showing promising growth prospects, fueled by increasing investments in modernizing communication infrastructure and expanding internet penetration rates.

Market Insights:

- The Global Communication Networks Market was valued at USD 2,473.67 million in 2024 and is projected to reach USD 3,637.59 million by 2032, growing at a CAGR of 4.60%.

- Rising demand for high-speed data transmission and low-latency connectivity is accelerating infrastructure upgrades.

- Expansion of IoT ecosystems and industrial automation is boosting adoption of advanced network technologies.

- High capital expenditure requirements and lengthy deployment cycles remain significant challenges.

- Cybersecurity risks from increased interconnectivity are driving the need for stronger security measures.

- North America leads the market, driven by advanced infrastructure and early 5G adoption.

- Asia Pacific is the fastest-growing region, fueled by urbanization, mobile penetration, and large-scale digital initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Accelerating Demand for High-Speed Data Transmission Across Sectors

The Global Communication Networks Market is expanding due to the surging requirement for faster and more reliable data transmission in both consumer and enterprise segments. Businesses are adopting advanced network infrastructure to handle growing volumes of data from IoT devices, connected systems, and cloud platforms. Consumers demand seamless connectivity for video streaming, gaming, and remote collaboration tools. Telecom operators are deploying fiber-optic networks and upgrading to 5G to meet performance benchmarks. The increase in remote work models drives higher network capacity investments. Industries such as healthcare and manufacturing are integrating connected systems that require low-latency communication. Government initiatives for broadband expansion further stimulate network deployments. This consistent demand is encouraging infrastructure upgrades worldwide.

Expansion of IoT Ecosystem and Industrial Automation Requirements

Industrial automation and IoT adoption are creating substantial growth prospects for the Global Communication Networks Market. Factories, logistics hubs, and utilities are integrating connected devices for real-time monitoring and control. These applications require networks with high bandwidth, low latency, and strong security protocols. Smart city projects are leveraging IoT-driven communication infrastructure to enhance services such as traffic management and energy distribution. The automotive sector’s move toward connected and autonomous vehicles further boosts demand for resilient networks. Utility companies deploy advanced metering infrastructure that relies on stable communication links. Enterprises are prioritizing private 5G networks to secure industrial data flows. This shift is prompting increased investments in scalable, high-performance communication systems.

Rising Cloud Adoption and Need for Data Center Interconnectivity

Cloud computing expansion is directly influencing the growth trajectory of the Global Communication Networks Market. Enterprises are migrating workloads to hybrid and multi-cloud environments that require secure, high-capacity interconnections. Data centers need robust network solutions to facilitate seamless workload distribution and disaster recovery capabilities. Cloud-based applications in sectors such as banking, retail, and healthcare demand uninterrupted connectivity. The adoption of SaaS platforms fuels higher dependency on optimized network routes. Edge computing deployments require network designs that minimize latency between endpoints and processing nodes. Telecom operators are forming partnerships with cloud providers to integrate network services with application delivery. The combined demand from cloud and edge ecosystems strengthens the need for continuous network upgrades.

- For example, AWS, Microsoft Azure, and Google Cloud are expanding hyperscale campuses to support large-scale AI and machine learning workloads. They use high-capacity fiber-optic backbones with advanced WDM technologies to ensure low-latency data center interconnection and strong disaster recovery, though exact capacity figures are not publicly disclosed.

Government Policies Supporting Digital Infrastructure Expansion

Government-driven initiatives are a significant catalyst for the Global Communication Networks Market. National broadband plans, spectrum auctions, and funding programs for underserved regions are enabling faster network rollouts. Public investments in rural connectivity projects aim to bridge the digital divide. Policies promoting 5G spectrum allocation accelerate commercial deployments. Incentives for telecom infrastructure development attract private sector participation. Regulatory frameworks are evolving to support emerging technologies such as satellite internet and open RAN solutions. Governments are also mandating cybersecurity standards to protect communication networks from threats. Collaborative efforts between public agencies and private companies are ensuring faster deployment timelines. This coordinated approach ensures long-term network modernization.

- For instance, the U.S. Bipartisan Infrastructure Law dedicates $42.45 billion for broadband infrastructure, prioritizing fiber projects, while the Affordable Connectivity Program provides a $14.2 billion subsidy for broadband affordability.

Market Trends

Integration of Artificial Intelligence for Network Optimization

The Global Communication Networks Market is witnessing a surge in AI-driven solutions for network management and optimization. Operators deploy AI algorithms to predict traffic patterns, detect faults, and automate maintenance activities. AI-powered analytics enable real-time decision-making, enhancing network reliability and efficiency. Predictive maintenance reduces downtime and operational costs. AI is improving spectrum management in 5G and beyond. Machine learning models support dynamic resource allocation, improving quality of service for end-users. AI-enhanced security systems identify and mitigate cyber threats faster. This technological integration is transforming network operations into more adaptive and self-healing ecosystems.

Emergence of Software-Defined Networking and Virtualization Models

Software-defined networking (SDN) and network function virtualization (NFV) are reshaping the operational landscape of the Global Communication Networks Market. These technologies decouple network functions from physical hardware, enabling more flexible and scalable infrastructure. Service providers can introduce new services faster through centralized control. Virtualization reduces capital expenditure by optimizing hardware usage. Enterprises leverage SDN for improved network visibility and agility. NFV supports faster deployment of services such as firewalls, load balancers, and VPNs without physical installations. This model enhances disaster recovery capabilities by enabling quick reconfiguration of network routes. The shift toward programmable networks is becoming a competitive differentiator.

Growth in Satellite-Based Communication Services

The Global Communication Networks Market is expanding with increased adoption of satellite communication systems. Low-Earth orbit (LEO) satellite constellations are delivering high-speed connectivity to remote and underserved regions. Enterprises in maritime, aviation, and energy sectors rely on satellite links for operational continuity. Governments use satellite networks for disaster response and defense communications. Advancements in satellite manufacturing and launch technologies reduce operational costs. Integration of satellite and terrestrial networks ensures seamless connectivity. Satellite-based IoT services are enabling new applications in agriculture, environmental monitoring, and logistics. This segment is gaining strategic importance in the global connectivity ecosystem.

- For example, SpaceX’s Starlink operates the world’s largest satellite constellation, comprising thousands of mass-produced low-Earth orbit (LEO) satellites that deliver high-speed internet access to remote and underserved regions. Its network continues to expand, reinforcing its leading position in global satellite connectivity.

Edge Computing Adoption Enhancing Network Efficiency

The Global Communication Networks Market is experiencing strong momentum in edge computing adoption. Enterprises deploy edge infrastructure to process data closer to its source, reducing latency and bandwidth usage. This model supports applications in autonomous vehicles, industrial automation, and augmented reality. Telecom providers integrate edge computing with 5G networks to deliver low-latency services. Content delivery networks leverage edge nodes to improve streaming quality. Edge deployments enhance cybersecurity by localizing sensitive data. The healthcare sector uses edge computing for real-time diagnostics and remote patient monitoring. This trend is driving demand for distributed, high-capacity network designs.

- For instance, Hewlett Packard Enterprise (HPE) has deployed Edgeline systems and the GreenLake platform to deliver ruggedized, converged compute and data acquisition capabilities in industrial and edge environments, supporting real-time decision-making and OT-IT integration across a customer base of 61,000 employees.

Market Challenges Analysis

High Capital Expenditure and Long Deployment Cycles Impacting Rollouts

The Global Communication Networks Market faces the challenge of significant upfront investments in infrastructure. Deploying fiber-optic lines, 5G base stations, and satellite networks requires substantial financial resources. Many operators struggle to secure funding, especially in emerging markets. Long deployment timelines delay revenue realization for service providers. The complexity of integrating new technologies with existing infrastructure further increases costs. Regulatory approvals and site acquisition processes extend project schedules. Economic uncertainties affect operators’ ability to commit to large-scale rollouts. This capital-intensive nature limits the pace of network modernization.

Cybersecurity Threats and Operational Vulnerabilities in Complex Networks

The Global Communication Networks Market encounters growing cybersecurity risks due to increased interconnectivity and diverse endpoints. Expanding IoT deployments create more entry points for cyberattacks. Service disruptions from ransomware or DDoS attacks can damage brand reputation. Securing multi-vendor networks poses challenges for operators. The adoption of virtualized and cloud-based networks requires enhanced security protocols. Regulatory compliance demands continuous monitoring and reporting. Operators face difficulty in balancing network performance with robust security measures. The evolving threat landscape compels constant investment in advanced defense mechanisms.

Market Opportunities

Expansion Potential in Emerging Economies and Rural Connectivity Projects

The Global Communication Networks Market has strong prospects in developing regions with low internet penetration. Governments and private operators are investing in rural broadband initiatives. Affordable device availability is encouraging network adoption in underserved areas. Telecom providers can capture new customer bases by offering localized service packages. Satellite-based and wireless broadband solutions are enabling cost-effective rural deployments. The rising demand for e-learning, telemedicine, and digital banking in these areas boosts connectivity requirements. Partnerships with local enterprises enhance market penetration strategies.

Integration with Next-Generation Technologies for High-Value Services

The Global Communication Networks Market can leverage emerging technologies to create differentiated service offerings. Integration with AI, IoT, and edge computing enables premium solutions for enterprises. Private 5G networks provide opportunities in sectors such as manufacturing, logistics, and energy. Cloud service partnerships open avenues for bundled offerings. Smart city projects demand advanced communication infrastructure. Network slicing in 5G environments allows customized solutions for diverse industry needs. These innovations strengthen revenue streams and long-term customer engagement.

Market Segmentation Analysis:

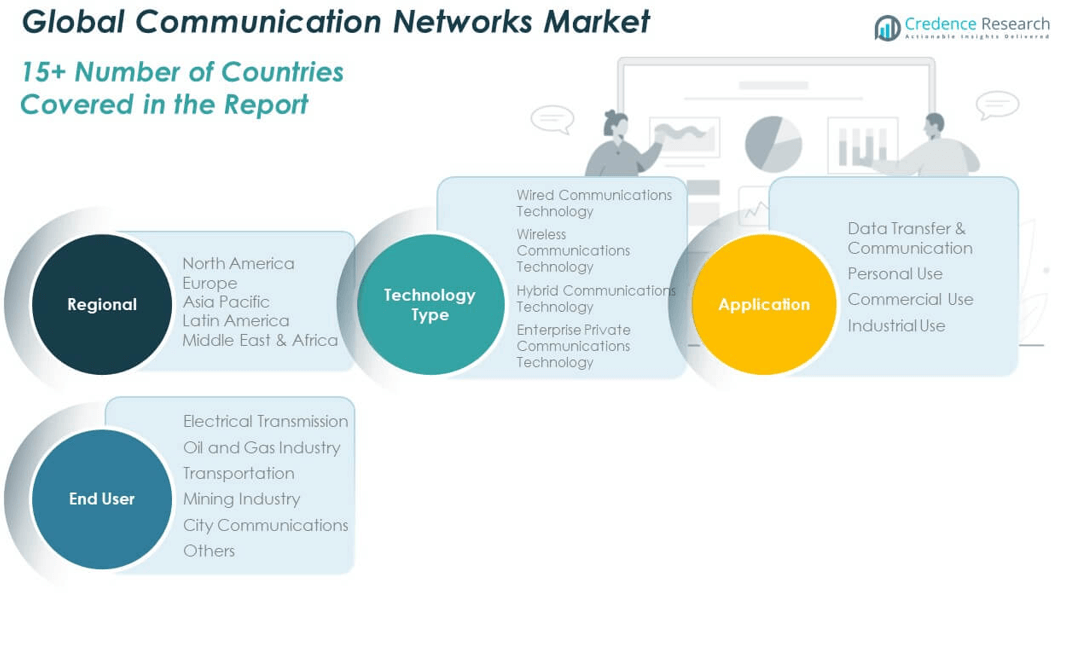

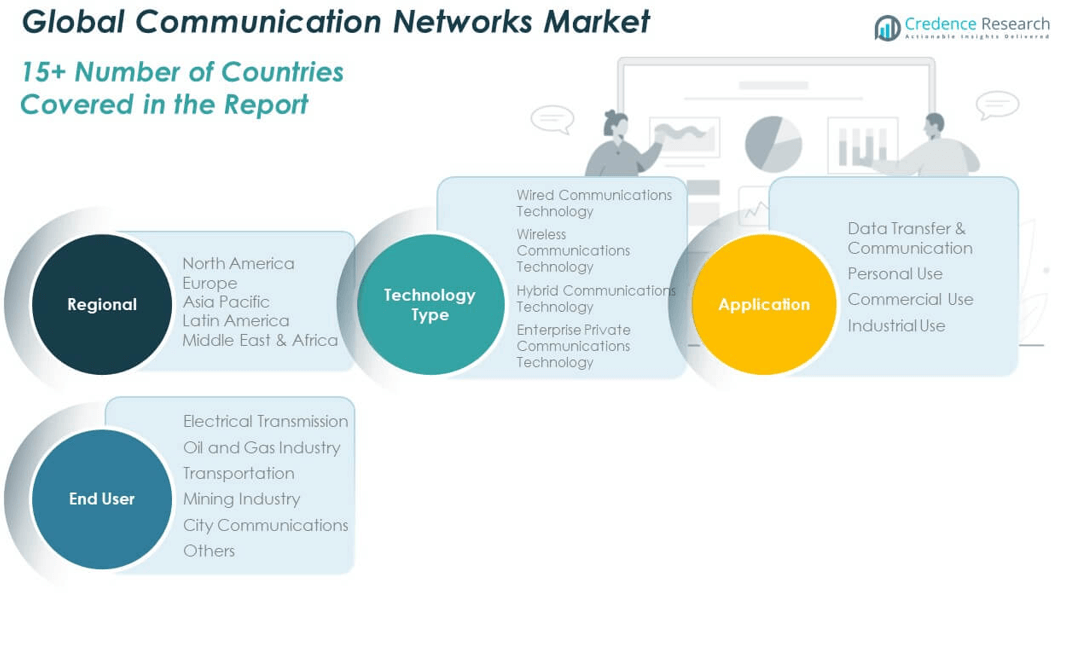

The Global Communication Networks Market is structured across technology type, application, and end user segments, reflecting diverse operational needs and deployment environments.

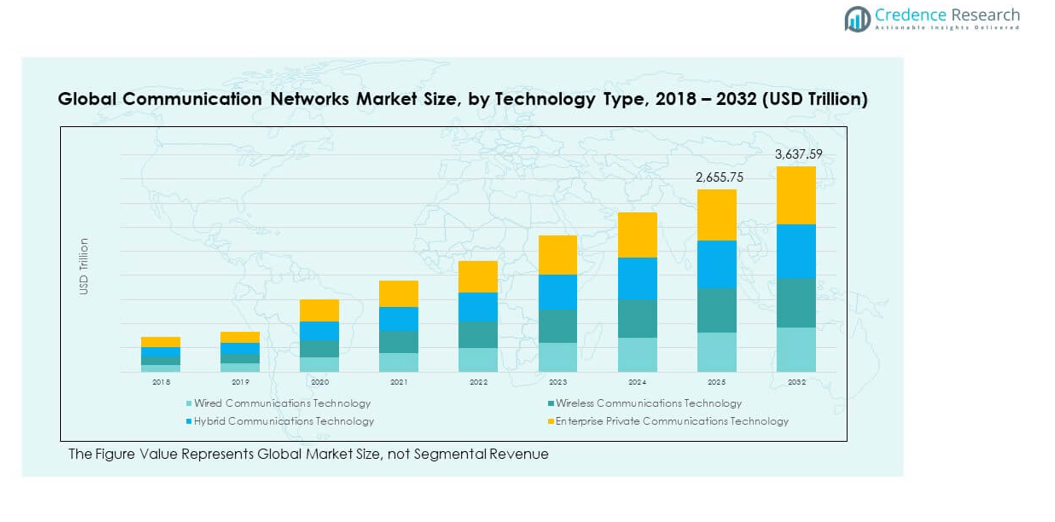

By technology type, wired communications technology remains a preferred choice for stable, high-capacity connections in enterprise and industrial settings. Wireless communications technology leads in mobility and scalability, supporting large-scale consumer adoption and emerging 5G services. Hybrid communications technology combines wired reliability with wireless flexibility, appealing to organizations seeking resilience. Enterprise private communications technology serves specific operational requirements, enabling secure, dedicated connectivity for critical applications.

- For example, Siemens’ use of Industrial Ethernet in manufacturing, particularly via PROFINET, demonstrates robustness and performance. PROFINET RT can support cycle times around 1 ms in practical industrial setups.

By application, data transfer and communication dominate due to the exponential growth in digital services, cloud integration, and IoT deployments. Personal use covers consumer-driven activities such as streaming, social media, and virtual communication. Commercial use spans corporate connectivity, retail networks, and service delivery platforms. Industrial use demands low-latency, high-reliability networks for automation, monitoring, and remote operations.

By end user, electrical transmission operators rely on robust networks for grid management and smart metering. The oil and gas industry adopts specialized systems for offshore, onshore, and pipeline monitoring. Transportation networks integrate advanced communication for traffic control, fleet management, and passenger services. The mining industry leverages ruggedized networks for remote site operations. City communications support public safety, infrastructure management, and smart city initiatives. Other end users include sectors with niche or mixed communication requirements, reflecting the market’s adaptability across industries.

- For example, Great Britain’s national smart meter network connects over 30 million devices, operated via the DCC. These connections provide real-time data to energy suppliers and distribution operators like National Grid, helping optimize grid performance and support efficient network management.

Segmentation:

By Technology Type

- Wired Communications Technology

- Wireless Communications Technology

- Hybrid Communications Technology

- Enterprise Private Communications Technology

By Application

- Data Transfer & Communication

- Personal Use

- Commercial Use

- Industrial Use

By End User

- Electrical Transmission

- Oil and Gas Industry

- Transportation

- Mining Industry

- City Communications

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global Communication Networks Market size was valued at USD 821.92 million in 2018 to USD 1,079.98 million in 2024 and is anticipated to reach USD 1,592.50 million by 2032, at a CAGR of 4.6% during the forecast period. It holds a market share of 43.65% in 2024, driven by advanced digital infrastructure and early adoption of 5G technologies. The region benefits from significant investments by major telecom operators and technology companies, enhancing network capacity and reliability. Demand is strong across enterprise, industrial, and consumer applications, with robust growth in IoT deployments. Cloud adoption and data center expansion further strengthen network requirements. Government programs promoting rural broadband expansion contribute to wider coverage. Strategic partnerships between network providers and technology vendors accelerate innovation. The competitive landscape features global leaders with extensive service portfolios, supporting continuous technological upgrades.

Europe

The Europe Global Communication Networks Market size was valued at USD 526.08 million in 2018 to USD 673.13 million in 2024 and is anticipated to reach USD 931.65 million by 2032, at a CAGR of 3.8% during the forecast period. It commands a 27.21% market share in 2024, supported by strong regulatory frameworks and cross-border connectivity initiatives. The region focuses on digital transformation in manufacturing, transportation, and public services. Investments in 5G and fiber-optic networks are accelerating, particularly in Western Europe. Eastern European markets are expanding through infrastructure modernization programs. Enterprises are adopting private network solutions to enhance operational efficiency. Sustainability goals drive energy-efficient network deployments. Strategic funding from the EU supports innovation in communication infrastructure. The market benefits from a mature telecom sector and collaborative technology development.

Asia Pacific

The Asia Pacific Global Communication Networks Market size was valued at USD 361.90 million in 2018 to USD 520.37 million in 2024 and is anticipated to reach USD 865.77 million by 2032, at a CAGR of 6.2% during the forecast period. It represents a 21.04% market share in 2024, driven by rapid urbanization, a growing mobile user base, and expanding broadband penetration. Major economies such as China, Japan, India, and South Korea lead in network infrastructure investments. Government-backed programs for smart cities and digital inclusion stimulate market growth. The rollout of 5G networks is accelerating across metropolitan and rural areas. Cloud adoption and industrial IoT demand are expanding the need for high-performance networks. Technology providers are focusing on scalable, cost-efficient solutions to address diverse market needs. Cross-border connectivity projects strengthen regional integration. The competitive landscape includes both global leaders and strong domestic players.

Latin America

The Latin America Global Communication Networks Market size was valued at USD 88.21 million in 2018 to USD 115.65 million in 2024 and is anticipated to reach USD 150.57 million by 2032, at a CAGR of 3.0% during the forecast period. It accounts for a 6.14% market share in 2024, with demand driven by increasing digitalization across enterprises and public services. Countries such as Brazil and Mexico lead regional adoption of advanced network solutions. Investment in fiber and wireless broadband infrastructure is growing, particularly in urban centers. Rural connectivity programs aim to reduce the digital divide. Cloud services and e-commerce expansion create additional network capacity requirements. Regulatory reforms are encouraging competition and private sector participation. Partnerships between telecom operators and technology firms support service innovation. The market outlook remains positive with opportunities in both consumer and enterprise segments.

Middle East

The Middle East Global Communication Networks Market size was valued at USD 43.08 million in 2018 to USD 51.25 million in 2024 and is anticipated to reach USD 60.81 million by 2032, at a CAGR of 1.8% during the forecast period. It holds a 2.72% market share in 2024, characterized by steady investment in telecom modernization. Gulf Cooperation Council (GCC) countries lead regional advancements with smart city projects and 5G rollouts. Public sector initiatives focus on enhancing digital services and economic diversification. Enterprise adoption of private networks is increasing in energy, logistics, and finance sectors. Satellite communication plays a key role in remote area connectivity. Regulatory frameworks are evolving to support new technologies and international collaboration. Regional operators are investing in high-capacity fiber networks. The market faces challenges from geopolitical uncertainties but remains resilient through diversified investments.

Africa

The Africa Global Communication Networks Market size was valued at USD 22.06 million in 2018 to USD 33.30 million in 2024 and is anticipated to reach USD 36.30 million by 2032, at a CAGR of 0.7% during the forecast period. It captures a 1.34% market share in 2024, driven by gradual improvements in digital infrastructure. Mobile networks dominate connectivity due to limited fixed-line infrastructure. Governments and private operators are expanding broadband access in urban and semi-urban areas. International funding supports undersea cable projects, enhancing global connectivity. Telecom operators are focusing on affordable, scalable solutions to reach underserved communities. Adoption of mobile banking and e-learning services is boosting network demand. Energy constraints and regulatory hurdles pose challenges to faster growth. The market is gradually progressing toward higher-capacity, more resilient networks to support future demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cisco Systems

- Huawei Technologies

- Siemens

- ABB

- Fujitsu

- Verizon

- Xylem

- Ashley Electronics

- COMnet Solutions

- Deerns

Competitive Analysis:

The Global Communication Networks Market features a competitive landscape dominated by multinational technology companies, telecom operators, and specialized network solution providers. Leading players such as Cisco Systems, Huawei Technologies, Siemens, ABB, Fujitsu, and Verizon maintain strong market positions through broad product portfolios and advanced R&D capabilities. It is characterized by continuous innovation in 5G, IoT integration, and cloud-based networking solutions. Strategic partnerships, mergers, and acquisitions are common to expand geographic reach and enhance service offerings. Regional players compete by delivering cost-effective, localized solutions tailored to specific market needs. Competitive differentiation relies on technological innovation, network reliability, and service scalability. The presence of both global and regional competitors creates a balanced mix of established leaders and agile emerging firms.

Recent Developments:

- In July 2025, Ericsson completed the Aduna joint venture with 12 global communication service providers. This partnership aims to sell aggregated network APIs worldwide, a move designed to enable broader access to network services and advanced capabilities for developers and enterprises across international markets. The collaboration signals a push for greater interoperability and market reach by leveraging shared resources among leading service providers.

- In March 2025, the PR World Alliance formed a strategic partnership with the MISSION Hubs Network. This alliance, effective April 1, 2025, is focused on jointly expanding global communication and marketing networks. Both organizations have agreed to offer each other’s member agencies and clients access to a broad range of expertise, including AI development, SEO, and digital services.

- In September 2024, EXA Infrastructure announced the acquisition of Global Communication Net AD (GCN), a Bulgarian telecommunications company, marking a key expansion of EXA’s assets in South-Eastern Europe. The acquisition, expected to complete in the fourth quarter of 2024, will integrate GCN’s 2,500km fiberoptic network into EXA’s extensive infrastructure.

Market Concentration & Characteristics:

The Global Communication Networks Market demonstrates moderate to high concentration, with a few global leaders controlling significant market share across multiple regions. It is marked by high capital requirements, advanced technological capabilities, and extensive infrastructure networks. Competitive advantages stem from innovation, strategic alliances, and large-scale deployment capacity. The market is innovation-driven, with frequent product upgrades and integration of emerging technologies to meet evolving connectivity demands. Regulatory compliance and cybersecurity remain critical competitive factors. Regional markets often feature niche players focusing on tailored solutions for specific industries or geographies.

Report Coverage:

The research report offers an in-depth analysis based on Technology Type, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Deployment of advanced 5G infrastructure will enhance connectivity speed and support emerging applications.

- Expansion of IoT ecosystems will create sustained demand for high-capacity, low-latency networks.

- Integration of AI and machine learning will improve network efficiency, predictive maintenance, and security.

- Growth in edge computing adoption will drive the need for distributed, high-performance network architectures.

- Cloud migration across industries will increase requirements for secure, scalable interconnectivity solutions.

- Development of smart cities will accelerate investment in integrated communication infrastructure.

- Satellite communication advancements will expand coverage to remote and underserved regions.

- Rising cybersecurity threats will prompt increased investment in advanced defense systems.

- Collaboration between telecom providers and technology firms will foster innovation in service delivery.

- Regulatory initiatives promoting universal connectivity will expand market reach across developing regions.