Market Overview

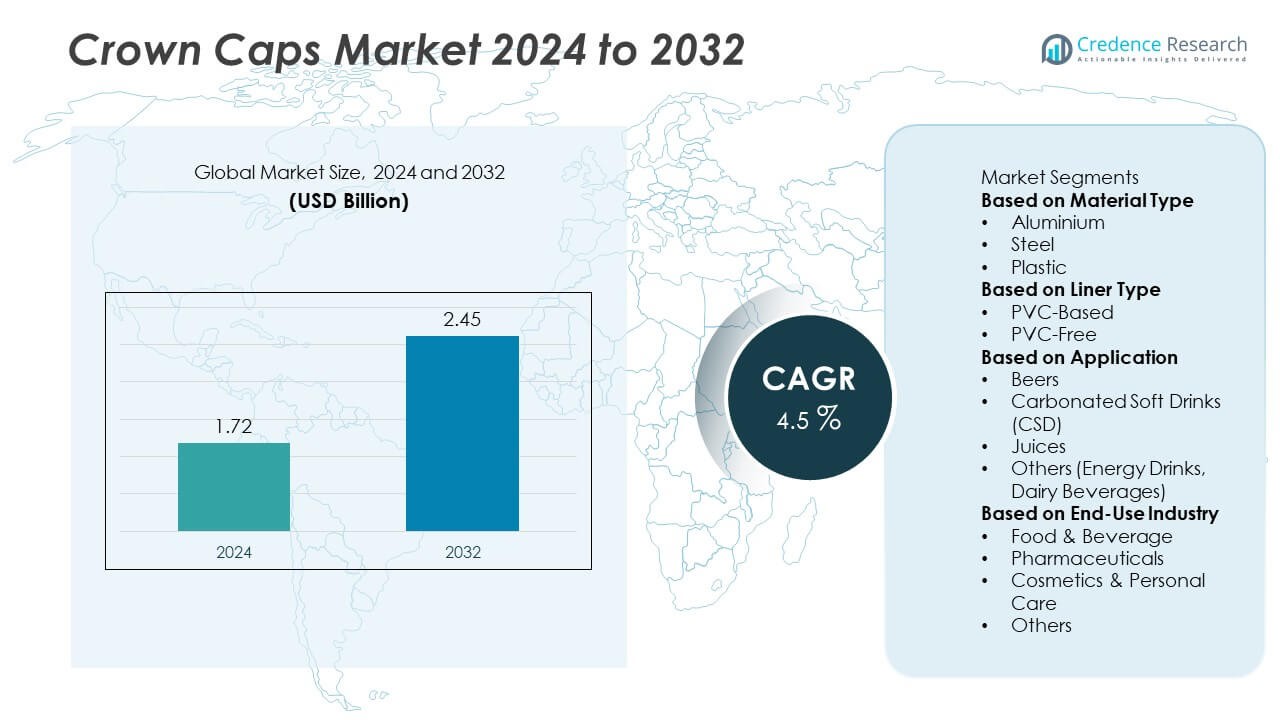

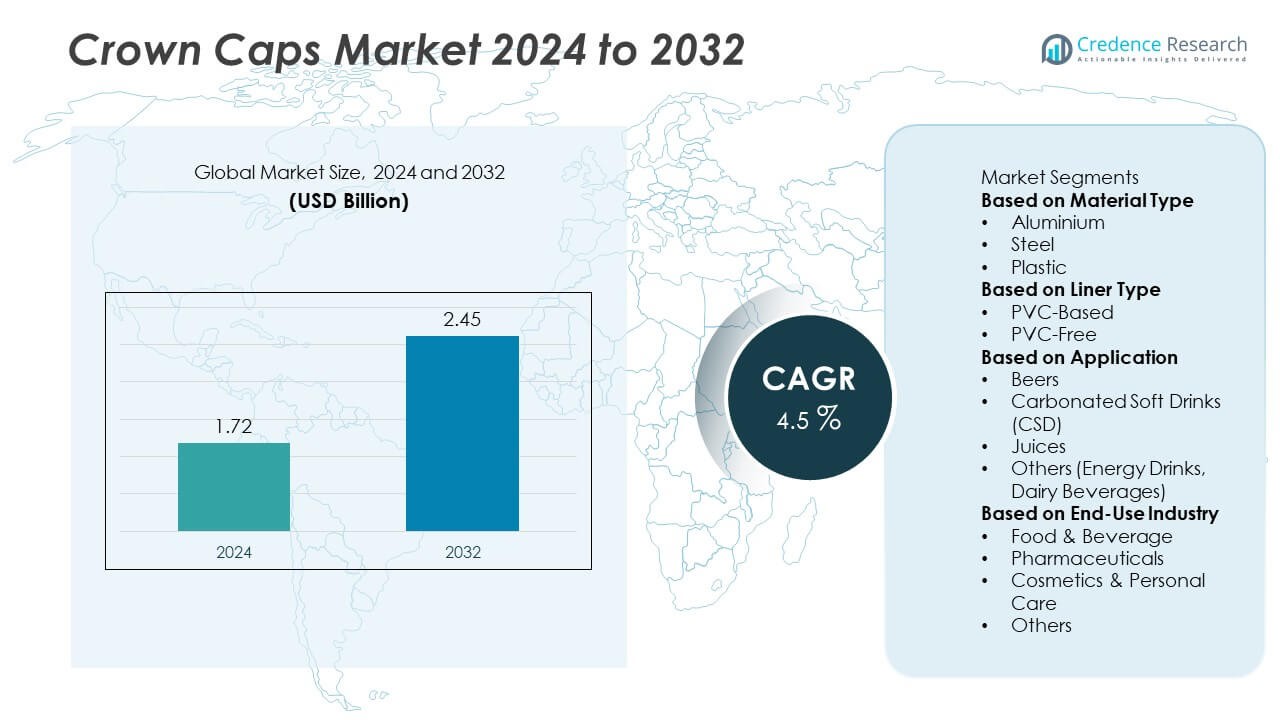

The Crown Caps market was valued at USD 1.72 billion in 2024 and is projected to reach USD 2.45 billion by 2032, growing at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crown Caps Market Size 2024 |

USD 1.72 Billion |

| Crown Caps Market, CAGR |

4.5% |

| Crown Caps Market Size 2032 |

USD 2.45 Billion |

The Crown Caps market is dominated by major players such as Crown Holdings, Ferropack Industries, Finn-Korkki, Ajanta Bottle, Brouwland, Crown Seal, Amigo Sampoorna Panacea, Arishtam, Brijrani Enterprises, and Brewnation. These companies lead through innovative designs, sustainable materials, and strong partnerships with global beverage brands. Crown Holdings remains the top player with its advanced manufacturing capabilities and global presence. North America leads the market with a 34% share, driven by strong beverage consumption and premium packaging demand, followed by Europe with 31% and Asia-Pacific with 28%, where rapid industrial growth and rising bottled beverage production boost adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Crown Caps market was valued at USD 1.72 billion in 2024 and is expected to reach USD 2.45 billion by 2032, growing at a CAGR of 4.5%.

- Increasing consumption of beer and carbonated soft drinks drives market growth, supported by rising demand for durable and recyclable packaging materials.

- Growing trends include the adoption of PVC-free liners and lightweight aluminum caps to enhance sustainability and reduce manufacturing costs.

- Key players such as Crown Holdings, Ferropack Industries, and Finn-Korkki focus on expanding eco-friendly production and forming partnerships with beverage brands to strengthen competitiveness.

- North America leads with a 34% market share, followed by Europe with 31% and Asia-Pacific with 28%, while the steel material segment dominates with 53% share due to its strength, cost-efficiency, and recyclability in beverage bottling applications.

Market Segmentation Analysis:

By Material Type

The steel segment dominated the crown caps market with a 59% share in 2024. Its dominance is attributed to excellent strength, corrosion resistance, and sealing capability, making it ideal for carbonated beverages and beer packaging. Steel caps maintain carbonation effectively and are cost-efficient for mass production. Beverage manufacturers prefer steel due to its recyclability and compatibility with high-speed bottling lines. Aluminum follows as a growing alternative, favored for lightweight properties and eco-friendly appeal, especially in premium beverage packaging applications across developed markets.

- For instance, Crown Holdings, a major metal packaging manufacturer, produced 82 billion beverage cans in 2024 and utilizes various closure technologies, including some that use tin-free steel. These technologies, alongside other factors, help maintain product freshness and contribute to the overall shelf life of beer and other packaged beverages.

By Liner Type

The PVC-free segment accounted for the largest 55% share of the crown caps market in 2024. Increasing environmental regulations and consumer demand for sustainable materials are driving the shift from PVC-based liners to PVC-free alternatives. These liners provide equal sealing performance while eliminating harmful plasticizers, aligning with global sustainability initiatives. Manufacturers are investing in bio-based and thermoplastic elastomer linings to meet safety standards for beverages. Growing adoption of non-toxic materials across food and beverage packaging continues to strengthen the market dominance of PVC-free crown caps.

- For instance, Finn-Korkki Oy introduced a PVC-free liner technology capable of maintaining carbonation pressure up to 6.2 bar without deformation. The company’s patented ring-pull crown design is tested to open in under 9 newton-meters of torque while ensuring leak-free performance for over 24 months of storage stability in export beer packaging.

By Application

The beer segment led the crown caps market with a 47% share in 2024, supported by the large-scale use of glass bottles in the brewing industry. Crown caps ensure an airtight seal, maintaining carbonation and extending shelf life, which is critical for beer packaging. Rising craft beer production and growing consumption in Asia-Pacific and Europe further boost demand. The carbonated soft drinks segment also shows steady growth, driven by increasing beverage consumption and the expansion of bottling facilities. Enhanced branding and decorative cap designs continue to support segment expansion globally.

Key Growth Drivers

Rising Consumption of Packaged and Carbonated Beverages

The increasing global consumption of bottled beers, soft drinks, and carbonated beverages is a major driver of the crown caps market. Beverage producers rely on crown caps for reliable sealing and preservation of carbonation. The growth of urban lifestyles and rising disposable incomes, especially in Asia-Pacific, are boosting beverage packaging demand. Expanding brewery operations and product diversification among major beverage brands further strengthen market adoption. The surge in premium and craft beer consumption also supports consistent demand for high-quality metal crown caps.

- For instance, Anheuser-Busch InBev operates in over 50 countries with over 170 breweries and a diverse portfolio of approximately 400 brands. While they use various packaging types including cans, returnable bottles, and single-use bottles, in their 2024 annual report, they stated their circular packaging percentage was 89.8%.

Expansion of Beverage Manufacturing and Bottling Infrastructure

Growing investments in modern bottling facilities and automated packaging systems are driving the crown caps market. Beverage producers are upgrading production lines to meet higher output efficiency and hygiene standards. Crown caps remain the preferred closure for glass bottles due to durability, tamper resistance, and recyclability. Emerging economies, particularly in Asia and Latin America, are witnessing rapid expansion of domestic breweries and soft drink bottlers. This infrastructure growth continues to boost crown cap demand across multiple beverage segments globally.

- For instance, Coca-Cola HBC and its subsidiary, the Nigerian Bottling Company (NBC), commissioned a high-speed PET bottling line at their Challawa plant in 2022 to meet high demand in Nigeria. The line features automated processes and advanced digital controls to maximize efficiency and maintain packaging quality.

Increasing Focus on Recyclability and Sustainability

Environmental concerns and regulatory mandates promoting sustainable packaging are fueling demand for recyclable metal crown caps. Manufacturers are adopting eco-friendly materials such as aluminum and developing PVC-free liners to reduce environmental impact. Recyclability and reusability align with global circular economy goals, improving the market appeal of crown caps over plastic closures. Beverage companies are also partnering with packaging suppliers to introduce lightweight, low-carbon designs. This sustainability-driven shift is creating long-term opportunities for innovation in cap design and material selection.

Key Trends and Opportunities

Adoption of Digital Printing and Branding Innovation

Advancements in digital printing technologies are transforming crown cap designs into effective branding tools. Beverage companies are using customized, high-resolution graphics for promotional campaigns and brand differentiation. Decorative crown caps are gaining traction in the craft beer and specialty beverage sectors. This trend enables flexible production runs with reduced setup time and waste. Enhanced visual appeal and brand recognition through digital printing are turning crown caps from functional components into key marketing assets in competitive beverage markets.

- For instance, Ferropack Industries in India produces puff-lined crown caps suitable for sterilised bottles, which are commonly used for flavoured milk, fruit juices, ketchups, and sauces. Their caps come in two variants, Puff and Dry Blend, and are made from high-quality tin sheets.

Growing Demand from Emerging Economies

Rapid industrialization, population growth, and increased beverage consumption in emerging economies are creating strong opportunities for crown cap manufacturers. Countries such as India, China, Brazil, and Indonesia are witnessing high demand for bottled drinks due to expanding retail networks and urbanization. Rising investments in local breweries and beverage packaging facilities are supporting steady market penetration. Additionally, affordable production costs and easy material availability in these regions enhance supply chain efficiency. The shift of global beverage manufacturing toward Asia-Pacific continues to drive regional market expansion.

- For instance, Ajanta Bottle is a prominent glass packaging company in India that serves the food, beverage, and pharmaceutical industries, and through its Akikai Packaging Machines division, it supplies various types of capping equipment. The company operates an online B2B portal for wholesale glass bottles and jars and is known for emphasizing quality and offering comprehensive packaging solutions, including closure and labeling services.

Key Challenges

Fluctuating Raw Material Prices

Volatility in steel and aluminum prices poses a major challenge for crown cap manufacturers. The market’s dependency on metal availability and cost directly impacts production margins. Supply disruptions and increased energy costs can further affect pricing stability. Manufacturers are adopting strategic sourcing and recycling initiatives to mitigate these effects, but fluctuating costs still influence profitability. Price-sensitive markets, especially in developing regions, face difficulties maintaining cost competitiveness amid material price variations, affecting long-term growth potential.

Competition from Alternative Packaging Solutions

The growing adoption of plastic and twist-off closures in the beverage industry presents a strong challenge to crown cap demand. PET bottles with lightweight caps offer greater convenience and resealability, especially for non-alcoholic drinks. This shift in consumer preference is driving beverage brands to explore alternative packaging solutions. Additionally, sustainability concerns over steel production emissions may further affect metal cap usage. To remain competitive, manufacturers must innovate through eco-friendly designs and lightweight metal alternatives that balance performance and sustainability.

Regional Analysis

North America

North America held a 31% share of the crown caps market in 2024, supported by high consumption of alcoholic and non-alcoholic beverages. The United States leads the region, driven by a strong craft beer culture and well-established bottling infrastructure. Beverage companies are adopting premium and decorative metal caps for branding and sustainability. Growing consumer demand for recyclable and eco-friendly packaging further enhances the adoption of steel and aluminum crown caps. The presence of major beverage manufacturers and continuous packaging innovations sustain North America’s leadership in the global market.

Europe

Europe accounted for a 28% share of the crown caps market in 2024, driven by its mature beer and soft drink industries. Countries such as Germany, the United Kingdom, and Poland are key consumers due to their long-standing brewery heritage. Sustainability regulations promoting metal recycling and PVC-free liners are influencing production trends. European packaging manufacturers focus on lightweight, eco-friendly crown caps that meet circular economy targets. Increasing demand for premium bottled beverages and innovations in cap printing technologies further strengthen Europe’s position as a key contributor to global market growth.

Asia-Pacific

Asia-Pacific dominated the crown caps market with a 30% share in 2024, fueled by rapid growth in beverage consumption and expanding manufacturing capabilities. China and India lead demand, supported by rising disposable incomes and a growing preference for bottled beer and carbonated drinks. The expansion of local breweries and modernization of bottling facilities are accelerating market growth. Manufacturers are investing in large-scale steel and aluminum cap production to cater to domestic and export markets. Increasing urbanization and government initiatives promoting sustainable packaging further enhance Asia-Pacific’s dominance in the crown caps industry.

Latin America

Latin America held a 7% share of the crown caps market in 2024, driven by rising beverage production and growing beer consumption in countries such as Brazil and Mexico. Local and international breweries are investing in advanced bottling technologies to improve product preservation. The region’s growing middle-class population and shift toward packaged beverages are key demand drivers. While economic fluctuations pose short-term challenges, the expansion of local manufacturing capacity and trade partnerships with North America are strengthening Latin America’s position in the global crown caps supply network.

Middle East & Africa

The Middle East & Africa accounted for a 4% share of the crown caps market in 2024. The United Arab Emirates and South Africa are leading markets, driven by the growing beverage and bottled water industries. Increasing investments in food and beverage processing facilities are enhancing regional demand. The shift toward metal-based recyclable packaging aligns with sustainability initiatives across the Gulf region. In Africa, urbanization and expanding soft drink consumption are driving gradual adoption. Partnerships between regional bottlers and international cap producers are expected to support steady market growth in the coming years.

Market Segmentations:

By Material Type

By Liner Type

By Application

- Beers

- Carbonated Soft Drinks (CSD)

- Juices

- Others (Energy Drinks, Dairy Beverages)

By End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Crown Caps market includes key players such as Crown Holdings, Ferropack Industries, Ajanta Bottle, Finn-Korkki, Brouwland, Brijrani Enterprises, Crown Seal, Amigo Sampoorna Panacea, Arishtam, and Brewnation. These companies compete through innovation in design, material sustainability, and customization for beverage and food packaging. Crown Holdings leads with advanced manufacturing technologies and global distribution capabilities, while regional players such as Ferropack Industries and Ajanta Bottle focus on cost efficiency and local supply networks. Growing emphasis on recyclable materials, digital printing, and PVC-free liners drives product innovation across the industry. Strategic partnerships with breweries and beverage companies, along with expansion in emerging markets, strengthen the competitive positioning of major producers. Continuous investment in automation and eco-friendly production further enhances efficiency and aligns with global sustainability goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Crown Holdings

- Ferropack Industries

- Ajanta Bottle

- Finn-Korkki

- Brouwland

- Brijrani Enterprises

- Crown Seal

- Amigo Sampoorna Panacea

- Arishtam

- Brewnation

Recent Developments

- In April 2025, Ajanta Bottle introduced a diversified crown closure portfolio featuring customized embossed aluminum caps designed for artisanal beverage producers, aligning with its broader packaging sustainability program across India.

- In 2025, Ferropack Industries expanded its crown cap division by commissioning a new metal closure line in Maharashtra, India, enhancing domestic beer and soda closure capacities for breweries using recyclable tinplate material.

- In August 2024, Guala Closures, part of Special Packaging Solutions Investments (SPSI), acquired Astir Vitogiannis, a crown caps manufacturing through its subsidiary, Coleus Packaging.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Liner Type, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for crown caps will rise with increasing global beverage consumption.

- Aluminum caps will gain traction due to recyclability and lightweight benefits.

- PVC-free liners will dominate as sustainability regulations become stricter.

- Growth in craft beer and premium beverage sectors will boost cap innovation.

- Automation in manufacturing will improve production efficiency and quality control.

- Emerging markets will expand due to rising bottled drink consumption.

- Strategic collaborations between beverage brands and cap manufacturers will strengthen market presence.

- Technological advancements in printing and design will enhance brand customization.

- E-commerce and retail beverage sales will increase demand for packaged drinks.

- Asia-Pacific and Europe will remain key regions driving long-term market growth.