Market Overview

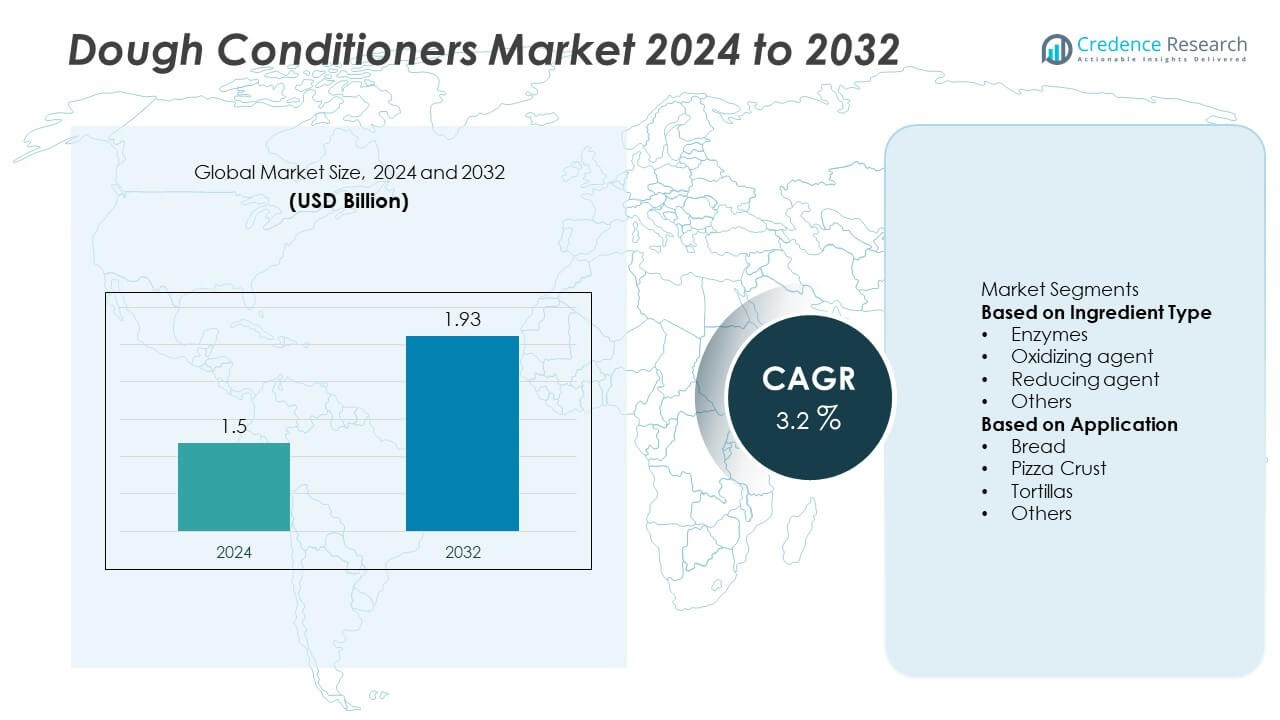

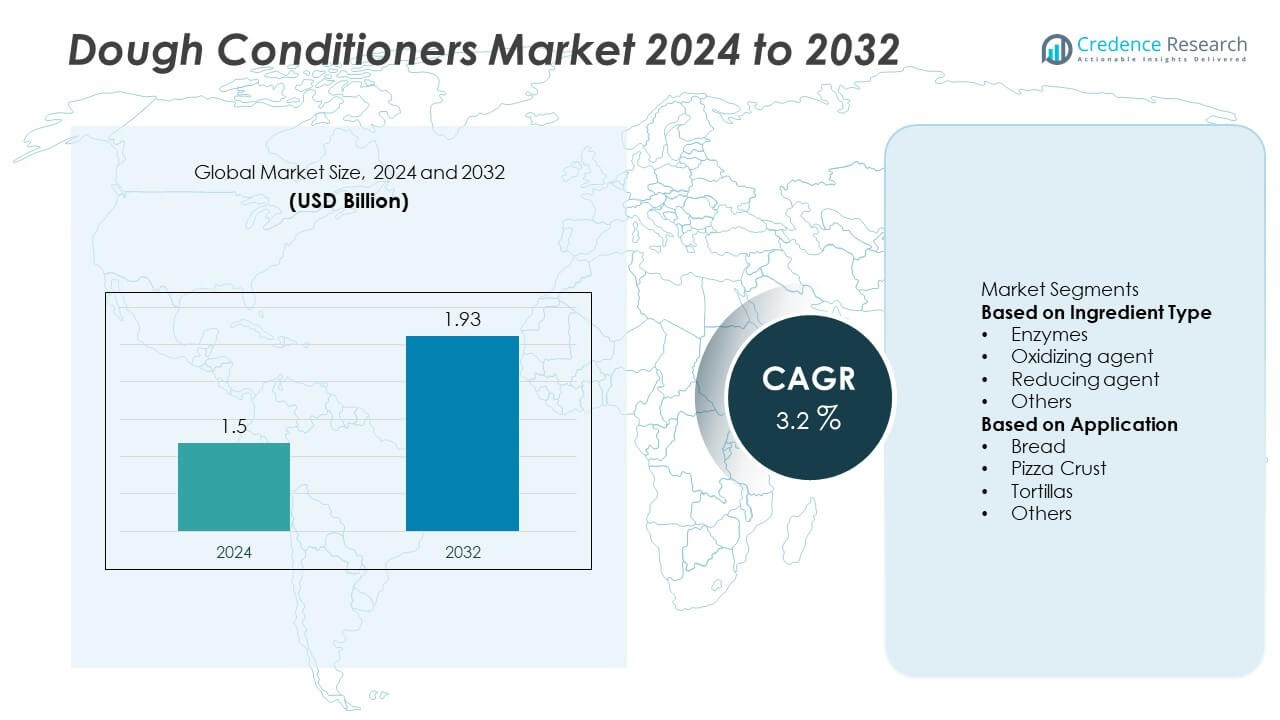

The Dough Conditioners market was valued at USD 1.5 billion in 2024 and is projected to reach USD 1.93 billion by 2032, growing at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dough Conditioners Market Size 2024 |

USD 1.5 Billion |

| Dough Conditioners Market, CAGR |

3.2% |

| Dough Conditioners Market Size 2032 |

USD 1.93 Billion |

The Dough Conditioners market is led by major companies such as Puratos Group, Caldic B.V, Lallemand Inc, Corbion, Oriental Yeast Co. Ltd, E.I. Du Pont De Nemours and Company, Lesaffre, Archer Daniels Midland Company, Calpro Foods Pvt. Ltd, and Watson Inc. These players focus on enzyme-based and clean-label formulations that enhance dough strength, elasticity, and shelf life for large-scale bakery operations. North America dominated the market with a 33% share in 2024, supported by a mature bakery industry and high demand for packaged products. Europe followed with 29%, driven by sustainability initiatives, while Asia-Pacific accounted for 26% due to rising bakery consumption and rapid urbanization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dough Conditioners market was valued at USD 1.5 billion in 2024 and is projected to reach USD 1.93 billion by 2032, growing at a CAGR of 3.2%.

- Market growth is driven by the rising consumption of baked and packaged food products, supported by industrial bakeries’ demand for improved dough elasticity and extended shelf life.

- Key trends include increasing adoption of enzyme-based and clean-label conditioners, aligning with consumer preference for natural and sustainable ingredients.

- Leading players such as Puratos Group, Corbion, and Lesaffre focus on innovation, product diversification, and partnerships to expand their global footprint.

- North America leads with a 33% share, followed by Europe with 29% and Asia-Pacific with 26%, while the enzymes segment holds 46% share, driven by growing preference for bio-based bakery formulations.

Market Segmentation Analysis:

By Ingredient Type

The enzymes segment dominated the Dough Conditioners market in 2024 with a 46% share. Enzymes are widely used for improving dough texture, volume, and fermentation stability, enhancing product quality in large-scale baking operations. Their natural origin and compatibility with clean-label formulations make them preferred over chemical agents. Oxidizing and reducing agents also play vital roles by improving dough strength and elasticity. The growing demand for sustainable, additive-free bakery products and advancements in enzyme biotechnology continue to drive the adoption of enzyme-based dough conditioners across industrial and artisanal bakeries.

- For instance, Lesaffre Group’s Saf Pro® Star-Zyme™ STR 701 R reduced mixing time by 2.5 minutes in hamburger bun trials while replacing five traditional dough improvers.

By Application

The bread segment held the largest share of 58% in the Dough Conditioners market in 2024. Bread manufacturers rely heavily on dough conditioners to achieve uniform texture, extended freshness, and better machinability during large-scale production. Rising consumption of packaged and ready-to-eat bread, especially in urban markets, supports steady growth. Pizza crust and tortilla applications are expanding rapidly due to increasing fast-food consumption and global restaurant chains. Continuous innovation in multifunctional conditioners enhances performance across varied flour types and baking processes.

- For instance, Lallemand Inc.’s Essential® GR 1620 WW allowed bakeries to reduce added gluten usage by 20 % to 50 % in bread formulations, thereby improving dough strength and machinability.

Key Growth Drivers

Rising Demand for Processed and Packaged Bakery Products

The growing consumption of packaged and ready-to-eat bakery goods such as bread, pizza crusts, and pastries drives the demand for dough conditioners. These additives improve dough strength, texture, and consistency, enhancing product quality during mass production. Urbanization and busy lifestyles are fueling bakery consumption globally. Manufacturers are also expanding product lines with fortified and high-fiber bakery items, further increasing the use of dough conditioners for maintaining quality and uniformity across large-scale production.

- For instance, Watson Inc. introduced micro-encapsulation technology that protected enzyme blends until baking. The company is known for its ingredient systems for the food industry and uses microencapsulation to increase nutrient stability and shelf life.

Advancements in Enzyme-Based Formulations

Innovation in enzyme technology has become a key growth driver for the Dough Conditioners market. Enzyme-based conditioners offer natural, efficient, and clean-label solutions compared to synthetic chemicals. They improve dough fermentation, texture, and gluten development while aligning with regulatory and consumer trends favoring sustainable ingredients. The growing focus on replacing chemical additives with bio-based enzymes in industrial and artisanal bakeries supports product diversification and regulatory compliance, boosting market expansion across developed and emerging economies.

- For instance, Lallemand Inc.’s LallZyme® MA True is a maltogenic-amylase enzyme designed to improve the quality of soft sandwich bread. The manufacturer states this enzyme enhances crumb resilience and springiness, while also extending the bread’s shelf life.

Expansion of Industrial Baking and Foodservice Sectors

The global rise of industrial bakeries and quick-service restaurants is fueling dough conditioner demand. These sectors require consistent dough quality for high-volume operations. Conditioners enhance process tolerance, elasticity, and shelf stability, allowing standardized production across multiple locations. The surge in frozen bakery production and international food chains further amplifies the need for functional additives. Manufacturers are investing in advanced formulations tailored for large-scale automated baking lines, supporting efficiency, product uniformity, and reduced waste in foodservice operations.

Key Trends & Opportunities

Shift Toward Clean-Label and Natural Ingredients

The industry is witnessing a clear shift toward clean-label dough conditioners as consumers demand transparency and natural ingredients. Enzyme- and plant-derived conditioners are replacing chemical oxidizers and emulsifiers. Manufacturers are focusing on formulations that enhance dough performance without synthetic additives. This trend presents strong opportunities for producers investing in enzyme innovation, natural emulsifiers, and microbial fermentation technologies to meet rising health and regulatory standards across global bakery markets.

- For instance, Corbion’s Origin® plant-based dough improvers use certified acerola extract to improve dough machinability and structure, enabling dough conditioners to rely on natural ingredients instead of synthetic additives.

Growing Demand for Frozen and Gluten-Free Bakery Products

The popularity of frozen and gluten-free bakery products is creating new growth avenues. Dough conditioners designed for cold storage and gluten-free formulations are gaining traction to maintain dough flexibility and quality. Manufacturers are developing multifunctional conditioners to improve baking stability and extend product shelf life in these segments. The growing acceptance of plant-based diets and health-conscious eating habits further encourages the adoption of specialty dough conditioners supporting product innovation.

- For instance, Cargill’s functional system for bakery applications (Becodur™, Emulthin™, Emulzym™) supports dough conditioning and freeze-thaw stability in frozen dough, water-binding and ice crystal control for frozen products.

Key Challenges

Rising Raw Material and Production Costs

Fluctuations in the prices of raw materials, including enzymes, emulsifiers, and specialty ingredients, pose challenges for manufacturers. The need for high-quality inputs and complex production processes raises overall costs. Smaller bakery operators often struggle to absorb these expenses, limiting adoption. To address this, producers are focusing on optimizing formulations and developing cost-effective enzyme blends to maintain competitiveness while ensuring performance consistency in large-scale production environments.

Stringent Food Regulations and Labeling Requirements

Strict global food safety regulations and labeling norms limit the use of certain chemical dough conditioners. Manufacturers must ensure compliance with regional standards such as FDA, EFSA, and FSSAI, which increases operational complexity. The shift toward clean-label formulations adds additional pressure for reformulation and testing. Meeting these requirements without compromising dough quality or shelf life remains a challenge, especially for companies serving multiple markets with differing regulatory frameworks.

Regional Analysis

North America

North America held a 33% share of the Dough Conditioners market in 2024. The region’s dominance is supported by a well-established bakery industry and high consumption of packaged bread and frozen bakery products. The U.S. leads the market with strong demand from industrial bakeries and foodservice chains. Growing consumer interest in gluten-free and clean-label bakery items is encouraging the use of enzyme-based conditioners. Advancements in baking technology and product innovation further strengthen the regional market, supported by major manufacturers introducing customized dough enhancer blends for large-scale production.

Europe

Europe accounted for a 29% share of the Dough Conditioners market in 2024. The region benefits from a mature bakery sector with strong demand for artisan and organic baked products. Countries such as Germany, France, and the U.K. dominate due to established bread consumption habits and innovation in enzyme formulations. The growing preference for sustainable and natural ingredients aligns with EU food regulations promoting clean-label solutions. Manufacturers are investing in research to replace chemical conditioners with bio-based alternatives, supporting market growth driven by health-conscious consumers and regulatory compliance.

Asia-Pacific

Asia-Pacific captured a 26% share of the Dough Conditioners market in 2024, driven by expanding bakery production in China, India, Japan, and South Korea. Rising urbanization and increasing disposable income are accelerating the consumption of packaged and ready-to-eat bakery goods. The growth of quick-service restaurants and Western-style bakeries boosts demand for dough conditioners that improve elasticity and shelf life. Local manufacturers are adopting enzyme-based and cost-effective formulations to meet the needs of rapidly growing bakery sectors in emerging economies.

Latin America

Latin America held an 8% share of the Dough Conditioners market in 2024. The region’s growth is supported by rising consumption of bread, pastries, and convenience foods across Brazil, Mexico, and Argentina. Expansion of supermarket chains and the increasing presence of international bakery brands are key drivers. Economic improvements and urban lifestyles encourage greater demand for packaged baked goods. However, price sensitivity and limited awareness of advanced conditioners among small bakeries pose challenges, prompting manufacturers to focus on affordable and multifunctional formulations tailored for regional preferences.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share of the Dough Conditioners market in 2024. Growth is driven by increasing bakery product consumption in urban centers across the UAE, Saudi Arabia, and South Africa. Expanding quick-service restaurant chains and rising demand for Western-style bread and pastries support the adoption of dough conditioners. International manufacturers are strengthening their presence through partnerships with local bakeries. However, limited technological capabilities and reliance on imports constrain large-scale adoption, though rising disposable income and modernization of bakery production indicate long-term potential.

Market Segmentations:

By Ingredient Type

- Enzymes

- Oxidizing agent

- Reducing agent

- Others

By Application

- Bread

- Pizza Crust

- Tortillas

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Dough Conditioners market includes key players such as Puratos Group, Caldic B.V, Lallemand Inc, Corbion, Oriental Yeast Co. Ltd, E.I. Du Pont De Nemours and Company, Lesaffre, Archer Daniels Midland Company, Calpro Foods Pvt. Ltd, and Watson Inc. These companies focus on developing innovative enzyme-based and clean-label dough conditioner formulations to meet evolving consumer and industry demands. Market leaders emphasize sustainability, cost efficiency, and compliance with global food safety standards. Strategic partnerships, acquisitions, and regional expansions help strengthen their market presence and product portfolios. Companies are also investing heavily in R&D to enhance dough performance, improve texture, and extend shelf life while minimizing the use of chemical additives. The growing adoption of biotechnology and customized formulations for industrial bakeries further fuels competition, positioning innovation and product differentiation as key factors for long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Puratos Group

- Caldic B.V

- Lallemand Inc

- Corbion

- Oriental Yeast Co., Ltd

- I. Du Pont De Nemours and Company

- Lesaffre

- Archer Daniels Midland Company

- Calpro Foods Pvt. Ltd

- Watson Inc

Recent Developments

- In September 2025, Puratos announced a joint venture with Guelph Foods Ltd. in China focusing on plant-based egg-wash alternatives and advanced UHT production for bakery applications across Asia-Pacific.

- In September 2025, Corbion N.V. took a leading role in clean-label reformulation at the IBIE 2025 event, highlighting dough conditioner solutions for commercial bakers focused on transparent and simple ingredient systems.

- In June 2025, Puratos Group and AMF Bakery Systems launched a new pilot bakery facility at Puratos’ U.S. headquarters in Pennsauken, NJ for accelerated recipe development and scale-up of bakery innovations.

Report Coverage

The research report offers an in-depth analysis based on Ingredient Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dough conditioners will grow with the expansion of commercial and industrial bakeries.

- Enzyme-based formulations will replace synthetic additives due to clean-label demand.

- Growth in frozen and gluten-free bakery products will create new opportunities.

- Manufacturers will focus on multifunctional conditioners for diverse bakery applications.

- Adoption of sustainable and bio-based ingredients will increase across developed markets.

- Technological innovation in enzyme processing will enhance dough performance efficiency.

- Partnerships between ingredient suppliers and bakery chains will strengthen global supply networks.

- Rising urbanization and changing diets will boost bakery consumption in emerging regions.

- Online retail and foodservice expansion will drive consistent bakery production demand.

- Regulatory focus on food safety and labeling will influence future product innovation.