Market Overview:

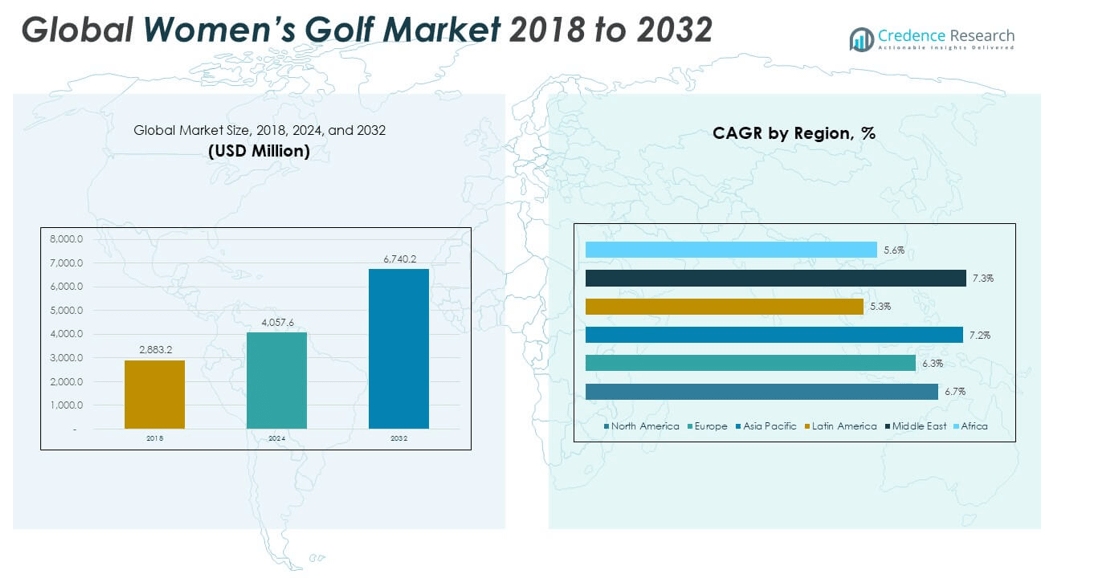

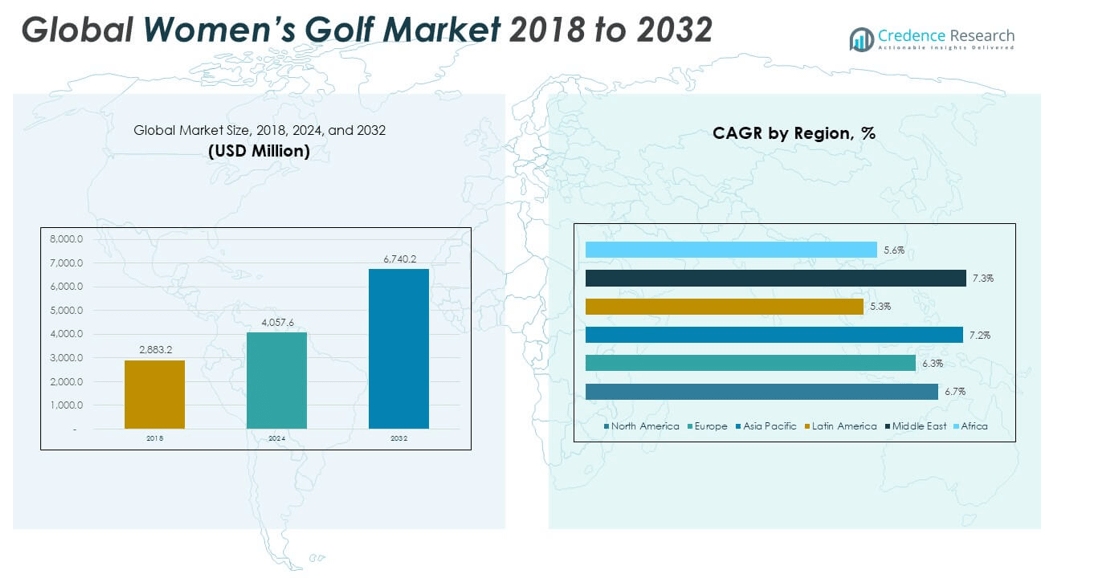

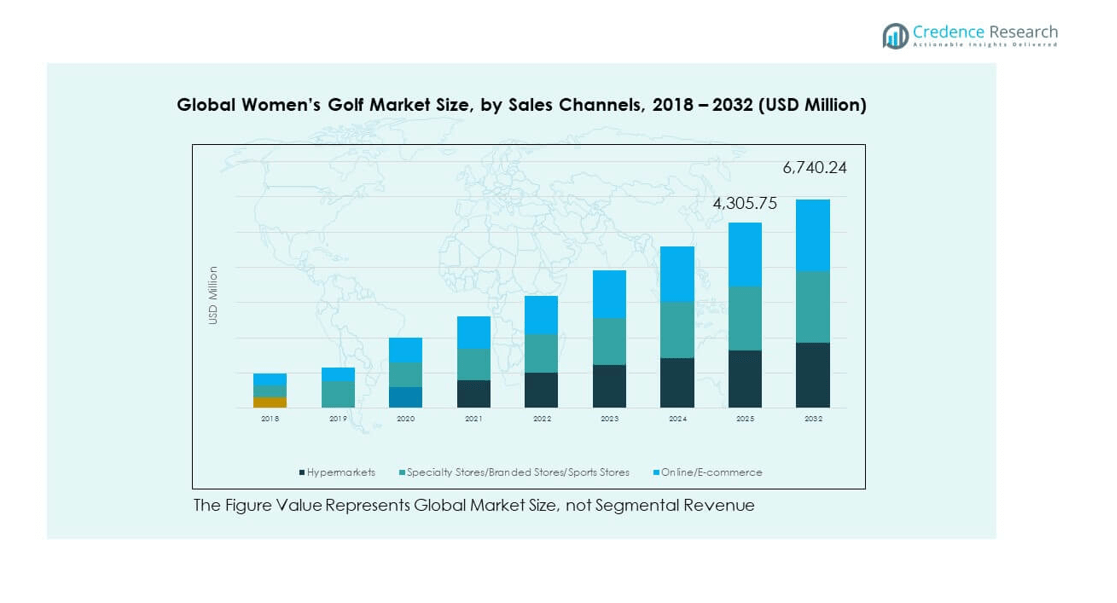

The Global Women’s Golf Market size was valued at USD 2,883.2 million in 2018 to USD 4,057.6 million in 2024 and is anticipated to reach USD 6,740.2 million by 2032, at a CAGR of 6.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Women’s Golf Market Size 2024 |

USD 4,057.6 million |

| Women’s Golf Market, CAGR |

6.61% |

| Women’s Golf Market Size 2032 |

USD 6,740.2 million |

The market is experiencing robust growth driven by rising female participation in golf, supported by increasing professional tournaments, sponsorship opportunities, and the expansion of women-focused golf apparel and equipment lines. Lifestyle changes and the growing perception of golf as a fitness and networking activity are attracting younger demographics. Moreover, the influence of social media and celebrity endorsements is fueling brand engagement, while advancements in training technologies and inclusive club policies are creating a more welcoming environment for new entrants.

Regionally, North America leads the market due to a strong golfing culture, established infrastructure, and active participation across various age groups. Europe follows closely, benefiting from heritage golf destinations and a steady increase in women’s tournaments. The Asia-Pacific region is emerging rapidly, driven by rising interest in countries like South Korea, Japan, and China, supported by governmental sports initiatives and the global visibility of Asian women golfers. The Middle East also shows growing potential with luxury golf tourism and international event hosting.

Market Insights:

- The Global Women’s Golf Market was valued at USD 4,057.6 million in 2024 and is projected to reach USD 6,740.2 million by 2032, growing at a CAGR of 6.61%.

- Rising female participation in professional and amateur golf, supported by tournaments, sponsorships, and grassroots programs, is driving sustained demand.

- Technological advancements in equipment design, including lighter clubs and digital training aids, are enhancing player performance and market appeal.

- High infrastructure costs, membership fees, and limited accessibility in certain regions are restraining broader adoption.

- Europe leads the market share in 2024, supported by heritage golf destinations, tournament culture, and strong female participation.

- Asia Pacific is expected to record the fastest growth, driven by increasing interest in countries such as South Korea, Japan, and China, alongside rising investments in golf tourism.

- North America maintains strong demand through advanced infrastructure, high spending capacity, and consistent growth in apparel and equipment sales.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Female Participation Supported by Expanding Professional Platforms

The Global Women’s Golf Market is experiencing strong growth due to increasing female participation at both amateur and professional levels. Greater visibility of women’s tournaments is inspiring more young players to take up the sport. Corporate sponsorships and media coverage have provided female golfers with enhanced exposure. Golf associations are implementing inclusive policies to attract women into clubs and competitive leagues. Sports academies are offering dedicated training programs tailored for female athletes. Apparel and equipment brands are investing in product lines designed specifically for women. The market benefits from social acceptance of golf as both a sport and a lifestyle choice for women. It continues to strengthen through partnerships between sports federations, schools, and corporate entities.

- For instance, in 2023, approximately 7million women and girls played golf on a course in the U.S., making up 26% of on-course participants—the highest proportion on record. Globally, women represent 23% of adult registered golfers, with countries like the Republic of Korea, Germany, and The Netherlands having particularly high female participation rates.

Support from Government and Sports Development Initiatives

Government-backed sports programs are contributing significantly to the expansion of women’s golf. National sports bodies are funding infrastructure projects to improve access to courses and practice facilities. Scholarships and grants for promising female athletes are increasing participation rates. The Global Women’s Golf Market benefits from initiatives that integrate golf into school and college sports curriculums. International sports events are receiving logistical and financial support from public agencies. Regulatory frameworks are promoting gender equality in sports funding. Tourism boards are promoting golf destinations with packages designed for women travelers. It is also witnessing an increase in cross-border player participation due to ease of travel and event coordination.

- For instance, in Wales, a £1million Women’s Golf Legacy Fund supported 74 projects at nearly 50 golf clubs in 2025, enhancing facilities such as on-course toilets and dedicated women’s coaching areas.

Lifestyle Evolution and Higher Disposable Incomes

Changing lifestyle preferences are influencing the growth of women’s golf worldwide. Higher disposable incomes allow women to invest in premium golfing equipment and memberships. The Global Women’s Golf Market gains momentum as working professionals view golf as a networking and leisure activity. Urban development projects are integrating golf courses into residential and hospitality spaces. Health-conscious consumers are recognizing golf’s fitness and mental well-being benefits. Businesses are hosting women-exclusive corporate golf events, creating exposure to the sport. Celebrity endorsements are encouraging wider audience engagement. It is also supported by digital platforms that offer learning modules for beginners.

Technological Advancements in Golf Equipment and Training

Innovation in golf equipment design is enhancing gameplay for women. Lighter clubs, optimized grip sizes, and advanced swing analysis tools are improving performance. The Global Women’s Golf Market benefits from the integration of smart sensors in clubs and balls for real-time feedback. Indoor simulation technology enables year-round practice regardless of climate. Data analytics tools help players refine strategies and improve consistency. Retailers are offering customization services for personalized club fitting. Brands are launching digital coaching platforms for remote learning. It is further supported by social media content that educates and engages prospective players.

Market Trends

Growth of Women-Centric Golf Apparel and Accessory Lines

Fashion trends are reshaping product offerings within women’s golf. Brands are introducing stylish, performance-oriented apparel tailored for female golfers. The Global Women’s Golf Market is seeing a rise in specialized footwear with improved comfort and traction. Accessories such as gloves, visors, and golf bags are being designed with both aesthetics and ergonomics in mind. Seasonal collections are attracting fashion-conscious golfers. Premium brands are collaborating with sports personalities to launch signature lines. Retail channels are expanding online sales platforms for golf wear. It is also benefitting from sustainability-focused apparel collections targeting environmentally aware consumers.

- For example, ALYN a women’s golf apparel brand founded by former professional golfer Tisha Alyn debuted its Terra Collection, which introduces adjustable-length skirts and dresses designed to provide a customizable fit for heights ranging from 4′10″ to 5′10″. The tops include integrated sports bra support, delivering comfort and structure without additional layering.

Integration of Digital Engagement and Social Media Influence

Digital platforms are playing a major role in shaping the popularity of women’s golf. Influencers and professional golfers are using social media to engage audiences. The Global Women’s Golf Market is seeing strong engagement through video tutorials, live match coverage, and interactive content. Brands are leveraging digital campaigns to promote new product launches. Golf communities are connecting through online forums and virtual tournaments. E-commerce platforms are providing easy access to premium golfing gear. Streaming services are broadcasting niche women’s golf events to wider audiences. It is supported by mobile applications that track player performance and offer training resources.

Expansion of Golf Tourism Targeted at Female Travelers

Golf tourism is emerging as a strong trend, with packages designed specifically for women. Resorts are hosting women-only tournaments and training retreats. The Global Women’s Golf Market is benefitting from destinations that combine luxury travel with golfing experiences. Event organizers are creating itineraries that include wellness, spa, and cultural tours alongside golf activities. International golf festivals are featuring women’s divisions with attractive prizes. Airlines and hospitality providers are offering discounts for group golf travel. Travel agencies are promoting off-season packages to encourage year-round participation. It is also supported by media coverage of exotic golf destinations catering to women.

Collaborations Between Sports Organizations and Lifestyle Brands

Partnerships between sports bodies and lifestyle brands are shaping market growth. The Global Women’s Golf Market is experiencing co-branded events that merge sport with lifestyle experiences. Luxury brands are sponsoring exclusive tournaments. Sportswear companies are working with golf academies to supply training gear. High-profile events are incorporating fashion shows, product showcases, and networking sessions. Beverage and wellness brands are creating on-course experiences for participants. It is also seeing the introduction of loyalty programs that reward repeat participation. Celebrity-led campaigns are driving brand alignment with aspirational lifestyles.

- For example, in 2025, Gap partnered with Malbon Golf to launch a 33-piece limited‑edition collection that fuses Malbon’s streetwear‑inspired golf aesthetic with Gap’s prep‑school essentials, designed for both men and women.

Market Challenges Analysis

High Infrastructure Costs and Limited Accessibility in Certain Regions

The Global Women’s Golf Market faces challenges due to the high cost of developing and maintaining golf courses. Limited availability of affordable public courses restricts access in many regions. Urban areas often face land scarcity, reducing opportunities for new facilities. Membership fees and equipment costs remain barriers for entry-level players. It encounters difficulties in reaching underdeveloped markets with lower disposable incomes. Seasonal climate conditions in some areas limit year-round participation. Transportation to remote golf destinations can also impact accessibility. It must address these infrastructure and cost-related limitations to achieve broader participation.

Balancing Traditional Perceptions with Modern Engagement Strategies

Cultural perceptions in some regions hinder female participation in golf. The Global Women’s Golf Market needs to address gender biases and outdated views on sports involvement. Conservative dress codes and exclusive membership rules can deter new entrants. Marketing efforts must adapt to younger audiences without alienating traditional enthusiasts. It must also address competition from alternative sports and leisure activities. Maintaining player engagement over time is a challenge when competing with fast-paced, tech-driven entertainment options. Sponsorship opportunities can be uneven across regions, limiting exposure. It requires targeted outreach to align tradition with evolving consumer expectations.

Market Opportunities

Expanding Youth Development Programs and Grassroots Engagement

Youth-focused programs offer significant growth potential for the Global Women’s Golf Market. Training academies and school partnerships can introduce the sport at an early age. Affordable starter equipment can make entry easier for young players. Scholarships for talented female golfers can encourage competitive participation. It can also benefit from community-based initiatives that promote inclusivity. Corporate sponsorship for junior leagues can strengthen the pipeline of future professionals. Partnerships with non-profit organizations can further extend outreach to underserved communities.

Leveraging Technology for Wider Market Reach and Personalization

Adoption of virtual training platforms and AI-powered swing analysis tools presents strong opportunities. The Global Women’s Golf Market can benefit from gamified learning apps to attract younger demographics. Personalized equipment fitting services can enhance player experience. It can also use virtual reality to simulate global course play for training and leisure. Data analytics can optimize marketing strategies and player retention programs. Collaborations with tech companies can accelerate innovation in equipment and training systems.

Market Segmentation Analysis:

By product, the clubs segment holds the largest share in the Global Women’s Golf Market, driven by consistent demand from both amateur and professional players. Innovation in club design, including lighter materials and ergonomic grips, is enhancing playability for women. The training aids segment is gaining momentum with the adoption of swing analyzers, simulators, and portable practice tools that improve performance. Apparel is evolving from functional sportswear to a blend of performance and style, with brands introducing moisture-wicking fabrics, tailored fits, and designs that cater to varied climates. It continues to benefit from premiu.m positioning and brand collaborations with professional golfers.

- For example, TaylorMade designs women’s fairway woods with lightweight components women’s flex graphite shafts typically weigh around 40–45 grams, which improves swing speed and feel for female golfers

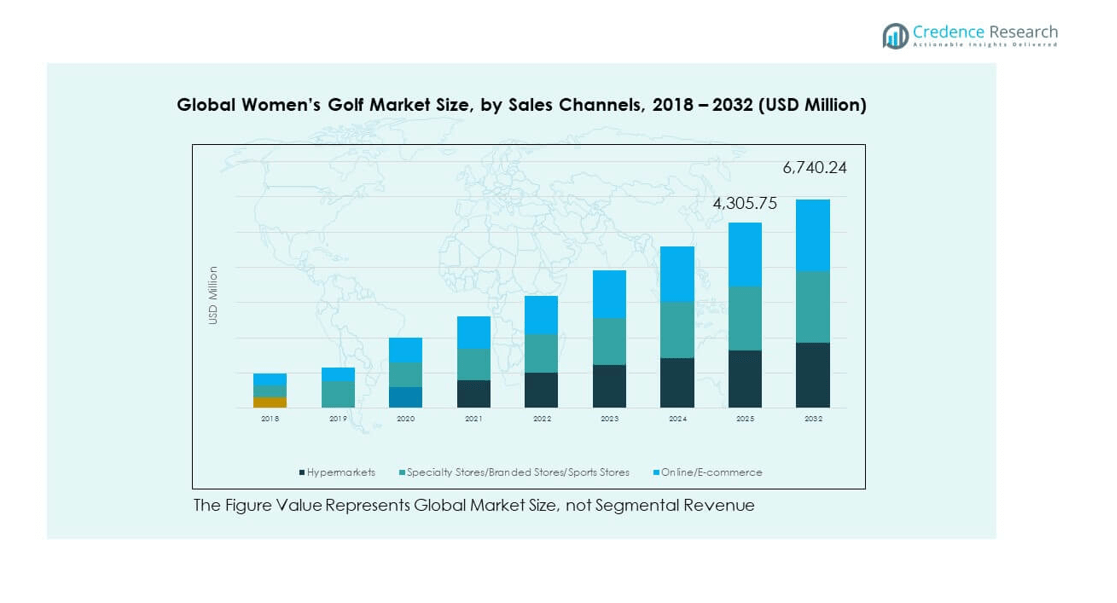

By sales channel, specialty stores, branded outlets, and sports stores dominate due to the advantage of personalized fitting services, expert guidance, and exclusive product availability. Hypermarkets contribute significantly in regions with strong retail penetration, offering competitive pricing and wide accessibility. Online and e-commerce channels are expanding rapidly, fueled by the convenience of doorstep delivery, a broad product range, and the integration of virtual fitting tools. It is also supported by digital marketing campaigns, influencer partnerships, and interactive shopping platforms that attract both new and experienced players.

- For example, Decathlon, Europe’s largest sporting goods retailer, actively promotes golf products across its French and Spanish hypermarket locations through seasonal campaigns such as “Golf Month,” offering discounts on apparel, clubs, and accessories under its in-house brand Inesis.

Segmentation:

By Product

- Clubs

- Training Aids

- Apparel

By Sales Channel

- Hypermarkets

- Specialty Stores / Branded Stores / Sports Stores

- Online / E-commerce

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global Women’s Golf Market size was valued at USD 765.48 million in 2018 to USD 1,085.63 million in 2024 and is anticipated to reach USD 1,821.89 million by 2032, at a CAGR of 6.7% during the forecast period. North America accounts for 26.75% of the global market share in 2024, supported by its well-established golfing culture, extensive infrastructure, and high consumer spending power. The U.S. dominates regional demand, driven by a dense network of golf courses, professional tournaments, and active participation across all age groups. It benefits from strong brand presence, advanced retail networks, and access to premium golfing technology. Canada and Mexico are witnessing steady growth through tourism-driven events and grassroots programs. Regional sports associations actively promote female participation through scholarships, league events, and training initiatives. E-commerce platforms are expanding their footprint, catering to younger demographics seeking convenience. Golf apparel and equipment brands in the region are leveraging celebrity endorsements and digital campaigns to sustain growth.

Europe

The Europe Global Women’s Golf Market size was valued at USD 909.93 million in 2018 to USD 1,259.87 million in 2024 and is anticipated to reach USD 2,047.01 million by 2032, at a CAGR of 6.3% during the forecast period. Europe holds 31.04% of the global market share in 2024, supported by its heritage golf destinations and a growing number of women’s tournaments. The UK, Germany, and France lead in participation, with golf associations investing in grassroots programs. It is supported by advanced training facilities, seasonal tourism, and a strong culture of competitive play. Southern European countries such as Spain and Italy are attracting international players through resort-based golf tourism. The region benefits from cross-border leagues and pan-European tournaments that enhance visibility for female golfers. Apparel and accessory brands are integrating European fashion trends with performance gear to attract style-conscious players. Sponsorship from luxury and lifestyle brands is expanding opportunities for women athletes.

Asia Pacific

The Asia Pacific Global Women’s Golf Market size was valued at USD 631.99 million in 2018 to USD 921.76 million in 2024 and is anticipated to reach USD 1,602.83 million by 2032, at a CAGR of 7.2% during the forecast period. Asia Pacific represents 22.71% of the global market share in 2024, with rapid growth driven by rising interest in countries like South Korea, Japan, China, and Australia. Governments are investing in sports infrastructure and hosting international tournaments to boost tourism. It benefits from the global visibility of Asian women golfers excelling in professional tours. Japan and South Korea lead in market maturity, with high adoption of premium golf equipment and apparel. China and India are emerging markets with significant growth potential due to rising middle-class participation. Digital platforms are popular among younger players for skill development and product purchases. Golf tourism combining leisure and cultural experiences is expanding in Southeast Asia.

Latin America

The Latin America Global Women’s Golf Market size was valued at USD 294.37 million in 2018 to USD 387.50 million in 2024 and is anticipated to reach USD 584.38 million by 2032, at a CAGR of 5.3% during the forecast period. Latin America holds 9.55% of the global market share in 2024, supported by increasing interest in golf tourism and amateur tournaments. Brazil and Argentina are key markets, with golf courses integrated into luxury resorts. It benefits from favorable weather conditions that allow year-round play in many locations. Regional sports bodies are promoting female participation through development programs and partnerships with schools. Online retail growth is making premium equipment and apparel more accessible. Cross-border events with North America are boosting competitive exposure. Economic conditions influence purchasing behavior, making value-oriented product lines important. Brand-sponsored events and training clinics are gradually expanding the sport’s reach.

Middle East

The Middle East Global Women’s Golf Market size was valued at USD 211.05 million in 2018 to USD 309.01 million in 2024 and is anticipated to reach USD 539.89 million by 2032, at a CAGR of 7.3% during the forecast period. The Middle East accounts for 7.62% of the global market share in 2024, fueled by luxury golf tourism, high-profile tournaments, and investments in premium facilities. The UAE and Saudi Arabia are leading markets, hosting international events and developing women-focused golfing programs. It is supported by government initiatives to promote sports inclusivity and diversify tourism offerings. Golf resorts offer premium experiences that combine hospitality, wellness, and professional coaching. Retailers are catering to affluent customers with high-end apparel and customized equipment. Partnerships with global brands are increasing product availability. Regional events attract international players, boosting visibility and engagement.

Africa

The Africa Global Women’s Golf Market size was valued at USD 70.35 million in 2018 to USD 93.79 million in 2024 and is anticipated to reach USD 144.24 million by 2032, at a CAGR of 5.6% during the forecast period. Africa represents 2.87% of the global market share in 2024, with South Africa leading due to its established golfing infrastructure and international event hosting. Egypt and Morocco are emerging destinations for golf tourism. It benefits from a growing interest in women’s sports and regional training programs. Accessibility remains a challenge in rural areas due to limited facilities. Equipment imports play a key role in market supply. Climate diversity across the continent supports year-round golfing in certain regions. Local initiatives and corporate sponsorships are expanding awareness and participation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Women’s Golf Market is characterized by strong competition among established brands such as Acushnet Company, Ping, Mizuno Corporation, TaylorMade Golf, Wilson Sporting Goods, and Sun Mountain Sports. These companies focus on product innovation, premium quality, and targeted marketing strategies to maintain market leadership. It is witnessing increased collaborations between sports brands and professional female golfers to enhance brand visibility. Emerging players are entering niche segments such as women-specific apparel and advanced training aids. Distribution strategies include expansion into e-commerce platforms and specialty stores to reach wider audiences. Competitive positioning is influenced by product customization, technological integration, and sustainability-focused offerings.

Recent Developments:

- In June 2025, Acushnet Company, known for its Titleist and FootJoy brands, launched a new digital platform— the Acushnet Hub— to streamline ordering for trade partners, making it easier for golf retailers worldwide to access the latest women’s golf equipment and custom club services. This platform rollout is paired with the continued strong performance of new product launches like the latest Pro V1 golf balls, which have contributed to a 5% year-over-year increase in net sales for the company in Q2 2025

- In May 2025, Mizuho Americas renewed its title sponsorship agreement with the LPGA Tour for the Mizuho Americas Open, extending through 2030. The company announced that it would raise the tournament purse to $3.25million starting in 2026, making it one of the largest purses on the LPGA Tour outside of the majors.

- In January 2025, Sun Mountain Sports unveiled several new products at the PGA Show, including the innovative Eclipse E-Series golf bags and a premium AW25 apparel collection—reflecting the brand’s strategy to reinvent equipment specifically with women golfers in mind. This launch highlights Sun Mountain’s continued role as a leader in performance golf gear and apparel.

Market Concentration & Characteristics:

The Global Women’s Golf Market demonstrates moderate concentration, with a mix of global leaders and regional brands competing for market share. It is driven by innovation in product design, brand endorsements, and the integration of digital retail channels. Leading companies maintain dominance through extensive distribution networks and strong brand equity. The market shows seasonal sales patterns influenced by regional golfing climates. Product differentiation and targeted promotions are essential for sustaining growth. Sustainability initiatives and eco-friendly materials are gaining traction among premium brands. Strategic partnerships with tourism boards and event organizers are expanding the market’s visibility and consumer engagement.

Report Coverage:

The research report offers an in-depth analysis based on Product and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of women-focused golf academies will strengthen talent pipelines in both developed and emerging markets, fostering greater participation at competitive and recreational levels.

- Growing adoption of technology-driven training aids, including swing analyzers and simulators, will enhance skill development, improve performance, and attract tech-savvy consumers.

- Lifestyle-driven demand for golf apparel will open avenues for collaborations between fashion labels and sportswear brands, blending style with performance functionality.

- E-commerce growth will improve global accessibility to premium equipment, apparel, and accessories, supported by targeted online marketing campaigns.

- Rising popularity of golf tourism will drive demand for integrated travel experiences, combining sporting events with luxury accommodations and leisure activities.

- Strategic partnerships between professional women golfers and leading brands will increase consumer trust, visibility, and loyalty.

- Development of affordable starter kits will encourage younger demographics and first-time players to take up the sport.

- Sustainability-focused product innovation will influence purchase decisions, particularly in premium and eco-conscious segments.

- Increased media coverage and international tournaments will elevate visibility, attracting new participants and audiences worldwide.

- Investment in grassroots and community-based programs will expand the sport’s reach across underserved and remote regions.